#VC PE Funds

Text

Seeking Funding for FLYING METALS - The Aerospace B2B E-commerce Supply Chain

We have an excellent Investment Opportunity - FLYING METALS - The Aerospace B2B Supply Chain Management Ecommerce the world's First. Solving the Supply Chain problems for Aerospace Industry. Inflation Fight? Invest with FLYING METALS, The Best Investments

DRONES FLYING METALS PTY LTD AUSTRALIA INDIA SINGAPORE

FLYING METALS PTY LTD

www.flyingmetals.com

What ‘Flying Metals’ is all about / The Product:

FLYING METALS

At ‘Flying Metals’, we provide the latest and the most modern B2B Marketplace specifically for the aerospace Industry connecting Buyers with Suppliers.

We are building the World’s Largest E Commerce B2B platform for Aerospace…

View On WordPress

#Aerospace#aircraft#Airplanes#aviation#B2B#b2b cloud#B2B Ecommerce#b2b platform#Capital Funding#ecommerce for avaition#Family Offices#flight metals#flying metals#funding#Investors#Private Equity Finance#raising funds#Shrikant Shete MD & CEO#VC Funds#VC PE Funds#Venture Capital

2 notes

·

View notes

Text

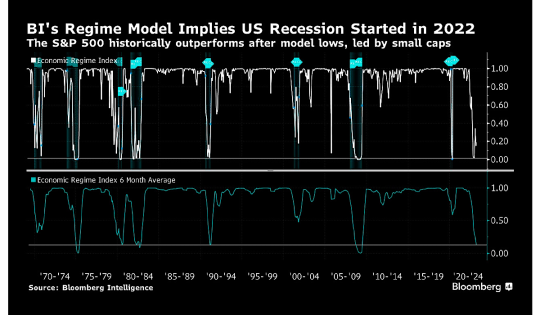

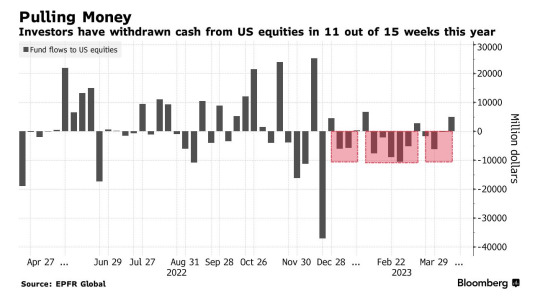

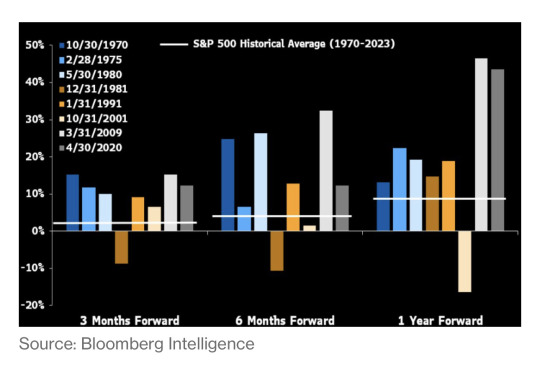

Optimism in the ….

Case for Stocks Is Seen in Model Showing Economic Bottom Is Past

https://www.bloomberg.com/news/articles/2023-04-16/case-for-stocks-is-seen-in-model-showing-economic-bottom-is-past?srnd=premium&sref=G3KZUlEH #fed #fund #equity #investor #ennovance

#privateequity#chemicals#ennovance#economy#investor#pe#equity#debt#loan#energy#credit#fund#investors#finance#manufacturing#merger#healthcare#vc#asc#bubble

5 notes

·

View notes

Text

What Private Equity Firms Are and How They Operate

Private equity firms can raise money from institutional investors like pension funds and insurance companies. Corporations utilize private equity services that guide them in fundraising. Private equity firms hold more than 4 trillion USD in assets. Also, return on investment (ROI) makes this financial instrument remarkably attractive to investors. This post will elaborate on how private equity firms work.

What is a Private Equity Firm?

Private equity (PE) means the company is not publicly held. It allows companies to increase their financial capacity by offering investors partial ownership. Private equity services also help publicly listed companies become private by completely replacing previous owners.

Professional teams hired by private equity firms work on market trend analytics by outsourcing investment research and creating appropriate reports. An investment research report depicts the advantages and risks associated with each portfolio management decision.

Investing in private equity is financially riskier than traditional investment vehicles. Therefore, private equity funds use tried and tested investment strategies to redistribute risks. An experienced fund manager will use investors’ capital for private equity opportunities with an excellent ROI.

How Does Private Equity Work?

Private equity services can charge 2% of assets as management fees. Otherwise, they require 20% of gross profits if company ownership undergoes a thorough structural change.

Passive investors are known as limited partners (LPs) who do not affect the company’s decisions and policies. However, general partners (GPs) can determine managerial and executive strategies, affecting how the company operates.

Investment research outsourcing assists private equity firms in networking with more investors and optimizing their strategies for different industries. Besides, each investor can contribute to financial improvements by mentoring the company owners.

Therefore, private equity benefits the company by enriching its knowledge base with the recommendations made by veteran investors.

Types of Private Equity Investment Strategies

1| Venture Capital

Startups require financial assistance to launch their products and services or expand their production capabilities. Venture capital (VC) helps them secure capital resources and business management intelligence. After all, venture capitalists often have a personal connection with the startup ideas they support.

Venture capitalists use private equity services to evaluate investment decisions and a new company’s growth potential as part of their risk mitigation efforts. They share their knowledge with inexperienced young leaders at startups to increase efficiency and build stronger teams.

VC financing involves investing up to 10 million USD in different startups. So, successful investments in well-performing startups will balance the risks originating from the less stable business models of other firms.

2| Leveraged Buyouts

LBO means leveraged buyout, and private equity services utilize borrowed capital to acquire company ownership through this investment strategy. Additionally, a company’s assets are collateral for the respective debt.

This strategy helps private equity funds leverage their investments without committing financial capital directly. While the borrowed money attracts interest, the ROI of highly efficient companies can easily offset the repayment outflows. Many private equity firms have acquired new companies through multiple rounds of leveraged buyouts.

PE professionals often employ the LBO strategy when privatizing a public enterprise. Privatization results in decreased regulatory obligations and enhanced operational freedoms. Later, new ownership will implement policies to make the public enterprise more efficient and marketable.

You may also notice how LBO-based corporate acquisitions divide the company into segments with a narrower industry focus. Doing so makes selling the company and settling the debt obligations more flexible.

Conclusion

Unlisted companies explore unique outsourcing services to identify fundraising opportunities via extensive investment research. Private equity is a practical financial instrument that helps businesses generate the capital necessary for business expansion.

Simultaneously, general partners acquire decision-making authority and empower startups with business development insights. Therefore, private equity supports the companies on two frontiers: financial assistance and managerial mentorship.

A leader in investment research outsourcing, SG Analytics helps investors and business owners successfully deploy data-driven fundraising activities. Contact us today to obtain analytical support for deal sourcing, target screening, and excellent business modeling.

0 notes

Text

Jack Selby at Integro Bank CEO Club

Another fantastic evening at the Integro Bank CEO Club last night. Jack Selby gave an insightful presentation on private equity (PE) and how venture capital (VC) can be vastly different.

Jack Selby, the managing partner at AZ-VC, which happens to be the biggest venture capital fund in Arizona, delivered an informative session on the significance of capital access and the distinctions among different types of capital in today's market.

Read the full article

0 notes

Link

0 notes

Text

Oister Global launches ₹440 cr India-focused fund to back PE, VC firms | Mint

Copyright © HT Digital Streams Limited All Rights Reserved.

View On WordPress

0 notes

Text

Oister Global to invest ₹4,500 crore in PE/VC funds in next two years Mint

The Gurugram-based firm invests in private market funds, with a focus on venture capital, venture debt, private equity, and private credit.

READ MORE...OISTER - We Invest In Top-Tier Venture Capital Private Equity Funds

0 notes

Text

#BusinessOpportunities#EntrepreneurialDreams#SeizeTheMoment#NextBigThing#BusinessGrowth#FranchiseOpportunities#Partnerships#InvestmentVentures#TurnkeyBusinesses#ExploreAndCapitalise#BusinessSuccess#StartYourVenture#GrowYourBusiness#UserFriendlyInterface#FilterByIndustry#ConnectDirectly#SupplementYourIncome#TransformYourCareer#EndlessPossibilities#ProfitableVentures#MergerDomo#InvestmentBanking#BusinessDeals

0 notes

Text

Unleashing Growth: Venture Capital and Private Equity as Alternative Investments in India

In the dynamic landscape of alternative investments in India, venture capital (VC) and private equity (PE) stand out as powerful catalysts for economic growth, innovation, and entrepreneurship. With a burgeoning startup ecosystem and a growing appetite for risk capital, VC and PE investments have emerged as attractive avenues for investors seeking high returns and exposure to promising businesses. This article explores the role of venture capital and private equity as alternative investment vehicles in India, examining their impact on the economy, opportunities for investors, and key considerations for successful investment strategies.

Venture capital and private equity investments play a pivotal role in fueling the growth of startups and emerging companies in India's vibrant entrepreneurial ecosystem. From technology and e-commerce to healthcare and fintech, VC and PE investors provide critical funding, strategic guidance, and industry expertise to help promising startups scale their operations, penetrate new markets, and achieve sustainable growth. By supporting innovation and entrepreneurship, VC and PE investments contribute to job creation, wealth generation, and economic development, driving India's transition towards a knowledge-based economy.

One of the key attractions of venture capital and private equity investments in India is the potential for high returns. While investing in startups and early-stage companies involves inherent risks, successful exits through initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales can yield substantial returns for investors. With India's rapidly growing economy and burgeoning consumer market, VC and PE investors have ample opportunities to identify and capitalize on high-growth sectors and disruptive business models, potentially generating outsized returns for their portfolios.

Moreover, venture capital and private equity investments offer investors exposure to diverse sectors and industries, allowing them to build a well-rounded and diversified investment portfolio. While technology startups dominate the VC landscape, opportunities abound in sectors such as healthcare, education, consumer goods, and renewable energy, providing investors with a range of options to diversify their risk and capture growth opportunities across multiple sectors of the Indian economy.

Despite the opportunities, venture capital and private equity investments in India come with their share of challenges and considerations. Investing in startups and early-stage companies requires a high tolerance for risk, as many startups fail to achieve commercial success or realize significant returns for investors. Moreover, navigating India's complex regulatory environment, market volatility, and cultural nuances can pose challenges for investors, necessitating thorough due diligence, sector expertise, and local market knowledge to make informed investment decisions.

Furthermore, venture capital and private equity investments typically involve longer investment horizons and illiquidity compared to traditional asset classes, such as equities or fixed income securities. Investors must be prepared to commit capital for an extended period and have a clear exit strategy in place to realize returns on their investments. Additionally, investors should carefully evaluate the track record, reputation, and alignment of interests with fund managers to ensure transparency, accountability, and alignment of objectives.

In conclusion, venture capital and private equity investments represent compelling opportunities for investors seeking exposure to India's dynamic startup ecosystem and high-growth sectors. With the potential for high returns, diversification benefits, and contributions to economic development, VC and PE investments play a vital role in driving innovation, entrepreneurship, and wealth creation in India. However, investors should approach these investments with caution, conducting thorough due diligence and adopting a long-term perspective to navigate the inherent risks and complexities associated with investing in startups and emerging companies in India.

0 notes

Text

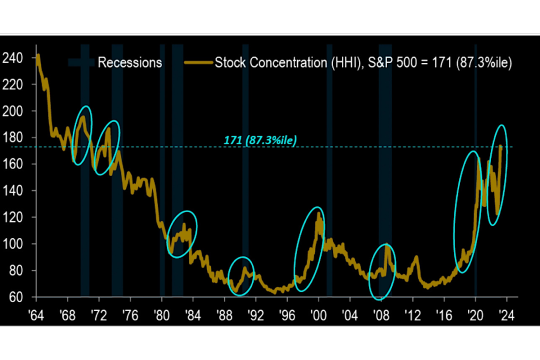

Extreme Concentration in Market Capitalization

The current market performance is explained by the narrowest leadership in 30 years.

#riskmanagement #Arbitrage #QT #Interestrate #fund #investments #equity #credit #AI #ChatGPT #productivity #wage #ennovance

https://twitter.com/mohossain/status/1668084151075983360?s=46&t=GtuOmoaTjOwevz2JidiiDQ

1 note

·

View note

Text

Legal Compliances for Venture Capitalists (VCs) and Private Equity (PE) Investors before Investing Money: Lawyers Advice on Foreign Investments in India | | FDI Attorney in Delhi NCR | FDI Attorney in India | India Business Entry

The business scenario in today’s time is dependent on investments or what is known as fund raising especially for new startups and small businesses. This increasing culture of investments has led a rapid growth of Private equity investment in India. Public Equity is an alternate investment option used by companies that are not public or listed on the stock exchange. It used by High Net Worth individuals or firms to purchase shares or interest in private companies or public companies with an aim to make them private and delist from the public stock exchanges. Usually small or new companies which high growth prospective are targeted. Read more

#“BEST FOREIGN INVESTMENT LAWYER IN INDIA”#“TOP CORPORATE LAW FIRM IN DELHI”#“TOP CORPORATE LAW FIRM IN GURUGRAM”#“TOP FDI LAW FIRM IN INDIA”#“TOP FOREIGN INVESTMENT LAW FIRM IN INDIA”

0 notes

Text

Equity's Role in the Financial System: A Crucial Analysis

In a dynamic financial system, equity is the cornerstone, and its threads are woven into everything from entrepreneurial dreams to global economic stability. It's more than just a number in the stock market; It is the engine of innovation, the fuel of growth, and the engine of the development of industries and markets. However, as the financial landscape evolves and the winds of change blow, it is important to think outside the box and understand the true role of real estate capital in this dynamic world. The current market provides a particularly fascinating setting for this exploration.

The total VC and PE equity funding globally as of December 2023 stands at $ 1 trillion down from $ 5.8 trillion in 2021! That is a mammoth 82% decline in equity funding. It is first important to understand the origins of this fall.

Once a land of boundless optimism, the venture capital landscape is now characterized by a watchful eye that requires clear paths to profitability and solid business models. This shift has changed the landscape of stocks, emphasizing their role as a reward for long-term value creation rather than a fleeting excitement. As Forbes recently reported, companies like Uber and Lyft that were once valued at astronomical values are now much lower, highlighting the consequences of favoring short-term profits over sustainable growth models. The implications of this evolving landscape extend far beyond the startup space.

Kansaltancy Ventures is a Global Investment Management & IB firm into Venture Capital, Debt, M&A, Consulting & Virtual CFO with a network of 450+ VC Funds, Family Offices, Banks & Financial Institutions. Check https://www.Kansaltancy.com

Established companies faced with economic challenges and disruptive technologies are increasingly turning to equity instruments to unlock value and support their strategic transformations. Consider the example detailed in the Wall Street Journal of Ford Motor Company, which considered a debt-for-equity swap to free up cash for key electric vehicle investments. This shows how stocks can be a powerful tool for survival and flexibility in a dynamic market.

However, the effect of justice is not universal. Different industries face unique challenges and opportunities when raising equity. For technology startups where disruption and innovation are the norm, equity serves as a catalyst that attracts investors and drives rapid growth. This is obvious given the $28 trillion financial market funding that comes from equities.

On the other hand, infrastructure and real estate companies that rely on hard assets often use their capital more conservatively and focus on stable profits and long-term value creation.

Understanding these industry nuances is critical to making informed decisions and navigating the complex world of equity financing, as described in a recent TechCrunch article about the challenges female founders face in securing fair valuations. To succeed in this dynamic environment, companies must adopt an adaptive decision-making process and a strategic approach to capital management. Mastering the art of financial modelling combined with a deep understanding of market trends and potential risks is essential to making informed decisions about when and how to harness the power of stocks.

Additionally, the use of scenario planning and stress testing, as recommended by The Economist, allows companies to anticipate potential challenges and adjust their capital strategies accordingly.

Ultimately, the true value of stocks lies not only in their ability to generate financial returns, but also in their role as a catalyst for progress. It promotes the entrepreneurial journey and enables the creation and development of innovative companies that shape our world. It allows people to share in the ownership of a company and its success. As Peggy Noonan recently wrote in the Wall Street Journal, leadership in a dynamic market requires not only financial knowledge but also a commitment to building a sustainable and equitable future.

Kansaltancy Ventures is a Global Investment Management & IB firm into Venture Capital, Debt, M&A, Consulting & Virtual CFO with a network of 450+ VC Funds, Family Offices, Banks & Financial Institutions. Check https://www.Kansaltancy.com

The role of justice in the financial system is not without challenges.

Issues of inequality and access to capital continue to plague the market and require continued efforts to create a more inclusive and equitable environment. However, if we recognize the key role of capital in driving innovation, supporting economic growth, and empowering individuals, we can work to build a financial system that benefits everyone. The insights gained from this research will reverberate beyond companies and individual investors, shaping the broader capital allocation landscape and determining the future of economic development in a dynamic and ever-changing world.

About Tushar Kansal, Kansaltancy Ventures:

Tushar Kansal is the Founder and CEO of Kansaltancy Ventures, a distinguished professional recognized as a "Thought Leader" and "Thought Influencer." With a proven track record, Tushar has provided support to startups and growth-stage companies across various sectors. As a Venture Advisor with a Canadian VC Fund, he has contributed to over 350 investments spanning more than 60 countries.

Tushar's expertise is highly regarded in the business community, and his opinions are frequently sought by leading business news channels and publications, including CNN-News18, VCTV (Venture Capital Tv), Business World, Inc42, TechThirsty, and Digital Market Asia. He has delivered over 300 talks, available for viewing on YouTube and Google, showcasing his vast knowledge and insights.

Connected with 450+ investors globally, Tushar Kansal engages in sector-agnostic deal-making, with a typical ticket size ranging from USD 1-50 million.

Contact Information:

Email: [email protected]

LinkedIn: Tushar Kansal on LinkedIn

Personal Website: Tushar Kansal's Website

Blog: Indus Churning Blog

Company Profiles:

LinkedIn Company Profile

Kansaltancy Ventures Website

Facebook Page

Twitter Account

Instagram Page

0 notes

Text

The Role of Buy-Side Firms in the Financial Market

Financial markets are multifaceted networks in which institutional investors make strategic investments. Buy-side entities encompass a spectrum of institutions that invest in capital markets. These entities include mutual, hedge, pension, and insurance companies.

The players on the buy-side have substantial resources and expertise, all oriented to generate returns for their clients or stakeholders. Many factors shape their investment decisions, including the specific objectives of their fund, client preferences, and potential profitability.

Buy-side firms typically invest in various assets, such as company stocks, bonds, government securities, and diverse financial products. The core mission remains constant: maximizing returns while minimizing risks.

Buy-side firms maximize profits by seeking undervalued assets poised for growth. Their returns often measure their success. Typically, such firms charge a management fee alongside a performance-based cut, as in hedge funds' common "2 and 20” fee arrangement.

The track record of these firms, indicated by their historical percentage of return, is of paramount importance. A strong track record bolsters credibility and attracts clients. Assets under management (AUM) gauge the size and success of buy-side firms. A larger AUM often signifies a robust and reputable firm.

The advantages of buy-side traders are many. Their ability to execute large transactions enables them to minimize trading costs, contributing to profitability. Moreover, these firms possess extensive internal trading resources that help them analyze, identify, and capitalize on investment opportunities.

Buy-side firms, huge firms, wield considerable market power. Their significant market share allows them to influence market prices with strategic moves. However, the Securities and Exchange Commission (SEC) 13-F filing requirements typically disclose their investments quarterly. Due to the market's competitive nature, buy-side firms maintain confidentiality in their investment strategies despite their influence. This secrecy safeguards their position.

Buy-side analysts evaluate the potential of an investment and assess its alignment with the firm’s investment strategy. They formulate recommendations based on this evaluation. These recommendations, designed solely for the firm that hires them, remain confidential and inaccessible to entities outside the firm. If a firm employs a skilled analyst, it aims to keep the advice exclusive to maintain a competitive edge. The success or proficiency of a buy-side analyst is measured by the number of profitable recommendations they offer for the firm’s benefit.

The primary market introduces new financial products. Buy-side firms engage in underwriting or funding, helping companies raise capital through debt or equity financing. Additionally, Buy-side firms purchase or sell companies in acquisitions or mergers. Buy-side companies in the primary market include private equity (PE), venture capital (VC), and corporations.

Private equity firms typically invest in mid-stage or established companies, frequently acquiring a controlling majority stake in the company. Conversely, venture capital firms specialize in supporting early-stage companies by providing the necessary funding to initiate brand development and achieve profitability.

Conversely, the secondary market involves buying and selling existing financial products. Buy-side firms in the secondary market include asset management companies (AMCs), hedge funds, pension funds, mutual funds, and insurance companies. These entities pool capital from investors and strategically invest in a wide range of assets.

Buy-side firms remain pivotal players, orchestrating investments, managing risks, and driving market dynamics through strategic moves. Their influence and practices shape and redefine the global financial markets.

0 notes

Text

I've been monitoring economics for fun since my late twenties. I got a little more serious about it after the GFC, awareness of wealth inequality, climate change, particularly water issues, a ravaging of my hometown and awareness of the responsibility of what it means to choose to bring children into the world.

This is a tidy little summary of how I see ZIRP. It's like squeezing a tube of toothpaste into various vacant spaces. Much like a river creates tributaries. The money is consolidated in the WRONG places. This is not capitalism. MMT is as socialist as it gets without understanding math.

Zirp and MMT combined have created an offshoring of middle class earned wealth.

The main mechanisms are VCs, hedge funds, and PE, gold, shadow banks. Not always willingly. Make no mistake, entrepreneurship is a cornerstone of American supremacy. The opaqueness and fraud is not. The elimination of glass-ateagall facilitated the .com bubble.

We keep the same mistakes layered with new tech

This extraction and wealth accumulation concentrates wealth not based on merit as capitalism would. But through access that only a socialist govt could provide. It's speaks directly to citizens united. Corporations have agendas like a nation within a nation. They also don't pick winners or losers based on merit.

The debt and gdp figures fascinate me. It's so hard to untangle the money flows

0 notes

Text

Current status of China’s private equity market

Spreadex Ltd

In recent years, China's private equity (PE) market has experienced significant growth and transformation, becoming an important part of the country's financial landscape. This article will provide an overview of the current status of China's private equity market, including its growth drivers, regulatory environment and investment trends.

Market Growth and Size: China's private equity market has experienced significant growth, driven by factors such as economic development, entrepreneurship and increased investor interest in alternative investments. According to industry reports, the total amount of private equity transactions in China has hit new highs in recent years, reflecting the size and potential of the market.

Regulatory environment: The regulatory environment for private equity in China has evolved to support market development and protect investor interests. Regulatory agencies such as the China Securities Regulatory Commission have taken measures to increase transparency, improve corporate governance and standardize fundraising activities. These regulations aim to strike a balance between promoting market growth and reducing the risks associated with private equity investments.

Investment focus: China's private equity investments are diversified and cover a wide range of fields, including technology, healthcare, consumer goods, financial services, etc. The technology sector in particular has attracted widespread attention, with investments in areas such as e-commerce, artificial intelligence and fintech. In addition, the healthcare industry has also seen significant growth due to China's aging population and increasing demand for quality medical services.

Venture capital and growth capital: Venture capital (VC) and growth capital investments have always dominated the Chinese private equity market. Venture capital focuses on early-stage companies with high growth potential, while growth capital investing targets more mature companies seeking capital for expansion or strategic initiatives. These two types of investments play a vital role in supporting China's entrepreneurship, innovation and economic development.

Spread EX

Government support: The Chinese government actively supports the development of the private equity market through various initiatives. These include the establishment of government-backed funds, tax incentives for investors and policies to attract foreign investment. Government support helps create a favorable investment environment and promotes cooperation between domestic and foreign investors.

Challenges and Risks: Despite the growth and potential of the Chinese private equity market, investors should consider challenges and risks. These include regulatory uncertainty, market volatility, corporate governance issues and the possibility of an economic slowdown. Additionally, the competitive landscape and the need for thorough due diligence pose challenges for investors seeking attractive investment opportunities.

International participation: China’s private equity market has attracted strong interest from international investors. Foreign private equity firms, institutional investors and sovereign wealth funds have been actively participating in the market, seeking exposure to China's growing economy and investment opportunities. The inclusion of China A-shares in global indices further facilitates international participation in China’s private equity market.

In summary, China's private equity market has experienced significant growth and transformation, driven by economic development, regulatory reform and investor interest in alternative investments. This market offers diversified investment opportunities across industries, with a focus on technology and healthcare. Despite challenges and risks, government support and market potential continue to attract domestic and foreign investors to the Chinese private equity market.Spread EX

0 notes

Link

0 notes