#Financial Freedom

Text

FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM FINANCIAL FREEDOM

#financial freedom#money manifestation#money making#abundantmindset#abundance#abundant#abundance mindset#777#888#level up#level up journey#blessings

3K notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

354 notes

·

View notes

Text

I've been saying this 👆 for years. The new Earth is coming. 🤔

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think about it#think for yourselves#think for yourself#do your homework#do some research#do your own research#ask yourself questions#question everything#new earth#new system#new everything#tax free#financial freedom#freedom

218 notes

·

View notes

Text

The goal is financial freedom,baby!!

503 notes

·

View notes

Note

Hey, I've recently discovered a Youtube channel, The Financial Diet, and they have some really good material. I've mostly been listening to the stuff about how domestic chores aren't evenly distributed in marriage. Whether a woman chooses to be a career woman or a housewife, she's still getting the short end of the stick and will usually bare the majority of the weight for the household. I'd recommend this video in particular, Solving The Problem Of The Adult Toddler Husband. They bring up some really good points that have sat with me since I first watched it. For example, a group of very accomplished women left the house for 2 hours and WWIII broke out at home because their husbands couldn't manage. All the women had to abandon their plans and go tend to the house. Hearing stuff like this gives me pause. I'd really like to get married and be a mother, but it just seems like a bad business move, no matter the type of man a woman marries. I'm not the sacrificial type--I want to be a mother and a wife and still maintain my own identity. Just thought I'd share this here because I live in a region where I'm not allowed to bring up these issues lest I sound like a, feminist (*gasp*).

Hi love! Yes, I think The Financial Diet channel is great. Chelsea has some great, easy-to-understand tips regarding personal finance/money management, and I love her guest contributors/podcast guest episodes. Oh, this notion highlighted in this episode is SO true IRL. A 2008 study found that husbands add 7 hours of housework a week to their wives' plates, while wives decreased a husband's household chores by 1 hour per week.

Check out Melanie Hamlett on TikTok if you want to dive further into this topic. She labels the man in this dynamic under the patriarchy as "King Baby," and it gets me every time!

The Commercialization Of Intimate Life by Arlie Russell Hochschild is a wonderful read on this topic (and the most intersectional text I've found on the subject).

Glad to share more on this topic in the future if there's interest xx

#patriarchy#emotional labor#feminist#intersectional feminism#feminism#childfree#decentering men#gender roles#gender norms#household chores#womens rights#women's empowerment#marriage equality#femmefatalevibe#female socialization#equity and inclusion#personal finance#financial freedom#women's rights

120 notes

·

View notes

Text

everything.aligns

#Happiness#health#peace#joy#adventure#romance#fitness#deep sleep#healthy foods#good company#harmony#financial freedom

19 notes

·

View notes

Text

A soft life is what I deserve and will inevitably have 😌. I pay my bills with ease and gratitude. I attract all the resources I need to be abundantly prosperous in all my endeavors. I’m surrounded by unconditional love, respect, creativity, wisdom and wealth.

Im here to take up space in the most gentle yet powerful way✨

#affirmations#soft life#soft living#me#no worries and stress anymore#financial freedom#I’m taking up space#i said what i said#🥰#💅🏾#unconditional love#luxurious lifestyle

220 notes

·

View notes

Text

I am a magnet for abundance, and it flows freely into my life.

#abundance#affirmations#affirmyourreality#daily affirmations#law of attraction#mindfulliving#prosperity#money manifestation#financial freedom

10 notes

·

View notes

Text

Time gone never returns.

#financial freedom#financial literacy#moneyquotes#personal finance#budgeting#finance#money mindset#money management#financial education#happylife#moneytips#financial independence#financial tips#financialfreedom

110 notes

·

View notes

Text

I want wealth so solid my great grandkids gone feel it.

#soft life#soft girl#soft black girls#soft black women#luxury lifestyle#wealth#financial freedom#money manifestation#money#money making#law of abundance#law of attraction#abundance mindset#abundance#black women luxury#generational wealth#luxury black women#rich black women#rich black girls#wealthy black women

1K notes

·

View notes

Note

Hi! I was wondering if you have a one-stop place to learn financial literacy you recommend?

Yep! Our grand list of all articles is a good place to start. Or you could go through our master posts:

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

{ MASTERPOST } Everything You Need to Know about Getting a Job, Raise, or Promotion

{ MASTERPOST } Everything You Need to Know about Self-Care

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

{ MASTERPOST } Everything You Need To Know About Living Independently for the First Time

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

{ MASTERPOST } Everything You Need to Know about Investing for Beginners

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

When it comes to financial literacy, you have to keep in mind that a lot of it is a trap to get you to buy something. Beware the Dave Ramsey/Suze Orman/Robert Kiyosaki industrial complex.

That's literally why we do what we do: we don't think people should have to pay a ton of money to eek out a tiny bit of understanding of the rules of our patriarchal capitalist hellscape. That's why BGR runs primarily on donations. We could make a lot more money if we charged fat bucks for our information or kept upselling folks to our next ~*~wealth-building seminar~*~.

Instead, we humbly ask that if we've helped you out, you tip us here on Tumblr, join our Patreon, or throw a few dollars our way on PayPal.

138 notes

·

View notes

Text

#pay attention#educate yourselves#educate yourself#reeducate yourself#knowledge is power#reeducate yourselves#think for yourselves#think about it#think for yourself#do your homework#do your own research#do some research#astrology#question everything#wisdom#fight for freedom#financial freedom#freedom#united we stand

75 notes

·

View notes

Text

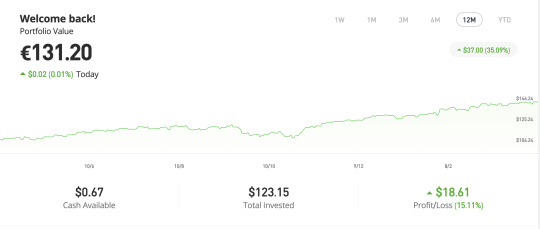

the beginner's guide to making money by investing in stocks (hot girl version)

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

7 notes

·

View notes

Text

“Some women choose to follow men, and some women choose to follow their dreams. If you're wondering which way to go, remember that your career will never wake up and tell you that it doesn't love you anymore.” - unknown

Credit: @studyforherdreams

#study#study with me#study motivation#studyspo#studying#studyblr#study aesthetic#study blog#student#women empowering woman#dreams#financial freedom#academia aesthetic#academia quotes#academia

17 notes

·

View notes