Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

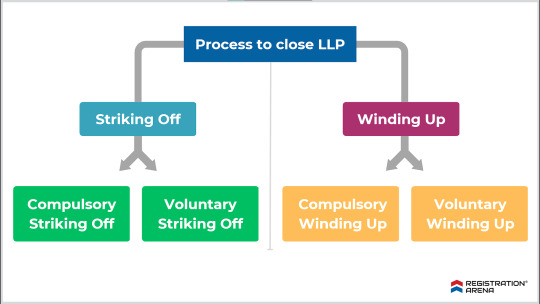

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

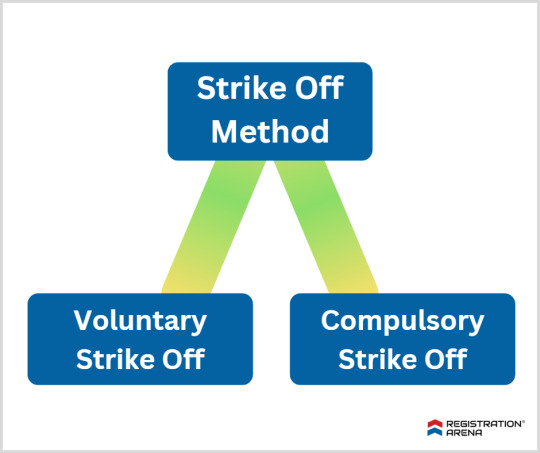

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Formation of Wholly Owned Subsidiary In India

A Wholly Owned Subsidiary refers to a company whose shares or voting rights are totally owned by the parent company.

A Wholly Owned Subsidiary (WOS) is distinct from a subsidiary since the former signifies that the parent company holds 100% of the whole shares or voting rights, while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

In India, a Private Limited company can be established by Foreign companies to conduct business or invest, which would be considered a Wholly Owned Subsidiary. However, this is subject to government regulations on Foreign Direct Investment (FDI) and other applicable provisions.

Requirements of Wholly Owned Subsidiaries

At least one director to be a resident of India: A Wholly Owned Subsidiary company must have at least one director who is a resident of India.

The term "resident" refers to an individual director who has lived in India for an equivalent of or more than 182 days in the preceding year.

No Minimum Capital: As per MCA guidelines, there is no minimum capital required to create the company.

Minimum one shareholder (and nominee) and 2 directors: As per Section 3(1)(b) of the Companies Act, 2013, it is crucial for every company to have at least one shareholder and one nominee shareholder, along with a minimum of two directors.

How to Form a Wholly Owned Subsidiary in India

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

Retain Original Name: The foreign company can decide to keep its original name for the subsidiary in India to carry forward its goodwill.

Add India as a Suffix: The foreign company can add India as a suffix to its original name to indicate its status as a subsidiary in India.

Use Registered Trademark: If the foreign company has a registered trademark in another country, it can use the same trademark for the subsidiary in India.

Choose a New Name: The foreign company can also pick a new name for the subsidiary if it wishes to do so.

Read more to know about the formation of WOS in India

#wholly owned subsidiary#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal consultation#legal services

0 notes

Text

Appointment of Director in a company

Introduction

A Director of a company is an individual elected by the shareholders to supervise the company's affairs in accordance with its Memorandum of Association (MOA) and Articles of Association (AOA). Since a company is a legal entity, it can only act through the representation of a natural person.

Therefore, the Board of Directors, consisting of living individuals, is entrusted with the management of the company. Depending on the shareholders' requirements, the appointment of directors may be required at various times throughout the life of the business.

Who can be a Director of a Company in India?

To become a director of a company in India, an individual must fulfill the criteria outlined in the Companies Act, 2013, and the Articles of Association of the respective company. The needs of the Companies Act are uniform, whereas the provisions of the Articles of Association differ from one company to another.

There are two types of directors that can be appointed in a company:

Executive Directors

Managing Director

A Managing Director is designated as a director based on the Articles of Association of a company, an agreement with the company, or a resolution passed in a general meeting or by the Board of Directors. This is because the Board of Directors is liable for managing the company's affairs and has substantial powers in doing so.

Whole-time director

An executive director or whole-time director is an individual who is employed by the company on a full-time basis.

Non-Executive Director

Independent director

Independent directors are board members of a company who are not financially or personally connected to the company or its management. They offer an unbiased viewpoint in the board's decision-making process, ensuring that the company operates in the best interests of all stakeholders.

Read more to know about the Appointment of a Director in a company

#llp registration#private limited company registration#opc registration#startup registration#nidhi company registration#annual compliance of llp#annual compliance of private limited company#trademark registration#itr filing#tds return filing#director kyc#legal consultation#legal services#iso certificate online

0 notes

Text

How to Obtain a Well-Known Trademark

In India, over 350,000 trademark applications were filed in the year 2019, and this number is predicted to grow rapidly. By 2025, over 600,000 trademark applications are projected to be submitted annually. The Trade Mark Rules 2017 introduced a new procedure for announcing a trademark as "well-known."

To acquire this status, trademark owners can submit an application (TM-M form) to the Registrar. A well-known trademark receives special protection against violation and passing off. Recognition as a well-known trademark is based on reputation, both domestically and internationally, and across borders.

What is a Well-Known Trademark

According to the Trademarks Act of 1999, a well-known trademark is a mark that has earned recognition among a substantial portion of the public who use the goods or services associated with the mark.

This recognition is so strong that the use of the mark in relation to other goods or services is likely to be sensed as a connection between those goods or services and the person who uses the mark in relation to the first-mentioned goods or services.

The criteria used to determine whether a trademark is well-known

While choosing whether a trademark is a well-known trademark, the Registrar shall consider all facts that he thinks relevant for determining a trademark as a well-known trademark, including the following factors:

The level of recognition of the trademark among the general public in India.

The number of individuals involved in the distribution channels of goods or services related to the trademark.

The number of existing or potential buyers of the goods or services associated with the trademark.

The duration, extent, and geographical scope of the trademark's use.

The business community deals with the goods or services related to the trademark.

The trademark's enforcement record, precisely the extent to which it has been recognized as a well-known mark by any court or Registrar.

The Trademark Rules 2017. (Rule 124)

The latest set of rules for trademark registration in India is the Trademark Rules of 2017. Under these rules, trademark owners can request that their mark be recognized as "well-known" by approaching the Trademark Registry. A separate application process is established, which outlines the standards for determining well-known trademarks.

Those desiring to have their trademark designated as well-known can file an application in the TM-M form, along with the requisite fee (paid online). Rule 124 empowers the registrar to grant a trademark the status of "well-known" based on the application proposal.

Read more to know about Well-Known Trademark

#Well known trademark#legal advisers#legal consultation#llp registration#pvt ltd company registration#startup registration#opc registration#annual compliance of private limited company#annual compliance of llp#trademark registration#itr filing#tds return filing#private limited company registration#gst registration

0 notes

Text

An International Trademark is a trademark that is registered globally. It allows the owner to extend their market and file a single application in multiple countries through the centralized system of the World Intellectual Property Organization, International Bureau.

Advantages of International Trademark Registration

One application can cover registration in multiple countries.

International recognition of your brand is possible with an International Trademark.

Operating online allows for easier access to your products by global consumers.

Sole ownership of the trademark is granted to the registered owner.

Trademark registration creates an intangible asset for an organization, known as Intellectual Property.

Competitors or third parties cannot use the registered trademark.

Maintenance and renewal fees are only due every ten years after the trademark is registered.

How to register a Trademark internationally

You can file for international trademark registration in two ways. The first method is by using the Madrid Protocol, while the second method is to hire a local attorney in each country where you seek trademark rights and have them file the application on your behalf.

The Madrid System

The Madrid Protocol, also referred to as the Madrid system, is a highly-regarded option for global trademark registration. WIPO (World Intellectual Property Organization) utilizes the Madrid system to streamline international trademark registration and management.

Using the Madrid system not only offers an expedient solution but also a cost-efficient one for registering and overseeing trademarks across the globe.

Read more to know about the International Trademark Registration

#llp registration#private limited company registration#opc registration#nidhi company registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#trademark registration#international trademark registration#legal advisers#legal consultation#legal services

0 notes

Text

In India, launching a restaurant can be a challenging process, but obtaining the necessary licenses and adhering to regulations can make it easier. Before opening, a comprehensive list of licenses is required to ensure the smooth and lawful operation of the restaurant.

One of the essential licenses a restaurant must obtain is the FSSAI License, issued by the Food Safety and Standards Authority of India. This license assures customers that the food served at the restaurant complies with India's food safety standards, making it a critical endorsement from the regulatory authority.

To obtain the FSSAI license, the restaurant owner must provide various documents, including a valid identity and address proof issued by a government authority, a declaration of the food safety management plan, proof of possession of the location/premises, a kitchen layout plan, and more.

The restaurant owner can apply for the license by visiting the FSSAI website, creating a username for registration, and completing the online application form while attaching all necessary documents. They should then print out the completed form and supporting documents and submit them to the Regional/State Authority within 15 days of making the online submission.

By following these steps and providing the required documents, the restaurant owner can ensure that their application for the FSSAI license is complete and ready for processing.

Read more to know about the Licenses required to open a restaurant In India

#llp registration#private limited company registration#opc registration#nidhi company registration#trademark registration#annual compliance of llp#annual compliance of private limited company#gst registration#itr filing#tds return filing#fssai registration#iso certification online#legal services#legal advisors

0 notes

Text

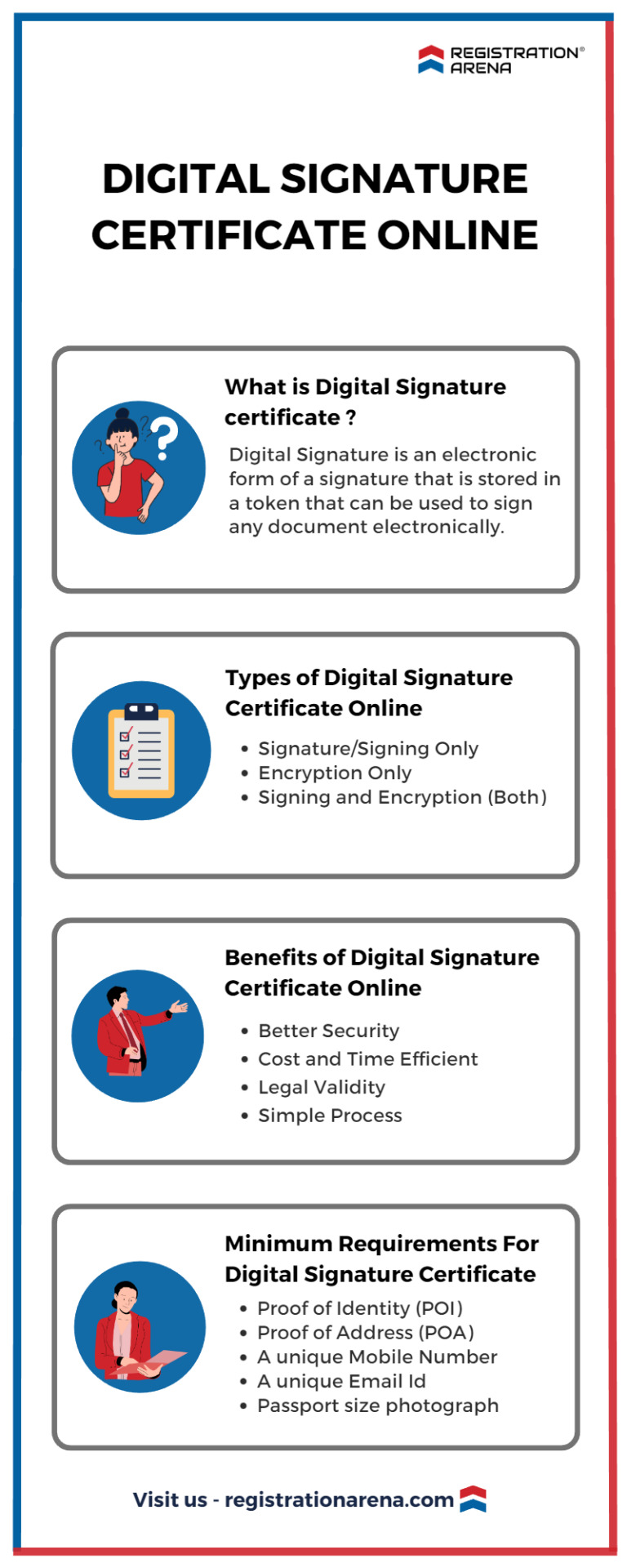

A DSC or ID is also referred to as a digital signature certificate online. To digitally sign official documents, the issuing authority must possess an active digital certificate. A digital certificate is issued by a certificate authority. Third-party certificate authorities offer the option to either purchase a DSC online or apply for a digital signature online. The risk of duplication or alteration of the signed document can be minimized by Digital signatures. DSC users are provided with a unique token password to authenticate, verify their identity and sign the respective document

#llp registration#private limited company registration#opc registration#startup india registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#digital signature certificate online#legal advisers#legal consultation#legal services

0 notes

Text

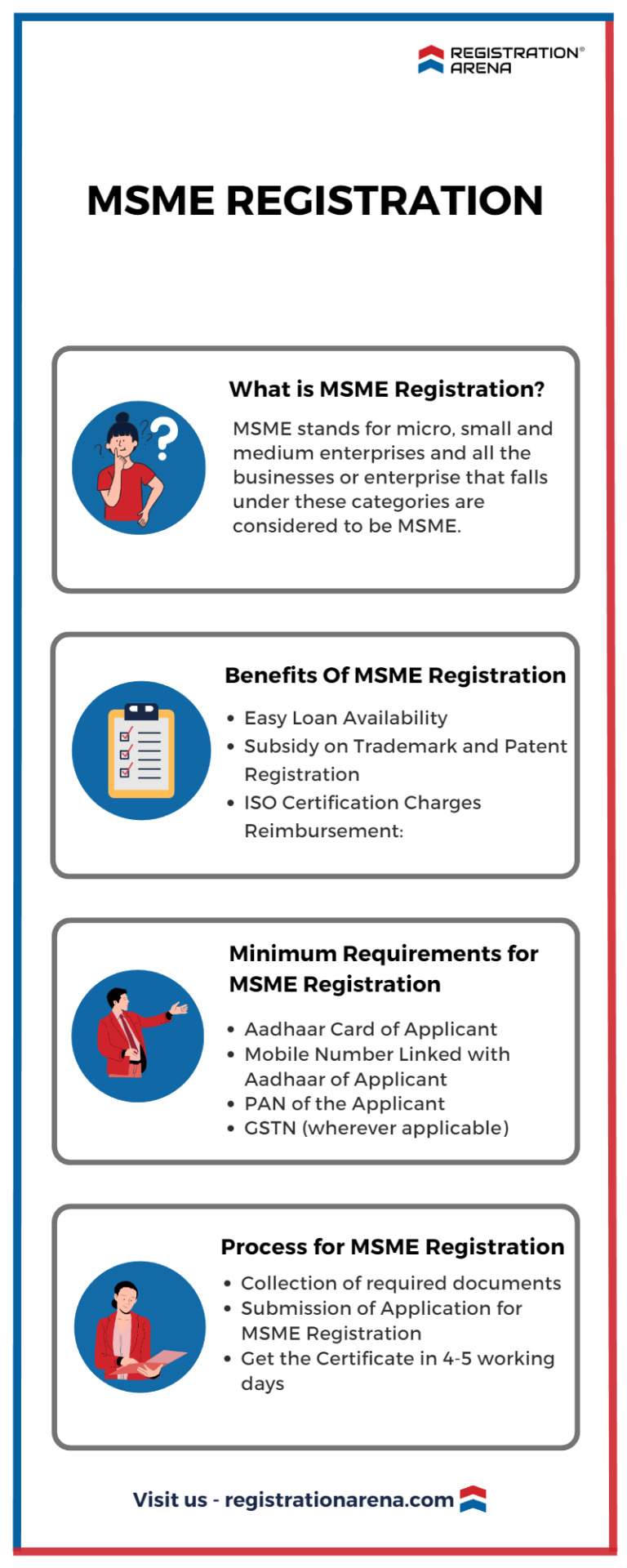

MSMEs, which include micro, small, and medium-sized businesses, have emerged as a flourishing sector of the Indian economy in recent years, playing an essential role in the country's socioeconomic improvement. These businesses are very helpful in creating jobs, producing goods, and exporting products. The duty of promoting and encouraging the growth of MSMEs mainly falls under the state governments

#llp registration#private limited company registration#opc registration#nidhi company registration#msme registration#trademark registration#startup india registration#sole proprietorship#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#iso certification online#legal consultation#legal advisers#legal services

0 notes

Text

The Government of India created the FSSAI or Food Safety and Standards Authority of India to oversee the manufacturing, storage, distribution, sale, and import of food to guarantee the availability of safe and healthy food for human consumption. Additionally, FSSAI registers and licenses Food Business Operators (FBO) nationwide and regulates the guidelines for operating any food-related business in India.

#llp registration#private limited company registration#opc registration#nidhi company registration#trademark registration#startup india registration#annual compliance of llp#annual compliance of private limited company#iso certification online#import export code#itr filing#tds return filing#fssai registration

0 notes

Text

The Government of India began the Startup India program on 16th January 2016, to assist individuals curious about establishing their own enterprises. The primary purpose of this program is to set up a robust ecosystem that encourages innovation and promotes the growth of startups throughout the country, which, in turn, would boost sustainable economic progress and create extensive employment opportunities.

#LLP registration#Private Limited Company registration#opc registration#nidhi company registration#trademark registration#annual compliance of llp#annual compliance of private limited company#startup india registration#gst registration#itr filing#tds return filing#iso certification online#import export code#legal advisers#legal consultation

0 notes

Text

The ISO certificate establishes guidelines for organizations, facilitating innovation and trade development. It is a necessary certification for establishing standards that guarantee the quality, safety, and efficiency of products and services. Additionally, it confirms that the company's products and services adhere to both customer and regulatory requirements. It certifies that the management system of the company is in compliance with ISO standards, which benefits the business, clients, and employees.

#legal advisers#legal consultation#private limited company registration#llp registration#opc registration#trademark registration#gst registration#annual compliance of llp#annual compliance of private limited company#itr filing#iso certification online

0 notes

Text

To engage in importing or exporting goods, all business entities are required to obtain a 10-digit identification number known as the Importer-Exporter Code (IEC). Without a valid IEC number, a person or entity is not permitted to conduct any import or export activities. In India, the Director General of Foreign Trade (DGFT) is responsible for granting IECs. IEC registration is a completely online process and can be finished within 4-5 days. IEC once issued shall be valid for a lifetime.

#legal advisers#legal consultation#legal services#llp registration#private limited company registration#sole proprietorship#public limited company#annual compliances of llp#annual compliance of private limited company#startup india registration#trademark registration#partnership firm registration#tds return filing#itr filing#Import-export code#opc registration

0 notes

Text

Difference between TM (™) and R (®) symbol

We often come across two symbols associated with Trademarks - ‘TM’ and ‘R’. Each symbolizes a different type of trademark. The ‘R’ symbol represents the Registered Trademark, while ‘TM’ represents an Unregistered Trademark. The trademark itself can be a signature, symbol, logo, design, etc., followed by the symbol in superscript.

A trademark is a form of intellectual property that delivers the owner with exclusive rights to use and authorize others to use the trademark with the owner's permission, in exchange for adequate consideration. It serves as a means to identify the origin of a product.

Registered Trademark

A trademark that is officially registered under the Trademarks Act, of 1999 is known as a registered trademark. The registration of a trademark provides the owner with exclusive rights, including the sole use of the mark in relation to their products or services. The registration period for a trademark is ten years, after which it can be renewed. The entire registration process for trademarks is managed by the Trademarks Act of 1999.

Why Register?

It identifies the origin of goods and services

Advertises goods and services

Guards the commercial goodwill of a trader

Protects buyers from buying the second-rate quality goods

Registering a trademark grants the mark a monopoly right within a specific territory, preventing unauthorized use of the trademark in relation to goods and services. The test for infringement is whether a consumer would be confused about the origin of the goods or services. Legal action can be carried against trademark infringement, and registration decreases the burden of proof for the plaintiff.

Any person or entity declaring to be the owner of a trademark used or to be used in the future may apply for registration to the Registrar, of the area of authority under whom the applicant’s place of business falls, in the manner prescribed for trademark registration. In India, registering a trademark takes about 2 to 3 years (when there is no opposition from a third party).

Read more to know about the Difference between TM (™) & R (®) symbols.

#llp registration#private limited company registration#trademark registration#opc registration#sole proprietorship#section 8 company registration#annual compliance of llp#annual compliance of private limited company#gst registration#itr filing#tds return filing#startup india registration#legal consultation#legal advisers#legal services

0 notes

Text

Input tax credit under GST

The Input Tax Credit refers to the tax amount paid on purchases, which can be claimed when paying taxes on sales. While this provides basic knowledge, there are several important provisions under the GST law that should be considered. This article will explain these provisions in detail.

What is an input tax credit?

Under GST, the Input Tax Credit is subject to multiple sections and rules. This advantage is accessible to the supplier and helps to reduce their tax liability for sales. The fundamental necessities for Input Tax Credit are outlined in Section 16 of the CGST Act, while Section 17 imposes some restrictions on its availability. Additionally, Section 18 deals with how Input Tax Credit is handled during the transfer or shifting in a business entity.

How does the Input tax credit mechanism work?

GST is a value-added tax, which means that each individual in the chain is responsible for paying tax only on their value addition. To better understand this concept, consider the following example:

Mr. A is a manufacturer who spends Rs. 80, plus tax, to manufacture a glass bottle. He then sells the bottle for Rs. 100, plus tax. In this scenario, Mr. A is only required to pay tax on his value addition, which is Rs. 20. However, he must still report and pay tax on the full sale amount. To ensure that he is only paying tax on his value addition, he can use the tax amount paid on his cost of Rs. 80 at the time of paying taxes on his sales. Therefore, when he sells the bottle for Rs. 100, he will only pay the tax on his value addition of Rs. 20 via cash ledger.

Tax on Rs. 100 less Tax on rupees 80= Tax on Rs. 20.

It will be declared in his return. In his return, he will show sales of Rs. 100 and input a tax credit of a tax amount of Rs. 80. He will adjust the tax on Rs. 100 with the tax of Rs. 80 first and then will pay the balance via cash ledger.

Read more to know about Input tax credits in GST

#llp registration#legal consultation#legal services#legal advisers#private limited company registration#sole proprietorship#tds return filing#trademark registration#itr filing#startup india#startup india registration#annual compliances of llp#annual compliance of private limited company#opc registration#section 8 company registration

0 notes

Text

A WOS or Wholly Owned Subsidiary in India refers to a company where the foreign parent company possesses 100% of the shares. Foreign-based corporations are eligible to establish wholly-owned subsidiaries in India, which offer numerous advantages, such as total control over operations, diversification, utilization of Indian resources, and risk reduction.

Registration Arena assists startups and growing businesses by providing services such as company or LLP registration, IPR registrations, preparing their books of accounts, auditing, company law compliances, filing of income tax returns, etc.

#private limited company registration#llp registration#opc registration#wholly owned subsidiary#trademark registration#annual compliances of llp#legal consultation#legal advisers#legal services#startup india registration#annual compliance of llp

0 notes

Text

A Section 8 Company is a type of organization that is incorporated under the Companies Act 2013 for non-profit or charitable purposes, such as promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or other similar objectives.

Registration Arena assists startups and growing businesses by providing services such as company or LLP registration, IPR registrations, preparing their books of accounts, auditing, company law compliances, filing of income tax returns, etc.

#private limited company registration#llp registration#legal advisers#legal services#legal consultation#opc registration#section 8 company#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#wholly owned subsidiary#startup india registration#director kyc

0 notes

Text

Annual compliance for LLP

An LLP incorporated under LLP Act 2008 has to comply with different laws provided by authorities such as the Ministry of Corporate Affairs (MCA), Income Tax Department, GST Departments, etc.

Annual Compliance of LLP is all about bookkeeping and accounting, auditing, payment of taxes, regular filing of annual returns, financial statements, Designated Partners KYC, and all other compliances as required from time to time. Every LLP incorporated in India irrespective of its size and turnover has to carry out annual compliances as applicable.

An LLP is required to manage multiple operations in day-to-day business in line with the complex corporate and tax laws, which can be sometimes a challenging task. Therefore, it is best to do various activities under the guidance of a professional for understanding the legal requirements and timely fulfillment of the compliances so as to avoid penalties and fines.

Advantages Of Annual Compliance for LLP

Get an easy loan, finance, and subsidies

LLP’s credibility and reliability are measured by the financial statements and regularity in compliance. An LLP with a good track record can smoothly approach government and private organizations for loans, financial assistance, subsidies, tenders, and other similar purposes based on its established credibility, reliability, and reputation.

Avoid Heavy Penalty

Statutory compliances are to be compulsory and followed under law, if an LLP does not follow the compliances regularly or doesn’t file required returns within the specified time period then the government charges heavy penalties and punishment on the LLP and its partners. Therefore, filing multiple compliances on time will help the LLP to avoid heavy penalties, as the cost of non-compliance is always greater than the cost of compliance.

Attracts Potential Investors

Potential investors usually inspect the financial records and compliance status of the LLP under various laws, before investing in any LLP. Therefore, LLPs with proper and regular compliance are preferred more for funding and investment by investors.

Active status of LLP

If an LLP fails to comply with the requirements under the law, then apart from heavy penalties, the Registrar of Companies (ROC) shall also declare the LLP as a defunct LLP and remove its name from the register, after which the LLP losses its existence and becomes ineligible to carry out further business operations.

Builds Trust of Customers

Nowadays, not only business peers but also customers check and verify the status of compliance of an organization before entering into transactions with them. Therefore, a Compliant LLP will always build the trust of potential customers and gain their trust.

Read more to know about Annual Compliance for LLP

#legal consultation#legal advisers#legal services#llp registration#private limited company registration#opc registration#trademark registration#annual compliance of llp#annual compliance of private limited company#startup India registration#itr filing#tds return filing#gst registration#nidhi company registration

0 notes