#wealth gap

Text

let that sink in....

#capitalist hell#systemic inequality#billionaires#wealth gap#wealth inequality#eat the rich#capitalist system#capitalism#anti capitalism#banksters#class divide#class system#awareness#class awareness#change the system

17K notes

·

View notes

Text

Canada is in deep crisis. It’s unfashionable in centrist circles to say so, but it’s true. The country is literally on fire and facing extraordinary and growing threats from climate change. It is staring down rising extremism, creeping toxic polarization, and low trust. Wealth inequality is on the rise. Its federal system is showing cracks, particularly when it comes to the relationship between Alberta and the national government. Oligopolies and monopolies run wild, exploiting consumers.

There are plenty of other problems too. But of the lot, the confluence of a few major challenges scream, House of cards coming down! Those are the country’s housing crisis, consumer debt, and high — and potentially rising — interest rates. Taken together, they paint a picture of working people staring down lives they can’t afford in the day-to-day. This hellish scenario persists, no matter how hard people work, and no matter how rigidly they follow the rules of the game — rules they were told are fair and just.

Full article

Tagging: @politicsofcanada

#cdnpoli#canada#canadian politics#canadian news#canadian#climate change#climate crisis#wealth inequality#wealth gap#income inequality#right wing extremism#housing crisis

1K notes

·

View notes

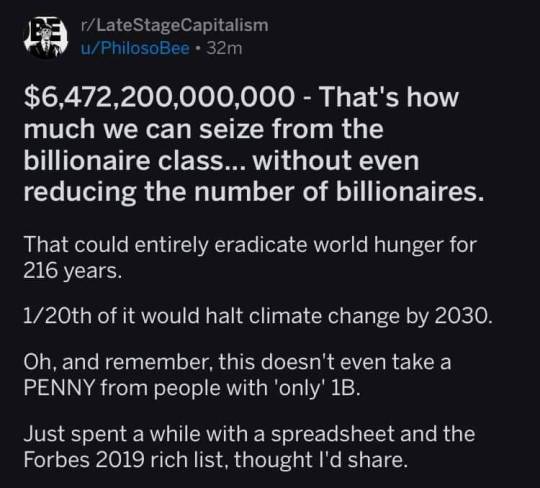

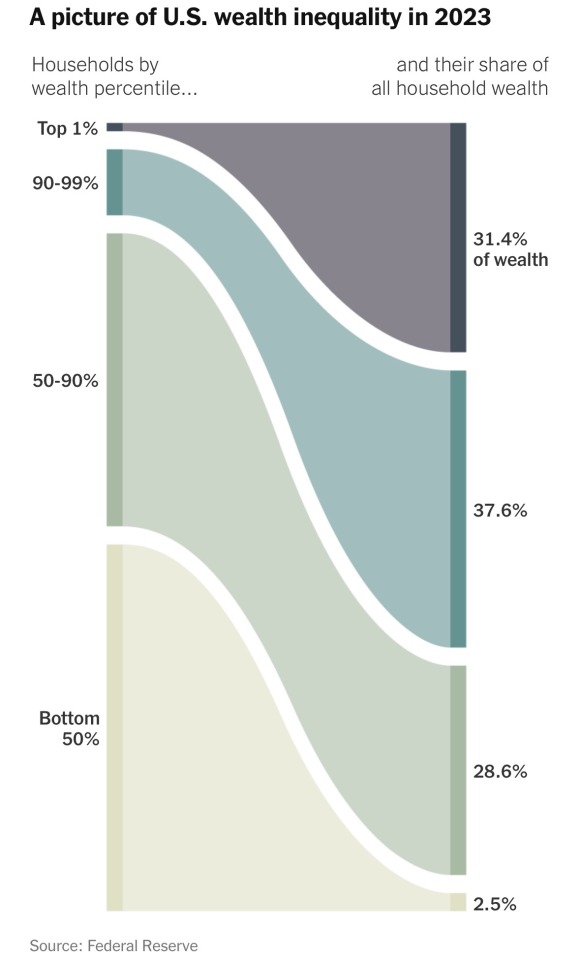

Text

Source

Top 1% of Americans own 31% of US wealth

Bottom 50% of Americans own just 2.5%

Only 19% of Americans feel better off financially compared to a year ago

35% feel worse off compared to last year

#wealth inequality#economics#politics#us politics#government#Joe Biden#economy#news#current events#the left#socioeconomic inequality#eat the rich#wealth gap

519 notes

·

View notes

Text

#anti capitalism#eat the rich#capitalism#anticapitalism#anti billionaires#billionaires should not exist#tax the rich#tax avoidance#wealth hoarding#wealth gap#wealth inequality#income inequality

94 notes

·

View notes

Text

“White people claiming that American society is merit-based is like claiming they won a race when their opponent has their hands and legs bound.

The myth of meritocracy claims that Americans live in a fair, equal society, where hard work and resilience are the factors most responsible for shaping our lives. Under this theory, nothing stops anyone from succeeding other than, perhaps, themselves. This worldview may seem like a harmless attempt to encourage self-determination until you discover the carpet doesn't match the drapes. Once you realize that racism hinders equality, the myth of meritocracy is left bare and exposed, like the emperor, who wasn't wearing any clothes.

While the myth of meritocracy attempts to justify racial disparities as normal, this worldview is challenged by the data.

According to The Survey of Consumer Finances, the wealth of a typical White household was 7.8 times that of the typical Black household. Faced with this stark reality, many would concede that racist laws, policies, and practices created and maintained this racial wealth gap, while others, those who endorse the myth of meritocracy, would insist that Black people don't work hard enough. If they punched the clock more often, then all of their suffering would be alleviated, those endorsing the myth expect us to believe.

Many endorse racial stereotypes to justify racial disparities, calling Black people lazy or making other blanket claims to disparage the state of the black family.

It's easier for some White people to believe the world is fair than to commit to doing their part to make it so.”

—Allison Wiltz

#politics#meritocracy#the myth of meritocracy#just world fallacy#structural racism#alison wiltz#racism deniers#aversive racism#casual racism#inequality#racial wealth gap#wealth gap#racial stereotypes#victim blaming

61 notes

·

View notes

Video

Addiction and class

#tiktok#addiction#housing#homelessness#class struggle#class#John Mulaney#rehab#illness#mental illness#soberiety#sober#crime#wealth inequality#wealth gap#wealth#policy

214 notes

·

View notes

Text

Billionaires don’t fear for their lives enough. That’s a legit issue.

#hunt the rich for sport#eat the rich#burn the rich#billionaires#tax the wealthy#tax the rich#tax the billionaires#tax the 1%#tax billionaires#fuck elon#elongated muskrat#elon musty#elon musk#redistribute wealth#wealth inequality#wage inequality#wealth gap#late stage capitalism#capitalism

402 notes

·

View notes

Text

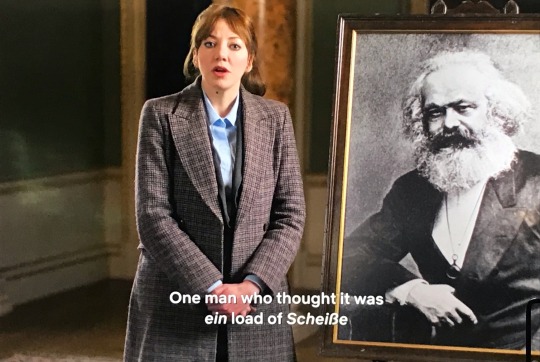

“A world like this, where the masses toil for pennies while a tiny elite grow rich, seems so obviously unfair and unthinkable to us today, we can scarcely imagine what it might have been like.

One man who thought it was ein load of Scheiße was German thinker Karl Marx. It’s hard to tell, but if you look closely at this photograph, you might notice he had a beard.

Marx also had a vision, which he wrote down in a book called The Commonest Man in Festo.”

#cunk on earth#philomena cunk#diane morgan#Karl Marx#wealth gap#gilded age#capitalism#oligarchy#communism

293 notes

·

View notes

Text

Beauty standards are generally based more off of what rich people of the era look like than actual health or science.

Back in day if you could afford large amounts of food you were seen as attractive. Someone could tell if you had the means based off your waistline.

Nowadays if you have the money to not live off fast food, have the time to exercise, and/or have the means to buy exercise equipment/gym memberships/personal trainers/etc, your wealth is shown in your abs or your slimness.

How you look does not equate to health, but your wealth does equate to how you look. Money looks good on everyone, money just looks different depending on the era.

#anti capitalism#body building#body positive#body posititivity#body postivity#body neutrality#beauty standards#wealth gap#wealth inequality#feminism#lgbt#lgbtq+#lgbtqia#lgbtq#queer#trans rights

40 notes

·

View notes

Text

x

#401(k)#savings#tax-advantaged retirement#bipartisan legislation#wealth gap#federal budget#financial industry#lobbying#retirement security#tax law#retirement savings#bipartisan#wealth disparities#federal deficit#financial services industry#tax-advantaged accounts#tax breaks#Congress#lobbyists#Social Security#Medicare

15 notes

·

View notes

Text

"At one point in their conversation, [Chris] Wallace grilled [Bernie] Sanders about whether he thought it would be better if Walmart didn’t exist and hence the million and a half American Walmart employees didn’t have jobs... If they’d continued on this subject, Bernie undoubtedly would have talked about the ways his social democratic program would help these workers — for example, by making it easier for them to organize labor unions. But none of this quite gets to the heart of the point Wallace was raising. Isn’t it good that the enterprises owned by billionaires exist and provide all those jobs?

Here’s how Sanders could have answered:

Yes, it’s good for the enterprises to exist and provide people with an income. But there’s no reason they need to be controlled by oligarchs. Walmart, for example, could be nationalized. Or it could be turned into a giant worker-owned cooperative. Either of these options, or some hybrid like converting it into a publicly owned entity whose governing board was split between public appointees and worker representatives, would cut the Walton family out of the picture — which would be all to the good.

The average full-time worker at Walmart makes between $25,000 and $30,000 a year. Jim Walton brings in about $5 billion a year — almost 167,000 times more than the high end of that range. He doesn’t get all that money because he’s 167,000 times smarter or more talented or less replaceable than any of the people actually doing the work to keep Walmart going. He gets it because capitalist ownership relations let him just take it.

If Walmart were organized as a worker co-op, the pay scale wouldn’t necessarily be entirely flat. A majority of worker-owners might be convinced to go along with higher incomes to attract candidates to apply for administrative positions carrying a lot of stress and responsibility — or conversely, to incentivize people to take particularly dirty or dangerous jobs. But good luck to anyone trying to persuade their fellow workers that whatever they did was so essential they deserve to earn 167,000 times more than what everyone else gets.

You only get to pay yourself a billion dollars — never mind five billion a year — if you have immense structural power to decide how a firm’s revenues are divided up. Even in a fully socialist economy, some people might have higher incomes than others for a variety of reasons. But you only get the kind of staggeringly unequal distributions of wealth that make some people billionaires when you have extreme inequality in the distribution of economic power.

Of course billionaires shouldn’t exist."

- Ben Burgis, from "Bernie Sanders: Billionaires Shouldn’t Exist." Jacobin, 4 May 2023.

#ben burgis#quote#quotations#bernie sanders#democratic socialism#economics#wealth gap#wealth inequality#walmart#eat the rich#neoliberalism#capitalism

68 notes

·

View notes

Text

A new report is detailing how poorly all levels of government are doing when it comes to addressing poverty in Canada.

Food Banks Canada issued a first-of-its-kind "report card" for all provincial and territorial governments on how it is addressing food insecurity, poverty and reduction efforts.

According to the report published on Tuesday, Canada overall received a D+ for its efforts.

"All governments in Canada are proving quite frankly inadequate in their approach to poverty reduction across the board," Kirstin Beardsley, CEO of Food Banks Canada, told CTVNews.ca in an interview. "We need to see more action everywhere."

Full article

Tagging: @politicsofcanada

#cdnpoli#canada#canadian politics#canadian news#canadian#poverty#income inequality#wealth gap#food insecurity#food banks canada

111 notes

·

View notes

Text

Source

#eat the rich#end capitalism#capitalism#income inequality#working class#wealth inequality#wealth gap#tax the rich#world affairs

3K notes

·

View notes

Text

Nimona's Subtle Racial Placement in a World of Wealth Gaps

The racial placement of Nimona was not lost on me, and its something I'm seeing more of in media, so lets talk about how Nimona did it and why:

The Queen was black, and as a black woman she was the one who chose Ballister, a commoner, a brown kid, to be the next Knight of the Realm. She chose him above all the elitist kids because she saw his merit, and chose not to let the status of the others affect her decisions. And she was killed for it by a white insurrectionist.

For years Ballister was bullied by Todd, a white man, while the other elitist knights did nothing. Except for Ambrosius, an Asian man (presumably since he's modeled after Eugene Lee Yang), who not only stood up for him, but ended up becoming so close to him that they became lovers.

There's a lot of diversity in this movie, both within the wealth classes (the highest position of power being held by a black woman while Nimona, who's whole story is about being oppressed and ostracized, is white), and among the general populace of multi-racial and ethnic side characters. Yet there's still mostly white knights among the Queen's guard, not to mention the original story of Gloreth revolves around a white girl brought into legacy. You could even argue colorism with how Ambrosius has a lighter complexion (especially considering he was originally white in the comics) and is brought up as the trusted descendent of Gloreth over the commoner Ballister.

Despite being a movie about classism that's set in a diverse world, Nimona still has a subtle racial aspect within its character dynamics. It does this for a very important reason: to bridge the gap between art and reality. In real life, we have white supremacy. In real life, we have capitalism. And Nimona uses its racial aspects to further make its point about the class divide and bigotry within a caste system.

Racial supremacy and the dismantling of it is a complex matter. Diversifying the world is easiest to achieve among the working class; you can show people of different skin tones in movies and TV, hire a more diverse racial pool within work environments, etc. But what gets difficult is changing the diversity within the elite spaces, because their place in the wealth gap has made them near impossible to touch from a working class position. Diversifying the space in a local diner? Easy, as long as the manager is willing. Diversifying the spaces within the Electoral College? Harvard alumni? HBO Executives? Good luck, you'd give an arm and a leg just to change maybe one person's position in those spaces. Because the power is so hoarded and privatized that changing anything, like racial diversity, would include upending the entire system that allowed for them to exist as they do. A local diner involves being able to convince one person in a small position to either change their model, or changing out that person with someone with a different model. The systems of supremacy don't have roots as deep within that scenario, but the elitists? They are the system. And to change them is to change the system entirely. You cannot eliminate the racism from elite spaces without dissolving the wealth gap.

Nimona shows this subtly, in that among the common people its super diverse (black news anchors, people of different skin tones occupying the same spaces, etc), but within the elite institutions, the Knight of the Realm was always someone who was from the elite, and had nepotism to get them through. Ambrosius was expected to be the Knight because of his heritage, and most of the knights in the guard along him and Ballister were white and had Old Money. The movie didn't need to include racism in their message against classism, but the creators wanted to bridge that gap between

"movie metaphor for real world issues" and actual real world issues. They created "commoner" and made sure the audience knew that represented not just the "working class", but the racial working class. They made sure the implications of racial bias were there and readable for the people who could relate to the struggle of being a person of color in a supremacist society. They even made queer people feel seen, not just with Ambrosius and Ballister's relationship, but with Nimona's entire allegory for gender-queerness. Its a movie that aims to have its art reflect reality for the sake of making people get invested in their own real world issues within our real world society. Many "progressive" works now utilize talking points from progressive movements without actually giving representation to those affected, causing a case of appropriation painted as representation. Nimona aimed to create genuine representation that would be seen by the people who needed it most, not just with the obvious messages from the story-telling, but from the subtle bridges that connect this piece of fiction to the very real world it took inspiration from. And I think its safe to say Nimona achieved just that.

#anyway go watch Nimona#right now#and Sea Beast while you're at it#nimona#nimona movie#politics#wealth gap#racism#classism

27 notes

·

View notes

Video

price gouging medication that was paid for by tax payers

#tiktok#drug prices#price gouging#Healthcare#Health Care#health insurance#medical news#medication#wealth inequality#hoarding wealth#wealth gap#wealth#billionaire#tax payer#tax payers#tax money#bernie sanders#vaccine apartheid#vaccines#COVID-19#the pandemic

278 notes

·

View notes

Text

Stop bailing out the rich and start taxing them.

The problem is that a good portion of our politicians are in the 1% and why would they vote to tax themselves?

They won’t unless we give them no other option

#let’s be honest#they’d spend that money on military and police#can’t subjugate the masses without adequately militarizing your police forces#at what point to wh break out the guillotine#capitalism#late stage capitalism#eat the rich#tax the rich#tax the wealthy#wealthy inequality#wealth gap#wealth redistribution

171 notes

·

View notes