#business enterprise frauds

Text

Many firms prefer ready-made AI software with a few tweaks - Technology Org

New Post has been published on https://thedigitalinsider.com/many-firms-prefer-ready-made-ai-software-with-a-few-tweaks-technology-org/

Many firms prefer ready-made AI software with a few tweaks - Technology Org

Artificial intelligence has changed nearly every industry, from manufacturing and retail to construction and agriculture. And as AI becomes even more ubiquitous, firms often opt for off-the-shelf technology that can be modified to meet their needs.

Chris Forman, the Peter and Stephanie Nolan Professor in the Dyson School of Applied Economics and Management in the Cornell SC Johnson College of Business, was part of a research team that examined firms’ decisions to adopt AI technology and how that adoption was sourced: by purchasing ready-made software; by developing their own; or with a hybrid strategy, which the researchers say may reflect “complementarity” among sourcing approaches.

In an analysis of more than 3,000 European firms, they found that many—particularly in science, retail trade, finance, real estate, and manufacturing—are increasingly opting for ready-made technology tailored to the firm’s specific needs. While AI may seem to be threatening the human workforce, these findings indicate that workers with AI-related skills will still be needed.

“In the vast majority of industries, firms are doing both readymade and in-house development, and I think it’s an interesting question for future work to understand why that’s the case,” said Forman, co-author of “Make or Buy Your Artificial Intelligence? Complementarities in Technology Sourcing,” which published March 5 in the Journal of Economics and Management Strategy.

“Ready-made software is important,” he said, “but for the vast majority of firms, it does not appear to be a substitute for in-house software, which suggests that it’s not, at least in the short run, going to eliminate the need for AI-related skills.”

Charles Hoffreumon, a doctoral student at the Solvay Brussels School of Economics and Management, is the corresponding author. Nicolas van Zeebroeck, a professor of digital economics and strategy at the Solvay Brussels School, is the other co-author.

For their study, the researchers examined data from a survey conducted in 2020 by the Directorate-General of Communications Networks, Content and Technology from the European Commission (EC), which assessed AI adoption across the 27 countries of the European Union. The team used data from 3,143 firms across Europe in the study.

Business software is hard to implement, and historically as new technologies spread firms have relied on ready-made software. “This aspect of trying to understand the extent to which ready-made software could potentially substitute for the need for skills was interesting.” Forman said.

The study’s data comprised firms in 10 industry sectors, with the largest share coming from manufacturing (19%), trade and retail (18%), and construction (12%). Industries with the smallest share of respondents included agriculture (4%) and utilities (3%).

Firms most commonly use AI for the following purposes: fraud or risk detection, process or equipment optimization, and process automation in warehouses or robotics.

Among respondents who had adopted at least one AI application, more than 58% reported using ready-made software; nearly 38% hired an external consultant; 24% used modified commercial software; 20% used in-house software; and 20% modified open-source technology for their firm’s needs. Some firms deployed the technology in multiple ways.

Among the findings: The financial and scientific sectors – and to a lesser extent IT – preferred developing and customizing their own software while agriculture, construction and human health preferred ready-made solutions.

Forman said that in the past, as new technology spreads, the demand for different types of skills emerges. “Historically, the net effect has tended to be that, overall, labor demand goes up,” he said, “but it remains to be seen what happens in this case.”

As often happens with new technology, Forman said, the diffusion of AI technology to early adopters has resulted in users’ best practices getting incorporated into ready-made software, which makes these solutions even better. This was the case, he said, with enterprise resource planning – automation software that helps to run an entire business.

“When you look at prior digital technologies, there’s often a process of complementary innovation, or co-invention, where you figure out how to use this digital technology most effectively for your firm,” Forman said. “That usually takes place over time, through experimentation and figuring out what works and doesn’t.”

The authors wrote that this research “has taken the first steps toward highlighting the importance of sourcing strategies to understanding the diffusion of AI.”

Source: Cornell University

You can offer your link to a page which is relevant to the topic of this post.

#000#A.I. & Neural Networks news#agriculture#ai#Analysis#artificial#Artificial Intelligence#artificial intelligence (AI)#automation#Business#business software#college#commercial software#communications#construction#content#data#detection#development#diffusion#Digital technology#Economics#enterprise#enterprise resource planning#equipment#Europe#european union#finance#financial#fraud

0 notes

Text

Best Practices in Corporate Risk Management in Hong Kong

With an increasingly complex legal, regulatory, economic, and technological environment, effectively managing organizational risks is critical for companies striving towards sustainable growth in Hong Kong. By taking a strategic approach to identifying key risk exposures and establishing governance policies to address vulnerabilities, both local and multinational corporations can enhance resilience.

Conduct Extensive Risk Assessments

The foundation for building robust risk oversight is to regularly conduct enterprise-wide assessments, tapping perspectives from leaders across functions on risks emerging within main business units, as well as at the corporate level. Special focus should be placed on emerging risks - from supply chain disruptions to fast-evolving cybersecurity threats. Risks posed by Hong Kong regulations and legal responsibilities around data, employment, IP, taxation and import/export controls should also be incorporated.

Appoint Centralized Risk Leadership

While business heads are accountable for risks within their domains, oversight at the core by a Chief Risk Officer and/or risk management committee provides critical independence and cross-functional coordination. Responsibilities span creating risk reporting procedures to keeping senior leadership and board directors appraised, to aligning mitigation plans with corporate strategy. Risk managers also liaise with insurance providers to secure proper coverage against financial hazards.

Implement Key Risk Policies

Findings from risk assessments should drive key policy changes, be it business continuity planning to address operational crises, instituting ethics training to reduce fraud and corruption, or enacting information handling protocols to avoid data leaks, hacking and illegal trading incidents that would undermine Hong Kong stock listings. Anti-money laundering and sanctions/export controls compliance also need special attention in Hong Kong as a gateway between China and global trade.

Monitor External Signals

In addition to internal risk monitoring, closely follow legislative or law enforcement policy shifts, as well as economic/political disruptions arising locally as well as in mainland China that stand to impact operations. Participate in trade groups and maintain contacts in agencies like InvestHK to receive critical market updates. Regular stress tests help evaluate Hong Kong megaprojects like the Greater Bay Area growth plan or One Belt One Road initiative - and gauge ensuing risk reprioritizations.

By approaching risk oversight as an integrated corporate capability monitoring both internal weaknesses and external threats, companies gain enhanced visibility into vulnerabilities which allows preemptively strengthening of operations against cascading Hong Kong/China hazards - thereby boostinglong-term performance and valuation for shareholders.

#Hong Kong risk management#Hong Kong enterprise risk#Hong Kong risk assessment#Hong Kong business risks#Hong Kong operational risks#Hong Kong cybersecurity risks#Hong Kong regulatory risks#Hong Kong legal risks#Hong Kong financial risks#Hong Kong political risks#Hong Kong Chief Risk Officer (CRO)#Hong Kong risk committee#Hong Kong risk governance#Hong Kong risk reporting#Hong Kong risk policies#Hong Kong business continuity planning#Hong Kong fraud prevention#Hong Kong data protection#Hong Kong information security#Hong Kong anti-money laundering#Hong Kong export controls#Hong Kong trade compliance#Hong Kong InvestHK

1 note

·

View note

Text

Kickstarting “The Bezzle” audiobook, sequel to Red Team Blues

I'm heading to Berlin! On January 29, I'll be delivering Transmediale's Marshall McLuhan Lecture, and on January 30, I'll be at Otherland Books (tickets are limited! They'll have exclusive early access to the English edition of The Bezzle and the German edition of Red Team Blues!).

I'm kickstarting the audiobook for The Bezzle, the sequel to last year's Red Team Blues, featuring Marty Hench, a hard-charging, two-fisted forensic accountant who spent 40 years in Silicon Valley, busting every finance scam hatched by tech bros' feverish imaginations:

http://thebezzle.org

Marty Hench is a great character to write. His career in high-tech scambusting starts in the early 1980s with the first PCs and stretches all the way to the cryptocurrency era, the most target-rich environment for scamhunting tech has ever seen. Hench is the Zelig of tech scams, and I'm having so much fun using him to probe the seamy underbelly of the tech economy.

Enter The Bezzle, which will be published by Tor Books and Head of Zeus on Feb 20: this adventure finds Marty in the company of Scott Warms, one of the many bright technologists whose great startup was bought and destroyed by Yahoo! (yes, they really used that asinine exclamation mark). Scott is shackled to the Punctuation Factory by golden handcuffs, and he's determined to get fired without cause, so he can collect his shares and move onto the next thing.

That's how Scott and Marty find themselves on Catalina island, the redoubt of the Wrigley family, where bison roam the hills, yachts bob in the habor and fast food is banned. Scott invites Marty on a series of luxury vacations on Catalina, which end abruptly when they discover – and implode – a hamburger-related Ponzi scheme run by a real-estate millionaire who is destroying the personal finances of the Island's working-class townies out of sheer sadism.

Scott's victory is bittersweet: sure, he blew up the Ponzi scheme, but he's also made powerful enemies – the kinds of enemies who can pull strings with the notoriously corrupt LA County Sheriff's Deputies who are the only law on Catalina, and after taking a pair of felony plea deals, Scott gets the message and never visits Catalina Island again.

That could have been the end of it, but California's three-strikes law – since rescinded – means that when Scott picks up one more felony conviction for some drugs discovered during a traffic stop, he's facing life in prison.

That's where The Bezzle really gets into gear.

At its core, The Bezzle is a novel about the "shitty technology adoption curve": the idea that our worst technological schemes are sanded smooth on the bodies of prisoners, mental patients, kids and refugees before they work their way up the privilege gradient and are inflicted on all of us:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

America's prisons are vicious, brutal places, and technology has only made them worse. When Scott's prison swaps out in-person visits, the prison library, and phone calls for a "free" tablet that offers all these services as janky apps that cost ten times more than they would on the outside, the cruelty finds a business model.

Working inside and outside the prison Marty Hench and Scott Warms figure out the full nature of the scam that the captive audience of prisoners are involuntary beta-testers for, and they discover a sprawling web of real-estate fraud, tech scams, and offshore finance that is extracting fortunes from the hides of America's prisoners and their families. The criminals who run that kind of enterprise aren't shy about fighting for what they've got, and they're more than happy to cut some of LA County's notorious deputy gangs in for a cut in exchange for providing some kinetic support for the project.

The Bezzle is exactly the kind of book I was hoping I'd get to write when I kicked off the Hench series – one that decodes the scam economy, from music royalties to prison videoconferencing, real estate investment trusts to Big Four accounting firm bogus audits. It's both a fast-moving, two-fisted crime novel and a masterclass on how the rich and powerful get away with both literal and figurative murder.

It's getting a big push from both my publishers and I'll be touring western Canada and the US with it. The early reviews are spectacular. But despite all of this, I had to make my own audiobook for it, which I'm pre-selling on Kickstarter:

http://thebezzle.org

Why? Because Audible – Amazon's monopoly gatekeeper to the audiobook world, with more than 90% of the market – refuses to carry my work.

Audible uses Digital Rights Management to lock every audiobook they sell to their platform. Legally, only an Audible-authorized app can decrypt and play the audiobooks they sell you. Distributing a tool that removes Audible DRM is a felony under Section 1201 of the 1998 DMCA.

That means that if you break up with Audible – delete your Audible apps – you will lose your entire audiobook library. And the fact that you're Audible's hostage makes the writers you love into their hostages, too. Writers understand that if they leave the Audible platform, their audience will have to choose between following them, or losing all their audiobooks.

That's how Audible gets away with abusing its performers and writers, up to and including the $100m Audiblegate wage-theft scandal:

https://www.audiblegate.com/

Audible can steal $100m from its writers…and the writers still continue to sell on the platform, because leaving will cost them their audience.

This is canonical enshittification: lock in users, then screw suppliers. Lots of companies abuse DRM to do this, but none can hold a candle to Amazon, who understand that the DMCA is a copyright law that protects corporations at the expense of creators.

Under DMCA 1201 commercial distribution of a "circumvention device" carries a five-year prison sentence and a $500,000 fine. That means that if I write a book, pay to have it recorded, and then sell it to you through Audible, I am criminally prohibited from giving you the tool to take it from Audible to another platform. Even though I hold the copyright to that work, I would face a harsher sentence than you would if you simply pirated the audiobook from some darknet site. Not only that: if you shoplifted the audiobook in CD form, you'd get a lighter sentence than I, the copyright holder, would receive for giving you a tool to unlock it from Amazon's platform! Hell, if you hijacked the truck that delivered the CD, you'd get off lighter than I would. This is a scam straight out of a Marty Hench novel.

This is batshit. I won't allow it. My books are licensed on the condition that they must not be sold with DRM. Which means that Audible won't sell my books, which means that my publishers are thoroughly disinterested in paying thousands of dollars to produce audiobooks of my titles. A book that isn't sold in the one store than accounts for 90% of all sales is unlikely to do well.

That's where you come in. Since 2020, I've used Kickstarter to pre-sell five of my audiobooks (I wrote nine books during lockdown!). All told, I've raised over $750,000 (gross! but still!) on these crowdfunders. More than 20,000 backers have pitched in! The last two of these books – The Internet Con and The Lost Cause – were national bestsellers.

This isn't just a way for me to pay off a lot of bills and put away something for retirement – it's proof that readers care about supporting writers and don't want to be locked in by a giant monopolist that depends on its drivers pissing in bottles to make quota.

It's a powerful message about the desire for something better than Amazon. It's part of the current that is driving the FTC to haul Amazon into court for being a monopolist, and also part of the inspiration for other authors to try treating Amazon as damage and routing around it, with spectacular results:

https://www.kickstarter.com/projects/dragonsteel/surprise-four-secret-novels-by-brandon-sanderson

And I'm doing it again. Last December, I went into Skyboat Media's studios where Gabrielle De Cuir directed @wilwheaton, who reprised his role as Marty Hench for the audiobook of The Bezzle. It came out amazing:

https://archive.org/details/bezzle-sample

Now I'm pre-selling this audiobook, as well as the ebook and hardcover for The Bezzle. I'm also offering bundles with the ebook and audiobook for Red Team Blues (naturally these are all DRM-free). You can get your books signed and personalized and shipped anywhere in the world, courtesy of Book Soup, and I've partnered with Libro.fm to deliver DRM-free audiobooks with an app for people who don't want to mess around with sideloading.

I've also got some spendy options for high rollers. There's three chances to name a character in the next Hench novel (Picks and Shovels, Feb 2025). There's also five chances to commission a Hench short story about your favorite tech scam, and get credited when the story is published.

The Kickstarter runs for the next three weeks, which should give me time to get the hardcopy books signed and shipped to arrive around the on-sale date. What's more, I've finally worked out all the post-Brexit kinks with shipping my UK publisher's books to EU backers. I'm working with Otherland Books to fulfill those EU orders, and it looks like I'm going to be able to sign a giant stack of those when I'm in Berlin later this month to give the annual Marshall McLuhan lecture at the Canadian embassy:

https://transmediale.de/en/2024/event/mcluhan-2024

Red Team Blues and its sequels are some of the most fun – and informative – work I've done in my quarter-century career. I love how they blend technical explanations of the scam economy with high-intensity technothrillers. That's the the same mix as my bestselling YA series Little Brother series – but these are firmly adult novels.

The Bezzle came out great. I hope you'll give it a try – and that you'll come out to see me in late February when I hit the road with the book! Here's that Kickstarter link again:

http://thebezzle.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/10/the-bezzle/#marty-hench

#pluralistic#kickstarter#audible#the bezzle#bezzles#prison tech#disciplinary technology#crowdfunding#wilw#wil wheaton#audiobooks#publishing#science fiction#marty hench#martin hench#red team blues#shitty technology adoption curve#reits

661 notes

·

View notes

Text

It’s stock is defying any norms of legit business practices. The company is worth practically nothing and keeps hemorrhaging customers and advertising revenues which should lead to a collapse. Despite plunging somewhat, shares actually went up five dollars recently. It appears to be crypto all over again in that drug cartels, rogue nations, and criminal enterprises are using it to launder money.

#stock manipulation#stock market irregularities#white collar crime#insider trading#corporate greed#money laundering#massive fraud#republican assholes#traitor trump#crooked donald#never trump#republican hypocrisy#economy

104 notes

·

View notes

Text

And the hits keep coming. (Updated 6/7/24)

Meet Donald Trump's Criminal Enterprise.

Donald Trump: Former so-called President & Convicted Felon: Found Guilty On All 34 counts Of Business Document Fraud. Found Liable For Se*ual Assault of E. Jean Carroll

Rep. Chris Collins: Trump's Former Mouthpiece in Congress - Convicted

Rick Gates: Trump's Former Deputy Campaign Manager - Convicted

Paul Manafort: Trump’s Former Campaign Chair - Convicted

George Papadopoulos: Trump's Former Foreign Policy Advisory - Convicted

Mike Flynn: Trump’s Former National Security Adviser - Convicted

Michael Cohen: Trump's Former Attorney and Fixer - Convicted

Roger Stone: Former Political Consultant for the Trump Campaign - Convicted

Steve Bannon: Former Trump White House Chief Strategists and Senior Counselor To Trump - Convicted

Allen Weisselberg: ��Chief Financial Officer of the Trump Organization - Convicted

Jenna Ellis: Former Trump Lawyer – Convicted

Sidney Powell: Former Trump Attorney – Convicted

Peter Navarro: Former Trump Advisor – Convicted

Mark Meadows: Former White House Chief Of Staff - Indicted

Rudy Giuliani: Trump's Former Attorney - Indicted

John Eastman: Former Trump Attorney – Indicted

Christina Bobb - Former Trump Attorney – Indicted

Boris Epshteyn: Former Trump Attorney – Indicted

Walt Nauta: Trump Aide - Indicted

Kenneth Cheseboro: Right-wing Attorney – Indicted

Michael Roman: Former Trump Campaign Official – Indicted

Jeffrey Clark: Former Trump Administration Official - Indicted

The Trump To Prison Pipeline:

18 People Indicted In Fulton County, GA

18 People Indicted For Election Interference In AZ

15 People Indicted For Election Forgery In MI

3 People Indicted For Fake Electors Scheme In WI

2 People Indicted For Obstruction Of Justice And Mishandling Of Classified Documents In Florida

1,400 people Arrested For January 6th, 2021 Insurrection At the U.S. Capitol

#trump#donald trump#trump convicted felon#guilty#guilty on 34 counts#stormy daniels#trump crime syndicate#vote blue#vote blue to save democracy#vote biden#biden 2024

66 notes

·

View notes

Note

Bruce Wayne deliberately leaks information about various Wayne companies to Poison Ivy. He plans these leaks to encourage her to target facilities with bad environmental records, at times when the facilities will be mostly or entirely empty.

He does this for two reasons: First, if the Wayne Enterprises board of directors won't let him shut a facility down or do major improvements (too expensive!), having Poison Ivy wreck it lets him use insurance money to improve the facility; And second, sending Ivy after small facilities keeps her too busy to plan large attacks.

Technically this is insurance fraud, but that's the least of Batman's many crimes.

213 notes

·

View notes

Note

any damian and tim bonding headcannons? since dc is utterly set on making them hate each other urgh

Once in a while Tim likes to knock Damian down a peg by reminding him he already discovered Batman and Robin's identity while Damian was in diapers

Damian showed up to Tim's room on a random Saturday afternoon. It took some prodding to figure out the petting zoo got a new goat, but the adults were busy and he wasn't accustomed to asking for "frivolous" things like that

Damian: "Do you have games on your phone?"

Tim, handing Damian his phone: "No"

Pet photoshoots are one thing, but consider: pet music videos

Damian is jealous of how the law keeps him from doing things meanwhile Tim has freedom as an emancipated minor. Tim responds by saying "haha loser"

Tim is in Camp "If you ruin Damian's excitement I'll frame you for tax fraud 4 months from now"

Tim's playlist gets put through the Damian Test, which is like Rotten Tomatoes except Damian plays it for Titus to see how he reacts. Tim has a solid 22% approval rate

Damian's a vegetarian but he'll still fight Tim over the wishbone

Damian stays inside with the dogs during Fourth of July fireworks. Tim swings by to drop a cup of hot chocolate and sneak his dirty laundry into Damian's hamper

Tim's favorite "-core" aesthetic is Microsoft Windows Landscape Screensaver Core. Damian's is Change Your Brother's Microsoft Windows Landscape Screensaver To A Lungfish Core

Tim let Damian drive home one night. Damian took two wrong exits, almost rear-ended a truck, and kept forgetting to use his blinker. When Tim said, "I thought you knew how to drive" Damian replied, "Yes. I never said I drove well. Come on, Drake, I can hardly reach the brakes" (Tim also had a small moment of being proud that Damian picked up his sense of humor)

Damian convinced Tim to chaperone his group on a class field trip to the harbor because Damian wanted to dig through the sludge for evidence on a case

When Damian tells him not to do something, that's when Tim stops and re-evaluates the kind of danger he's willing to put himself in

Tim's apartment was stocked with frozen pizza, coffee, Doritos, and Mountain Dew prior to moving in. Damian's housewarming gift was an apple

Damian occasionally peels and puts an orange on Tim's desk when he's gone too long without a snack

Unlike Dick, Tim doesn't censor himself around Damian, and unlike Jason, he doesn't avoid uncomfortable topics for the sake of not getting in trouble with Bruce. Thus, Tim taught Damian what the peach emoji actually means

Damian: "Drake, how do you like your egg?"

Tim: "Scrambled"

Damian: "Too bad. Pennyworth forbade me from cooking"

They veered from patrol on a side quest to try Jokerized seasoning on top of as many things as they could

Tim once napped through a Wayne Enterprises fire drill. He woke up to firefighters knocking at his window with Damian next to them making an L on his forehead

When Tim went off on a mission with Young Justice, Damian packed him a lunch box consisting of a loaf of bread, two 5-hour energy shots, a flash grenade, Cheese Viking band-aids, Damian's lucky pen, a fake ID, and a handwritten note saying "I'm stealing your pants. Don't expect them back"

#ask#anonymous#tim drake#red robin#damian wayne#robin#batfamily#batfam#batboys#batbros#batkids#batsiblings#batman family#dc comics#headcanon#tw food mention

1K notes

·

View notes

Text

Today’s Reminder that it’s not a Trump “hush money” trial. Hush money payments are generally legal.

It’s a Trump “Criminal Fraud” Trial.

Trump stands accused of violating criminal statutes on Election Fraud [17-152)] and on Tax Fraud [1801(a)(3) and 1802]

~~~~~~~~~~ELABORATION ~~~~~~~~~~~~~~~

New York Election Law § 17-152 prohibits a conspiracy to use “unlawful means” to promote or prevent a person’s election. The phrase “unlawful means” is interpreted broadly and is not limited to crimes but rather includes any conduct unauthorized by law. In denying Trump’s motion to dismiss, Justice Merchan upheld DA Bragg’s theory under this statute, namely: “the People allege that Defendant intended to violate N.Y. Election Law § 17-152 by conspiring to ‘promote the election of any person to a public office… by entering a scheme specifically for purposes of influencing the 2016 presidential election; and that they did so by ‘unlawful means,’ including by violating FECA through the unlawful individual and corporate contributions by Cohen, Pecker, and AMI; and… by falsifying the records of other New York enterprises and mischaracterizing the nature of the repayment for tax purposes.’ People’s Opposition at pg. 25

For the purposes of tax violations, Bragg relies on two related tax provisions: New York Tax Law §§ 1801(a)(3) & 1802. Section 1801(a) sets out relevant tax fraud acts, with subsection (3) prohibiting “knowingly suppl[ying] or submit[ting] materially false or fraudulent information in connection with any [tax] return, audit, investigation, or proceeding.” The tax fraud includes four elements: (1) a tax document filed, submitted or supplied; (2) falsity; (3) materiality; and (4) intent (willfulness). Any person who commits a tax fraud act, including under 1801(a)(3), is guilty, at a minimum, of criminal tax fraud in the fifth degree, a Class A misdemeanor crime under Section 1802, where the tax liability is less than $3,000. No additional mens rea is required, such as an intent to evade taxes or defraud the state. In this case, the primary alleged tax violation was Cohen falsely declaring the reimbursement as income, which artificially increased his tax liability. As Justice Merchan already found, however, an allegation of tax fraud where the state “was not financially harmed … and instead would wind up collecting more tax revenue” does not preclude the tax violation from being a predicate act for the first degree falsification of business records.

34 notes

·

View notes

Text

do you know how in american teen romcoms the boy and the girl like eachother but they're in this gay relationship limbo because both think they'll be rejected? imagine knowing, for a fact, that the other will love you and think you're the hottest bitch they ever had and eventually grow as obsessed with you as you are with them? that's me. there's no steps done towards even hinting at feelings but i know if i were to drop the "i have to confess how i really feel about you" in the inbox i would crush the man. which is why i keep that shit to myself. on that note this is true for every man out there. there hasn't been a man who didn't crush on me and i mean that in the worst way possible. coworkers. bosses. teachers. friends dads. i can see it in their eyes. and i feel for them man, they can't help it. speaking of, i have this pressure to research and discover cloning so i can start my business of shipping incels real gfs who will love them unconditionally. my enterprise singlehandedly solved the male loneliness problem but there is one little issue. the specimen ordered began to kill themselves, there was overall about a 60% suicide tendency. it seems so obvious. since they're all me and i wouldn't want to hop into bed with just anyone, why would my copy. i once again failed to consider the merchandise as autonomous individuals rather than a soulless product. the prejudice of the clones to stay alive for twinks and handsome put together men was not lost on the customer. people were outraged. the lawsuit for fraud came down hard and i was left a ruined person who died in poverty

46 notes

·

View notes

Text

High-Risk Merchant Processing Solutions: A Deep Dive for Businesses

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving world of commerce, the integration of credit card payments has become a pivotal aspect. However, for businesses categorized as "high-risk," this integration can feel more like scaling a mountain than establishing a foundation. Fear not, as we delve into the realm of high-risk merchant transaction solutions. In this exhaustive guide, we'll explore everything from the basics of payment processing for high-risk industries to the role of e-commerce in this domain. So, fasten your seatbelts as we embark on a journey to unravel the strategies of High-Risk Merchant Processing.

DOWNLOAD THE HIGH-RISK MERCHANT PROCESSING INFOGRAPHIC HERE

Payment Processing for High-Risk: Navigating the Challenges

Payment processing for high-risk businesses presents a unique set of challenges that demand careful navigation. These businesses often operate within sectors such as CBD, credit repair, and online gaming, characterized by a higher incidence of fraud and chargebacks. In this intricate landscape, high-risk merchant transactions play a pivotal role as the essential bridge enabling businesses to adeptly handle and mitigate the specific challenges linked with transaction processing within their sectors, ensuring financial stability and security.

Accepting Credit Cards: A Transformative Move

Embracing the acceptance of credit cards marks a pivotal turning point in the realm of high-risk merchant processing. This fundamental aspect holds the potential to revolutionize business operations within sectors deemed high-risk. By providing customers with the convenience and security of credit card payments, businesses can not only boost their sales but also cultivate a deeper sense of trust among their clientele. This transformation holds true irrespective of the challenges accompanying high-risk sectors, reaffirming the critical role credit card acceptance plays in the landscape of modern commerce.

Merchant Accounts: The Core of Payment Processing

At the core of effective payment processing lies the pivotal role of merchant accounts. They serve as the pulsating core of any enterprise aspiring to embrace the convenience and security of credit card payments. In the realm of high-risk businesses, where scrutiny is often heightened, high-risk merchant accounts assume paramount importance. These specialized accounts are tailored to the unique needs of businesses operating in sectors like CBD, credit repair, and online gaming, ensuring they can navigate the intricacies of payment processing without encountering unnecessary obstacles.

High-Risk Transaction Gateway: Your Digital Cashier

A high-risk transaction gateway functions as your digital cashier in today's digital era. This advanced technology is the backbone of secure and seamless online transactions, making it an absolute necessity for e-commerce enterprises operating in high-risk sectors. It's the virtual counterpart of a traditional cashier, efficiently handling electronic payments and ensuring the safety and fluidity of every transaction conducted in the high-risk sector. This pivotal tool not only streamlines payment processes but also plays a crucial role in maintaining the trust and security that customers and businesses alike require in the complex landscape of high-risk merchant processing.

E-commerce Payment Processing: The Future of High-Risk Business

E-commerce payment processing represents the future of high-risk business. In today's dynamic business landscape, where online commerce serves as the heartbeat of modern trade, high-risk sectors such as CBD and credit repair are no exceptions. Embracing e-commerce payment processing not only opens doors to a broader customer base but also paves the way for substantial revenue growth. Whether you're in the CBD sector or engaged in credit repair, integrating e-commerce payment solutions is pivotal to staying competitive and thriving in an increasingly digital world.

Credit Card Acceptance for CBD: Navigating Legality

Navigating the legal landscape can be particularly challenging for CBD businesses, often leading to them being labeled as high-risk. The ambiguity surrounding the legal status of CBD products can create a stigma that makes payment processing seem like a daunting task. Despite these challenges, it's crucial to understand that accepting credit cards for CBD is not only feasible but also a pivotal step toward sustainable growth. By partnering with the right high-risk merchant processing solutions, CBD businesses can not only process payments securely but also gain the trust of their customers, ultimately fueling their expansion and success.

Credit Restoration Transaction Processing: Rebuilding Financial Futures

Credit restoration businesses play a crucial role in assisting individuals on their journey to reclaim financial stability. These enterprises specialize in rectifying credit issues, and they are not exempt from the challenges of processing payments efficiently and securely. Therefore, it's imperative for credit restoration firms to explore and adopt specialized credit restoration transaction processing solutions tailored to their unique needs. These solutions empower credit restoration businesses to navigate the intricacies of payment processing seamlessly, allowing them to focus on what truly matters: restoring the financial futures of their clients.

youtube

Online Credit Card Processing: The Key to Expansion

Online credit card processing is an absolute necessity for high-risk businesses in our contemporary digital era. Beyond merely enabling seamless financial transactions, it serves as a crucial tool for generating invaluable insights that fuel business expansion. This technology empowers high-risk sectors to transcend the limitations of conventional payment methods and gain a competitive edge by harnessing the potential of the digital marketplace. By seamlessly integrating online credit card processing into their operations, businesses can unlock doors to new opportunities and sustainable growth while staying ahead in today's rapidly evolving business landscape.

High-risk merchant processing is not the insurmountable challenge it may seem to be. With the right solutions and partners, businesses in high-risk sectors can thrive, accept credit cards, and expand their horizons. Whether you're in CBD, credit repair, or any other high-risk sector, embracing modern payment processing systems and e-commerce can be a game-changer.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#high risk payment processing#credit card payment#accept credit cards#payment#Youtube

21 notes

·

View notes

Text

By: Adam B. Coleman

Published: May 17, 2024

The law of attraction dictates that you attract what you are, so it is by no coincidence that the Diversity Industrial Complex often attracts con artists.

It’s an industry predicated on siphoning phoning money from gullible corporations who are desperate to project themselves as societal changemakers.

This is how immoral people like ex-Facebook and Nike diversity program manager, Barbara Furlow-Smiles, were able to extract millions of dollars from resource abundant corporations.

Smiles, who led the diversity, equity, and inclusion (DEI) programs for Facebook from January 2017 to September 2021, pleaded guilty in December to a wire fraud scheme that helped her steal more than $4.9 million from Facebook and a six-figure sum from Nike.

Atlanta US Attorney Ryan Buchanan lamented how Smiles was “utilizing a scheme involving fraudulent vendors, fake invoices, and cash kickbacks.”

“After being terminated from Facebook, she brazenly continued the fraud as a DEI leader at Nike, where she stole another six-figure sum from their diversity program,” Buchanan stated.

Smiles used her authority to approve invoices to pay for services and events that never occurred, funneling the money to several personal associates and pay Smiles in kickbacks.

She would later submit fake expense reports claiming her associates completed work for Facebook, such as providing marketing help and merchandise fulfillment.

Smiles’ lavish lifestyle will be replaced with a stiff punishment of five years imprisonment, three years of supervised release and an order to pay back the money she stole from both Facebook and Nike.

There is something apropos about a sham employee like Smiles being able to climb the ranks of a sham sector of corporate America.

Post-George Floyd’s death, business enterprises fell in love with — or were backmailed into — the idea of a marriage between capitalism and social philanthropy.

DEI job positions increased 123% between May and September of 2020, according to Indeed.

It was no longer enough to have financial success in the business environment, they now wanted to become adored by the public — or at least not be accused of white supremacy.

But when you’re desperate for an outcome, there will always be fraudsters waiting to exploit you.

DEI is a sham because you can’t quantify if it’s succeeding. There are never enough programs or seminars or representation — it just keeps expanding.

Smiles likely was able to get away with what she was doing for years at Facebook because DEI is treated like a new romance; constantly given the benefit of the doubt despite their red flags.

Falling for a scam has nothing to do with intelligence or experience; literally anyone can get scammed.

We fall for scams when we become so desperate for an outcome that we’re willing to suspend belief and overlook common sense.

The problem is that ego prevents industry leaders from hearing our warnings about the falsehoods they’re being fed.

People who believe they’re always the smartest ones in the room won’t conceive how they’re being played by ideological nitwit college graduates who are motivated by ending capitalism.

They’re scared of being accused of being racist, and thus surround themselves with con artists who enjoy manipulating their empathy to drain their wealth.

Corporate America loves chasing love; DEI loves their money.

Adam B. Coleman is the author of “Black Victim to Black Victor” and founder of Wrong Speak Publishing. Follow him on Substack: adambcoleman.substack.com.

--

See:

==

DEI is inherently fraudulent. It's premised upon fraudulent grievance "scholarship," it's unquantifiable, untestable and unfalsifiable, and will accuse you of istaphobism for expecting that its objectives should be quantifiable, testable and falsifiable. Much like traditional religion.

In practice, it's like doing phrenology or dowsing for hidden "bigotry," and "curing" it with more identity homeopathy.

So, it's unsurprising that a fraudulent industry is rife with frauds. We've seen non-stop academic fraud and plagiarism from DEI academics, so we should expect comparable fraud from DEI practitioners.

Interesting how these DEI types are usually raging anti-capitalists, though.

#Adam B. Coleman#Barbara Furlow Smiles#DEI#diversity equity and inclusion#diversity#equity#inclusion#DEI must die#DEI bureaucracy#fraud#diversity chief#diversity officer#corruption#grifters#grifters gonna grift#con artist#scam artists#religion is a mental illness

8 notes

·

View notes

Text

Byron H. Robb’s Pertinacious Gall Got Him Evicted From Cincinnati And Honored In Texas

In the long and sordid roster of Queen City scalawags, Byron H. Robb holds a prominent place. He was delightfully incorrigible, congenitally incapable of telling the truth and absolutely unrepentant when exposed.

Robb fabricated so consistently that it is often difficult to separate any facts from the overwhelming flood of mendacity in his wake. It appears that he was born around 1836 in or near Parkman, Ohio, a tiny hamlet east of Cleveland and northwest of Youngstown. His parents named him Harvey, but he found that name uninspiring and relegated it to a middle initial. He began calling himself Byron, after the British poet.

At the age of 19, Robb launched a lifelong career as a bamboozler, selling a concoction guaranteed to produce luscious curls when applied to the scalp. At least one unfortunate customer went totally bald when she saturated her hair with the stuff. He got into the oil business by purchasing a dry well, then pouring oil stolen from nearby tanks into it. He then fobbed the now “productive” rig onto some credulous farmer. During the Civil War, Robb raised a cavalry company he dubbed the “Geauga Rangers” and offered it for service, claiming the rank of lieutenant on the basis of his own fabricated experience as a Texas Ranger. The United States Army wasn’t that desperate.

Among Robb’s myriad victims was Harriet Beecher Stowe, author of “Uncle Tom’s Cabin.” Mrs. Stowe ordered some “mammoth gourd seeds” from Robb to plant at her winter home in Florida. Robb claimed these seeds yielded gigantic gourds that could be used as washtubs. When her first shipment failed to sprout, Mrs. Stowe ordered another, and sent a letter inquiring what she had done wrong!

At various times, Robb popped up in St. Louis, New Orleans and a number of other locales, usually one step ahead of the law. When the constabulary sniffed too close to his fraudulent enterprises, Robb would “rent” another man’s name and resume business under that appellation until the coast was clear. During the 1860s, Robb paid a gardener named William Chappell $25 annually so he could advertise yet another hair tonic under the “Chappell’s Hyperion” brand.

It was reported that Robb dumped his first wife by encouraging her interest in another man. Robb sent her to Indiana to secure a divorce while he romanced an employee who would become the second Mrs. Robb.

Around 1875, Robb rented a house in Bellevue, Kentucky, establishing his business offices in Cincinnati. Entries in the city directories for the next half-dozen years indicate the constant churn of his schemes. At first, he listed himself as a “general agent,” which covered a multitude of sins. Next, he became the proprietor of the Monitor Manufacturing Company, then manager of the Monitor Lamp & Glass Works, and then President of the American and European Secret Service Company, then manager of the Electro Magnetic Hair and Flesh Brush Company.

Interestingly, at least two of these companies had some basis in actual inventions patented by Robb. In 1877, Robb was awarded a patent for a device that extinguished a kerosene lamp if it was knocked over. In 1879 and 1880, he earned patents for “galvanic” hairbrushes. Unfortunately, Robb preferred fraud to manufacturing. People who ordered his lamps often got nothing at all, while customers of his galvanic brushes received nothing but a cheap comb with a bit of copper wire wrapped around it.

It was his “Secret Service” company that achieved the pinnacle of Robb’s infamy. The American and European Secret Service Company placed hundreds of advertisements throughout the United States, offering to enlist any correspondent as a bona-fide detective, complete with a frameable certificate and a shiny new badge for the low, low price of only $3.60. After paying this fee, applicants were advised to keep their day jobs in order to remain undercover until an assignment came up. Young men throughout the country signed up in abundance – many of them career criminals who believed that an appointment as a detective offered a credible alibi. There are reports of bushels of mail arriving every day at Robb’s Fifth Street office, half containing money orders for $3.60 and half containing dunning letters from newspapers that were never paid for running Robb’s advertisements.

Eventually the postal inspectors caught up with Robb and he was subpoenaed to court. Robb procured the cream of the Cincinnati bar for his defense, including Stanley Matthews, later appointed to the United States Supreme Court, and George Hoadly, later elected governor of Ohio. His lawyers reviewed the evidence collected by the Post Office and informed Robb that he was undoubtedly going to lose the case. His best option was to plead guilty and throw himself on the mercy of the court.

Robb responded by firing his crack legal team. He then sent telegrams to a dozen or so of his “detectives,” directing them to take the next train westward, to proceed to some remote location and to apprehend a red-headed, one-eyed man missing one finger and walking with a limp. The young operatives, delighted to finally be on assignment, followed orders and reported back that no such man could be found. Robb thanked them for their diligence, paid their salary and expenses and told his proteges to await their next assignment.

In court, Robb produced several of these young men as witnesses. They testified under oath that they had applied to the Secret Service Company, paid the initiation fee, received their badge and certificate, and had received an assignment from Robb and had been paid for it. The Post Office case crumbled. No matter they could prove nothing in court, the United States Postmaster announced in 1880 that nine Cincinnati companies controlled by Robb were prohibited from using the postal service in any manner.

Byron H. Robb responded to this temporary setback with his usual flair. First, he went to court and had his name legally changed to Byron H. Van Raub, claiming it was the ancestral version of the family surname. Then he relocated to Texas and acquired some property he claimed was the famous Don Carlos Ranch, which it was not, and then got into the Shetland Pony business, and then the cowboy school business, and then the bloodhound dog business, and then the Buff Leghorn egg business and then the milch goat business. And he had the nearest Bexar County railroad whistle stop renamed Van Raub, after himself.

Every time Robb, or Van Raub, embarked on some new scam, newspapers around the country published scathing exposés of his extensive rap sheet. Newspaper owners were delighted to attack him because the one constant in Robb’s career was his reluctance to pay for advertising. Still, there was always someone willing to believe his folderol. One newspaper, reporting that Van Raub was seeking young men willing to become cowboys (and willing to send him $5.00 for particulars – sound familiar?) claimed he was a retired Prussian cavalry officer who insisted on stern discipline. When Robb died in 1913, the obituaries included some highly unlikely embellishments such as selling Shetland ponies to European nobility.

Amazingly, Robb’s bullshit endures to this very day. Out where Van Raub, Texas, once existed – by the 1920s, his namesake was nothing more than a ghost town – there is an official historic marker that reads in part:

“This community, named after Byron Van Raub, an English gentlemen rancher, was established along the route of the Kerrville Branch. It is said that this successful gentleman rancher developed the first dude ranch in Texas as a means to train fellow Englishman in the rigors of creating successful Texas ranching operations.”

The shifty little shyster from rural Ohio got himself memorialized as an English gentleman, capping a positively breathtaking life of unrelenting chutzpah.

5 notes

·

View notes

Text

Reading the latest Levine:

Voyager was going around telling customers that their deposits of crypto at Voyager were backed by the Federal Deposit Insurance Corp., but they were not

> "I used Voyager to replace my savings account as it was advertised as FDIC insured, I am now filled with regret for doing so and fear that I pretty much lost everything for trusting this company."

If a company can advertise (Illegal! But they can!) that they are FDIC insured, and then you can still lose your money - then what value to me, the customer, any claim that you are FDIC insured?

If I was Finance Dictator for Life and I cared about bank stability and reputation enough to keep the FDIC around, I think I would make it so everybody claiming to be FDIC insured is, for the purpose of customer recovery, FDIC insured. Their customers will be made whole, the reputation of FDIC being sacrosanct else what is the point.

"How to pay for that?" The insurance payments from institutions who legitimately are insured by FDIC.

Though obviously this sets up some bad incentives.

--- More words about incentives under the readmore ---

Consider this business plan:

Fail to make legitimate profits.

(A) EITHER - Definitely go bankrupt, hurting creditors.

(B) OR - Become fraudulent to make profits.

And then, if you become fraudulent, expand B into:

(B1) EITHER - Fail and go bankrupt anyway.

(B2) OR - Succeed, get profits, pivot profits into legitimacy, make money in legitimate markets, use profits to pay off fines and damages for earlier fraud.

(B3) OR - Succeed, get profits, keep running profitable criminal enterprise until you get caught and/or you take the money and run.

This is hard to deter with bankruptcy! Even if nobody involved wants B3, if your only tool to disincentivize fraud is bankruptcy, the whole thing simplifies to

Fail to make legitimate profits.

(A) EITHER - Definitely go bankrupt.

(B1+B2) OR - Maybe go bankrupt, maybe don't.

What if we added some fines to it? Unfortunately, that doesn't change much - maybe the fines bankrupt your company, maybe they don't.

You could absolutely convince me that, if all of Voyager's personnel were gathered and their emergent combined strategy was actually written down, it could be summarized like that.

Probably nobody at voyager wanted to run a criminal enterprise. They wanted to run a profitable business and, just, they just had to be a little criminal to avoid failure (With no victims! There will only be victims if we fail and we're doing this to not fail!) and then they failed anyway.

What if we added some amount personal skin in the game by making people personally liable, or fining them, or with actual imprisonment?

Sure. That deters some people. That's where we are today. It clearly failed to deter Voyager.

Specifically it fails to deter these groups:

Arrogant people who think they cannot fail and this will definitely let them pivot to a profitable business.

Hopeful people who think this will probably not fail and will probably let them pivot to a profitable business.

Gangsters who don't care about running a legitimate business and think they can succeed at running a criminal enterprise.

Changing the incentives for gangsters is real hard, especially if they're judgement proof.

But you can change the incentives for the hopefuls and the arrogant people.

You want to change

Fail to make legitimate profits.

(A) EITHER - Definitely go bankrupt.

(B1+B2) OR - Maybe go bankrupt, maybe don't.

(B3) OR - Pivot to a criminal enterprise.

into

Fail to make legitimate profits.

(A) EITHER - Definitely go bankrupt.

(B1+B2) OR - Still definitely go bankrupt.

(B3) OR - Pivot to a criminal enterprise.

If the arrogant people and the hopeful people learn that they are definitely going bankrupt either way, "do fraud to avoid bankruptcy" stops making sense.

And the way to do that is to make the fine completely unbounded, fully retroactive, and personal. Even if they manage to right their course.

If your history looks like

Negative 10 million

Lies about FDIC

Positive 10 million

Stops lying about FDIC

Regular profitability: 100 million

Old FDIC lies discovered today

Then, as Finance Dictator for Life, I am fining you and the company 100 million each, today. When you decided to lie about FDIC, you decided that your company would never make a legitimate profit ever again, and I am killing it, effective immediate.

"What if some people lied and other people "- listen there are a lot of nuances,

19 notes

·

View notes

Text

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

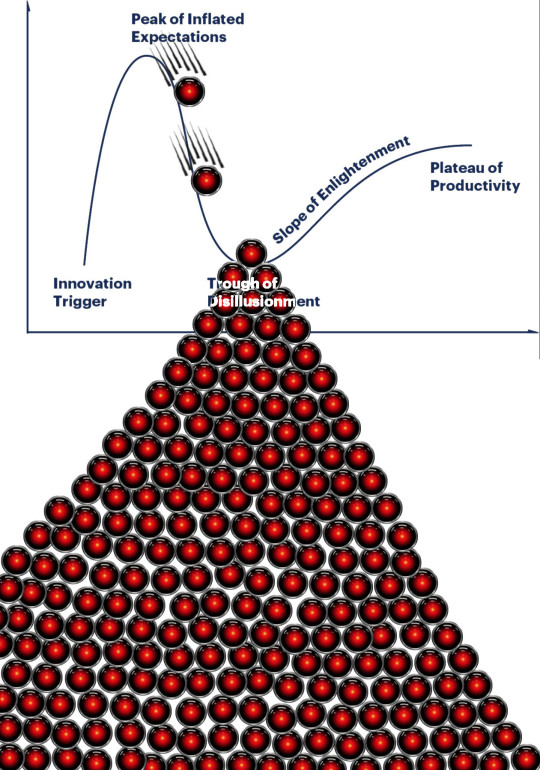

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

The Justice Department is expected to recommend dropping a fraud lawsuit which implicates Dish Network as early as this Friday, according to sources with the FCC. This proposed dismissal comes just before Dish’s CEO and Democratic donor Charlie Ergen and executives at BlackRock were scheduled to be deposed.

The case goes back to a 2015 FCC Spectrum Auction for valuable bandwidth that could be used for wireless internet. To promote competition, the FCC issued a 25 percent discount called “bidding credits” to “very small businesses” which averaged below $15 million in revenue over the previous three years. Between 2011 and 2014, Dish’s revenue ranged from $13.5 to 15 billion. Nonetheless, Dish, with backing from BlackRock, financed two ostensibly small companies Northstar Wireless and SNR Wireless, which went on to win the auctions, with discounts worth over $3 billion.

SNR and Northstar acknowledged the financing, but certified they had total independence. An FCC inquiry later found “persuasive...evidence” that the two companies served “as arms of Dish,” which had “de facto control.” The FCC, under Ajit Pai, doubted “these companies are, or could ever become, truly independent enterprises” and revoked the credits in 2020.

A senior FCC official familiar with the process tells me, “multi-billion dollar corporations setting up shell corporations to get subsidies designed for ‘very small businesses’ demands serious scrutiny in court.” This scrutiny comes in the form of a qui tam suit filed by Vermont National Telephone Company, which lost the auction to Dish and its financed “very small businesses.” Qui tam actions are filed by private parties on behalf of the U.S. Government, which will recover the bulk of defrauded money under the False Claims Act. Both the Justice Department and FCC supported the lawsuit, noting there was “a substantial interest in any discovery produced in this case that relates to Defendants’ alleged failure to disclose material facts to the Commission.”

4 notes

·

View notes

Photo

[The Daily Don] :: If GOP polling means anything, I guess being an inadequate sex pest is a feature not a flaw.

* * * *

LETTERS FROM AN AMERICAN

May 10, 2023

HEATHER COX RICHARDSON

MAY 11, 2023

This morning, federal prosecutors charged Representative George Santos (R-NY) with seven counts of wire fraud, three counts of money laundering, two counts of making materially false statements to the House of Representatives, and one count of stealing public funds. The charges are tied to his campaign fundraising and unemployment fraud; prosecutors say he received about $25,000 in unemployment insurance benefits during 2020 and 2021, during the worst of the pandemic, when he was, in fact, making about $120,000 a year.

Santos pleaded not guilty and was released on $500,000 bail and immediately began to fundraise off his arrest.

This is another embarrassment for the Republicans. House Republican Conference Chair Elise Stefanik, the third-ranking Republican in the House, has championed Santos in ads as “the next generation of Republican leadership.” And today, while the House Republicans were in the midst of a press conference about their plan to crack down on unemployment fraud, news broke that one of their own has been charged with it. Ironically, Santos is a co-sponsor of the bill.

With the news about Santos this morning and the news last night of former president Trump’s liability for sexual abuse and defamation, the release this morning of a report from the House Judiciary Committee, led by Representative Jim Jordan (R-OH), looked as if it was designed to be a distraction.

The report insisted that “that Hunter Biden’s laptop and emails were real”—by which the Republicans meant to say that the idea there was something incriminating on them was real—rather than possibly Russian disinformation, as a letter from former intelligence officials said when the story first broke. The report promised to prove that “senior intelligence community officials and the Biden campaign worked to mislead American voters.”

But the report was a bizarre effort. Despite the breathless allegations in it, the 65-page document seems to prove that the former intelligence officials who said the news story about the laptop had the hallmarks of a Russian disinformation effort believed what they were saying and went through the proper channels at the Central Intelligence Agency to clear their statement. The person who did appear to be trying to make a political statement was Trump’s loyalist director of national intelligence, John Ratcliffe.