#tax avoidance

Text

Microsoft put their tax-evasion in writing and now they owe $29 billion

I'm coming to Minneapolis! Oct 15: Presenting The Internet Con at Moon Palace Books. Oct 16: Keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing.

If there's one thing I took away from Propublica's explosive IRS Files, it's that "tax avoidance" (which is legal) isn't a separate phenomenon from "tax evasion" (which is not), but rather a thinly veiled euphemism for it:

https://www.propublica.org/series/the-secret-irs-files

That realization sits behind my series of noir novels about the two-fisted forensic accountant Martin Hench, which started with last April's Red Team Blues and continues with The Bezzle, this coming February:

https://us.macmillan.com/books/9781250865847/red-team-blues

A typical noir hero is an unlicensed cop, who goes places the cops can't go and asks questions the cops can't ask. The noir part comes in at the end, when the hero is forced to admit that he's being going places the cops didn't want to go and asking questions the cops didn't want to ask. Marty Hench is a noir hero, but he's not an unlicensed cop, he's an unlicensed IRS inspector, and like other noir heroes, his capers are forever resulting in his realization that the questions and places the IRS won't investigate are down to their choice not to investigate, not an inability to investigate.

The IRS Files are a testimony to this proposition: that Leona Hemsley wasn't wrong when she said, "Taxes are for the little people." Helmsley's crime wasn't believing that proposition – it was stating it aloud, repeatedly, to the press. The tax-avoidance strategies revealed in the IRS Files are obviously tax evasion, and the IRS simply let it slide, focusing their auditing firepower on working people who couldn't afford to defend themselves, looking for things like minor compliance errors committed by people receiving public benefits.

Or at least, that's how it used to be. But the Biden administration poured billions into the IRS, greenlighting 30,000 new employees whose mission would be to investigate the kinds of 0.1%ers and giant multinational corporations who'd Helmsleyed their way into tax-free fortunes. The fact that these elite monsters paid no tax was hardly a secret, and the impunity with which they functioned was a constant, corrosive force that delegitimized American society as a place where the rules only applied to everyday people and not the rich and powerful who preyed on them.

The poster-child for the IRS's new anti-impunity campaign is Microsoft, who, decades ago, "sold its IP to to an 85-person factory it owned in a small Puerto Rican city," brokered a deal with the corporate friendly Puerto Rican government to pay almost no taxes, and channeled all its profits through the tiny facility:

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

That was in 2005. Now, the IRS has come after Microsoft for all the taxes it evaded through the gambit, demanding that the company pay it $29 billion. What's more, the courts are taking the IRS's side in this case, consistently ruling against Microsoft as it seeks to keep its ill-gotten billions:

https://www.propublica.org/article/irs-microsoft-audit-back-taxes-puerto-rico-billions

Now, no one expects that Microsoft is going to write a check to the IRS tomorrow. The company's made it clear that they intend to tie this up in the courts for a decade if they can, claiming, for example, that Trump's amnesty for corporate tax-cheats means the company doesn't have to give up a dime.

This gambit has worked for Microsoft before. After seven years in antitrust hell in the 1990s, the company was eventually convicted of violating the Sherman Act, America's bedrock competition law. But they kept the case in court until 2001, running out the clock until GW Bush was elected and let them go free. Bush had a very selective version of being "tough on crime."

But for all that Microsoft escaped being broken up, the seven years of depositions, investigations, subpoenas and negative publicity took a toll on the company. Bill Gates was personally humiliated when he became the star of the first viral video, as grainy VHS tapes of his disastrous and belligerent deposition spread far and wide:

https://pluralistic.net/2020/09/12/whats-a-murder/#miros-tilde-1

If you really want to know who Bill Gates is beneath that sweater-vested savior persona, check out the antitrust deposition – it's still a banger, 25 years on:

https://arstechnica.com/tech-policy/2020/09/revisiting-the-spectacular-failure-that-was-the-bill-gates-deposition/

In cases like these, the process is the punishment: Microsoft's dirty laundry was aired far and wide, its swaggering founder was brought low, and the company's conduct changed for years afterwards. Gates once told Kara Swisher that Microsoft missed its chance to buy Android because they were "distracted by the antitrust trial." But the Android acquisition came four years after the antitrust case ended. What Gates meant was that four years after he wriggled off the DoJ's hook, he was still so wounded and gunshy that he lacked the nerve to risk the regulatory scrutiny that such an anticompetitive merger would entail.

What's more, other companies got the message too. Large companies watched what happened to Microsoft and traded their reckless disregard for antitrust law for a timid respect. The effect eventually wore off, but the Microsoft antitrust case created a brief window where real competition was possible without the constant threat of being crushed by lawless monopolists. Sometimes you have to execute an admiral to encourage the others.

A decade in IRS hell will be even more painful for Microsoft than the antitrust years were. For one thing, the Puerto Rico scam was mainly a product of ex-CEO Steve Ballmer, a man possessed of so little executive function that it's a supreme irony that he was ever a corporate executive. Ballmer is a refreshingly plain-spoken corporate criminal who is so florid in his blatant admissions of guilt and shouted torrents of self-incriminating abuse that the exhibits in the Microsoft-IRS cases to come are sure to be viral sensations beyond even the Gates deposition's high-water mark.

It's not just Ballmer, either. In theory, corporate crime should be hard to prosecute because it's so hard to prove criminal intent. But tech executives can't help telling on themselves, and are very prone indeed to putting all their nefarious plans in writing (think of the FTC conspirators who hung out in a group-chat called "Wirefraud"):

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Ballmer's colleagues at Microsoft were far from circumspect on the illegitimacy of the Puerto Rico gambit. One Microsoft executive gloated – in writing – that it was a "pure tax play." That is, it was untainted by any legitimate corporate purpose other than to create a nonsensical gambit that effectively relocated Microsoft's corporate headquarters to a tiny CD-pressing plant in the Caribbean.

But if other Microsoft execs were calling this a "pure tax play," one can only imagine what Ballmer called it. Ballmer, after all, is a serial tax-cheat, the star of multiple editions of the IRS Files. For example, there's the wheeze whereby he has turned his NBA team into a bottomless sinkhole for the taxes on his vast fortune:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Or his "tax-loss harvesting" – a ploy whereby rich people do a "wash trade," buying and selling the same asset at the same time, not so much circumventing the IRS rules against this as violating those rules while expecting the IRS to turn a blind eye:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

Ballmer needs all those scams. After all, he was one of the pandemic's most successful profiteers. He was one of eight billionaires who added at least a billion more to his net worth during lockdown:

https://inequality.org/great-divide/billionaire-bonanza-2020/

Like all forms of rot, corruption spreads. Microsoft turned Washington State into a corporate tax-haven and starved the state of funds, paving the way for other tax-cheats like Amazon to establish themselves in the area. But the same anti-corruption movement that revitalized the IRS has also taken root in Washington, where reformers instituted a new capital gains tax aimed at the ultra-wealthy that has funded a renaissance in infrastructure and social spending:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

If the IRS does manage to drag Microsoft through the courts for the next decade, it's going to do more than air the company's dirty laundry. It'll expose more of Ballmer's habitual sleaze, and the ways that Microsoft dragged a whole state into a pit of austerity. And even more importantly, it'll expose the Puertopia conspiracy, a neocolonial project that transformed Puerto Rico into an onshore-offshore tax-haven that saw the island strip-mined and then placed under corporate management:

https://pluralistic.net/2022/07/27/boricua/#que-viva-albizu

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/13/pour-encoragez-les-autres/#micros-tilde-one

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#irs#puerto rico#puertopia#microsoft#micros~1#tax avoidance#tax evasion#pure tax play#big tech can't stop telling on itself#corporate crime#rough ride#the procedure is the punishment#steve ballmer#pour encouragez les autres

889 notes

·

View notes

Text

#anti capitalism#eat the rich#capitalism#anticapitalism#anti billionaires#billionaires should not exist#tax the rich#tax avoidance#wealth hoarding#wealth gap#wealth inequality#income inequality

94 notes

·

View notes

Text

🗣The United States Supreme Court is a corrupt, depraved, illegitimate institution

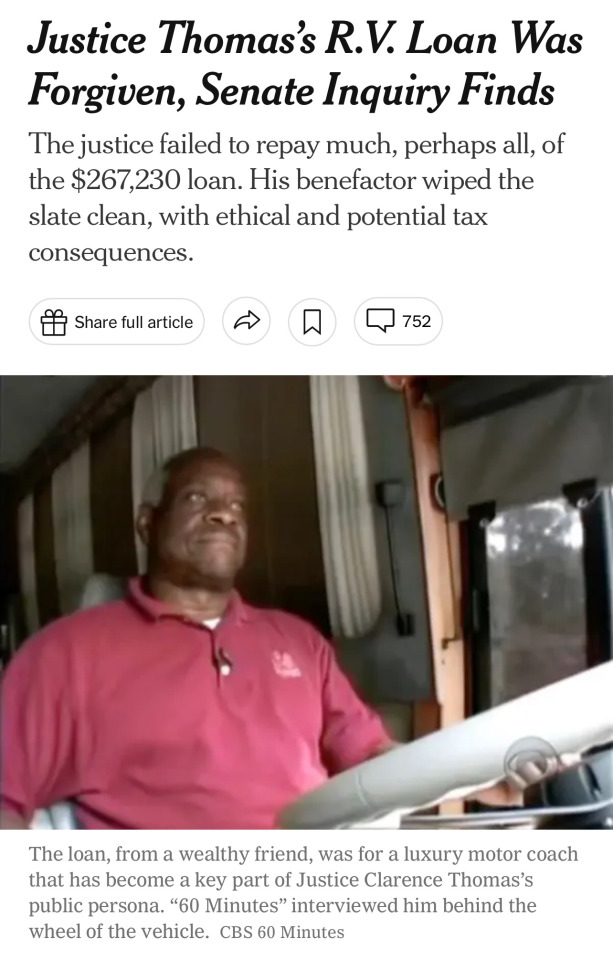

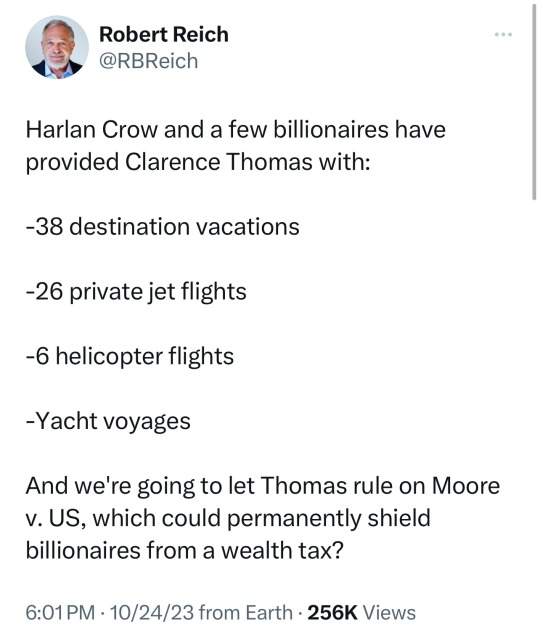

This coming term, the Supreme Court will hear United States v. Moore, a case that could determine the constitutionality of a hypothetical wealth tax. Given his years of palling around with billionaire benefactors, one thing seems quite clear: Justice Clarence Thomas needs to recuse himself from the case. Commentators who downplay Thomas’ acceptance of massive gifts ask: Maybe it looks bad, but why does it matter? Moore tells us loud and clear.

Moore involves a provision of the 2018 Trump tax bill enacting a “mandatory repatriation tax” for any U.S. taxpayer who owns shares in a foreign corporation, even if the taxpayer never cashed out the money, but automatically reinvested it. Behind this seemingly abstruse issue is a crucial constitutional question: Does the 16th Amendment, which enables the federal government to tax “income,” allow the government to put levies on taxpayers’ assets if they didn’t actually get the money in cash?

In other words, can the federal government place a tax on wealth? This has real implications for both the budget and inequality. Indeed, most ultra-high-wealth individuals possess their assets: They make investments, and hold them. When they die, their heirs’ tax is figured not on the amount of profit earned off of the original cost, but the amount of profit earned off of its value at the time of the original purchaser’s death.

Thus, hundreds of billions of dollars go untaxed—which is just the way multibillionaires like it.

(continue reading) → (more)

#politics#scotus#clarence thomas#harlan crow#wealth tax#taxes#inequality#tax avoidance#united states v. moore#tax dodgers#inheritance tax#legalized bribery#bribery

62 notes

·

View notes

Text

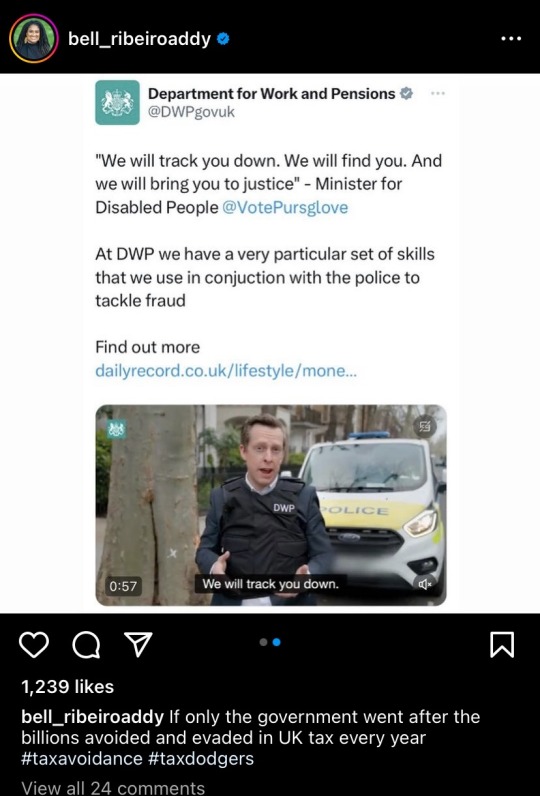

Shut down tax avoidance so we can save our NHS and public services

12 notes

·

View notes

Text

#guilty feminist#the guilty feminist#feminism#feminist#women’s rights#human rights#instagram#woman’s rights#uk politics#uk news#fuck the tories#tax dodgers#tax inequality#tax avoidance#two tier system#rich vs poor#apr 2023

34 notes

·

View notes

Text

“When the rich rob the poor it is called business” Mark Twain

As if we didn’t know already, the very wealthy expect the rest of us to literally work ourselves into an early grave so they can become richer still. Millionaire Rishi Sunak’s father-in-law, billionaire NR Narayana Murthy is a case in point:

“We need to be disciplined and improve our work productivity. I think unless we do that, what can poor government do? And every government is as good as the culture of the people. And our culture has to change to that of highly determined, extremely disciplined and extremely hard-working people.”

Poor government indeed! Crumbling national infrastructure and collapsing public survives are the fault of lazy working families. If only we would get up off our backsides and put in the 70 hour week Mr Murthy suggests then all would be well.

The arrogance of the super-rich knows no bounds. Working people are already putting in more hours than ever before. People Management had this headline at the beginning of the year:

“More than four million UK workers considering a second job to combat cost of living, survey finds." (09/01/23)

Even during the pandemic, when you would have expected people to be working less hours, that wasn’t necessarily the case. Forbes, the American financial and business magazine had this to say:

“We Worked Longer Hours During The Pandemic—Research Says We Need To Work Smarter, Not Harder… The extra hours worked during the pandemic would be less of a concern if they were just a temporary phenomenon, a blip on the screen. However, overwork is a longstanding problem." (Forbes:18/08/21)

The move to working from home since the pandemic has also led to an increase in hours and workload.

“Employees who work from home are spending longer at their desks and facing a bigger workload than before the Covid pandemic hit." (Guardian: 04.02/21)

And we have this from the BBC:

“Overwork culture is thriving; we think of long hours and constant exhaustion as a marker of success….New studies show that workers around the world are putting in an average of 9.2 hours of unpaid overtime per week – up from 7.3 hours just a year ago.” (BBC:Worklife: 10/04/21)

More recently we had this headline:

“In the current economic climate, Gen Zers are pulling especially long hours – and pushing themselves to the brink of burnout…18-24 (year olds) tend to put in an extra eight hours and 30 minutes of ‘free’ work per week by starting early, staying late or working during breaks and lunchtimes.” (BBC: Worklife: 29/05/23)

So Mr Murthy, people are not sitting on their backsides. They are working harder than ever, often for “free”. What’s more, many have two jobs because you and your rich friends refuse to give them a living wage, because you are more interested in accruing even more billions than you are in seeing working families being paid a living wage.

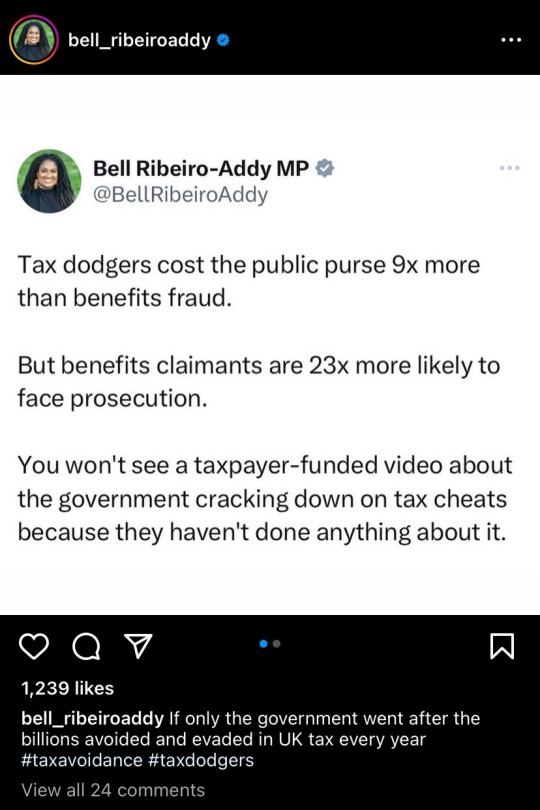

Rather than lazy workers, it is the greed of the rich and super-rich that has led to the collapse of public services and infrastructure. The system is rigged in their favour, designed for them to escape paying their fair share of taxes. As I quoted in my last blog, “Tax evasion, and, more broadly, tax avoidance, is not inevitable; it is the result of policy choices” and while we have people like Mr Murthy’s son-in-law in charge of government, nothing will ever change.

#uk politics#rishi sunak#Narayana Murthy#super rich#living wage#blame game#overwork#billionaires#tax avoidance#tax evasion#working families

11 notes

·

View notes

Text

#farrukh#political twitter#rishi sunak#nahim zahawi#jeremy hunt#conservative party#uk news#uk politics#uk economy#hmrc#tax avoidance#tax evasion

42 notes

·

View notes

Text

#Ppe scandal#uk#politics#tory#conservative party#Michelle mone#ukpol#coronavirus#medpro#corruption#tax avoidance

15 notes

·

View notes

Text

See, what a lot of people dont realise is that we do not need to increase tax for the rich (yet). Their tax rates are quite high. The problem, however is that rich people DONT FUCKING PAY.

before saying "tax the rich more" the first step is to close up tax loopholes so that rich people cannot avoid tax, otherwise no matter how high their taxes, they will not even be paying it.

3 notes

·

View notes

Text

16 notes

·

View notes

Text

Apple Launches New, Beautifully-Designed Tax Avoidance Program

#apple music#apple news#apple#tax avoidance#taxes#income tax#tax#apple watch#apple wallet#apple white#apple event#apple emoji#apple ecosystem#apple repair#apple recipe#apple records#apple tv#apple tree#apple tart#apple tablet#apple turnovers#apple unveils iphone 15 series – complete with usb c charging port#apple inc#apple ipad#apple iphone#apple ios#apple ii#apple of my eye#apple orchard#apple original films

2 notes

·

View notes

Link

A record share of the nation’s wealth is in the hands of billionaires, who pay a lower tax rate than the average American. This is indefensible

#TAX THE RICH#inequality#tax avoidance#tax evasion#taxation#poverty#EAT THE RICH#but marinate well#and keep antacid handy

18 notes

·

View notes

Link

[Marlena Sonn, a former Getty wealth advisor] had started out in wealth management determined to help people find “tax-efficient” ways of clearing their conscience but had come to see an ethical flaw in that ambition. “The financial-services industry lives between the letter of the law and the spirit of the law,” she said. “That’s what tax efficiency is.”

Sarah Getty insisted that the sisters had acted in accordance with their family’s values. “Everything we were trying to do was lawful,” she said. “I’m not against paying taxes at all, because I think they’re very important, especially if they go in the right things. I would want the right government to be in control, though, because, if the wrong government is in control, then they go to all the stuff I don’t support. I’m very against military and guns and weapons, and very pro-planet.”

Massive wealth truly warps one’s perspective, even for people who see themselves as progressives. In the real world, some tax money will be spent on things you don’t like, and wishing for “the right government” is an anti-democratic sentiment.

#Getty#Getty family#wealth#inequality#wealth management#tax avoidance#inheritances#Marlena Sonn#taxes

7 notes

·

View notes

Text

View on Twitter

From 2005 to 2018, Taylor paid ZERO federal income tax on her $444 million gained, with a distinct possibility that she would never have to pay income taxes again. All thanks to loopholes and a massive oil spill that her company caused.

(Source)

#tax avoidance#fossil fuels#Late Stage Capitalism#billionaire#Climate Change#Climate Crisis#oil spill#My Tweets

6 notes

·

View notes

Text

“Leadership is a privilege to better the lives of others. It is not an opportunity to satisfy personal greed.” ~ Mwai Kibaki

Cash for honours? Who knows, but when you have donated £5 million to the Tory Party and are then knighted by Rishi Sunak for “ business, charity and political service” a few eye brows are bound to be raised.

I am not sure what political service the Egyptian billionaire Mohamed Mansour has performed for Britain other than being a senior treasurer for the Conservative Party and donating £5 million pounds to their coffers in 2023. What we do know is that his time in Egyptian politics was rife with controversy.

In 2005 he was appointed Transport Manager under the Mubarak dictatorship. Mubarak was swept from power in 2011 after the Egyptian people had finally had enough of his dictatorial, undemocratic rule. During this time:

“Mansour was known to be part of the team of Mubarak’s son, Gamal. The general public quickly came to think of this collection of businessmen as being in government to serve their own corporate empires..." (Middle East Eye: 16/12/22)

In October 2009, after two passenger trains collided causing the death of 50 people, Mansour was sacked from his post as Mubarak’s Transport Minister. Returning to his business empire, he was again embroiled in political scandal when he was accused of:

“…partnering up with his cousin, Ahmed al-Maghrabi, who had served as housing minister under Mubarak, to buy thousands of square kilometres of land to construct a residential compound for a fraction of its market price.” ((Middle East Eye: 16/12/22)

Another political controversy involved sanction busting. In 2022 it came to light that Mansour’s Caterpillar dealership, Unatrac, was supplying machinery to Russia's oil and gas industry despite the international sanctions impose on Russia following Putin's invasion of Ukraine.

As for receiving a knighthood for his charity work, it seems he maybe less concerned with charity than in avoiding business taxes. Not only was Mansour’s company Unatrac trading with Russia despite international sanctions, it was also subject to HMRC investigations into tax avoidance.

“The firm co-owned by billionaire Tory treasurer Mohamed Mansour paid £3.2million in additional tax following an HMRC probe into the potential use of tax havens, it has emerged." (Sunday Mirror: 05/02/23)

Correct me if I am wrong, but surely if ALL taxes that are due were paid in full, then there would be less need for charity?

Billionaire Mansour, it would seem, is more interested in business, especially his own, than in politics or public service. The fact that the Tory Party are now prepared to accept money from donors who advocate the shooting of black MP's and from donors associated with dictators and tax avoidance says it all.

#uk politics#rishi sunak#mohamed mansour#tax avoidance#dictators#mubarak#scandal#hmrc#cash for honours#putin#sanction busting

4 notes

·

View notes