#Capital Funding

Text

Seeking Funding for FLYING METALS - The Aerospace B2B E-commerce Supply Chain

We have an excellent Investment Opportunity - FLYING METALS - The Aerospace B2B Supply Chain Management Ecommerce the world's First. Solving the Supply Chain problems for Aerospace Industry. Inflation Fight? Invest with FLYING METALS, The Best Investments

DRONES FLYING METALS PTY LTD AUSTRALIA INDIA SINGAPORE

FLYING METALS PTY LTD

www.flyingmetals.com

What ‘Flying Metals’ is all about / The Product:

FLYING METALS

At ‘Flying Metals’, we provide the latest and the most modern B2B Marketplace specifically for the aerospace Industry connecting Buyers with Suppliers.

We are building the World’s Largest E Commerce B2B platform for Aerospace…

View On WordPress

#Aerospace#aircraft#Airplanes#aviation#B2B#b2b cloud#B2B Ecommerce#b2b platform#Capital Funding#ecommerce for avaition#Family Offices#flight metals#flying metals#funding#Investors#Private Equity Finance#raising funds#Shrikant Shete MD & CEO#VC Funds#VC PE Funds#Venture Capital

2 notes

·

View notes

Text

Oh…. Well, it’s over for Crunchyroll I guess

#Crunchyroll#piracy#funimation#money hungry ass streaming service#rambling#I’ve never paid for a streaming service in my life thank god#I appreciated using others accounts but I personally cannot see myself paying this much for a service if I had the funds 😭!#get back to pirating kings!!!#anime has always been one of the easiest forms of media to pirate anyway so y’all got this#CR is definitely not worth paying for though#CR is certainly not worth paying this much for even if it’s a yearly one time fee#capitalism#the fact that CR has always had pretty bad quality as a streaming service anyway#it buffers every time you pause or rewind anything

83K notes

·

View notes

Text

Driving Growth: The Crucial Role of SME Loans in Economic Development in the MENA Region

As SMEs navigate the challenges of scaling and expansion, access to capital funding emerges as a critical factor in unlocking their growth potential. In this exploration, we delve into the pivotal role of SME loans in fueling economic development in the MENA region, focusing on debt financing solutions and shedding light on the significance of working capital financing and business loans in Dubai.

Empowering Entrepreneurship through SME Loans:

SMEs play a pivotal role in driving innovation, fostering entrepreneurship, and stimulating economic growth in the MENA region. However, one of the primary challenges faced by SMEs is accessing adequate capital funding to fuel their expansion plans and drive innovation. SME loans serve as a catalyst for entrepreneurship, providing these enterprises with the necessary financial resources to invest in infrastructure, expand operations, and seize growth opportunities.

Fostering Economic Growth and Job Creation:

The availability of SME loans has a direct and tangible impact on economic growth and job creation in the MENA region. By providing SMEs with access to capital funding, governments and financial institutions stimulate investment, innovation, and productivity, thereby driving economic expansion and creating employment opportunities across various sectors. SMEs, in turn, contribute to economic diversification, resilience, and competitiveness, making them key drivers of sustainable development in the region.

Supporting SMEs through Working Capital Financing:

Maintaining adequate working capital is essential for the day-to-day operations and sustainability of SMEs. Working capital financing solutions, such as lines of credit, invoice factoring, and trade finance facilities, provide SMEs with the liquidity needed to manage cash flow, cover operational expenses, and capitalize on growth opportunities. By facilitating access to working capital financing, SME loans enable these enterprises to navigate short-term financial challenges and invest in long-term growth initiatives.

Unlocking Growth Opportunities with Business Loans in Dubai:

Dubai, as a thriving business hub in the MENA region, offers a conducive environment for SMEs seeking to obtain business loans. With a robust financial ecosystem comprising banks, financial free zones, and government-backed entities, SMEs in Dubai have access to a wide range of financing options tailored to their unique needs. Business loans in Dubai come with competitive interest rates, flexible repayment terms, and personalized financial solutions, enabling SMEs to unlock their growth potential and thrive in the dynamic business landscape.

In conclusion, SME loans play a crucial role in driving economic development, fostering entrepreneurship, and creating job opportunities in the MENA region. By providing SMEs with access to capital funding and working capital financing solutions, governments and financial institutions empower these enterprises to innovate, expand, and contribute to sustainable economic growth. As SMEs continue to thrive and evolve, their resilience and dynamism will remain central to shaping the future of the MENA economy.

0 notes

Text

youtube

Unlocking Startup Success: Angel Investors vs. Venture Capital Funding#youtubefeed

👼 Angel Investors: Discover the key players who can provide the financial wings your startup needs. Learn how to attract angel investors, what they look for in a potential investment, and how to make a compelling pitch that sets your business apart.

🌱 Venture Capital: Explore the realm of venture capital and understand how it can your startup's growth. From securing meetings with venture capitalists to negotiating term sheets, we cover the essentials to help you navigate this dynamic funding source.

1 note

·

View note

Text

1 note

·

View note

Text

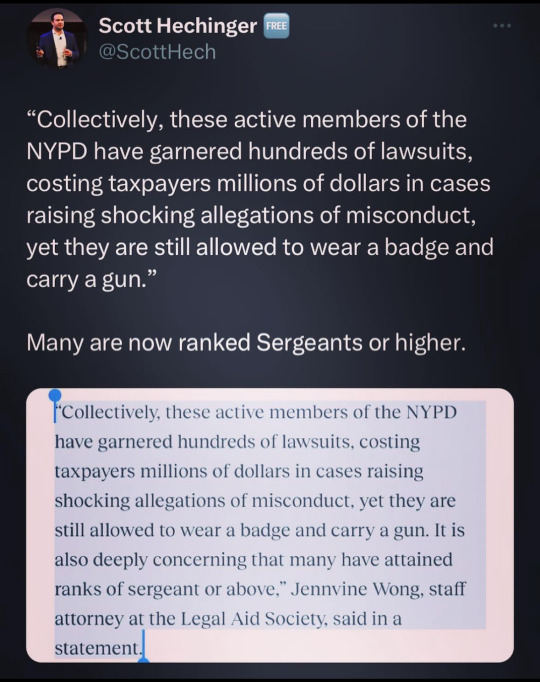

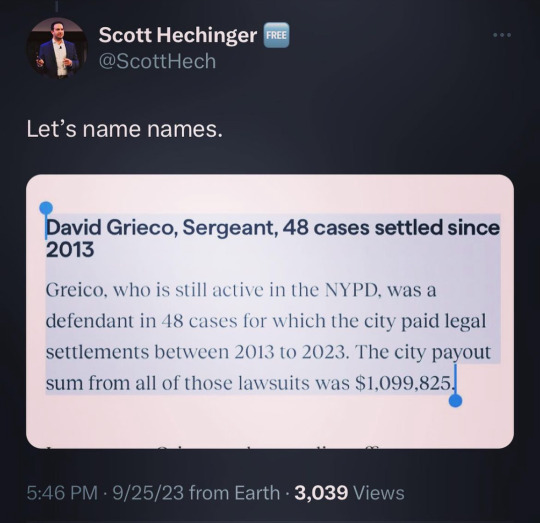

#ftp#defund the police#defundthepolice#police brutality#capitalist system#capitalism kills#no justice no peace#defund the police fund our communities#nyc police#fuck the nypd#defund nypd

4K notes

·

View notes

Text

I have found that the biggest deterrent to assholes is asking "why?" Over and over.

"We can't have universal healthcare!"

Why?

"Because I don't wanna pay for a strangers health!"

Why?

"Because if they can't afford their own health care that isn't my problem!"

Why?

And so on and so on. Keep making them dig. Keep making them explain until they can't anymore and are faced with nothing but the ugly mask of bias and prejudice. Only then can they truly see that taking it off is an option. Whether they do or not is up to them. And that choice tells you whether they deserve more of your energy or not.

Trans kids can't be trans. Why? Why not? Why?

Free food is bad for ppl. Why? Why? Why? Why is feeding ppl bad?

Why?

Why is helping one another bad?

Why is doing what humans are genetically designed to do, to help and care for one another to ensure survival, bad?

#money aside#just think about it#then realize we HAVE the money#we have the money to fund all of this#through laundering in goverments and billionares who refuse to share wealth for the bettermemt of mankind#then get angry#and be radicalized#helping your fellow man through kindness is the biggest fuck you to capitalism#anti capitalism#politics#democratic socialism#socialism#eat the rich#and do this to yourself when you have bias#why did you think that way or do that action?#why was this your first response difference?#dig until you cant...and take off the mask

3K notes

·

View notes

Text

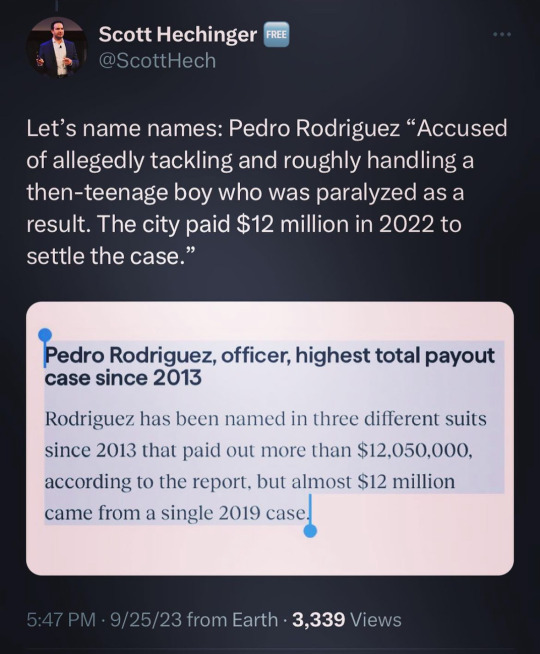

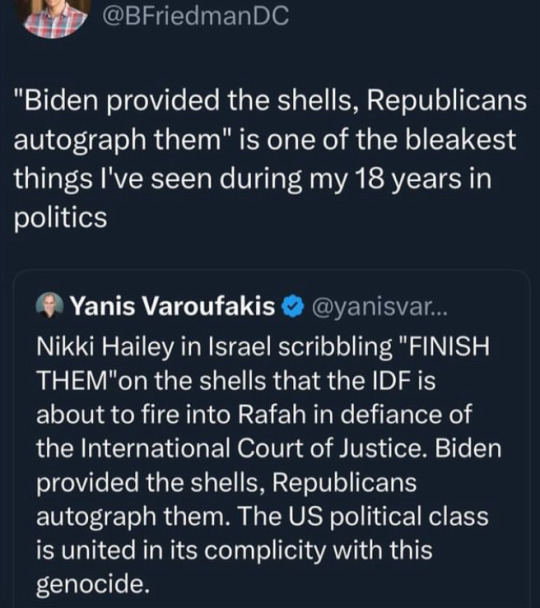

#relevant#two party system#imperialism#end occupation#capitalism#fascisim#free palestine#arms embargo now#us politics#fascist police state#end apartheid#all eyes on Gaza#all eyes on Rafah#Biden#us complicity#stop funding genocide#Nikki Haley

158 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

152 notes

·

View notes

Text

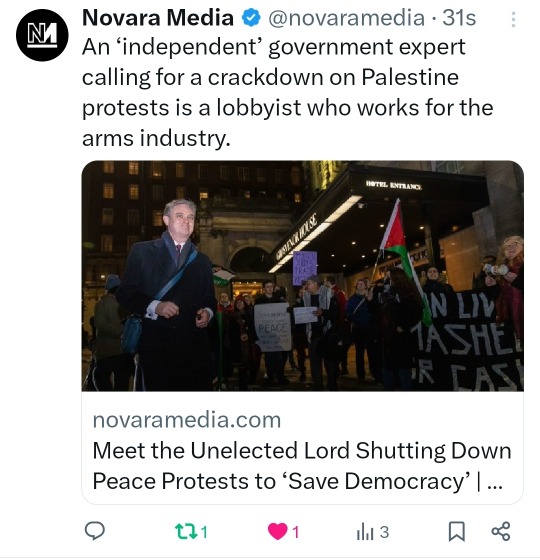

Why do we still have lords in the uk?

#fuck uk politics#uk politics#politics#anti capitalism#anarchism#anarchist#palestine#arms industry#stop funding genocide#stop funding israel#free gaza#free palestine#gaza#israel#israel is committing genocide#israel is a war criminal#fuck israel#end israeli occupation#boycott israel#fuck the lords#fuck the uk government

122 notes

·

View notes

Text

I have 5 days left to gather $650.

venmo - secretladyspider

cashapp- secretladyspider

PayPal- [email protected]

I hate being here again. I feel like I’m just in a hole trying to dig out but the hole keeps filling with more dirt, and mud, and sometimes spiders. It’s kind of been like this as long as I can remember. the times where I didn’t have to pick between food & utilities or making sure my car works and supplements that healthcare doesn’t cover or dietary needs or again food are like when I have a foothold. But it’s never sturdy. And every pile of dirt, every job that doesn’t pay enough or takes so much out of me i get worse, every abusive boss, every “service fee” just to get something accessible, every day that I can’t function, every depression that capitalism doesn’t pause for, every burn out and fit of crying and sitting in my car counting quarters outside dollar tree so I can do something like buy shampoo… it’s more dirt that gets poured in makes it even worse and more stressful. Because no, you can’t budget your way out of poverty or hard work your way into your job respecting you, but you can work yourself so hard that your body breaks down from the years of chronic stress and trauma of it being difficult just to stay alive. Without friends and kind strangers, I’d be dead. I know I’m not the only one. And… I know not everyone has anyone to help. So… I’m thankful for your help. I really am. Because this is… this is so stressful. It feels like I could shatter, and I’m just hoping that I don’t get dropped.

Anything and everything helps, especially as this is time sensitive. thank you.

#text post#mutual funds#mutual aid#gofundme#fundraising#queer#lgbtqia#mental health#adhd#ace#disability#capitalism

84 notes

·

View notes

Text

My sister in law really needs clothes. She's going to live with us after all since it's the safest place for her to be but she still can't access her belongings.

She decided to press charges and police have told her to wait til the judge can make a court order to get her things but she needs stuff now.

Stuff meaning clothes mostly. She was able to get a lot of things she needed last time y'all sent money but not very many clothes.

I wanna take her to thrift store and such when I'm able. Thank you all so much. Y'all are for real helping to change her life.

/200

cashpp: $CEOofAntifa

Venmo: CEOofAntifa

Paypal: here

#idk how much clothes cost tbh#i dont shop much#but 200 seems fair???#help#signal boost#reblog#mutual aid#escaping violence#lgbt#direct action#leftist#capitalism#important#text post#funds#queer

246 notes

·

View notes

Text

A Guide to Obtaining Business Loans for SMEs in the Middle East

Small and Medium Enterprises (SMEs) play a pivotal role in driving economic growth and innovation. However, one of the significant challenges faced by SMEs is securing adequate capital funding to fuel their expansion plans. In this guide, we delve into the process of obtaining business loans tailored specifically for SMEs in the MENA region, focusing on debt financing solutions and shedding light on the nuances of working capital financing and business loans in Dubai.

Understanding the Importance of Capital Funding for SMEs:

Capital funding serves as the lifeblood for SMEs, empowering them to invest in infrastructure, expand operations, and innovate. Business loans tailored for SMEs provide a vital source of financing, enabling these enterprises to bridge financial gaps and capitalize on growth opportunities without diluting equity ownership.

Preparing for the Loan Application Process:

Before embarking on the journey to secure a business loan, SMEs must meticulously prepare by assessing their financial health, developing a comprehensive business plan, and identifying the purpose for which the loan will be utilized. Lenders in the MENA region often require detailed financial projections, historical performance data, and collateral to evaluate the creditworthiness of SMEs.

Exploring Debt Financing Solutions for SMEs:

Debt financing offers SMEs in the MENA region a variety of options to access capital funding. Traditional financial institutions, such as banks and credit unions, provide business loans tailored to the specific needs of SMEs, offering competitive interest rates and flexible repayment terms. Additionally, government-backed entities and specialized financial institutions offer SME loans with subsidized interest rates and extended repayment periods, aimed at fostering entrepreneurship and economic development in the region.

Navigating Working Capital Financing:

Maintaining adequate working capital is essential for the day-to-day operations of SMEs. Working capital financing solutions, such as lines of credit, invoice factoring, and trade finance facilities, provide SMEs with the liquidity needed to manage inventory, cover operational expenses, and capitalize on growth opportunities. These financing options offer flexibility and scalability, enabling SMEs to adapt to changing market conditions and seize emerging opportunities.

Accessing Business Loans in Dubai:

Dubai, as a thriving business hub in the MENA region, offers a conducive environment for SMEs seeking to obtain business loans. With a well-established financial ecosystem comprising banks, financial free zones, and government-backed entities, SMEs in Dubai have access to a wide range of financing options tailored to their unique needs. Business loans in Dubai come with competitive interest rates, streamlined application processes, and personalized financial solutions, enabling SMEs to unlock their growth potential and thrive in the dynamic business landscape.

In conclusion, obtaining a business loan for SMEs in the Middle East requires careful preparation, strategic planning, and an understanding of the diverse debt financing solutions available in the region. By leveraging working capital financing and exploring business loans in Dubai, SMEs can overcome financial hurdles and embark on a trajectory of sustainable growth and success in the vibrant MENA business ecosystem.

0 notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

Been a minute since I posted on my tumblr but, this is a better time than ever; I have a few announcements.

First, I’ve just recently started my transition and am now, she/they. 🏳️⚧️✨

Second, Me and my partner started a gofundme in order help fund our escape from the south. We’re currently living in one of the more conservative and anti-bipoc/anti-trans part of the southern US and need assistance fleeing. Outside of how dangerous it is for us and the violence we’re facing, it’s also been very isolating living here as we have lost contact with our family..

We are moving to the PNW where we can have better gender affirming health care, more equitable healthcare in general and be in/find a new community. Hopefully one where a newly transitioned, black trans fem (myself) would be less likely to experience acts of violence and fatal hate crimes simply for existing.

We have to vacate where we currently live on Sept 28th so please help us crowdfund.

Every every donation and every bit of interaction to this posts counts!

#mutual aid#trans#gofundme#support bipoc#crowd funding#moving#gender affirming healthcare#anti capitalism#boost this#signal boost

198 notes

·

View notes

Text

41 notes

·

View notes