#Robert T. Kiyosaki

Photo

Failure defeats losers ~ @theRealKiyosaki

Failure defeats losers, failure inspires

inspiration, failure, business, business quotes, failure quotes, inspiration quotes, loser, loser quotes, winner, winner quotes, Robert T. Kiyosaki, Robert T. Kiyosaki quotes #PICTUREQUOTES, #QUOTES

#inspiration#failure#business#business quotes#failure quotes#inspiration quotes#loser#loser quotes#winner#winner quotes#Robert T. Kiyosaki#Robert T. Kiyosaki quotes#PICTURE QUOTES#QUOTES

5 notes

·

View notes

Text

6 libros para leer, si quieres emprender o aprender sobre el funcionamiento del dinero

Lectura inteligente sobre el dinero, las deudas, finanzas, el ahorro y el emprendimiento

Hola, Curly hace unos meses me propuse sanar mi economía y mejorarla. No solo para este momento, sino para el futuro. Luego se me ocurrió, que de paso podía aprender a montar un negocio. Para conseguir estos dos objetivos tenía que saber los pasos básicos para llevarlo a cabo. Y eso significaba: uno ir a la…

View On WordPress

#deudas#dinero#El hombre más rico de Babilonia#emprender#finanzas#Georges s. Clason#gestión de ahorro#lectura#leer#Napoleon Hill#paciencia#Padre rico Padre pobre#Piense y hagase rico#problemas#Robert T. Kiyosaki

0 notes

Text

Descobri que muita gente usa arrogância para tentar esconder a própria ignorância.

1 note

·

View note

Text

Memahami Pola Pikir Keuangan Robert T. Kiyosaki

Memahami Pola Pikir Keuangan Robert T. Kiyosaki

tebuireng.co- “Kaya dan miskin itu takdir!” begitu banyak masyarakat yang mengatakan demikian. Hal ini cukup bertentangan dengan Robert T Kiyosaki penulis buku literasi finansial yang cukup banyak disukai. Melalui bukunya yang berjudul The Cashflow Quadrant, Robert T. Kiyosaki memberikan solusi permasalahan banyak orang sekaligus menjadi solusi isu dunia terkait resesi ekonomi.

Setelah terbitnya…

View On WordPress

1 note

·

View note

Text

Belajar Mengelola Keuangan Dengan Robert T. Kiyosaki

Belajar Mengelola Keuangan Dengan Robert T. Kiyosaki

Belajar Mengelola Keuangan Dengan Robert T. Kiyosaki

Siapa yang tidak kenal Robet T. Kiyosaki? Beliau adalah penulis buku ‘Rich Dad, Poor Dad’, yang terkenal dengan pemikirannya dalam mengelola keuangan. Juga pemikirannya mengenai bagaimana uang bekerja untuk kita, bukan kita yang bekerja untuk uang. Sejak buku Rich Dad Poor Dad cetak ulang pada 2021, nama Robert T. Kiyosaki makin santer publik…

View On WordPress

1 note

·

View note

Text

Zitat von Robert T. Kiyosaki

Zitat von Robert T. Kiyosaki

Sag nie, dass du dir etwas nicht leisten kannst. Frag stattdessen, wie du es dir leisten kannst.

View On WordPress

1 note

·

View note

Text

youtube

TODAY'S TOPIC:

In our exploration of Robert T. Kiyosaki's "Rich Dad Poor Dad," we've uncovered 33 pivotal lessons for wealth-building. These lessons encompass a spectrum of principles, from embracing financial education and mastering assets and liabilities to making money work for you through strategic investments. The importance of entrepreneurship, learning from mistakes, and developing financial discipline were highlighted, alongside the need to embrace change and leverage time wisely.

Strategic networking, continuous self-improvement, and prudent risk management emerged as crucial elements in the journey to financial success. Diversifying investments, understanding market trends, and fostering continuous innovation were emphasized, while tax efficiency and a strong credit profile were deemed essential. Lessons on asset protection, legal awareness, and patience in investments rounded out the practical aspects of wealth-building.

Effective communication, a long-term perspective, and social responsibility were highlighted as key traits, along with the pursuit of financial independence and adaptability in career choices. The art of selling, creating multiple income streams, and the prudent use of debt were identified as valuable skills. Mastering emotions, legacy building, and a commitment to lifelong learning concluded our wealth-building insights.

These lessons collectively provide a comprehensive guide, offering actionable strategies and insights to navigate the intricate path to financial prosperity. Join us for more wisdom on "The Wealthy Status" as we continue to unravel the secrets of enduring wealth.

#robert t kiyosaki#robert kiyosaki#rich dad poor dad#how to make money#rich dad#how to get rich#poor dad#rich dad poor dad summary#book#books#33#life lessons#life advice#money#wealthy#wealth#robert kiyosaky#invest#fine living#money mindset#5 club#dicipline#kiyosaki#robert kiyosaki interview#robert#kiyosaki books#investing#create wealth#millionare#rich

0 notes

Text

Robert T. Kiyosaki – Zengin Baba Yoksul Baba

Robert T. Kiyosaki Zengin Baba Yoksul Baba zengin olmak için önce finansal konuları iyice öğrenmeniz gerektiğini söyleyerek başlıyor. Bunun öğrenilebilir olduğunu vurguluyor. Finansal okur yazarlık çok önemli.; eğer bunlar öğrenilmezse faturaları ödemek için çalışmaya devam edeceğimizi açık yüreklilikle yüzümüze vuruyor.

Nasıl zengin olunur, kendi işimi mi kurmalıyım yoksa başkasının yanında mı çalışmalıyım, paranın nasıl çalıştığını bilmek zengin olmak için yeterliyse muhasebeciler veya bankalarda çalışanlar neden zengin değiller, okullarda para konusunda ne öğreniyoruz? Yazar bu tip sorulara cevap vermeye çalışmış.

Yoksul baba bir konu hakkında derinlemesine bilgi sahibi olmayı takıntı haline getirmiş, ne kadar çok bilirsem o kadar çok para kazanırım veya ne kadar çok çalışırsam o kadar çok para kazanırım diye düşünüyor. Zengin baba ise her konu hakkında az da olsa bilgi sahibi olmanın doğru olduğuna inanan ve çok çalışarak değil, az da olsa kazandığı parayı çalıştırma yollarını araştıran, yani paranın para getirmesi için uğraşan birisi.

Zengin babaya göre bireysel olarak vergiden kaçınmak mümkün değilken şirket sahiplerinin bu konuda çeşitli seçenekleri var. Başkası için çalışan birisi daha maaşı bankaya yatmadan vergileri kesilirken şirketlerin vergi ödemeden önce atabileceği bazı adımlar var. Yoksul baba maaşını ne kadar artırırsa ödediği vergi de o kadar artıyor, bu sebeple zengin olması mümkün değil çünkü parasını devlete kaptırıyor. İnsanların şirket kurmayı gözlerinde çok büyüttüğü, ayrıca bu konularda yeterince bilgi sahibi olmadığını söylüyor yazar. Bu konu ülkemizde de bu şekilde. Para idaresi, şirket kurmak, vergiler gibi konuları bilmeyi bırakın çoğu çalışan hukuki haklarını dahi bilmiyor.

Yani yoksul baba para biriktirmeye uğraşırken, zengin baba kenara konan paranın beklerken bile kaybettirdiğini düşünüyor. Yazar ilk fırsatta ev, araba almak yerine yatırım yapmak gerektiğini vurguluyor. Önerilerden de görüldüğü üzere, kitapta nasıl zengin olurum sorusuna yanıt bulamayacağız. Ancak bu sorgulamalar bizi borsa ve para hakkında ne kadar bilgi sahibiyim, vergiler ve şirket yapılanması konusunda neler biliyorum, para kazanmak için nelerden taviz verebilirim gibi soruları düşünmeye itebilir.

Kaynak: https://www.e-kitapstore.com/robert-t-kiyosaki-zengin-baba-yoksul-baba

#robert t kiyosaki#zengin baba yoksul baba#kitap#Ekitap#kitapönerisi#kitap incelemesi#pdf kitap indir

1 note

·

View note

Text

10 citations inspirantes de Robert T. Kiyosaki

Clique-ici pour découvrir 10 citations inspirantes de Robert T. Kiyosaki

« Ce n’est pas ce que vous dites de votre bouche qui détermine votre vie, c’est ce que vous vous murmurez à vous-même qui a le plus de pouvoir! »

― Robert T. Kiyosaki

tags: inspiration, vie, autodétermination, image de soi, sagesse

« À l’école, nous apprenons que les erreurs sont mauvaises et nous sommes punis pour les avoir commises. Pourtant, si vous regardez la façon dont les humains sont…

View On WordPress

1 note

·

View note

Photo

Failure defeats losers ~ @theRealKiyosaki

Failure defeats losers, failure inspires

inspiration, failure, business, business quotes, failure quotes, inspiration quotes, loser, loser quotes, winner, winner quotes, Robert T. Kiyosaki, Robert T. Kiyosaki quotes #PICTUREQUOTES, #QUOTES

#inspiration#failure#business#business quotes#failure quotes#inspiration quotes#loser#loser quotes#winner#winner quotes#Robert T. Kiyosaki#Robert T. Kiyosaki quotes#PICTURE QUOTES#QUOTES

1 note

·

View note

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

91 notes

·

View notes

Text

The poor and the middle class work for money. The rich have money work for them.

From RICH DAD POOR DAD By Robert T. Kiyosaki

#dark academia#spilled thoughts#bookish#book review#book quotes#booklover#self help#self help books#motivatedmindset#chaotic academia#quoteoftheday#phycology#aesthetic#rich dad poor dad#money#how to heal#how to get rich

27 notes

·

View notes

Text

“Each one of your expenses is someone else’s income, and each one of your liabilities is someone else’s asset. Every time you spend money, you are adding to someone else’s income instead of augmenting your own” - Robert T. Kiyosaki

#financial literacy#financialfreedom#finance#financial#economy#ecommerce#investors#investing#invest#stock market#stocks#stock#real estate#investor#self love#encouragement#encourage#selfworth#manifest#growth#grow#improvement#motivation#motivatedmindset#mindset#growthmindset#improve#quote#quotes#inspirational quotes

90 notes

·

View notes

Text

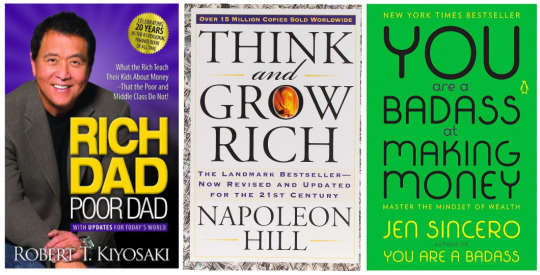

The Self-Improvement Project: Books To Become A Money Magnet

Rich Dad, Poor Dad by Robert T. Kiyosaki

Think and Grow Rich by Napoleon Hill

The Psychology of Money by Morgan Housel

You Are a Badass At Making Money: Master the Mindset of Wealth by Jen Sincero

Money: A User's Guide by Laura Whateley

Girls That Invest by Simran Kaur

How To Make It Happen by Maria Hatzistefakis

Secrets Of Six-Figure Women by Barbara Stanny

MONEY Master The Game: 7 Simple Steps To Financial Freedom by Tony Robbins

We Should All Be Millionaires: A Women's Guide To Earning More, Building Wealth and Gaining Economic Power by Rachel Rodgers

Lean In: Women, Work and The Will To Lead by Sheryl Sandberg

The Millionaire Mind by Thomas J Stanley

How To Be An Overnight Success by Maria Hatzistefakis

#books#book blog#booklr#readblr#book reccs#book recommendations#bookaddict#bookworm#book list#finance#books about money#books about finance#financial independence#think and grow rich#rich dad poor dad#you are a badass at making money#the psychology of money#bookblr#book blogger#book community#book lover#self improvement#money magnet#money

9 notes

·

View notes

Text

Qızıl qaydanı yadında saxla: qaydaları qızılı olanlar qoyur.

Varlı Ata, Kasıb Ata,

Robert T. Kiyosaki

8 notes

·

View notes

Text

Rich Dad Poor Dad Book Review

Rich Dad Poor Dad book is written by Robert T. Kiyosaki, who is an American businessman and author.

It’s a must have book for the beginners, who wants to gain knowledge about financial education. He had explained it with sharing his own experiences, based on the principles of financial literacy – investing, accounts, returns, liabilities, mutual funds etc.

He had shared his own journey, as a…

View On WordPress

#blog#blogger#blogpost#book#book blogger#book club#book community#book lover#book marks#book nerd#book review#books#bookworm#classic novel#read#reader

2 notes

·

View notes