#payment processing

Text

Future-Proof Payment Solutions: A Guide to Merchant Account Innovations

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the fast-paced world of online commerce, payment solutions have evolved into the linchpin for the success of businesses spanning diverse industries. Whether steering an e-commerce venture, specializing in credit repair, or navigating the CBD retail landscape, procuring an apt merchant account and avant-garde payment processing system is paramount. This guide delves into the domain of payment innovation, spotlighting future-proof solutions crafted to meet the exigencies of contemporary high-risk businesses.

DOWNLOAD THE FUTURE-PROOF PAYMENT SOLUTIONS INFOGRAPHIC HERE

The Core of Merchant Accounts

Merchant accounts, serving as the bedrock of secure payment processing, play an instrumental role in facilitating various transactions, including credit and debit card payments. The significance of reliable and efficient merchant processing services cannot be overstated. Whether operating in the high-risk echelons or mainstream e-commerce, securing the right merchant account is a prerequisite for ensuring the fluidity of transactions.

Navigating the Landscape of High-Risk Payment Processing

Industries perched in the high-risk echelons, such as credit repair and CBD, grapple with distinctive challenges in the realm of payment processing. Traditional payment processors often shy away from these ventures due to perceived risks. However, this guide unravels the nuances of high-risk payment processing, spotlighting innovations designed to fortify and safeguard businesses operating in these precarious niches.

E-Commerce Payment Prowess

In this digital epoch, the ascent of e-commerce is meteoric. To flourish in this fiercely competitive landscape, online enterprises must proffer payment options that seamlessly meld convenience with security. This section delves into e-commerce payment processing solutions, underscoring the perks of embracing a dedicated e-commerce merchant account. Whether dealing in products or services, the payment gateway emerges as the conduit to triumph.

Bespoke Services for Credit Repair

Credit repair entities assume a pivotal role in aiding individuals to reconstruct their financial landscapes. Yet, the distinctive nature of this terrain necessitates specialized merchant processing services. This guide unravels the intricacies of payment processing and payment gateways uniquely tailored for credit repair merchants, ensuring compliance with industry regulations.

youtube

Mastery of Payment Processing in the CBD Realm

While the CBD industry witnesses unprecedented growth, it concurrently stands as one of the most high-risk sectors for payment processing. Securing a dependable CBD merchant account and payment gateway is imperative for enterprises navigating this domain. This section dissects the challenges confronting CBD retailers and unveils innovative solutions engineered to usher in secure and efficient credit card processing for CBD products.

In the ever-evolving realm of payment processing, proactive adaptation is the linchpin for businesses of every stature and kind. From high-risk payment processing to e-commerce sagas and specialized solutions for credit repair and CBD landscapes, the payment tableau is undergoing a metamorphosis. Armed with the right merchant account and payment gateway, businesses can fortify their standing in the digital arena, future-proofing their enterprise while presenting customers with a payment experience that seamlessly amalgamates security and convenience.

#high risk merchant account#credit card processing#payment processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#merchant processing#payment#youtube#Youtube

22 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

Nurit Credit Card Processing Terminals: A Comprehensive Overview

#Nurit Credit Card Processing Terminals: A Comprehensive Overview#credit card processing#credit card terminal#credit#processing#nurit#credit card machine#credit card payments#card processing#emv credit card processing#exs credit card processing#accept credit cards#terminals#payment processing#credit card#best way to accept credit cards#credit card (industry)#free emv credit card terminal#process credit card payments#emv credit card terminal#cardpointe credit card terminal#credit card services

1 note

·

View note

Text

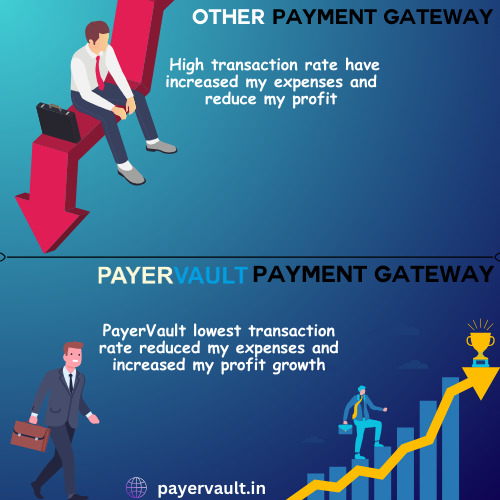

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness"

Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

2 notes

·

View notes

Text

Empower Your Business with a Custom Merchant Account for Payment Ease

Looking to secure a merchant account for your business? Our team of payment processing professionals provides a complete range of merchant account services tailored to match your distinct business requirements. Covering everything from processing credit and debit cards to offering virtual terminals and mobile payment options, we're here to accelerate your transactions and enhance your financial results. Connect with us now to gain insights into our merchant account solutions and initiate the process of embracing payments to drive your business's expansion.

3 notes

·

View notes

Text

1 note

·

View note

Text

The Future of Digital Payments: Trends and Innovations

Introduction

In an increasingly digital world, the way we handle financial transactions has undergone a significant transformation. Digital payments have become a cornerstone of our everyday lives, offering convenience, speed, and security. As we look to the future, it is essential to examine the emerging trends and innovations that will shape the landscape of digital payments. From mobile wallets to cryptocurrencies, from IoT payments to biometric authentication, this blog explores the exciting possibilities that lie ahead.

1- Mobile Wallets and Contactless Payments

Mobile wallets have already gained substantial popularity, enabling users to make payments using their smartphones. As we move forward, the future of mobile wallets looks even more promising. We can expect to see enhanced features such as integration with loyalty programs, personalized offers, and seamless cross-border transactions. The convenience of contactless payments will continue to drive their adoption, with technologies like Near Field Communication (NFC) and biometric authentication ensuring secure and hassle-free transactions.

2- Cryptocurrencies and Blockchain Technology

The rise of cryptocurrencies, led by Bitcoin, has sparked a revolution in financial systems worldwide. As we look ahead, the acceptance and integration of cryptocurrencies into mainstream payment systems will likely continue to grow. Blockchain technology, the underlying technology behind cryptocurrencies, offers unparalleled security, transparency, and efficiency. Smart contracts, enabled by blockchain, will revolutionize business transactions, automating agreements and ensuring trust and immutability.

3- Internet of Things (IoT) Payments

The Internet of Things (IoT) is expanding rapidly, connecting various devices and enabling seamless communication. In the future, IoT devices will play a significant role in digital payments. For instance, smart refrigerators could automatically reorder groceries when supplies run low and connected cars could pay for tolls and parking fees without human intervention. The integration of IoT with payment systems will provide a frictionless experience, streamlining everyday transactions.

4- Biometric Authentication and Facial Recognition

Traditional methods of authentication, such as passwords and PINs, are prone to security breaches. Biometric authentication, including fingerprint and facial recognition, presents a more secure and convenient alternative. As technology advances, we can expect widespread adoption of biometric authentication in digital payments. This will enhance security, reducing the risks of identity theft and fraud while providing a seamless user experience.

5- Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing various industries, and digital payments are no exception. AI-powered systems can analyze vast amounts of data, detect patterns, and identify fraudulent activities in real time. These technologies will strengthen security measures, reduce false positives, and enhance fraud detection and prevention capabilities. AI chatbots and virtual assistants will improve customer support, providing personalized recommendations and assistance in making payment decisions.

6- Cross-Border Payments and Digital Currencies

Cross-border transactions often face challenges such as high fees, long settlement times, and regulatory complexities. Digital currencies and blockchain technology have the potential to revolutionize cross-border payments. By eliminating intermediaries, reducing costs, and increasing transaction speed, cryptocurrencies or stablecoins backed by fiat currencies can facilitate instant and secure cross-border transfers. This will foster global economic integration and financial inclusion.

Conclusion

The future of digital payments holds immense potential for innovation and transformation. Mobile wallets, cryptocurrencies, IoT payments, biometric authentication, AI-powered systems, and cross-border innovations are just some of the trends that will shape the digital payment landscape. As we embrace these advancements, it is crucial to prioritize security, user privacy, and regulatory frameworks to ensure a seamless and secure digital payment experience for all. The digital payment ecosystem is evolving rapidly, and staying informed and adaptable will be key to capitalizing on the opportunities that lie ahead. With technology as an enabler, the future of digital payments is poised to enhance.

2 notes

·

View notes

Photo

New Post No fraudulent purchases https://torontocreditcardprocessing.com/no-fraudulent-purchases/

Fraud; Deceit; Trickery, An Imposter, a Cheat. To put it lightly, not a nice person.

Nochargebacks.ca provides an online gateway or payment gateway, giving you and your customers peace of mind. With a nochargebacks.ca payment gateway, your clientele can spend money on their credit cards all around the world, and you receive payment within hours instead of having to wait 6 to 8 weeks to see reimbursement in your account.

With nochargebacks.ca, there is no more worrying about fraudulent purchases or having to refund your customers.

The only way a chargeback happens is if the customer doesn’t receive their merchandise following online payment. And, with the additional security in place, this almost never happens.

Why choose an Online Gateway with fraud protection

Online gateways have a number of benefits, but the greatest one is that, because of the fraud protection, the rates are cheaper. When both banks and merchants are saved the hassle of having customers call to complain that someone used their card to order a ten thousand dollar watch, they are happier.

Choose nochargebacks.ca. Better rates for you and your company, and better statistics next year from the Canadian Anti-Fraud Center!

nochargebacks.ca is a sales agent

Call direct to Paul’s cell : (416) 687-5373

Apply for this service on nochargebacks.ca

#chargeback

#chargebacks

#chargebacks9II

#chargebackmanagement

#chargebackprotection

#onlinepaymentmethods

#fraudprotection

#fraudprotectionservices

#Accept debit#Accept debit Toronto#Chargeback#chargebackmanagement#chargebackprotection#chargebacks#Credit Card Processing Canada#credit card processing declined#credit card processing toronto#Debit card#Debit Machine#debit machine canada toronto#Debit Machine Toronto#fraudprotection#fraudprotectionservices#Merchant account#merchant account Canada#merchant account Toronto#payment processing#Payment Processing Toronto#POS terminals#POS terminals Toronto#Toronto Credit Card Processing

3 notes

·

View notes

Text

Credit card processing for small businesses or big businesses is similar. However, the monthly volume is surely different for the two. Nowadays and the payment reaches the merchant in a short time.

4 notes

·

View notes

Text

Innovations in Credit Repair Payment Gateway Integration

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the swiftly changing world of e-commerce and high-risk merchant processing, the demand for secure and efficient payment gateways is crucial. As we explore the innovations in Credit Repair Payment Gateway integration, this journey empowers businesses to thrive in the digital age. This article delves into cutting-edge solutions and strategies while keeping your business's financial security at the forefront.

DOWNLOAD THE INNOVATIONS IN CREDIT REPAIR INFOGRAPHIC HERE

Embracing High-Risk Payment Processing

Payment processing for high-risk industries has been historically challenging. However, the contemporary technology-driven world provides notable solutions. Pioneering companies specializing in Merchant Processing Services lead the way in high-risk merchant processing. They grasp the unique challenges faced by businesses in this sector and have developed tailored solutions. In a landscape where trust and security are paramount, a credit repair payment gateway plays a pivotal role, offering a lifeline to broader customer outreach for businesses navigating high-risk waters.

The Role of Credit Repair Payment Gateway

The term "Credit repair payment gateway" essentially refers to the backbone of your e-commerce payment processing system. It not only facilitates the acceptance of credit and debit card payments but also plays a crucial role in building trust with your customers. A robust credit repair payment gateway acts as your bridge to accepting payments online. It serves as a secure intermediary between your website and financial institutions, ensuring each transaction is encrypted and protected. This level of security fosters trust among your customers, especially vital in high-risk industries.

Expanding Horizons with CBD Merchant Accounts

CBD businesses, on the rise, often encounter difficulties in securing a payment processing partner. High-risk payment gateways bridge the gap by offering specialized solutions for CBD merchants. By choosing to accept credit cards for CBD, businesses in this industry can unlock tremendous growth potential. CBD merchant accounts are a game-changer, designed to cater to the unique needs of CBD sellers often in the high-risk category due to the evolving legal landscape. With the right payment gateway, seamlessly processing payments for CBD products expands your customer base and revenue streams.

The Evolving Landscape of Online Payment Gateways

As e-commerce continues to flourish, the demand for reliable and secure online payment gateways grows. Your credit repair business can thrive by integrating the right e-commerce credit card processing solution. This technology empowers you to accept credit cards for credit repair with ease, catering to the evolving needs of your customers. Online payment gateways have evolved significantly, facilitating transactions and offering enhanced security features. This is particularly important for businesses in high-risk industries where trust is paramount.

The Power of Innovation: Credit Card Processing

The cutting-edge credit card payment processing system ensures your business stays ahead. This high-risk merchant account provider offers the flexibility and security to navigate the complex terrain of payment processing for credit repair. In credit card processing, reliability and security are non-negotiable. Specialized companies understand the unique needs of businesses in high-risk industries and tailor solutions accordingly. Partnering with a trusted provider streamlines your payment processes, allowing a focus on growing your credit repair business.

Merchant Processing for High-Risk Industries

High-risk merchant processing demands a unique set of tools and expertise. It's essential to partner with a provider understanding the intricacies of your industry. By integrating a high-risk payment gateway, you're not only safeguarding transactions but also opening doors to a broader customer base. In high-risk industries, trust and security are paramount. Your choice of merchant processing services can make or break your business. It's crucial to work with a provider specializing in high-risk transactions, offering robust security measures to protect your business and customers.

youtube

The Future of Accepting Credit Cards

Looking ahead, accepting credit cards for e-commerce remains a cornerstone. Innovations in payment gateway integration ensure your customers can transact seamlessly, fostering trust and loyalty. The future of accepting credit cards is bright, with continuous advancements in technology. Payment gateways will continue to evolve, offering enhanced features and security measures. Staying up-to-date with these innovations positions your business to thrive in the ever-changing landscape of e-commerce.

In the realm of high-risk e-commerce payment processing, embracing innovation becomes the linchpin of success. Forward-thinking providers comprehend the distinctive requirements of businesses, spearheading pioneering solutions meticulously designed for specific industries. Wholeheartedly embracing groundbreaking advancements in the integration of payment gateways for credit repair fuels business growth, nurturing the potential for a prosperous future in your financial ventures. This unwavering commitment to innovation promises to illuminate the path forward, ensuring promising prospects and boundless growth for enterprises.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment processing#high risk payment gateway#credit card payment#accept credit cards#payment#youtube#credit repair#Youtube

22 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Secure Online Payments Made Easy with OnePay

Welcome to the world of modern business, where convenience is king and adaptation is the key to success. If you're a business owner, big or small, you've probably heard about the importance of accepting card payments and processing transactions online. But what exactly does that entail? Don't worry, we're here to break it down for you in the simplest terms possible. Think of it as your trusted guide to navigating the world of payments with ease and confidence. Let's get started!

Understanding Card Payments

First things first, let's break down what card payments entail. When a customer pays with a credit or debit card, the transaction involves several steps:

Authorization: The customer swipes, inserts, or taps their card at the point of sale (POS) device or enters their card details online.

Authentication: The card issuer verifies the transaction's legitimacy and the availability of funds.

Settlement: The funds are transferred from the customer's account to the merchant's account.

Why Accept Card Payments?

Accepting card payments offers numerous benefits for your business:

Convenience: Customers prefer the ease and security of paying with cards.

Increased Sales: Studies show that businesses that accept cards typically see higher transaction volumes.

Global Reach: With online payments, you can reach customers beyond your local area or even your country.

Security: Card transactions come with built-in fraud protection, reducing the risk for both you and your customers.

Accepting Payments Online

Nowadays, having an online presence is crucial for any business. Here's how you can start accepting payments online

Choose a Payment Gateway: A payment gateway is an online service that authorizes card payments. Popular options include PayPal, Stripe, and Square.

Integrate with Your Website: Most payment gateways offer easy-to-implement plugins or APIs to seamlessly integrate with your website or e-commerce platform.

Secure Checkout: Ensure that your checkout process is secure and user-friendly to instill trust in your customers.

Stay Compliant: Familiarize yourself with relevant regulations such as PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive cardholder data.

Simplifying the Process

While the technical aspects of card payments and online transactions may seem daunting, there are tools and services available to simplify the process for you:

All-in-One Solutions: Consider using platforms like Shopify or WooCommerce that provide integrated payment processing along with e-commerce functionalities.

Customer Support: Choose payment providers that offer responsive customer support to assist you whenever you encounter challenges.

Educational Resources: Take advantage of online guides, tutorials, and customer forums provided by payment service providers to learn and troubleshoot effectively.

Conclusion

Accepting card payments and processing transactions online doesn't have to be overwhelming. By understanding the basics, leveraging reliable payment gateways, and utilizing available resources, you can simplify the process and focus on growing your business. Embrace the opportunities that digital payments offer, and watch your business thrive in today's interconnected world.

1 note

·

View note

Text

Searching for Easy Payment Solutions? Our Sales Manager, Michael Nelson, Can Help

Like it or not, if you own a business, you’re going to need some kind of payment processing.

But our industry doesn’t do much to clarify things for merchants, and for the most part, it fails to provide easy payment solutions, keeping everything as convoluted as possible.

That being said, we understand how difficult it can be for business owners like you to try to understand what payment processing is, how it works, what exactly it is you’re paying for, and what provider you should choose to get the best service and the best deal.

With that in mind, at Lucid Payments, we’re on a mission to protect the best interests of business owners, provide easy payment solutions, and give you greater clarity on your payment processing.

And if there’s one member of our team who best embodies these goals, it has to be our long-time Sales Manager, Michael Nelson.

Our customers are constantly raving about the services Michael provides, as he loves to go above and beyond for them in whatever way he can.

As a show of our appreciation, we want to take this opportunity to highlight Michael’s dedication to our customers and introduce him to merchants like you.

So, if you’re searching for easy payment solutions, and you need someone to answer your questions and help you get everything set up, keep reading to learn how Michael can help.

Looking for Easy Payment Solutions? Michael Can Help

Whether you’re in the market for online payment solutions, payment solutions for retail, or something else entirely, Michael can make everything easy for you.

But before we go any further into that, let’s take a moment to get to know Michael a bit better.

Michael has been doing sales in one form or another for the last 25 years, he’s been with Lucid Payments for the last six years, and he currently lives in Sylvan Lake, Alberta.

Aside from his work in sales, before Michael joined Lucid Payments, he worked as a DJ for 27 years and ran his own IT business, which involved things like setting up networks and installing surveillance cameras.

Michael is also a single dad with four kids and the proud owner of a Chihuahua named Gringo.

When he’s not helping business owners, hanging out with family, or walking the dog, Michael loves to spend time cruising around on his Onewheel and dancing at music festivals.

Why Michael Chose to Work for Lucid Payments

Before starting with Lucid Payments, Michael had an awful experience working for another payment processor, not least because he felt like they weren’t being honest with him.

This was having a decidedly negative effect on Michael’s ability to do his job, and if they weren’t being honest with him, then you can bet they were doing the same thing with their customers.

“I worked for them for about three months,” he said. “And I walked away from it because I was ready to pull out my hair. I couldn’t even get answers to simple questions.”

Then he spoke to our VP of Operations, Steven Cumiskey, and that one phone call was enough to change Michael’s perspective on our industry.

Steven was able to answer almost all the questions Michael had, and the couple of things that he didn’t know offhand, he got back to him about the next day.

“I’ve used the term smoke and mirrors as my description of this industry,” said Michael. “But Lucid Payments offered all the clarity I was missing.”

What’s more, our mission, which is to protect the best interests of business owners, give them greater clarity, and provide simplified payment processing, really resonated with Michael.

“That’s exactly how I live my life,” he said. “When somebody needs something, I’m going to try and figure out a way to help them. And if I can’t, I’m going to try and find somebody I know who can.”

As a business owner himself, the most fulfilling part of Michael’s role with Lucid Payments has been helping other business owners.

Whether it’s helping them set up their equipment, showing them how to operate it, explaining how our industry works, going over their statements to explain what they’re paying for, or helping them save money on their payment processing, there’s nothing Michael loves more.

How Michael Has Helped Our Customers

Throughout his more than six years with Lucid Payments, Michael has helped countless customers.

Whether it’s issues with equipment, poor customer service, or just being tired of paying too much, if you’ve got a problem with your payment processing, or you’re looking for easy payment solutions, chances are, he can help.

And to give you a better idea of how he can help, here are some examples of what Michael has been able to accomplish for our customers:

Chief’s Pub & Eatery

Before choosing to work with Lucid Payments, Chief’s Pub & Eatery used to have lots of technical issues with the outdated payment terminals that were provided by their previous processor.

Michael recently switched them over to newer and more reliable machines, which has solved all of these problems for them, and we were even able to save them over 60 per cent on their monthly processing costs.

Mullets Barbershop

When they opened their first location about three years ago, Michael was able to help Mullets Barbershop get their payment processing set up and made sure they understood everything.

Since then, they’ve opened four more locations, and as a result of how happy they’ve been with the service Michael’s provided, they’ve chosen to work exclusively with Lucid Payments for their payment processing.

Party Chef

Party Chef, which combines a restaurant and local artisanal market, had a rough start when they launched a couple of years ago.

When they first opened, they went with a processor from Ontario, and within the first two days, they were already having issues accepting Mastercard and debit payments.

The following week, they agreed to go with Lucid Payments, and Michael was able to solve these problems by switching them to a more reliable and efficient payment terminal.

Shortly after that, they wanted to launch their website, so Michael worked with them on the initial setup, and he’s always available to answer any questions they have.

“I highly recommend Michael for his exceptional local service, strong communication skills, and willingness to go above and beyond to assist. He is always readily available to provide support and ensures that his clients receive the attention they need. Whether it’s a quick question or a more complex issue, Michael is consistently reliable and responsive,” said Party Chef’s owner, Lydia Neergaard.

“His dedication to helping others is evident in his proactive approach to problem-solving and his genuine interest in addressing clients’ needs. I have been consistently impressed with his professionalism and commitment to delivering top-notch service. I am grateful for his assistance and would not hesitate to recommend him to others.”

What Our Customers Have to Say About Michael

We’re constantly getting compliments from satisfied customers who can’t help but rave about the experience they’ve had working with Michael.

Whether it’s his helpful and friendly demeanour, dedication, expertise, or ability to provide easy payment solutions, our customers have no shortage of good things to say about him.

One look at our Google reviews, many of which mention Michael by name, should be enough evidence of that. Here are some of the compliments he’s received so far:

Still searching for easy payment solutions? You can call Michael at (403) 396-6941, email him at [email protected], or contact us for more information.

#easy payment processing#payment processing options#payment processing#paying online#online payment options

0 notes

Text

High-Risk Merchant Account | ECS Payments

ECS Payments offers specialized high-risk merchant account solutions designed to facilitate secure payment processing for businesses operating in challenging industries. Our tailored solutions provide advanced fraud protection, robust encryption, and comprehensive risk management features, ensuring the safety of your transactions. With ECS Payments as your trusted partner, you can confidently navigate the complexities of high-risk industries while benefiting from seamless payment processing and reliable customer support. Take control of your business's financial operations with our high-risk merchant account solutions.

#payment processing#merchant account#credit card processing#high-risk payment processing#high-risk merchant account

2 notes

·

View notes

Text

Best Guide On How To Manage Your Personal Finances

Do you need help making your money last? If so, you're not alone, as most people do. Saving money and spending less isn't the easiest thing in the world to do, especially when the temptation to buy is great. The personal finance tips below can help you fight that temptation.

You can save on energy bills by using energy efficient appliances. Switch out those old light bulbs and replace them with Energy Star compliant ones. This will save on your energy bill and give your lamps a longer lifespan. Using energy efficient toasters, refrigerators and washing machines, can also help you save a lot of money in the long haul.

Set up a bank account for emergency funds, and do not use it for any daily expenses. An emergency fund should only be used for any unexpected expense that is out of the ordinary. Keeping your emergency fund separate from your regular account will give you the peace of mind that you will have money to use when you most need it.

To get out of debt faster, you should pay more than the minimum balance. This should considerably improve your credit score and by paying off your debt faster, you do not have to pay as much interest. This saves you money that you can use to pay off other debts.

Every time you get a raise, set aside at least half of the new, after-tax increase for saving more each month. You will still enjoy a higher income and will never miss the extra money which you were never used to spending. It is even better if you set up your paycheck or checking account to transfer the money to savings automatically.

Your cell phone is an expense that can vary, depending on the frequency of use. If there are applications or programs that you do not use on your phone, cut these out immediately. Payments for services that you are not making use of, should be eliminated as soon as possible to reduce spending.

Use cash for purchases. Eliminate credit cards and debit cards and use cash for purchases. Use the envelope system to allocate a budget for monthly expenses. Have a separate envelope for each different type of expense, and place a specific amount of cash in each one. This way, you won't over-spend on any monthly expenses. A good idea is to have another envelope marked 'emergency', containing cash that can only be used if really necessary. Seal this envelope, as this will make you less tempted to 'borrow' from it.

One of the best things that you can do in order to effectively manage your personal finances is by educating yourself about it. Make an effort to read financial magazines from well-known and successful people. You can also check the internet for reputable content about this topic. Knowledge is key to being successful in everything.

Comb through your monthly budget and find things that you don't use or you use it so little that you don't get any benefit out of the money that you spend. In this way, you can save some money each and every month by canceling those services.

Understand that keeping track of your personal finances requires actual effort. It's not enough to simply add up some things in your head. Keep track of your monthly spending by thoroughly checking all statements and receipts. You need to be on top of things if something's not lining up right.

Starting your kids out early and teaching them about personal financial issues, is a great way to help them in the future. Teach them the importance of saving by getting them a piggy bank, and let them understand what it means to work by paying for chores completed. Try to keep credit out of the equation.

Even if you are trying to build up your credit it is not a wise idea to apply for too many credit cards at once. Each time a creditor makes an inquiry it lowers your credit score so applying for too much credit will actually cause more harm than good.

To help yourself cut back your spending, track your spending. There are many free spending tracking applications available for phones and computers. Take a look at what you're spending the most money on, and see how essential it is. Seeing where your money goes each month can be sobering, and will let you know what areas cutbacks should be focused on.

You, like many other people, may need help making your money last longer than it does now. Everyone needs to learn how to use money wisely and how to save for the future. This article made great points on fighting temptation. By making application, you'll soon see your money being put to good use, plus a possible increase in available funds.

0 notes

Text

Payment Processing

An efficient Payment Processing system is the heart of any successful business; they can handle transactions and cash flow from customers' accounts to the business owner’s bank. Payment processing is a crucial part of any sales process that helps to handle payment securely and efficiently. Payment methods vary from one method to another, and each method has its nuances in processing, generally, most payment methods follow similar steps. The first step is digital payment, this step starts when the customer decides to purchase checkout time customer gives their credit or debit card, electronic wallet, or any other payment options. If the vendor accepts that payment method then the transaction begins. Other steps are payment authorization, bank verification, and approval, merchant notification, and settlement.

0 notes