#annual compliance of private limited company

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

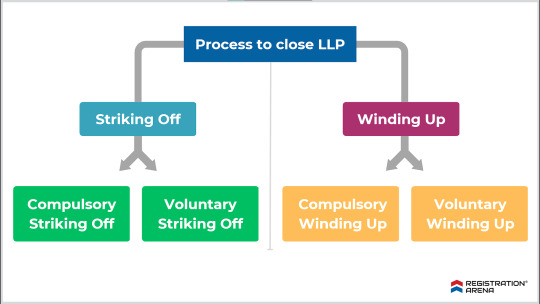

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Annual Compliances of Private Limited Companies| Annual Compliances of Private Limited services

Mycompanywala.com presents the best package for annual compliances of private limited companies, covering ROC compliances, CA audit advisory, and CS corporate law advisory. For queries, call us at 770-3833-927.

Annual Compliances of Private Limited Companies

https://www.mycompanywala.com/annual-compliances-for-private-limited.php

#Annual Compliances of Private Limited Companies#Annual Compliances for Section 8 Company#Annual Compliances for Producer Company

0 notes

Text

ROC Compliance for Private Limited Company

Ensure smooth ROC compliance for Private Limited Company with Legal Pillers. Expert assistance ensures seamless documentation and adherence to regulations. Trust them for reliable ROC compliance services, ensuring good standing with government authorities and smooth business operations. Visit their website for more details.

0 notes

Text

#annual compliance for private limited company#compliances for private limited company#private limited company compliances#annual compliances for private limited company

0 notes

Link

The company's board of directors and shareholders can communicate with one another through this filing. The form also provides shareholders with information regarding their investments and discloses all financial transactions made during the fiscal year. Additionally, this formality must be completed within 30 days of the annual general meeting. The following ought to be mentioned...

#annual filing of private limited#private limited compliance#pvt ltd company annual compliance#mandatory compliance for private limited company#Company Annual Compliance for Startups#Annual Compliance of Pvt Ltd Company#Private Limited Company Annual Compliance

0 notes

Text

#Annual Compliances for Private Limited Company#Annual Compliance for Startups#Annual Compliance for Startup Company

0 notes

Text

youtube

Business Name:

Company Registration in Mumbai - Virtual Auditor

Street Address:

Office No 2 , Workafella Business Centre AK Estate, Off Veer Savarkar Flyover, SV Rd, Goregaon West

City:

Mumbai

State:

Maharashtra

Zip Code:

400062

Country:

INDIA

Business Phone:

077000 89597

Website:

https://virtualauditor.in/

Business Description:

Company Registration in Mumbai - GST Registration in Mumbai, Valuation services and business valuation

Company Registration in Mumbai process it with you experts Virtual Auditor. Leading Business Setup Firm in Mumbai. Virtual Auditor is India's largest online business advisory services platform dedicated to helping people easily start and grow their business, at an affordable cost. #1 Company Registration Service in Mumbai. We provide all registration services starting form company registration in Mumbai,Income Tax filing services, Digital Service Certificates, We are experts in business valuation and start up valuation we are firm of registered Valuers

Our team specialized in Business advisory Services and best business set up services.

Google My Business CID URL:

https://www.google.com/maps?cid=8657467965498112244

Business Hours:

Sunday Closed

Monday 10am-7pm

Tuesday 10am-7pm

Wednesday 10am-7pm

Thursday 10am-7pm

Friday 10am-7pm

Saturday 10am-7pm

Services:

Company Registration, TAX Filing, Accounting, Annual Compliances

Keywords:

Company Registration in Mumbai, private limited company registration in mumbai, pvt ltd company registration in mumbai, online company registration in mumbai, registration of company in mumbai

Yearly Revenue:

50,000-100,000

Location:

Service Areas:

2 notes

·

View notes

Text

Benefits of LLP Registration in India

The following are the benefits of LLP Registration in India:

1. Low Cost and Less Compliance:

The overall cost of establishing a Limited Liability Partnership is low compared to the cost of registering a Private or Public Limited Company in India. The compliances to be followed by the LLP are also low. The LLP needs to file only 2 Statements yearly (i.e., an Annual Return and a Statement of Accounts and Solvency.

2. Liabilities are limited:

Limited Liability Partnership provides a limited liability benefit to all the designated partners. In case of s business insolvency or loss, the partners’ liability is restricted to the capital contribution as per the LLP agreement. Moreover, one partner is not held responsible for the actions of negligence/misconduct of any other partner.

3. Separate Legal Existence:

Just like a Company, an LLP has a separate legal entity. The Limited Liability Partnership is different from its partners. An LLP in India can sue & be sued in its own name. The Contracts are signed in the name of the Limited Liability Partnership (LLP) which helps to gain the trust of various stakeholders & gives the customers and suppliers a sense of confidence in the business.

4. Tax Benefits:

It is also exempted from various taxes like DDT (Dividend Distribution Tax) & Minimum Alternative Tax. The tax rate on LLP is less than that of the Company.

5. No Minimum Capital:

For the LLP formation in India, no minimum capital is required. No minimum capital contribution is required from partners. An LLP can be incorporated even with Rs. 2000 as a total capital contribution.

What are the Features of an LLP in India?

The following are the features of an LLP in India:

It’s a body corporate & legal entity separate from its members;

The members of an LLP have a limited liability, limited to their agreed contribution to the LLP;

It has the organizational flexibility of a Partnership;

It has a perpetual succession, it continues to exist even after the founding partners leave the organization. All it requires is to have at least 2 partners;

Its accounting & filing requirements are similar to that of a Company;

Less compliance and regulations;

No requirement for minimum capital contribution;

At least one partner must be a resident of India;

There is no upper limit on the maximum number of Partners.

0 notes

Text

The Board Stanbic IBTC Plc will seek shareholders’ approval to establish a Debt Issuance Programme of up to ₦400 billion to issue diverse debt securities through various methods and terms, subject to the grant of all required approvals from the relevant regulatory authorities.

This was contained in the group’s notice of the Annual General Meeting seen by Nairametrics.

According to the notice, the company will also request that the directors are authorized to execute all necessary agreements and engage professional parties for the Company’s N400 billion Programme, including compliance with regulatory directives.

Additionally, to seek endorsement for ordinary resolution granting the Directors authority, contingent upon regulatory approval and Clause Seven of the Company’s Memorandum of Association, to raise additional equity capital of up to N150 billion via a Rights Issue or offer for subscription, with terms to be determined by the Directors.

The statement reads:

“That subject to receipt of any required regulatory approvals and pursuant to Article One of the Company’s Articles of Association, the Directors be and are hereby authorised to establish a Debt Issuance Programme (the “Programme”) in an amount of up to ₦400,000,000,000 (four hundred billion naira) or such foreign currency equivalent thereof as the Directors may consider appropriate, for the purpose of issuing debt securities (to include senior unsecured or secured, subordinated, convertible, preferred, equity linked or such other forms of debt obligations) by way of public offering, private placement, additional tier one or tier two capital raising, investments, book building process or any other method, in tranches of such amounts and at such dates, coupon or interest rates and upon such terms and conditions as may be determined by the Directors, subject to the grant of all required approvals from the relevant regulatory authorities

That the Directors be and are hereby authorised to enter into and execute all such agreements, deeds, notices and documents as may be necessary for or incidental to the Company’s ₦400 billion Programme and the Directors are also authorised to appoint all such professional parties necessary for or incidental to, the actualisation of the Programme, including, without limitation, complying with the directives of any regulatory authority.”

To consider and if thought fit pass the following sub-joined resolutions as an ordinary resolution: 9.1 “That subject to receipt of any required regulatory approvals and pursuant to Clause Seven of the Company’s Memorandum of Association: a. The Directors be and are hereby authorised to raise additional equity capital of up to ₦150,000,000,000 (One Hundred and Fifty Billion Naira) by way of a Rights Issue or offer for subscription on such terms, tranches, conditions and dates as may be determined by the Directors.

In the event of an under-subscription to any Rights Issue or Offer for Subscription, the Directors are authorised to offer the unsubscribed shares first to interested existing shareholders; and where following such offer, any portion of the shares, remain unsubscribed, then the Directors are hereby authorised to offer such unsubscribed shares that may be outstanding, to interested investors on similar terms to the Rights Issue or Offer for subscription”.

At the upcoming AGM, the shareholders will also have the opportunity to consider and pass the following special resolutions:

That in accordance with Article Six of the Company’s Articles of Association, the Board of Directors (“the Board”) be and unconditionally authorised to exercise the power conferred on them by Article Six of the Company’s Articles of Association as may from time to time be varied so that, to the extent and in the manner determined by the Directors, the holders of ordinary shares in the Company may be permitted to elect to receive new ordinary shares in the Company, credited as fully paid, instead of the whole or any part of any cash dividends (including interim div...

View On WordPress

0 notes

Text

Unveiling the Ultimate Guide to Company Incorporation in India

Embarking on the journey of company incorporation in India can be both exhilarating and daunting. As a burgeoning entrepreneur, you're poised to delve into the vast opportunities that the Indian market presents. However, the complexities of legal frameworks, bureaucratic procedures, and regulatory compliance might seem like formidable obstacles on your path to establishing your business entity.

Understanding Company Incorporation: A Comprehensive Overview

What is Company Incorporation?

Company incorporation is the process through which a business entity obtains legal recognition as a separate and distinct entity from its owners. In the context of India, it involves registering a company under the provisions of the Companies Act, 2013, with the Ministry of Corporate Affairs (MCA).

Types of Companies in India

India offers various forms of business structures, each with its own set of advantages and requirements. These include:

Private Limited Company: Ideal for small to medium-sized enterprises, offering limited liability protection and ease of ownership transfer.

Public Limited Company: Suited for larger enterprises seeking to raise capital from the public through the sale of shares.

One Person Company (OPC): Allows sole proprietors to operate as a separate legal entity, providing limited liability.

Key Steps in Company Incorporation

Name Reservation: Selecting a unique name for your company and obtaining approval from the Registrar of Companies (ROC).

Drafting Memorandum and Articles of Association: Defining the company's objectives, rules, and regulations governing its operations.

Filing Incorporation Documents: Submitting necessary documents, including the Memorandum and Articles of Association, with the ROC.

Obtaining Certificate of Incorporation: Upon successful review of documents, the ROC issues a Certificate of Incorporation, signifying the legal existence of the company.

Regulatory Compliance and Post-Incorporation Obligations

Once incorporated, companies in India must adhere to various regulatory and compliance requirements, including:

Tax Registration: Obtaining Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Goods and Services Tax (GST) Registration: Mandatory for businesses with annual turnover exceeding specified thresholds.

Annual Filings: Filing annual returns, financial statements, and other requisite documents with the MCA.

Advantages of Incorporating in India

Limited Liability Protection

One of the most significant benefits of company incorporation is the limited liability protection it offers to shareholders. This means that the personal assets of shareholders are safeguarded against business liabilities, reducing financial risk.

Access to Funding and Investment Opportunities

Incorporated companies have access to a wider pool of funding options, including bank loans, venture capital, and equity financing. Moreover, the credibility associated with a registered business entity enhances investor confidence and facilitates fundraising efforts.

Legal Recognition and Prestige

Operating as a registered company instills trust and credibility among customers, suppliers, and stakeholders. It reflects professionalism and commitment to regulatory compliance, thereby enhancing the brand reputation and market positioning of the business.

Conclusion: Embark on Your Entrepreneurial Journey with Confidence

In summary, company incorporation in India is a pivotal step towards realizing your entrepreneurial aspirations. By understanding the intricacies of the incorporation process, adhering to regulatory compliance, and leveraging the myriad benefits it offers, you can establish a strong foundation for your business venture in the dynamic Indian market.

0 notes

Text

Which is a better OPC or Pvt. Ltd. company in Ghazipur?

Choosing between an OPC (One Person Company) and a Pvt. Ltd. (Private Limited Company) depends on your specific business needs, objectives, and circumstances. Here are some key differences between the two to help you make an informed decision:

Ownership:

OPC: Owned by a single person.

Pvt. Ltd.: Owned by multiple shareholders.

Minimum Requirement:

OPC: Requires only one director and one nominee.

Pvt. Ltd.: Requires a minimum of two directors and two shareholders.

Liability:

OPC: Limited liability protection to the owner.

Pvt. Ltd.: Limited liability protection to shareholders.

Compliance and Regulation:

OPC: Less stringent compliance requirements compared to Pvt. Ltd.

Pvt. Ltd.: More compliance requirements, including annual filings, board meetings, and shareholder meetings.

Growth and Expansion:

OPC: Limited to a turnover of up to Rs. 2 crore in three consecutive years.

Pvt. Ltd.: Suitable for businesses with high growth potential and seeking external investment.

Cost:

OPC: Generally lower initial setup and maintenance costs.

Pvt. Ltd.: Higher setup and operational costs due to increased compliance and regulatory requirements.

Credibility and Perception:

OPC: May be perceived as less established compared to Pvt. Ltd.

Pvt. Ltd.: Often considered more credible and trustworthy due to the involvement of multiple shareholders.

Considering the specific needs and objectives of your business in Ghazipur, you should evaluate these factors carefully. If you want more flexibility and are looking for a simpler business structure with fewer compliance requirements, an OPC might be suitable. On the other hand, if you plan to scale your business, attract external investment, and establish a more credible business image, a Pvt Ltd. company could be a better choice.

Choose Vakilkaro for private limited company in Ghazipur

Do you want to your private limited company registration in Ghazipur? Choose Vakilkaro for a seamless and hassle-free experience. With our expert guidance, you can easily navigate the complexities of Private Limited Company Registration. Trust lawyers to handle all your legal needs efficiently. To get business advice, contact Vakilkaro team today on this number (9828123489).

#company in india|#top mlm company in india#which cement is best for house construction#ultratech super cement is opc or ppc#best mlm company#company utrakhand#company wrong young fashion value marketing#wrong company#direct company se cement kaise kharide#what is difference between rtgs and neft#how many percentage of gypsum is available in ultratech super cement#what is overhead water tank#what is overhead water tank and its construction

0 notes

Text

Formation of Wholly Owned Subsidiary In India

A Wholly Owned Subsidiary refers to a company whose shares or voting rights are totally owned by the parent company.

A Wholly Owned Subsidiary (WOS) is distinct from a subsidiary since the former signifies that the parent company holds 100% of the whole shares or voting rights, while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

In India, a Private Limited company can be established by Foreign companies to conduct business or invest, which would be considered a Wholly Owned Subsidiary. However, this is subject to government regulations on Foreign Direct Investment (FDI) and other applicable provisions.

Requirements of Wholly Owned Subsidiaries

At least one director to be a resident of India: A Wholly Owned Subsidiary company must have at least one director who is a resident of India.

The term "resident" refers to an individual director who has lived in India for an equivalent of or more than 182 days in the preceding year.

No Minimum Capital: As per MCA guidelines, there is no minimum capital required to create the company.

Minimum one shareholder (and nominee) and 2 directors: As per Section 3(1)(b) of the Companies Act, 2013, it is crucial for every company to have at least one shareholder and one nominee shareholder, along with a minimum of two directors.

How to Form a Wholly Owned Subsidiary in India

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

Retain Original Name: The foreign company can decide to keep its original name for the subsidiary in India to carry forward its goodwill.

Add India as a Suffix: The foreign company can add India as a suffix to its original name to indicate its status as a subsidiary in India.

Use Registered Trademark: If the foreign company has a registered trademark in another country, it can use the same trademark for the subsidiary in India.

Choose a New Name: The foreign company can also pick a new name for the subsidiary if it wishes to do so.

Read more to know about the formation of WOS in India

#wholly owned subsidiary#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal consultation#legal services

0 notes

Text

How do I choose a business structure when applying for company registration?

Before settling on the appropriate business structure for your company registration, it's essential for every entrepreneur to ponder over the following key considerations:

Number of Partners or Members: Entrepreneurs must decide whether they prefer sole ownership or partnership. Single owners or those who wish to retain control over their ideas often lean towards sole proprietorship or One Person Company (OPC). Conversely, businesses with multiple members tend to be perceived as more structured and trustworthy by investors.

Initial Capital Investment: If an individual aims to minimize initial expenses, options like sole proprietorship or partnership can be advantageous, as they typically entail fewer tax obligations and initial registration costs compared to other structures like corporations.

Liability and Personal Risk Management: The level of risk associated with a business hinges on its legal structure. Entities like Hindu Undivided Family (HUF) and partnership firms entail unlimited liabilities, whereas Limited Liability Partnerships (LLPs), Private Limited Companies (Pvt. Ltd.), and Public Limited Companies (PLCs) offer limited personal risk and liability.

Taxation Framework: Entrepreneurs should thoroughly grasp the tax implications of different business structures before proceeding with registration, as tax burdens can vary significantly across structures.

Registration and Ongoing Costs: While the initial registration fees are fairly uniform across most business structures under the Companies Act of 2013, sole proprietorship firms typically incur lower registration costs. Additionally, ongoing maintenance expenses, such as annual compliance fees, can vary depending on the chosen structure.

Access to Investment: Securing investment is vital for business growth, and having an appropriate business structure can facilitate this process. Well-established structures often instill confidence in investors and lenders, making it easier to attract funding or obtain loans.

0 notes

Text

Navigating the Seas of Private Limited Annual Compliance: Ensuring Stability and Growth

In the realm of business, navigating the seas of Private Limited (Pvt Ltd) Annual Compliance is crucial for ensuring stability and fostering growth. it is an unavoidable journey that every Pvt Ltd company must undertake to avoid legal consequences. Pvt Ltd Company compliance, particularly concerning the Registrar of Companies (RoC), plays an important role in maintaining legality and transparency in operations. Annual Compliance, a cornerstone of Pvt Ltd Company RoC compliance, demands attention to detail and adherence to regulatory requirements. You can read through to understand the complexities of Annual Compliance and how Pvt Ltd companies can leverage online platforms for streamlined processes.

What is Pvt Ltd Company compliance?

Let us begin with the basic understanding. A Pvt Ltd Company compliance is essential for businesses seeking to uphold legal standards and operational integrity. Compliance with RoC regulations ensures the legitimacy and credibility of Pvt Ltd companies in the eyes of stakeholders and regulatory authorities. Annual Compliance encompasses various obligations, including filing annual returns, financial statements, and other essential documents with the RoC.

Key Takeaways - Pvt Ltd Company Compliance:

Following Rules: Pvt Ltd companies need to follow rules set by the government to stay legal and trustworthy.

Doing Things Right: Compliance helps Pvt Ltd companies do things right, so people can trust them.

Making People Happy: When Pvt Ltd companies follow rules, people like investors and customers feel happy and trust them more.

Doing Paperwork: Pvt Ltd companies have to do paperwork like filing forms and financial papers with the government.

Being on Time: Pvt Ltd companies need to do paperwork on time to avoid getting in trouble.

Using the Internet: Pvt Ltd companies can use the Internet to do paperwork, making things easier and faster.

Getting Help: If Pvt Ltd companies need help with paperwork, they can ask experts to help them.

Keeping an Eye: Pvt Ltd companies need to keep watching rules and making sure they're following them.

Growing Strong: Following rules helps Pvt Ltd companies become stronger and grow better over time.

In today's digital age, Pvt Ltd Company RoC compliance online has revolutionized the compliance landscape, offering convenience and efficiency. Online platforms provide user-friendly interfaces for filing documents, tracking deadlines, and receiving notifications, simplifying the compliance journey for Pvt Ltd companies. Timely compliance is important for Pvt Ltd companies to avoid penalties, fines, or legal actions. Adhering to deadlines reflects organizational discipline and responsibility, contributing to the overall stability and reputation of the company.

One of the significant benefits of leveraging online platforms for Pvt Ltd Company Annual Compliance is the reduction of paperwork and administrative burden. By embracing technology-driven solutions, Pvt Ltd companies can streamline compliance processes, minimize errors, and enhance efficiency also with the help of professional compliance consultants in the market like the team Valcus based in Delhi, India.

Pvt Ltd Company RoC Compliance - At a Glance

Now let us have a glance at the Pvt Ltd Company RoC Compliance. It will help enhance your knowledge and make better decisions.

What does it mean?

Pvt Ltd Company RoC compliance is about following rules set by the government's Registrar of Companies (RoC).

Why Important?

It's important because it keeps Pvt Ltd companies legal and trustworthy.

What to Do?

Pvt Ltd companies need to do paperwork like filing forms and financial documents with the RoC.

Being on Time:

Doing this paperwork on time is crucial to avoid getting into trouble.

Using Technology:

Pvt Ltd companies can use online platforms to do this paperwork, which makes things quicker and easier.

Getting Help:

If Pvt Ltd companies need assistance with this paperwork, they can seek help from experts.

Staying Updated:

Companies should keep an eye on any changes in the rules to ensure they're always following them correctly.

Ensuring Growth:

Following RoC compliance helps Pvt Ltd companies stay strong and grow steadily.

Remember, navigating Annual Compliance may pose challenges, including understanding regulatory changes and staying updated on filing requirements. Seeking professional assistance from consultants specializing in Pvt Ltd Company compliance can provide invaluable support and guidance. Keep in mind that continuous monitoring and adaptation are key to ensuring long-term compliance success for Pvt Ltd companies. Regular audits, staying informed about regulatory updates, and proactive adaptation to changes are essential practices for maintaining compliance and fostering growth.

Why choose Valcus in Delhi for Pvt Ltd Company compliance & Annual Compliances?

Choosing Valcus in Delhi for Pvt Ltd Company compliance, including RoC compliance and Annual Compliance, offers numerous benefits. Valcus specializes in providing comprehensive services to ensure that Pvt Ltd companies meet all regulatory requirements, maintaining legality and operational integrity.

Firstly, the team at Valcus has extensive expertise in Pvt Ltd Company compliance, with a deep understanding of the regulatory landscape. This expertise ensures that all compliance processes, including RoC compliance and Annual Compliance, are handled efficiently and accurately.

Secondly, we provide dedicated support tailored to the specific needs of Pvt Ltd companies. Our team of experts guide you through every step of the compliance process, offering personalized assistance and ensuring that all regulatory obligations are fulfilled promptly.

Thirdly, Valcus leverages technology to streamline compliance processes, including RoC compliance and Annual Compliance. By utilizing our website, you can gather information on our different services and company registration services. We help you simplify document submission, deadline tracking, and communication, making compliance management more efficient and accessible for Pvt Ltd companies.

Additionally, we also provide transparency and clarity in our service charges, ensuring that our clients know exactly what to expect without any hidden costs or surprises. This transparent approach builds trust and confidence among clients, further enhancing the overall compliance experience.

Furthermore, we stay up-to-date with regulatory changes and updates, ensuring that Pvt Ltd companies remain compliant with evolving requirements. This proactive approach minimizes the risk of non-compliance and helps our clients avoid penalties or legal issues. Moreover, we also offer dedicated client support and after-sales service.

Understanding the complexities of Private Limited Annual Compliance is crucial for building a strong foundation for stability and success. By recognizing the importance of compliance, adopting technology-driven solutions, and seeking guidance from experts, Pvt Ltd companies can confidently go through the compliance process. Diligence, adaptability, and utilizing online resources are essential elements for navigating these seas effectively. Abiding by these principles not only ensures stability but also sets the stage for sustained growth. In conclusion, Pvt Ltd companies can secure their future by prioritizing compliance, leveraging technology, and seeking professional assistance when needed, thus paving the way for long-term prosperity and sustainability. Choosing Valcus in Delhi for Pvt Ltd Company compliance, including RoC compliance and Annual Compliance, ensures efficiency, accuracy, and peace of mind. With our expertise, dedicated support, satisfactory solutions, transparent pricing, and proactive approach to compliance, Valcus is the ideal partner for Pvt Ltd companies seeking reliable and comprehensive compliance services. Connect with us anytime for a highly satisfactory and professional solution to your various business registration, compliance, and other needs.

1 note

·

View note

Photo

Corpseed agency is one of the best annual compliance companies. Mandatory annual compliances are made easy at Corpseed. We file documents for statutory compliance and annual returns for your business. If you want startup annual compliance companies you contact compliance for private limited company at 7558640644. We are available 24*7 for your help...

#private limited company annual return filing#compliance for private limited company#annual filing of private limited#private limited compliance#pvt ltd company annual compliance#mandatory compliance for private limited company#Company Annual Compliance for Startups#Annual Compliance of Pvt Ltd Company#Private Limited Company Annual Compliance#Annual Compliances For Private Limited Company#annual compliance certificate#annual compliance services#annual compliance

0 notes

Text

Private Limited Company Registration in Delhi, India

Demystifying the Private Limited Company Registration Process

Embarking on the journey of entrepreneurship often begins with the crucial step of company registration. Among the various business structures available, the private limited company stands out for its distinct advantages in terms of limited liability, separate legal identity, and scalability. Understanding the registration process is essential for aspiring business owners looking to establish a private limited company. Let's demystify the steps involved:

Name Reservation:

The first step in registering a private limited company in India is selecting a unique name that complies with regulatory guidelines. The name should not infringe upon existing trademarks and must adhere to specified naming conventions. Once chosen, the name can be reserved through the online portal of the Registrar of Companies (ROC).

Obtaining Digital Signatures:

Digital signatures are required for filing various documents during the registration process. Directors and subscribers of the company must obtain Digital Signature Certificates (DSC) from authorized agencies to digitally sign the incorporation documents.

Preparation of Documents:

Several documents are necessary for private limited company registration in India, including the Memorandum of Association (MOA) and Articles of Association (AOA), consent and declarations from directors, and address proofs. These documents need to be prepared and notarized before submission.

Filing Application with ROC:

Once the necessary documents are in order, the application for company registration can be filed with the ROC. The application includes details such as the company's registered office address, share capital, and director information. Upon verification, the ROC issues the Certificate of Incorporation, marking the formal establishment of the company.

Obtaining PAN and TAN:

Following incorporation, the company must apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the respective authorities. These identifiers are essential for tax compliance and financial transactions.

Compliance with Statutory Requirements:

Post-registration, the company must fulfill various statutory requirements, including maintaining books of accounts, conducting board meetings, and filing annual returns with the ROC. Compliance ensures adherence to regulatory norms and sustains the company's legal standing.

Navigating the private limited company registration process demands meticulous planning, adherence to regulatory guidelines, and a clear understanding of legal obligations. By following these steps diligently, aspiring entrepreneurs can establish a robust foundation for their business endeavors and embark on the path to success.

For More Information >> Click Here

#Private Limited Company Registration in Delhi#private limited company registration process#private limited company registration in India

0 notes