#prepaid cards

Photo

Welcome bestcarding :-Im providing my hacking and carding service in the darknet and deepweb since a decade. Finally i decided to offer my services to normal customers who cant find me in darknet. Im using botnets,spamming,skimmers,stealers and some my private program to get bank,paypal,skrill,credit cards and western unions transfers data hacked.

-------------------------------------------------------------------------------------------------------

This is my Facebook page to sell remittances at very cheap prices. Enter a page and discover it. I have a lot of reviews. Enter the page for those interested in buying.

https://www.facebook.com/Bestcarding99

12 notes

·

View notes

Text

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

Prepaid Cards – Empowering Secure Transactions in India’s Digital Payment Landscape | AGS India

Prepaid card market in India is projected to witness a CAGR of 31.5% during 2021-2025, reaching USD 89.8 billion by 2025, up from USD 30 billion in 2020.

0 notes

Text

Enjoy unbeatable rates on prepaid international calling cards for both landline and mobile, connecting you to over 150 countries.

0 notes

Text

The Crucial Role of Fintech in Empowering India's Underbanked Population

In the vast landscape of India, where economic diversity is as pronounced as its cultural richness, there exists a significant portion of the population that remains underbanked. Despite the strides made in financial inclusion over the years, a considerable number of individuals still lack access to basic banking services. This underbanked segment faces numerous challenges, ranging from limited financial literacy to geographical barriers. In this context, the emergence of Financial Technology (Fintech) companies has proven to be a game-changer, offering innovative solutions to address the unique needs of the underbanked population.

Understanding the Underbanked

The underbanked population in India comprises individuals who, for various reasons, do not have full access to traditional banking services. This could be due to factors such as remote geographical locations, lack of proper documentation, or insufficient income levels. The consequences of being underbanked are profound, as it restricts opportunities for savings, access to credit, and participation in the formal economy.

Challenges Faced by the Underbanked

Limited Access to Banking Infrastructure: Many underbanked individuals reside in remote rural areas where traditional banking infrastructure is scarce. This geographical divide makes it challenging for them to access basic financial services.

Financial Literacy Barriers: A significant portion of the underbanked population lacks adequate financial literacy. This hinders their ability to make informed decisions regarding savings, investments, and accessing credit.

Documentation Hurdles: Traditional banks often require a plethora of documentation, which can be a significant barrier for the underbanked who may lack the necessary paperwork. Fintech companies, leveraging technology, have found ways to navigate these hurdles efficiently.

How Fintech Companies Bridge the Gap

Digital Payments and Wallets: Fintech companies have pioneered the adoption of digital payment solutions and mobile wallets. These tools empower the underbanked by providing a secure and convenient way to conduct transactions without the need for a traditional bank account.

Simplified Onboarding Processes: Unlike traditional banks, Fintech firms often employ simplified onboarding processes that reduce the need for extensive documentation. This facilitates the inclusion of individuals who may lack the paperwork required by traditional financial institutions.

Credit Access Through Alternative Data: Traditional credit scoring models may not accurately reflect the creditworthiness of the underbanked. Fintech companies are leveraging alternative data sources, such as utility bill payments and mobile phone usage, to assess creditworthiness and provide access to credit for those without a traditional credit history.

Customized Financial Products: Understanding the diverse needs of the underbanked, Fintech companies design products tailored to their requirements. This includes microloans, insurance products, and investment options that are more accessible and flexible than traditional offerings.

Conclusion

As India strides towards becoming a digital economy, the role of Fintech companies in addressing the financial needs of the underbanked cannot be overstated. By leveraging technology and innovation, these companies are breaking down barriers, making financial services more inclusive and accessible. The positive impact of financial inclusion extends beyond individual empowerment; it contributes to the overall economic growth of the nation. As Fintech continues to evolve, it holds the key to unlocking the full potential of every individual, regardless of their socio-economic background.

#banking#business ideas#finance#fintech#business#underbanked population#money#expert says#matm#aeps#DMT#money transfer services#prepaid cards#prepaid recharge

0 notes

Text

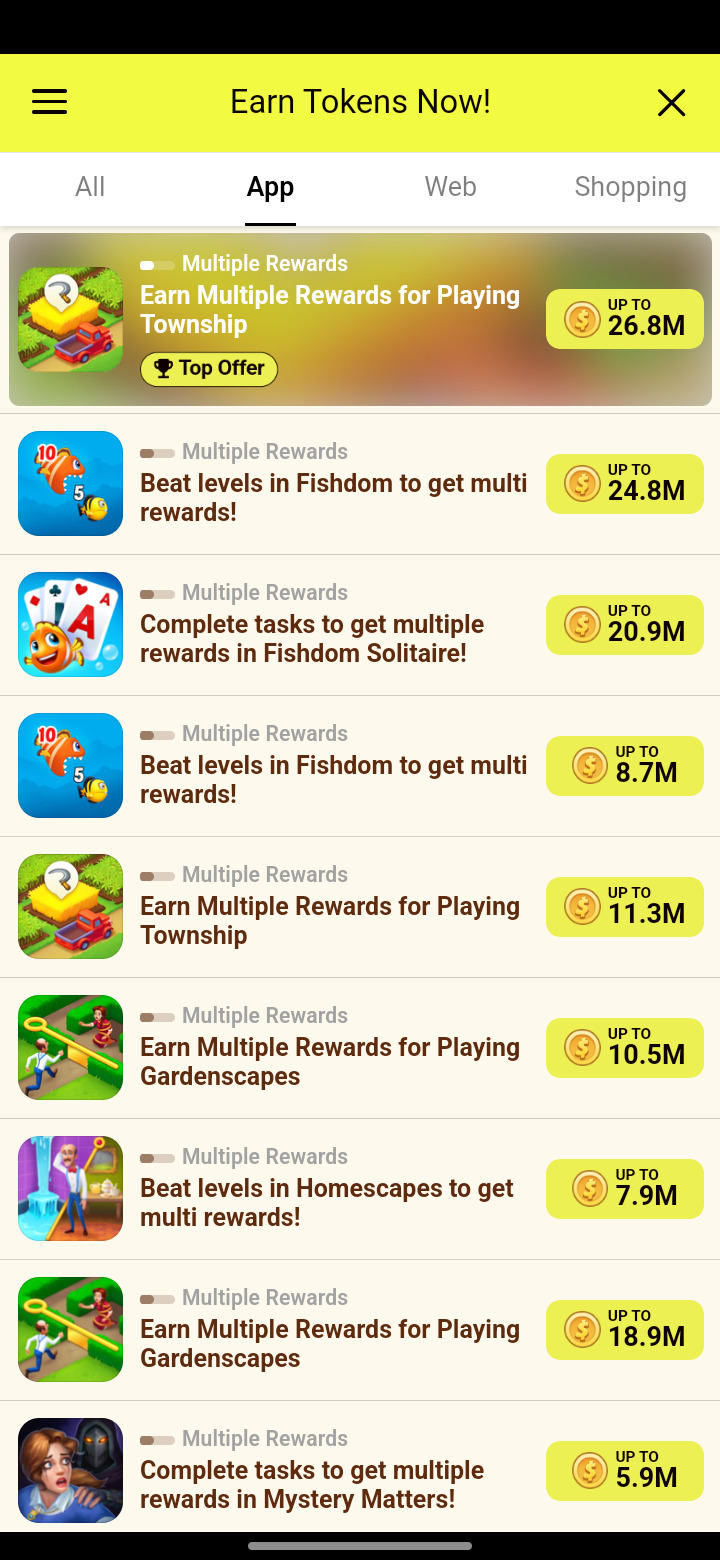

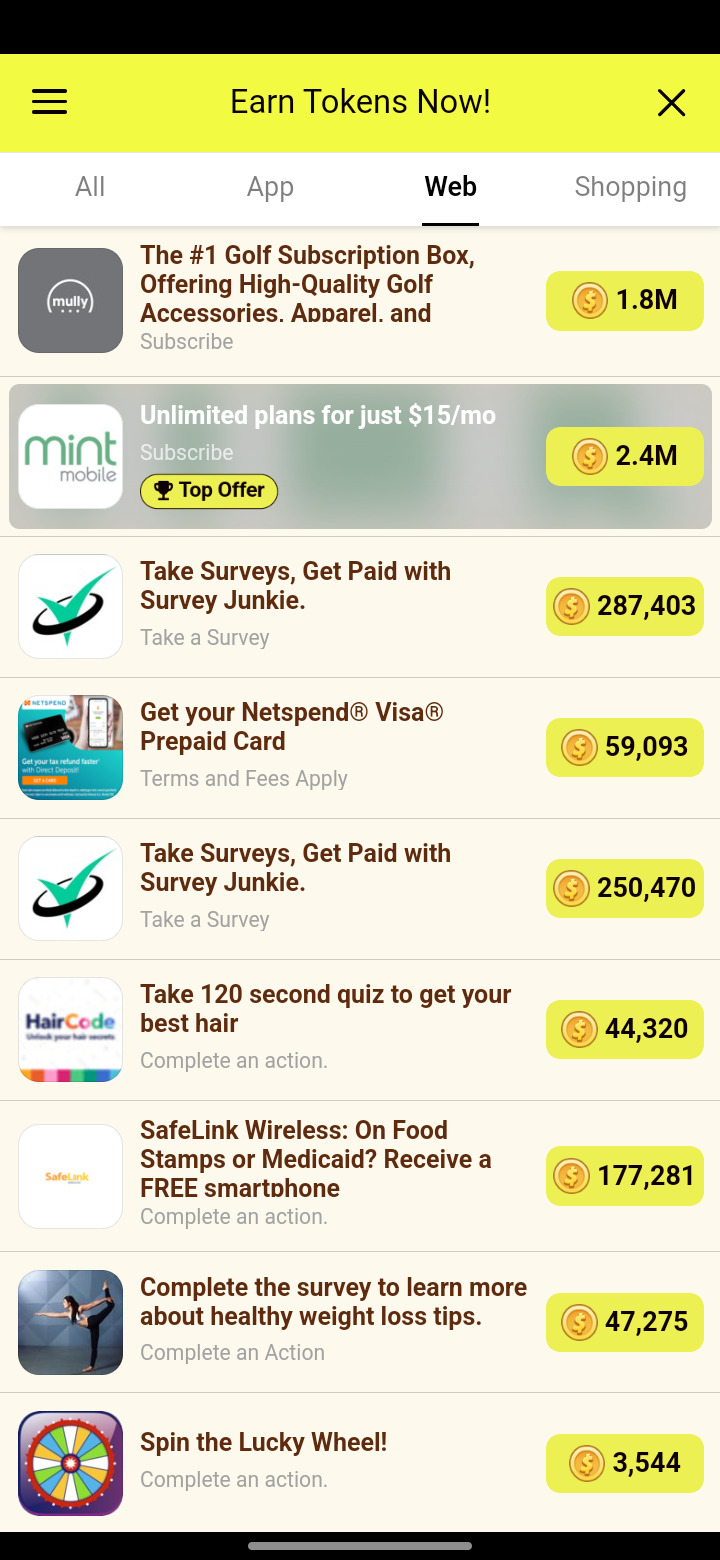

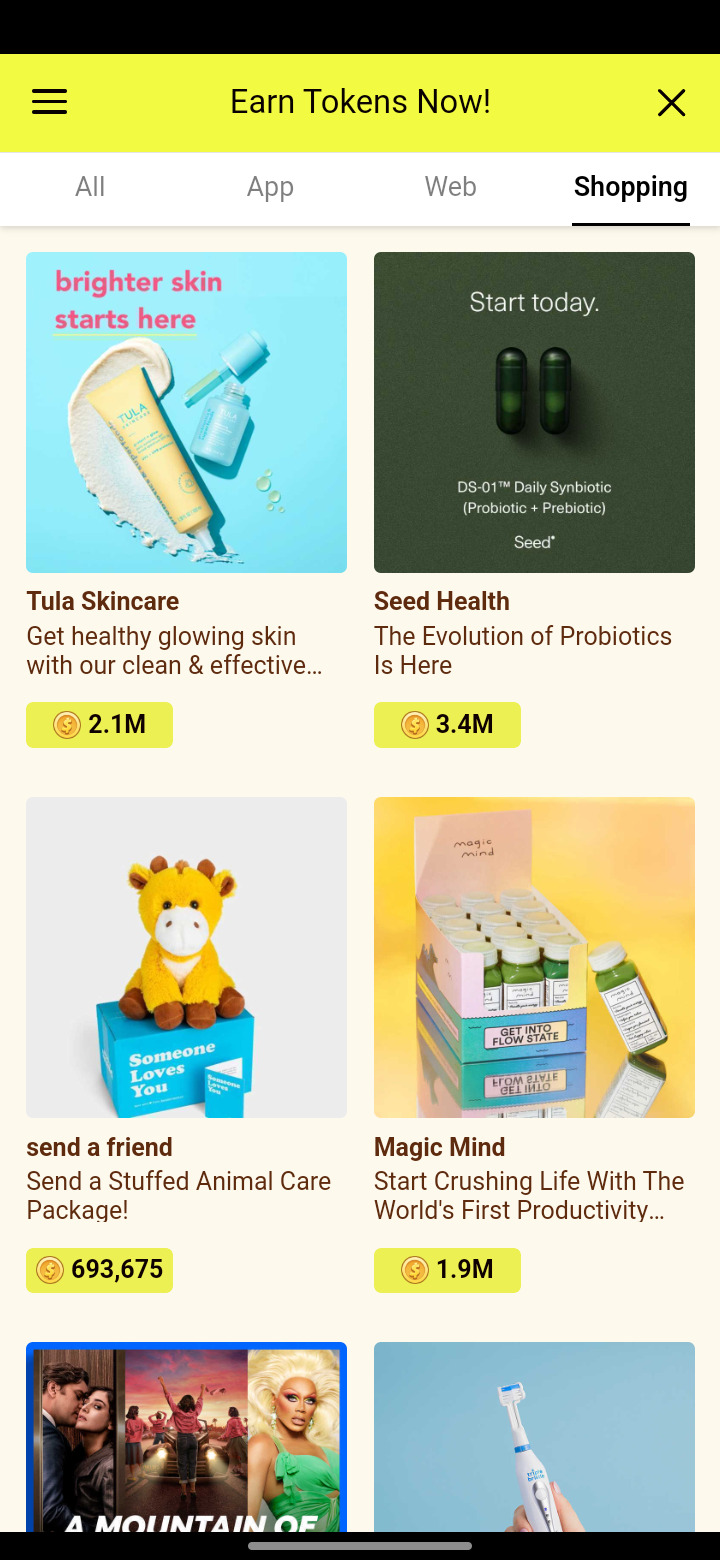

Am I the only one who noticed the offer wall in "Words With Friends"?

#gaming#video games#mobile games#words with friends#zynga#offer walls#tapjoy#mobile apps#online shopping#online survey#streaming services#earning coins#cards#prepaid cards

0 notes

Text

The Power of Efficiency and Control: Exploring the Benefits of Corporate Credit Cards

Introduction:

In the corporate world, managing expenses efficiently while maintaining control over financial transactions is crucial for the success and growth of businesses. Corporate credit cards have emerged as powerful tools that streamline expense management, enhance employee spending control, and offer various benefits to organizations. In this article, we will delve into the advantages of corporate credit cards and shed light on how they contribute to optimizing financial processes and improving overall business operations.

Simplified Expense Management:

Corporate credit cards simplify the complex process of expense management by consolidating all business-related transactions into a single account. This eliminates the need for employees to use personal funds for work-related expenses and submit expense reports for reimbursement. Instead, transactions made with corporate credit cards are automatically recorded, categorized, and easily tracked, streamlining the expense reconciliation process.

Enhanced Spending Control:

Corporate credit cards provide organizations with a high level of control over employee spending. Administrators can set spending limits, restrict card usage to specific merchants or categories, and even define transaction limits and frequency. This control mitigates the risk of overspending and unauthorized purchases, ensuring adherence to company policies and budgets.

Streamlined Reporting and Reconciliation:

By utilizing corporate credit cards, businesses can streamline reporting and reconciliation processes. Detailed transaction statements provided by credit card issuers simplify the tracking of expenses and eliminate the need for manual data entry. This saves time and resources, allowing finance teams to focus on more strategic activities rather than getting mired in tedious administrative tasks.

Expense Tracking and Analytics:

Corporate credit cards often come with robust expense tracking and reporting tools. These tools provide real-time insights into spending patterns, allowing businesses to analyze expenses, identify cost-saving opportunities, and make data-driven decisions. The availability of comprehensive reports facilitates budget planning, expense forecasting, and efficient financial management.

Rewards and Benefits:

Many corporate credit cards offer rewards programs tailored to businesses. Companies can earn cashback, airline miles, or other rewards based on their spending patterns. These rewards can be reinvested into the organization, used to offset travel expenses, or given as employee incentives, further enhancing the value proposition of corporate credit cards.

Improved Cash Flow Management:

Corporate credit cards provide a more flexible approach to managing cash flow. Instead of relying on cash reserves or delayed invoice payments, businesses can leverage credit card payment terms to optimize cash flow. Credit card billing cycles often provide a grace period, allowing organizations to make necessary payments while maintaining liquidity.

Conclusion:

Corporate credit cards have become indispensable tools for businesses seeking to optimize expense management, enhance spending control, and streamline financial processes. By leveraging the advantages of simplified expense tracking, enhanced control, streamlined reporting, and access to valuable rewards, organizations can improve operational efficiency, make informed financial decisions, and effectively manage their cash flow. With the right corporate credit card program, businesses can gain a competitive edge in the dynamic corporate landscape while ensuring financial stability and growth.

#Virtual Mastercard#UnionPay Prepaid Card#UnionPay Debit Card#Prepaid Credit Cards#Prepaid Cards#Visa Prepaid Card#High-Limit Prepaid Card#Best Prepaid Card#International Prepaid Card#Travel Card#Reloadable Cards#Corporate Cards#Corporate Credit Card

1 note

·

View note

Text

Quote of the Day: Checking Accounts Versus Prepaid Card Accounts

Life, like a temp agency job, is transient. Prepaid cards survive when banks fail. Not everyone lives by owing a bank, card, or credit card. Some people prefer to pay in advance.- King-Galaxius Stravinsky

View On WordPress

#Bank#banking industry#banks#blogging#checking#checking account#internet#King-Galaxius#King-Galaxius Stravinsky#prepaid#prepaid card accounts#prepaid cards#Quote of the Day#Quote of the Day: Checking Accounts Versus Prepaid Card Accounts#Stravinsky#wordpress

0 notes

Text

Corporate Credit Card:-

It's simple to issue a card. Make countless virtual and actual cards available. Utilize cards to control Procure-to-Pay, Purchase Order, and Subscription requests. overall costs such as food, fuel, or reimbursements.

0 notes

Text

#prepaid cards#cards#banking#gift cards#virtual cards#corporate cards#fintech api platform#prepaid card service provider company#api banking#api platform#fidypay#fintech company

0 notes

Text

Business Prepaid Cards for Employee Expenses In India | Happay

Happay Corporate Prepaid Cards / Business Expenses Card helps to track & manage employee spending in Real-time control & visibility on business spending.

0 notes

Text

Travel Expense Management Software & System | T&E Expenses

Automate and manage travel expenses with Happay's prepaid cards - Best Travel & expense management solution. Get Real-Time Visibility of t&e expenses & More

0 notes

Text

Personalized bright plan for your finances | Get your personal Bright Plan

Personalized bright plan for your finances | Get your personal Bright Plan

Tailored for you. Hassle-free. Automatic.

Credit cards

Over 191 million Americans carry at least one credit card, and most have four cards to their name.

Mobile payments

Mobile payments are transactions made through mobile phones.

Bank transfers

Bank transfers use the highest level of security.

E-wallets

E-wallets, also known as virtual wallets, store your payment card details on your mobile phone, allowing you to make mobile payments.

Prepaid cards

Prepaid cards are preloaded with funds to use for transactions

• Open loop.

• Closed-loop.

Bright thrives on cashless

Bright functions as a cashless service, moving funds to and from your bank accounts, making payments on your cards, and allocating funds to savings all in cashless, digital transfers. read more

0 notes

Text

Read This to Know How Pandemic Has Fueled the Growth of Prepaid Cards?

In recent years, a new player in the financial industry has been gaining popularity. It's none other than prepaid cards.

0 notes