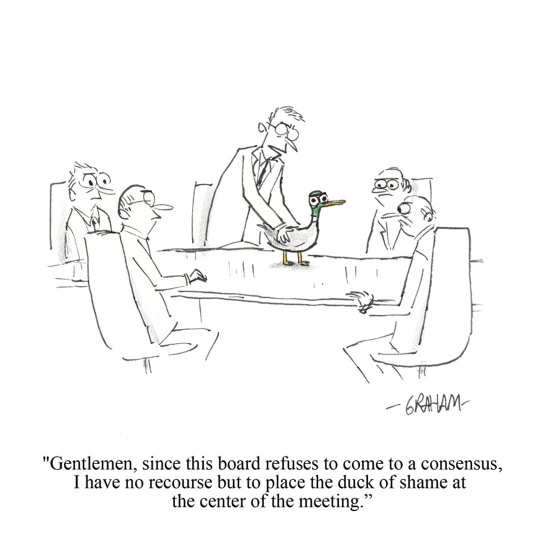

#business

Text

Feel its power.

1K notes

·

View notes

Text

I will not be calling Twitter “X”. I will not be calling HBOMax “Max”. And I will never call Facebook “Meta”.

These names are the branding equivalent of greige. Uninspired, personality-less “minimalist” rebranding die challenge.

8K notes

·

View notes

Text

What kind of bubble is AI?

My latest column for Locus Magazine is "What Kind of Bubble is AI?" All economic bubbles are hugely destructive, but some of them leave behind wreckage that can be salvaged for useful purposes, while others leave nothing behind but ashes:

https://locusmag.com/2023/12/commentary-cory-doctorow-what-kind-of-bubble-is-ai/

Think about some 21st century bubbles. The dotcom bubble was a terrible tragedy, one that drained the coffers of pension funds and other institutional investors and wiped out retail investors who were gulled by Superbowl Ads. But there was a lot left behind after the dotcoms were wiped out: cheap servers, office furniture and space, but far more importantly, a generation of young people who'd been trained as web makers, leaving nontechnical degree programs to learn HTML, perl and python. This created a whole cohort of technologists from non-technical backgrounds, a first in technological history. Many of these people became the vanguard of a more inclusive and humane tech development movement, and they were able to make interesting and useful services and products in an environment where raw materials – compute, bandwidth, space and talent – were available at firesale prices.

Contrast this with the crypto bubble. It, too, destroyed the fortunes of institutional and individual investors through fraud and Superbowl Ads. It, too, lured in nontechnical people to learn esoteric disciplines at investor expense. But apart from a smattering of Rust programmers, the main residue of crypto is bad digital art and worse Austrian economics.

Or think of Worldcom vs Enron. Both bubbles were built on pure fraud, but Enron's fraud left nothing behind but a string of suspicious deaths. By contrast, Worldcom's fraud was a Big Store con that required laying a ton of fiber that is still in the ground to this day, and is being bought and used at pennies on the dollar.

AI is definitely a bubble. As I write in the column, if you fly into SFO and rent a car and drive north to San Francisco or south to Silicon Valley, every single billboard is advertising an "AI" startup, many of which are not even using anything that can be remotely characterized as AI. That's amazing, considering what a meaningless buzzword AI already is.

So which kind of bubble is AI? When it pops, will something useful be left behind, or will it go away altogether? To be sure, there's a legion of technologists who are learning Tensorflow and Pytorch. These nominally open source tools are bound, respectively, to Google and Facebook's AI environments:

https://pluralistic.net/2023/08/18/openwashing/#you-keep-using-that-word-i-do-not-think-it-means-what-you-think-it-means

But if those environments go away, those programming skills become a lot less useful. Live, large-scale Big Tech AI projects are shockingly expensive to run. Some of their costs are fixed – collecting, labeling and processing training data – but the running costs for each query are prodigious. There's a massive primary energy bill for the servers, a nearly as large energy bill for the chillers, and a titanic wage bill for the specialized technical staff involved.

Once investor subsidies dry up, will the real-world, non-hyperbolic applications for AI be enough to cover these running costs? AI applications can be plotted on a 2X2 grid whose axes are "value" (how much customers will pay for them) and "risk tolerance" (how perfect the product needs to be).

Charging teenaged D&D players $10 month for an image generator that creates epic illustrations of their characters fighting monsters is low value and very risk tolerant (teenagers aren't overly worried about six-fingered swordspeople with three pupils in each eye). Charging scammy spamfarms $500/month for a text generator that spits out dull, search-algorithm-pleasing narratives to appear over recipes is likewise low-value and highly risk tolerant (your customer doesn't care if the text is nonsense). Charging visually impaired people $100 month for an app that plays a text-to-speech description of anything they point their cameras at is low-value and moderately risk tolerant ("that's your blue shirt" when it's green is not a big deal, while "the street is safe to cross" when it's not is a much bigger one).

Morganstanley doesn't talk about the trillions the AI industry will be worth some day because of these applications. These are just spinoffs from the main event, a collection of extremely high-value applications. Think of self-driving cars or radiology bots that analyze chest x-rays and characterize masses as cancerous or noncancerous.

These are high value – but only if they are also risk-tolerant. The pitch for self-driving cars is "fire most drivers and replace them with 'humans in the loop' who intervene at critical junctures." That's the risk-tolerant version of self-driving cars, and it's a failure. More than $100b has been incinerated chasing self-driving cars, and cars are nowhere near driving themselves:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Quite the reverse, in fact. Cruise was just forced to quit the field after one of their cars maimed a woman – a pedestrian who had not opted into being part of a high-risk AI experiment – and dragged her body 20 feet through the streets of San Francisco. Afterwards, it emerged that Cruise had replaced the single low-waged driver who would normally be paid to operate a taxi with 1.5 high-waged skilled technicians who remotely oversaw each of its vehicles:

https://www.nytimes.com/2023/11/03/technology/cruise-general-motors-self-driving-cars.html

The self-driving pitch isn't that your car will correct your own human errors (like an alarm that sounds when you activate your turn signal while someone is in your blind-spot). Self-driving isn't about using automation to augment human skill – it's about replacing humans. There's no business case for spending hundreds of billions on better safety systems for cars (there's a human case for it, though!). The only way the price-tag justifies itself is if paid drivers can be fired and replaced with software that costs less than their wages.

What about radiologists? Radiologists certainly make mistakes from time to time, and if there's a computer vision system that makes different mistakes than the sort that humans make, they could be a cheap way of generating second opinions that trigger re-examination by a human radiologist. But no AI investor thinks their return will come from selling hospitals that reduce the number of X-rays each radiologist processes every day, as a second-opinion-generating system would. Rather, the value of AI radiologists comes from firing most of your human radiologists and replacing them with software whose judgments are cursorily double-checked by a human whose "automation blindness" will turn them into an OK-button-mashing automaton:

https://pluralistic.net/2023/08/23/automation-blindness/#humans-in-the-loop

The profit-generating pitch for high-value AI applications lies in creating "reverse centaurs": humans who serve as appendages for automation that operates at a speed and scale that is unrelated to the capacity or needs of the worker:

https://pluralistic.net/2022/04/17/revenge-of-the-chickenized-reverse-centaurs/

But unless these high-value applications are intrinsically risk-tolerant, they are poor candidates for automation. Cruise was able to nonconsensually enlist the population of San Francisco in an experimental murderbot development program thanks to the vast sums of money sloshing around the industry. Some of this money funds the inevitabilist narrative that self-driving cars are coming, it's only a matter of when, not if, and so SF had better get in the autonomous vehicle or get run over by the forces of history.

Once the bubble pops (all bubbles pop), AI applications will have to rise or fall on their actual merits, not their promise. The odds are stacked against the long-term survival of high-value, risk-intolerant AI applications.

The problem for AI is that while there are a lot of risk-tolerant applications, they're almost all low-value; while nearly all the high-value applications are risk-intolerant. Once AI has to be profitable – once investors withdraw their subsidies from money-losing ventures – the risk-tolerant applications need to be sufficient to run those tremendously expensive servers in those brutally expensive data-centers tended by exceptionally expensive technical workers.

If they aren't, then the business case for running those servers goes away, and so do the servers – and so do all those risk-tolerant, low-value applications. It doesn't matter if helping blind people make sense of their surroundings is socially beneficial. It doesn't matter if teenaged gamers love their epic character art. It doesn't even matter how horny scammers are for generating AI nonsense SEO websites:

https://twitter.com/jakezward/status/1728032634037567509

These applications are all riding on the coattails of the big AI models that are being built and operated at a loss in order to be profitable. If they remain unprofitable long enough, the private sector will no longer pay to operate them.

Now, there are smaller models, models that stand alone and run on commodity hardware. These would persist even after the AI bubble bursts, because most of their costs are setup costs that have already been borne by the well-funded companies who created them. These models are limited, of course, though the communities that have formed around them have pushed those limits in surprising ways, far beyond their original manufacturers' beliefs about their capacity. These communities will continue to push those limits for as long as they find the models useful.

These standalone, "toy" models are derived from the big models, though. When the AI bubble bursts and the private sector no longer subsidizes mass-scale model creation, it will cease to spin out more sophisticated models that run on commodity hardware (it's possible that Federated learning and other techniques for spreading out the work of making large-scale models will fill the gap).

So what kind of bubble is the AI bubble? What will we salvage from its wreckage? Perhaps the communities who've invested in becoming experts in Pytorch and Tensorflow will wrestle them away from their corporate masters and make them generally useful. Certainly, a lot of people will have gained skills in applying statistical techniques.

But there will also be a lot of unsalvageable wreckage. As big AI models get integrated into the processes of the productive economy, AI becomes a source of systemic risk. The only thing worse than having an automated process that is rendered dangerous or erratic based on AI integration is to have that process fail entirely because the AI suddenly disappeared, a collapse that is too precipitous for former AI customers to engineer a soft landing for their systems.

This is a blind spot in our policymakers debates about AI. The smart policymakers are asking questions about fairness, algorithmic bias, and fraud. The foolish policymakers are ensnared in fantasies about "AI safety," AKA "Will the chatbot become a superintelligence that turns the whole human race into paperclips?"

https://pluralistic.net/2023/11/27/10-types-of-people/#taking-up-a-lot-of-space

But no one is asking, "What will we do if" – when – "the AI bubble pops and most of this stuff disappears overnight?"

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/19/bubblenomics/#pop

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

--

tom_bullock (modified)

https://www.flickr.com/photos/tombullock/25173469495/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

4K notes

·

View notes

Photo

38K notes

·

View notes

Text

We don't just need to bring back mixed-use zoning, we also need to bring back corner stores where the owner lives on the second floor. Heck, I'm pretty sure that's the only way to prevent mixed-use zones from being cannibalised by corporate horseshit in our present climate: only allow businesses which are also the owner's primary residence.

4K notes

·

View notes

Text

29K notes

·

View notes

Text

Hi I'm newly here and I'm ready for all kind of fun and vibes🥰

#transgender#beauty#trans nsft#transisbeautiful#transgirl#trans love#trans man#trans lover#ig bios#igbtq#igbtq community#igbt#igbtq positivity#autos#business

2K notes

·

View notes

Text

#if you listen to the end you either get a secret message or you'll have wasted your precious time on earth being tricked by a nefarious tag#aren't you excited to see which one it is#it's probably just a trick to make you waste your time#drum up some notes#that's marketing babey#sales#business#charts#KPIs#suits#uhhhhhhh#branding#touch base#logistics#circle around#as per my last email

3K notes

·

View notes

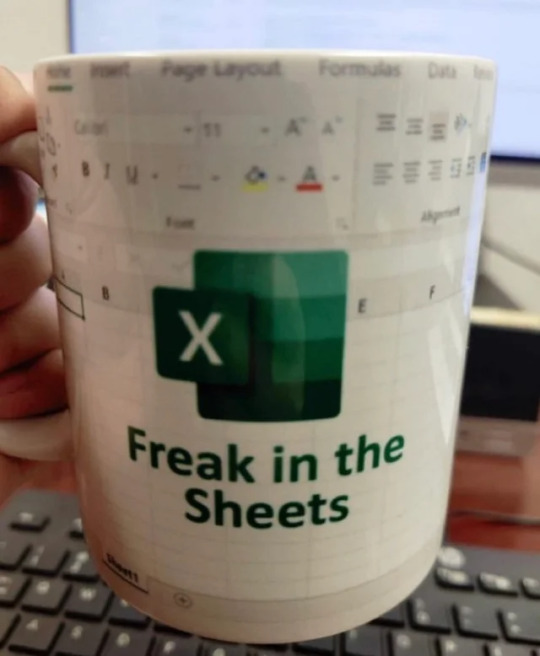

Photo

Here’s the secret most ecommerce platforms don’t want you to find out: with most of them, you don’t actually own your store. They own it – along with your data. WE KNOW. Kinda backwards, right? Instead of renting your store, own your future. Make it yours with WooCommerce and start selling online today.

9K notes

·

View notes

Text

Convert Images Between WebP and PNG Formats for Free

As someone who runs a small business online, I'm always looking for ways to optimize my images without sacrificing quality. That's why I was excited to find webppng.com, a free online image converter that lets you quickly switch between WebP and PNG file formats.

For those not familiar, WebP is an advanced compressed image type created by Google that can drastically reduce file sizes compared to PNGs. The only catch is that some older browsers don't support WebP.

That's where webppng.com comes in! Their free WebP to PNG converter lets me upload my WebP product photos and download optimized PNG versions compatible with more websites and apps. And when I have PNGs, their PNG to WebP converter lets me benefit from the smaller file sizes of the WebP format.

I love that webppng.com offers:

Fast bulk conversion right in your browser

Preserved image quality with customizable compression

An easy drag and drop interface that's simple to use

Unlimited usage with no hidden costs or limits

Being able to seamlessly switch between WebP and PNG has been a huge help for my small online store. I can have smaller WebP files for modern browsers while still supporting PNGs for maximum compatibility across platforms.

If you work with lots of product images like me, I'd definitely recommend checking out webppng.com's free WebP and PNG converter. It's an easy way to optimize your site's images for speed and performance.

2K notes

·

View notes

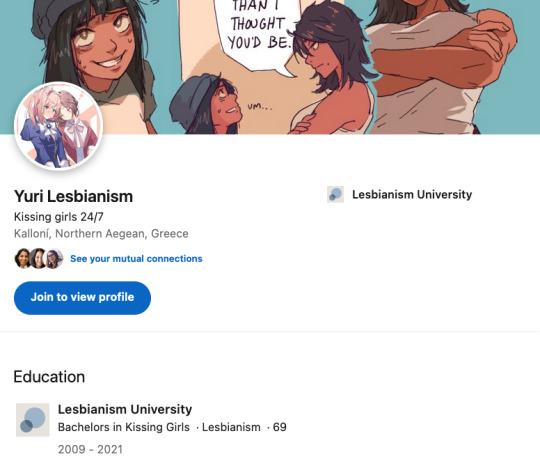

Text

hi guys i made a linkedin account, can fellow Lesbianism University alumni follow me? ^-^

im very businesscore and super productivity oriented, i post very insightful business related content :3

1K notes

·

View notes

Text

[earlier] "Your vintage-style handmade chest business is struggling. But I have a plan."

Treasure Chests [Explained]

Transcript Under the Cut

[Black Hat is holding a treasure chest in one hand and pointing with a stick to a poster that features a shovel at the top, three circled X's below it, and five question marks around them.]

Black Hat: First, I'll fill three of these chests with $1,000 each in small silver and gold coins, and take videos of them being buried in unidentified lawns around town.

Black Hat: Next year, I post the videos.

Black Hat: Then we sit back and let the local kids do the rest.

[Caption below the panel:] The proposal for creating business for our lawn care company was unorthodox but extremely effective.

914 notes

·

View notes

Text

Takeaways from my mentor

I meet with my mentor as and when he’s available. He manages my family’s money and he’s very good at what he does - his firm manages about $5 billion, and I have great conversations with him.

I don’t want to talk too much about him, but he came from a lower middle class background and today is wealthy beyond comprehension. He could buy a plane or two in the middle of the night if he wanted.

Today we focused a lot of personal growth in my career.

He gave me two books - The Inheritors by Sonu Bhasin and Fortune’s Children by Arthur Vanderbilt.

Here are some brief takeaways:

Work backwards from the outcome you want.

Define the outcome of where you want to be and plan it backwards to your current position.

2. Eliminate, eliminate, eliminate.

Life is all about elimination. Don’t focus on your weaknesses, focus on your strengths. Eliminate all the things you know you’re not good at, you have no interest in and that make you depressed.

3. Intellectual honesty.

Be honest with yourself about things you are good at and are not. The easiest person to fool is yourself.

4. Read one business biography a week.

Everything you’re going in life, there’s a 99% chance someone else has gone through it and come out of it victorious. He also mentioned this article.

5. Outline 3 strengths and 3 weaknesses.

6. (In business/ corporate careers) You’re either primarily an investor (you’d rather fund companies and start ups than start them), an operator (you’d rather build something hands on), or a manager (you’d rather periodically manage something hands off. Like for instance you could have your own franchise bakery chain where you don’t need to exercise minute control over every franchise but you still ensure that there’s some managing done from your part).

7. Do not have extreme ideologies at this age.

Not when it comes to religion, politics, etc.

8. Emotions, money and your time are something you need to be ruthless about. Absolutely ruthless.

Be careful about the friends you have and the influence they have on you.

#ceo aesthetic#that girl#personal growth#strong women#powerful woman#balance#getting your life together#c suite#q/a#productivity#Business#Mentor#mentoring#takeaways#business advice#Corporate#success

1K notes

·

View notes

Text

On the one hand, yes, there's no obligation for an artist to have a "style", but on the other hand, if you're planning on drawing shit for money, taking the time to cultivate a handful of a specific styles for your portfolio can be hugely useful – not even in terms of giving people a clear idea of what exactly they're paying for (though there's definitely that), but in terms of managing your own workload.

The exact same composition drawn to the exact same spec could easily take ten times as much time and effort in style A as it does in style B, often for reasons that won't be obvious just from looking at the finished piece, and if you're winging your stylistic choices as you go, you'll have no idea which of those scenarios you're in.

Having an identifiable "style" isn't just a personal branding thing: it also makes it much, much easier to correctly assess what you're getting into with any given piece. Heck, I know a lot of artists who've taken the time to develop multiple distinct portfolio styles and charge different rates depending on which one the client wants.

1K notes

·

View notes

Text

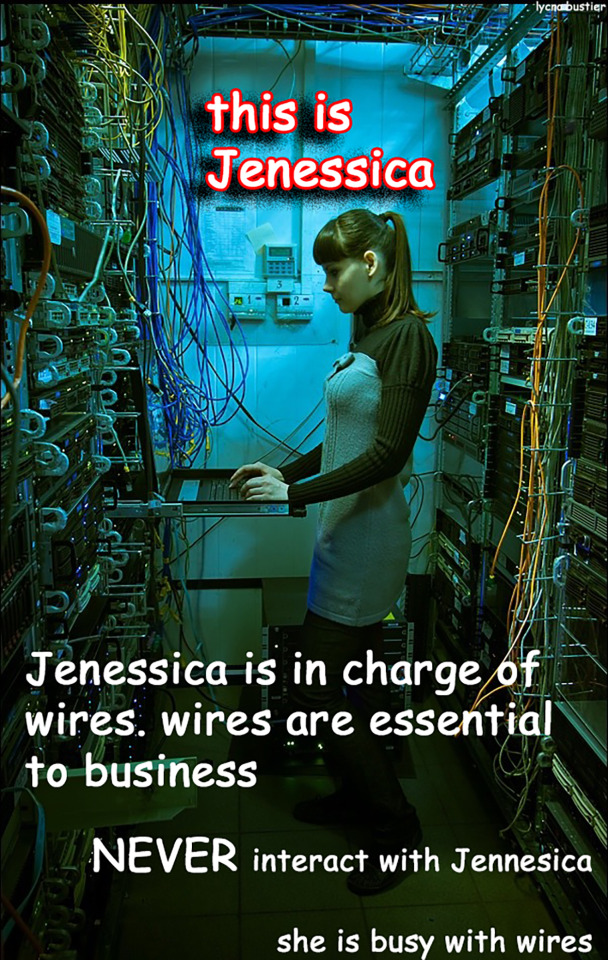

if you interact with Jenessica you will be reassigned to the JAR.

#business#businesscore#business memes#office space#memes#this is business#business tips#IT#business woman#server room#technology#wires#capitalist hell#officecore#corporate hell

555 notes

·

View notes

Text

✨ 𝑩𝒐𝒐𝒌𝒔 𝒐𝒏 𝑩𝒖𝒔𝒊𝒏𝒆𝒔𝒔 𝒂𝒏𝒅 𝑭𝒊𝒏𝒂𝒏𝒄𝒆 ✨

❣️ 𝑺𝒎𝒂𝒓𝒕 𝑾𝒐𝒎𝒆𝒏 𝑭𝒊𝒏𝒊𝒔𝒉 𝑹𝒊𝒄𝒉 - 𝑫𝒂𝒗𝒊𝒅 𝑩𝒂𝒄𝒉

❣️𝑻𝒉𝒆 𝑷𝒔𝒚𝒄𝒉𝒐𝒍𝒐𝒈𝒚 𝒐𝒇 𝑴𝒐𝒏𝒆𝒚: 𝑳𝒆𝒔𝒔𝒐𝒏𝒔 𝒐𝒏 𝑾𝒆𝒂𝒍𝒕𝒉, 𝑮𝒓𝒆𝒆𝒅 𝒂𝒏𝒅 𝑯𝒂𝒑𝒑𝒊𝒏𝒆𝒔𝒔 - 𝑴𝒐𝒓𝒈𝒂𝒏 𝑯𝒐𝒖𝒔𝒆𝒍

❣️𝑺𝒆𝒄𝒓𝒆𝒕𝒔 𝒐𝒇 𝒕𝒉𝒆 𝑴𝒊𝒍𝒍𝒊𝒐𝒏𝒂𝒊𝒓𝒆 𝑴𝒊𝒏𝒅: 𝑴𝒂𝒔𝒕𝒆𝒓𝒊𝒏𝒈 𝒕𝒉𝒆 𝑰𝒏𝒏𝒆𝒓 𝑮𝒂𝒎𝒆 𝒐𝒇 𝑾𝒆𝒂𝒍𝒕𝒉 - 𝑻. 𝑯𝒂𝒓𝒗 𝑬𝒌𝒆𝒓

❣️𝑹𝒊𝒄𝒉 𝑫𝒂𝒅, 𝑷𝒐𝒐𝒓 𝑫𝒂𝒅 - 𝑹𝒐𝒃𝒆𝒓𝒕 𝑲𝒊𝒚𝒐𝒔𝒂𝒌𝒊

❣️𝑻𝒉𝒆 𝑳𝒊𝒕𝒕𝒍𝒆 𝑩𝒐𝒐𝒌 𝒐𝒇 𝑪𝒐𝒎𝒎𝒐𝒏 𝑺𝒆𝒏𝒔𝒆 𝑰𝒏𝒗𝒆𝒔𝒕𝒊𝒏𝒈: 𝑻𝒉𝒆 𝑶𝒏𝒍𝒚 𝑾𝒂𝒚 𝒕𝒐 𝑮𝒖𝒂𝒓𝒂𝒏𝒕𝒆𝒆 𝒀𝒐𝒖𝒓 𝑭𝒂𝒊𝒓 𝑺𝒉𝒂𝒓𝒆 𝒐𝒇 𝑺𝒕𝒐𝒄𝒌 𝑴𝒂𝒓𝒌𝒆𝒕 𝑹𝒆𝒕𝒖𝒓𝒏𝒔 - 𝑱𝒐𝒉𝒏 𝑪. 𝑩𝒐𝒈𝒍𝒆

❣️𝑻𝒉𝒊𝒏𝒌 𝒂𝒏𝒅 𝑮𝒓𝒐𝒘 𝑹𝒊𝒄𝒉 - 𝑵𝒂𝒑𝒐𝒍𝒆𝒐𝒏 𝑯𝒊𝒍𝒍

❣️𝑨 𝑹𝒂𝒏𝒅𝒐𝒎 𝒘𝒂𝒍𝒌 𝒅𝒐𝒘𝒏 𝒕𝒉𝒆 𝒔𝒕𝒓𝒆𝒆𝒕 : 𝑰𝒏𝒄𝒍𝒖𝒅𝒊𝒏𝒈 𝒂 𝑳𝒊𝒇𝒆 𝑪𝒚𝒄𝒍𝒆 𝑮𝒖𝒊𝒅𝒆 𝒕𝒐 𝑷𝒆𝒓𝒔𝒐𝒏𝒂𝒍 𝑰𝒏𝒗𝒆𝒔𝒕𝒊𝒏𝒈 - 𝑩𝒖𝒓𝒕𝒐𝒏 𝑴𝒂𝒍𝒌𝒊𝒆𝒍

❣️𝑼𝒏𝒔𝒄𝒓𝒊𝒑𝒕𝒆𝒅 : 𝑳𝒊𝒇𝒆, 𝑳𝒊𝒃𝒆𝒓𝒕𝒚 𝒂𝒏𝒅 𝒕𝒉𝒆 𝑷𝒖𝒓𝒔𝒖𝒊𝒕 𝒐𝒇 𝑬𝒏𝒕𝒓𝒆𝒑𝒓𝒆𝒏𝒆𝒖𝒓𝒔𝒉𝒊𝒑 - 𝑴.𝑱 𝑫𝒆𝑴𝒂𝒓𝒄𝒐

❣️𝑻𝒉𝒆 𝒕𝒐𝒕𝒂𝒍 𝒎𝒐𝒏𝒆𝒚 𝒎𝒂𝒌𝒆𝒐𝒗𝒆𝒓 - 𝑫𝒂𝒗𝒆 𝑹𝒂𝒎𝒔𝒆𝒚

❣️𝑻𝒉𝒆 𝒎𝒊𝒍𝒍𝒊𝒐𝒏𝒂𝒊𝒓𝒆 𝒏𝒆𝒙𝒕 𝒅𝒐𝒐𝒓: 𝑻𝒉𝒆 𝑺𝒖𝒓𝒑𝒓𝒊𝒔𝒊𝒏𝒈 𝑺𝒆𝒄𝒓𝒆𝒕𝒔 𝒐𝒇 𝑨𝒎𝒆𝒓𝒊𝒄𝒂'𝒔 𝑾𝒆𝒂𝒍𝒕𝒉𝒚 - 𝑻𝒉𝒐𝒎𝒂𝒔 𝑱. 𝑺𝒕𝒂𝒏𝒍𝒆𝒚

❣️𝑻𝒓𝒊𝒃𝒆𝒔 - 𝑺𝒆𝒕𝒉 𝑮𝒐𝒅𝒊𝒏

❣️𝑻𝒉𝒆 𝑪𝒖𝒍𝒕𝒖𝒓𝒆 𝑴𝒂𝒑 : 𝑩𝒓𝒆𝒂𝒌𝒊𝒏𝒈 𝑻𝒉𝒓𝒐𝒖𝒈𝒉 𝒕𝒉𝒆 𝑰𝒏𝒗𝒊𝒔𝒊𝒃𝒍𝒆 𝑩𝒐𝒖𝒏𝒅𝒂𝒓𝒊𝒆𝒔 𝒐𝒇 𝑮𝒍𝒐𝒃𝒂𝒍 𝑩𝒖𝒔𝒊𝒏𝒆𝒔𝒔 - 𝑬𝒓𝒊𝒏 𝑴𝒆𝒚𝒆𝒓

❣️𝑻𝒉𝒆 𝑹𝒊𝒄𝒉𝒆𝒔𝒕 𝑴𝒂𝒏 𝒊𝒏 𝑩𝒂𝒃𝒚𝒍𝒐𝒏 - 𝑮𝒆𝒐𝒓𝒈𝒆 𝑺𝒂𝒎𝒖𝒆𝒍 𝑪𝒍𝒂𝒔𝒐𝒏

❣️𝑻𝒉𝒆 𝑰𝒏𝒕𝒆𝒍𝒍𝒊𝒈𝒆𝒏𝒕 𝑰𝒏𝒗𝒆𝒔𝒕𝒐𝒓 - 𝑩𝒆𝒏𝒋𝒂𝒎𝒊𝒏 𝑮𝒓𝒂𝒉𝒂𝒎

❣️𝑹𝒂𝒅𝒊𝒄𝒂𝒍 𝑪𝒂𝒏𝒅𝒐𝒓 : 𝑯𝒐𝒘 𝒕𝒐 𝑮𝒆𝒕 𝑾𝒉𝒂𝒕 𝒀𝒐𝒖 𝑾𝒂𝒏𝒕 𝒃𝒚 𝑺𝒂𝒚𝒊𝒏𝒈 𝑾𝒉𝒂𝒕 𝒀𝒐𝒖 𝑴𝒆𝒂𝒏 - 𝑲𝒊𝒎 𝑺𝒄𝒐𝒕𝒕

❣️𝑵𝒆𝒗𝒆𝒓 𝑺𝒑𝒍𝒊𝒕 𝒕𝒉𝒆 𝑫𝒊𝒇𝒇𝒆𝒓𝒆𝒏𝒄𝒆 : 𝑵𝒆𝒈𝒐𝒕𝒊𝒂𝒕𝒊𝒏𝒈 𝑨𝒔 𝑰𝒇 𝒀𝒐𝒖'𝒓𝒆 𝑳𝒊𝒇𝒆 𝑫𝒆𝒑𝒆𝒏𝒅𝒆𝒏𝒕 𝒐𝒏 𝑰𝒕 - 𝑪𝒉𝒓𝒊𝒔𝒕𝒐𝒑𝒉𝒆𝒓 𝑽𝒐𝒔𝒔 & 𝑻𝒂𝒉𝒍 𝑹𝒂𝒛

❣️𝑰𝒏𝒇𝒍𝒖𝒆𝒏𝒄𝒆: 𝑻𝒉𝒆 𝒑𝒔𝒚𝒄𝒉𝒐𝒍𝒐𝒈𝒚 𝒐𝒇 𝒑𝒆𝒓𝒔𝒖𝒂𝒔𝒊𝒐𝒏 - 𝑹𝒐𝒃𝒆𝒓𝒕 𝑪𝒊𝒂𝒍𝒅𝒊𝒏𝒊

❣️𝑻𝒉𝒆 𝑨𝒍𝒎𝒂𝒏𝒂𝒄𝒌 𝒐𝒇 𝑵𝒂𝒗𝒂𝒍 𝑹𝒂𝒗𝒊𝒌𝒂𝒏𝒕 : 𝑨 𝑮𝒖𝒊𝒅𝒆 𝒕𝒐 𝑾𝒆𝒂𝒍𝒕𝒉 𝒂𝒏𝒅 𝑯𝒂𝒑𝒑𝒊𝒏𝒆𝒔𝒔 - 𝑬𝒓𝒊𝒄 𝑱𝒐𝒓𝒈𝒆𝒏𝒔𝒐𝒏

❣️𝑻𝒉𝒆 𝑾𝒂𝒚 𝒐𝒇 𝒕𝒉𝒆 𝑺𝒖𝒑𝒆𝒓𝒊𝒐𝒓 𝑴𝒂𝒏 - 𝑫𝒂𝒗𝒊𝒅 𝑫𝒆𝒊𝒅𝒂

❣️𝑻𝒉𝒆 𝑴𝒊𝒍𝒍𝒊𝒐𝒏𝒂𝒊𝒓𝒆 𝑭𝒂𝒔𝒕𝒍𝒊𝒏𝒆 : 𝑪𝒓𝒂𝒄𝒌 𝒕𝒉𝒆 𝑪𝒐𝒅𝒆 𝒇𝒐𝒓 𝑾𝒆𝒂𝒍𝒕𝒉 𝒂𝒏𝒅 𝑳𝒊𝒗𝒆 𝑹𝒊𝒄𝒉 𝒇𝒐𝒓 𝑨 𝑳𝒊𝒇𝒆𝒕𝒊𝒎𝒆 - 𝑴.𝑱. 𝑫𝒆𝑴𝒂𝒓𝒄𝒐

❣️𝑻𝒉𝒆 𝑫𝒆𝒇𝒊𝒏𝒊𝒏𝒈 𝑫𝒆𝒄𝒂𝒅𝒆 : 𝑾𝒉𝒚 𝒚𝒐𝒖𝒓 𝑻𝒘𝒆𝒏𝒕𝒊𝒆𝒔 𝑴𝒂𝒕𝒕𝒆𝒓 𝒂𝒏𝒅 𝑯𝒐𝒘 𝒕𝒐 𝑴𝒂𝒌𝒆 𝒕𝒉𝒆 𝑴𝒐𝒔𝒕 𝒐𝒇 𝒕𝒉𝒆𝒎 𝑵𝒐𝒘 -𝑴𝒆𝒈 𝑱𝒂𝒚

❣️ 𝑴𝑶𝑵𝑬𝒀 𝑴𝒂𝒔𝒕𝒆𝒓 𝒕𝒉𝒆 𝑮𝒂𝒎𝒆 : 𝟕 𝑺𝒊𝒎𝒑𝒍𝒆 𝑺𝒕𝒆𝒑𝒔 𝒕𝒐 𝑭𝒊𝒏𝒂𝒏𝒄𝒊𝒂𝒍 𝑭𝒓𝒆𝒆𝒅𝒐𝒎 - 𝑻𝒐𝒏𝒚 𝑹𝒐𝒃𝒃𝒊𝒏𝒔

❣️𝑴𝒊𝒍𝒍𝒊𝒐𝒏𝒂𝒊𝒓𝒆 𝑺𝒖𝒄𝒄𝒆𝒔𝒔 𝑯𝒂𝒃𝒊𝒕𝒔 - 𝑫𝒆𝒂𝒏 𝑮𝒓𝒂𝒛𝒊𝒐𝒔𝒊

❣️𝑻𝒉𝒆 𝑹𝒖𝒍𝒆𝒔 𝒐𝒇 𝑾𝒆𝒂𝒍𝒕𝒉 - 𝑹𝒊𝒄𝒉𝒂𝒓𝒅 𝑻𝒆𝒎𝒑𝒍𝒂𝒓

❣️𝑹𝒊𝒄𝒉 𝑫𝒂𝒅'𝒔 𝑪𝒐𝒏𝒔𝒑𝒊𝒓𝒂𝒄𝒚 𝒐𝒇 𝒕𝒉𝒆 𝑹𝒊𝒄𝒉: 𝑻𝒉𝒆 𝟖 𝑵𝒆𝒘 𝑹𝒖𝒍𝒆𝒔 𝒐𝒇 𝑴𝒐𝒏𝒆𝒚 - 𝑹𝒐𝒃𝒆𝒓𝒕 𝑲𝒊𝒚𝒐𝒔𝒂𝒌𝒊

❣️𝑩𝒖𝒊𝒍𝒅 𝒀𝒐𝒖𝒓 𝑭𝒂𝒎𝒊𝒍𝒚 𝑩𝒂𝒏𝒌: 𝑨 𝑾𝒊𝒏𝒏𝒊𝒏𝒈 𝑽𝒊𝒔𝒊𝒐𝒏 𝒇𝒐𝒓 𝑴𝒖𝒍𝒕𝒊𝒈𝒆𝒏𝒆𝒓𝒂𝒕𝒊𝒐𝒏𝒂𝒍 𝑾𝒆𝒂𝒍𝒕𝒉- 𝑬𝒎𝒊𝒍𝒚 𝑮𝒓𝒊𝒇𝒇𝒊𝒕𝒉𝒔-𝑯𝒂𝒎𝒊𝒍𝒕𝒐𝒏

❣️𝑴𝒐𝒏𝒆𝒚. 𝑾𝒆𝒂𝒍𝒕𝒉. 𝑳𝒊𝒇𝒆 𝑰𝒏𝒔𝒖𝒓𝒂𝒏𝒄𝒆: 𝑯𝒐𝒘 𝒕𝒉𝒆 𝑾𝒆𝒂𝒍𝒕𝒉𝒚 𝑼𝒔𝒆 𝑳𝒊𝒇𝒆 𝑰𝒏𝒔𝒖𝒓𝒂𝒏𝒄𝒆 𝑨𝒔 𝒂 𝑻𝒂𝒙-𝑭𝒓𝒆𝒆 𝑷𝒆𝒓𝒔𝒐𝒏𝒂𝒍 𝑩𝒂𝒏𝒌 𝒕𝒐 𝑺𝒖𝒑𝒆𝒓𝒄𝒉𝒂𝒓𝒈𝒆 𝑻𝒉𝒆𝒊𝒓 𝑺𝒂𝒗𝒊𝒏𝒈𝒔-𝑱𝒂𝒌𝒆 𝑻𝒉𝒐𝒎𝒑𝒔𝒐𝒏

#affirmdaily#law of assumption#self concept#neville goddard#entrepreneur#business#subconscious#money#wealth#success story#luxury#wealthy#sofia richie#lori harvey

2K notes

·

View notes