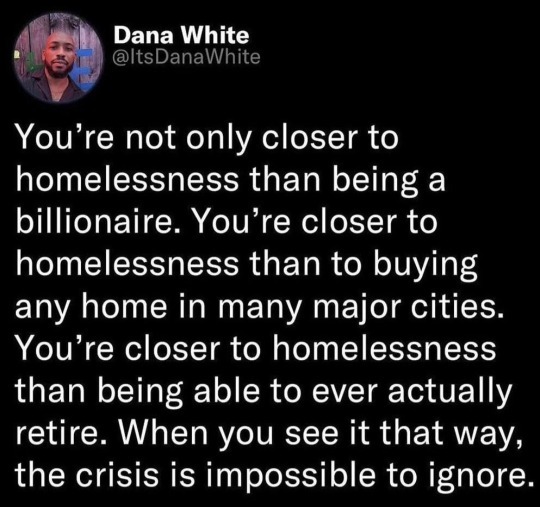

#retirement

Text

#politics#us politics#progressive#capitalism#homelessness#class war#eat the rich#billionaire#retirement#inequality#wealth inequality#homelessness crisis#poverty#middle class

1K notes

·

View notes

Text

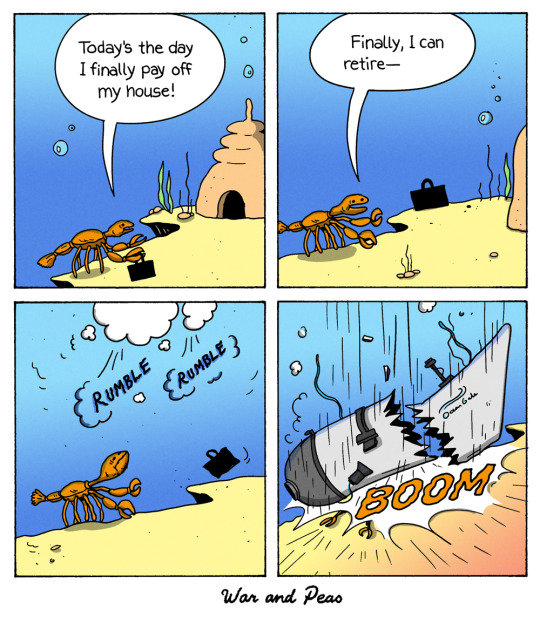

Today's the Day

View On WordPress

#accident#boom#comic#comics#crab#funny#humor#Ocean Gate#OceanGate#retire#retirement#rumble#Ship#shipwreck#war and peas#webcomic

1K notes

·

View notes

Text

Simon Riley x Hybrid! Male Reader

-

|| Masterlist ||

—

Authors Note: I’m back! I want to start off by saying thank you everyone for being patient with me and for 8k followers! I know this shot isn’t long and pretty short, but I will be working on more soon. Unfortunately, at this time I am in my Hybrid era phase for some reason ( ◠‿◠ ) sooo don’t judge me. Also the beautiful artwork below belongs to @ave661 all credit goes to them please follow them because their work is amazing!

Summary: Simon finally gets to retire and get the peace that he finally needs in life, only for Laswell to convince him to take home a hybrid companion back home as company.

Warnings: Fluff, simple plot, hybrid dog reader, Simon is a softy, nightmares, mentions of service dog, military, history, short story, animal features and characteristics.

Word Count: 1.3K

—

—

Simon wasn’t one for retirement.

His whole life he thought that he would be protecting people until the day that he is shot dead in the field.

Only to end up retiring.

He wasn’t retiring because of his age, no. He was retiring for being tired of having to see so much pain and bloodshed, seeing it when he was only a child and going into adulthood something that he never stopped hearing or seeing in his life. He reached a point where he no longer wanted to deal with this blood shed and finally be able to sit back without having to worry about someone trying to kill him.

When Simon made the decision of leaving the special forces he knew it was the right choice that he ended up surprising Price. The same man that he met when he first joined the military, befriending the older man and trusting him with his life. He expected Price to reject his retirement request only for the man to give him his approval on the spot, knowing Simon well enough to know that he needed this break. This peace in his life.

When news spread that ‘Ghost’ was officially retiring it shocked the whole base to know that the most dangerous and intimidating man that the know will be leaving his military life behind for something normal. Price had helped him find a remote place for him to stay in the meantime until he decided to either leave and find somewhere else to call home or perhaps stay at the small house that Price was able to find him.

Simon thought that it would be an easy start until Laswell recommended that he get himself a ‘service dog’ or a ‘companion’ to keep him company. He was against the idea of having someone or something living in the same place as him and so soon, but Laswell had insisted to give it a try in order to have some company around in case he ever felt too isolated from society. Which he later caves into Laswells offer and agrees to have a companion of his own.

Simon expected someone that Laswell and Price knew that had the balls to stay with him until he got adjusted to having a normal life, only to come face to face with a very rare and calm German Shepherd Hybrid.

Simon had heard about Hybrids co existing with society, living their lives hiding from the others due to them being so different from others. It wasn’t until laws were established back in 2010 for Hybrids to be able to live a life like humans; getting jobs, owning homes and property along with getting an education. That didn’t mean that they were entirely free.

Hybrids still had their own set of strict rules. Any hybrid who showed signs of aggression towards a human would be locked away, still keeping them in check for years knowing that they didn’t have total control of their own biology, but after years the laws changed either getting harsher or lighter for them to cope with, reaching a point where hybrids were reaching extinction.

Many were taken, sold to black markets, slavery, or even used for their unique features caused many to go into hiding again or to slowly die off. Very few were protected, but in the end they all died.

The hybrid that Simon took with him wasn’t like the ones that he would see in public.

He was quiet and respectful of his boundaries, never doing anything that Simon didn’t like. He was technically a ‘service dog’ from what Laswell said, trained by her own special team and her wife in order to have Y/n help soldiers with trauma or perhaps those who feared being alone and in need of a friend.

Expect Simons situation was different, Y/n wasn’t just there to keep him company for a short period of time. Instead he was their permanently.

It took Simon some time to adjust to the hybrids existence whenever he woke up in the mornings only to come downstairs to see the hybrid cooking him breakfast other times he would find him outside tending to the ruined gardens, keeping himself busy while Simon focused on his own thing.

The two didn’t really converse with each other until two months into living together. It was the night that Y/n was woken up by the sound of Simons thrashing and heavy breathing that alerted him to rush into Simon’s room. He can smell the sweat and anxiety off of him along with hearing his soft murmurs, clearly showing signs of a nightmare.

When Y/n first met Simon he promised the man that he wouldn’t do anything he didn’t like and kept well to his promise until now. His own instincts were going off and couldn’t stand to the side and watch the man deal with his nightmare. So, he did the only thing he knew what to do.

Y/n had crawled into Simons bed, lying down in the empty spot next to him and moving himself closer to the bigger man, head against his chest as his ears lower in worry when he hears how fast his heart is beating. “Simon…” He whispers in a soft tone, glancing up at the man in distraught. “I’m here Simon, you’re not alone.” He adds on, keeping his head against his chest while his tail brushed up against his hip, causing a small gasp to escape his lips when he feels Simons hand take hold of his tail in his sleep. The soft fur on his tail quickly relaxing the man as his heavy breathing decreases.

The hybrid ears perk up as he listens to his heart beat, hearing it slow down to a proper rate. He stays in this position for the rest of the night without another nightmare occurring.

When Simon woke up that morning he was shocked to find Y/n in bed with him, curled up close to his chest. The warmth of the others mans body heat brings him a sense of comfort, instead of getting out of bed and waking up the hybrid he instead stays in bed a little longer, watching the other man sleep against him.

Simon hated the idea of having company for his first few weeks of retirement, but after getting used to Y/n’s presences in his life their are current things that Simon had grown adjusted to in his every day life. The smell of breakfast being made every morning by the hybrid became a familiar routine, finding the man on his hands and knees while he tends to the backyard digging up a few holes in order to plant new flowers or perhaps some fruit.

Simon favorite part of their day together was sitting outside on the porch as they watched the horizon. Simon would notice the way that Y/n’s ears would twitch as he listens to his surroundings taking in the familiar noise that he hears every morning. The way that his tail would wag whenever he sees kids running down the street with their bikes or scooters in hand, hearing as they would argue with each other and laugh.

The image alone brought a small smile to Simons lips.

Their bonded deepened with time to the point that the two were having regular day to day conversations. Y/n was no longer the closed off and shy hybrid that would be cautious when speaking with Simon and instead became someone who wasn’t afraid to speak up for himself or to be selfish every once an while.

Simon could say that he was grateful for Laswell convincing him to bring Y/n into his life, having him as a company whenever he came home or when the two would go out to run some simple errands, granting Simon the domestic life that he craved for whenever he was on missions and he finally has it

#Simon Riley x male reader#hybrid male reader#male reader#ghost x male reader#ghost x reader#Simon Riley x reader#retirement#simon riley mw2#simon riley imagine#ghost call of duty#ghost mw2#ghost#ghost cod

1K notes

·

View notes

Text

1K notes

·

View notes

Text

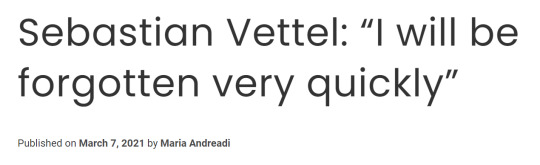

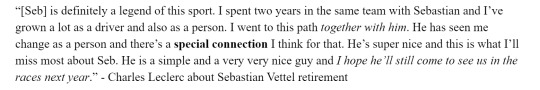

I don't think Charles will let that happen.

part 2

#web weaving#sebchal#ferrari f1#f1#f1edit#scuderia ferrari#charles leclerc#sebastian vettel#sv5#cl16#retirement#collage#mine

1K notes

·

View notes

Text

Samantha Mewis with the puck drop at the PWHL Boston game against the PWHL Minnesota tonight 27/1/24

#PWHL boston#pwhl minnesota#sam mewis#Samantha Mewis#soccer#uswnt#ice hockey#womens ice hockey#woso#nwsl#football#hockey#puck drop#guest#retirement#futbol#pwhl#professional women's hockey league#ccm

284 notes

·

View notes

Text

Klaus: Five:

#the umbrella academy#umbrella academy#tua#five hargreeves#klaus hargreeves#ben hargreeves#luther hargreeves#diego hargreeves#viktor hargreeves#the umbrella academy s3 spoilers!!#allison hargreeves#the sparrow academy#retirement#lila pitts

4K notes

·

View notes

Text

Biden wants to ban ripoff “financial advisors”

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Once, American workers had "defined benefits pensions," where their employers promised to pay them a certain amount every year from their retirement to their death. Jimmy Carter swapped that out for 401(k)s, "market" pensions where you have to guess which stocks will be valuable or starve in your old age:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The initial 401(k) rollout had all kinds of pot-sweeteners that made them seem like a good deal, like heavy employer matching that doubled or even tripled the value of every dollar you put into the market for your retirement. But over the years, as Reaganomics took hold and workers' power ebbed away, all these goodies were clawed back. In the end, the market-based pension makes you the sucker at the poker table, flushing your savings into a rigged casino that is firmly tilted in favor of finance barons and other eminently guillotineable plutocrats.

Neoliberalism is many things, but most of all it is a cult of individualism. The fact that three generations of workers are nows facing down retirement without pensions that will provide them with secure housing and food – let alone money to see the odd movie, buy birthday gifts for their grandkids, or enjoy a meal out now and then – is framed as millions of individual failures, not a systemic one.

In other words, if you are facing food insecurity and homelessness after a lifetime of hard work, it's because you saved wrong. Perhaps you didn't save enough (through a 40-year run of wage stagnation and skyrocketing housing, health and education costs). Or perhaps you saved wrong, making the wrong bets on the stock market. If you can't afford to run your air conditioner during a heat dome, that's on you: you should have been better at stocks.

Apologists for this system will say that you don't have to be good at stocks – you just have to pay an Independent Financial Advisor to pick the stocks for you and you'll be fine. But IFAs don't work for free! What if you can't afford one?

Enter "predatory inclusion" – the practice of offering scammy, overpriced and substandard products to poor people and declaring it to be a good deed, because otherwise, those poor people would have to do without. The crypto bubble relied heavily on this: think of Spike Lee and others shilling for pump-and-dump scams as a way of "building Black wealth":

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

More recently, Intuit and other scammy tax-prep services have argued against the IRS's plan to offer free tax preparation as bad for Black and brown people, because it will deny them the chance to be deceived and ripped off with TurboTax:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Back in 2018, Trump won the predatory inclusion Olympics, when his Department of Labor let the Fifth Circuit abolish the "Fiduciary Rule" for Independent Financial Advisors:

https://www.investopedia.com/updates/dol-fiduciary-rule/

What was the Fiduciary Rule? It said that your IFN had to put your interests ahead of their own. Like, if there were two different funds you could bet on, and one would pay your IFN a big commission, while the other would be a better bet for you, the IFN couldn't put your retirement savings into the fund that offered them a bribe.

When Trump killed the Fiduciary Rule, he proclaimed it a victory for poor people, especially Black and brown people. After all, if IFNs weren't allowed to accept bribes for giving you bad financial advice, then they would have to make up the difference by charging you for good advice. If you couldn't afford that advice, well, you'd have to make bad retirement investments on your own, without the benefit of their sleazy self-dealing.

The Biden Administration wants to change that. Biden's Acting Labor Secretary is Julie Su, and she's very good at her job. Last spring, she forced west coast dockworkers' bosses to cough up the contract they'd stalled on for a year, with 8-10% raises for every worker, owed retroactively:

https://pluralistic.net/2023/06/16/that-boy-aint-right/#dinos-rinos-and-dunnos

Su has proposed a way to reinstate the Fiduciary Rule, as part of the Biden Administration's war on junk fees, estimating that this will increase retirees' net savings by 20%:

https://prospect.org/labor/2023-11-07-julie-su-labor-retirement-savers/

The new rule will force advisors who cheat their clients to pay restitution, and will require them to deliver all their advice in writing so that this cheating can be detected and punished.

The industry is furious, of course. They claim that "The Market (TM)" will solve this: if you get bad retirement savings advice and end up homeless and starving, then you will choose a different advisor in your next life, after you are reincarnated (I guess?).

And of course, they're also claiming that forcing IFNs to stop cheating their clients will deny poor people access to expert (bad) advice. As the Financial Services Institute's Dale Brown says, this will have a "negative impact on Main Street Americans’ access to financial advice":

https://www.fa-mag.com/news/legal-challenge-predicted-for-new-dol-fiduciary-proposal-75257.html

Here's that rule – read it for yourself, then submit a comment expressing your views on it. The government wants to hear from you, and administrative law requires them to act on the comments they receive:

https://www.federalregister.gov/documents/2023/11/03/2023-23782/proposed-amendment-to-prohibited-transaction-exemptions-75-1-77-4-80-83-83-1-and-86-128

Su is part of a wave of progressive, technically skilled regulators in the Biden administration that resulted from a horse-trading exercise called the Unity Task Force, which divvied up access to top appointments among the progressive wing and the finance wing of the Democratic Party. The progressive appointments are nothing short of incredible – the most competent and principled agency leaders America has seen in half a century:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

But then there's the finance wing's appointments, like Judge Jacqueline Scott Corley, who ruled against Lina Khan's attempt to block the rotten Microsoft/Activision merger (don't worry, Khan's appealing):

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

Perhaps the worst, though, is Biden's Secretary of Commerce Gina Raimondo, a private equity ghoul who did a stint for the notorious wreckers Bain Capital before founding her own firm. Raimondo has stuffed her department full of Goldman Sachs alums, and has sidelined labor and civil society groups as she sets out to administer everything from the CHIPS Act to regulating ChatGPT.

As Henry Burke writes for the Revolving Door Project and The American Prospect, Raimondo's history as a corporate raider, her deference to the finance sector, and she and her husband's conflicts of interest from their massive stakes in companies she's regulating all serve to undermine Biden's agenda:

https://prospect.org/economy/2023-11-08-commerce-secretary-gina-raimondo-undercutting-bidenomics/

When the administration inevitably complains that its popular economic programs aren’t breaking through the media coverage, they’ll have no one to blame but themselves.

The Unity Task Force gave us generationally important policymakers, but ultimately, it's a classic "pizzaburger." If half your family wants pizza, and the other half wants burgers, and you serve them something halfway in between that makes none of them happy, you haven't made a wise compromise – you've just made an inedible mess:

https://pluralistic.net/2023/06/17/pizzaburgers/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

#pluralistic#julie su#fiduciary rule#intergenerational warfare#aging#retirement#401ks#old age#pensions#finance#pizzaburgers#Gina Raimondo

261 notes

·

View notes

Text

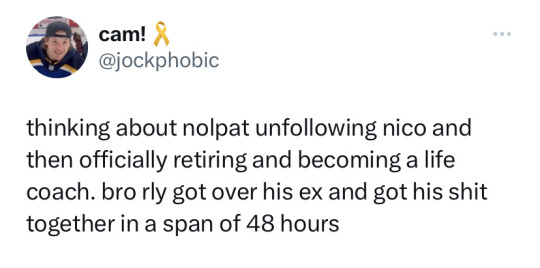

Twitter content is just unmatched regarding anything Nolan Patrick related

#bfksjdjdjsjshshs#48 hours of full on chaos may I add#back to back#no chill#he’s ripping off the band aid in one go#nolpat#nolan patrick#nico hischier#philidelphia flyers#new jersey devils#np19#retirement

308 notes

·

View notes

Link

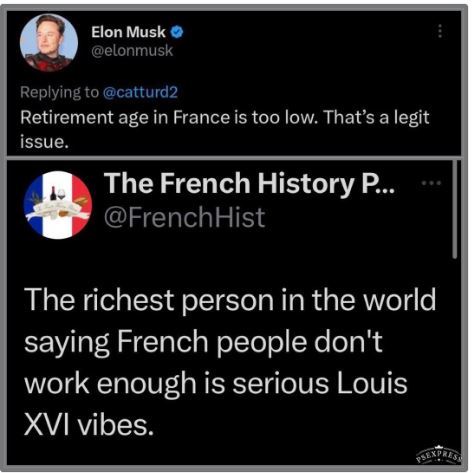

If you read U.S. coverage of the French pension fight, the impression you may get is that Macron was trying to be fiscally responsible, while an impassioned French public that could not accept basic math was clinging to existing generous retirement benefits because of its “national identity.” For instance, here is what the New York Times wrote:

The case for the overhaul was strong. It was not only to Mr. Macron that retirement at 62 looked untenable as lives grew longer. The math, over the longer term at least, simply does not add up in a system where the ratio of active workers to the retirees they are supporting through their payroll taxes keeps dropping.

The Wall Street Journal similarly explained that “the golden age of French pensions is coming to an end, one way or another, in an extreme example of the demographic stress affecting the retirement systems of advanced economies throughout the world.” France once had more than four workers for every retiree, but soon will have only 1.5, and its pension system (which gives retirees around 75 percent of what they earned when they worked full-time) is set to start running multi-billion dollar annual deficits. Macron has thus claimed that while the population may want generous retirement benefits, it is his duty as someone who Understands Economics (Macron is a former banker) to “reform” the system.

But when we look closer, we see that actually, the idea that the reform is necessary is predicated on the assumption that certain other things must not change. Macron’s government “has ruled out increasing taxes to shore up deficits, saying taxes in France are already high” and “abolished the country’s hallowed wealth tax before taking up the pension fight. France 24 reported on findings in 2019 that showed the French pension system was not actually unsustainable in the long term.

As with the phony American Social Security “crisis,” then, the idea that unless benefits are cut, the system will collapse, seems to be manufactured. But the French people are also more rational than accounts of them suggest—the idea being that their resistance is because of “national identity.” They simply have higher expectations for what working people deserve. They don’t believe that people’s lives should be spent toiling until they are near death. They believe long retirements ought to be a right. And they’re correct.

[...]

The French have figured out a few things that we haven’t about how to live the good life. It’s the law there that your boss can’t email you on the weekend or force you to seem “fun” at work. They’re pushing back hard against having two more years of their lives stolen from them by work, and good for them. Press accounts often point out that France is an “outlier” even in Europe, where retirement ages tend to be higher. But they’re an outlier in a good way, and instead of France raising its retirement age, other countries should strive to give people the kinds of comfortable retirements that France does. (France has one of the lowest elder poverty rates, around 4 percent, while the U.S. is over 20 percent). I hope the French give Macron the kind of fight they gave King Louis XVI when he put the comfort of the rich over the basic entitlements of the people. They are fighting for the kinds of satisfying lives that everyone on Earth should get.

889 notes

·

View notes

Text

We can’t go on like this. Between oligarchs directly squeezing employees to their Republican puppets cutting and blocking aid were on the precipice of a catastrophe. Possibly more than half the population could be broke, without insurance, and homeless in a few years.

We need to remove the Republicans and start passing drastic social legislation to stave off this impending crisis.

#republican assholes#oligarch assholes#social security#Individual Retirement Accounts#pension plans#retirement#retirement crisis#traitor trump#crooked donald#republican hypocrisy#republican values#republican family values#maga morons#never trump

131 notes

·

View notes

Text

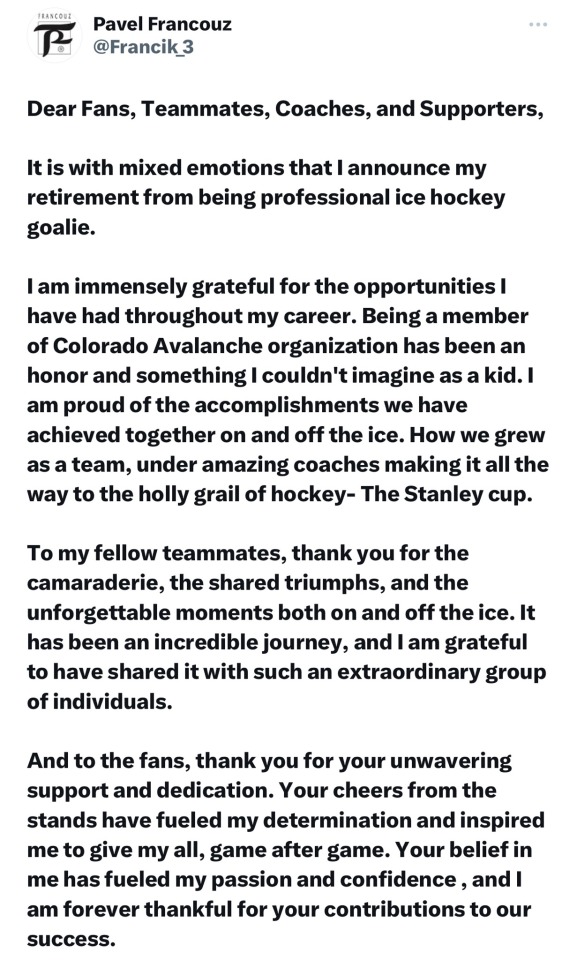

forever #39 in our hearts & forever a stanley cup champion 🤧❤️

#oh my precious goalie#oh my god#i’m still torn up#i knew it was coming but#i’m just a girl#pavel francouz#colorado avalanche#nhl#retirement#avs news#goalies

86 notes

·

View notes

Text

Just a quick note that I am retiring this fan page and will no longer be updating it with Pedro content. tl;dr it's not needed anymore in this fandom.

I started it when Pedro had fewer than 5k followers here on Tumblr. Now there are hundreds of thousands, and big blogs sharing his work more widely, more quickly, and impactfully, than I ever could. My tiny pebble in the lake to promote his work, and him as a wonderful person, no longer has any impact. An argument could be made it never did. And I see the direction this fandom in general is going, and it's not a good fit for me. But I hope at least something I posted helped someone get to know Pedro and his work in a positive way. I'm not taking this page down, just no longer updating it.

In conjunction with giving up on the Reddit sub I started for Pedro, it feels like the right time to shut this door. I wish everyone supporting Pedro in a positive way a happy Pedro experience.

255 notes

·

View notes

Text

Retired MafiaBakugo HC

Bakugo isn't that much older than you, he just acts like he is. His body aches sometimes, muscles spasming or clenching involuntarily. If he steps wrong his knee pops out of place and you've got to push it back in. There's bullet wounds you don't like to look at for too long since he only has them because of you.

Playfully you call him your old man, to which he responds one of two ways. On tired days: he'll sigh, hands reaching for you while he growls out an "I know."

On those days where he's feeling more like himself, he'll bark, face scrunching into a snarl. "I'm not old dammit! We're nearly the same fucking age!"

You especially like saying it while he's busy doing something. Like how he struggles bench pressing while snarling at you, or the one time he fucked up his measuring too busy arguing with you. You're just such a big distraction, can't think of anything else once you've gotten his attention.

Bakugo still acts like he's in the Mafia, he can't help it. You've tried to teach this old dog new tricks but he found his tricks transfer over real well. When ever new people come around he squares up and cracks his neck. He stares them down all scary and intimidating. He takes up as much space as possible when entering a room.

Your husband when not on the phone rest it on his crotch and inner thigh just like he used to with his gun.

He speaks to you without speaking to you. Blinks for just a second longer when he's about to lose his temper. You rush into conversations all polite and open-minded. Even though the conversations have moved from negotiations that could end in death, to "I'm surprised you do all the house work." Sometimes it just means you need to take a breath and let the argument end where it is.

He'll raise his pointer finger and beckon you closer with a curl from the end. He watches you carefully waiting for you to tap your finger twice as a signal to him. Though now it's only reserved for when you can't breathe while he's down your throat, he remembers it from when things would start to get unsafe. Your husband watches for that fake smile you give, flashing a single one of your fangs. You use it when you need to get out of places, this includes awkward conversations.

You've grown used to his paranoia. Checking the locks on the doors everytime he passes them. Keeping the garage key opposite to where the garage is. Occasionally he'll take a different route home just to see if that car was really following him. You learned not to get too attached to these houses after the third move, to which your husband promised was your last. True to his word you've lived stabile in this home just fine.

You've grown used to his nightmares, finger twitching in his sleep like it's still on the trigger. Groans that arch his back, and have him double over his stomach. He can still feel the searing pain that comes with the bullets. The ones that penetrate leave mark deep with his brain despite never coming close to his head. He only remembers them, because they're yours. Because the bullets were fired for you, shots that never hit but were supposed too. He was lucky enough to jump in the way in time, shooting out his rounds just moments before he was even hit.

Katsuki killed that bastard. There's no question about it. It was nice and slow, and he'd do it again.

#headcanon#katsuki bakugo x reader#katsuki bakugo x you#mafia au#retirement#bakugou katsuki#x reader#bnha#domestic fluff

187 notes

·

View notes

Video

Melo Monday

450 notes

·

View notes