#digital payments

Text

The Rise of Cashfree Payments: A Paradigm Shift in Financial Transactions

The way we handle financial transactions has undergone a dramatic transformation. Traditional cash payments are gradually being phased out, making way for the era of cashfree payments. With the advent of digital payment methods such as mobile payments, UPI transactions, and international payments, consumers and businesses alike are embracing the convenience and efficiency offered by cashfree solutions. In this blog post, we will explore the various facets of cashfree payments, from their advantages to common misconceptions and their potential impact on the future of finance.

2 notes

·

View notes

Text

My recent Ganondorf sketch as digital ✨✨ I'll post the watercolour version soon :)

Do not repost my artwork, but likes, reblogs and follows are massively appreciated!!

#my art#art#artwork#digital art#digital drawing#digital payments#drawing#botw#breath of the wild#link#zelda#zelda fanart#fanart#small artist#botw2#loz#ganon#ganondorf#totk#totk fanart

16 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

Electronic Check LTD Reviews - Give Your Business A New Definition

That "e" in the work of e-commerce, is electronic yet should be "fundamental." No matter the extent or scope of your business, if you are not aware of electronic payments, you are missing out on something very important. Today, online customers are more than important for any business, and this is the reason why you need to continue reading about the services from Electronic Check LTD. Check out Why Services Like Electronic Check Ltd UK. Are Important for Onboarding New Employees.

Not sure what is E-Check? Indeed, you are not the only one. Starting around 2019, 65% of U.S. independent companies yet haven’t invested in a website. So, for what reason would it be a good idea for you to begin accepting electronic installments?

Electronic payments or eChecks

Electronic payments or installments allude to digital payments, for example, those made via ACH. When we discuss electronic installments, we are alluding to installments made on the web.

Top ways your business can benefit from eChecks:

Reach out to more online customers: An ever-increasing number of purchasers are shopping on the web. With electronic checks, you offer them the ease to make their payment securely and faster than any other mode of payment. To know more, read Businesses Ought To Give Electronic Check LTD Reviews A Try If Haven’t Done Yet.

Sell more: This web-based customer traffic is driving crazy deals. The U.S. Registration Bureau reports that the web-based businesses' contribution rose by 12.5% for Q1 2019 from Q1 2018, while retail deals expanded only by 2.7%.

Satisfy shopper need for a reliable encounter across all channels: The present-day purchasers are consolidating their online purchases with different channels. The larger part — 75% — are Omni-trade customers whose purchasing venture incorporates instore, direct mails, and online experiences.

Upgrade security: The relocation to EMV had increased concerns regarding fraudsters focusing on web-based exchanges all things considered. In any case, a significant number of online deals consolidate improved security measures to help safeguard against fraud and data breaches.

Improved efficiency: By automating business transactions, online businesses save time and money. Simple electronic payments wipe out manual undertakings, for example, paper invoices, data entry, and overseeing client queries.

Instructions to initiate electronic payments

To begin with, you will require a site and an installment arrangement that makes it feasible for your site to acknowledge installments. This comes as a shopping cart with an electronic checkout feature. One method for achieving this is with an electronic payment gateway associating your installment processor to your business website.

A merchant account payment gateway is a customary technique for acknowledging online installment, matching your dealer account with an installment passage. The payment gateway associates your web-based store to your bank account similar to what is utilized in your actual store. Simply apply for the payment gateway and trader account from Electronic Check LTD and they will assist you with its functionality that is extremely easy to operate.

#Electronic Check LTD#Electronic Check LTD Reviews#Electronic Check LTD UK#Electronic Check#e-checks#payment#digital services#digital payments#electronic payments#echecks#Business

23 notes

·

View notes

Text

baizhuuuuuu

2 notes

·

View notes

Text

AEPS Service Provider Company List that covers 95% Market in 2023

Looking for the best AEPS service provider company in India? Check out this comprehensive list compiled by AEPS India. Find the right AEPS solution for your business and start offering secure and convenient banking services to your customers.

top aeps company

#digitalpayments#cashless#UPI#financialinclusion#bankingtechnology#paymentsolution#AEPSIndia#fintechIndia#cashlesseconomy#paymentgateway#bankingsector#financialservices#IndiaFinance#banking#finacialfreedom#fintach#indiafinance#digital payments

2 notes

·

View notes

Text

AeronPay Prepaid Card Is the Best Prepaid Card in India

AeronPay is a trusted and experienced company that provides prepaid card services. AeronPay prepaid card is issued by YES BANK, in partnership with Neokred.

You can use your card across a wide network of merchant establishments in India accepting RuPay-enabled cards.

You can also use the card to withdraw cash from any ATM, check the available balance on your card, and check the transaction history through a mini statement.

Prepaid cards have the flexibility of prepaid and traditional debit cards for making purchases, paying bills, and withdrawing money from ATMs. Enabling the service of a prepaid card is super easy with AeronPay.

Key features of AeronPay prepaid cards that make them different from others:

· Available in both physical cards, as well as a virtual cards.

· Tap and pay service enable.

· No hidden charges are there.

· We can withdraw money from ATMs with a physical card.

· Card charges have to be paid only once and then you can use lifetime.

· Get CashBack above transactions of 10,000/-

· Easy to manage your card through applications.

· You can swipe your card anywhere and shop everywhere.

· No bank account is required.

· It’s safer than carrying cash.

2 notes

·

View notes

Text

Understanding NPCI's Role in Shaping India's Digital Payments Future

By the end of this year, the National Payments Corporation of India (NPCI) might change its decision about limiting the market share of companies offering Unified Payments Interface (UPI) services to 30%. The deadline for this limit to take effect is December 2024.

A source in the industry told Business Standard that the 30% cap on transaction volume for UPI services will be reviewed by the end of the year.

In November 2022, a 30% cap on transaction volume for third-party app providers was proposed. UPI players were asked to limit their market share to 30% within two years.

In March, the NPCI discussed UPI growth with new players and strategies to empower them in the UPI ecosystem. This included encouraging third-party payment apps to attract users through investments and incentives.

Brands like Cred, Slice, Fampay, Zomato, Groww, and Flipkart are trying to attract users and promote their UPI services.

Last year, NPCI introduced an interchange fee on prepaid payment instrument (PPI)-based merchant transactions through UPI. The interchange fee for PPI issuers on transactions over Rs 2,000 is up to 1.1%, but it applies only to PPI-based merchant UPI transactions. UPI transactions in India increased by 56% in volume and 44% in value in FY24 compared to the previous year.

Google Pay, PhonePe, and Paytm were not invited to a recent meeting. This was because these three companies control more than 90% of both the number and value of UPI transactions.

NPCI wants to hear from different people about how they can make things fairer for smaller companies in the payment system.

Earlier this week, NPCI said One 97 Communications (OCL), Paytm's parent company, can move its users to new banks for UPI payments. This means Paytm can now offer UPI services through other banks.

In March, NPCI also let OCL work as a Third-Party Application Provider (TPAP) using many banks.

"After NPCI said yes on March 14, 2024, to let OCL work as a Third-Party Application Provider (TPAP) using many banks, Paytm has made it easier to move user accounts to Axis Bank, HDFC Bank, State Bank of India (SBI), and YES Bank. All four banks are now ready to help Paytm with this," the company said in a stock exchange filing.

0 notes

Text

Experience Centi’s innovative fintech solutions for seamless, low-cost transactions, empowering businesses and consumers. Join us in driving financial inclusion and innovation

0 notes

Text

Accounts Receivable Can be Easily Managed with Digital Payment Platforms

Having a good method for managing accounts receivable is very important for businesses focused on making profits. Regulating cash flow through collecting pending payments from customers will provide more flexibility to a firm. With online payment platforms becoming more popular, the way accounts receivable management is handled has undergone considerable changes. The swiftness and efficiency provided by digital platforms and online banking has made this process much easier.

Faster Payments: Traditional accounts receivable practices involve a lot of manual processes including creating invoices, mailing them to customers and entering data into ledgers. With online payment platforms, this whole procedure is simplified. Today, you have softwares that can create digital invoices, e-checks and other documents and send them to vendors in a timely fashion. The manual labor associated with the whole process can be completely avoided by using digital payment platforms.

Systematic Approach: A major benefit of using digital payment platforms to handle financial transactions is that the automated systems provide scope for better efficiency. Paper based invoices create delays and are prone to human error. A mistake in the payee bank details or other relevant information can make the already slow process even more complicated. Online payment platforms often use advanced software to handle accounts receivable management, which result in error free operations and timely payments.

Easy Tracking: If you switch from paper bills to online payment methods, you won't have to deal with the trouble of keeping track of payments and reviewing your transactions. Printouts and actual papers are bad because they are easy to lose or misplace. If that happens, monitoring your accounts receivable payments will become impossible. With digital platforms, it is much easier to track and analyze payment statuses and make decisions based on the data you have gathered.

Better Customer Relationships: Another advantage of using digital platforms is that you can give your clients different payment options which makes the transaction process more convenient. Faster payments always lead to a better relationship between businesses and their customers. Digital platforms also often have tools like easy-to-use payment and alerts that are sent automatically. So, companies and users can talk and understand each other better through this. When companies make it simple and quick for customers to pay, they can connect with them better and stand out from others.

Global Reach: If you have clients outside the US, initiating payments and processing transactions might take longer than local transactions. If you are using digital payment platforms, you can reduce the time taken to transfer credit as most platforms accept payments from customers across the globe. You can take your business global by using online transactions.

Conclusion:

If you own a business and still handle your accounts receivable by hand, you should really think about going digital. You'll save time and money this way, and your ties with customers will get better. You can also enhance client payment monitoring with digital tools and platforms. Your overall financial management can be taken to the next level by adopting digital technology.

0 notes

Text

Unveiling Vendekin's Convenient Machines: From Coffee to Ice Cream, We Vend It All!

Are you tired of outdated vending machines that only offer limited options and require constant maintenance? Say hello to Vendekin's state-of-the-art vending machines, revolutionizing the vending industry in India.

From sizzling cups of coffee to indulgent deliciousness of ice cream, Vendekin's Automatic Vending Machines cater to every craving, in every location imaginable. Whether you're highlighting your products at the airport, providing a quick bite at an office, or trying to satisfy your customer’s sweet tooth at the mall, our vending solutions are there to serve you.

With these awesome 10 reasons get ready to revolutionize your business with Vendekin's innovative vending solutions.

Versatility: Whether you're in need of a snack vending machine for your office or a beverage vending machine for your supermarket, Vendekin has a solution for every business need. Our vending machines cater to a wide range of industries, including airports, railway stations, malls, and more.

Cashless Convenience: With the rise of digital payments, Vendekin's vending machines offer cashless options for a seamless and hassle-free experience. Say goodbye to fumbling for loose change and hello to quick and secure transactions.

Coffee Lover's Dream: Fuel your employees or customers with Vendekin's cashless coffee vending machines. Whether it's a piping hot cappuccino or a refreshing iced latte, our machines deliver premium quality coffee at the touch of a button.

Beverage Variety: Quench your thirst with Vendekin's beverage vending machines, offering a wide selection of drinks including sodas, juices, and energy drinks. Perfect for supermarkets, petrol stations, and snack shops, our machines keep customers coming back for more, giving your brand that extra edge over the market.

Automatic Ice Cream Delights: Indulge your sweet tooth with Vendekin's automatic ice cream vending machines. Whether it's a single serving cup or a decadent family pack, our machines serve up frozen treats in seconds, making them a hit at malls and amusement parks.

Hot Food on Demand: Craving a quick and satisfying meal? Look no further than Vendekin's hot food vending machines. From piping hot pizzas to savory sandwiches, our machines offer a convenient solution for busy office workers and on-the-go shoppers.

Smart Technology: With Vendekin's smart and automated vending machine management software, you can now easily monitor and manage your machines remotely, ensuring optimal performance and minimal downtime. Our best vending machine software provides real-time data analytics and inventory tracking for maximum efficiency.

Affordable Pricing: Worried about the cost of purchasing a vending machine? Vendekin offers competitive pricing options to fit your budget. Whether you're a small startup or a large corporation, we have flexible payment plans to suit your needs.

Reliable Supplier: As one of the leading vending machine companies in India, Vendekin prides itself on quality products and exceptional customer service. Our team of experts is dedicated to providing you with the best vending machine experience possible.

Easy Installation: Ready to upgrade your business with Vendekin's vending machines? Our team will handle the installation process from start to finish, ensuring a seamless transition and minimal disruption to your operations.

In conclusion, Vendekin's vending machines offer a convenient and efficient solution for businesses of all sizes. With cashless options, versatile offerings, and smart technology, Vendekin is revolutionizing the vending industry in India. Moreover, with our cutting-edge Vending Machine Management Software at the helm, we at Vendekin ensure seamless operation and optimal performance, making us one of the best vending machine companies in India.Therefore, don't miss out on the opportunity to enhance your business with Vendekin's state-of-the-art machines. Contact us today to learn more about our vending machine options and pricing.

#snack vending machine#beverage vending machine#digital payments#cashless coffee vending machines#automatic vending machine

0 notes

Text

Secure Online Payments Made Easy with OnePay

Welcome to the world of modern business, where convenience is king and adaptation is the key to success. If you're a business owner, big or small, you've probably heard about the importance of accepting card payments and processing transactions online. But what exactly does that entail? Don't worry, we're here to break it down for you in the simplest terms possible. Think of it as your trusted guide to navigating the world of payments with ease and confidence. Let's get started!

Understanding Card Payments

First things first, let's break down what card payments entail. When a customer pays with a credit or debit card, the transaction involves several steps:

Authorization: The customer swipes, inserts, or taps their card at the point of sale (POS) device or enters their card details online.

Authentication: The card issuer verifies the transaction's legitimacy and the availability of funds.

Settlement: The funds are transferred from the customer's account to the merchant's account.

Why Accept Card Payments?

Accepting card payments offers numerous benefits for your business:

Convenience: Customers prefer the ease and security of paying with cards.

Increased Sales: Studies show that businesses that accept cards typically see higher transaction volumes.

Global Reach: With online payments, you can reach customers beyond your local area or even your country.

Security: Card transactions come with built-in fraud protection, reducing the risk for both you and your customers.

Accepting Payments Online

Nowadays, having an online presence is crucial for any business. Here's how you can start accepting payments online

Choose a Payment Gateway: A payment gateway is an online service that authorizes card payments. Popular options include PayPal, Stripe, and Square.

Integrate with Your Website: Most payment gateways offer easy-to-implement plugins or APIs to seamlessly integrate with your website or e-commerce platform.

Secure Checkout: Ensure that your checkout process is secure and user-friendly to instill trust in your customers.

Stay Compliant: Familiarize yourself with relevant regulations such as PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive cardholder data.

Simplifying the Process

While the technical aspects of card payments and online transactions may seem daunting, there are tools and services available to simplify the process for you:

All-in-One Solutions: Consider using platforms like Shopify or WooCommerce that provide integrated payment processing along with e-commerce functionalities.

Customer Support: Choose payment providers that offer responsive customer support to assist you whenever you encounter challenges.

Educational Resources: Take advantage of online guides, tutorials, and customer forums provided by payment service providers to learn and troubleshoot effectively.

Conclusion

Accepting card payments and processing transactions online doesn't have to be overwhelming. By understanding the basics, leveraging reliable payment gateways, and utilizing available resources, you can simplify the process and focus on growing your business. Embrace the opportunities that digital payments offer, and watch your business thrive in today's interconnected world.

1 note

·

View note

Text

COMMS ARE OPEN YAY

My discord is @Raftah bc leaving my phone number private

$ sheet ( I know it's hectic )

BG's I'd do if asked, but I am not good at it so 😭

Ask if any questions! Also you can ask for any of my art as a reference

Refunds are on the table, but it depends

#art commisions#commission#art#ref sheet#reference sheet#long time no post#fyp#tumblr fyp#fypage#digital art#digital illustration#digital painting#yay#digital payments#bad handwriting

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Electronic Check LTD Reviews - Here Is Why High-Risk Businesses Should Give Electronic Checks A Try

Electronic checks or eChecks are the most well-known elective installment strategy in the United States. Adding electronic checks to your website’s checkout page is the quickest method for improving sales. Many people consistently pay for products and services utilizing eChecks as opposed to cards.

Let us look at the advantages of using eChecks from Electronic Check LTD for high-risk vendors and investigate how electronic payments look at enhancing your benefits. To know more read, How Electronic Check LTD Reviews — Why More People Are Opting for Digital Admin Support Services.

EChecks are well known with organizations and online customers. It offers an elective installment choice rather than cards. Echecks are generally open to organizations delegated high risks.

Here are some reasons why high-risk vendors need to add echecks as an installment strategy.

Fewer Restrictions: eChecks accompany fewer limitations than numerous other installment strategies. High-risk traders for the most part have various limitations forced on them by the merchant account on their credit cards. These limitations incorporate limits for exchange size and cutoff points on sums that can be used in a single transaction. An eCheck accompanies fewer limitations, permitting high-risk entrepreneurs to make exchanges effectively without restrictions on the transaction amount.

Lower Cost: High-risk vendors today are generally watching out for ways of decreasing transaction expenses and creating more income. High-risk vendors get a good deal on echeck exchanges since there is no trade engaged with electronic payments. In this manner, echeck installments decrease your expense of deals. Check out The Real Need for Services Like Electronic Check Ltd.

More Approval: Many organizations today face incalculable difficulties concerning acquiring a card handling vendor account. Echecks don't have similar limitations on chargebacks that merchant accounts face. What's more, utilizing echecks as an elective installment strategy safeguards your merchant processing accounts against any kind of fraud.

Actual checks are currently redundant: The development of advanced techniques for exchange straightforwardly corresponds with the consistent decrease in customary strategies for installment such as paper checks. The installments made through paper checks were reduced by around 2.7 billion from the year 2012 and year 2016. Electronic checks are becoming extremely popular as it offers transparency as well as speed to your everyday transactions.

More Convenient: The main role of a digital monetary exchange is to be advantageous for all interested parties. Electronic Checks are helpful for both; customers and merchants. eChecks are an ideal option for recurring payments where you do not have to enter your data time and again and the payment is safely transferred to the merchant's account.

#Electronic Check Ltd#Electronic Check Ltd Reviews#Electronic Checks#Echecks#Business#payment#digital payments#safe transaction

18 notes

·

View notes

Text

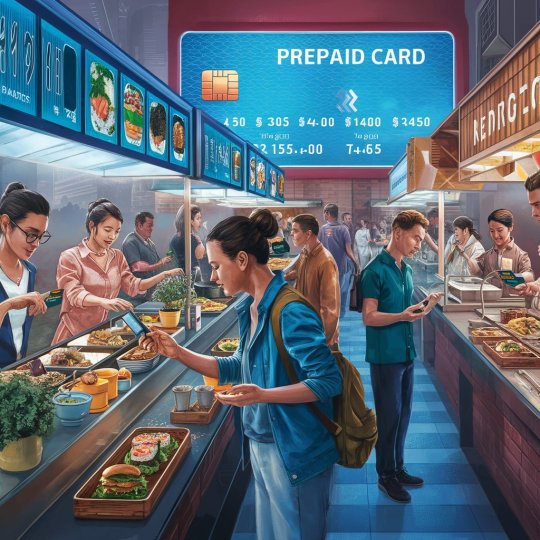

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes