#LLP Company Registration Online

Text

Before adding a designated partner to your company, you must follow the rules of the LLP Act. For the Best Online Legal Solutions, contact Eazystartups.

0 notes

Text

#LLP registration in Surat#llp registration services#llp registration#llp company registration#llp registration online#llp registration cost#limited liability partnership registration#llp firm registration#llp company registration online#llp registration finaccle

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

0 notes

Text

5 Main Security Service Approaches

As the world becomes increasingly complex and unpredictable, businesses are recognizing the importance of having a robust security strategy in place. One key component of this strategy is hiring the right security personnel. However, finding and retaining qualified security guards can be a daunting task for businesses of all sizes.

This is where a security staffing agency like Spring Staffing Services comes in. We specialize in providing businesses with top-notch security guards who are trained, experienced, and equipped to handle a variety of security challenges.

Here are some of the reasons why businesses should consider partnering with a security staffing agency like Spring Staffing Services:

Quality staff: At Spring Staffing Services, we pride ourselves on our ability to identify, recruit, and retain the best security talent in the industry. Our security guards undergo rigorous training and are thoroughly vetted to ensure that they meet our high standards of professionalism and competence.

Flexibility: We understand that every business has unique security needs, which is why we offer a range of staffing options to meet your specific requirements. Whether you need security personnel for a one-time event or a long-term contract, we can provide you with the right staffing solution.

Cost-effective: Hiring and managing security personnel in-house can be a costly and time-consuming process. By partnering with a security guard staffing agency, you can save time and money while still ensuring that your business is protected.

Industry expertise: Our team of security experts has extensive experience in the industry and can provide valuable insights and advice to help you develop and implement an effective security strategy.

Peace of mind: With Spring Staffing Services, you can rest assured that your business is in good hands. Our security guards are trained to handle a variety of security challenges and are equipped with the latest tools and technology to ensure your safety and security.

In conclusion, partnering with a security staffing agency like Spring Staffing Services can provide businesses with the peace of mind they need to focus on their core operations while ensuring that their security needs are met. Contact us today to learn more about our security staffing solutions.

For more details

Mobile: +1(318) 906-0809, +1 (780) 235-3613

Website: https://springstaffingservice.com/security-guard-staffing/

#income tax filing consultants#it returns filing consultants online#llp company registration for small companies india#private limited company registration consultants online

0 notes

Text

Appointment of Director in a company

Introduction

A Director of a company is an individual elected by the shareholders to supervise the company's affairs in accordance with its Memorandum of Association (MOA) and Articles of Association (AOA). Since a company is a legal entity, it can only act through the representation of a natural person.

Therefore, the Board of Directors, consisting of living individuals, is entrusted with the management of the company. Depending on the shareholders' requirements, the appointment of directors may be required at various times throughout the life of the business.

Who can be a Director of a Company in India?

To become a director of a company in India, an individual must fulfill the criteria outlined in the Companies Act, 2013, and the Articles of Association of the respective company. The needs of the Companies Act are uniform, whereas the provisions of the Articles of Association differ from one company to another.

There are two types of directors that can be appointed in a company:

Executive Directors

Managing Director

A Managing Director is designated as a director based on the Articles of Association of a company, an agreement with the company, or a resolution passed in a general meeting or by the Board of Directors. This is because the Board of Directors is liable for managing the company's affairs and has substantial powers in doing so.

Whole-time director

An executive director or whole-time director is an individual who is employed by the company on a full-time basis.

Non-Executive Director

Independent director

Independent directors are board members of a company who are not financially or personally connected to the company or its management. They offer an unbiased viewpoint in the board's decision-making process, ensuring that the company operates in the best interests of all stakeholders.

Read more to know about the Appointment of a Director in a company

#llp registration#private limited company registration#opc registration#startup registration#nidhi company registration#annual compliance of llp#annual compliance of private limited company#trademark registration#itr filing#tds return filing#director kyc#legal consultation#legal services#iso certificate online

0 notes

Text

The Complete Guide to Registering a Private Limited Company Online in India

Starting your own business can be a daunting and confusing task. There are so many boxes to check and paperwork to get through that it can seem overwhelming. But don’t worry; we’ve got you covered! This comprehensive guide will walk you through private limited company registration online in India.

We’ll cover everything from understanding the different types of business entities available to choosing the registered office address and filing documents with the Registrar of Companies (RoC). So let’s get started!

Read More: The Complete Guide to Registering a Private Limited Company Online in India

#online company registration in india#private limited company registration online#limited liability partnership registration#llp registration online

0 notes

Text

The Ultimate Guide To Setting Up A Limited Liability Partnership Company

Starting a business can be daunting, but setting up the right kind of business entity is key to safeguarding your investments and minimizing any liability you might incur. This article will provide an overview of what Limited Liability Partnership (LLP) companies are and how you can get one set up quickly and easily. Learn more about the benefits of LLP Registration in India and how this could be the ideal choice for your business!

What Is a Limited Liability Partnership (LLP)?

A limited liability partnership (LLP) is a business structure that combines the features of a partnership and a corporation. An LLP Registration Online is composed of one or more general partners, who manage the company and are each liable for its debts, and one or more limited partners, who are not liable for the debts of the company beyond the amount they have invested.

An LLP can be formed by two or more individuals or entities. The partners must execute and file a Certificate of Limited Partnership with the state in which the LLP will do business. The Certificate must include the name of the LLP, the names and addresses of all partners, and the duration of the partnership.

An LLP has several advantages over other business structures. For example, it limits the personal liability of each partner for debts incurred by the LLP, protects partners from being held liable for actions taken by other partners, and provides flexibility in the management structure. Additionally, LLPs are not subject to many of the taxes that apply to other business structures, such as corporate income tax.

If you are considering forming an LLP, you should consult with an experienced business attorney to discuss your options and ensure that you are taking all steps necessary to protect your interests.

Benefits of LLP Registration

There are many benefits of online LLP registration in India, including:

1. Limited liability: This is the biggest advantage of an LLP over a traditional partnership. The partners’ liability is limited to their investment in the business, meaning they are not personally liable for debts incurred by the business. This gives peace of mind to partners and makes it easier to attract investment.

2. Tax benefits: LLPs are taxed as partnerships, meaning that profits are only taxed once at the partner level. This can bring about huge expenses in investment funds contrasted with other business structures.

3. Flexibility: LLPs offer flexibility in terms of management and ownership structures. Partners can easily join or leave an LLP without disrupting the business or affecting the other partners.

4. Simplicity: LLPs are relatively simple to set up and maintain compared to other business structures. There are fewer paperwork and compliance requirements, making it a cost-effective option for businesses.

How to Register an LLP in India?

To Register LLP in India, you will need to follow these steps:

1. First, you will need to obtain a DIN (Director Identification Number) for each of the partners of the LLP. This can be done by applying online through the MCA21 portal.

2. Once you have obtained the DINs, you will then need to fill out the LLP registration form (Form 2). This form can also be found on the MCA21 portal.

3. Along with Form 2, you will need to attach a copy of the partnership agreement, as well as any other required documents.

4. Once all of the forms and documents have been submitted, you will then need to pay the registration fee (which is currently Rs 5,000). This can be paid online through the MCA21 portal or offline at any authorized bank branch.

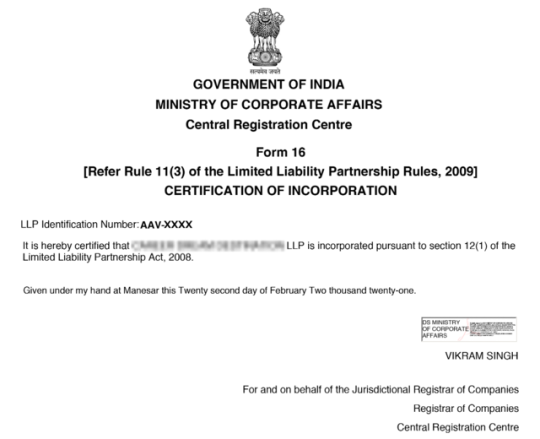

5. After the registration fee has been paid, you will then need to submit a printout of Form 2 along with all of the supporting documents to the Registrar of Companies (ROC). The ROC will then issue a Certificate of Incorporation, which is evidence that your LLP has been registered in India.

Documents Required by LLP Registration Consultant for LLP Registration in India

There are a few documents required by LLP Registration Consultant for LLP Registration in India These are:

1. Partnership Deed: This is the most important document required for LLP registration. It is a contract between the partners of the LLP that sets out the rights, duties, and responsibilities of each partner.

2. Certificate of Incorporation: This document is issued by the Registrar of Companies after the LLP has been registered. It contains the name, address, and other details of the LLP.

3. Memorandum of Association: This document sets out the objectives of the LLP and its members.

4. Articles of Association: This document sets out the rules and regulations governing the internal affairs of the LLP.

Fees and Timeline for LLP Registration

LLP Registration fees vary depending on the state in which the LLP is registered. The filing fee for an LLP in India, for example, is 10000. The timeline for LLP registration can also vary by state but is typically around 2-4 weeks.

Step-by-Step Process of Setting up an LLP

Assuming you have already decided to form an LLP, the first step is to find a registered agent in the state where you wish to form your business. The registered agent will be responsible for receiving and processing any legal documents on behalf of your company. Once you have found a registered agent, the next step is to file a Certificate of Formation with the state government. The Certificate of Formation must include the name and address of your registered agent, the names of the partners, and the purpose of your business. After filing the Certificate of Formation, you will need to draft an Operating Agreement. This agreement will outline the roles and responsibilities of each partner, as well as how profits and losses will be distributed. Finally, you will need to obtain an Employer Identification Number from the IRS to open a business bank account and file taxes on behalf of your LLP.

Managing and Operating an LLP

An LLP, or Limited Liability Partnership Registration in India, is a business structure that combines the features of a corporation with the flexibility of a partnership. An LLP is made up of one or more partners, who each have limited liability for the debts and obligations of the business. This means that if the LLP goes bankrupt, the partners will not be held personally liable for any debts incurred by the business.

Operating an LLP is similar to operating a partnership. The partners must agree on decisions regarding the management and operation of the business, and they are jointly liable for any debts or obligations incurred by the business. However, unlike a partnership, an LLP has no general partner who has unlimited liability for the debts and obligations of the business.

An LLP is formed by filing Articles of Partnership with the Secretary of State in the state where the LLP will be doing business. The Articles of Partnership must include the names of all partners, as well as the registered address and principal place of business of the LLP. The Articles of Partnership must also set forth certain other information about the LLP, such as its purpose, duration, and governing law.

Once an LLP is formed, it must file an annual report with the Secretary of State's office to stay in good standing. An annual report is a brief document that includes basic information about the LLP, such as its name and address, as well as information about its partners.

If you are thinking about forming an LLP, it is important to

Taxation of an LLP

When it comes to taxation, an LLP is taxed as a partnership rather than a corporation. This means that the partners are responsible for paying taxes on their share of the LLP's profits, rather than the LLP itself being taxed as a separate entity. The tax rates for an LLP depend on the individual partners' tax bracket and whether they are classified as active or passive partners. Active partners are those who take an active role in running the business, while passive partners are typically investors who do not take an active role.

Conclusion

We hope this guide has helped explain the steps to setting up a limited liability partnership company and the benefits of doing so. With these tips, you should be well on your way to creating a successful business with limited liability for its partners. While there are plenty of decisions to make when launching a new business venture, having a solid foundation as provided by an LLP can help ensure its success. Consider consulting an attorney or financial advisor if you want more guidance while making your way through the legal aspects of forming an LLP. Good luck!

#llp#llp registration#limited liability partnership#limited liability partnership company#llp registration consultant#llp registration in india#online llp registration#limited liability company

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

Financial Consultant

Get your company registered.

By the best professionals

-Company Registration

-GST Registration

-Annual Compliance

-Tax Advisory

-Accounting

-Trademark Registration

Get it done today !

#LLP Registration#Private limited registration#One person company registration#Company Registration in India#Online Accounting services#VCFO services#GST Registration#Online GST registration#Accounting for Startups#Tax and Accounting services#15ca and 15cb#Stock audit#Bank audit#Valuation services#Income tax preparation near me

1 note

·

View note

Text

If LLP or Limited Liability Partnership is your preferred business structure, we shall assist you in that regard as well. The liability of the partners varies here.

#LLP Registration Online#Limited Liability Partnership India#LLP Company Registration Online#Eazystartups#India

0 notes

Text

How to register a limited liability partnership online in India

You can register LLP online through Companies Next. While we make LLP registration a simple step process for you, the actual registration process is elaborate and is explained for your click here - https://bit.ly/3RX1nhc

#limited liability partnership registration in India#limited liability partnership registration online in India#llp registration in India#llp company registration in India#llp registration online in India

0 notes

Text

#legalzone#Legal Zone#Legal Zone India#Legal Zone Trading#Talk to CA#GST registration#Private Limited Company Registration Online#Limited Liability Partnership registration#LLP Registration In India#One Person Company registration#One Person Company (OPC) Registration#FSSAI Licence registration#FSSAI Registration Online#Shop and Establishment Registration#Shop and Establishment Registration in India#MSME Registration in India#MSME Registration Online#UDYAM registration online#Import Export Code Registration in India#Import Export Code Registration#Digital Signature Certificate Service Online India#Digital Signature Certificate Service#Trademark Hearing#Trademark Registration Online in India#Trademark Registration Service#Trademark Renewal in India#Trademark Renewal Online in India#Professional Logo Designing Service in India#Professional Logo Designing Service#Trademark Objection Reply Draft In India

1 note

·

View note

Text

How to do LLP registration in India

Online registration LLP facility is available in India. You must, therefore, electronically approve the documents required for LLP registration online. With a digital signature, you can authenticate any documents that you upload online. Since the process is online, you must visit an LLP portal and register as a new user. The Form 1 application for LLP registration in India is used to reserve the LLP's name. Form 2 is used for the LLP's incorporation and subscriber statement. After the ministry has approved both forms, you have 30 days from the date of LLP registration to file the initial LLP agreement. It has to be delivered utilising Form 3. As soon as your Online LLP Registration has been formally registered, you can start running your business.

LLP Registration Online process:

An LLP's name must be distinct and cannot be identical to or misleadingly similar to the name of any other registered or unregistered company, LLP, or trademark. The partners' liability in an LLP is limited to the amount of their investment.

Since it is a distinct legal entity and juristic person, an LLP can sue and be sued separately from its partners. Even after a partner dies, the LLP continues to operate. Furthermore, an LLP's ownership can be easily transferred to a different party; however, the recipient must be admitted as an LLP-designated partner.

To do LLP Company Registration, the enterprise must be a separate legal entity and body corporate from its partners. It will continue indefinitely. The LLP form is a type of business model that is organised and operates on the basis of an agreement, allowing for flexibility without imposing detailed legal and procedural requirements. Furthermore, LLP Registration Online enables professional expertise and initiative to be combined with risk-taking financial capacity in a novel and efficient manner.

Documents required for online LLP registration in India

The Partners' PAN cards

The Partners' Identification proof

Address proof of all the partners

Ids with the partners' photos

The partners' passports (if the partners are either foreign nationals or (NRIs)

Evidence of the registered office's address

DSC (Digital Signature Certificate)

Online LLP registration for a Business

2008 saw the start of LLP registration in India. This has quickly gained popularity among small businesses because it has a lower registration fee and some compliance requirements than a private limited company. Prior to November 2015, LLP registration and investment in India were time-consuming processes. As a result, NRIs and foreign nationals preferred company formation over LLP formation. However, since the November 2015 relaxation of FDI regulations, NRIs and foreign nationals can now easily do online LLP Registration. It is regarded as the best investment strategy for starting a small business in India, according to the FDI policy.

Since an LLP registration in India contains elements of both a "corporate structure" and a "partnership firm structure," it is referred to as a "hybrid" between a company and a partnership. The duties and mutual rights of the partners in an LLP are governed by an agreement among the partners or between the partners and the LLP, as the case may be. The LLP Company Registration, on the other hand, is not released from liability for its other obligations as a separate entity.

Changes in partners won't stop the Limited Liability Partnership (LLP) from continuing to exist. It has the legal authority to hold property in its own name and to enter into contracts. Even though the LLP is a distinct legal entity and is accountable for all of its assets, the partners' liability is only as great as their agreed-upon share of the LLP's assets. Additionally, no partner is responsible for the independent or unauthorised actions of other partners; as a result, each partner is exempt from joint liability resulting from the bad judgment or misconduct of another partner.

Foreign Limited Liability Partnership structure

Various Gulf nations, Australia, Singapore, the United Kingdom, and the United States of America all offer the Limited Liability Partnership (LLP) structure. The LLP Act is largely based on the UK LLP Act 2000 and Singapore LLP Act 2005, according to experts who have researched LLP laws in various nations. Both of these Acts permit the formation of LLPs in the corporate body form, that is, as a distinct legal entity from its partners or members.

The distinction between a Traditional Partnership Firm and an LLP

Every partner in a "traditional partnership firm" is responsible for the firm's actions, both jointly and severally, with the other partners. At the same time, the liability of a partner is capped by his agreed-upon contribution in a Limited Liability Partnership (LLP) structure. Additionally, no partner is responsible for the independent or unauthorized actions of other partners, protecting each partner from joint liability brought on by the wrongdoing or misconduct of another partner.

The distinction between a LLP and a Company

The internal administrative structure of a company is governed by statute (i.e., the Companies Act, 1956), whereas a Limited Liability Partnership (LLP) would be by a deal agreement between partners. This is a fundamental distinction between an LLP and a joint stock company.

A firm that has done Online LLP Registration will be subject to fewer compliance requirements than companies.

Compared to a company, an LLP will be more flexible.

A firm that has done Online LLP Registration does not have the ownership-management split that exists in a company.

0 notes