#wealth management

Text

#the vatican bank#savings#offshore banking#investing#emergency fund#wealth management#assets#the 1%#tax haven#elite#tax shelter#private banking

24 notes

·

View notes

Text

#money#old money#y2k#cyber y2k#y2kcore#y2k moodboard#y2k aesthetic#positive thoughts#positive quotes#positivity#wealth management#girly stuff#girlcore#girl blogger#girly#dream girl tips#girlblogging#motivation#motivación

8 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

28 notes

·

View notes

Text

Prioritize ruthlessly: Don't try to do everything at once. Identify the 2-3 most important tasks for the day and focus on those first

follow me

4 notes

·

View notes

Note

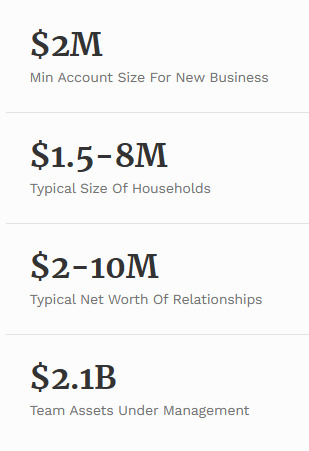

Here's a fun fact The Swift Group ranked no. 23 in Forbes' America's Top Wealth Management Teams: High Net Worth in 2022. www.forbes.com/lists/top-wealth-management-teams-high-net-worth/?sh=21ff420323e1

That's rather impressive indeed. $2 million minimum investment made my eyes water! There's a lot of Merrill Lynch teams in that list!

16 notes

·

View notes

Text

#real estate investment#real estate guide#investment guide#property investment#investing#money earning#wealth management

3 notes

·

View notes

Text

Sam Sutterfield - An Avid Traveler

Sam Sutterfield has poured his experience and exceptional talent into Elevate Wealth Management, a financial advisory firm committed to supporting clients in creating the best future planning solutions.

2 notes

·

View notes

Text

How Doctors Enhance Their Medical Practices with Specialized Services

Financial Planning: Collaborating with medical accountants allows doctors to craft customized financial strategies aligned with their practice's growth objectives, ensuring long-term financial stability. https://www.apsense.com/article/beyond-the-stethoscope-how-doctors-enhance-their-medical-practices-with-specialized-services.html

2 notes

·

View notes

Text

How To Do Financial Planning

Introduction

Financial Planning is important for everyone, regardless of income or age. It can help you make smart decisions with your money, reach your financial goals, and make the most of your income.

There are a few key steps to financial planning: determine your financial goals, analyze your current finances, create a budget, invest your money, and review your progress. By taking these steps and sticking to your plan, you can improve your financial health and secure a bright future.

The Importance of Financial Planning.

Why You Should Plan Your Finances

Advice Only Financial planning is important because it allows you to take control of your finances and set yourself up for success in the future. By creating a budget and investing your money wisely, you can make sure that you are prepared for whatever life throws your way.

There are many benefits to financial planning, including:

• Giving you peace of mind: If you know that your finances are in order, you can relax and enjoy your life without worrying about money.

• Helping you reach your goals: A good financial plan will help you save up for things like a down payment on a house or retirement.

• Making sure you are prepared for emergencies: If you have an emergency fund, you will be less likely to go into debt if something unexpected comes up.

• Saving you money in the long run: By planning ahead, you can avoid costly mistakes like overspending or taking on too much debt.

How Financial Planning Can Benefit You

Financial planning can benefit everyone, regardless of their income or net worth. Whether you are just starting out in your career or nearing retirement, there are many ways that financial planning can help improve your life.

Some of the benefits of financial planning include:

No matter what your financial situation is, there are many benefits to be gained from creating a financial plan.

Steps to Financial Planning.

Determine Your Financial Goals

The first step to Advice Only financial planning is to determine your financial goals. What do you want to achieve financially? Do you want to save for retirement, purchase a home, or pay off debt? Once you know your goals, you can begin to develop a plan to reach them.

Analyze Your Current Finances

The next step is to analyze your current finances. This will give you a good starting point for developing your financial plan. You will need to know how much income you have, what your expenses are, and what debts you owe. This information will help you create a budget and make informed decisions about investing your money.

Create a Budget

Once you have analyzed your current finances, you can begin to create a budget. A budget is a tool that can help you track your spending and make sure that your money is being used in ways that align with your financial goals. Creating a budget may seem like a daunting task, but there are many resources available to help you get started.

Invest Your Money

One of the most important aspects of financial planning is investing your money wisely. There are many different ways to invest money, and it is important to choose an investment strategy that fits your goals and risk tolerance. Some common investment options include stocks, bonds, mutual funds, and real estate.

Review Your Progress

It is important to periodically review your progress towards meeting your financial goals . This will allow you to make adjustments to your budget or investment strategy as needed . Reviewing your progress also allows you to celebrate successes and keep motivated towards reaching your goals .

Conclusion

Financial planning is important for everyone, regardless of their income level. By taking the time to understand your finances and set goals, you can make smart decisions with your money that will lead to a brighter future. Follow the steps outlined in this blog post and you'll be on your way to financial success.

#financial planning#retirement planning#financial advice#financial submission#financialadvisor#financial freedom#financial technology#personal finance#wealth management#personal savings#personal loans#business#financial market news#make money fast#income#loans#personalfinance#savings#earn money online

15 notes

·

View notes

Link

[Marlena Sonn, a former Getty wealth advisor] had started out in wealth management determined to help people find “tax-efficient” ways of clearing their conscience but had come to see an ethical flaw in that ambition. “The financial-services industry lives between the letter of the law and the spirit of the law,” she said. “That’s what tax efficiency is.”

Sarah Getty insisted that the sisters had acted in accordance with their family’s values. “Everything we were trying to do was lawful,” she said. “I’m not against paying taxes at all, because I think they’re very important, especially if they go in the right things. I would want the right government to be in control, though, because, if the wrong government is in control, then they go to all the stuff I don’t support. I’m very against military and guns and weapons, and very pro-planet.”

Massive wealth truly warps one’s perspective, even for people who see themselves as progressives. In the real world, some tax money will be spent on things you don’t like, and wishing for “the right government” is an anti-democratic sentiment.

#Getty#Getty family#wealth#inequality#wealth management#tax avoidance#inheritances#Marlena Sonn#taxes

7 notes

·

View notes

Text

Financial Econometrics

By. Jacinda T. Thomas, Masters of Science in Wealth Management { An American in Switzerland }

#jacindathomas #wealthmanagement

Financial econometrics appears to be the measuring of the financial economy.

But let's look and see what others have to say about the topic...

First let's start with econometrics.

youtube

Now Financial Econometrics

So financial econometrics is the application of statistical methods to financial market data. Within financial economics we study capital markets, financial institutions, corporate finance, and corporate governance. Topics often revolve around asset valuation of individual stocks, bonds, derivatives, currencies and other financial instruments.

We focus on analyzing the price of financial assets traded at competitive liquid markets.

It's a tool to analyze time and money.

2 notes

·

View notes

Text

How to Work Less to Achieve More

Key Point:

keep your attention on an important task by adopting hyperfocus. When you hyperfocus, you rid your environment of distractions, and become aware of what’s occupying your mind. What’s more, every time your attention strays, redirect it. Remember is that scatterfocus can help you with tricky problems that require creative solutions. With scatterfocus, you allow the mind to wander and make unusual connections. You can help create scatterfocus by nourishing your mind and allowing time to reflect.

In our fast-paced world, working long hours has become the norm. However, the key to achieving more is not simply working harder or longer—it's about working smarter. In this article, we will explore strategies to help you work less while accomplishing more. By training yourself to enjoy hyperfocus, cultivating meta-awareness and intentional focus, eliminating distractions, harnessing the power of scatterfocus for creative thinking, connecting seemingly unrelated information, and nourishing your mind, you can optimize your productivity and achieve greater success.

Train yourself to enjoy hyperfocus more.

Hyperfocus is a state of intense concentration where you become fully immersed in a task or activity. To work less and achieve more, it's important to train yourself to enjoy and leverage hyperfocus. Set clear goals, break tasks into manageable chunks, and eliminate distractions. Engage in activities that naturally captivate your attention and give you a sense of fulfillment. By training yourself to enjoy hyperfocus, you can maximize productivity and accomplish more in less time.

Meta-awareness and intentional focus are key to managing your attention.

Meta-awareness refers to being aware of your own thoughts and mental processes. Intentional focus involves directing your attention consciously and purposefully. Cultivating these skills is essential for effective attention management. Develop the ability to notice when your mind starts to wander and gently bring your focus back to the task at hand. By practicing meta-awareness and intentional focus, you can reduce time wasted on distractions and stay on track to achieve your goals.

Achieve hyperfocus by ridding your environment of distractions.

Distractions can significantly impact productivity and hinder your ability to work efficiently. Create a conducive work environment by minimizing distractions. Turn off notifications on your phone, close unnecessary browser tabs, and create a physical workspace that promotes focus. Consider using productivity tools or apps that block or limit access to distracting websites or applications. By eliminating external distractions, you can enter a state of hyperfocus and accomplish more in less time.

Scatterfocus helps you plan and think creatively.

Scatterfocus is the practice of intentionally allowing your mind to wander and explore different ideas, without a specific goal or objective. This mental state can be beneficial for planning and creative thinking. Set aside dedicated time for scatterfocus, allowing your mind to freely explore different thoughts and possibilities. Embrace daydreaming, engage in activities that stimulate your imagination, and give yourself permission to think outside the box. By incorporating scatterfocus into your work routine, you can generate fresh ideas and enhance your problem-solving skills.

Use scatterfocus to connect the dots between seemingly unrelated bits of information.

One of the unique benefits of scatterfocus is its ability to facilitate connections between seemingly unrelated information. During moments of scatterfocus, your mind can make unexpected connections and insights. Capture these ideas by carrying a notebook or using a note-taking app to jot down your thoughts. When you revisit these notes later, you may discover valuable connections and insights that can fuel your productivity and lead to innovative solutions.

Nourish your mind to make the most of scatterfocus.

To optimize scatterfocus and enhance your overall productivity, it's important to nourish your mind. Engage in activities that promote mental well-being, such as regular exercise, quality sleep, and mindfulness practices. Take breaks throughout the day to recharge and refresh your mind. Additionally, fuel your brain with nutritious foods that support cognitive function, such as fruits, vegetables, whole grains, and omega-3 fatty acids. By prioritizing self-care and nourishing your mind, you can maximize the benefits of scatterfocus and achieve more with less effort.

Working less while achieving more is within your reach. By training yourself to enjoy hyperfocus, cultivating meta-awareness and intentional focus, eliminating distractions, harnessing the power of scatterfocus for creative thinking, connecting seemingly unrelated information, and nourishing your mind, you can optimize your productivity and achieve greater success. Remember, it's not about working longer hours, but about working smarter. Embrace these strategies, experiment with different techniques, and find the balance that works best for you. As you implement these practices, you'll discover the power of effective attention management and witness your productivity soar.

Action Plan: Have a cup of coffee to help you hyperfocus.

Caffeine and hyperfocus are a match made in heaven. Caffeine keeps you alert and focused. It helps you persevere when work gets boring. And perhaps most importantly, it can improve your performance on a number of cognitive tasks. So the next time you need a burst of intense concentration, make sure you’ve got a cup of coffee to hand – if nothing else, it tastes wonderful.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

12 notes

·

View notes

Text

Building a Solid Financial Foundation: Budgeting, Saving, and Emergency Funds

The importance of budgeting for financial stability

Creating and sticking to a personal budget is essential for achieving financial stability. A budget helps individuals track their income and expenses, identify areas for saving and cutting costs, and ultimately achieve their financial goals [1]. By creating a budget, individuals can gain a better understanding of their financial situation and…

View On WordPress

#Budgeting#Debt Reduction#Emergency Funds#Financial Education#Financial Goals#Financial Independence#Financial Literacy#Financial Planning#Financial Stability#Frugal Living#Investment Strategies#Money Management#Money Mindset#Personal Finance#Retirement Planning#Saving Money#Smart Spending#Wealth Building#Wealth Management

5 notes

·

View notes

Video

youtube

How To Buy Gold And Silver, Share and Earn! Special Easter Weekend Event

Now more than ever it is important to protect and build your wealth. Special presentation shares how to save, share and earn with silver and gold -Defying the myth you have to be rich in order to save in silver and gold

Special offer to find out more

#gold#silver#wealth protection#wealth management#precious metals#how to buy gold#how to buy silver#gold online#silver online#silverandgoldsolutions#economic uncertainty

3 notes

·

View notes

Text

“Investments for a secured life.”

Money is a tool that can help you to achieve your goals. It can provide comfort and stability for your family, make it easier to plan for the future, and allow you to save for important milestones.

Making your money work for you means taking control of your finances, then using that control to continuously improve your financial stability and security.

You may eventually be able to gain financial independence or build wealth through investing. But neither of those things can happen without first understanding where your money is going and learning better ways to use it.

#wealth management#businessstrategy#money#vaidikecosystems#vikassingh#businesscoach#financial advisor#financial planning#investing

13 notes

·

View notes

Text

Best Wealth Management Company in Gujarat - Concept Investwell

Concept Investwell is a boutique Investment Services Company. We are offering our services for fund management and advisory. Established in 1995, the Concept Investwell group has a successful track record of 27 years.

We are one of the leading players in the financial services industry. We offer value-added services of investment in the Indian Capital Market. We have our PMS CONCEPT WEALTH PLUS with 3 plans Legend, Marvel, and AI Dynamic, mutual funds.

We also leverage rich investment management and financial product distribution.

For more information, visit our website: Concept Investwell Private Limited - Creation of Wealth

#wealth planner#wealth advisor#wealth management#wealth management company#asset management company in surat#PMS Services in Gujarat#portfolio advisor#equity portfolio management services in surat#Mutual funds advisor#mutual fund distributor

3 notes

·

View notes