#esg investing

Note

What do you think of the new NY Times article about rampant deception in ESG investing? From the article, "But contrary to the spirit of E.S.G. investing (and likely unknown to most investors), the leading rating agencies are not scoring companies on their degree of environmental or social responsibility. Instead, they are measuring how much potential harm E.S.G. factors like carbon emissions have on companies’ financial performance."

I think it's fucking TRUE. And not even the entirety of the problem with ESG investing.

We just recorded an episode on this for the podcast (it'll come out in a couple weeks, my doves), so I won't spoil it. But basically, ESG is a bit like corporate greenwashing. Unless you're paying VERY close attention, it's easy to invest in ESG funds that are the exact opposite of what you value. For example: several oil and gas corporations are listed in supposedly environmentally friendly ESG funds. Yeah.

Here's the NYT article for anyone who wants to read it:

One of the Hottest Trends in the World of Investing Is a Sham

*ESG= Environmental, Social, & (corporate) Governance. Basically meant to signal an ethical company to invest in.

58 notes

·

View notes

Text

Chiltern TMC's ESG Reporting provides comprehensive and transparent insights into the company's environmental, social, and governance (ESG) practices. With a focus on sustainability, Chiltern TMC discloses its efforts to reduce carbon emissions, promote diversity and inclusion, and uphold ethical business practices. The report showcases Chiltern TMC's commitment to responsible corporate citizenship and highlights key initiatives aimed at minimizing their environmental footprint while fostering positive social impact.

2 notes

·

View notes

Text

Excerpt:

Environmental, social, and governance (ESG) investing refers to a set of standards for a company’s behavior used by socially conscious investors to screen potential investments.

Environmental criteria consider how a company safeguards the environment, including corporate policies addressing climate change, for example. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Read more.

3 notes

·

View notes

Text

ESG Investing: Top Trends to Watch Out for in 2022

Explore the latest ESG (Environmental, Social, and Governance) investing trends that shaped the financial landscape in 2022. Stay informed about sustainable investment strategies, responsible corporate practices, and the evolving ESG landscape to make informed investment decisions.

1 note

·

View note

Text

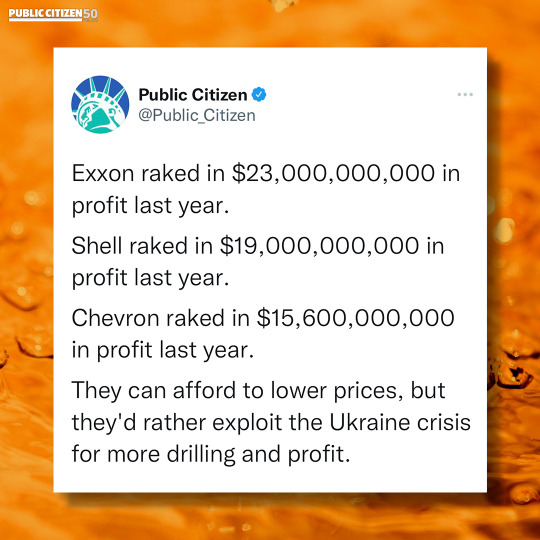

Corporate greed is killing our economy and our climate.

3 notes

·

View notes

Text

Quantifying the Returns of ESG Investing: An Empirical Analysis with Six ESG Metrics

Quantifying the Returns of ESG Investing: An Empirical Analysis with Six ESG Metrics. “ We find that aggregating individual ESG ratings improves portfolio performance. In addition, we find that a portfolio based on Treynor-Black weights further improves the performance of ESG portfolios.” By Florian Berg, Andrew W. Lo, Roberto Rigobon, Manish Singh. All are associated with the Massachusetts…

View On WordPress

0 notes

Text

https://truedata.in/blog/esg-investing-what-you-need-to-know

0 notes

Text

Delve into the significance of ESG criteria in investment decisions, and how it goes beyond financial performance to assess a company's sustainability and ethical practices.

For more such blogs:

Visit our blog site today: https://tradingbells.com/blogs

And for Financial Advice reach us at: https://tradingbells.com/ Phone: +91 932 953 6100

0 notes

Text

What is Environmental, Social, and Governance (ESG) Framework?

Environmental, Social, and Governance (ESG) management Framework is a pivotal tool that offers a comprehensive evaluation of a company’s performance in environmental, social, and governance areas. ESG Framework serves as a holistic lens to assess a company’s impact on the environment, its commitment to social responsibility, and the effectiveness of its governance structure.

The Environmental, Social, and Governance goals of ESG is to capture all the non-financial risks and opportunities inherent to a company’s day to day activities.Environmental, Social, and Governance goals involve a commitment to continuous improvement, transparency, and responsible business practices. It’s about creating a positive impact on the environment, society, and governance while aligning with the organization’s overall mission and vision.

Read more..................environmental and social management framework

0 notes

Text

At ESG Consultancy NV, we're committed to leading by example. That's why we're thrilled to announce the latest addition to our fleet: the Audi e-tron, a testament to our dedication to sustainability and innovation. #WalkTheTalk #SustainableMobility #ESGLeadership

#sustainability#esg#esgstrategies#esg data#esg investing#esg services#esg reporting#csr#esgconsultancy

0 notes

Text

Data-Driven ESG Compliance: Challenges, Opportunities, and Best Practices

In the wake of a recent Supreme Court decision on affirmative action, concerns arose about potential challenges to environmental, social, and governance (ESG) strategies. However, ESG isn’t just political; it’s fundamentally good for business. Research shows a positive correlation between ESG performance and financial value creation.

At Hitachi America, Ltd. R&D, we’re actively co-creating sustainable digital solutions, committed to decarbonizing our operations and achieving global carbon neutrality in our value chain by 2050.

Despite the positive trajectory, challenges persist. Accurate ESG data is crucial, yet its availability and quality often hinder sustainable investment adoption. Regulatory concerns also loom, with worries that ESG regulations might limit business options. Additionally, smaller and minority-owned firms, while willing, struggle to incorporate ESG due to financial constraints.

To navigate these challenges, a holistic data-driven approach to ESG is essential.

Creating comprehensive audit trails around data ensures measurable ESG decisions throughout supply chains.

Standardized, globally coordinated ESG disclosure standards are vital, helping investors and stakeholders make informed decisions.

Companies must integrate ESG directly into their operations, making it a part of their core strategy.

Hitachi’s Take on ESG and Sustainability

Hitachi is actively working to facilitate the adoption of ESG practices, believing in the transformative power of sustainability. ESG-focused investments are on the rise, indicating a shifting paradigm in investment strategies. In this dynamic environment, actionable ESG practices will be instrumental, in guiding organizations toward a more sustainable future for all.

Learn how Hitachi is working to help companies make it easier to adopt and integrate ESG practices into their businesses.

https://social-innovation.hitachi/en-us/think-ahead/manufacturing/actionable-esg-compliance-for-businesses/

#sustainability#decarbonization#esg#esg reporting#esg data analytics#esg data management#esg investing#esg financing#esg strategy#esg compliance

0 notes

Text

Discover cutting-edge environmental sustainability consulting services. Our experts guide you towards eco-friendly practices, ensuring your business contributes to a healthier planet. Elevate your environmental stewardship.

1 note

·

View note

Text

ESG and Sustainable Investing: A Guide for ESG-Focused Investors in 2024

ESG investing continues to gain momentum, driven by a growing awareness of sustainability issues and a shift towards more responsible investing practices. As an ESG-focused investor in 2024, staying informed, conducting thorough research, and aligning investments with personal values and goals are crucial for success in this evolving landscape.

0 notes

Text

Is ESG Investing Good for the Economy?

View On WordPress

0 notes

Text

ESG Objectives: How Prioritizing Environmental Social Governance Can Benefit Your Business and the Planet

ESG considerations can help companies identify and mitigate potential risks related to environmental regulations, social issues, and governance practices. By engaging with stakeholders, companies can build trust, address concerns, and foster long-term relationships. ESG investing can help to address some of India's most pressing environmental and social challenges, such as climate change, air pollution, and water scarcity.

Read Here For Complete Blog :

1 note

·

View note