#llp compliance services

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

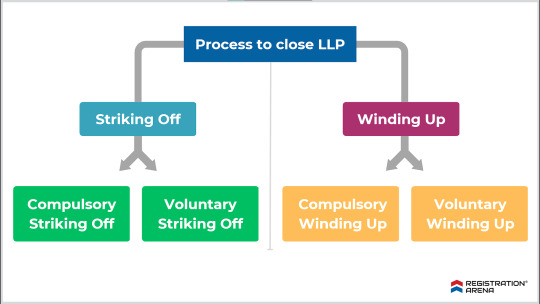

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Kenyan Business Registration Services by CR Advocates LLP

CR Advocates LLP is a prominent business law firm in Kenya that specializes in providing expert legal advice and services to businesses of all sizes. With years of experience in the industry, our team of skilled professionals can assist you with all aspects of business registration in Kenya, ensuring that your business is fully compliant with all relevant regulations and laws. We offer a comprehensive range of services, including company formation, registration, and licensing, as well as advice on tax and regulatory compliance. Our mission is to help our clients navigate the complex legal landscape in Kenya and achieve their business objectives with confidence.

CR Advocates LLP offers a wide range of legal service for businesses in Kenya, including:

Business registration and incorporation

Corporate governance and compliance

Commercial contracts drafting and review

Tax advisory and compliance

Intellectual property registration and protection

Employment law advisory services

Mergers and acquisitions advisory services

Dispute resolution and litigation services

Regulatory compliance and licensing services

Banking and finance advisory services

We work closely with our clients to understand their unique needs and provide tailored legal solutions to help them achieve their business objectives. Our team of experienced lawyers has a deep understanding of the Kenyan legal system and business environment, allowing us to provide high-quality legal advice and services to our clients.

Conclusion: CR Advocates LLP is a trusted legal partner for businesses seeking expert guidance on business registration and other legal matters in Kenya. Our team is committed to delivering effective solutions to help our clients succeed.

#CR Advocates LLP#Business Registration in Kenya#law firm in Kenya#law firm#legal services#Tax advisory and compliance#Intellectual property registration and protection

0 notes

Text

#llp compliances#llp annual compliance#compliances for llp#annual compliance for llp#legal services#business#startups

0 notes

Text

Streamlining Success: Formation and Incorporation of Company with Mas LLP

In the vibrant landscape of business, laying the groundwork for your company's success begins with a strategic approach to formation and incorporation. At Mas LLP, we understand the intricacies involved in this pivotal process, and we offer comprehensive solutions tailored to simplify the Formation and incorporation of company of your company. Let's explore why Mas LLP stands out as your premier choice for company formation and incorporation services.

Expert Guidance: With Mas LLP, you're not just navigating the formation and incorporation process alone. Our team of seasoned professionals brings years of experience and expertise to the table. From choosing the right business structure to navigating legal requirements, we provide expert guidance and support every step of the way.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of services designed to streamline the formation and incorporation process. Whether you're starting a new venture or expanding your existing business, we handle every aspect of company formation and incorporation, ensuring compliance with regulatory requirements and minimizing administrative burdens.

Tailored Approach: We understand that every business is unique, with its own goals, objectives, and challenges. That's why we take a personalized approach to company formation and incorporation, offering tailored solutions that align with your specific needs and aspirations. Whether you're a small startup or a large corporation, we have the expertise and resources to support you on your journey.

Transparency and Efficiency: Transparency and efficiency are at the core of everything we do at Mas LLP. We believe in keeping our clients informed and empowered throughout the formation and incorporation process, providing regular updates, clear communication, and transparent pricing. Our streamlined approach minimizes bureaucratic hurdles and accelerates the process, allowing you to focus on building and growing your business.

Compliance Assurance: Staying compliant with regulatory requirements is essential for maintaining the legal and financial integrity of your company. Mas LLP helps clients navigate the complexities of company formation and incorporation, ensuring adherence to all applicable laws, rules, and regulations. With our proactive approach to compliance, you can minimize potential liabilities and focus on achieving your business goals.

Dedicated Support: At Mas LLP, we're committed to providing exceptional service and support to our clients. Our dedicated team of professionals is here to answer your questions, address your concerns, and provide expert guidance every step of the way. With personalized attention and responsive support, you can trust Mas LLP to be your reliable partner in company formation and incorporation.

In the competitive business landscape, the Formation and incorporation of company of your company are critical steps towards achieving your entrepreneurial dreams. With Mas LLP as your trusted partner, you can navigate these processes with confidence and clarity.

Contact us today to learn more about our Formation and incorporation of company services and take the first step towards building a successful and sustainable business.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

youtube

Business Name:

Finch McCranie, LLP

Street Address:

229 Peachtree St NE #2500

City:

Atlanta

State:

Georgia (GA)

Zip Code:

30303

Country:

United States

Phone:

(404) 658-9070

Website:

https://www.finchmccranie.com/

Facebook:

https://www.facebook.com/FinchMcCranie/

Twitter:

https://twitter.com/finchmccranie

LinkedIn:

https://www.linkedin.com/company/finch-mccranie-llp

Justia:

https://lawyers.justia.com/firm/finch-mccranie-llp-13790

Description:

Finch McCranie, LLP is one of the most accomplished trial practice law firms in the Southeast, resulting in the firm earning a list of accolades for high professional achievement from national organizations like Martindale-Hubbell, Best Lawyers in America, and Super Lawyers. For over 50 years, Finch McCranie has successfully litigated a wide range of complex civil and criminal cases in court, including catastrophic personal injury and wrongful death lawsuits, white-collar and federal criminal cases, whistleblower claims, and business disputes. Through practicing law with care, compassion, and a dedication to excellence, the lawyers at Finch McCranie have recovered more than $500 million in verdicts and settlements for their clients.

Google My Business CID URL:

https://www.google.com/maps?cid=12050955574324636230

Business Hours:

Sunday Closed

Monday 9:00 am - 6:00 pm

Tuesday 9:00 am - 6:00 pm

Wednesday 9:00 am - 6:00 pm

Thursday 9:00 am - 6:00 pm

Friday 9:00 am - 6:00 pm

Saturday Closed

Services:

Personal Injury, White Collar Criminal Defense, Whistleblower Claims, Securities, Enforcement & Regulation, Internal Investigations, Compliance & Monitorships

Keywords:

personal injury attorney atlanta, criminal justice attorney atlanta, whistleblower lawyer atlanta, administrative attorney Atlanta

Location:

Service Areas:

2 notes

·

View notes

Text

Experts say this practice carries a heightened risk of maternal mortality. It is not widely available in the UK, with triple embryo transfers banned in all but exceptional circumstances.” Surrogacy exploits poor women.

Shanti Das, Simon Bowers and Malia Politzer

Sun 18 Dec 2022 03.00 EST

Women recruited by an international surrogacy agency to carry babies for wealthy clients are being asked to undergo “unethical” medical procedures that increase their risk of serious complications, an investigation suggests.

New Life Global claims to have brokered more than 7,000 cross-border deals between clients mostly based in the UK, western Europe and North America and surrogates in countries including Mexico, Colombia, India, Ukraine and Georgia.

Facebook adverts offer women the chance to earn life-changing money to be surrogates, while marketing says “commissioning parents” including same-sex couples and those struggling with fertility problems are “guaranteed” a baby.

But a joint investigation by international media outlets including the Observer, funded by the Pulitzer Center and coordinated by Finance Uncovered, has found evidence of ethically questionable and potentially illegal practice by the agency, which has a UK-registered firm and offices around the world. New Life denied the allegations, saying it has helped thousands of couples “achieve their goals” and operates in full compliance with local laws.

Analysis of marketing materials, contracts and other documents suggests the company has for years taken advantage of lax regulation in developing countries to offer controversial services to clients not available to them in their home countries.

Websites for several New Life branches, including those in Georgia and Ukraine, promote multi-embryo transfer, which involves two or three embryos being implanted into surrogates and increases the chance of twins or triplets being born.

Experts say this practice carries a heightened risk of maternal mortality. It is not widely available in the UK, with triple embryo transfers banned in all but exceptional circumstances.

New Life branches, including those in Asia, Mexico and Ukraine, which is currently closed due to the war, also allow or have recently allowed clients to select the sex of their baby. Clients might want to do this “to balance the gender in the family”, to prevent genetic disorders linked to a particular sex and to meet “cultural and social norms”, its website says.

While permitted in those New Life locations, sex selection for non-medical reasons is banned in Australia, Canada, the UK and other countries in Europe. The Human Fertilisation and Embryology Authority, which regulates fertility clinics in the UK, said it had no control over treatments offered abroad but described the findings as “extremely concerning”.

It said selecting the sex of a child for any reason other than preventing serious inherited illness was allowed in some countries but “strictly prohibited by UK law”, and that the offer to implant multi embryos was “deeply worrying”. “A multiple pregnancy increases the risk of stillbirth, neonatal death and disability. Risks to [the surrogate] include late miscarriage, high blood pressure, pre-eclampsia and haemorrhage,” it said. There is no suggestion the practices were offered in the UK.

Separate evidence suggests New Life may have flouted UK laws when brokering agreements linked to its London-registered entity, New Life Global Network LLP. While altruistic surrogacy is permitted in the UK, commercial surrogacy is banned, with those brokering or offering to negotiate surrogacy arrangements for profit risking a three-month prison sentence and unlimited fine.

New Life is registered in the UK and says on its website that it is headquartered in London. It is actively offering to “meet parents willing to discuss surrogacy/egg donation options” in the UK and has issued contracts bearing the name of its UK entity.

Three legal experts who reviewed New Life contracts said they believe the firm may have violated UK laws.

Dr Kirsty Horsey, an expert in surrogacy law at Kent University, said: “The terms of the agreement are: you will find me a surrogate and I will pay you money for it,” which she said appeared to be a “criminal activity on their part”. Professor Emily Jackson, an expert in medical law and ethics at the London School of Economics, said the documents looked “really concerning”, adding: “I would avoid this [agency] with a bargepole.”

Founded in 2008 by Georgian doctor Mariam Kukunashvili, New Life Global offers low-cost surrogacy to international clients, many of whom live in countries where surrogacy is illegal, prohibitively expensive or the number of surrogates is limited.

In the UK, commercial surrogacy is banned but altruistic surrogacy is permitted and surrogates can be paid reasonable expenses. An historic lack of surrogates has driven some to look abroad. In 2020-21, more than 300 applications for parental orders were made, around half of whichwere international surrogacy arrangements.

With “hundreds of employees” worldwide and at least 16 active websites advertising services in 10 languages, New Life is a major agency catering to the demand and boasts of a “world renowned reputation”.

The women it recruits as surrogates typically come from lower income countries where regulation is nonexistent or relaxed. The amount they can earn ranges but Facebook ads recruiting New Life surrogates in Colombia last year said they would receive $12,000.

Legal experts believe New Life’s decision to operate in “grey markets” where surrogacy is neither legal or illegal leaves both surrogates and commissioning parents exposed. In these countries surrogacy agreements are unlikely to be enforceable by law, they say. In the UK, all surrogacy agreements are legally unenforceable.

New Life has previously said lax regulation allows it to operate with more freedom. The website for its former Kenya branch, which has now been removed, said the absence of “strict criteria and legal restrictions” in the country allowed it to provide “the best possible service to our intended parents by adjusting to patient individual needs in a very flexible and comfortable manner”.

In an extreme example, its branch in Ukraine previously suggested babies born with disabilities could be legally abandoned at an orphanage if they were unwanted, telling potential customers from overseas that, in the event of their surrogate giving birth to a baby with an “anomaly”, they “have a right to leave the baby” at an orphanage. “In this case government dedicated office from government side undertakes the responsibility toward baby and no lawyer is needed for this,” an FAQ page told customers until 2015.

This weekend, New Life Global denied claims of unethical practice and said all its branches operate in jurisdictions where commercial surrogacy is legal. After being contacted for comment, the company removed a section on its Georgian website that said it recommended multiple embryo transfer. The site for its Ukraine branch continues to promote the procedure, telling clients that “generally, it is a good practice to transfer more than 1 embryos (2 or 3 ) at a time”.

David Bezhuashvili, the firm’s owner and husband of Mariam Kukunashvili, its founder, said the materials were out of date.

“The guideline for multiple embryo transfers has been changed ... and companies under New Life strictly follow the rules on one embryo transfer,” he said.

“We have assisted many people to overcome poverty and earn a living,” Bezhuashvili added. “We have made our worthy contribution to the cause of human importance.”

The company did not answer questions about its UK operations or the enforceability of contracts issued by its London registered company, which it said “acts as an international marketing and promotion tool” for affiliates around the world.

“Due to the limited functions of the company in respect of marketing and promotion, the ownership structure has been simplified by top management,” Bezhuashvili added. Financial statements filed by the company in October show it reported earning £343,000 in commission in 2021-22, more than double the year before.

The Department of Health said it was assessing evidence passed to it by the Observer and would refer it to relevant authorities if it appeared that UK laws on commercial surrogacy were being broken.“We encourage people considering surrogacy to remain in the UK, take independent legal advice and use recognised UK-based surrogacy organisations,” it said.

#New Life Global#Anti surrogacy#Anti exploiting women#Anti turning babies into commodities#Surrogacy for profit is a form of human trafficking#No one is entitled to bio kids

6 notes

·

View notes

Text

Top 25 Most Trusted Lawyers in Delhi India 2023

Advocate Amit Suden is one of India’s foremost senior corporate immigration attorneys with 25+ years of experience as one of India’s senior corporate mobility lawyers, Mr. Amit is recognized as an experienced authority on expatriate mobility matters.

"Top 25 Most Trusted Lawyers in Delhi India 2023"

ADVOCATE AMIT SUDEN FIRM SPECIALISING IN EXCELLENT TAILOR-MADE LEGAL SOLUTIONS

Demand for legal services in India is growing exponentially with large infrastructure projects expected to be launched by the Government to combat the economic slowdown with the increasing number of companies in the nation; many Indian companies engaging in cross-border transactions; increasing levels of legal awareness, regulation & compliance. One law firm that has been able to seize these opportunities and add value to its clientele is New Delhi, headquartered Riar Global LLP.

Founded in 2010, Riar Global carries a legacy of quality and integrity and caters to a wide range of legal requirements of a diverse clientele. The firm continuously helps clients get through the maze of complex legislation in a world where globalisation and technology are constantly changing. It is concentrated on providing clients with counsel that would guarantee the most excellent feasible resolution without compromise.

youtube

#Amit Suden#best corporate lawyer in India#corporate lawyer singapore#corporate lawyers in noida#corporate lawyer#corporate lawyers in kolkata#corporate lawyers in dubai#Best Lawyers in Delhi#senior lawyer#supreme court#high court#lawyer#lawmakers#law firms#lawfirm#cannabis legalization blog#legal action#for legal reasons this is a joke#reuters-legal#legal#law firm#lawyer life#justice#Advocate Amit Suden#advocate

2 notes

·

View notes

Text

Shekhawat Law: The Importance of Technology Law Firms

In today's fast-paced digital world, technology law firms play a crucial role in helping businesses navigate the complex legal landscape surrounding the rapidly evolving tech industry. These specialized firms are like expert guides, helping companies big and small steer through the legal challenges unique to the world of technology.

What Do Technology Law Firms Do?

Technology law firms specialize in a variety of legal matters specific to the tech sector. This includes things like protecting intellectual property (think patents and copyrights), ensuring data privacy, and dealing with cybersecurity issues. They also help with things like licensing agreements (those contracts that let companies use each other's technology), raising money through venture capital, and making sure companies follow all the rules and regulations.

Why Choose a Specialized Firm?

It's like hiring a doctor who specializes in a specific kind of illness. Technology law firms understand the unique challenges faced by tech businesses. They know all about software development, digital rights, and patent protection. Plus, they're experts in Internet law, which can get pretty tricky.

Top Firms in the Industry

There are some big-name law firms that are like rock stars in the world of technology law. These firms have a great track record, tons of experience, and really happy clients.

Wilson Sonsini Goodrich & Rosati: They're like the pioneers of Silicon Valley, helping startups and big tech companies with all their legal needs.

Cooley LLP: Known for helping tech companies with big deals like IPOs (when a company goes public), mergers, and protecting their intellectual property.

Orrick, Herrington & Sutcliffe LLP: These guys are like legal globetrotters, helping tech companies with deals all around the world.

DLA Piper: They're all about helping tech companies with everything from protecting data to solving disputes.

Latham & Watkins LLP: They're like the wise counselors of the tech world, giving great advice to both big and small tech companies.

Key Services Offered

Technology law firms offer a bunch of different services to help tech companies stay on the right side of the law. Some of the important ones include:

Protecting Intellectual Property: Think of it as putting a big legal fence around your ideas so no one else can steal them.

Data Privacy and Security: Making sure companies follow all the rules about keeping your personal information safe.

Licensing and Technology Transactions: Helping companies make deals about using each other's technology.

Corporate Governance and Compliance: Making sure companies follow all the rules about how they're supposed to be run.

Choosing the Right Firm

When picking a technology law firm, it's important to find one that knows your industry inside and out, has a good reputation, and really gets what you need. You want to find a firm that can give you practical advice that helps your business grow while also following all the rules.

Conclusion

In the end, technology law firms are like the superheroes of the tech world, fighting legal battles so businesses can focus on what they do best: innovating and growing. Whether you're a tiny startup or a big tech giant, having the right law firm by your side can make all the difference in the world. So, here's to the unsung heroes of the digital age – technology law firms!

#intellectual property law#sudarshan singh shekhawat#top ipr law firms in india#patent law firms in india#shekhawat law#technology law firms#patent application in india#best technology law firms

0 notes

Text

<h1>What Administration Accountants Do</h1>

Professional legal recommendation must be obtained before taking or refraining from any motion on account of the contents of this document. By method of instance, Vestiaire Collective, a luxurious resale platform, raised $216 million in a funding spherical in March 2021. Part of the company’s manifesto to its current and potential investors was its intention to become B Corp certified, which it then went on to attain in September 2021. “We’ve been in a place to deliver back 39 folks into our manufacturing facility, and a social employee we make use of on the ground is helping dozens of beforehand employed employees find work opportunities,” he says. It is an amended version of section 172 of the 2006 Companies Act which covers the duties and duties of administrators. The text for different legal varieties (CIC, limited by assure and LLP) are within the appendix at the finish of this doc.

Accounting corporations considering making use of for B Corp status must ensure they collect “as a lot knowledge as possible” in order to reduce internal friction, accounting market individuals have mentioned. One day per week will be dedicated to on the job coaching with us and off the job training with an exterior training provider, learning in course of your AAT Level 2 qualification. The other four days might be working as a Client Finance Assistant (CFA). Our CFAs ensure that we do what we are saying and keep our commitments to every other and our clients. They provide constant supply and release our Client Managers to fulfil their roles, giving them time to give consideration to the wants of our shoppers and the general quality of our work.

Download this free report to learn how the stakeholder model as practiced by B Corps is gaining international traction and validation. Beneficial State Bank (BSB) focuses on social justice and the setting. It is a socially responsible bank with all of the certifications corresponding to GABV, B Corp, and CDFI credentials. And it provides business banking services to community-based organizations, SMEs, and nonprofits.

Each bank within the network creates a optimistic difference in the neighborhood by solving problems. Do you want to put money into clear and sustainable firms but are not sure which company to choose? Learn more about the most effective B Corp banks to consider when opening an account. Corporate accounting is answerable for making certain that all the financial activities of an organization are correct, informative, and in compliance with the law. It additionally ensures that all the activities taken are by the organizational policies. Like any accounting job, there’s sure to be some reconciliation and categorization.

It is a progressive journey and we're committed to attaining a better score that will help our future B Corp re-verification course of, which occurs every three years. Discuss any sticking points and learn how making small changes could make the world of distinction. The article is available to read on the Accountancy Age web site here. Bussell additionally argues that, regardless of time or resource constraints, the benefits of turning into a B Corp far outweigh this. Bussell additionally praises the initiatives put in place by the firm within the years prior to its B Corp software, arguing that this paid off when it came to being assessed by B Lab. He explains that this allowed him to simply liaise with the firm’s HR director, head of finance and chief digital officer to accumulate the relevant info.

Mid-market corporations expertise largest proportion enhance in charge income in 2023, as consultancy providers start to become main revenue streams for the ... BKL’s business growth director Simon Bussell welcomes the accelerating sustainability efforts of UK companies, stressing the importance of ‘’balancing folks, planet and profit’’. Regionally-focused b corp certified accountant uk provide continuous enter on B Lab’s standards, particularly focusing on context, relevance, and best practices from all over the world. Working Groups are engaged to support the development of industry- or topic-specific suggestions to the Standards Advisory Council. Corporate non-public accounting is just one type of accounting, and generally makes use of non-public accountants employed by businesses.

So did Aloha, the makers of organic plant-based protein bars, powders and drinks. These organizations have joined more than 3,900 firms from seventy four international locations achieve “B corporation” status. As new benchmarks emerge on completely different components of this spectrum between depth and breadth, benchmark users are pressured to find out what's "adequate." The first group to sort out this methodically was IDH.

However, BKL managing parnter Lee Brook argues that this isn’t “job done” for the firm, and that measures should continue to be taken to make sure sustainability and accountability. For Emmeline Skelton, head of sustainability on the Association for Chartered Certified Accountants, these accomplishments by BKL show a dedication to the growing consensus on ESG. We want future talent to see telic as an employer of choice where the traditional benefits are simply the beginning and the future facing technique and objectives are something which they want to be a half of. Some of the best-known B Corps embody crowdfunding large Kickstarter, ice cream maker Ben & Jerry’s and clothes model Patagonia. So, while we love getting stuck into your tax advice, audit, transactions, and monetary planning, we will deal with some planet-sized issues together, too.

Our staff is uniquely positioned to advise on the certification process. We advised on the establishment of B Corporations within the UK and have been instrumental in the development of the UK legal test for certification. Luke Fletcher and Louise Harman both at present sit on B Lab UK’s coverage council, shaping coverage and considering regulatory issues for B Corps.

Mascoma Bank makes an impression by providing inexpensive housing and neighborhood growth. Mascoma Bank has been funding the group for nearly a hundred and twenty years, their space of experience. Sunrise Banks is CDFI certified and has accumulated $1 billion in property. They have six locations in Minneapolis and a total of 250 staff.

#b corp certified accountant uk#b corp certified#b corp#b corp accountant#b corp status#b corp status uk#certified business accountant

0 notes

Text

HHS-OCR Issues Bulletin Regarding Use of Online Tracking by HIPAA Covered EntitiesDiscover insights into the recent bulletin from the HHS OCR concerning online tracking by HIPAA covered entities. This bulletin sheds light on crucial considerations and regulations surrounding online tracking practices, ensuring compliance and safeguarding sensitive health information in digital environments. Stay up-to-date on crucial developments in healthcare law with Nicholson & Eastin, LLP's latest blog post.

#Nicholson & Eastin Florida Healthcare Attorneys#Florida Healthcare Attorneys#Florida Healthcare Lawyers#Health Care Focused Law Firm

0 notes

Photo

An LLP is a body corporate formed and incorporated under the Limited Liability Act 2008, it has a legal entity separate from that of its partners. Also, has perpetual succession, any change in the partners of an LLP will not affect its existence, rights, or liabilities of LLP. The provisions of the Partnership Act, 1932 will not apply to LLP. Furthermore, a Limited Liability Partnership means a business where a minimum of two partners is required and there is no limit on the maximum number of partners. The liability of the partners is limited up to the extent of Capital contribution done by each partner in checklist for llp registration.

#llp compliance#llp compliance checklist#llp annual compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#llp compliance checklist 2022#annual compliance of llp#llp compliance services#llp compliance services india#LLP Annual Filing in India#Annual Compliance for LLP Company#llp compliance online services india#online llp compliance services#llp annual compliance cost#annual return for llp#llp company compliance

0 notes

Text

Formation of Wholly Owned Subsidiary In India

A Wholly Owned Subsidiary refers to a company whose shares or voting rights are totally owned by the parent company.

A Wholly Owned Subsidiary (WOS) is distinct from a subsidiary since the former signifies that the parent company holds 100% of the whole shares or voting rights, while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

In India, a Private Limited company can be established by Foreign companies to conduct business or invest, which would be considered a Wholly Owned Subsidiary. However, this is subject to government regulations on Foreign Direct Investment (FDI) and other applicable provisions.

Requirements of Wholly Owned Subsidiaries

At least one director to be a resident of India: A Wholly Owned Subsidiary company must have at least one director who is a resident of India.

The term "resident" refers to an individual director who has lived in India for an equivalent of or more than 182 days in the preceding year.

No Minimum Capital: As per MCA guidelines, there is no minimum capital required to create the company.

Minimum one shareholder (and nominee) and 2 directors: As per Section 3(1)(b) of the Companies Act, 2013, it is crucial for every company to have at least one shareholder and one nominee shareholder, along with a minimum of two directors.

How to Form a Wholly Owned Subsidiary in India

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

Retain Original Name: The foreign company can decide to keep its original name for the subsidiary in India to carry forward its goodwill.

Add India as a Suffix: The foreign company can add India as a suffix to its original name to indicate its status as a subsidiary in India.

Use Registered Trademark: If the foreign company has a registered trademark in another country, it can use the same trademark for the subsidiary in India.

Choose a New Name: The foreign company can also pick a new name for the subsidiary if it wishes to do so.

Read more to know about the formation of WOS in India

#wholly owned subsidiary#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal consultation#legal services

0 notes

Text

Types of Company Registration in Bangalore

Types of Companies in Bangalore:

1. Private Limited Company: This is the most common type of company preferred by startups and small to medium-sized enterprises (SMEs) due to its limited liability feature and ease of raising funds.

2. Public Limited Company: These are suitable for larger businesses intending to raise capital from the public through the stock market. Public limited companies' compliance requirements are more stringent than private limited companies.

3. One-Person Company (OPC): Introduced to support single entrepreneurs, an OPC allows a single promoter to operate a corporate entity with limited liability.

4. Limited Liability Partnership (LLP): LLP combines the advantages of a traditional partnership with the limited liability feature of a company. It is a popular choice among professional services firms and small businesses.

Read More..,

0 notes

Text

The Benefits Of filing Annual Compliance For LLP | Ebizfiling

Introduction

LLP stands for Limited Liability Partnership. It is an alternative corporate structure where the members benefit from the feature of limited liability (which means that the members are liable for the shares they own) and the feature of the flexibility of partnership (which means that the members are free to decide the duties and responsibility of their own through an LLP agreement). When you register your business as LLP there is certain compulsory annual compliance for LLP that is required to be filed. In this blog, we will learn about the various LLP annual compliance and the benefit of filing annual compliance for LLP.

What is an LLP annual compliance?

Every Limited Liability Partnership must file LLP annual compliance each financial year to maintain an active status on the MCA portal. Regardless of the fact the LLP is in operation or not. LLP annual compliance is compliance which an LLP files to MCA and Income Tax Authorities. There are two different forms to be submitted to the MCA and one Income Tax Return form submitted to the Income Tax authorities.

Various annual compliance for LLP

Below are the 3 e-forms filed by the LLP every year with MCA and Income Tax Department:

1. Statement of insolvency and accounts

Fill the Form 8 for filing the accounts and insolvency statement of an LLP as instructed by the MCA. Along with the form attach details of the assets and liabilities of the LLP, a statement of revenue and expenditure, and a declaration of the financial state of the LLP by its authorized partners. The form 8 should be filed by the partners and it should be certified by the CS/ CA. It is an annual compliance for LLP which should be filed on 30th October of every financial year. It should be noted that the CS/ CA should audit the books in case the annual turnover of LLP is more than INR 40 lakh or the contribution is more than INR 20 lakh.

2. Filing of annual return

Fill the Form 11 for filing the annual return of the LLP as instructed by MCA. The annual return should be filed with the Registrar of Companies. Along with Form 11 attach the DSC of the designated partners. The form 11 should be filed by the partners and certified by the CS/ CA only when the annual turnover is more than INR 5 Cr. or the contribution is more than INR 50 lakh. It is an LLP annual compliance which should be filed on 30th May in every financial year.

3. Filing of income tax return

Since LLP is a separate legal, partners have to file LLP annual tax return. ITR form 5 is the form for filing the income tax returns of LLP. The purpose of filing ITR 5 is to file the annual turnover of the LLP. According to the section 139(1) of the Income Tax Act, 1961 each LLP registered in India needs to file an income tax return. The due date for filing ITR 5 is 31st July in case of no audit and if the audit is required then the due date is 30th September. The audit happens when the turnover of the LLP is more than INR 40 lakhs or the capital exceeds INR 25 lakhs, the accounts of the LLP should be audited by Chartered Accounted.

Benefits of filing annual compliance for LLP

Listed below are some benefits of filing annual compliance for LLP every year:

A. Simpler conversion

Filing annual compliance every year can help the LLP to convert to any other type of company easily and smoothly. The Registrar may ask for the records of LLP compliance to check if it is filed regularly at the time to conversion.

B. Active status

If the LLP continuously fails to submit annual return and statements of insolvency & accounts, then it can be declared as inactive or a default status will be given. So to maintain the status active, it is important to file each LLP annual compliance in every financial year.

C. Avoid penalties

If an LLP files compliance regularly then it can avoid the fines or penalties associated with non-filing of compliance or late filing of compliance. So filing annual compliance for LLP is must.

D. Financial worth

The forms filed by the LLP are accessible to other companies. As a result, the interested party may consider the financial worthwhile entering into contracts or executing big undertakings. So filing the forms along with the necessary financials can give an idea to the interested person.

Conclusion

We will conclude by saying that it is beneficial for the Limited Liability Partnership to file compliance for LLP every year in many ways. Filing the annual compliance of an LLP is easier than any type of company because LLP has less compliance compared to a company. There is not one single benefit but many benefits of filing annual compliance of LLP such as conversion, avoid penalties, active status, etc.

#llp compliances#llp annual compliance#compliances for llp#annual compliance for llp#legal services#startups#business

0 notes

Text

Unlocking GST Success: Your Guide to Finding the Right GST Expert in India from Mas LLP

In the dynamic world of Indian taxation, Goods and Services Tax (GST) has revolutionized the way businesses operate and comply with tax regulations. Navigating the complexities of GST requires expert guidance and support from seasoned professionals who understand the intricacies of the tax system. At Mas LLP, we pride ourselves on being leading GST expert in India, offering comprehensive solutions tailored to meet the diverse needs of businesses across the country. Let's delve into why Mas LLP is your go-to partner for GST success.

Unparalleled Expertise: With extensive experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our GST expert in India have in-depth knowledge of GST laws, rules, and compliance requirements, enabling us to provide expert guidance and support across a wide range of GST-related matters.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of GST services designed to address the diverse needs of businesses in India. Whether you're a small startup, a mid-sized enterprise, or a multinational corporation, we have the expertise and resources to support you at every stage of your GST journey. From GST registration and compliance to filing returns and managing audits, we handle every aspect of GST with precision and professionalism.

Tailored Approach: We understand that every business is unique, with its own set of goals, objectives, and challenges. That's why we take a tailored approach to GST consulting, offering customized solutions that align with your specific needs and aspirations. Whether you're looking to optimize your GST strategy, mitigate risks, or resolve compliance issues, we work closely with you to develop tailored solutions that deliver results.

Transparency and Trust: At Mas LLP, transparency and trust are at the core of everything we do. We believe in building long-term relationships with our clients based on honesty, integrity, and reliability. Our transparent pricing, clear communication, and ethical business practices ensure that you always know where you stand and can trust us to act in your best interests.

Client-Centric Focus: We're committed to providing exceptional service and support to our clients. Our dedicated team of GST expert in India is here to answer your questions, address your concerns, and provide expert guidance every step of the way. Whether you need assistance with GST planning, compliance, or dispute resolution, we're here to help you achieve your GST goals.

In the competitive landscape of Indian business, having the right GST expert in India by your side can make all the difference. With Mas LLP as your trusted partner, you can navigate the complexities of GST with confidence and clarity. Contact us today to learn more about our GST services in India and take the first step towards GST success.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes