#underbanked population

Text

The Crucial Role of Fintech in Empowering India's Underbanked Population

In the vast landscape of India, where economic diversity is as pronounced as its cultural richness, there exists a significant portion of the population that remains underbanked. Despite the strides made in financial inclusion over the years, a considerable number of individuals still lack access to basic banking services. This underbanked segment faces numerous challenges, ranging from limited financial literacy to geographical barriers. In this context, the emergence of Financial Technology (Fintech) companies has proven to be a game-changer, offering innovative solutions to address the unique needs of the underbanked population.

Understanding the Underbanked

The underbanked population in India comprises individuals who, for various reasons, do not have full access to traditional banking services. This could be due to factors such as remote geographical locations, lack of proper documentation, or insufficient income levels. The consequences of being underbanked are profound, as it restricts opportunities for savings, access to credit, and participation in the formal economy.

Challenges Faced by the Underbanked

Limited Access to Banking Infrastructure: Many underbanked individuals reside in remote rural areas where traditional banking infrastructure is scarce. This geographical divide makes it challenging for them to access basic financial services.

Financial Literacy Barriers: A significant portion of the underbanked population lacks adequate financial literacy. This hinders their ability to make informed decisions regarding savings, investments, and accessing credit.

Documentation Hurdles: Traditional banks often require a plethora of documentation, which can be a significant barrier for the underbanked who may lack the necessary paperwork. Fintech companies, leveraging technology, have found ways to navigate these hurdles efficiently.

How Fintech Companies Bridge the Gap

Digital Payments and Wallets: Fintech companies have pioneered the adoption of digital payment solutions and mobile wallets. These tools empower the underbanked by providing a secure and convenient way to conduct transactions without the need for a traditional bank account.

Simplified Onboarding Processes: Unlike traditional banks, Fintech firms often employ simplified onboarding processes that reduce the need for extensive documentation. This facilitates the inclusion of individuals who may lack the paperwork required by traditional financial institutions.

Credit Access Through Alternative Data: Traditional credit scoring models may not accurately reflect the creditworthiness of the underbanked. Fintech companies are leveraging alternative data sources, such as utility bill payments and mobile phone usage, to assess creditworthiness and provide access to credit for those without a traditional credit history.

Customized Financial Products: Understanding the diverse needs of the underbanked, Fintech companies design products tailored to their requirements. This includes microloans, insurance products, and investment options that are more accessible and flexible than traditional offerings.

Conclusion

As India strides towards becoming a digital economy, the role of Fintech companies in addressing the financial needs of the underbanked cannot be overstated. By leveraging technology and innovation, these companies are breaking down barriers, making financial services more inclusive and accessible. The positive impact of financial inclusion extends beyond individual empowerment; it contributes to the overall economic growth of the nation. As Fintech continues to evolve, it holds the key to unlocking the full potential of every individual, regardless of their socio-economic background.

#banking#business ideas#finance#fintech#business#underbanked population#money#expert says#matm#aeps#DMT#money transfer services#prepaid cards#prepaid recharge

0 notes

Text

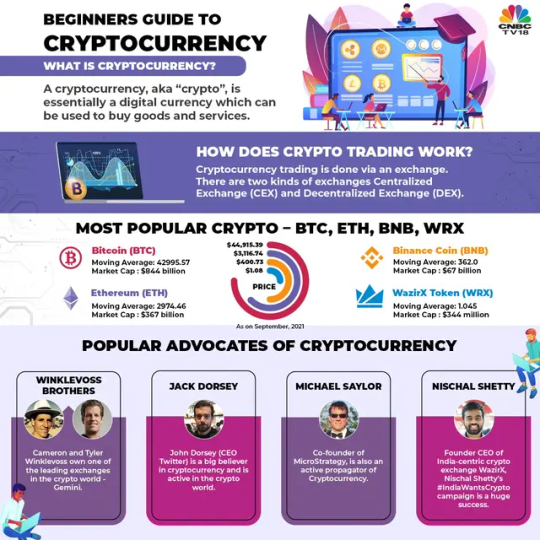

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

The Future of Fintech: Trends and Predictions

Introduction:

Financial technology, or fintech, has revolutionised the way we manage our finances. From mobile banking to digital payments, fintech has reshaped the financial landscape. fintech news As we look ahead, it is evident that fintech will continue to play a crucial role in shaping the future of finance. In this blog post, we will explore some of the emerging trends and make predictions about the future of fintech.

1.Artificial Intelligence and Machine Learning: AI and ML technologies are set to become even more integrated into fintech solutions. best fintech podcast They will enhance customer experience, automate processes, and provide personalised financial recommendations based on individual preferences and behavior's.

2.Blockchain and Cryptocurrencies: Blockchain technology has the potential to transform various aspects of finance, including cross-border transactions, supply chain finance, and identity verification. Investing in Cryptocurrencies Cryptocurrencies are likely to gain wider acceptance as more governments and institutions adopt regulatory frameworks.

3.Open Banking: Open banking initiatives will continue to gain momentum, enabling consumers to securely share their financial data with authorised third parties. The Future of Fintech This will foster innovation, competition, and the development of new financial services.

4.Financial Inclusion: Fintech will play a vital role in bridging the financial inclusion gap by providing access to banking and financial services for the unbanked and underbanked populations. Mobile banking, digital wallets, and microfinance solutions will empower individuals in emerging markets.

5.Cybersecurity and Data Privacy: As fintech continues to evolve, ensuring robust cybersecurity measures and protecting customer data will be paramount. Innovations in encryption, biometrics, and fraud detection will be crucial to maintain trust in digital financial services. top 10 financial podcasts

2 notes

·

View notes

Text

Impact of Lending Verification APIs on India's Financial Sector

In recent years, India's financial sector has seen a significant transformation, driven by technological advancements and digital innovation. One of the pivotal technologies reshaping the landscape of lending in the country is the Lending Verification API. These APIs play a crucial role in modernizing the traditional lending process, making it faster, more accurate, and accessible to a broader segment of the population. This article delves into the impact of Lending Verification APIs in India, exploring how they enhance operational efficiencies, contribute to financial inclusion, and reshape the customer lending experience.

Streamlining the Lending Process

Lending Verification APIs automate and streamline various aspects of the loan application process. By integrating these APIs, banks and non-banking financial companies (NBFCs) can quickly verify applicant information such as identity, income, employment history, and credit history. This automation significantly reduces the time taken from application to disbursement, cutting down processes that traditionally took days or weeks to just a few minutes or hours. For instance, APIs can pull real-time data from multiple sources to assess an applicant's creditworthiness more accurately and efficiently than ever before.

This efficiency not only boosts the productivity of financial institutions but also enhances customer satisfaction by delivering faster credit decisions. The immediacy and convenience offered by these APIs cater perfectly to the needs of today's consumers, who expect quick and seamless service delivery.

Enhancing Financial Inclusion

One of the most notable impacts of Lending Verification APIs in India is their role in enhancing financial inclusion. A significant portion of India's population remains underbanked or unbanked, often due to the lack of sufficient credit history or documentation required for traditional lending models. Lending Verification APIs bridge this gap by utilizing alternative data for credit scoring, such as utility bill payments, mobile phone usage, and even social media activity.

By leveraging such non-traditional data points, these APIs enable lenders to assess the creditworthiness of individuals who do not have a formal credit history. Consequently, more people can access financial products and services, helping to integrate them into the formal economy and promoting overall economic growth and stability.

Reducing Fraud and Improving Security

Fraud detection is another critical area where Lending Verification APIs are making a substantial difference. These APIs enhance the security of the lending process by providing advanced tools for identity verification and fraud prevention. By accessing various databases for real-time verification, these APIs help in accurately confirming the identity of loan applicants and reducing the incidence of fraud.

Moreover, the use of APIs helps in maintaining compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) standards. This not only protects the financial system but also builds trust among consumers regarding the security and integrity of financial transactions.

Challenges and the Path Forward

Despite their significant benefits, the implementation of Lending Verification APIs also presents certain challenges. Data privacy is a major concern, as the use of extensive personal data raises questions about the security and potential misuse of such information. Financial institutions must ensure that they adhere to stringent data protection laws to protect consumer privacy and build trust.

Additionally, there is a need for constant technological upgrades and integration capabilities to keep up with the evolving digital landscape and emerging security threats. Financial institutions must invest in robust cybersecurity measures and continuously update their systems to leverage the full potential of Lending Verification APIs.

Conclusion

The impact of Lending Verification APIs on India's financial sector is profound and far-reaching. By streamlining the lending process, enhancing financial inclusion, and improving security, these APIs are not just transforming how financial services are delivered but are also contributing to a more inclusive and secure financial ecosystem. As the technology evolves, it will continue to play a crucial role in shaping the future of lending in India, driving innovation and growth across the sector.

0 notes

Text

The Future of Finance Is Here: Why CYN Token Is a Game Changer

Introduction:

Ready to witness the future of finance? It's not just arriving; it's here, and it’s called CYN Token. This isn't just another cryptocurrency; it’s a complete overhaul of how we view and interact with money. Strap in as we show you why CYN Token is the game changer we’ve all been waiting for.

The Problem with Current Financial Systems:

Today's financial ecosystems are plagued with inefficiencies: high fees, slow transactions, lack of transparency, and exclusion of underbanked populations. These outdated systems no longer serve the majority but the privileged few.

Enter CYN Token:

CYN Token breaks away from traditional financial paradigms by utilizing blockchain technology to create a system that is fast, secure, and inclusive. This is more than evolution; it's a revolution in finance.

Key Features of CYN Token:

Speed and Efficiency: Forget days-long bank transfers. CYN Token transactions are nearly instantaneous, no matter where you are in the world.

Unparalleled Security: Leveraging the blockchain’s robust security protocols, CYN Token ensures that your financial data and assets are secure against cyber threats.

Total Transparency: Every transaction with CYN Token is recorded on a transparent ledger, accessible to everyone. This transparency eliminates fraud and builds trust.

Democratizing Finance:

One of CYN Token's core missions is to make financial services accessible to everyone. Whether you’re in a bustling city or a remote area, CYN Token gives you the same access to financial services, democratizing the ability to trade, save, and invest.

Global Impact:

CYN Token is not just changing individual lives but also transforming global trade. By simplifying cross-border transactions and reducing costs, CYN Token facilitates smoother international commerce, benefiting economies worldwide.

Sustainable Practices:

Beyond financial transactions, CYN Token is committed to sustainability. Blockchain technology allows for a reduction in the environmental impact associated with traditional financial services, aligning with global goals for a greener future.

Why CYN Token Is the Future:

The financial world is ripe for change, and CYN Token is leading the charge. By addressing the fundamental flaws of traditional systems and introducing groundbreaking features, CYN Token is not just part of the future—it’s creating it.

Conclusion:

The future of finance isn’t something we can afford to ignore—it’s something we need to actively shape. With CYN Token, you’re not just adapting to new financial realities; you’re driving them. Be part of a movement that’s setting new standards for what finance can and should be.

Call to Action:

Are you ready to step into the future with CYN Token? Visit CYN Token today to find out how you can join the revolution in finance. Don’t just keep up with the times—stay ahead of them with CYN Token.

Embrace the future—embrace CYN Token and revolutionize your financial world today!

0 notes

Text

Unraveling the World of Cryptocurrency: A Comprehensive Exploration

Introduction:

Cryptocurrency, a digital form of currency built on blockchain technology, has emerged as a transformative force in the global financial landscape. Since the inception of Bitcoin in 2009, cryptocurrencies have garnered widespread attention, sparking debates, controversies, and innovations in the realm of finance, technology, and beyond. In this comprehensive exploration, we delve into the intricate world of cryptocurrency, examining its origins, mechanics, impact, and future prospects.

Origins and Evolution of Cryptocurrency:

Trace the origins of cryptocurrency back to the release of Bitcoin by an anonymous entity known as Satoshi Nakamoto in 2009.

Explore the underlying principles of blockchain technology, the decentralized ledger system that powers cryptocurrencies, and its potential for revolutionizing traditional financial systems.

Discuss the proliferation of alternative cryptocurrencies (altcoins) such as Ethereum, Litecoin, and Ripple, each offering unique features, functionalities, and use cases.

Mechanics of Cryptocurrency:

Explain the basic concepts of cryptocurrency, including cryptographic keys, wallets, transactions, and mining.

Illustrate how blockchain technology enables secure, transparent, and immutable record-keeping, eliminating the need for intermediaries such as banks or governments.

Detail the process of cryptocurrency mining, where participants use computational power to validate transactions and secure the network in exchange for rewards.

Use Cases and Applications:

Examine the diverse range of use cases for cryptocurrency, from peer-to-peer payments and remittances to decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts.

Highlight the potential of cryptocurrency to empower financial inclusion by providing access to banking services for the unbanked and underbanked populations worldwide.

Showcase real-world examples of businesses, industries, and organizations adopting cryptocurrency for payments, fundraising, and asset management.

Opportunities and Challenges:

Evaluate the opportunities presented by cryptocurrency, including increased efficiency, transparency, and accessibility in financial transactions, as well as the potential for democratizing access to capital and investment opportunities.

Address the challenges and concerns associated with cryptocurrency, such as price volatility, regulatory uncertainty, security risks, and environmental impact.

Discuss ongoing efforts to address these challenges through technological innovations, regulatory frameworks, and industry best practices.

Regulatory Landscape:

Analyze the evolving regulatory landscape surrounding cryptocurrency, with different countries adopting varying approaches ranging from outright bans to embracing innovation.

Explore the implications of regulatory decisions on the adoption, development, and mainstream acceptance of cryptocurrency, as well as the broader implications for global finance and economics.

Future Outlook:

Speculate on the future trajectory of cryptocurrency, considering factors such as technological advancements, market trends, regulatory developments, and societal acceptance.

Discuss emerging trends and innovations in the cryptocurrency space, including the rise of central bank digital currencies (CBDCs), stablecoins, and blockchain interoperability.

Offer insights into the potential long-term impacts of cryptocurrency on financial systems, governance structures, and socio-economic dynamics worldwide.

Conclusion:

Cryptocurrency represents a paradigm shift in the way we think about money, finance, and technology. As it continues to evolve and mature, cryptocurrency holds the promise of reshaping traditional financial systems, empowering individuals, and fostering innovation on a global scale. However, challenges remain, and the future of cryptocurrency is not without uncertainties. By fostering dialogue, collaboration, and responsible stewardship, we can navigate the complexities of the cryptocurrency landscape and harness its potential for positive change in the years to come.

Continue Reading

0 notes

Text

Crafting Success: Cryptocurrency Development Services for Businesses

Welcome to the world of cryptocurrency, where innovation and technology are shaping the future of finance. As businesses seek to capitalize on this digital revolution, the demand for cryptocurrency development services is on the rise. In this comprehensive guide, we'll explore what these services entail, why they are essential for businesses, and how to choose the right provider to ensure success in the ever-evolving crypto landscape.

Understanding Cryptocurrency Development Services

What Are Cryptocurrency Development Services?

Cryptocurrency development services encompass a range of offerings designed to help businesses create, launch, and manage their own digital currencies or blockchain-based applications. These services may include:

Blockchain Development: Building and customizing blockchain networks tailored to the specific needs of the business.

Smart Contract Development: Creating self-executing contracts that automate transactions on the blockchain.

Wallet Development: Designing secure digital wallets for storing and managing cryptocurrencies.

Token Development: Generating custom tokens for use in decentralized applications (dApps) or tokenized assets.

The Importance of Cryptocurrency Development for Businesses

In today's digital economy, embracing cryptocurrencies offers numerous advantages for businesses:

Financial Inclusion: Cryptocurrencies provide access to financial services for the unbanked and underbanked populations, opening up new markets and opportunities.

Cost Efficiency: Transacting in cryptocurrencies eliminates intermediaries, reducing transaction fees and lowering operational costs.

Security: Blockchain technology ensures transparent and tamper-proof transactions, enhancing security and reducing the risk of fraud.

Innovation: By leveraging blockchain technology, businesses can create innovative products and services that differentiate them from competitors.

Choosing the Right Cryptocurrency Development Partner

Factors to Consider

When selecting a cryptocurrency development partner, businesses should consider the following factors:

Experience: Look for a company with a proven track record in cryptocurrency development and a portfolio of successful projects.

Expertise: Ensure the team has expertise in blockchain technology, smart contract development, and security best practices.

Customization: Seek a partner who can tailor solutions to meet the unique needs and goals of your business.

Regulatory Compliance: Verify that the company adheres to relevant regulations and compliance standards to avoid legal issues down the line.

Support and Maintenance: Choose a partner who offers ongoing support and maintenance services to ensure the smooth operation of your cryptocurrency ecosystem.

Case Studies

Case Study 1: XYZ Corporation

XYZ Corporation partnered with ABC Blockchain Solutions to develop a custom blockchain platform for supply chain management. The solution improved transparency and efficiency across the supply chain, leading to cost savings and increased customer satisfaction.

Case Study 2: DEF Enterprises

DEF Enterprises collaborated with GHI Crypto Services to create a tokenized rewards program for their customers. The program incentivized loyalty and boosted customer engagement, driving sales and revenue growth for the company.

Conclusion

In conclusion, cryptocurrency development services play a crucial role in helping businesses leverage the power of blockchain technology and digital currencies. By partnering with experienced and reliable providers, businesses can unlock new opportunities for growth, innovation, and success in the rapidly evolving crypto landscape. Whether it's building custom blockchain solutions, creating tokenized assets, or implementing smart contracts, investing in cryptocurrency development is a strategic move that can propel businesses to new heights in the digital economy.

0 notes

Text

Unlocking the Future of Commerce: A Deep Dive into Crypto Payment Processing

Introduction:

The realm of finance and commerce is undergoing a paradigm shift, with crypto currencies emerging as a disruptive force. Among the myriad applications of crypto payment processing stands out as a transformative innovation. In this comprehensive guide, we delve into the world of crypto payment processing, exploring its mechanisms, benefits, challenges, and the future it holds.

Understanding Crypto Payment Processing:

At its core, crypto payment processing involves facilitating transactions using digital currencies like Bitcoin, Ethereum, or stablecoins. Unlike traditional payment methods that rely on intermediaries like banks or payment processors, crypto transactions occur directly between peers on a decentralized network, known as the blockchain.

Mechanics of Crypto Payments:

Wallets: Users store their crypto holdings in digital wallets, which come in various forms such as software, hardware, or even paper wallets. These wallets contain cryptographic keys necessary to access and transfer funds securely.

Transactions: When a payment is initiated, a cryptographic signature authenticates the transaction, ensuring its validity. This signature, along with the sender's public address and the recipient's address, forms a digital signature that is verified by miners on the blockchain network.

Blockchain Confirmation: Once verified, the transaction is broadcasted to the network and grouped into a block. Miners compete to solve complex mathematical puzzles to validate the block, a process known as mining. Once confirmed, the transaction becomes irreversible and recorded on the blockchain.

Benefits of Crypto Payment Processing:

Decentralization: Crypto payments operate on decentralized networks, eliminating the need for intermediaries and reducing transaction costs.

Borderless Transactions: With crypto, geographical boundaries are irrelevant, enabling seamless cross-border transactions without the delays and fees associated with traditional banking systems.

Security: Cryptographic techniques ensure the security and integrity of transactions, mitigating the risk of fraud and unauthorized access.

Financial Inclusion: Crypto payment processing opens doors to financial services for the unbanked and underbanked populations, providing access to global markets and opportunities.

Challenges and Considerations:

Price Volatility: Cryptocurrencies are notorious for their price volatility, posing risks for both merchants and consumers. Fluctuations in value can affect the purchasing power of crypto assets and complicate accounting and financial planning.

Regulatory Uncertainty: The regulatory landscape surrounding crypto currencies varies widely across jurisdictions, creating compliance challenges for businesses operating in multiple regions. Regulatory changes and enforcement actions can impact the legality and viability of crypto payment processing.

Scalability: Blockchain networks face scalability issues, with limitations on transaction throughput and processing speeds. As adoption grows, scalability solutions such as layer-2 protocols and sharding are being explored to address these challenges.

User Experience: Despite technological advancements, user experience remains a barrier to mainstream adoption. Complexities related to wallet management, transaction fees, and security concerns can deter novice users from embracing crypto payments.

Emerging Trends and Future Outlook:

Stablecoins: Designed to minimize price volatility, stablecoins peg their value to fiat currencies like the US dollar or commodities like gold. Stablecoins offer stability and liquidity, making them attractive for merchants and consumers alike.

Central Bank Digital Currencies (CBDCs): Governments and central banks are exploring the issuance of CBDCs, digital representations of fiat currency backed by the state. CBDCs aim to modernize payment systems, enhance financial inclusion, and combat illicit activities.

DeFi Integration: Decentralized finance (DeFi) protocols are revolutionizing financial services by enabling peer-to-peer lending, borrowing, and trading without intermediaries. Integrating crypto payment processing with DeFi opens up new possibilities for decentralized commerce and financial innovation.

Layer-2 Solutions: Projects like Lightning Network for Bitcoin and Ethereum's Optimistic Rollups aim to enhance scalability and reduce transaction costs by processing transactions off-chain or through sidechains. These layer-2 solutions promise faster and cheaper transactions while maintaining the security of the underlying blockchain.

Conclusion:

Crypto payment processing represents a fundamental shift in the way we transact and interact with financial systems. While challenges persist, the potential for innovation and disruption is immense. As technology evolves and regulatory frameworks mature, crypto payments are poised to reshape the future of commerce, driving financial inclusion, efficiency, and accessibility on a global scale. Embracing this transformation opens doors to new opportunities and possibilities, ushering in a new era of digital finance.

0 notes

Text

Revolutionizing Remittances: Cryptocurrency's Role in Faster, Cheaper Cross-Border Transactions

In the era of globalization, the significance of quick and cost-effective cross-border transactions has never been more pronounced. The traditional banking system, often bogged down by its own red tape and geographical constraints, has been a necessary but cumbersome mechanism for these transactions. This is especially true for remittances, where workers send money across borders back to their families. However, with the advent of cryptocurrencies, there is a potential revolution underway in how these remittances are conducted.

Understanding the Remittance Market

Remittances represent a significant financial flow among countries, particularly from developed to developing regions. For many families in these regions, remittances are a lifeline that supports their day-to-day living. Traditional methods of sending remittances typically involve banks or specialized remittance services. These methods, while reliable, come with a set of challenges including high transaction fees, variable exchange rates, and slower processing times which can stretch to a few days. Visit https://cryptograb.io/

Cryptocurrency: A New Hope

Cryptocurrency offers an innovative alternative to traditional banking systems for remittances. By leveraging blockchain technology, cryptocurrency provides a decentralized platform that is not owned by any single entity. This technology supports the transfer of digital currencies across a network of computers globally, without the need for intermediaries. The result is a system where cross-border payments can be faster and cheaper compared to conventional methods.

Speed of Transactions

One of the most significant advantages of using cryptocurrencies for remittances is the speed of transactions. Transfers can be completed in a matter of minutes, regardless of the location of the sender and receiver. This is a considerable improvement over traditional methods, where transfers can take several days.

Lower Transaction Costs

Cryptocurrencies reduce the cost of transactions significantly. Traditional cross-border transactions involve various fees, including transfer fees, exchange rate margins, and sometimes hidden charges. Cryptocurrencies minimize these costs because the transactions do not require intermediaries like banks or remittance companies. The direct transfer between sender and receiver via the blockchain eliminates many of the overhead costs associated with traditional methods.

Accessibility

Cryptocurrencies can be particularly beneficial in regions with underdeveloped financial infrastructure. For populations that are unbanked or underbanked, cryptocurrencies offer an accessible way to receive money directly and securely, needing nothing more than a mobile device and an internet connection. This can empower individuals by giving them direct control over their finances without the necessity of a bank account.

Challenges and Considerations

Despite the advantages, the adoption of cryptocurrencies in remittance services does face challenges. The primary concern is the volatility of cryptocurrencies. The value of digital currencies can fluctuate wildly within very short periods, which can add a layer of risk to both senders and recipients. Moreover, there is also the issue of regulatory challenges. Cryptocurrencies operate in a relatively grey area of the law in many countries, and regulatory clarity is still evolving.

Regulatory Environment

For cryptocurrencies to become a mainstream tool for remittances, supportive regulatory frameworks will need to be established. These regulations will need to address concerns related to security, money laundering, and protection against fraud while also providing enough room for innovation and growth in the use of digital currencies.

Security Concerns

While blockchain itself is secure, cryptocurrency exchanges and wallets are vulnerable to hacks. Ensuring the security of these platforms is crucial for building trust among users. Education around securing digital wallets and awareness about phishing and other forms of cyber threats are necessary to protect users' assets.

The Future Outlook

The potential of cryptocurrencies to revolutionize the remittance industry is immense. As technology matures and more people become digitally literate, the adoption of cryptocurrencies could see a significant rise. This will depend heavily on improvements in technology, regulatory support, and the stability of digital currencies.

In conclusion, while cryptocurrencies present a promising solution to the challenges of traditional remittance methods, their success will hinge on overcoming the issues of volatility, regulatory uncertainties, and security risks. If these challenges can be addressed, cryptocurrencies could very well redefine the landscape of cross-border transactions, making them faster, cheaper, and more accessible to a global population.

0 notes

Text

Crypto Adoption in Emerging Markets - Opportunities and Challenges

Despite their many challenges, emerging countries represent a significant opportunity for crypto adoption. For one, they are the home to large populations of unbanked and underbanked citizens who could benefit from crypto’s decentralized nature and lower transaction fees. Additionally, many of these regions are suffering from high levels of inflation or remittance costs, making them ideal candidates for blockchain-based payment systems. Moreover, many of them are already exploring crypto as an alternative to fiat currencies. Several have already adopted Bitcoin as their national currency or tested pilot schemes for blockchain-powered payments. In addition, stablecoins like USDC can be particularly attractive in these markets as they are pegged to a more stable asset or currency.

However, the road to widespread cryptocurrency use in these markets is far from smooth. Regulatory uncertainty, lack of infrastructure, and limited awareness are some of the biggest barriers. In order to overcome these challenges, the industry must continue working with local communities to build momentum and foster acceptance. Educational initiatives and collaborations can help empower people to understand the benefits and risks of cryptocurrencies. Additionally, it is important to emphasize the positive aspects of crypto, such as its low cost and speed, in order to encourage widespread adoption.

In addition to education, it is also necessary to establish clear and supportive regulations for cryptocurrencies in these countries. Regulators must strike a delicate balance between encouraging innovation and tech ogle protecting consumers from the risk of fraud and money laundering. The success of this industry will depend on the creation of thoughtful and flexible rules that allow for innovation without hindering consumer protection.

While cryptocurrencies are still an emerging technology, they have already started to make a difference in the lives of millions of people across the globe. They have the potential to bring financial services to the 1.4 billion people who are currently unbanked or underbanked in developing countries, providing them with the tools they need to participate in the global economy.

Many of these countries are already using blockchain-powered payment platforms such as BitPesa to bring financial inclusion to their residents. Others are using the technology to tackle corruption, such as by using blockchain to record land titles and academic certificates. Meanwhile, Venezuela and other hyperinflation-prone nations are embracing digital currencies as a way to circumvent US sanctions and control inflation.

The study’s main limitation is the fact that it focuses on graduate students. These people are generally more liberal and more likely to embrace new technologies, so it is crucial to expand this research to include a more diverse demographic. Moreover, future studies should explore other factors that might influence a person’s receptiveness to crypto, such as their level of education. Finally, the sample was mainly from developed technology news countries and not emerging ones, so it would be beneficial to conduct a comparative study between developed and emerging economies. Nevertheless, the results of this study are promising and suggest that crypto is likely to become an integral part of the financial system in emerging markets in the coming years.

1 note

·

View note

Text

Cryptocurrency and Blockchain Technology

Cryptocurrency and blockchain technology have piqued the interest of investors, technologists, and legislators alike, promising to transform the financial landscape. This article will look at the latest trends, advancements, and prospective effects of cryptocurrency and blockchain technology on banking.

The Evolution of Cryptocurrency

Bitcoin, created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, marked the beginning of the cryptocurrency era. Since then, thousands of alternative cryptocurrencies, or altcoins, have emerged, each with unique features and purposes.

Growth of Blockchain Technology

Blockchain, the underlying technology behind cryptocurrencies, has also evolved significantly. Originally devised as to record Bitcoin transactions, blockchain technology is now being explored for a wide range of applications beyond digital currencies.

Latest Trends in Cryptocurrency

Decentralized finance, or DeFi, has emerged as a major trend in the bitcoin sector. DeFi platforms seek to duplicate traditional financial services including lending, borrowing, and trading without the use of intermediaries such as banks.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) have received a lot of interest due to their capacity to represent ownership of unique digital goods like artwork, collectibles, and digital real estate. The NFT industry has expanded rapidly, attracting artists, investors, and collectors alike.

Central Bank Digital Currencies (CBDCs)

Central banks are looking at the prospect of releasing their digital currency, known as central bank digital currencies, or CBDCs. These digital currencies seek to increase efficiency, lower expenses, and promote financial inclusion.

Developments in Blockchain Technology

Blockchain developers prioritize interoperability and scalability. Projects such as Polkadot, Cosmos, and Ethereum 2.0 are developing ways to improve blockchain network interoperability and scalability.

Enhanced Security and Privacy

Advances in cryptography approaches and privacy-preserving technology improve blockchain network security and privacy. These advancements are critical to establishing trust and confidence in blockchain-based systems.

Potential Impact on the Financial Landscape

Cryptocurrency and blockchain technology can potentially disrupt established banking institutions by providing faster, less expensive, and more inclusive financial services. This disruption could result in a shift of power in the banking industry.

Financial Inclusion and Access

Blockchain technology has the potential to provide financial services to the unbanked and underbanked populations worldwide, opening up new opportunities for economic empowerment and financial inclusion.

Regulatory Challenges and Opportunities

The rapid growth of cryptocurrency and blockchain technology has prompted governments and regulatory bodies to develop frameworks and policies to address concerns such as consumer protection, money laundering, and tax evasion. Clear and balanced regulation is essential to foster innovation while ensuring investor protection and financial stability.

Conclusion

Finally, cryptocurrencies and blockchain technology are fundamentally changing the financial world. The future of finance appears to be becoming more decentralized, digital, and inclusive, with the rise of non-fungible tokens, the research of central bank digital currencies, and advancements in blockchain technology. As these technologies advance and develop, their impact on the financial environment will only increase, ushering in a new era of innovation and opportunity.

Read the full article

#Blockchain#BlockchainApplications#BlockchainDevelopments#BlockchainSecurity.#CentralBankDigitalCurrency(CBDC)#CryptoInvestments#CryptocurrencyRegulation#CryptocurrencyTrends#DecentralizedFinance(DeFi)#DigitalAssets#DigitalCurrency#FinancialInnovation#FinancialTechnology(FinTech)#Non-FungibleTokens(NFTs)

0 notes

Text

Financial Inclusion and Accessibility

Financial institutions have a role to play in promoting financial inclusion and accessibility for underserved populations, including unbanked and underbanked individuals. Financial Service Cloud offers solutions to expand financial services reach and improve accessibility.

Key Features and Benefits:

Digital Banking for Underserved Populations: Financial Service Cloud supports digital banking initiatives tailored to underserved communities, offering simplified account opening processes, low-cost banking services, and educational resources.

Mobile Money and Microfinance: Integrating mobile money platforms and microfinance solutions within the platform enables financial institutions to reach remote areas, facilitate peer-to-peer transfers, and provide micro-loans to small businesses and individuals.

Financial Literacy and Education: Financial Service Cloud can host financial literacy programs, budgeting tools, and educational content to empower individuals with basic financial knowledge, money management skills, and access to resources.

Alternative Credit Scoring: Leveraging alternative data sources and non-traditional credit scoring models, Financial Service Cloud enables financial inclusion by assessing creditworthiness for individuals without extensive credit histories.

Challenges and Best Practices:

Technology Accessibility: Designing inclusive digital solutions requires consideration for accessibility standards, such as WCAG (Web Content Accessibility Guidelines), screen reader compatibility, and user interface adaptability for diverse user needs.

Localized and Multilingual Support: Catering to diverse communities with different languages, cultural backgrounds, and literacy levels necessitates multilingual support, localized content, and community engagement initiatives.

Partnerships and Collaborations: Collaborating with NGOs, community organizations, government agencies, and fintech providers can amplify efforts towards financial inclusion. Building strategic partnerships for financial literacy programs, affordable banking products, and outreach campaigns can broaden impact.

To know more: Financial Service Cloud

0 notes

Text

Exploring Central Bank Digital Currencies (CBDCs): Pioneering Finance into a New Era 💻💰

Hey Tumblr fam! Let's delve into the fascinating realm of Central Bank Digital Currencies (CBDCs) and ponder the question: Are we on the brink of a financial revolution? 🌐🚀

🏦 What are CBDCs? CBDCs are digital currencies issued by central banks, aiming to digitize traditional fiat currencies. Think of them as the digital equivalent of cash, directly backed by the government and regulated by the central bank. 💵💻

🔍 How do they differ from cryptocurrencies? Unlike cryptocurrencies like Bitcoin or Ethereum, CBDCs are centralized and maintain the backing and stability of traditional fiat currencies. They offer the convenience and security of digital transactions while retaining the trust and stability of government-backed currencies. 💳🔒

🌍 Impacts on Finance:

Financial Inclusion: CBDCs have the potential to increase financial inclusion by providing access to banking services for the unbanked and underbanked populations.

Payment Systems: They could revolutionize payment systems, offering faster, cheaper, and more efficient transactions domestically and globally.

Monetary Policy: Central banks could implement monetary policies more effectively through CBDCs, facilitating direct transfers to individuals and businesses.

💡 Challenges and Considerations:

Privacy Concerns: Balancing privacy with regulatory requirements and combating illicit activities remains a key challenge.

Technology Infrastructure: Building robust and secure technology infrastructure is essential to ensure the seamless adoption and operation of CBDCs.

International Cooperation: Coordination among central banks and regulatory bodies globally is crucial for the successful implementation of CBDCs on a global scale.

🚀 A New Era in Finance? CBDCs represent a bold step towards the digitization of money and the modernization of financial systems. While challenges exist, the potential benefits are immense, paving the way for a more inclusive, efficient, and resilient financial ecosystem.

What are your thoughts on CBDCs? Are they the future of finance or just another technological experiment? Let's keep the conversation going! 💬💡

#DigitalCurrencyRevolution#FinanceInnovation#CBDCs#finance#thefinrate#payment gateway#fintech#financialinsights#financetalks

0 notes

Text

Unveiling the Dominance of Cryptocurrency: A Comprehensive Review of its Power and Potential

In an era where traditional financial systems face increasing scrutiny and volatility, the emergence of cryptocurrency has been nothing short of revolutionary. With its decentralized nature and groundbreaking technology, cryptocurrency has rapidly transformed from a niche interest to a global phenomenon, captivating the imagination of investors, technologists, and the general public alike.

At the heart of cryptocurrency's allure lies its unparalleled power to disrupt traditional financial systems. Unlike traditional currencies controlled by central authorities, cryptocurrencies operate on decentralized networks, utilizing blockchain technology to ensure transparency, security, and immutability. This decentralization not only mitigates the risk of government interference and manipulation but also empowers individuals with unprecedented financial sovereignty.

One of the most captivating aspects of cryptocurrency is its potential to democratize finance. Through blockchain technology, individuals worldwide can participate in financial transactions without the need for intermediaries, opening up access to financial services for the unbanked and underbanked populations. This inclusivity not only fosters financial empowerment but also promotes economic equality on a global scale.

Moreover, cryptocurrency's borderless nature transcends geographical limitations, facilitating seamless cross-border transactions and fostering international trade and cooperation. By eliminating the barriers imposed by traditional financial systems, cryptocurrency empowers individuals and businesses to engage in frictionless global commerce, unlocking new opportunities for economic growth and innovation.

Furthermore, the innovative potential of cryptocurrency extends far beyond financial transactions. Smart contracts, powered by blockchain technology, enable the automation and execution of contractual agreements without the need for intermediaries, revolutionizing industries such as real estate, supply chain management, and intellectual property rights.

However, alongside its transformative potential, cryptocurrency also faces challenges and criticisms. Price volatility, regulatory uncertainty, and security concerns remain significant barriers to mainstream adoption. Moreover, the proliferation of scams and fraudulent schemes within the crypto space underscores the need for robust regulatory frameworks and investor education initiatives.

Despite these challenges, the trajectory of cryptocurrency remains undeniably upward. As institutional adoption accelerates and technological advancements continue to enhance scalability and security, the power and potential of cryptocurrency to reshape the global financial landscape are undeniable.

In conclusion, cryptocurrency represents a paradigm shift in the way we perceive and interact with money. Its decentralized nature, innovative technology, and potential to democratize finance make it a powerful force for positive change in the world. However, realizing this vision requires a collective effort from industry stakeholders, regulators, and the broader community to navigate challenges and foster responsible innovation. As we embark on this transformative journey, the true power of cryptocurrency awaits to be unleashed.

#CryptoWealthJourney

#DigitalAssetWealth

#CryptocurrencyInvesting

#BlockchainOpportunity

#WealthThroughCrypto

#FinancialFreedomQuest

#CryptoFortuneSeekers

#InvestingInDigitalAssets

#CryptocurrencyWealthBuilding

#DigitalCurrencyRiches

0 notes

Text

What impact will cryptocurrencies have on the future of FinTech?

Cryptocurrencies, with their decentralized nature and underlying blockchain technology, are poised to significantly impact the future of FinTech (Financial Technology). This paper explores the potential disruptions cryptocurrencies can bring, focusing on both the opportunities and challenges they present.

Financial Inclusion and Efficiency

One of the most significant areas of impact is financial inclusion. Cryptocurrencies, accessible through a smartphone and internet connection, offer the potential to bypass traditional banking infrastructure. This opens doors for the unbanked and underbanked populations worldwide, fostering financial independence and participation in the global economy.

Cross-border transactions can also benefit immensely. Cryptocurrencies can streamline international payments, making them faster, cheaper, and more transparent compared to traditional methods. This can significantly boost global trade and economic integration.

Innovation and a Wave of Change

Cryptocurrencies have already spurred a wave of innovation in FinTech. Blockchain technology, the backbone of cryptocurrencies, offers a secure and transparent way to record transactions. This has the potential to transform various sectors beyond finance, including supply chain management, healthcare, and voting systems.

Smart contracts, self-executing agreements stored on the blockchain, can automate financial processes and reduce the need for intermediaries. Decentralized applications (DApps) built on blockchain infrastructure can disrupt traditional financial services by offering peer-to-peer lending, borrowing, and trading platforms.

Challenges and Regulatory Hurdles

Despite the exciting possibilities, cryptocurrencies face significant challenges that can hinder their mainstream adoption and impact on FinTech. Volatility is a major concern, with cryptocurrency prices experiencing wild swings that deter risk-averse users. Scalability is another hurdle – popular blockchains often struggle to handle a high volume of transactions, leading to slow processing times and high fees.

Regulatory uncertainty is a major roadblock. Governments worldwide are still grappling with how to regulate cryptocurrencies, creating an environment of confusion for businesses and consumers. Concerns about money laundering, illegal activities, and consumer protection further complicate the regulatory landscape.

FinTech's Response: Adaptation and Collaboration

The FinTech industry is likely to respond to these challenges through adaptation and collaboration. Traditional financial institutions are already exploring ways to integrate blockchain technology into their existing infrastructure. This could lead to the development of hybrid systems that combine the security and efficiency of blockchain with the regulatory compliance of traditional finance.

Collaboration between FinTech startups and established financial institutions can be crucial for navigating the regulatory landscape and developing secure and user-friendly cryptocurrency solutions. Regulatory clarity and frameworks that foster innovation while addressing legitimate concerns will be essential for widespread adoption.

The Evolving Landscape: Potential Scenarios

The future of FinTech and cryptocurrencies remains uncertain, with several potential scenarios on the horizon:

Mass Adoption: Cryptocurrencies and blockchain technology become widely adopted, transforming financial services and revolutionizing global commerce. Traditional financial institutions adapt or risk becoming obsolete.

Co-existence: A hybrid model emerges, with cryptocurrencies used for specific purposes alongside traditional financial systems. Regulatory frameworks create a stable environment for innovation.

Limited Impact: Regulatory hurdles and security concerns prevent cryptocurrencies from achieving mainstream adoption. Their impact on FinTech remains limited.

Conclusion: A Catalyst for Change

Cryptocurrencies, with their disruptive potential and underlying technology, are undoubtedly a force to be reckoned with in the FinTech landscape. Whether they become the dominant force or a complementary element within a hybrid system, they are likely to be a significant catalyst for change. The future of FinTech hinges on navigating the challenges, fostering innovation, and establishing a regulatory environment that fosters trust and security.

Further Considerations

This paper has explored some of the key areas of impact, but the potential ramifications of cryptocurrencies on FinTech are vast. Here are some additional considerations:

The impact of cryptocurrencies on central banking and monetary policy.

The rise of Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) as new fundraising mechanisms.

The development of Decentralized Finance (DeFi) applications offering alternative financial services.

The environmental impact of certain blockchain technologies used in cryptocurrencies.

By staying informed about these ongoing developments, we can better understand the evolving relationship between cryptocurrencies and the future of FinTech.

Read More Blogs :

Game Changers: Top 10 Women Leaders in Gaming and Esports

How L&D Programs Elevate Women in Tech

Green Tech Leaders: 10 Women in Sustainable Technology

0 notes