#benefits of financial literacy

Text

youtube

The Beginnings of Journey | From Incarcerated To Incorporated

Embarking on a learning journey can be a transformative experience that can help individuals rebuild their lives, pursue personal growth, and reintegrate into society. Remember that everyone's learning journey is unique, and it's important to tailor your approach to your specific circumstances and goals.

#business mentoring#mentorship skill#mentorship goals#mentorship topic#mentorship benefits#mentorship vs mentoring#benefits of financial literacy#personal financial literacy#best books for financial literacy#financial literacy#financial literacy skills#why is financial literacy important#everfi financial literacy#best buy credit card#home depot credit card#capital one credit card#Youtube

0 notes

Text

The Envelope Budgeting Method: A Simple and Effective Way to Track Expenses

Written by Delvin

Keeping track of expenses is a fundamental aspect of maintaining financial stability and achieving financial goals. In a world of digital transactions and complex budgeting apps, the envelope budgeting method offers a refreshingly simple and effective approach. In this blog post, we will explore the envelope budgeting method, how it works, and why it can be a powerful tool for…

View On WordPress

#Benefits of Envelope Budgeting#Budgeting and Allocating Funds#dailyprompt#Financial#Financial Literacy#knowledge#money#Money Management#Personal Finance#The Basics of Envelope Budgeting#The Envelope Budgeting Method#Using Cash for Expenses

2 notes

·

View notes

Text

youtube

#The Miracle Money Vehicle: How to Make Money Make Babies#Financial Freedom Strategies with Randolph Love III | KAJ Masterclass LIVE Join Randolph Love III#a fractional CFO#franchise consultant#and author of the forthcoming book as he shares his wealth of knowledge on financial literacy and asset protection. In this insightful epis#Randolph delves into topics such as legally avoiding taxes#properly structuring businesses#understanding index universal life policies#and the benefits of trusts and tax strategies. Discover why life insurance policies may be a better retirement vehicle than traditional 401#Randolph's expertise promises to provide valuable insights into creating a secure financial future and achieving true wealth.

🔥*Empower#enhance your skills#or even appear as a special guest on my show! Schedule on my calendar at https://calendly.com/kajofficial Ready to take it further? Explore#Youtube

0 notes

Text

What is a Financial Coach, and What do They do Exactly?

Discover the multifaceted role of a financial coach and how they serve as invaluable guides on the path to financial stability and prosperity. Explore the diverse services they offer and the transformative impact they can have on your financial well-being.

#Financial coach#Personal finance guidance#Budgeting assistance#Debt management strategies#Wealth building techniques#Financial education#Investment planning#Retirement preparedness#Financial empowerment#Money mindset transformation#Financial goal setting#Financial literacy#Financial wellness support#Savings tactics#Accountability in finances#Money management skills enhancement#Financial independence coaching#Comprehensive financial planning#Benefits of financial coaching#Gateway of Healing#dr.chandnitugnait

0 notes

Text

From Fibromyalgia to Freedom: How Yoga and Astrology Inspired My Healing

My 30-day transformational yoga journey amid the Aquarius-Pluto alignment demonstrates the powerful synergy between physical practices and cosmic influences.

By La Trecia Doyle-Thaxton

Just recently I completed 30 days of yoga during the 31 days of January. I missed only one day and felt like it was the worst day ever because nothing went well for me and I am glad I experienced that because it was motivation to keep going and to not miss another day for the rest of the month.

I wanted to stick to the commitment to the challenge I had placed on…

View On WordPress

#Afro-Boho Lifestyle#Ankh Earring Collection#Aries Sun Characteristics#Astrology and Wellness#Black Family Empowerment#Breaking Generational Curses#Canva Designing Tips#Capricorn Rising Insights#Chakra Balancing#Chronic Pain Management#Crafting for Mindfulness#DIY Home Office Décor#Domestic Violence Recovery#Empath Empowerment#Energy Healing Techniques#Fibromyalgia Healing#Financial Literacy for Families#Holistic Yoga Benefits#Homeschooling Tips#Libra Moon Emotions#Mindfulness Practices#Moon Phase Manifesting#Multiple streams of income#Plant-Based Healing#Positive Change Strategies#Reiki for Fibromyalgia#Self-Care for Introverts#Stock Options for Beginners#Teen Mom Support

1 note

·

View note

Text

The Pros and Cons of Energy Investment Explored by Mike Mauceli

Welcome to our blog post where we, Mike Mauceli, delve into the fascinating world of energy investment. In this article, we will explore the pros and cons of investing in this dynamic sector. With our extensive knowledge and expertise, we aim to provide you with valuable insights and a comprehensive understanding of the opportunities and challenges that lie ahead. So join us as we embark on this…

View On WordPress

#business ideas#cashflow game#financial education#financial literacy#how to get rich#how to invest#how to invest in oil#how to make money#kiyosaki#make money#mike mauceli#motivational speakers#network marketing#oil and gas investments#passive income#REI energy oil and gas#rich dad poor dad#robert#Robert Kiyosaki#tax benefits

0 notes

Text

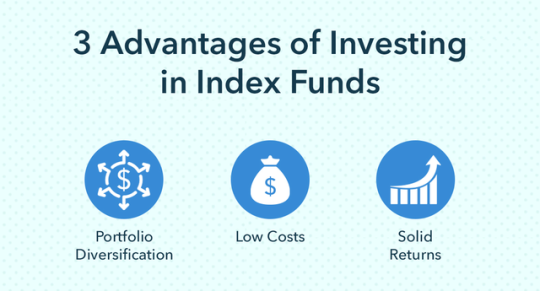

How to Save for Retirement

Good news: There's a lot about retirement savings that you DO NOT have to thoroughly understand to make savvy investments. You don't have to be a math person or have a traditional job or have a "5 year plan".

1) Start saving as early as you can. The one financial advantage we have over the older generations is TIME, so USE IT. Starting early means making "free money," your interest earns interest that will be paid back to you. The amount you save in the early years is expected to double every decade, so the more years with an account, the more free money.

2) Start today if you haven't yet. I mean it. Even if it's only 50-100 / month. You will have an account earning free money in your name, and it's easy to add more funds later when the basics are already set up. If you don't have access to a 401(k) or similar, open an IRA (the Roth IRA kind is for those with a low income and a low tax payment in the springs). NOW is more important than which type of account.

3) Choose an "index fund" with a "target date" around the age you expect to retire. Index funds are basically a tiny sliver of the whole economy around you - stocks for companies large and small, bonds for the US government, real estate, international components. Index funds provide better returns for a lower fee than "actively managed" funds, where the professional's guess wrong more often than not. If you are investing in an index, or piece of the market, than the market can never leave you behind. Target dates mean more higher risk, higher reward stocks in the earliest years, and gradually adjusting to more stable and steady bonds as you near retirement and have less time to recoop a loss. If any of this sounds scary or complicated, this is the common and proven best way to invest over a lifetime.

4) If your employer offers a retirement match contribution (often 2% - 5% of your takehome pay), invest at least that much of your own pay, because again we love FREE MONEY.

5) Increase your retirement payments to yourself anytime life gets easier. Significant raise at work? Moved to a cheaper town? Paid off your car / house / student loans / day care years? Send some of that new monthly money straight into the retirement fund.

6) Your eventual goal is to save 15% of your annual income toward retirement. If this seems insane, start where you can, and aim to add an additional 1-2% with every new year.

7) "Set it and forget it." DO NOT TOUCH your retirement money. Don't even look at it. Maybe once / year if you are curious. The road of compound interest will include some downturns with the stock market is down. This is normal for everyone, but keeping that steady investment through highs & lows is the best strategy for longterm growth of your money.

7b) It is not a kindness to your children to pull money out of your retirement savings on their behalf. You'll lose that much money plus the years of "free money" accumulation plus some early withdrawal fees &/ weird tasks. This makes you more likely to become financially dependent on your kids during your retirement. Not a favor in the long run.

8 ) "If investing feels fun and exciting, then you are not investing, you are gambling." If you are intrigued by the idea of investing in particular companies or trying to time the market - cool. Take some money that wouldn't be disastrous to lose and try your luck - the odds are not in your favor. But your retirement plan must be slow and steady.

Source

#personal finance#financial awareness#financial literacy#retirement#investment#401k#roth ira#compound interest#retirement savings#retirement security#retirement strategies#retirement planning#npr#npr life kit#gambling#investing#benefits#stocks#bonds#stock market#index funds#time is on my side#do not touch#slow and steady

0 notes

Text

Femme Fatale Guide: How To Master Your Money & Tips On Financial Literacy

Understanding and taking control of your finances improves your quality of life in many ways. Making strides toward better financial literacy can save you a lot of stress, unnecessary fees and helps you play a more active role in taking control over this aspect of adulthood. Once you understand the game of money, saving, and investing, it becomes infinitely simpler to devise a plan to set yourself up for a more financially-free future. Here are some practical tips to keep your finances streamlined, secure, and systemized to help you gain more financial literacy and win in this area of life.

Overview:

Track Your Income & Expenses

Set Financial Goals & Realistic Limitations

Invest Higher-Quality Items To Save Later

Educate Yourself On Different Types of Banking & Investment Accounts

Establish Credit, But Know Yourself

Create An Emergency Fund

Leverage Credit Card Benefits

Understand The Power of A Roth IRA (or Backdoor Roth IRA) & HSA

Automate Whenever Possible

Get Familiar With Taxes & Write-offs

Stay Informed About Employer Benefits

Purchase Seasonally & With Discount Codes (When Available)

Protect Yourself

Read Books

Seek Expert Advice

TIPS ON MASTERING FINANCIAL LITERACY:

Track Your Income & Expenses: Always have a record of all of the money going in and out of your accounts. Use the tool on your banking account app(s) to confirm your monthly income and expenses. Tools like Mint also are great to track your spending to see where every dollar is going all in one place. Aside from personal use, for small business owners, Quickbooks is my favorite invoicing and expense-tracking option.

Set Financial Goals & Realistic Limitations: Once you know your exact monthly income, budget your essentials, savings, investments, and fun money accordingly. Make sure necessities like rent, food, health insurance, electricity, WiFi, toiletries, etc. are accounted for before anything else. Depending on your financial situation, experts (not me – I try to educate myself as best as I can, but am no expert!) recommend trying to save and invest between 15-30% of your pre-tax income. Give yourself the liberty to spend the rest (say 15-20%) of your income, so you don’t feel deprived and stay on track with your goals.

Invest Higher-Quality Items To Save Later: Initially purchasing a higher-quality item often cuts your overall expenses in a certain area over the long run. (Ex: Well-made clothing, shoes, furniture, kitchen appliances, coffee maker, hair dryer, etc.). If you invest upfront on an item you regularly use, there’s a lower chance that it will deteriorate, rip, break, or otherwise become unusable for the next few years. When you opt for the cheaper option, this practice might save you a few bucks in the short term, but you will probably end up having to replace it a few times over time and spend more in the long run. This tip might seem counterintuitive to some, but it truly does save you a lot of money (and frustration). However, I will place a caveat here and say that this advice comes from a place of privilege. Never purchase something you can’t afford. If you have the means, spend a bit more upfront - it is better for your future wallet, allows you to indulge in a better quality of life, and helps you let go of any scarcity mindset/financial limiting beliefs.

Educate Yourself On The Different Types of Banking & Investment Accounts: Know the differences between and the use purpose of different accounts: Checking, Savings, CDs, 401K, Roth IRA, HSA, etc. Always opt for a high-yield savings account option to help preserve your money’s value over time with rising living costs and inflation.

Establish Credit, But Know Yourself: Your credit score is like your adult report card. It’s essential for so many aspects of life, like renting or buying a home, insurance, cell phone plans, etc., so it’s important to start building your credit as early as you can. However, if you know you’re the type of person to overspend with a credit card, look into secured credit card options (you deposit the money that acts as a credit limit, so it’s like a debit card with credit-building benefits).

Create An Emergency Fund: Pay yourself first. Have between 3-12 months of expenses available in a high-yield savings account at all times. If you have a family or are self-employed, aim for 6-12 months of necessary savings to stay sane. Saving this amount of money takes time. Be patient, and cut back on frivolous expenses if needed for the short term.

Leverage Credit Card Benefits: If you have enough self-control, always use a credit card instead of a debit card – but spend in the same way you would as though the money is coming directly out of your bank account. This gives you additional flight and other purchasing perks, such as cashback and exclusive discounts. Using a credit card provides additional security, too.

Understand The Power of A Roth IRA (or Backdoor Roth IRA, depending on your income) & HSA: Compound interest is your best friend financially. Depending on your income, invest as much as you can into a Roth IRA account or set up a backdoor Roth IRA through your brokerage firm (I use Vanguard!). HSA (Health Saving Accounts) accounts offer so many benefits – they can serve as a tax write-off, lower your overall healthcare costs, and be leveraged to use as an additional retirement investment account, too (I use Fidelity).

Automate Whenever Possible: Automate a portion of your paycheck to savings and your investments, so you never see this money. Pay yourself first before spending (on anything but necessities).

Get Familiar With Taxes & Write-offs: This mainly applies to anyone self-employed or a small business owner (been in the game for 5 years!). However, this point can also potentially be beneficial for students who can leverage an education credit for tax purposes. Explore all of your options to see what write-offs are available in your specific situation. Understand how your income and expenses influence your tax bracket. Investing in a CPA can save you a considerable amount of money and all of your sanity if you’re not a salaried employee. Look over the standardized section C document, and speak with a professional to help maximize your write-off potential (legally and honestly, of course). My CPA is my lifeline!

Stay Informed About Employer Benefits: Always maximize your 401K match (whatever percentage that is at your company), any wellness perks (like a gym membership or massage credit), or any meals and car services credits for late nights/work trips.

Purchase Seasonally & With Discount Codes (When Available): Try to purchase items off-season when you can (e.g. purchase classic winter closet staples in the summer when they’re on sale). Utilize plug-ins like Honey or Cently on your browser to have discount codes for any site readily available.

Protect Yourself: Stay on top of fraud alerts. Freeze your credit bureau accounts if necessary.

Read Books: Educate yourself on saving, investing, budgeting, building a business, etc. See the ‘Finance’ section of my Femme Fatale Booklist for some recommendations. I also love Graham Stephan’s Youtube channel – his videos are highly useful and practical for beginners in this life arena!

Seek Expert Advice: Use licensed professionals (CPAs, brokerage firms, your bank, etc.) as a resource, too, for your personal goals.

This is a lot to take in, so try to implement one action item (or a few) at a time, so you can work towards your goals without getting overwhelmed. Also, for reference, I’m in the United States, so all of these tips are focused on how the system works in my country - if you know of any international equivalents, feel free to drop them in the comments to guide others.

Hope this helps xx

#life advice#finance#adulting#femme fatale#dark femininity#dark feminine energy#it girl#hypergamy#high value woman#divine feminine#high value mindset#hypergamous#the feminine urge#success mindset#productivity#spending habits#entreprenuership#level up#self improvement#ideal self#female power#female excellence#personal growth#investing#girl advice#that girl#femmefatalevibe

1K notes

·

View notes

Text

[“There is not one banking sector. There are two—one for the poor and one for the rest of us—just as there are two housing markets and two labor markets. The duality of American life can make it difficult for some of us who benefit from the current arrangement to remember that the poor are exploited laborers, exploited consumers, and exploited borrowers, precisely because we are not. Many features of our society are not broken, just bifurcated. For some, a home creates wealth; for others, a home drains it. For some, access to credit extends financial power; for others, it destroys it.

It is quite understandable, then, that well-fed Americans can be perplexed by the poor, even disappointed in them, believing that they accept stupidly bad deals on impulse or because they don’t know any better. But what if those deals are the only ones on offer? What good is financial literacy training for people forced to choose the best bad option?

Poverty isn’t simply the condition of not having enough money. It’s the condition of not having enough choice and being taken advantage of because of that. When we ignore the role that exploitation plays in trapping people in poverty, we end up designing policy that is weak at best and ineffective at worst. When legislation lifts incomes at the bottom—say, by expanding the Child Tax Credit or by raising the minimum wage—without addressing the housing crisis, those gains are often recouped by landlords, not wholly by the families the legislation was intended to help. A 2019 study conducted by the Federal Reserve Bank of Philadelphia found that when states raised minimum wages, families found it easier to pay rent. But landlords quickly responded to the wage bumps by increasing rents, which diluted the effect of the policy. (This happened after the COVID-19 rescue packages, too, but commentators preferred discussing the matter using the bloodless language of inflation.)

In Tommy Orange’s début novel, There There, a man trying to describe the problem of suicides on Native American reservations says, “Kids are jumping out the windows of burning buildings, falling to their deaths. And we think the problem is that they’re jumping.” The poverty debate has suffered from a similar kind of myopia. For the past half century, we’ve approached the poverty question by attending to the poor themselves—posing questions about their work ethic, say, or their welfare benefits—when we should have been focusing on the fire. The question that should serve as a looping incantation, the one we should ask every time we drive past a tent encampment, those tarped American slums smelling of asphalt and bodies, every time we see someone asleep on the bus, slumped over in work clothes, is simply: Who benefits? Not Why don’t you find a better job? or Why don’t you move? or Why don’t you stop taking out such bad loans? but Who is feeding off this?”]

matthew desmond, from poverty: by america, 2023

229 notes

·

View notes

Text

LIFE-CHANGING ways to UPGRADE/ LEVEL UP your life (and they don't cost money)⬆️

It's often assumed that the road to living the luxe life is paved only with the most potentially bankrupting investments. However, that is not entirely true, dare I say not even mostly true. Many of the investments one has to make in order to improve their quality of life and socio-economic standing require a currency not found in purses, savings accounts or piggy banks. They often require time and effort, and funnily enough, this is where most people fall off. Even in this economy it is easier to throw money 💸 at the problem than it is to dedicating time⏳and consistent effort over the long term, but that has to change if you wish to flourish.

So, here are some financially free, but effort-wise expensive ways to glow up holistically:

Reading - A one-stop shop for improved vocabulary, communication & conversation skills as well as improved imagination.

Journaling - An amazing way to organize and track problems, concerns and fears.

Daily walks - Offer many benefits including improved cardiovascular fitness and increased metabolism.

Decluttering - Provides you with clarity & space for what matters both physically and mentally.

Budgeting - Is the backbone of financial literacy and sound money management.

Meditating - The best first step to becoming more present and reducing unnecessary stress.

Change your attitude - It can better your psychological and physical well-being.

Goal tracking - A tried and true way to keep yourself accountable for your progress

Learn a new skill - To challenge yourself and boost your confidence by encouraging you to become a multilayered person.

Practice good penmanship - An unexpectedly good way to stimulate brain activity and decrease learning obstruction.

In order for any of these tips to work, you have to, first.💯

If you don't go get it, you won't have it💫

#glow up#billionaire#luxury aesthetic#luxury#level up#boss#millionaire#girl boss aesthetic#self love#self care#work in progress#business#girl bosses#luxe life#successmindset#black girl aesthetic#black girl luxury#luxurious#luxuries#high value woman#high quality#best#divine feminine#entrepreneur#ascension#old money#money#new money#confidence#rich aesthetic

119 notes

·

View notes

Text

Now that the final SoKP episodes have passed thru my eyes... Things I miss from the novel:

* Sorry but Jiang Xuening should have killed You Fangyin's murderer with her own hands.

* Jiang Xuening becoming obsessed with Xie Wei's cooking, such that she loves to quietly hang out in the kitchen with him whenever there's a break in the scheming. It's their safe space.

* Jiang Xuening going from being in the palace and part of the target/victims of the rebellion in Life 1 to being one of the financial backers of it in Life 2 and accompanying their fighting forces as they move up through the country as Xie Wei outsmarts the emperor & Xue family & Lord Pingnan's forces at the same time. Spending her 2 years away building the capital needed to help spearhead the rescue of the princess and then go to fuck up the emperor who sent his sister a letter to end her life for the benefit of the country.... (chef's kiss)

* The glorious revolution and making the royal family kill each other to save themselves in order to demonstrate the type of people they are

* Jiang Xuening moving into Kunning Palace at the end, as basically the unofficial minister of finance. She ended up in the same place at the end, but hearts & minds are changed and so the result is different

* Jiang Xuening putting the pieces together that the princess died in the 1st life due to her pregnancy & the emperor cutting ties (intrigue!) Team Fuck The System helping her safely give birth to her son, who she loves despite his origin. Our fav lesbian never has to get married to another dude and can just chill with her son, the cabinet of ministers, and her Ning Ning (with psycho husband in tow, but hey nobody's perfect 😂). Using her power to spread schools for women's literacy with Xie Wei terrifying the detractors into submission.

* When they try to use the Jiang family in the capital to threaten XW and he's like, so what? I was gonna pay back those bastards next for Ning'er so you're saving me time lmaaaaaaoooo

* Speaking of which tbh I prefer the lack of a last ditch bandaid on the Jiang family relationship. She's let all of the pain of the past go and isn't personally seeking to take anything away from them in this life... but she is just done with it. Dad is nicer but he's let his wife behave like this and has been mostly hands off. Feels sorta like Story of Minglan to me - letting the favoritism & emotional abuse happen while playing nice guy. In both novel & drama, he spends years not protesting how Jiang Xuening is cast as the troublesome, uncouth, inferior model. But then the drama decides to rehabilitate them. (Though to be fair, even the drama was half-hearted on this 'wash', cause at the end she's mentioning they're not close and in the last scenes the parents are with the sister and Ning'er is with her found family.)

Improvements in the drama:

* I liked that we got to see Jiang Xuening tell multiple people that she loves XW before she gives him her answer. The angst of it being uncertain what conversations she's having with the princess & ZZ, the risk that she's going to abandon XW for being a hot mess... it made for good dramatic tension in the novel. But for the ROMANCE and creating a sense that the feelings he has are truly returned... It makes the ship better.

* The relationship that FL and ML had with the fake Xue Dingfei was richer. He was a standout for me.

* Yan Lin had a happier ending. He really stole my heart in this 2nd life and like Jiang Xuening I felt no need to see him haunted by his vile actions in another universe. It was emotionally satisfying in the drama to see him at peace. You got us all rooting for him.

* Consolidated the Lord Pingnan plot! We really didn't need to get into their factions and introduce more antagonists.

* Consolidated the You Fangyin romantic interests - no need for a marriage of convenience with 1 dude and then Xie Wei's buddy also carrying a torch.

* I felt like the drama gave Zhang Zhe more personality and I did find it delightful when he was "fighting" side by side with Xie Wei.

* Xue Shu (the Xue daughter) felt like a more developed, fully realized antagonist.

* As much as it "sings" in the narrative to have her end up in Kunning Palace with power in the government at the end of the novel (that was brilliant)... maybe emotionally it spoke to me more to see her initial wish from the start of her rebirth fulfilled. Her original reborn goal was to avoid reentering the palace & exit-out of everything to have a quiet life of peace. None of that power ever made her happy.

* Marriage scenes of the otp thank uuuuuuuuu

* No and actually.. After her royal marriage in the 1st life she definitely doesn't need another big celebration. And with her messed up family relationships and his dead parents... Them doing the marriage ceremony all on their own, cause it's another pact between them, makes a lot of sense and I dig it.

* The reverse callback of whispering while she's waiting for a kiss to say "I'm yours" instead of "get out" 👌👌👌

#story of kunning palace#cdrama#spoilers#im one of those people who really likes to see the same story#adapted in different medias#its just fun

118 notes

·

View notes

Text

Exploring the Rise of Decentralized Finance (DeFi)

Written by Delvin

In recent years, a revolutionary financial phenomenon has emerged, disrupting traditional financial systems and empowering individuals with newfound financial freedom. This phenomenon is known as Decentralized Finance, or DeFi. In this blog post, we will delve into the rise of DeFi, its core principles, and the transformative impact it is having on the global financial…

View On WordPress

#Benefits and Challenges of Defi#Core Defi Use Cases#Crypto#dailyprompt#Financial#Financial Literacy#Key Principles of Defi#The Future of Defi#Understanding Defi#Wealth

0 notes

Text

How wealthy is Hob Gadling?

Look, there's just so many ways to talk about how wealthy Hob would be after 600+ years alive, and obviously every fic writer is going to approach it differently according to their tastes and the story they want to write, and most likely no two takes will be the same which is the point of fandom.

In addition, we have 1689 as canonical proof that it's possible for Hob to reach the heights of prosperity only to come crashing back down to earth when history and circumstances and pure bad luck come into play.

H o w e v e r, just speaking for myself, it is inconceivable to me that by the 21st century, Hob isn't so ungodly wealthy that he no longer needs to work again, ever, and just picked up teaching as a way to stay busy. The man is walking, one man, generational wealth with the added benefit of no dispersal across multiple family branches and financial literacy to boot, along with having learned the lessons of 1689 to make him especially cautious about ever being in a position again to lose it all.

In 1789, Hob even says he's been socking money away all over the world because he's worried about the global political situation after all these revolutions, like in America and France. Hob has learned the lessons of 1689 and he's not going to get caught without an emergency fund somewhere ever again.

Even if he gave it all away after 1789 in compensation for his role in the "shipping business", in the 200+ years since all he would have to do is put some money away in a bank for safekeeping and then leave it there for a bit as he went along for him to be ungodly wealthy by today. He might need to move the money around at times to keep it in active institutions, but there are absolutely 200+ year old banks/investment vehicles (Lloyd's Banking Group has within it institutions that go back to 1695, just as an example) and so long as he stayed nominally on top of making sure he kept money scattered around and moved it before a place went under, there'd always be seed capital for him somewhere.

Did I mention one man generational wealth? At a certain point, it really would just make more sense for Hob to set up a family trust and use various shell companies to keep things anonymous. Given the man has been in business in one fashion or another on and off since the 1500s I'm going to credit him with a certain amount of financial literacy. The 1600s were truly unusual with being brought up on charges as a witch, because he would have lost everything and gone back to zero, unable to even reclaim those assets as a distant relative, because he was tried and convicted for witchcraft and his assets were almost certainly confiscated by the Crown/by greedy witch hunters.

Again, with just a little diversity of investment and where he stored his deposits, Hob should never fall back to 1600s levels again. He could literally just store some of his older, more valuable durable possessions (like jewelry) or bury a purse of gold somewhere, and know that the historical value of such coins and or items will only appreciate over time.

If he just did as Benjamin Franklin did and put in that day's value $2,000 dollars in a normal bank it would, by modern day, be worth $5,000,000 in today's money by interest alone, doing nothing else. Do that in a few dozen different banks, especially anonymous Swiss accounts or equivalent, and you don't even have to worry if most of them don't make it to modern day.

I cannot stress enough, generational wealth is usually lost because it gets dispersed across multiple children, or because the later generations are not as good with the money as the previous one. Hob does not have that problem. He isn't just generational wealth he is money savvy, dynastic wealth, he can build the same sort of wealth that noble families like the Bonaparte descendants sit on for centuries. Whether or not you think that's the moral thing is beside the point. There comes a point in truly staggering amounts of wealth where it's almost impossible to give it all away, Bezos's ex wife talked about how she made many huge donations with her billions from the settlement and it barely made a dent because of interest on that money.

Could Hob have simply lost money over the years in ill-considered ventures or given it all away? Yes, of course, and it would be very human and thus very Hob of him to do so. But given his convertible in 1989 and being the owner of the New Inn in the 21st century, to me there are more signs canonically that he has put together a pretty decent safety net at the very least all the way up to being very wealthy, we're talking low to mid double digit millions, in my opinion, at minimum, with the upper reaches possibility of very wealthy or more (triple digit millions or more) if he's done things like make good investments throughout, for example in new technology, and socked it away in Swiss accounts and set up an anonymous family trust with some use of shell companies. All of that is on the table as possibilities of the level of wealth he'd have when you factor in two hundred years of business sense and decent business practices, with a healthy dose of paranoia about losing it all again.

382 notes

·

View notes

Text

What is a Financial Coach, and What do They do Exactly?

Discover the multifaceted role of a financial coach and how they serve as invaluable guides on the path to financial stability and prosperity. Explore the diverse services they offer and the transformative impact they can have on your financial well-being.

#Financial coach#Personal finance guidance#Budgeting assistance#Debt management strategies#Wealth building techniques#Financial education#Investment planning#Retirement preparedness#Financial empowerment#Money mindset transformation#Financial goal setting#Financial literacy#Financial wellness support#Savings tactics#Accountability in finances#Money management skills enhancement#Financial independence coaching#Comprehensive financial planning#Benefits of financial coaching#Gateway of Healing#dr.chandnitugnait

0 notes

Text

BOLD THE FACTS

tagged by @vayneoc and @morganlefaye79 (thank you!!)

tagging: @faepunkprince @therealnightcity @dreamskug @breezypunk @drunkchasind @pinkyjulien @elvenbeard @chevvy-yates @mhbcaps @t0tentanz @imaginarycyberpunk2023 @genocidalfetus

PERSONAL

$ Financial: wealthy / moderate / poor / in poverty

✚ Medical: fit / moderate / sickly/ disabled / disadvantaged / non-applicable

✔ Education: qualified/ unqualified / studying / other

✖ Criminal Record: yes, for major crimes / yes, for minor crimes / no / has committed crimes, but not caught yet/ yes, but charges were dismissed

FAMILY

◒ Children: had a child or children / has no children / wants children

◑ Relationship with Family: close with sibling(s) / not close with sibling(s) / has no siblings / sibling(s) is deceased

◔ Affiliation: orphaned / abandoned / adopted / disowned / raised by birth parent(s) / not applicable

TRAITS + TENDENCIES

♦ extroverted / introverted / in-between

♦ disorganized / organized / in-between

♦ close-minded / open-minded / in-between

♦ calm / anxious / in-between / highly contextual

♦ disagreeable / agreeable / in-between

♦ cautious / reckless / in-between / highly contextual

♦ patient / impatient / in-between

♦ outspoken / reserved / in-between / highly contextual

♦ leader / follower / in-between

♦ empathetic / vicious bastard / in-between

♦ optimistic / pessimistic / in-between

♦ traditional / modern / in-between

♦ hard-working / lazy / in-between

♦ cultured / uncultured / in-between / unknown

♦ loyal / disloyal / in-between / unknown

♦ faithful / unfaithful / in-between / unknown

BELIEFS

★ Faith: monotheist / polytheist / atheist / agnostic

☆ Belief in Ghosts or Spirits: yes / no / don’t know / don’t care / in a manner of speaking

✮ Belief in an Afterlife: yes / no / don’t know/ don’t care / in a manner of speaking

✯ Belief in Reincarnation: yes / no / don’t know / don’t care / in a manner of speaking

❃ Belief in Aliens: yes / no / don’t know / don’t care

✧ Religious: orthodox / liberal / in between / not religious

❀ Philosophical: yes / no / highly contextual

SEXUALITY & ROMANTIC INCLINATION

❤ Sexuality: heterosexual / homosexual / bisexual / asexual / pansexual

❥ Sex: sex-repulsed / sex neutral / sex favorable / naive and clueless

♥ Romance: romance repulsed / romance neutral / romance favorable / naive and clueless / romance suspicious

❣ Sexually: adventurous / experienced / naive / inexperienced / curious

⚧ Potential Sexual Partners: male / female / agender / other / none / all

⚧ Potential Romantic Partners: male / female / agender / other / none / all

ABILITIES

☠ Combat Skills: excellent / good / moderate / poor/ none

≡ Literacy Skills: excellent / good / moderate / poor / none

✍ Artistic Skills: excellent / good / moderate / poor / none

✂ Technical Skills: excellent / good / moderate / poor / none

HABITS

☕ Drinking Alcohol: never / special occasions / rarely / sometimes / frequently / alcoholic / former borderline alcoholic turned sober

☁ Smoking: tried it / trying to quit/ quit / never / rarely / sometimes / frequently / chain-smoker

✿ Recreational Drugs: tried some / never / special occasions / sometimes / frequently / addict

✌ Medicinal Drugs: never / no longer needs medication / some medication needed / frequently / to excess

☻ Unhealthy Food: never / special occasions / rarely / sometimes / frequently / binge eater

$ Splurge Spending: never / sometimes / frequently / shopaholic

♣ Gambling: never / rarely / sometimes / frequently / compulsive gamble

I thought some of these needed elaboration so I wanna touch on some things!!

$: Dagger puts very little stock in actual money. He thinks its essentially pointless and only exists for the benefit of the rich (obviously). He doesn't actively seek it out or acquire it but given his violent crime life proclivities he ends up with it a lot of it. He doesn't really use it. Anything he wants, he'll steal or kill to get, and he lives in caves and ghost towns, so he doesn't usually keep any around accessible to him at any given time. BUT you can bet he's easily sitting on hundreds of thousands stashed away, either in accounts or quite literally buried across the desert. So he technically has it, but its collecting dust. (At some point in the future, he secretly starts giving really large donations to Blood Nation in Al's name because it was her family's nomad clan.)

✔: He doesn't have official education, but nomad schooling is actually meant to be pretty good. Unfortunately, problem child that he was, he mostly ditched camp as a rebellious kid and and chose to teach himself. He knows a lot about certain things (art, history) but is really bad at others (math, science).

◑: He and his brother used to be very close, and when they were orphaned Dagger was extremely protective over him, to the point where he pretty much wouldn't let anyone near him. (9 year old Dagger literally biting anyone who comes close to his lil brother. The first person Dagger killed was a kid who kept bullying his brother when he was 11). But as they got older, his brother acclimated with the rest of the clan whereas Dagger just couldn't. So he got more distant and even a little resentful and stopped being around. Then he accidentally slits his brother's throat and thinks hes dead :) They reunite years later and Dagger still cares for him very much but they don't get to see each other very often. Its complicated!!

♥: Dagger is extremely hesitant and also totally oblivious to romance. It's not a feeling he ever allowed himself to feel, and it never really came to him anyway. Feelings and relationships are weaknesses and people are just pawns and he doesn't need anyone. So when he starts to actually have some feelings he's pretty much the last person to realize it.

✌: Dagger takes all kinds of drugs, mostly recreational, but he does end up on some mood stabilizers after a stint in therapy and though that entire experience has very little positive impact on him, he does come to realize that they actually do help him feel a bit better, so he stays on them after that. He's not always good at taking them, but there's a bit of an effort on his part. He'll also take certain meds to help mitigate nightmares but they're not always effective.

#oc: dagger#wrote a little more about some of these under the cut#ty for the tags and no pressure to anyone to do it !!

30 notes

·

View notes

Text

Bold the Facts Game

Include a picture of your OC and bold or highlight the remarks below that apply to them.

Personal

Financial: wealthy / moderate / poor / in poverty

Medical: fit / moderate / sickly / disabled / disadvantaged (chronic headaches and addiction) / non applicable

Class or Caste: upper / middle / working / unsure / other

Education: qualified / unqualified / studying / other

Criminal Record: yes, for major crimes / yes, for minor crimes / no / has committed crimes, but not caught yet / yes, but charges were dismissed

Family

Children: had a child or children / has no children / wants children

Relationship with Family: close with sibling(s) / not close with sibling(s) /has no siblings / sibling(s) is deceased

Affiliation: orphaned / adopted / disowned / raised by birth parent(s) / not applicable

Traits & Tendencies

Expressiveness: extroverted / introverted / in between

Management: disorganized / organized / in between

Receptiveness: close-minded / open-minded / in between

Temperment: calm / anxious / in between

Attitude: disagreeable / agreeable / in between (goes with whatever idea is best)

Forethought: cautious / reckless / in between

Patience: patient / impatient / in between

Opinions: outspoken / reserved / in between

Station: leader / follower / in between (he's a lone wolf)

Sensibility: empathetic / vicious bastard / in between

Outlook: optimistic / pessimistic / in between (he's an opportunist)

Customs: traditional / modern / in between

Work Ethic: hard-working / lazy / in between

Sophisticatedness: cultured /uncultured / in between / unknown

Alliances: loyal / disloyal / unknown (his loyalty is to whatever/whoever benefits him most)

Devotedness: faithful / unfaithful / unknown

Beliefs

Faith: monotheist / polytheist / atheist / agnostic / Spiritual

Belief in Ghosts or Spirits: yes / no / don’t know / don’t care

Belief in an Afterlife: yes / no / don’t know / don’t care

Belief in Reincarnation: yes /no / don’t know / don’t care

Belief in Aliens: yes / no / don’t know / don’t care

Religious: orthodox / liberal / in between / not religious

Philosophical: yes / no

Sexuality & Romantic Inclination

Sexuality: heterosexual / homosexual / bisexual / asexual / pansexual

Sex: sex repulsed / sex neutral / sex favorable / naive and clueless

Romance: romance repulsed / romance neutral / romance favorable / naive and clueless / romance suspicious

Sexually: adventurous / experienced / naive / inexperienced / curious

Potential Sexual Partners: male / female / agender / other / none / all

Potential Romantic Partners: male / female / agender / other / none / all

Abilities

Combat Skills: excellent / good / moderate / poor / none

Literacy Skills: excellent / good / moderate / poor / none

Artistic Skills: excellent / good / moderate / poor / none

Technical Skills: excellent / good / moderate / poor / none

Habits

Drinking Alcohol: never / special occasions / sometimes / frequently / Alcoholic

Smoking: tried it / trying to quit / quit / never / rarely / sometimes / frequently / chain-smoker

Recreational Drugs: never / special occasions / sometimes / frequently / addict

Medicinal Drugs: never / no longer needs medication / some medication needed / frequently / to excess

Unhealthy Food: never / special occasions / sometimes / frequently / binge eater

Splurge Spending: never / sometimes / frequently / shopaholic

Gambling: never / rarely / sometimes / frequently / compulsive gambler

tagging: no one, I just found this game and thought it looked funny!

You can allll do it

13 notes

·

View notes