#Section 8 Company Registration(NGO)

Text

Does a Section 8 company pay tax?

In general, Section 8 companies in India, which are formed under the Companies Act, 2013 (previously Section 25 companies under the Companies Act, 1956), are non-profit organizations that are formed for promoting charitable, educational, or other socially beneficial objectives.

Section 8 companies are granted certain tax benefits by the government. They may be eligible for exemptions from income tax under Section 12A and Section 80G of the Income Tax Act, provided they fulfill certain conditions and comply with the relevant regulations.

choose Vakilkaro for Section 8 microfinance company registration?in Lakhimpur Kheri

For swift and reliable Section 8 Microfinance Company registration in Lakhimpur Kheri, choose Vakilkaro. With their expertise in legal procedures and meticulous attention to detail, they streamline the registration process efficiently. Vakilkaro ensures compliance with all regulatory requirements, guiding you through every step seamlessly. Trust Vakilkaro for hassle-free Section 8 Microfinance Company registration in Lakhimpur Kheri. And reach out to Vakilkaro's team today on this number: 9828123489!

#section 8 company#section 8 company registration#section 8 company registration process#section 8 company benefits#section 8 company kya hai#section 8 company registration fees#section 8 company ngo#section 8 company act 2013#section 8 company compliances#section 8 company under companies act 2013#section 8#how to register section 8 company#section 8 company registration online#audit of a section 8 company#section 8 of companies act 2013

0 notes

Text

Section 8 Company Registration process in India

Section 8 Company Registration allows NGOs in India to function as non-profit organizations, Granting the ability to fundraise and offering tax benefits to support charitable initiatives. PSR compliance simplifies the process of registering a Section 8 company into just a few steps.

0 notes

Text

#charitable organizations#Companies Act#Digital Signature Certificate#limited liability#Ministry of Corporate Affairs#NGOs#non-profit organizations#Section 8 company registration online#tax exemptions

0 notes

Text

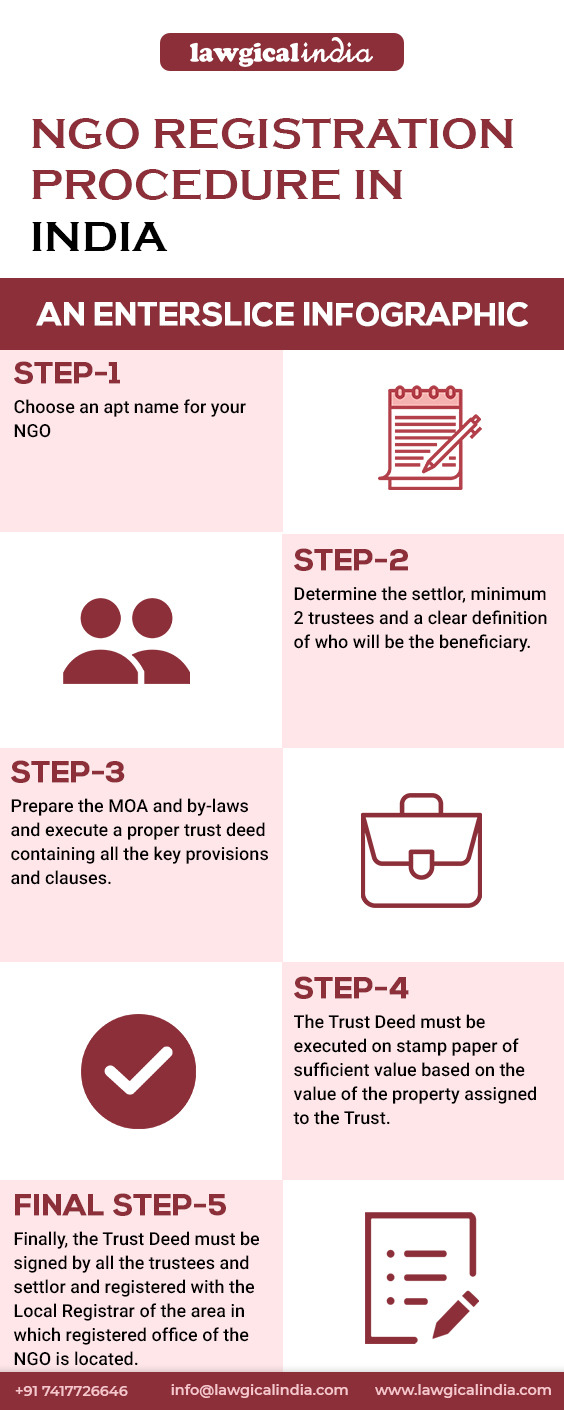

Online NGO Registration - Types, Procedure, Fees, Documents Required

Establishing a Non-Government Organization (NGO) helps you work for the betterment and improvement of society. To register an NGO, you need to understand what they are, how they work, and the registration requirements. There are three forms of NGO - Section 8 company, Society, and Trust.

In effect from April 1, 2021, all NGOs need to file Form CSR-1 to register with Central Government to get CSR funding. Furthermore, FCRA registration is required if the NGO is seeking funds from foreign sources.

A non-governmental organization (NGO) is a non-profit organization established by a group of natural persons for charitable and social purposes.

Types of NGO Registration:

Section 8 Company Registration under the Companies Act, 2013

Trust Registration under the Trust Act, 1882

Society Registration under the Societies Registration Act, 1860

NGO Registration fees:

The total cost of registering a section 8 company, including government and professional fees, would be Rs. 4,999

The total cost of trust registration, including government and professional fees, would be Rs. 13,999

The total cost of society registration, including government and professional fees, would be Rs. 12,999

To know more (click here)

#business#india#startup#manage business#business growth#partnership firm registration#ngo#ngoindia#ngo in noida#ngo donation#ngo registration#ngo for children#ngo in india#private limited company registration in chennai#section 8 registration#section 8 microfinance company registratioin#section 8 company in india

0 notes

Photo

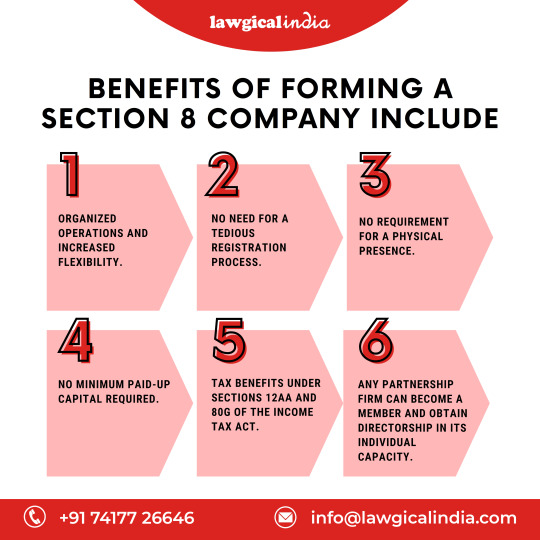

Benefits of forming a section 8 company include

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

#Section 8 NGO Registration#Section 8 NGO Registration Company#Section 8 NGO Registration Company in pune

0 notes

Text

https://ngoexperts.com/1023c/

10 (23c) registrations in India

10 (23c) registrations in India. Organization consultants have many choices for forming a constitution, as well as trust, society, and discomfit eight corporations. All NGOs square measure needed to get registration below Neath section 12A of the taxation Act, 1961 so as to assert exemptions below Neath phases eleven and twelve. Visit site: https://ngoexperts.com/ Contact us+91-8929218091

#Society registration in Noida#society registration in noida#csr registration#trust registration in noida#section 8 company registration#niti aayog registration for company#csr funding in india#niti aayog registration#ngo consultants#niti aayog registration for society#ngo consultancy noida

0 notes

Text

Online NGO Registration in India

Non-Governmental Organizations (NGOs) play a pivotal role in addressing societal issues, driving positive change, and advocating for the underprivileged. The foundation of every impactful NGO lies in its legal establishment – a process known as NGO registration. This article serves as a comprehensive guide to navigating the intricacies of NGO registration in India, empowering aspiring changemakers to embark on their journey of social impact.

NGO registration is a legal process that endows organizations with the official status required to carry out philanthropic activities. It serves as a gateway to credibility, transparency, and various benefits, including tax exemptions. In India, NGOs can be registered under different legal structures, such as Trusts, Societies, or Section 8 Companies.

Classification of NGOs in India

NGOs in India can be classified based on their orientation and level of operation:

1. By the Level of Orientation:

2. By the Level of Operation:

NGO Registration Process

The following is the process for NGO Registration in India:

1: Type Determination: Choose the suitable NGO structure – Trust, Society, or Section 8 Company – based on your organization’s objectives.

2: Name Selection: Choose a unique name reflecting your mission.

3: Drafting MoA and AoA: Prepare the Memorandum and Articles of Association.

4: Governing Body Formation: Establish a governing body or managing committee.

5: Registered Office Designation: Provide an official address for communication.

6: Documentation Preparation: Gather required identity proofs, address proofs, and photographs.

7: Registration Application Submission: Submit the application to the relevant authority – Registrar of Trusts, Registrar of Societies, or Registrar of Companies.

8: Review and Approval: Await review, with possible clarification requests.

9: Registration Certificate Obtention: Upon approval, obtain the registration certificate.

10: Tax Exemption Application: Apply for tax exemptions under relevant sections.

11: Compliance and Reporting: Adhere to statutory requirements, including accounts maintenance, annual returns filing, and audited financial statement submission.

0 notes

Text

Concept and Process for Temple Registration under NGO StartupFino

StartupFino explains that temple registration as an NGO can be achieved through trust, society, or Section 8 company, each offering unique benefits for legal compliance and public engagement in charitable or cultural activities.

Read more:-https://shorturl.at/aAES6

0 notes

Text

How many members are required for Section 8 company?

In the field of commercial administration, the Section 8 microfinance company registration is of great importance, especially for entities aiming to pursue charitable or non-profitable objects. Also, an important question arises that how many members are required to register a company, about which we will know.

Section 8 Company A detail Overview:

Before delving into the class conditions, it is important to understand the principles of Section 8 organization. These realities, known as Non-Profit Associations (NPOs), are formed mainly to promote charitable causes, social welfare, education, religion, art, knowledge, exploration or analogous objects, Whose objective is not to generate profit for the members.

Class essentials for Section 8 Microfinance Company Registration The Companies Act, 2013, governs the conformation and functioning of Section 8 companies in India. According to the vittles laid down by the Act, the minimal number of members needed to establish a Section 8 company differs from that of other types of commercial realities.

Section 8 companies have a different set of demands than private limited companies, which require a minimum of two members to register, or public limited companies, which require a minimum of seven members. As per the statutory recognition, a Section 8 microfinance company can be formed with a minimum of two persons.

This minimalist approach to class underscores the legislative intent to grease the establishment of associations devoted to social causes with relative ease. By allowing a Section 8 company to commence operations with only two members, the legal framework aims to encourage humanitarian trials and streamline the enrollment process for similar realities.

likewise, while the Companies Act authorizations a minimal demand, there is no upper limit specified for the number of members in a Section 8 company. This provision offers inflexibility, enabling these associations to expand their class base as their enterprise grow and evolve over time.

Linking Class Conditions with Section 8 Microfinance Company Registration:

In the environment of microfinance, the significance of Section 8 company enrollment can not be exaggerated. Microfinance institutions( MFIs) play a vital part in extending fiscal services to underserved communities, empowering them to ameliorate their livelihoods and foster profitable development.

When meaning the enrollment of a Section 8 microfinance company, understanding the minimal class demand becomes pivotal. With just two members demanded to initiate the objectification process, aspiring microfinance entrepreneurs can embark on their trip of socio- profitable commission with relative ease.

Conclusion:

In conclusion, the question of how numerous members are needed for a Section 8 microfinance company underscores the foundational aspects of its conformation process. With a minimalist approach to class essentials, the legislative frame aims to grease the establishment of realities devoted to social weal and charitable trials. Whether aspiring to form a microfinance institution or pursue other humanitarian objects, individualities can navigate the enrollment process with clarity and confidence, armed with a clear understanding of the class prerequisites for Section 8 company enrollment .

Read more blogs-

How many members are required for Section 8 company?

How many members are required for Section 8 company?

#section 8 company#section 8 company registration process#section 8 company registration#section 8#section 8 company benefits#documents required for section 8 registration#section 8 company ngo#section 8 company registration procedure#society and section 8 company ngo#non profit making section 8 company#section 8 company registration online#what is section 8 company#section 8 company compliances#section 8 company act 2013

0 notes

Text

We, at Maurvish Advisors deals in Trademark Registration, Pvt. Ltd. Company Registration, OPC Registration, ISO Certification, GST Registration, Section 8 NGO Registration, Nidhi Company Registration, LLP registration, Public Company Registration, Producer Company Registration, Startup India Business Registrations and handle all your compliances.

Maurvish Advisors LLP, a business consultancy firm which provides all types of business registrations to the person who wants to start their new business.

For more details, Connect at

CS Heena Aggarwal

9971164429

0 notes

Text

#platform for growing up India's Entrepreneurs#Growup India#Grow Up India#growupindia#growup-india#startup registration#Digital signature#company registration#trademark registration#GST registration#ITR filling#Income tax return#ISO certification#IEC registration#society registration#Haryana society registration#Section-8 registration#NGO registration#12A registration#80G registration#FCRA registration#FSSAI registration#accouting for startups#small business#financial advisory for MSME#financial accounting#accouting#payroll services#financial management#digital certificate

0 notes

Text

Forming a Section 8 Company: Your Guide to Non-Profit Ventures

Learn all about establishing a Section 8 Company, a unique non-profit entity in India aimed at promoting charitable objectives. Explore the intricacies of registration, compliance, and benefits for socially impactful ventures. Registrationwala offers expert guidance to navigate the legal framework and realize your philanthropic vision efficiently and effectively.

0 notes

Photo

The advantages of using a Section 8 business over alternative methods of NGO registration are as follows.

It operates precisely and is incredibly flexible.

avoids difficult registration processes and does not need actual presence.

There is no requirement for a minimal paid-up capital.

complete acquisition of tax benefits under I.R.C. sections 80G and 12AA.

#section 8 ngo registration online#section 8 ngo registration#section 8 company registration online#best legal services in india#online legal services india#online legal services

1 note

·

View note