#car insurance

Text

Automakers are collecting driving data from customers and quietly providing it to insurance companies, and the practice has resulted in some unassuming drivers seeing their coverage increased or even terminated due to the practice, a new report reveals.

The New York Times reported this week that car manufacturers like General Motors and Ford are tracking drivers’ behavior through internet-connected vehicles, and sharing it with data brokers such as LexisNexis and Verisk, which create “consumer disclosure reports” on individuals that insurance companies can access.

The consumer reports do not show where a driver has traveled, but they do provide information on length of trips and driving behavior, such as “hard braking,” “hard accelerating” and speeding. Insurance companies can use those reports to assess the risk of a current or potential customer, and adjust rates or refuse coverage based on the findings.

The Times highlighted the case of Kenn Dahl, the driver of a leased Chevrolet Bolt, who learned he and his wife's driving habits were being tracked when an insurance agent told him in 2022 that his LexisNexis report was a factor behind his insurance premium jumping 21%.

“It felt like a betrayal,” Dahl told the newspaper. “They’re taking information that I didn’t realize was going to be shared and screwing with our insurance.”

(continue reading) related ←

#politics#lexisnexis#data mining#smart cars#car insurance#privacy rights#kenn dahl#spyware#capitalism#privacy#consumer disclosure reports

119 notes

·

View notes

Text

Is big brother riding shotgun in your car? 🤔

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think about it#think for yourselves#think for yourself#do your homework#do some research#do your own research#ask yourself questions#question everything#car insurance#spies#spying#cars#vehicles#you decide

231 notes

·

View notes

Text

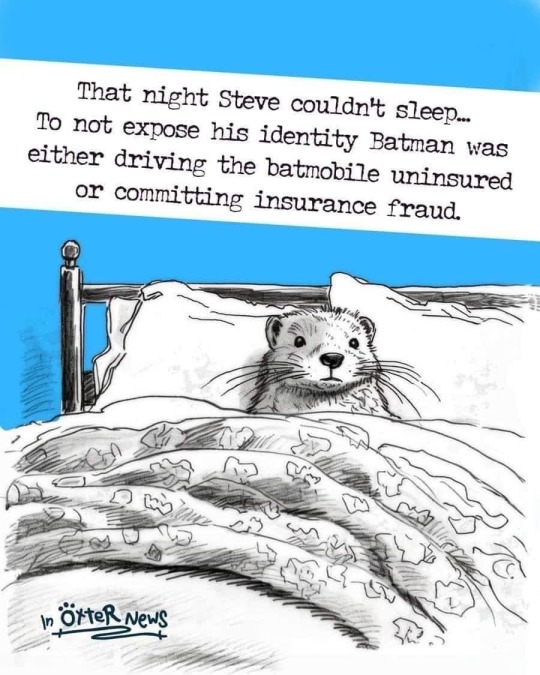

despite all the people in Gotham who keep losing their cars for various reasons (read: Batman and co.), they don't really complain - not when Bruce Wayne conveniently pays for the Car insurance, saying "it's because the destroyed cars are surrounding my property, it gives a terrible look"

(you could think The Batman does this on purpose too; the cars who usually get absolutely destroyed are usually already broken, and then to have Mr.Wayne pay for it for practically no reason)

88 notes

·

View notes

Note

Which would be better to do: pay my car insurance in one lump sum reducing my emergency savings to almost nothing or put my car insurance on monthly payments which would slightly increase the amount I pay but allow me to keep my emergency savings intact. I know this is probably a personal preference question but was hoping the almighty bitches might have some input to help me make a decision.

Option #2.

I'd only pre-pay auto insurance if your emergency savings fund would NOT be depleted by it. This is what I do to save a little money every year, but my emergency fund is nice and fat and I can easily replace it within a few months when I use it.

Here's why: You will need your emergency fund to pay for your insurance deductible in the event of an insurance claim. If you've spent it all on your monthly insurance payment, then you will have nothing left for your deductible.

And if that didn't make sense, we explain all about it in these posts:

Dafuq Is Insurance and Why Do You Even Need It?

You Must Be This Big to Be an Emergency Fund

3 Times I Was Damn Grateful for My Emergency Fund (And Side Income)

Did we just help you out? Tip us!

#insurance#car insurance#insurance premium#insurance deductible#how insurance works#finance#personal finance#advice#money tips

45 notes

·

View notes

Text

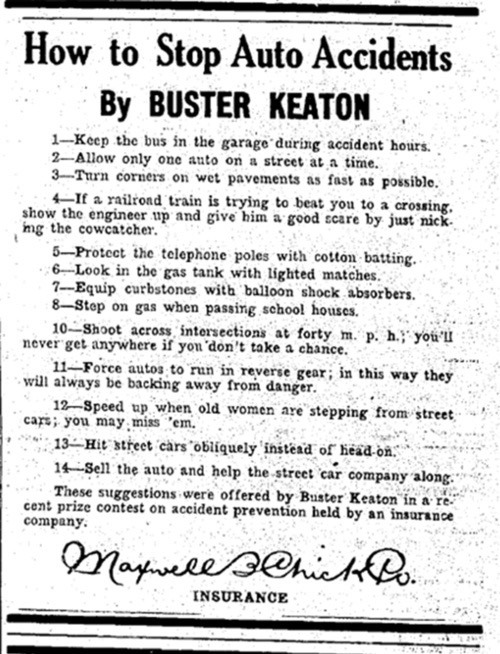

Good Job Buster! 👍

#buster keaton#comedy#insurance#car insurance#accident prevention#silent movies#1920s#silent film#silent comedy#1920s cinema#golden age of hollywood#hollywood#slapstick

34 notes

·

View notes

Text

The provincial government has vowed to take steps to close a troubling loophole that allows prohibited drivers to buy vehicle insurance in their name through ICBC, following Global News reporting.

Roy Heide was a prohibited driver with no licence before he earned the dubious distinction of holding what the Abbotsford Police Department believes is the worst impaired driving rap sheet in Canadian history.

Yet ahead of the August 2022 crash that secured his 21st impaired driving conviction last month, Abbotsford police said Heide was able to insure his motorcycle with B.C.’s public auto insurer as the registered owner.

Continue Reading

Tagging @politicsofcanada

32 notes

·

View notes

Text

I don't think people realize that with universal Healthcare, car insurance costs would go to to 1/3rd or 1/4 of what they are today.

Car insurance in the US for a 2022 Subaru (for example) is $150 a month or about $1750 a year for normal insurance. In Germany insuring the same car would cost $327 a YEAR.

If you want to get the best, complete coverage insurance, it would cost $981. Universal Healthcare would save money on our insurance premiums, medicine, hospitals, and also our god damn cars.

20 notes

·

View notes

Text

Don't you just love dealing with insurance as a disabled person?

in august, someone driving a company vehicle hit my car and wrote it off. This car was modified to allow me to drive it, it had old mechanical hand controls that were nothing special but they got the job done. I can't drive without hand controls, physically or legally.

They f*cked us around with the claims process for so long that we decided we needed to go and try to get a car, paying out of pocket (putting ourselves in dept to do so) because public transport where we live is shit and I need to be able to go to appointments, not to mention my partner is a door dasher who depends on a car for our income.

In early November the insurance of the company the at-fault driver belonged to finally answered us back (but only after my partner and I AND the towing company who took the car threatened legal action because they were ghosting everyone) and they finally admitted they were at fault and asked for our terms. We only asked for the hand controls to be covered and that they pay the towing company and other costs associated with the accident (I think there were fees from council or something because oil spilled on the road but I don't remember details).

Much to my suprise, they agreed to pay for all of it, explicitly stating, in writing, that they'd pay for the cost of the hand controls and their installation in the new car. We gave them a quote from the only place "in our area" (aka 2 hours away) that could do the installation. The style I had no longer exists, and the next cheapest option is $8,800.

They answered us back today and offered us $3,000 total. That won't even cover the cost of the assessment the NSW government insists that I have to get done before they can be installed. Hell I don't even think that would cover the cost to get the old mechanical ones installed if they still existed, I paid $5,000 for them back in 2018/2019 and prices for all disability-related stuff has sky-rocketed since then. So despite them admitting their client was at fault, they still think it's fair that I should be out over $5,000 just to be able to use the car that replaced the one thier client wrecked. That's not even touching on how much we were out for the cost of the new car itself. We didn't ask for that, we just wanted the hand controls covered.

As if I don't have enough going on right now, I not get to add "fight with insurance" to the list.

[ID:A Gif showing a woman with black hair, a white shirt and blue skirt angrily flip over a small plastic table/End ID]

#I promise I'll stop with the rant posts soon but god I'm so tired 😭#Disabled Tax#disability#disabled#insurance#car insurance

24 notes

·

View notes

Text

38 notes

·

View notes

Text

Thinking about the time I burst into a fit of hystaric crying as an ~8 year old because of car insurance.

11 notes

·

View notes

Text

In New York, drivers with a clean driving record but a low credit score are quoted $1,367 more for car insurance, on average, than otherwise identical drivers with excellent credit, according to a new analysis of tens of thousands of car insurance quotes.

For drivers in ZIP codes with predominantly Black residents, the gap yawns even wider: The cost of poor credit in those areas is $3,411 a year, on average.

These disparities were uncovered in a study of nearly 100,000 insurance quotes from 10 major New York car insurance companies. It was conducted by the Consumer Federation of America, a nonprofit advocacy organization.

The findings show just how much car insurance premiums can be inflated by factors that aren’t directly related to how safely a driver behaves on the road. They also reveal how a driver’s credit score can combine with their ZIP code to raise the cost of car insurance, which is mandatory for drivers in nearly every state.

“We’re talking about experienced drivers with no history of accidents or tickets facing premiums that are hundreds or sometimes thousands of dollars more, simply because of what shows up in their credit reports,” says Douglas Heller, the CFA insurance expert who led the new study. “This is unmistakably harmful to the people of New York.”

The same dynamic plays out across the country. Only California, Hawaii, and Massachusetts bar insurers from using drivers’ credit scores to set premiums. Everywhere else, a low credit score will likely raise your car insurance price, and your ZIP code could multiply the damage. (Insurers use a special “credit-based insurance score” for pricing, but it’s calculated in a very similar way to your normal credit score.)

By law, insurers aren’t allowed to use race and income to set car insurance premiums or decide whom to insure. But critics say factors like credit scores and ZIP codes can have a particularly significant effect on certain racial groups.

For example, Black, Latino, and Indigenous Americans are much more likely to have poor credit than white Americans, a reflection of decades of discriminatory policies including redlining that have limited opportunities for communities of color to build wealth.

This sets up a double whammy for drivers of color. “When you marry credit and territorial pricing, you get a disastrous result,” Heller says. “There’s an amplification of the credit penalty in majority nonwhite ZIP codes.”

(continue reading)

#credit scores#car insurance#black tax#structural racism#zip codes#two americas#double standards#white privilege#zip code discrimination#racism by proxy

61 notes

·

View notes

Text

please stay on topic

14 notes

·

View notes

Text

One time I was talking with my friends about their sucky exes, and I said to one of them, “he’s literally just a guy, hit him with your car!!!” And the guy who was with us said with such sincere worry in his voice, “no, don’t do that! Your car insurance will go up!”

19 notes

·

View notes

Note

Hola ladies! I have a very..specific odd scenario and was wondering if you have any financial wisdom to impart! I own my own car outright, like I worked my heinie off to pay for it and now triumphantly have the title in hand. However, I have never had a license because I have an undiagnosed seizure/vertigo(??) issue which makes driving dangerous af. My longtime partner is the driver. Our current insurance is fine with this situation and I get my homeowners insurance through them too, but their rate has steadily gotten higher over time despite nothing changing on our end (no claims, no tickets). I was looking into getting quotes from other insurance companies and NONE of them want to insure me/us because I don't have a license! So now I feel trapped in this high-rate insurance. :(

I'm so sorry, puggle! This is such an odd scenario. One option is to put your partner on the car's deed as a co-owner, and insure it under their license instead. Obviously, that would require a level of trust and permanence with your partner.

But it's very unusual to own a car without a license, and the insurance agencies are probably incentivized to NOT insure an unlicensed driver, which is why they're giving you trouble.

Either way, you need cheaper insurance, so keep shopping around! Sometimes even calling your current insurer and saying "hey, I got a better offer elsewhere, how much can you lower my bill to keep me as a customer?" will help.

How To Maintain Your Car When You’re Barely Driving It

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

If you found this helpful, consider joining our Patreon!

20 notes

·

View notes

Text

Hate asking, but I’m worried. I’m in need of $1,005 for monthly expenses for November. Stuff like rent, electric, car insurance, internet. All the things that keep me housed.

Any little bit, every reblog, even $5, adds up.

Venmo is secretladyspider,or you can find other things thru linktree.

Thank you. ♥️

#mutual aid#adhd#mental health#november#rent#car insurance#queer#lgbtqia#disability#stuff#actually adhd#idk what tags to use#demisexual#demisexuality#demi ace#just putting the things I am in the tags#and my frequently used tags#mental illness#positive#depression#video#recovery#ptsd#cats#asexual#cute#dpdr#bipolar disorder#depersonalization#derealization

70 notes

·

View notes

Text

I know we all hate making phone calls, but after getting an email about a $45 per month increase in my car insurance rate, I took the time to call the insurance company.

We made sure I was getting all the discounts I qualify for, and then the rep (Tatiana, a beautiful person) said we could try rewriting the policy, as that sometimes results in a lower rate. If it didn't change anything, we would just stick with my same policy, but she said it was worth trying.

So we gave it a shot, and now instead of a $45 per month increase, I have a $130 decrease instead.

I realize I'm coming from a place of privilege, both having the spare time and having insurance in the first place, but I just wanted to say that sometimes making a phone call, hard as it can be, is worth it.

10 notes

·

View notes