#finance capital

Text

Welcome to BIG, a newsletter on the politics of monopoly power. If you’re already signed up, great! If you’d like to sign up and receive issues over email, you can do so here.

Today, as the U.S. is drawn into wars in Israel and Ukraine, as well as the defense of now-peaceful Taiwan, I’m writing about war. Not the policy choices, or whether U.S. military power is a net force for good or ill, but the actual practical machinery behind the American defense base that produces the weaponry necessary to sustain the military.

As stockpiles dwindle, there is now widespread agreement among policymakers that America must rebuild its capacity to arm itself and its allies. But according to a new scorching government report released this week, that’s mostly just talk. The Pentagon doesn’t bother tracking the guts of defense contracting, which is who owns the mighty firms that build weaponry.

But first, I have a personal announcement. I am going on leave this week, and I’ve hired a colleague named Lee Hepner to take over for BIG while I am out. You are in for a treat. Hepner works with me at the American Economic Liberties Project. He’s a lawyer with over a decade's worth of policy and political experience at the state and local level, and when I have a question on the law or procedure, Hepner’s one of my go-to people. He’s drafted important legislation, and has recently been focusing on the airline industry, labor issues, and a lot of the major antitrust litigation I've written about here, including the trials of the Meta-Within merger, the Microsoft-Activision acquisition and the Google monopolization case. You're in good hands.

And now, let’s talk the defense base. Here’s an exceptionally boring chart that involves all the money in the world. Welcome to the Pentagon.

One of the more important side stories to the recent wars in Ukraine and Israel, and competition with China over Taiwan, is that the U.S. defense industrial base, composed of 200k plus corporations, is being forced to actually build weapons again. Defense is big business, and since the end of the Cold War, the government has allowed Wall Street to determine who owns, builds, and profits from defense spending.

The consequences, as with much of our economic machinery, are predictable. Higher prices, worse quality, lower output. Wall Street and private equity firms prioritize cash out first, and that means a once functioning and nimble industrial base now produces more grift than anything else. As Lucas Kunce and I wrote for the American Conservative in 2019, the U.S. simply can’t build or get the equipment it needs. There are at this point a bevy of interesting reports coming out of the Pentagon. The last one I wrote up earlier this year showed that unlike the mid-20th century defense-industrial base, today government cash goes increasingly to stock buybacks rather than actual armaments. And now, with a dramatic upsurge in need for everything from missiles to artillery shells to bullets, we’re starting to see cracks in the vaunted U.S. military.

The signs are unmistakable. In Ukraine, fighters are rationing shells. Taiwan can’t get weapons it ordered years ago. The Pentagon has put together a secret team to scour stockpiles to find high-precision armaments in demand on every battlefield and potential battlefield. But the problem goes beyond national defense. In Lake City, Missouri, the largest small arms ammunition plant in the world has decided all ammo production is going to the military, meaning that there is going to be a domestic shortage for hunters, sportsmen, and maybe even police. This shortage may look like a story of a sudden surge in demand, but it’s actually, as Elle Ekman wrote in the Prospect in 2021, a story of consolidation and de-industrialization.

Surges due to wars aren’t new, and there’s always some time lag between the build-up and the delivery. But today, the lengths of time are weirdly long. For instance, the Army is awarding contracts to RTX and Lockheed Martin to build new Stinger missiles, which makes sense. But the process will take.. five years. Why? What is new is Wall Street’s role in weaponry. We used to have slack, and productive capacity, but then came private equity and mergers. And now we don’t. The government can’t actually solicit bids from multiple players for most major weapons systems, because there’s just one or two possible bidders. So that means there’s little incentive for firms to expand output, even if there’s more spending. Why not just raise price?

But don’t take my word for it, take that of the Pentagon. In 2022, the DOD reported that “that consolidation of the industrial base reduces competition for DOD contracts and leads DOD to rely on a more limited number of suppliers. This lack of competition may in turn increase the risk of supply chain gaps, price increases, reduced innovation, and other adverse effects.” And that’s why, more than a year into the Ukraine conflict, the ramp-up is still not where it needs to be.

This week, the Government Accountability Office (GAO), which is a Congressional office charged with investigating problems in government and business, explained why. The GAO came out with a report on how the Pentagon is doing essentially zero oversight of Wall Street’s acquisitions of defense contractors. The title is as boring as you’d expect, designed to have few people pay attention, but offering a red-alert to procurement officials.

The report is simply jaw-dropping. Despite all the chatter about consolidation at high levels within the Pentagon, and in Congress, the bureaucracy has made essentially no progress whatsoever. For instance, we have a trillion dollar defense budget, but there are just two people in the Department of Defense who look at mergers in the defense base. You couldn’t staff the morning shift of a small coffee shop with that, and yet two people are supposed to look at the estimated four hundred mergers plus going on every year among defense contractors and subcontractors.

Four hundred mergers every year is a lot, but of course, that’s just an estimate. Why don’t we know how many acquisitions happen in the defense base? As it turns out, it’s an estimate because the Pentagon isn’t tracking defense mergers anymore. To put it in boring GAO-speak, Pentagon“officials could not say with certainty how many defense-related M&A now occur annually because they no longer track or maintain data on all M&A in the defense industrial base.” So the DOD is almost totally blind to the corporate owners of contractors and subcontractors, which might be one reason that, say, Chinese alloys are being discovered in sensitive weapons systems like the state of the art F-35.

It gets worse. There’s no policy or guidance on mergers, and DOD doesn’t even require contractors or subcontractors to tell them that there is new ownership when an acquisition occurs. In fact, the Pentagon relies on public news to learn of mergers. They often do not know that the mergers are going on, or that the Federal Trade Commission is reviewing them. When big mergers happen, even if the Pentagon is concerned, no one tracks what happens after it closes. They do no analysis of industry sectors, as their “M&A office is not collecting robust data or conducting recurring trend analyses that could help them identify M&A in risky areas of consolidation among defense suppliers.”

The Pentagon’s head-in-the-sand approach is why Lockheed now has a chokehold on nuclear missile modernization, since it bought the key supplier of rocket engines and denies those engines to rivals bidding for the contract to upgrade what is known as the nuclear triad.

So how does the U.S. government manage defense base mergers? Well, the Pentagon defers to the antitrust agencies to look solely at competition. “While DOD policy directs Industrial Base Policy and DOD stakeholders to assess other types of risks, such as national security and innovation risks,” wrote the GAO, “they have not routinely done so.” Basically, dealing with their own defense base is someone else’s job.

What I found most useful about the GAO report is the Pentagon’s response, a classic bureaucratic hand wave. The DOD agreed with all the conclusions of the GAO. It should track mergers and what happens afterwards, it should have more personnel doing so, it should consider national security aspects of corporate combinations, and it should have clear policy on mergers. But it doesn’t. The DOD says it will have a better strategy to deal with mergers… by 2024. Basically, you’re right, but it’s not our problem.

Every day, it seems like political leaders and consultants are saying it’s time to really get that arsenal of democracy going, and to re-industrialize for real. It’s quite possible to get a lot done. The FTC and DOJ now have significant amounts of national security-related information on mergers due to a Congressional change in pre-merger notification laws in 2022, so the DOD could easily do a better job of tracking what’s happening in the defense base.

More to the point, the Pentagon is very powerful. The Deputy Secretary of Defense, Kathleen Hicks could simply start smashing heads on competition and begin telling contractors that if they don’t shape up, she will start an internal war against them. Or the head of the Armed Services Committees could threaten the cushy cash flow that leads to record stock buybacks among contractors, if the ramp-up doesn’t start. Or they could grant antitrust authority for the DOD straight-up, which would rely on a national security standard that allows widespread corporate restructuring without the long slog of a court case. There are many paths.

But if you actually look at the guts of the bureaucracy, nothing is happening, because doing something about our industrial base means thwarting Wall Street, and that’s generally not something that’s considered on the table among normie policymakers. Giant bureaucracies are hard to change, but they are not immovable. One of the ways that you know a previously non-functional bureaucracy is on the right track is, ironically, if there is bitter infighting and anger among staff, who are being tasked to do things differently. But as the GAO showed this week, that’s just not happening in the Pentagon, or at least, not happening nearly fast enough.

And that’s why America is increasingly out of ammunition.

#military industrial complex#us military#nato#ukraine#israel#capitalism#economics#wall street#finance capitalism#finance capital#lockheed martin

7 notes

·

View notes

Text

War and Lenin in the 21st century, part 2

By Gary Wilson

Vladimir Lenin, the revolutionary leader of the Soviet Union and a key contributor to Marxist theory, outlined his theory of imperialism in “Imperialism, the Highest Stage of Capitalism,” published in 1916. In this work, he identified five key features of imperialism in the early 20th century.

#imperialism#Lenin#Marxism#capitalism#proxy war#hybrid war#finance capital#New Cold War#colonialism#USSR#Big Business#Struggle La Lucha

5 notes

·

View notes

Text

EMERYALİZM

Serbest rekabetçi kapitalizmde sermaye ihracı yoktur. O zaman sadece satılacak ürünler ihraç ediliyordu. Oysa emperyalizmde gündeme sermaye gereksinimi girdi. Sermaye ihracı, emperyalist süreçte kullanılan daha etkili bir sömürü biçimidir. Bu biçimde emperyalist ülke, meta üreterek ülkelere satmak yerine sermayesini alan bulduğu ülkeye yatırır ve üretimi de doğrudan kendisi gerçekleştirir. Emperyalistlerin bu yöntemi seçme nedeni, hem daha çok sömürü, hem de kendi ülkelerindeki sermaye fazlasına yeni alan ihtiyaçlarıdır. Burada hareket ettirici güç, kar hırsıdır. Çünkü emperyalist ülkelerde hala yatırım yapılacak alanlar vardır. Örneğin: Tarım alanları sanayi alanlarına göre daha geridirler. Fakat, emperyalizmin doğası budur ve o hiçbir zaman az karlı işlere yatırım yapmaz. Çünkü insanlığa, canlılara ve doğaya düşman bir yıkım sistemidir.

Üretimi arttırmak, ürünlerin maliyetini düşürmek için tekniği geliştirmeye büyük ağırlık veriyorlar, işçileri sömürmeyi de son noktasına kadar zorluyorlardı. Maliyeti düşürmenin sonucu fiyatlar düşüyor, rakiplerden hangisi daha düşük fiyatlı mal sürerse pazar onun eline geçiyordu. Kapitalist işletme dahilindeki sermaye, artı değer birikimi nedeniyle büyüyor, meta üretimi gittikçe çoğalıyordu. Böylece bir yandan sermaye, bir yandan üretim yoğunlaştı, yani büyüdü ve gittikçe az sayıda işletmenin elinde toplanmaya başladı, yani merkezileşti. Böylece, serbest rekabetçi kurallar içinde çekişen işletmelerin yerine kendi aralarında oluşturdukları birlikler yoluyla, serbest rekabeti ortadan kaldıran büyük tekeller oluştu. Serbest rekabetçi kapitalizmin yerini emperyalizm aldı. Tekellerin farklı örgütlenme biçimleri vardır, hepsinin yapısı özünde aynıdır. Kartel, tröst, konzern, anonim şirket en sık rastlanılan biçimleridir. Tekellerin birlikteliği olan holdingler de tekelin farklı bir örgütlenme biçimidir. Devletin giderek yalnızca tekeller çıkarına işlemesi, tekellerin devlet üzerinde oldukça etkili olması, devletle tekellerin bütünleşmesini sağladı. Tekelci burjuvazi, emperyalist devlet üzerinde oldukça etkin olduğu için artık yalnızca tekellerin çıkarına girişimde bulunur. Bu devlete tekelci kapitalist devlet, emperyalist devlet diyoruz. Bundan böyle devletin bütün işleri, tekellerin kararlarını garantileyecek doğrultudadır. Bu bir zorunluluktur.

Kapitalizmin emperyalist sürece geçmesi ilk küresel krizin sonucudur. Kriz sonucunda burjuvazinin merkezileşme ve yoğunlaşma süreci yaşandı. Küçük ve orta gelirli şirketler iflas etti. Bu noktada piyasa kontrolü ve devlet ekonomi politikaları, büyük şirketlerin tekeline girdi. Kapitalizm, emperyalist sürece geçerken ortakçılığa dayanan tröst ve kartellerle kendisini yapılandırdı. Bu süreçte banka burjuvazisi ve sanayi burjuvazisi arasında bir bağ oluştu. Büyük tekellerin devlet ihaleleri ve banka kredileriyle büyüdükleri bir sürece girildi. İlk krizle birlikte tekeller, ucuz ham madde ve yeni yatırım alanı arayışına girdiler. Bu arayışlar kapitalizmi küresel üretim biçimine dönüştürdü. Ekonomik olarak güçsüz ülkeler, jeopolitik savaş alanına dönüştü. Ham madde ticareti gelişince, ulaşım sorununu çözmek için büyük yatırımlar başladı. Kapitalist ülkelerdeki büyük tekeller arasındaki ham madde ve pazar arayışındaki rekabet, 1.Paylaşım savaşına neden oldu. Korumacılık ve kolonicilik politikaları rekabeti arttırdı. Bu rekabet sonucunda, silah ve savaş sanayine yatırımlar arttı. Kapitalizm bu krizden kurtulmak için köklü olarak yenilenerek emperyalist sürece geçti. Böylece kapitalizmin en yüksek süreci başladı.

Emperyalizm, kapitalist ülkelerin saldırgan dış politikalarının değil kapitalizmin "eşitsiz bileşik gelişim yasasının" kaçınılmaz ürünüdür. Kapitalizmin tekelleşmeye doğru yönelmesi, ilk başlarda yalnızca belirli bölgeler arasındaki ticareti geliştirdi. Emperyalizm süreci ise, sanayileşmenin büyük boyutlara yükseldiği ve kapitalizmin dünya sistemine dönüştüğü süreçte ticareti de evrenselleştirdi. Önceki dönemlerin tek boyutlu ticari ilişkilerinin yerini, sermaye birikiminde atılımlar yapan tekelci güçlerin iç içe geçmiş ilişkileri aldı. Farklı ülkelere ait finans kapital grupları, diğer egemen ülkelere ait kolonilerin sınırlarını aşmak ve yeni pazarlara sızmak istiyordu. Finans kapital, önündeki engelleri tanımayarak, karlı gördüğü her işe girişmeye başladı. Artık, ekonomik olarak güçsüz bir ülkede yalnızca tek bir egemen yoktu ve kolonyalizm dönemine ait mutlak tekel durumu sarsılıyordu ve ulusal burjuvaziler güç kaybediyordu. Emperyalizm sürecinde, tüm yatırım alanlarında tek bir kapitalist ülkenin tekelini kurması, bir yandan tekeller arasındaki rekabet, diğer yandan finans kapital grupları arasındaki karmaşık ilişkiler nedeniyle mümkün değildi. Emperyalist ilişkiler ağıyla güçlenmeye başlayan kapitalist ülkeler, kendi aralarında avantajlarını zayıflatmaya yönelik ilişkilerde uzmanlaştılar. Örneğin her biri kolonisi üzerinde hak iddia ederken, rakip ülkenin kolonisinde "ulusal bağımsızlık mücadelesini" destekledi. Koloni ülkelerde ulusal mücadeleler işçi mücadelelerine dönüşmediği sürece, bu ataklar birbirleri için doğal karşılanıyordu. Çünkü koloniciler, koloni olmaktan çıkarak ulus devlet kuran ülkenin, sıra ekonominin yapılanmasına geldiğinde, yanlarına varacağına güvenirler.

Emperyalizmden önce bankalar, ödemeler konusunda aracılıktan başka bir işe karışmazdı. Fakat tekelci kapitalizm çağında, sanayi sermayesi artınca, bankalarda da değişiklik oldu. Gelişen sanayinin mali gereksinimlerine bankalar yanıt verdi. Bankada bulunan para şeklinde sermaye, sanayi sermayesi ile bütünleşti. Büyük bankalar, küçüklerini ya kendilerine bağladı ya da yok etti. Büyük sanayideki yatırım alanları, büyük paraları ve kredi olanakları nedeniyle yavaş yavaş bu büyük bankalar tarafından kontrol edilir duruma geldiler. Artık bankalar, banka tekeliydi. Artık tüm kapitalistlerin mali işleri banka tekelindeydi. Şubeleri aracılığıyla sermaye ve gelirleri merkezileştirdiler. Banka müdürleri, sanayiye el attıklarından, artık denetim işi de yapıyordu. Ve işte böylece finans kapital doğdu. Finans kapital, yani mali sermaye, banka sermayesiyle sanayi sermayesinin tekelci süreçte birleşimidir. Finans kapitalin ortaya çıkışı, serbest rekabetçi kapitalizmden emperyalizme geçişin en önemli göstergesidir. Emperyalist baskının işleyişinde borç mekanizması çok önemli yer tutar. Emperyalizm sürecinde güçlülük kolonicilikte değil, ulusal burjuvazinin başka bölgelere etki etmesinde aranır. Emperyalizm sürecinde yükselen kapitalizm, üretici güçlerin uluslararasılaşmasıyla ulusal devlet biçimlenmesi arasındaki çelişkiyi, finans kapitalin yayılmacılığıyla atlatmaya çalışır. Ulus devletlerin de sırtında kambur olan bankalarla büyük sanayi tekelleri arasındaki bu iç içelik, ortaya bir avuç para babası çıkardı. Ben bu para babası tekeline ise yerel (finans oligarşisinin hizmetinde) ve küresel olarak tümleşen "finans oligarşisi" diyorum.

Emperyalizmin öncesi kapitalizm döneminde olan kolonyalizm politikaları, bugün de hala emperyalizm olarak tanımlanmaktadır. Emperyalizmi sömürgeci yayılmacılığa indirgemek yanılgıdır. Kolonicilik bir devletin başka ulusları, devletleri, siyasal ve ekonomik olarak ele geçirip yerli halk üzerinde kültürel asimilasyon uygulaması ve kolonileştirdiği toprakların mutlak egemeni olması anlamına gelir. Kolonileştirme, bir ülkenin siyasal, hukuksal, ekonomik tüm var oluş haklarının yok edilmesine dayanmaktadır. Kolonici güçler, koloni kontrolü kaybedene kadar mutlak egemen olmaktaydı. Başka hiçbir güç o koloninin üzerinde söz hakkına sahip olmamaktaydı. Koloniciliğin temel dayanağı egemenliği altına alma üzerinden gelişmekteydi.

Kapitalizm geliştikçe, tekelleşme süreci ilerledikçe bu egemenlik biçimi de baştan aşağıya boyut değiştirme sürecine girdi. Eskinin koloni imparatorlukları yerlerini tekellerin, kartellerin, finans kapitalin çoklu ilişkisi temelinde yerini emperyalizme bırakıyordu. Özet olarak, kolonyalizm siyasal bağımsızlıktan yoksun koloniciliğe dayanırken, emperyalizm ise güçlü finans kapital gruplarının küresel etki alanına dayanır. Emperyalizmi koloniciliğe indirgemek ona karşı mücadeleyi de milliyetçi bir temelde bağımsızlık mücadelesine indirgemeye karşılık gelir. Emperyalizm kapitalizmin dünya sistemine dönüşmesinin adıdır. Bunu bu şekilde kavrayamayıp yayılmacılık ve saldırgan bir dış politika olarak görmek, emperyalizme karşı küresel bir sınıf savaşı yerine küçük burjuva milliyetçisi bir eylemcilik oluşturur. Bunun yerine enternasyonalist bir yurtseverlik örgütlenebilir.

Artık kapitalizmin serbest rekabetçi zamanındaki tekellerin olmadığı süreçten söz edemeyiz. Finans oligarşisinin etkisindeki tekeller ekonomide söz sahibidir. Küçük sermaye sahibinin uluslar arası boyutta bir tekelle baş etmesi söz konusu değildir. Serbest rekabet değil, tekellerin egemenliği ve tekeller arası rekabet söz konusudur. Emperyalist kriz gelişirken, onun parçası olan güçler de kapsamlı bir vuruşmaya sürükleniyor. Emperyalizm, farklı devletlerin ilişkisinin, finans oligarşisinin etkisindeki tekellerin etkisiyle, dünya ekonomisinde ortaklığı olarak görülmediği sürece, parça-bütün ilişkisi ele alınmadan, saldırganlık ve savaş eğilimi çözümlenemeyecektir. Ayrıca emperyalist barbarlık, barbarlık noktasını aşmıştır. Milyarlarca işçinin yeryüzünün her yerinde (yaklaşık 4 milyarın üzerinde işçi olduğu, bu nüfusa ek olarak yaklaşık 2 milyar kayıt dışı işçi olduğu ve yaklaşık dünya nüfusunun %75’inin yoksul olduğu hesaplanıyor) temel ihtiyaçları için kölece çalıştığını hatırlamak yeterlidir. Buna modern kölelik demek, haksızlık olmaz. Emperyalizm kapitalizmin son evresidir ve bir toprak ya da fetih isteği değildir. Emperyalizm, birikim sürecinin bir sonucudur. Geriye çevrilemez!

#burjuvazi#emperyalizm#finans kapital#kartel#konzern#mali sermaye#sanayi burjuvazisi#şirket#tekel#tröst#bourgeoisie#imperialism#finance capital#cartel#financial capital#industrial bourgeoisie#company#monopoly

0 notes

Text

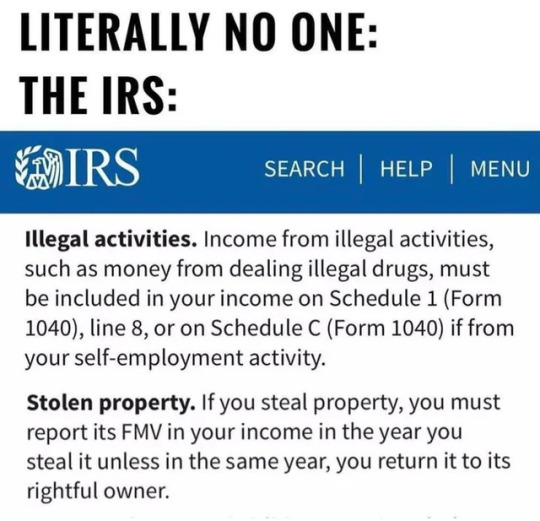

IRS needs their fair share of that....crime money :P

#Finance#Business#Work Meme#Work Humor#Excel#Hilarious#funny meme#funny#capitalism#socialism#accounting#office humor#consulting#dark humor#politics#anticapitalism

838 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

108 notes

·

View notes

Text

Union pensions are funding private equity attacks on workers

On October 7–8, I'm in Milan to keynote Wired Nextfest.

If end-stage capitalism has a motto, it's this: "Stop hitting yourself." The great failure of "voting with your wallet" is that you're casting ballots in a one party system (The Capitalism Party), and the people with the thickest wallets get the most votes.

During the Cultural Revolution, the Chinese state would bill the families of executed dissidents for the ammunition used to execute their loved ones:

https://www.quora.com/Is-it-true-the-Chinese-government-makes-the-families-of-executed-people-pay-for-the-cost-of-bullets

In end-stage capitalism, the dollars we spend to feed ourselves are used to capture the food supply and corrupt our political process:

https://pluralistic.net/2023/10/04/dont-let-your-meat-loaf/#meaty-beaty-big-and-bouncy

And the dollars we save for retirement are flushed into the stock market casino, a game that is rigged against us, where we are always the suckers at the table:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

Everywhere and always, we are financing our own destruction. It's quite a Mr Gotcha moment:

https://thenib.com/mister-gotcha/

Now, anything that can't go on forever will eventually stop. We are living through a broad, multi-front counter-revolution to Reaganomics and neoliberal Democratic Party sellouts. The FTC and DOJ Antitrust Division are dragging Big Tech and Big Meat and Big Publishing into court. We're seeing bans on noncompete clauses, and high-profile government enforcers are publicly pledging never to work for corporate law-firms when they quit public service:

https://pluralistic.net/2023/09/09/nein-nein/#everything-is-miscellaneous

And of course, there's the reinvigoration of the labor movement! Hot Labor Summer is now Perpetual Labor September, with 75,000 Kaiser workers walking out alongside the UAW, SAG-AFTRA and 2,350 other groups of workers picketing, striking or protesting:

https://striketracker.ilr.cornell.edu/

But capitalism still gets a lick in. Union pension plans are some of the most important investors in private equity funds. Your union pension dollars are probably funding the union-busting, child-labor-employing, civilization-destroying Gordon Gecko LARPers who are also evicting you from the rental they bought and turned into a slum, and will then murder you in a hospice that they bought and turned into a slaughterhouse:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Writing for The American Prospect, Rachel Phua rounds up the past, present and future of union pension funds backing private equity monsters:

https://prospect.org/labor/2023-10-04-workers-funding-misery-private-equity-pension-funds/

Private equity and hedge funds have destroyed 1.3 million US jobs:

https://united4respect.org/press-release/people-who-work-at-walmart-sears-amazon-formerly-toys-r-us-more-join-forces-together-as-united-for-respect-2-2-2-2-5-3/

They buy companies and then illegally staff them with children:

https://www.dol.gov/newsroom/releases/whd/whd20230217-1

They lobby against the minimum wage:

https://pestakeholder.org/wp-content/uploads/2021/04/Insire-Brands-memo-on-15-wage.pdf

They illegally retaliate against workers seeking to unionize their jobsite:

https://www.hoteldive.com/news/dc-hotel-workers-enlist-us-representatives-to-fight-sofitel-union-busting/650396/

And they couldn't do it without union pension funds. Public service union pensions have invested $650 million with PE funds. In 2001, the share of public union pensions invested in PE was 3.5%; today, it's 13%:

https://docs.google.com/spreadsheets/d/1B0vv26VEFmwtfw5ur6dSDMY8NftvZKij/

Giant public union funds like CalPERS are planning massive increases in their contributions to PE:

https://www.calpers.ca.gov/page/newsroom/calpers-news/2023/calpers-preliminary-investment-return-fiscal-year-2022-23

This results in some ghastly and ironic situations. Aramark used funds from a custodian's union to bid against that union's members for contracts, in an attempt to break the union and force the workers to take a paycut to $11/hour:

https://www.bloomberg.com/news/articles/2012-11-20/pension-fund-gains-mean-worker-pain-as-aramark-cuts-pay

Blackstone's investors include the California State Teachers Retirement System (CalSTRS). The PE ghouls who sucked Toys R Us dry were funded by Texas teachers.

Then there's KKR, one of the most rapacious predators of the PE world. Half of the investors in KKR's Global Infrastructure Investors IV fund are public sector pension funds. Those workers' money were spent to buy up Refresco (Arizona Iced Tea, Tropicana juices, etc), a transaction that immediately precipitated a huge spike in on-the-job accidents as KKR cut safety and increased tempo:

https://www.osha.gov/ords/imis/establishment.inspection_detail?id=1675674.015

Petsmart is the poster-child for PE predation. The company uses TRAPs ("TrainingRepaymentAgreementProvision") clauses to recreate indentured servitude, forcing workers to pay thousands of dollars to quit their jobs:

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Why would a Petsmart employee want to quit? Petsmart's PE owner is BC Partners, and under BC's management, workers have been forced to work impossible hours while overseeing cruel animal abuse, including starving sick animals to death rather than euthanizing them, and then being made to sneak them into dumpsters on the way home from work so Petsmart doesn't have to pay for cremation. 24 of BC Partners' backers are public pension funds, including CalSTRS and the NYC Employees' Retirement System:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

PE buyouts are immediately followed by layoffs. One in five PE acquisitions goes bankrupt. Unions should not be investing in PE. But the managers of these funds defend the practice, saying they "facilitate dialog" with the PE bosses on workers' behalf.

This isn't total nonsense. Once upon a time, public pension fund managers put pressure on investees to force them to divest from Apartheid South Africa and tobacco companies. Even today, public pensions have successfully applied leverage to get fund managers to drop Russian investments after the invasion of Ukraine. And public pensions pulled out of the private prison sector, tanking the valuation of some of the largest players.

But there's no evidence that this leverage is being applied to pensions' PE billions. It's not like PE is a great deal for these pensions. PE funds don't reliably outperform the market, especially after PE bosses' sky-high fees are clawed back:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3623820

Pension funds could match or beat their PE returns by sticking the money in a low-load Vanguard index tracker. What's more, PE is getting worse, pioneering new scams like inflating the value of companies after they buy and strip-mine them, even though there's no reason to think anyone would buy these hollow companies at the price that the PE companies assign to them for bookkeeping purposes:

https://www.institutionalinvestor.com/article/2bstqfcskz9o72ospzlds/opinion/why-does-private-equity-get-to-play-make-believe-with-prices

To inject a little verisimilitude into this obvious fantasy, PE companies sell their portfolio companies to themselves at inflated prices, in a patently fraudulent shell-game:

https://www.ft.com/content/646d00f4-af5d-4267-a436-54fb3bc1697b

What's more, PE funds aren't just bad bosses, they're also bad landlords. PE-backed funds have scooped up an appreciable fraction of America's housing stock, transforming good rentals into slums:

https://pluralistic.net/2022/01/27/extraordinary-popular-delusions/#wall-street-slumlords

PE is really pioneering a literal cradle-to-grave immiseration strategy. First, they gouge you on your kids' birth:

https://pluralistic.net/2021/10/27/crossing-a-line/#zero-fucks-given

Then, they slash your wages and steal from your paycheck:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3465723

Then, they evict you from your home:

https://pluralistic.net/2023/06/05/vulture-capitalism/#distressed-assets

And then they murder you as part of a scam they're running on Medicare:

https://pluralistic.net/2023/08/05/any-metric-becomes-a-target/#hca

As the labor movement flexes its muscle, it needs to break this connection. Workers should not be paying for the bullet that their bosses put through their skulls.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/05/mr-gotcha/#no-ethical-consumption-under-capitalism

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#labor#pensions#finance#private equity#toys r us#Rachel Phua#kkr#bain capital#calpers#aramark#Private Equity Stakeholder Project#RefrescoArizona Iced Tea#CalSTRS#Roark Capital#child labor#blackstone#PSSI

174 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

#socialism#leftist#anticapitalism#communism#anti capitalist#anti imperialism#economy#markets#business news#finance#business#economics#anti capitalism#fuck capitalism#late stage capitalism#capitalism#capitalist system#ftx

448 notes

·

View notes

Text

You know what is hilarious? Pretty much since Covid there is silent crisis in commercial real estate. Those are offices and shops mostly.

In most metropolitan areas vacancy of those spaces is either close to 50% or already exceeded them. Despite that, prices of those spaces somehow increased and despite falling demand keep rising.

Such scenario is only possible due to the fact that people who own and menage those spaces, think that "Price-Demand" relationship should only apply to poor people and by that they mean that you should work for less when times are hard (they are one's causing hard times). Those particular landlords have no way to terrorize thier customers the way regular landlords do because thier customers are other corporations and companies.

This crisis could be solved overnight by decrease in price but this simply does not register to those people as an concept because they've been raised to belive that thier profits and assets can only go up and everyone but them should take a hit. But now economy is booming while they are left behind. Many urban areas in USA are becoming commercial deserts because no one can afford rent there.

And what is arguably even worse is that there are usually multiple regulations in place to prevent anyone from changing those office spaces into residential ones to prevent prices of housing from going down too.

If you noticed push by corporations to "bring workers back to the office", its because shareholders who are often balls deep in that commercial real estate make it happen. Hoping for increase of demand. Not realizing thier entire business model is completly outdated (and parasitic). So they keep accumulating the debt instead of lowering the prices because they will go bankrupt before they allow anything to become more affordable.

76 notes

·

View notes

Text

A little birthday gift for myself. A goal of mine for the year is to become more financially literate but how to do that when I resent the need for money? This book was recommended to me. Review incoming as soon as I finish it.

#madeline pendleton#I survived capitalism and all I got was this lousy t-shirt#book#reading#leftist#leftblr#communist#socialist#communism#socialism#anti capitalist#anti capitalism#leftist politics#finances#money#money makes the world go round#book nerd#book recs

56 notes

·

View notes

Video

Corporate takeover of the US

https://en.wikipedia.org/wiki/Lewis_F._Powell_Jr.

#tiktok#Lewis f powell#powell memo#citizen's united#us supreme court#capitalism is a scam#labor movements#labor movement#advertising#reagan was a terrible president#ronald reagan#reagan#FTC#anti-trust laws#corporate greed#corporate welfare#us political lobbying#us political financing#robert reich#us elections#workers rights#workers vs capital#union workers#price gouging#taxes#history#american history

299 notes

·

View notes

Text

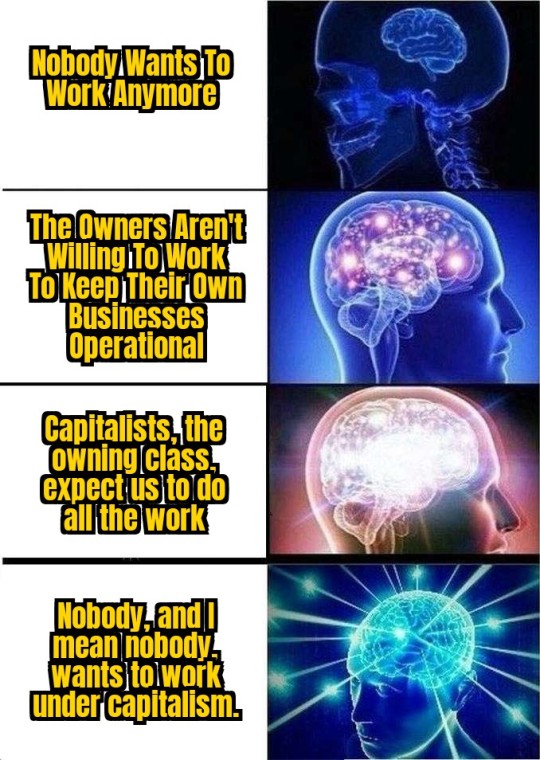

#anti capitalist#capitalism#taking the L#nobody wants to work anymore#fuck the patriarchy#fuck the man#fuck capitalism#labor rights#We Are Literally Financing A Class Of People Who Do Nothing To Better Humanity#The 1% are the real welfare queens#antiwork#punk#leftist#communism#anarchism#anarchy#eat the rich

21 notes

·

View notes

Text

#capitalism#anticapitalism#Finance#Business#Work Meme#Work Humor#Excel#Hilarious#funny meme#funny#socialism#accounting#office humor#consulting#dark humor#politics#eat the rich#wage#wages#living wage#wage gap#minimum wage

309 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

On poverty:

Starting from nothing

How To Start at Rock Bottom: Welfare Programs and the Social Safety Net

How to Save for Retirement When You Make Less Than $30,000 a Year

Ask the Bitches: “Is It Too Late to Get My Financial Shit Together?“

Understanding why people are poor

It’s More Expensive to Be Poor Than to Be Rich

Why Are Poor People Poor and Rich People Rich?

On Financial Discipline, Generational Poverty, and Marshmallows

Bitchtastic Book Review: Hand to Mouth by Linda Tirado

Is Gentrification Just Artisanal, Small-Batch Displacement of the Poor?

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Developing compassion for poor people

The Latte Factor, Poor Shaming, and Economic Compassion

Ask the Bitches: “How Do I Stop Myself from Judging Homeless People?“

The Subjectivity of Wealth, Or: Don’t Tell Me What’s Expensive

A Little Princess: Intersectional Feminist Masterpiece?

If You Can’t Afford to Tip 20%, You Can’t Afford to Dine Out

Correcting income inequality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

One Reason Women Make Less Money? They’re Afraid of Being Raped and Killed.

Raising the Minimum Wage Would Make All Our Lives Better

Are Unions Good or Bad?

On intersectional social issues:

Reproductive rights

On Pulling Weeds and Fighting Back: How (and Why) to Protect Abortion Rights

How To Get an Abortion

Blood Money: Menstrual Products for Surviving Your Period While Poor

You Don’t Have to Have Kids

Gender equality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

The Pink Tax, Or: How I Learned to Love Smelling Like “Bearglove”

Our Single Best Piece of Advice for Women (and Men) on International Women’s Day

Bitchtastic Book Review: The Feminist Financial Handbook by Brynne Conroy

Sexual Harassment: How to Identify and Fight It in the Workplace

Queer issues

Queer Finance 101: Ten Ways That Sexual and Gender Identity Affect Finances

Leaving Home before 18: A Practical Guide for Cast-Offs, Runaways, and Everybody in Between

Racial justice

The Financial Advantages of Being White

Woke at Work: How to Inject Your Values into Your Boring, Lame-Ass Job

The New Jim Crow, by Michelle Alexander: A Bitchtastic Book Review

Something Is Wrong in Personal Finance. Here’s How To Make It More Inclusive.

The Biggest Threat to Black Wealth Is White Terrorism

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

10 Rad Black Money Experts to Follow Right the Hell Now

Youth issues

What We Talk About When We Talk About Student Loans

The Ugly Truth About Unpaid Internships

Ask the Bitches: “I Just Turned 18 and My Parents Are Kicking Me Out. How Do I Brace Myself?”

Identifying and combatting abuse

When Money is the Weapon: Understanding Intimate Partner Financial Abuse

Are You Working on the Next Fyre Festival?: Identifying a Toxic Workplace

Ask the Bitches: “How Do I Say ‘No’ When a Loved One Asks for Money… Again?”

Ask the Bitches: I Was Guilted Into Caring for a Sick, Abusive Parent. Now What?

On mental health:

Understanding mental health issues

How Mental Health Affects Your Finances

Stop Recommending Therapy Like It’s a Magic Bean That’ll Grow Me a Beanstalk to Neurotypicaltown

Bitchtastic Book Review: Kurt Vonnegut’s Galapagos and Your Big Brain

Ask the Bitches: “How Do I Protect My Own Mental Health While Still Helping Others?”

Coping with mental health issues

{ MASTERPOST } Everything You Need to Know about Self-Care

My 25 Secrets to Successfully Working from Home with ADHD

Our Master List of 100% Free Mental Health Self-Care Tactics

On saving the planet:

Changing the system

Don’t Boo, Vote: If You Don’t Vote, No One Can Hear You Scream

Ethical Consumption: How to Pollute the Planet and Exploit Labor Slightly Less

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

Season 1, Episode 4: “Capitalism Is Working for Me. So How Could I Hate It?”

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

Shopping smarter

You Deserve Cheap Toilet Paper, You Beautiful Fucking Moon Goddess

You Are above Bottled Water, You Elegant Land Mermaid

Fast Fashion: Why It’s Fucking up the World and How To Avoid It

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

6 Proven Tactics for Avoiding Emotional Impulse Spending

Join the Bitches on Patreon

#poverty#economics#income inequality#wealth inequality#capitalism#working class#labor rights#workers rights#frugal#personal finance#financial literacy#consumerism#environmentalism

82 notes

·

View notes

Note

You live in the most exploitive city in the entire world, one that has a population that benefits the absolute most from american imperialism, how do you live in that environment and sleep at night?

lmao

people will see someone point out economic reality and assume that they subscribe to the same moralistic framework as them

69 notes

·

View notes

Text

What insights can we gain from characterizing the three capitalist institutions -- money, corporations, and nation-states -- as trusts?

57 notes

·

View notes