#continuation fraud

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

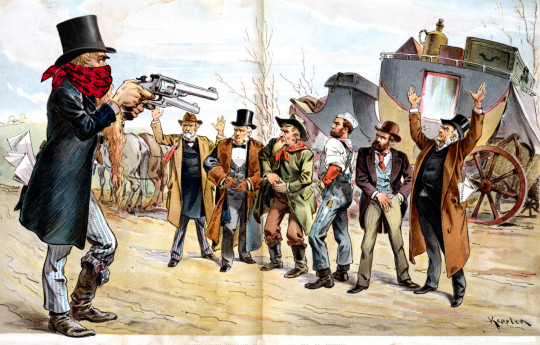

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

309 notes

·

View notes

Text

Wendy: Master, is that legal?

Makarov: When there's no cops around, anything's legal!

#HI I'M NOT DEAD JUST INTERNETLESS#makarov dreyar#makarov continues to be a mood#wendy marvell#source: gravity falls#idk i feel like makarov and grunkle stan have very similar vibes#like jicchan definitely has a secret twin and some identity fraud cases yk#fairy tail#incorrect fairy tail quotes#fairy tail incorrect quotes#incorrect quotes#incorrect quote#anime#manga

439 notes

·

View notes

Text

ichirou @neil in the math au

Submitted by @snazzy-jas-z-is-a-fan-of

#submission#Math Nerd AU#PFFT#Too bad Neil wrote it in a spreadsheet#Spreadsheet trumps diary#Also the idea of Ichirou having a diary is gold#Dear Diary#This may surprise you but I committed no Tax fraud today because Neil Josten continues to be useful#This may not surprise you but I did do a bit of contract killing#As a treat#Neil said such a funny joke#I will transcribe it below#Love the number one son#Ichirou Moriyama#Neil Josten

77 notes

·

View notes

Text

taking a moment to appreciate Legder

#the sims 4#ts4#oc: ledger gowers#finally a valid post 🤪#obviously he got a little makeover#he's so pretty I CANT STAND ITTTT#did I ever mention that he's graham's lawyer...? graham basically hired him a few weeks before his trial#his previous lawyer mysteriously disappeared#leaving him with nothing#and you know#he stayed 🤪#his father is committing financial fraud in a different country#and legder worked for him after graduation. and his mom is furious that he has now joined another bad guy#aside from working for graham legder also takes on other cases and continues to build his reputation#my sims#ts4 simblr#simblr#ocs#sims 4 ocs#showyoursims#ts4 cas

42 notes

·

View notes

Text

why am i sneezing so much oh stars oh misery oh my hVSH

#just me hi#hehhehlppp#hhhellppp#i'm dddyiinnggg [<- dramatic]#WHY IS IT AGGRAVATING MY COUGH. PLS#i'm perishing like canned peaches in an ill-sealed jar hhhelp#//ANYWAY i came on here to say I have 100 followers on artstreet so i decided to do some adopts#also celebrating the 1k on here that i never got around to doing hfhvhs#yea it was last year. i will Still do a victory dance about that thank you uvu#//literally hellp i'm sneezing#auhuhguahuah#tjhis is terrible. just awful. just horrible. just terrible#five thousand sneezes be upon ye [m'n'm hamster meme]#they were lying about frijoles making you stronger. if i was stronger i wouldn't be sneezing#literally the lies the fabrications the falsehoods the fibs the untruths the misconstrued reality the blatant perjury#the humbuginess of it all the fraud the fiction the fantasies they sold me the invisible fine writing these cheats denied 'phony'#'you're being dramatic' I AM SNEEZGING.#i am going to BE dramatic i'm literally dddyingg it's the end of the worrrlddsssddd [<- dramaPlus+]#//anywya. if i sorvive. adopts. perhaps in a quarter of a fortnite. maybees less. who knows :3#///and i continues to sneeze auhughgughgughgughuguuhguhg

21 notes

·

View notes

Text

another installment of my “dazai doesn’t pay his taxes and somehow bamboozled ango into filing for him every year bc it’s the “least he could do” for him”

ango: “137 million dollars… dazai?!”

dazai *scrambling through random bills and papers: “yes! and if i don’t pay up i’ll go to jail! for tax evasion!! i’m crazy enough to rage-quit the port mafia… but taking on the yokohama tax agency nooo thank you!”

ango *unamused with the enormous undertaking he has once again found himself responsible for- adjusting his glasses*: “fine fine, i’ll do it- move so i can get to work.”

dazai *with the stars in his eyes he gets when he’s being truly,,,, insufferable*: “i knew you would!” *skipping away before ango can ask any questions* “byeee!”

#dazai’s tax evasion continues#bsd dazai#bsd ango#ango deserves a BREAK#if ango sakaguchi is good for one thing it’s taxes#the only reason he hasn’t gotten in trouble for his many years of tax evasion and fraud is bc ango probably filed them for him#dazai bsd#he’s literally brilliant but things like taxes befall him#they’re so amusing to me#that is some messed up interpretation of atonement dazai….. smh#dazai the tax fraud#ango the exhausted#ango ain’t even gettin paid for this#give this man a raise#bsd#bungo stray dogs#bsd headcanons#bsd thoughts#plz let me relevant in fandom again i’m funny (sometimes)#bungo slay dogs#bsd anime#nothin like some funky fresh tax evasion

27 notes

·

View notes

Text

me: i ship denji with asa and reze.

But also me: BUT DO YOU SEE THE HOMOEROTIC UNDERTONES BETWEEN YOSHIDA AND DENJI? BECAUSE -

#☈ • ᴊᴜsᴛ ᴀ ᴄᴏɪɴᴄɪᴅᴇɴᴄᴇ / ᴏᴏᴄ.#i'm a joke#clown emoji and all#yes i ship yoshiden#but also not here for fanon's interpretation of yoshida#bleck get it out. throw it into the garbage disposal because i'm tired#buuut anyways#: )#ya'll i'm a fraud because i ship him with yoshida the most#let me continue sipping my preworkout

6 notes

·

View notes

Text

Ryang Eum: Jang Hyun wants to meet you. now me personally idgaf whether he even gets to see you but since he wants to and you don't want him to see you like this can i suggest something. just a very small thing it's not too complicated

#tv: my dearest#my dearest#mbc my dearest#namgoong min#nam goong min#ahn eun jin#kim yoon woo#kdrama#local gay watches My Dearest (and is subsequently f*cked up).txt#local gay watches k-dramas.txt#pregnancy fraud!!!!!! the scammer saga continues now Ryang Eum did you come up with this idea or did she bc either she's#killing it with the fake motherhood and Jang Hyun is just happy that as far he knows she is well. i need a JangChae bby fr now#as soon as possible but i'll take what i can get

7 notes

·

View notes

Text

I've always been under the impression that no one actually got in legal trouble for what happened in S4, Haida and Retsuko just stopped Himuro from using the fudged numbers and he got ousted by the board like they said they would if he didn't post a profit, and that seems to be confirmed by them saying Haida QUIT instead of being fired.

But that begs the question then why Haida had the trouble he did cause like. It'd be very easy to lie your way around that in an interview. The one we actually see him go to, and him talking to Retsuko later saying fraud is a big deal he can't just put behind him, I dunno, it just continues to paint the picture of Haida as not a smart man who's kinda causing his own problems.

#Aggretsuko#'we had an interim CEO who promoted me but wasn't well received by the board and left after just a quarter'#'I opted to leave because the company was continuing to associate me with the interim CEO worried something untoward had happened'#'My skills are transferrable and I still have good referenced from that job so i thought it'd be easier to just move on'#Boom done don't tell them you did a tax fraud you *idiot*#you have time to practice for interviews you shouldn't say anything in them you didn't rehearse anyway#Haida

23 notes

·

View notes

Text

hrt is so funny like. i smell slightly worse and have a gigantic zit in my armpit and these facts are making me feel great about myself. why does this work. why does this work.

#worlds funniest medication. thank you to the girls the gays and all committers of gender fraud. you know who you are.#Rhi talks#anyways continuing my journey as the worlds first transsexual cis woman 👩 just a new type of guy they’re testing out

9 notes

·

View notes

Note

I am here on behalf of King Asgore. You are late on your tax payments. You have a week to pay up.

◀︎◀︎───────────────── ⁛ ❄️ ⁛ ────────────────▶︎▶︎

4 notes

·

View notes

Text

i would take the bus anywhere but i dont have a bus pass and theyre so expensive rrghghrhghh

#they should continue giving me free student bus pass after i graduate forever. pleeeeeeease#might commit bus pass fraud (paying my roommate $20 to get me a 'replacement' student bus pass)

3 notes

·

View notes

Text

.

#I feel very intensely anxious about tomorrow!#feel underprepared!#feel like they are going to know I’m a fraud!#but also feel like continuing to rehearse things is not helpful!#because it makes me stiff and unnatural!#I just want to do well 😭#and I’m sure it’ll be fine#and honestly they say that the interviews don’t sway things all that much#so it’s okay#but god#I hate this very much

3 notes

·

View notes

Note

Sukuna really needed to summon adopted parents to beat Gojo

Sukuna resorting to a 3 vs 1 🤡

4 notes

·

View notes

Text

Janice: Hey, mom? Would you be worried I was trying to commit tax fraud if I told you I was creating a religion?

Mom: Yes. Absolutely.

#and then we continued to watch tv#fun convos with our mom#did system#did osdd#osddid#did#dissociative system#actually dissociative#actually did#plurality#No im not planning to commit tax fraud#yet

3 notes

·

View notes

Text

A while back I bought Simon Forman’s book, “astrological judgements of physick,” because I got interested in him because of a game called Astrologaster.

Anyways, he’s an interesting guy. He was an astrologist that worked as a doctor, basically. I suspect that the major reason he’s even remembered today is because he’s one of the only sources of descriptions of actual performances of shakespeare’s plays. I’m trying to read this book now because I thought it might be interesting to see how his thought process worked, and.

I can’t read this.

#malky reads#Simon forman#astrological judgements of physick#I’m still gonna continue with this because honestly#i find some of his griping funny#he spent a whole section in the beginning railing against people#who come to him with fake things to try to catch him out#and go all ‘haha see you’re a fraud’ or whatever#there was another section where he berates physicians#calling them people who basically use patients as experiments to test if such and such cure works or not#anyways this astrology stuff is completely incomprehensible to me#i need some sort of readers guide or something

10 notes

·

View notes