#fiduciaries

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

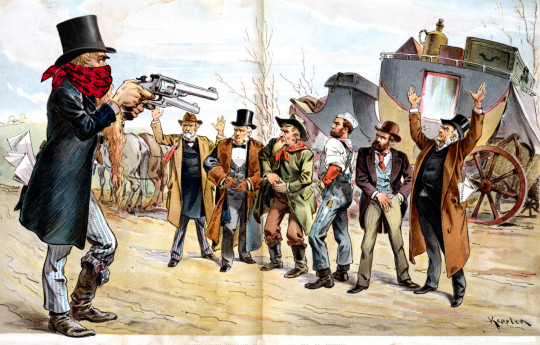

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

309 notes

·

View notes

Text

12 notes

·

View notes

Text

I am far too tired to make this coherent, but I am not surprised that OFMD didn't get renewed. It isn't just about the viewership, or the success of the seasons gone by. It isn't even about how successful s3 COULD be. It's just following that pattern that we are so used to with Netflix: a new show will get more NEW subscribers than continuing a show. Two seasons is mostly considered enough to maximise the number of new people signing up to the service.

Anyways fuck streaming services, the entire concept is awful.

#this isn't getting into the fact that the show was queer and the effect that had on its cancellation#but yeah it's a numbers game#max don't think that a third season would maximise their profits#it would make a profit but it wouldn't be *maximised*#and thanks to good ol' fiduciary responsibility to shareholders that's the only thing that matters#which is why streaming services are such a terrible business model#they are literally not profitable#ofmd#i wish i was more. anything#more angry more sad more disappointed#im just kinda numb instead#mine

7 notes

·

View notes

Text

prioritizing profit?

people i interview for my research on corporate sustainability and sustainable finance often tell me that they have a legal obligation to maximize financial value for shareholders. they don't normally use this obligation to justify a company doing patently bad things like illegally dumping chemicals in a river or murdering resistant locals (they would argue that this actually diminishing shareholder value by undermining a company's reputation and creating more risks of bad press and regulatory penalties), but they do often use it as a way of justifying a lack of what they consider "philanthropic activities." it's the ideology of milton friedman -- who famously argued that "the social responsibility of business is to increase its profits" -- retooled for an era of greenwashing.

i've been thinking about this "legal obligation" a lot lately as elon musk guts twitter. where are the other shareholders whose financial interests he is "legally obligated" to protect? the only case i could find was the orlando pension fund suing to delay musk's twitter takeover on the grounds that he is an "interested shareholder," which is apparently quite a difficult case to win.

it'll be interesting to see what happens as people who have big stakes in twitter start to push back against musk's chaotic mismanagement of the company, but for now i'm squirreling this story away as an easy rebuttal to future informants who say they have a legal obligation to the shareholder.

#twitter#elon musk#shareholder value#fiduciary duty#orlando pension fund#greenwashing#sustainability#finance#anthropology#political ecology

48 notes

·

View notes

Text

half of you already know this but I have it on good info from a redacted but highly reliable source that the entire season of succession was written on the fly. it was decided at the very last minute, from what I heard virtually just before shooting, that it would be four seasons instead of five. they had to write the scenes / episodes as they went. they were chucking the actors scripts day-of. at at least one point they had to send everybody home, cast and crew, because the scriptwriters hadn’t written any scenes and there was nothing to film. it was a complete and utter shitshow.

#i heard this all including the 'fourth season would be the last' about a month and a half before it was announced#i am not breaking any fiduciary duty or contractual obligations in posting this#so whatever i'm just going to post!#the people who did already broke theirs and can be more careful in the future if they so desire#i kept politely silent through all the 'uwu it's so nice when shows end at the right point' posting sjskj so.

19 notes

·

View notes

Text

reading for the week is Takuo Dome's The Political Economy of Public Finance in Britain 1767–1873 and (bits of) Goetzmann & Roewenhorst (eds) The Origins of Value. and THEN John Brewer's The Sinews of Power.

2 notes

·

View notes

Text

@kalilahrey financial advice 💪🏾💪🏾

12 notes

·

View notes

Text

Best Financial Advice Books Everyone Should Read

Advice Only Financial Advice

Rich Dad Poor Dad - Robert Kiyosaki

This book was written by Robert Kiyosaki after his father passed away. He took what he learned about money and business and created a book that would teach others how to become rich. He talks about the importance of education and learning about money early on. He then goes onto explain how to find work you enjoy and make money off of things you already do.

The Millionaire Fastlane - MJ DeMarco

MJ DeMarco talks about how to start making money at any age and how to build wealth. He explains how to change careers without having to go back to college, how to invest money for retirement, and how to travel the world almost forever.

How To Be A Full-Time Wealthy Person - JL Collins

JL Collins writes about how to achieve financial freedom if have a high income. He talks about many different ways to increase earnings and create passive income.

The Richest Man In Babylon - George S Clason

George S Clason talks about how to inherit money and turn it into billions. He teaches people how to invest their money in ways they might not have thought about.

The $100 Startup - Ryan Carson

Ryan Carson talks about how to launch a company and earn over $100,000 in just 2 years. Through trial and error, he has been able to perfect the system and offers insight on how to start a profitable and successful company.

The Cashflow Quadrant - Robert Kiyosaki

Robert Kiyosaki talks about how to use cash flow to make money, pay debts, save money, and plan for long-term goals.

The Art Of Travel - Rick Steves

Rick Steves writes about how to travel the world and experience everything we never had time for before.

Advice Only Financial Advice

#financial advisor#edward jones financial advisor#financial advisor salary#financial advisor near me#fiduciary financial advisor#how to become a financial advisor#what does a financial advisor do#what is a financial advisor#financial advisor jobs#fiduciary financial advisor near me#how much does a financial advisor cost#morgan stanley financial advisor#financial advice#financial submission#financial technology#personal finance#financial planning#financial freedom#retirement planning#financialadvisor#financial market news#business

7 notes

·

View notes

Text

Biden wants to ban ripoff “financial advisors”

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Once, American workers had "defined benefits pensions," where their employers promised to pay them a certain amount every year from their retirement to their death. Jimmy Carter swapped that out for 401(k)s, "market" pensions where you have to guess which stocks will be valuable or starve in your old age:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The initial 401(k) rollout had all kinds of pot-sweeteners that made them seem like a good deal, like heavy employer matching that doubled or even tripled the value of every dollar you put into the market for your retirement. But over the years, as Reaganomics took hold and workers' power ebbed away, all these goodies were clawed back. In the end, the market-based pension makes you the sucker at the poker table, flushing your savings into a rigged casino that is firmly tilted in favor of finance barons and other eminently guillotineable plutocrats.

Neoliberalism is many things, but most of all it is a cult of individualism. The fact that three generations of workers are nows facing down retirement without pensions that will provide them with secure housing and food – let alone money to see the odd movie, buy birthday gifts for their grandkids, or enjoy a meal out now and then – is framed as millions of individual failures, not a systemic one.

In other words, if you are facing food insecurity and homelessness after a lifetime of hard work, it's because you saved wrong. Perhaps you didn't save enough (through a 40-year run of wage stagnation and skyrocketing housing, health and education costs). Or perhaps you saved wrong, making the wrong bets on the stock market. If you can't afford to run your air conditioner during a heat dome, that's on you: you should have been better at stocks.

Apologists for this system will say that you don't have to be good at stocks – you just have to pay an Independent Financial Advisor to pick the stocks for you and you'll be fine. But IFAs don't work for free! What if you can't afford one?

Enter "predatory inclusion" – the practice of offering scammy, overpriced and substandard products to poor people and declaring it to be a good deed, because otherwise, those poor people would have to do without. The crypto bubble relied heavily on this: think of Spike Lee and others shilling for pump-and-dump scams as a way of "building Black wealth":

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

More recently, Intuit and other scammy tax-prep services have argued against the IRS's plan to offer free tax preparation as bad for Black and brown people, because it will deny them the chance to be deceived and ripped off with TurboTax:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Back in 2018, Trump won the predatory inclusion Olympics, when his Department of Labor let the Fifth Circuit abolish the "Fiduciary Rule" for Independent Financial Advisors:

https://www.investopedia.com/updates/dol-fiduciary-rule/

What was the Fiduciary Rule? It said that your IFN had to put your interests ahead of their own. Like, if there were two different funds you could bet on, and one would pay your IFN a big commission, while the other would be a better bet for you, the IFN couldn't put your retirement savings into the fund that offered them a bribe.

When Trump killed the Fiduciary Rule, he proclaimed it a victory for poor people, especially Black and brown people. After all, if IFNs weren't allowed to accept bribes for giving you bad financial advice, then they would have to make up the difference by charging you for good advice. If you couldn't afford that advice, well, you'd have to make bad retirement investments on your own, without the benefit of their sleazy self-dealing.

The Biden Administration wants to change that. Biden's Acting Labor Secretary is Julie Su, and she's very good at her job. Last spring, she forced west coast dockworkers' bosses to cough up the contract they'd stalled on for a year, with 8-10% raises for every worker, owed retroactively:

https://pluralistic.net/2023/06/16/that-boy-aint-right/#dinos-rinos-and-dunnos

Su has proposed a way to reinstate the Fiduciary Rule, as part of the Biden Administration's war on junk fees, estimating that this will increase retirees' net savings by 20%:

https://prospect.org/labor/2023-11-07-julie-su-labor-retirement-savers/

The new rule will force advisors who cheat their clients to pay restitution, and will require them to deliver all their advice in writing so that this cheating can be detected and punished.

The industry is furious, of course. They claim that "The Market (TM)" will solve this: if you get bad retirement savings advice and end up homeless and starving, then you will choose a different advisor in your next life, after you are reincarnated (I guess?).

And of course, they're also claiming that forcing IFNs to stop cheating their clients will deny poor people access to expert (bad) advice. As the Financial Services Institute's Dale Brown says, this will have a "negative impact on Main Street Americans’ access to financial advice":

https://www.fa-mag.com/news/legal-challenge-predicted-for-new-dol-fiduciary-proposal-75257.html

Here's that rule – read it for yourself, then submit a comment expressing your views on it. The government wants to hear from you, and administrative law requires them to act on the comments they receive:

https://www.federalregister.gov/documents/2023/11/03/2023-23782/proposed-amendment-to-prohibited-transaction-exemptions-75-1-77-4-80-83-83-1-and-86-128

Su is part of a wave of progressive, technically skilled regulators in the Biden administration that resulted from a horse-trading exercise called the Unity Task Force, which divvied up access to top appointments among the progressive wing and the finance wing of the Democratic Party. The progressive appointments are nothing short of incredible – the most competent and principled agency leaders America has seen in half a century:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

But then there's the finance wing's appointments, like Judge Jacqueline Scott Corley, who ruled against Lina Khan's attempt to block the rotten Microsoft/Activision merger (don't worry, Khan's appealing):

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

Perhaps the worst, though, is Biden's Secretary of Commerce Gina Raimondo, a private equity ghoul who did a stint for the notorious wreckers Bain Capital before founding her own firm. Raimondo has stuffed her department full of Goldman Sachs alums, and has sidelined labor and civil society groups as she sets out to administer everything from the CHIPS Act to regulating ChatGPT.

As Henry Burke writes for the Revolving Door Project and The American Prospect, Raimondo's history as a corporate raider, her deference to the finance sector, and she and her husband's conflicts of interest from their massive stakes in companies she's regulating all serve to undermine Biden's agenda:

https://prospect.org/economy/2023-11-08-commerce-secretary-gina-raimondo-undercutting-bidenomics/

When the administration inevitably complains that its popular economic programs aren’t breaking through the media coverage, they’ll have no one to blame but themselves.

The Unity Task Force gave us generationally important policymakers, but ultimately, it's a classic "pizzaburger." If half your family wants pizza, and the other half wants burgers, and you serve them something halfway in between that makes none of them happy, you haven't made a wise compromise – you've just made an inedible mess:

https://pluralistic.net/2023/06/17/pizzaburgers/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

#pluralistic#julie su#fiduciary rule#intergenerational warfare#aging#retirement#401ks#old age#pensions#finance#pizzaburgers#Gina Raimondo

261 notes

·

View notes

Text

What's Trustee Indemnity Insurance?

(b)has impact regardless of any provision prohibiting the charity trustees or trustees for the charity receiving any personal profit out of the funds of the charity. Our trusted supplier Zurich Insurance can present many various sorts of insurance cover, and provide threat management support. The threat administration process entails identifying, registering and assessing threat, contingency planning and developing a strong business plan, buying acceptable charity insurance and frequently reviewing risk at board degree. You can read a sequence of danger guides by Zurich Insurance or NCVO’s managing risk page.

Following publication of an article, the charity trustees had been sued for defamation by another charity with related objectives. fiduciary practitioners stated that certain statements made within the article were unfaithful and gave a false illustration of the charity. The scope of trustees’ private liability in circumstances during which a charity is deemed to be insolvent hinge (once again) on the charity’s company status. The consequences of a cyber security breach for a pension scheme and its members could possibly be vital. Pension trustees should familiarise themselves with the regulators steering and guarantee they meet the regulators expectations.

By Mike Addison Recently, the question of fidelity cover has arisen on the STO website and others. Here follows kind of what our pondering is by means of insuring the physique company I terms of PMR 29(2)(b). In a nutshell, trustees are supposed to see to it that the physique corporate has constancy cover, a sum, if any, to be decided by the body company at a common meeting. In different words, it should be determined at an AGM how much cover is needed for Fidelity. This important FAIS laws, coupled with the clear requirements of the CSOS and STSM Acts, rules and prescribed rules, places the burden of duty on the monetary advisor and trustees.

The penalties might be devastating to you and people who rely upon the work your organisation carries out.Specialist charity insurance helps be certain that your volunteers, fundraisers, supporters and the general public are properly protected. As to the price for trustee liability insurance, our minimum premium is round $5,000, and that's just for the smallest of trusts. Usually, a $1 million limit carries a $10,000 retention, and pricing falls between $7,000 and $10,000. When the property go as high as $75 million to $100 million, premiums may rise above $10,000. However, regardless of the asset levels are, if a grantor creates a number of trusts, say for kids and grandchildren, and appoints only one trustee, a single policy will suffice. The Scouts’ Trustees Indemnity policy covers the non-public liability of Scout trustees who, having acted responsibly and honestly, discover themselves being held to account for their group’s losses.

Our specialist team of underwriters are available to talk through any particular dangers or questions you would possibly have. Thanks to more and more high requirements of wiring and installation, electrical systems are actually typically safer than ever. However, the use of electricity in church buildings nonetheless has the potential to cause appreciable damage to property and critical personal damage.

So having trustee insurance in place is a straightforward method to make sure your trustees are both financially protected and given the assist and steerage they need to be able to take care of the fallout from a reputational crisis. The greatest form of trustee insurance is one which is tailored to an individual’s particular capability as a trustee and has been designed for them to protect themselves from liabilities. One thing trusts all have in common, is that trustees may be held legally accountable for any selections that they make and for any services provided. Where the sponsoring employer is required to indemnify a trustee or worker, the Policy reimburses the employer for the indemnity, thus providing useful balance sheet safety. Trustee indemnity insurance can present cowl for the legal bills and the damages awarded to the sufferer.

To cowl a broad range of non-profit risks, from animal shelters to charitable trusts. To provide charity and not-for-profit fundraisers with a further revenue stream for his or her organisations. Trustee indemnity policies can present cover, but it isn't all the time automated. Cover is unlikely to be granted the place one trustee makes a clam towards another. Trustee indemnity Insurance is unlikely to cover losses suffered by the charity itself.

The world during which professionals function is certainly one of ever-increasing strain and regulatory necessities, with calls for for fast solutions and cost-effective options. This pressure can result in errors and omissions by the professional which might and do give rise to claims. In a society the place shoppers are increasingly aware of their rights, the necessity for PI insurance is further underscored.Circumstances which give rise to professional liability claims are seldom clear cut. Even in instances where the professional is blameless, he or she might however be drawn into lengthy disputes which could be each financially and emotionally draining. In brief, even with a extremely professional trustee, error or omission lawsuits can and do happen. What trustee liability insurance does is shield the trustee, and anybody who assisted the trustee, within the event of litigation.

We're here to be sure to have the best pension trustee liability insurance in place to guard you. At get indemnity™ pension trustee liability insurance starts at £750 per million of canopy. Below we clarify how pension trustee liability works and how it can protect in opposition to particular liabilities. Trustees, administrators, officers, committee members and governors of such bodies can all be held liable for the decisions and actions made on behalf of their organisation. They may be sued or prosecuted for any mistakes and their consequences through the efficiency of their duties.

Even if your title or job description doesn't contain the word trustee, know that you could be nonetheless be thought-about one based mostly in your duties and actions. Before changing into a trustee, you should study all you possibly can in regards to the charity and what is to be anticipated of you. This includes studying the governing doc, annual reports, insurance policies and accounts and knowing what type of legal construction the charity is.

#fiduciary insurance#trustees liability insurance#fiduciary practitioners#trustees indemnity#trustees indemnity insurance#insurance for trustees#fiduciary liability insurance#professional indemnity insurance for ltd company

0 notes

Text

I hate the idea that a company should always be in growth mode and that mass layoffs, sorry, restructuring is something that should happen at set intervals. Steady profits are still profits and people will be less inclined to work or get invested in their work if they have to keep an emergency backup job in the back pocket no matter how good their work is.

To say nothing about how it limits social bonding 'cause there's only so many times you can go through seeing friends lose their job and have survivor's guilt or vice versa, or how since it's a known occurrence it means you know you're competing directly with friends.

Of course that's the point, along with the business idea that employment should follow the Pareto Principle even though it's pop science, demonstrably false, and an intentional misunderstanding of what was really an observation of coincidences.

And of course that means you're constantly shedding people who have knowledge, skills, and training to "streamline" things or to "increase production speed" when overworking already overworked employees and throwing greenhorns into it does the exact opposite.

It's not about making the company better, it's about making unionizing harder, paying people less, making it seem like the company is doing something, and giving the execs and shareholders more money.

While overworking those who kept their jobs.

#and how many times has a company bragged about how much money it made#only to turn around and fire a bunch of workers (but never execs)?#maybe even given themselves massive congratulatory bonuses to celebrate their 'hard work'#which was actually the work of dozens/hundreds of others#and iirc the pareto principle observation varied wildly from something like 5% to 50%#but it got turned into 80-20 for round numbers and because who cares about nuance#just sell it as 20% of your employees are slacking no matter what so you should fire 20% regularly#and of course there's the little thing known as fiduciary responsibility that's been warped by capitalism#so execs prioritize shareholders above all else#and of course the same companies often complain how no one wants to work anymore#or laments how people right out of college don't have a decade plus of experience with the company's proprietary system(s)#and sometimes they try to sneak no compete clauses into employment contracts so if someone is fired#they may have to stay out of the industry they have experience/training/degrees/interest in#no that such clauses can be enforced for something like this but it's a threat and warning to further cow workers#and a company bragging about making billions in profit and has a whole legal department#can easily afford the time and legal fees compared to someone who just lost their job even if they know they're going to lose#corporations literally have money earmarked in their budget for fines and settlements#which should tell you all you need to know about how much they care about laws#it's not even an emergency 'we fucked up' fund#it's 'this is the cost of business because it's cheaper to pay the fine and do what we want' fund

0 notes

Text

Colva Your Fiduciary Life Insurance Partner

Fiduciary life insurance advisors uphold a distinctive standard, legally obligated to prioritize the best interests of their clients. This commitment ensures High Net Worth (HNW) clients receive unbiased guidance, devoid of conflicts and biases. In contrast to traditional agents, fiduciary advisors prioritize client objectives above the interests of insurance companies.

0 notes