Photo

The Central Drugs Standard Control Organization (CDSCO registration) is the regulatory authority in India for pharmaceuticals and medical devices. Any person or entity involved in the manufacture, distribution, import, or sale of drugs or import license for medical devices in India must obtain a license from CDSCO.

#cdsco cosmetic registration#cdsco chennai#cdsco online application form#cdsco certification#adc noc for export#cdsco medical device manufacturing license#Form-43#cdsco ahmedabad#adc noc#cdsco mumbai

0 notes

Link

The Central Drugs Standard Control Organization CDSCO license is the regulatory authority in India for pharmaceuticals and medical devices. Any person or entity involved in the manufacture, distribution, import, or sale of drugs or import license for medical devices in India must obtain a license from CDSCO.

#cdsco registration certificate#cdsco kolkata#import of medical devices in india#adc noc for import#cdsco approval#cdsco license#cdsco test license#form 42 cdsco#Form MD-3#form 40 cdsco#Form MD-14

0 notes

Text

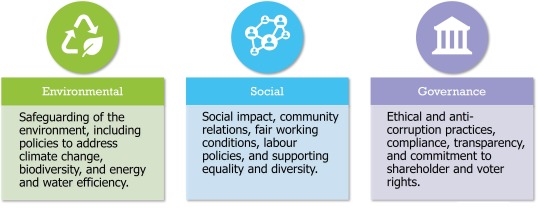

What is ESG sustainability Investing?

ESG sustainability investing, also known as environmental, social, and governance investing, is an investment approach that takes into consideration environmental, social, and governance factors when evaluating the performance and sustainability of companies or assets. ESG factors are considered alongside traditional financial factors to assess a company's overall sustainability and its impact on society and the environment.

Here's a brief overview of the three components of ESG sustainability investing:

Environmental: This considers a company's impact on the environment, including its carbon footprint, resource usage, waste management, pollution, and other environmental risks and opportunities. It assesses how a company manages and mitigates its environmental impacts and its efforts towards sustainability and environmental stewardship.

Social: This focuses on a company's relationships with its employees, customers, communities, and other stakeholders. It considers factors such as labor practices, human rights, diversity and inclusion, community engagement, product safety, and social impacts. It evaluates how a company manages its social responsibilities and contributes positively to society.

Governance: This looks at a company's leadership, management, and governance practices. It assesses factors such as board composition, executive compensation, shareholder rights, transparency, and accountability. Good governance is seen as crucial for long-term sustainability, as it helps ensure ethical decision-making and responsible management practices.

ESG sustainability investing aims to generate positive financial returns while also considering the environmental, social, and governance impact of investments. It is based on the belief that companies with strong ESG performance are more likely to be resilient, sustainable, and better positioned to manage risks and capture opportunities in the long run. ESG sustainability investing has gained popularity in recent years as investors seek to align their investments with their values and contribute to a more sustainable and equitable world.

How ESG reporting can help investors and the companies?

ESG reporting, or the practice of disclosing a company's performance and practices related to environmental, social, and governance factors, can benefit both investors and companies in several ways:

Better decision-making for investors: ESG reporting provides investors with relevant data and information to assess a company's sustainability performance and risks. This helps investors make more informed investment decisions, identify companies that align with their ESG preferences or values, and integrate ESG considerations into their investment strategies. ESG reporting can also help investors identify potential risks and opportunities related to environmental, social, and governance factors that may impact a company's financial performance in the long term.

Enhanced risk management for companies: ESG reporting can help companies identify and manage ESG risks and opportunities, including environmental risks such as climate change or resource scarcity, social risks such as labor practices or community relations, and governance risks such as board effectiveness or executive compensation. By disclosing this information, companies can proactively manage ESG risks, develop strategies to mitigate them, and demonstrate their commitment to responsible and sustainable business practices.

Improved stakeholder engagement for companies: ESG reporting facilitates communication and engagement with stakeholders such as investors, customers, employees, regulators, and communities. By disclosing ESG performance, companies can engage in meaningful dialogues with stakeholders, address concerns, and build trust. This can lead to better stakeholder relationships, improved reputation, and increased access to capital and market opportunities.

Enhanced long-term performance for companies: Companies with strong ESG performance are more likely to be sustainable in the long run. ESG reporting can help companies set goals, measure progress, and demonstrate their commitment to sustainability and responsible business practices. Companies that prioritize ESG factors may also attract investors who value sustainability and responsible investing, which can positively impact their access to capital and valuation over the long term.

Regulatory compliance: ESG reporting is increasingly being mandated by regulators in many jurisdictions, which requires companies to disclose their ESG performance. By complying with these regulations, companies can avoid legal and reputational risks and demonstrate their commitment to transparency and accountability.

In summary, ESG reporting in India can benefit investors by providing them with relevant information for decision-making, and companies by helping them manage risks, engage with stakeholders, improve performance, and comply with regulations. It promotes transparency, accountability, and sustainability, benefiting both investors and companies in the long term.

What is the importance of ESG sustainability Investing?

ESG sustainability investing is important for several reasons:

Addressing pressing global challenges: ESG sustainability investing recognizes the urgent need to address pressing global challenges such as climate change, social inequality, and corporate governance failures. By integrating environmental, social, and governance factors into investment decisions, it can contribute to addressing these challenges and promoting more sustainable and responsible business practices.

Promoting sustainability and positive impact: ESG sustainability investing encourages companies to adopt sustainable practices that consider their impact on the environment, society, and governance. This can drive positive change by promoting responsible resource management, reducing greenhouse gas emissions, fostering social inclusion and diversity, and enhancing corporate governance and transparency.

Mitigating risks and capturing opportunities: ESG sustainability investing acknowledges that companies face risks and opportunities related to environmental, social, and governance factors that can impact their long-term financial performance. By considering these factors in investment decisions, investors can better understand and mitigate risks, as well as identify opportunities for sustainable growth and value creation.

Aligning investments with values and stakeholder preferences: ESG sustainability investing allows investors to align their investments with their values and stakeholder preferences. It provides an avenue for investors to incorporate ethical, social, and environmental considerations into their investment decisions, reflecting their broader interests beyond financial returns. This can help investors achieve their financial goals while also supporting companies that are aligned with their values.

Enhancing stakeholder engagement and accountability: ESG sustainability investing promotes transparency, accountability, and stakeholder engagement. By encouraging companies to disclose their ESG performance, it fosters greater transparency and accountability, and enables stakeholders such as investors, customers, employees, and communities to hold companies to higher standards of sustainability performance.

Driving long-term sustainable returns: ESG sustainability report investing recognizes that sustainability and financial performance are not mutually exclusive, but rather can be mutually reinforcing. Companies that prioritize ESG factors may be better positioned to manage risks, innovate, and capture opportunities, leading to potential long-term sustainable returns for investors.

Influencing corporate behavior: ESG sustainability investing can serve as a powerful tool to influence corporate behavior. By allocating capital to companies that demonstrate strong ESG performance, investors can incentivize companies to improve their sustainability practices and drive positive change across industries and sectors.

In summary, ESG sustainability investing is important as it promotes sustainability, mitigates risks, aligns investments with values, enhances stakeholder engagement, and has the potential to drive long-term sustainable returns while influencing corporate behavior towards more responsible and sustainable practices.

What is the need of sustainability reporting?

Sustainability reporting is necessary for several reasons:

Transparency and Accountability: Sustainability reporting provides a platform for companies to transparently disclose their environmental, social, and governance (ESG) performance, practices, and impacts. It enables companies to be accountable for their sustainability commitments, actions, and progress, and allows stakeholders such as investors, customers, employees, regulators, and communities to assess a company's sustainability performance and hold it to account.

Stakeholder Communication and Engagement: Sustainability reporting facilitates communication and engagement with stakeholders on ESG matters. It provides a structured way for companies to share information on their sustainability initiatives, goals, progress, and challenges. It allows companies to engage in meaningful dialogues with stakeholders, address concerns, and respond to feedback, fostering trust, and building stronger relationships with stakeholders.

Risk Management and Opportunity Identification: Sustainability reporting helps companies identify and manage ESG risks and opportunities. By disclosing information on ESG performance, companies can identify potential risks such as climate change impacts, supply chain disruptions, regulatory changes, or social controversies, and develop strategies to mitigate them. Sustainability reporting also helps companies identify opportunities for innovation, cost savings, market differentiation, and long-term value creation through sustainable practices.

Performance Measurement and Goal Setting: Sustainability reporting enables companies to measure and track their sustainability performance over time. It provides a framework for setting goals, monitoring progress, and reporting on achievements. This allows companies to benchmark their performance, identify areas for improvement, and drive continuous sustainability performance improvement.

Compliance with Regulations and Standards: Sustainability reporting is increasingly mandated by regulations and standards in many jurisdictions. Companies may be required to disclose their ESG performance and practices to comply with legal requirements or industry-specific standards. Sustainability reporting helps companies meet these regulatory obligations, avoid legal and reputational risks, and demonstrate their commitment to transparency and accountability.

Investor Expectations and Access to Capital: Investors are increasingly incorporating ESG environmental factors into their investment decisions. Sustainability reporting provides companies with an opportunity to disclose their ESG performance, strategies, and goals, which can attract investment from ESG-focused investors. Companies that demonstrate strong ESG performance and transparency may have better access to capital, as investors increasingly prioritize sustainability and responsible investing.

Reputation and Brand Building: Sustainability reporting can enhance a company's reputation and brand image. It demonstrates a company's commitment to responsible and sustainable business practices, which can improve its reputation among stakeholders, customers, and communities. Sustainability reporting can also enhance a company's brand value by showcasing its sustainability initiatives, achievements, and positive impacts.

In summary, sustainability reporting is needed to promote transparency, accountability, stakeholder engagement, risk management, performance measurement, compliance, access to capital, and reputation building. It helps companies demonstrate their commitment to sustainability reporting, manage risks, identify opportunities, and drive positive change, while meeting stakeholder expectations and regulatory requirements.

Read more This Blog :- What is ESG framework and metrics?

#esg investing#esg reporting#sustainability report#esg sustainability#esg financial#esg corporate governance#environment esg#esg consulting#esg reports and ratings#esg environmental social#esg in india#esg governance#esg framework

0 notes

Photo

ESG stands for Environmental, Social, and Governance, and it refers to a framework that evaluates the sustainability and ethical impact of a company or investment. ESG metrics are quantitative and qualitative measures used to assess a company's performance in these areas. Here's a brief overview of each component of the ESG framework:

#esg investing#esg reporting#sustainability report#esg sustainability#esg financial#esg corporate governance#environment esg#esg consulting#esg reports and ratings#esg environmental and social governance#esg environmental social

0 notes

Photo

CDSCO stands for Central Drugs Standard Control Organization. It is the national regulatory authority for pharmaceuticals and medical devices in India. CDSCO md online is responsible for the regulation, approval, and quality control of drugs, cosmetics, medical devices, and diagnostics in the country. It operates under the Ministry of Health and Family Welfare, Government of India.

#cdsco#cdsco online#cdsco md online#cdsco registration#cdsco medical device registration#cdsco new drug approval#import license for medical devices in india#medical device cdsco#cdsco india#Form 42

0 notes

Link

ESG stands for Environmental, Social, and Governance, and it refers to a framework that evaluates the sustainability and ethical impact of a company or investment. ESG metrics are quantitative and qualitative measures used to assess a company's performance in these areas. Here's a brief overview of each component of the ESG framework:

#esg reporting india#esg environmental factors#esg work#esg reporting in india#esg in corporate governance#esg company#esg values#corporate esg#business responsibility reporting#esg strategies for companies

0 notes

Link

CDSCO stands for Central Drugs Standard Control Organization. It is the national regulatory authority for pharmaceuticals and medical devices in India. CDSCO Online is responsible for the regulation, approval, and quality control of drugs, cosmetics, medical devices, and diagnostics in the country. It operates under the Ministry of Health and Family Welfare, Government of India.

#cdsco kolkata#import of medical devices in india#adc noc for import#cdsco approval#cdsco license#cdsco test license#form 42 cdsco#Form MD-3#Form MD-14#form 40 cdsco#cdsco manufacturing license

0 notes

Link

Have you ever heard the term ESG Sustainability Performance Metrics? Or wondered about its significance in today's world? If yes, then this article can be an enlightening read for you. The best way to start is with the definition. ESG Sustainability Performance metrics, or we can say, ESG metrics are nothing but a set of criteria used worldwide to assess how a company is performing in terms of sustainability and social responsibility.

#esg reporting india#esg environmental factors#esg work#esg reporting in india#esg in corporate governance#esg company#esg values#corporate esg#business responsibility reporting#esg strategies for companies#esg services#esg and sustainability

0 notes

Link

What's the role that NBFCs play in the Indian financial system? Are they even that significant? And, what’s the procedure of NBFC registration in India? If all these questions trouble your mind, then reading this article is probably the best thing you be doing now. NBFCs, which stands for Non-Banking Financial Corporations, are entities that offer many financial instruments and services to the general public but do not possess a full banking license. Registered under the Companies Act of 2013 as companies, the principal business of NBFCs is financial activity.

#account aggregator nbfc#nbfc account aggregator#nbfc license rbi#rbi nbfc registration#nbfc registration in india#nbfc certificate#rbi nbfc license#nbfc company registration#nbfc registration

0 notes

Link

The Central Drugs Standard Control Organisation (CDSCO) is a part of the Ministry of Health and Family Welfare, Government of India, and serves as the National Regulatory Authority. CDSCO is responsible for approving drugs, conducting clinical trials, setting standards for drugs, ensuring the quality of imported drugs, and coordinating with State Drug Control Organizations to enforce the Drugs and Cosmetics Act.

#cdsco#cdsco online#cdsco md online#cdsco registration#cdsco medical device registration#cdsco new drug approval#import license for medical devices in india#medical device cdsco

0 notes

Photo

It's important to note that the specific eligibility criteria for CDSCO registration may vary depending on the type of product and the regulatory requirements at the time of application. It's recommended to consult with a qualified regulatory professional or CDSCO representative to ensure that you meet the latest eligibility criteria for CDSCO registration in India.

#cdsco registration#medical device cdsco#cdsco medical device#cdsco online registration#cdsco certificate#md 14 cdsco#cdsco certification#adc noc for export#Form MD-14#form 40 cdsco#Form MD-3#cdsco test license

0 notes

Link

It's important to note that the specific eligibility criteria for CDSCO registration may vary depending on the type of product and the regulatory requirements at the time of application. It's recommended to consult with a qualified regulatory professional or CDSCO representative to ensure that you meet the latest eligibility criteria for CDSCO registration in India.

#cdsco certificate#cdsco medical device#cdsco online registration#voluntary registration of medical devices in india#md 14 cdsco#adc noc online#cdsco import license#Form MD-15#medical device import license#cdsco registration certificate#cdsco kolkata

0 notes

Photo

ESG stands for Environmental, Social, and Governance, and it refers to a set of criteria used to assess the sustainability and ethical impact of an investment or a company's operations. ESG environmental factors are used to evaluate a company's performance in three main areas:

#environment esg#esg consulting#esg reports and ratings#esg environmental and social governance#esg environmental social#corporate esg#esg in india#esg importance#esg governance

0 notes

Link

ESG stands for Environmental, Social, and Governance, and it refers to a set of criteria used to assess the sustainability and ethical impact of an investment or a company's operations. ESG environmental factors are used to evaluate a company's performance in three main areas:

#esg environmental social#corporate esg#esg in india#esg importance#esg governance#business responsibility and sustainability report#sustainability consulting#esg strategy#esg consultant#esg framework#sustainability reporting#esg and sustainability#esg services#esg strategies for companies

0 notes

Link

CDSCO stands for the Central Drugs Standard Control Organization, which is the regulatory authority in India responsible for the approval, regulation, and registration of pharmaceuticals, medical devices, and cosmetics. CDSCO registration holds significant importance for several reasons:

#import license for medical devices in india#medical device cdsco#cdsco india#Form 42#cdsco certificate#cdsco medical device#cdsco online registration#voluntary registration of medical devices in india#md 14 cdsco

0 notes

Link

The Central Drugs Standard Control Organization (CDSCO) is the national regulatory authority in India responsible for the regulation of pharmaceuticals, medical devices, and cosmetics. Registration with CDSCO is mandatory for manufacturers, importers, and distributors of pharmaceuticals and medical devices in India.

#adc noc for import#cdsco approval#cdsco license#cdsco test license#form 42 cdsco#Form MD-3#form 40 cdsco#Form MD-14#cdsco manufacturing license#cdsco mumbai

0 notes

Photo

If you have a company and want to make it an NBFC company or you want to incorporate a new NBFC company or you have an NBFC company and want to get it registered under RBI regulations then this article is for you. Read it till the end and all your doubts and questions will be answered. We will let you know all the procedures to be followed, the authorities to be addressed, the documents to be submitted, and the details to be shared to get your NBFC Registration done.

#nbfc registration#nbfc company registration#how to start nbfc#how to start a nbfc in india#rbi nbfc license#nbfc certificate#nbfc registration in india#rbi nbfc registration

0 notes