#llp annual return

Text

Limited Liability Partnership (LLP) ROC Compliance

Limited Liability Partnership (LLP) ROC Compliance refers to the regulatory requirements that LLPs need to fulfill with the Registrar of Companies (ROC). In various jurisdictions, including India, LLPs are mandated to adhere to specific compliance norms set by the ROC to ensure transparency, legal conformity, and proper governance. These compliances typically include the timely filing of annual returns, financial statements, and other essential documents. Meeting LLP ROC Compliance is crucial for maintaining good standing with regulatory authorities and avoiding penalties. It underscores the commitment of LLPs to operate within the legal framework and uphold accountability in their business practices.

0 notes

Text

A complete guide on LLP Annual Filing and Process for LLP E-filing

Returns for a Limited Liability Partnership (LLP) should be filed on a regular basis to ensure compliance and avoid the harsh penalties imposed by the law for non-compliance. When compared to the compliance obligations placed on Private Limited Company, a Limited Liability Partnership has only a few compliances to follow each year. File your LLP annual returns with the professional help of Ebizfiling.

0 notes

Photo

Corpsee ITES Pvt Ltd company is the best llp compliance registration services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#annual return for llp#llp company compliance#llp compliance license#llp registration in india#llp registration india#online llp formation#register a llp in india#register llp online#register llp in india#registration of llp#llp formation india

0 notes

Text

Top LLP Company Compliance in Kolkata

Top LLP Company Compliance in Kolkata: Simplifying Compliance with Filemydoc

Introduction:

In the bustling city of Kolkata, numerous limited liability partnership (LLP) companies thrive and contribute to the region's vibrant business ecosystem. However, with the ever-increasing complexities of legal and regulatory frameworks, ensuring compliance can be a daunting task for business owners. This article aims to shed light on the top LLP company compliance requirements in Kolkata and how Filemydoc, a trusted online platform, simplifies the compliance process.

1. Understanding LLP Company Compliance:

Compliance for LLP companies in Kolkata involves adhering to various legal and regulatory obligations. These obligations ensure that businesses operate ethically, maintain transparency, and meet the standards set by the government and relevant authorities. Key compliance requirements for LLP companies in Kolkata include:

a) Registrar of Companies (RoC) Compliance: LLPs must comply with the filing of annual returns, financial statements, and other statutory documents with the RoC.

b) Tax Compliance: Complying with the Goods and Services Tax (GST), income tax, and other applicable tax regulations is crucial for avoiding penalties and maintaining financial transparency.

c) Employment Compliance: LLPs must adhere to labor laws, employee benefits, provident fund, professional tax, and other employment-related compliances.

2. The Importance of Top LLP Company Compliance in Kolkata:

Maintaining compliance is not just a legal requirement but also crucial for the long-term success and reputation of any LLP company in Kolkata. Here's why top LLP company compliance is essential:

a) Avoiding Legal Consequences: Non-compliance can result in hefty penalties, legal disputes, and even the dissolution of the LLP. Adhering to the regulations ensures the company's sustainability and protects its stakeholders.

b) Building Trust and Credibility: Compliant companies foster trust among customers, investors, and partners. Demonstrating commitment to compliance enhances the company's reputation and credibility in the market.

c) Ensuring Operational Efficiency: Compliance procedures often involve streamlining internal processes, leading to improved operational efficiency and reduced risk of errors.

3. Introducing Filemydoc: Simplifying LLP Company Compliance:

Filemydoc, a leading online platform, offers a comprehensive solution for LLP company compliance in Kolkata. With its user-friendly interface and advanced features, Filemydoc simplifies the compliance process, allowing businesses to focus on their core operations. Key features of Filemydoc include:

a) Automated Compliance Reminders: Filemydoc sends timely notifications and reminders about upcoming compliance deadlines, ensuring companies never miss a crucial filing date.

b) Document Management System: The platform provides a secure and centralized repository to store and manage all compliance-related documents, eliminating the hassle of manual record-keeping.

c) Expert Guidance and Support: Filemydoc offers expert guidance and assistance from professionals well-versed in the complexities of LLP company compliance. Users can seek advice and resolve queries through the platform's support channels.

4. Top LLP Company Compliance Services Offered by Filemydoc:

Filemydoc offers a range of services designed to address the specific compliance needs of LLP companies in Kolkata. Here are some of the top services provided by Filemydoc:

a) Annual Compliance Filings: Filemydoc facilitates seamless filing of annual returns, financial statements, and other statutory documents with the RoC, ensuring companies stay compliant.

b) Tax Compliance: The platform assists in GST registration, filing GST returns, income tax return filing, and other tax-related compliances, helping companies meet their tax obligations accurately and efficiently.

c) Legal and Regulatory Support: Filemydoc provides expert advice and assistance on legal and regulatory matters, including company incorporation, changes in partnership agreements, and compliance audits.

d) Compliance Audit and Due Diligence: The platform offers comprehensive compliance audits to identify areas of improvement and ensure adherence to all relevant regulations. This service is particularly useful during mergers, acquisitions, or partnership restructuring.

e) Annual Maintenance Packages: Filemydoc offers customized annual maintenance packages that cover all major compliance requirements, enabling companies to outsource their compliance management and focus on their business growth.

Conclusion:

Maintaining compliance with the legal and regulatory requirements is paramount for LLP companies in Kolkata. With the complexities involved, partnering with a reliable online platform like Filemydoc can simplify the compliance process significantly. By leveraging Filemydoc intuitive interface, automated reminders, and expert support, businesses can ensure seamless compliance management, avoid penalties, and build a strong reputation. Embrace Filemydoc to streamline your LLP company compliance in Kolkata and stay ahead in the dynamic business landscape

#LLP Annual Return Filing#LLP Registration in India#Limited Liability Partnership (LLP) Registration in India

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

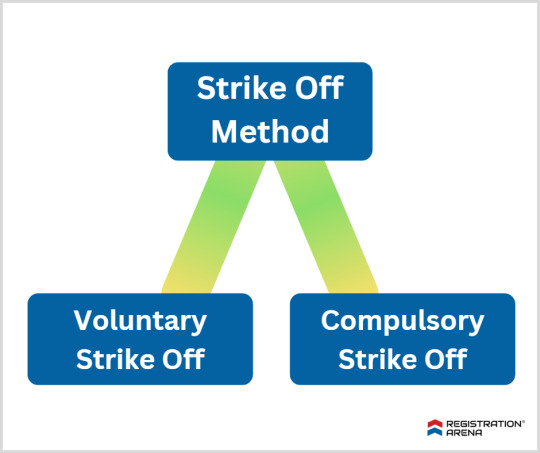

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

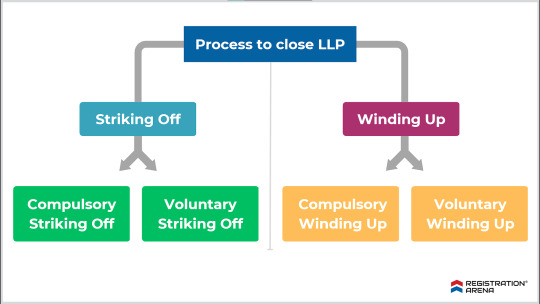

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Link

#LLP Annual Return Filing In Gujarat#LLP Annual Return Filing In Surat#LLP Annual Return Filing#LLP Roc Filing Due Date#LLP Annual Return Due Date 2022#LLP Annual Filing In Surat

0 notes

Text

Unveiling Limited Liability Partnership Registration: A Step-by-Step Guide

In the realm of business structures, Limited Liability Partnerships (LLPs) have emerged as a favored choice for entrepreneurs seeking a balance between liability protection and operational flexibility. Offering the advantages of both traditional partnerships and limited liability companies, LLPs provide a unique framework that appeals to a wide array of professionals and businesses. If you're considering forming an LLP, navigating through the registration process can seem daunting. However, fear not! In this comprehensive guide, we'll break down the intricacies of LLP registration, simplifying each step to set you on the path to success.

Understanding Limited Liability Partnerships

Before delving into the registration process, let's grasp the essence of Limited Liability Partnerships. An LLP combines features of both partnerships and corporations, providing its partners with limited personal liability akin to shareholders in a corporation. This implies that partners are not personally liable for the debts and obligations of the business beyond their investment. This protective shield for personal assets makes LLPs an attractive option for professionals such as lawyers, accountants, consultants, and small businesses.

Step-by-Step Guide to LLP Registration

1. Choose a Name

Ensure that your chosen name complies with the regulations stipulated by the relevant authority. It should not infringe on existing trademarks and should reflect the nature of your business.

2. Obtain Digital Signature Certificates (DSC)

LLP registration necessitates the use of Digital Signature Certificates (DSC) for filing various documents electronically. Obtain DSCs for all partners involved in the LLP.

3. Obtain Designated Partner Identification Number (DPIN)

This unique identification number is mandatory for all individuals intending to be appointed as partners.

4. Drafting LLP Agreement

The LLP agreement outlines the rights and duties of partners, profit-sharing ratios, decision-making procedures, and other pertinent details. Draft a comprehensive LLP agreement in accordance with the provisions of the LLP Act.

5. File Incorporation Documents

Compile and file the necessary incorporation documents with the Registrar of Companies (ROC). These documents typically include Form 1 (Incorporation Document) and Form 2 (Details of LLP Agreement). Pay the requisite fees along with the submission.

6. Registrar Approval and Certificate of Incorporation

Upon submission of documents, the Registrar will scrutinize the application. If all requirements are met satisfactorily, the Registrar will issue a Certificate of Incorporation, officially recognizing the LLP's existence.

7. Obtain PAN and TAN

After obtaining the Certificate of Incorporation, apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

8. Compliance with Regulatory Requirements

Ensure compliance with all regulatory requirements post-incorporation. This includes maintaining proper accounting records, filing annual returns, and adhering to tax obligations.

2 notes

·

View notes

Text

About Nick & The Team

Boston’s biotech cluster, often referred to as the “BioHub,” attracts vital investment and fosters partnerships between academia, startups, and established business players. She represents clients within the development of businesses, eating places, retail spaces, multifamily buildings, workplace and industrial buildings, warehouses, enterprise parks, and raw land. The dialogue began with a summarization of the present market, which they traced again to the Eighties when the state government took steps to draw bioscience firms to Massachusetts. As these companies entered the market, they clustered in Cambridge and Kendall Square, where they had access to expertise from native universities. The area remains a hotspot for biotech, with 175 life science companies forming in Massachusetts every year for the final three years.

It’s a cliched time period, however an organization founder ought to always be able to pitch if the opportunity arises. Prior to joining the firm, Tom practiced law at his personal firm, Griesinger, Tighe & Maffei, LLP. Prior to June 2000, Tom spent nearly thirty years at one of Boston’s large regulation corporations, the place he was a companion in litigation. We are additionally currently seeing a big variety of biotech companies launching in Boston from abroad. This implies that the right C-Suite rent might be someone already working for the corporate in another region, who is willing to relocate.

As one of many high vote-getters in the city and a champion for grassroots activists, Mejia has a means of forcing issues into the basic public conversation. Her persistent call for a slavery reparations conversation has resulted in a brand new task pressure. With Raytheon’s move to Virginia, Herrman’s firm trails only GE among the many state’s largest-revenue public corporations. He’s doing the entire in style things, too, committing the corporate to environmental sustainability and inclusivity.

In the United States, if the invention was generated using authorities funding, the settlement should follow federal IP management tips that can principally return the title of the invention to the researcher. Outside the United States, rules governing the return of rights vary by region and employer. Researchers should understand that though the institution will retain the proper to make use of the invention for analysis, institutional policies could prohibit development or improvement of the concept using institutional amenities.

Miller fits in personally with that ethos, sitting on nonprofit boards throughout Boston, including the Boys & Girls Clubs of Boston and the Urban League of Eastern Massachusetts. Twenty years after cofounding Wayfair, Shah continues to be running the company while remaining a fixture in native enterprise and civic circles. His philanthropic basis, run by his spouse, Jill Shah, has become a significant player due to its assist of native schooling, nutrition, and psychological well being initiatives. The outspoken Celtics celebrity is on the cusp of entering a model new section of his life—and career—as he focuses on selling social justice in the metropolis and past. “FemTech” isn't a time period you’d count on to listen to in the same breath as a 90-year-old Boston regulation agency, but that’s how of us are referring to Mintz’s new Women’s Health and Technology apply. It’s considered one of many ways that Popeo’s influential firm retains growing and adapting.

It was her question, at a January enterprise discussion board, about increasing diverse provider incentives that prompted Governor Healey to decide to an inter-agency fairness audit. She additionally finds time to cochair the Boys & Girls Clubs of Boston annual fundraising dinner. Since cofounding the Boston Black Hospitality Coalition, Grace has seen her work repay within the form of new companies galore—and her personal expanded presence on the restaurant scene. First, she opened the Underground Café and Lounge; this spring, it’s Grace by Nia within the Seaport. A actual estate website just lately known as her a “hospitality luminary,” and we wholeheartedly agree. He’s partnered with builders Darryl Settles and Richard Taylor to form the Boston Real Estate Inclusion Fund.

Advanced degrees and designations may be useful to set you aside from the competitors. Being an estate planner usually means understanding the tax code and all features of its legal implementation. Gaining this certification from organizations just like the National Institute of Certified Estate Planners, Inc. is usually a robust differentiator.

He typically acts as a mediator or arbitrator and has been retained as an professional witness on civil litigation and authorized ethics points. Tom is a Fellow of the American College of Trial attorneys, American Arbitration Association, and is listed in Top a hundred New England Super Lawyers and The Best Lawyers in America. We are a really full-service regulation firm serving shoppers in Greater Boston and communities all through Massachusetts. Our attorneys are ready to relentlessly advocate on your pursuits through mediation, different dispute resolution, and settlement in addition to in Massachusetts courtrooms when circumstances dictate such. Our status for profitable litigation permits us to secure higher settlement presents on a consistent basis. biotech investment planning boston of my law college application will see that I am in the center of my life.

#biotech wealth management#biotech financial services#biotech investment advisors#biotech tax planning#biotech estate planning#biotech investment planning#biotech retirement planning#biotech financial services boston#biotech investment advisors boston#biotech tax planning boston#biotech estate planning boston#biotech investment planning boston#biotech retirement planning boston

0 notes

Text

Benefits of LLP Registration in India

The following are the benefits of LLP Registration in India:

1. Low Cost and Less Compliance:

The overall cost of establishing a Limited Liability Partnership is low compared to the cost of registering a Private or Public Limited Company in India. The compliances to be followed by the LLP are also low. The LLP needs to file only 2 Statements yearly (i.e., an Annual Return and a Statement of Accounts and Solvency.

2. Liabilities are limited:

Limited Liability Partnership provides a limited liability benefit to all the designated partners. In case of s business insolvency or loss, the partners’ liability is restricted to the capital contribution as per the LLP agreement. Moreover, one partner is not held responsible for the actions of negligence/misconduct of any other partner.

3. Separate Legal Existence:

Just like a Company, an LLP has a separate legal entity. The Limited Liability Partnership is different from its partners. An LLP in India can sue & be sued in its own name. The Contracts are signed in the name of the Limited Liability Partnership (LLP) which helps to gain the trust of various stakeholders & gives the customers and suppliers a sense of confidence in the business.

4. Tax Benefits:

It is also exempted from various taxes like DDT (Dividend Distribution Tax) & Minimum Alternative Tax. The tax rate on LLP is less than that of the Company.

5. No Minimum Capital:

For the LLP formation in India, no minimum capital is required. No minimum capital contribution is required from partners. An LLP can be incorporated even with Rs. 2000 as a total capital contribution.

What are the Features of an LLP in India?

The following are the features of an LLP in India:

It’s a body corporate & legal entity separate from its members;

The members of an LLP have a limited liability, limited to their agreed contribution to the LLP;

It has the organizational flexibility of a Partnership;

It has a perpetual succession, it continues to exist even after the founding partners leave the organization. All it requires is to have at least 2 partners;

Its accounting & filing requirements are similar to that of a Company;

Less compliance and regulations;

No requirement for minimum capital contribution;

At least one partner must be a resident of India;

There is no upper limit on the maximum number of Partners.

0 notes

Text

A Guide To Registration Of Limited Liability Partnerships (LLPs) in India

As The Ministry of Corporate Affairs (MCA) has announced that LLP incorporation has moved to the web, just like SPICE+, as a result of the second amendment to the Limited Liability Partnership (Second Amendment) Rules, 2022. The incorporation document must be electronically filed with the Registrar in the form FiLLiP (Form for incorporation of Limited Liability Partnership) with the Registrar with jurisdiction over the registered office.

How Do You Form A Limited Liability Partnership (LLP)

LLPs combine the features of a corporation and a partnership in one business structure. They are a combination of corporations and partnerships. A small business in India often chooses an LLP Incorporation because of its low registration fees and easy maintenance.

Overview Of The Limited Liability Partnership (Second Amendment) Rules, 2022

A The LLP (Second Amendment) Rules, 2022 have undergone a few changes since they were announced on the 04th March 2022. These changes are as follows:

The number of designated partners at incorporation can be as many as five (without DIN numbers).

A PAN and TAN will be assigned as part of the LLP incorporation or registration process.

Incorporating an LLP through the web is similar to SPICE+.

It is also recommended to disclose contingent liabilities on Form 8 (Statement of Solvency) and Annual Return.

As a result, all LLP forms, including Form 9 - Consent of Partners, will be web-based, requiring all Designated Partners to sign digitally.

Incorporating A Limited Liability Company: Step-By-Step Guide

Name Reservation:

To incorporate an LLP, the first step involves reserving the name of the partnership. The applicant must fill out E-Form 1, which confirms availability.

Forming a Limited Liability Partnership (LLP):

If you wish to incorporate a Limited Liability Partnership (LLP), you must file FiLLiP after reserving a name. FiLLiP contains information about the LLP being formed, the partners/designated partners, and their consent to act as partners/ designated partners.

Agreement for Limited Liability Partnership:

A Within 30 days of LLP incorporation, the LLP Agreement must be executed and filed in E-Form 3. In LLP, mutual rights and duties are governed by an agreement between the partners or between the partners and the LLP, depending on the case. However, the LLP is still liable for its other obligations.

LLPs are incorporated using a Web-Based Process, which is as follows:

The LLP Incorporation (FiLLiP Form) is now available online as a result of the Limited Liability Partnership (Second Amendment) Rules, 2022. An DIN or DPIN applications are required along with name reservations, LLP incorporations, and/or new LLP incorporations under FiLLiP.

The eForm must include all supporting documentation, such as the names of designated partners and partners, etc. Once processed and found complete, an LLPIN is assigned.

A DIN/DPIN must also be issued to proposed designated partners/nominees of body corporate designated partners without valid DINs/DPINs.

When incorporating an LLP using this integrated form, the DIN/DPIN can be allocated to no more than five designated partners.

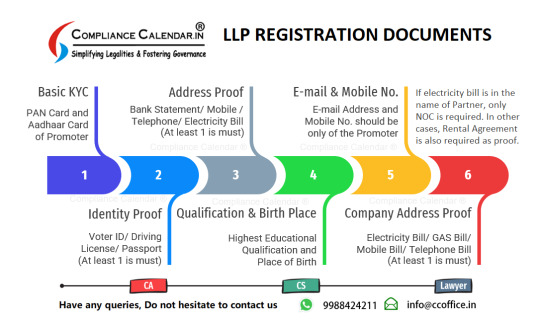

Document Requirements:

Documents required for the FiLLiP Form include:

It is required to submit the resolution on the letterhead of the body corporate being appointed a partner.

On the letterhead of that body corporate, an authorization/resolution naming the nominee/designated partner nominated to represent the company.

Document proving the address of a Limited Liability Partnership's Registered Office.

Subscriber consent form.

Regulatory authorities must approve the proposed name in principle before the attachment can be submitted.

Provide detail about the partnership/designated partnership(s) and/or company(s) in which the partner/designated partner is a director/ partner.

Owners or applicants of trademarks must approve trademark registration applications.

Any words or expressions in the proposed name that require approval from the Central Government.

The competent authority must approve collaboration and connection with a foreign country or place.

A copy of the Board Resolution of the existing company or the consent of the existing LLP is proof of no objection.

The advantages of LLP:

A Limited Liability Partnership is a type of business model that is

Based on an agreement, it is arranged and operated.

Provides flexibility without imposing detailed legal and procedural requirements.

Enables professional/technical expertise and initiative to interact with financial.

Thank you for giving your valuable time for reading this write-up, if still, you have any doubts regarding LLP Registration in India then please connect to our team at [email protected] or call us at 9988424211.

0 notes

Text

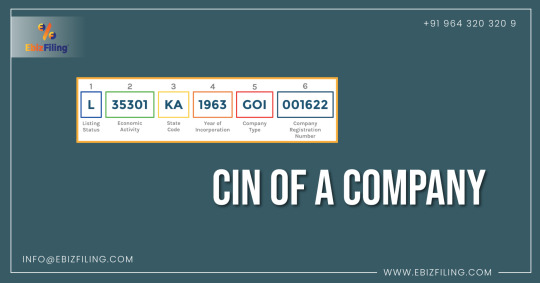

What is Corporate Identification Number (CIN)?

Introduction

This blog includes information on the corporate identification number (CIN), covering information on the CIN for companies, what it is, how to check it, and other related information. The Registrar of Companies (ROC) assigns each company incorporated in India with a unique identification number known as a Corporate Identification Number (CIN). After receiving their Registration Certificate, companies are granted their CIN by the ROC. The CIN is significant because every business is required to include this specific number on all documents submitted to the MCA, such as audits and other reports.

What is CIN Number?

The Ministry of Corporate Affairs issues the Corporate Identification Number (CIN), a 21-digit alpha-numeric identifier, to businesses that are formed in India after they have registered with the ROC in various states across the country.

All businesses that register in India are issued a CIN; examples are listed below.

One Person Company (OPC)

Nidhi Company

Limited Liability Company

State-owned enterprises

The company from Section 8 and others

On the other hand, Limited Liability Partnerships (LLP) registered in India do not acquire a CIN. LLPs are given a special 7-digit identifying number called the LLPIN (Limited Liability Partnership Identifying Number) by the ROC.

Description of the 21-digit of CIN

Section 1

The first character of a CIN shows whether a company is “Listed” or “Unlisted” on the Indian stock exchange. So, the first character indicates if the company is a stock market listed company. The CIN of a company will start with the letter “L” if it is listed, and with the letter “U” if it is not.

Section 2

The next five numeric digits classify a company’s economic activity or the industry to which it belongs. This categorization is based on the kind of economic activity that a facility like that would carry out. The MCA (Ministry of Corporate Affairs) has issued numbers to each category and industry.

Section 3

The next two letters represent the Indian state where the company is registered. As an illustration, GJ signifies Gujarat, MH signifies Maharashtra, KA signifies Karnataka, and so on. It works in the same way that a vehicle registration number does.

Section 4

The next four digits in a CIN number represent the year in which the company was created.

Section 5

The next three letters stand for the company class. These three letters indicate whether a company is a public limited or private limited company. If the CIN number is FTC, it means the business is a subsidiary of a foreign corporation, whereas the Government of India means the business is owned by the Indian government.

Section 6

The final six numerical digits represent the registration number provided by the concerned ROC (Registrar of Companies).

The importance of a company’s CIN number

The 21-digit CIN has a unique importance that is easy to understand and simplifies the identification of important corporate data.

It is used to obtain the fundamental data on businesses that are registered in the nation with the MCA (Ministry of Corporate Affairs).

A company’s CIN (Corporate Identification Number) must be submitted on all transactions with the relevant ROC (Registrar of Companies), and it is used to track all of its activities beginning with the time the ROC first established the company.

CIN numbers can be used to identify or track organizations for various levels of information maintained by MCA/ROC. The CIN provides details about the Registrar of Companies (ROC) as well as the identification of the company.

How to obtain a CIN number for your company?

Once you have chosen the type of business you want to establish, the steps to obtaining a CIN are as follows.

Get a DSC (Digital Signature Certificate).

Obtain a DIN (Director Identification Number).

The new user registration process must be finished.

After completing this, complete the company incorporation process.

Incorporate the Company

After receiving the company’s incorporation papers, the MCA (Ministry of Corporate Affairs) will evaluate and approve the application. After all of the application’s data has been verified, the CIN is assigned.

“Effortlessly meet compliance with our comprehensive LLP Annual Return Filing services. Expert assistance for seamless filings, ensuring your business stays on track. Stay focused on growth while we handle the paperwork.”

Summary

A business registration number, also referred as a CIN (Corporate Identification Number), a special identification number issued by the ROC (Registrar of Companies). In simple terms, a CIN is a special code that includes both the company’s identification number and extra details about how it operates.

0 notes

Photo

An LLP is a body corporate formed and incorporated under the Limited Liability Act 2008, it has a legal entity separate from that of its partners. Also, has perpetual succession, any change in the partners of an LLP will not affect its existence, rights, or liabilities of LLP. The provisions of the Partnership Act, 1932 will not apply to LLP. Furthermore, a Limited Liability Partnership means a business where a minimum of two partners is required and there is no limit on the maximum number of partners. The liability of the partners is limited up to the extent of Capital contribution done by each partner in checklist for llp registration.

#llp compliance#llp compliance checklist#llp annual compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#llp compliance checklist 2022#annual compliance of llp#llp compliance services#llp compliance services india#LLP Annual Filing in India#Annual Compliance for LLP Company#llp compliance online services india#online llp compliance services#llp annual compliance cost#annual return for llp#llp company compliance

0 notes

Text

What Is A CT600 Form

New Post has been published on https://www.fastaccountant.co.uk/what-is-a-ct600-form/

What Is A CT600 Form

You have probably heard the term “CT600 form” being thrown around, but do you really know what it is? Well, let us break it down for you. The CT600 form is a document that every limited company in the UK needs to complete and submit to HM Revenue and Customs (HMRC) as part of their tax obligations. It serves as a means for companies to report their taxable profits, along with any applicable deductions and reliefs. So, if you want to ensure compliance with tax regulations and avoid penalties, understanding what a CT600 form is and how to properly fill it out is essential.

youtube

Definition

Explanation of a CT600 form

A CT600 form, also known as a Company Tax Return, is a document that Ltd Companies in the United Kingdom need to fill out and submit to HM Revenue and Customs (HMRC) to report their taxable profits and calculate their corporation tax liability. It provides a comprehensive overview of a company’s financial activities and assists in the assessment and collection of taxes.

Who needs to fill out a CT600 form

All UK companies, including those operating as limited liability partnerships (LLPs), and non-profit organizations such as charities, are required to fill out a CT600 form if they are liable for corporation tax. This includes businesses with both active and dormant accounts, regardless of their size or annual revenue.

Purpose of a CT600 form

The primary purpose of a CT600 form is to ensure that businesses accurately report their taxable profits and pay the correct amount of corporation tax. By providing detailed information on a company’s finances, the form enables the HMRC to assess the tax liability and identify any discrepancies or potential tax evasion. Moreover, the CT600 form contributes to the transparency and accountability of businesses, as it ensures that their financial activities are properly documented and reported.

Key Information

Format of a CT600 form

The CT600 form consists of various sections that capture different aspects of a company’s accounts and tax computations. These sections include company details, accounts and tax computations, tax adjustments and losses, capital allowances, and other relevant information required by HMRC. Each section is designed to gather specific data and calculations necessary for the accurate assessment of corporation tax.

Where to obtain a CT600 form

Companies can obtain a CT600 form from the official HMRC website, where it is available for download in a printable format. Additionally, authorized software providers offer electronic versions of the form that can be completed and submitted online, simplifying the process for businesses.

Deadline for submitting a CT600 form

The deadline for submitting a CT600 form depends on the accounting period of the company. Generally, the form must be filed within 12 months of the end of the accounting period it relates to. For example, if a company has an accounting period ending on December 31st, the CT600 form must be submitted by the following December 31st. It is crucial for companies to meet this deadline to avoid penalties and ensure compliance with tax law.

Sections of a CT600 Form

Introduction

The introduction section of the CT600 form provides an overview of the purpose and requirements of the form. It outlines the legal obligations of companies to submit the form and highlights the penalties for non-compliance. This section also includes guidance on completing the form and important contact information for any queries or assistance.

Company details

In the company details section, businesses are required to provide information such as their legal name, registered address, company registration number (CRN), and Unique Taxpayer Reference (UTR). These details ensure the HMRC can correctly identify the company and link the CT600 form to the appropriate tax records.

Accounts and tax computations

The accounts and tax computations section is one of the most significant parts of the CT600 form. Here, companies report their financial information, including revenue, expenses, assets, and liabilities. Businesses must calculate their taxable profits accurately, taking into account any allowable deductions or adjustments according to tax laws and regulations. This section also requires details of any accounting treatments or adjustments made in the computation of taxable profits.

Tax adjustments and losses

In this section, companies report any tax adjustments or losses they have incurred during the accounting period. Tax adjustments include items such as capital allowances, research and development expenditure, and trading expenses not deducted in the accounts. Companies must provide accurate calculations and explanations for each adjustment or loss claimed.

Capital gains

If a company has disposed of any assets during the accounting period and made capital gains, those gains need to be reported in the capital gains section of the CT600 form. Companies must provide details of each disposal, such as the date, amount, and nature of the asset. Accurate calculations of capital gains or losses are essential to ensure compliance with tax regulations and avoid any underpayment or overpayment of corporation tax.

Other information

The other information section of the CT600 form allows companies to provide any additional information relevant to their tax computations or liability. This may include details on specific transactions, tax reliefs, or exemptions claimed. It is essential to provide complete and accurate information in this section to avoid potential discrepancies or inquiries from the HMRC.

Filling out a CT600 Form

Gathering required information

Before filling out the CT600 form, it is crucial to gather all the necessary information and documentation. This includes financial statements, profit and loss accounts, balance sheets, details of income and expenses, and any relevant supporting documents. By ensuring all the information is readily available, businesses can streamline the completion process and minimize the risk of errors.

Completing the sections of the form

To complete the CT600 form accurately, it is important to carefully read the instructions and guidance provided by the HMRC. Each section has specific requirements and calculations, and it is essential to understand the terminology used. It may be helpful to consult with an accountant or tax professional to ensure compliance with regulations and optimize for any tax reliefs or exemptions.

Understanding terminology and calculations

The CT600 form includes specific terminology and calculations that may be unfamiliar to those without a background in accounting or tax. Understanding these terms and computations is crucial to accurately report taxable profits and compute the correct amount of corporation tax. Companies can refer to the HMRC’s guidance or seek professional advice to ensure clarity on these terms and calculations.

Common Mistakes

Frequent errors made when completing a CT600 form

While completing a CT600 form, businesses may make certain errors inadvertently. Some common mistakes include inaccurate calculations of taxable profits, incomplete disclosures, incorrect application of tax rules, and data entry errors. Failure to report all relevant financial information and adjustments can also lead to errors in tax liability calculations.

Impact of mistakes on tax liabilities

Mistakes on a CT600 form can have significant implications for a company’s tax liabilities. Underestimating or overestimating taxable profits can result in underpayment or overpayment of corporation tax, leading to potential penalties and interest charges. Inaccurate disclosures and incomplete information can raise red flags, resulting in further inquiries or investigations by HMRC.

How to avoid common errors

To avoid common errors on a CT600 form, it is crucial to carefully review all information before submission. Double-checking calculations, ensuring all necessary details are provided, and seeking professional advice if needed can help minimize mistakes. Using accounting software or engaging the services of an accountant or tax professional can also provide additional assurance and expertise in preparing the form accurately.

Supporting Documents

Documents required when submitting a CT600 form

When submitting a CT600 form, companies must provide various supporting documents to verify the information reported. These documents typically include financial statements, profit and loss accounts, balance sheets, and any relevant schedules or calculations. It is important to ensure these documents are complete, accurate, and reflect the figures reported on the CT600 form.

Importance of accurate and complete documentation

Accurate and complete documentation is crucial when submitting a CT600 form, as it provides evidence and transparency of a company’s financial activities. The supporting documents serve as the basis for the figures reported on the form and help HMRC assess the accuracy of the tax computations. Maintaining organized and up-to-date records ensures compliance with tax law and facilitates the audit process if required.

Submitting a CT600 Form

HM Revenue and Customs (HMRC) guidelines for submission

HMRC provides guidelines and instructions on how to submit a CT600 form. These guidelines outline the different submission methods, deadlines, and requirements for each option. Businesses should carefully review these guidelines and follow the recommended procedures to ensure the smooth submission of their CT600 form.

Online submission process

The online submission process offers a convenient and efficient way for companies to submit their CT600 form. HMRC provides an online portal where businesses can upload the completed form and any supporting documents. Online submission reduces the risk of errors, enables faster processing and acknowledgment, and provides a digital record of the submission.

Paper submission process

Businesses can only choose to submit a paper version of the CT600 form by mail if they have a reasonable excuse. If a business decides to file a paper tax return, it must also submit a Form WT1 to provide reasons why it has decided to submit a paper CT600. It is essential to ensure that the paper form is accurately completed, signed, and accompanied by all the necessary documents. This method may take longer for processing and acknowledgment compared to online submissions.

Penalties for late or incorrect submission

Late or incorrect submission of a CT600 form can result in penalties and fines imposed by HMRC. The penalties vary depending on the severity of the non-compliance and can range from monetary fines to potential criminal investigations. It is crucial to meet the deadlines and ensure accurate completion and submission of the form to avoid these penalties and maintain compliance with tax regulations.

Benefits of Filing a CT600 Form

Compliance with legal obligations

Filing a CT600 form is a legal requirement for businesses in the UK liable for corporation tax. By submitting the form timely and accurately, companies demonstrate their compliance with tax regulations and fulfill their legal obligations. This compliance enhances their reputation and credibility with stakeholders, including investors, lenders, and customers.

Avoiding penalties and fines

One of the most significant benefits of filing a CT600 form correctly is the avoidance of penalties and fines. Meeting the submission deadline, providing accurate information, and following the guidelines help prevent unnecessary financial burdens and potential legal consequences. By proactively fulfilling their tax obligations, companies can focus on their core operations and avoid disruptions caused by non-compliance.

Establishing transparency and accountability

The CT600 form plays a critical role in establishing transparency and accountability for businesses’ financial activities. By providing a comprehensive overview of a company’s accounts and tax computations, the form enables the HMRC to monitor and assess tax liabilities accurately. This transparency enhances the trust and confidence of stakeholders, including shareholders, employees, and the wider community.

Importance for Small Businesses

Impact of the CT600 form on small businesses

The CT600 form is equally important for small businesses as it is for larger corporations. Although small businesses may have relatively simpler financial structures, accurate reporting and payment of corporation tax are essential. The form allows small businesses to determine their tax liabilities accurately, take advantage of applicable reliefs, and maintain compliance with regulations.

Understanding tax obligations and liabilities

For many small business owners, understanding tax obligations and liabilities can be challenging. The CT600 form serves as a valuable tool for educating small business owners on taxation requirements and providing a structured approach to reporting profits and calculating taxes. By familiarizing themselves with the form and seeking professional assistance as needed, small businesses can navigate the tax landscape more effectively.

Seeking professional assistance

Small businesses, especially those without dedicated accounting or tax departments, may benefit from seeking professional assistance when completing a CT600 form. Experienced accountants or tax professionals can provide guidance on understanding the form, optimizing tax reliefs, ensuring accurate calculations, and minimizing the risk of errors or non-compliance. Engaging professional help can alleviate the burden on small business owners and support their overall tax compliance efforts.

Future Developments

Potential changes to the CT600 form

HMRC periodically reviews and updates tax-related forms and processes to enhance efficiency and accuracy. There may be potential changes to the CT600 form in the future to streamline the reporting process, align with evolving tax legislation, and improve user experience. Businesses should stay updated with any changes or revisions made by HMRC to ensure continued compliance with their tax Lae.

Simplification of the form

One potential direction for future development is the simplification of the CT600 form. HMRC recognizes the complexities businesses face when completing the form and aims to make it more user-friendly and less burdensome. This could involve reducing unnecessary sections, providing clearer instructions, and leveraging technology to automate certain calculations or data input.

Digitalization and automation of the submission process

As technology continues to advance, HMRC is exploring digitalization and automation of the CT600 form submission process. This could involve implementing online systems that integrate with accounting software, allowing seamless transfer of financial data and calculations directly to the form. Digitalization and automation would streamline the submission process, minimize errors, and enhance efficiency.

In conclusion, the CT600 form is a vital tool for businesses in the UK to report their taxable profits and calculate their corporation tax liability accurately. While the form may seem complex, understanding its various sections, gathering the necessary information, and seeking professional assistance can aid in its completion. By ensuring accurate and timely submission of form CT600, businesses can demonstrate compliance with tax law, avoid penalties, and establish transparency and accountability. The form holds equal importance for small businesses, offering them an opportunity to understand tax obligations and liabilities while seeking professional assistance if needed. As the HMRC continues to explore future developments, potential changes to the CT600 form, simplification, and digitalization may further enhance the submission process, promoting efficiency and accuracy.

#CT600#CT600 Corporation Tax Return#Ct600 Form#What Is A Ct600#What Is A Ct600 Form#What Is Ct600 Form

0 notes

Text

Formation of Wholly Owned Subsidiary In India

A Wholly Owned Subsidiary refers to a company whose shares or voting rights are totally owned by the parent company.

A Wholly Owned Subsidiary (WOS) is distinct from a subsidiary since the former signifies that the parent company holds 100% of the whole shares or voting rights, while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

In India, a Private Limited company can be established by Foreign companies to conduct business or invest, which would be considered a Wholly Owned Subsidiary. However, this is subject to government regulations on Foreign Direct Investment (FDI) and other applicable provisions.

Requirements of Wholly Owned Subsidiaries

At least one director to be a resident of India: A Wholly Owned Subsidiary company must have at least one director who is a resident of India.

The term "resident" refers to an individual director who has lived in India for an equivalent of or more than 182 days in the preceding year.

No Minimum Capital: As per MCA guidelines, there is no minimum capital required to create the company.

Minimum one shareholder (and nominee) and 2 directors: As per Section 3(1)(b) of the Companies Act, 2013, it is crucial for every company to have at least one shareholder and one nominee shareholder, along with a minimum of two directors.

How to Form a Wholly Owned Subsidiary in India

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

Retain Original Name: The foreign company can decide to keep its original name for the subsidiary in India to carry forward its goodwill.

Add India as a Suffix: The foreign company can add India as a suffix to its original name to indicate its status as a subsidiary in India.

Use Registered Trademark: If the foreign company has a registered trademark in another country, it can use the same trademark for the subsidiary in India.

Choose a New Name: The foreign company can also pick a new name for the subsidiary if it wishes to do so.

Read more to know about the formation of WOS in India

#wholly owned subsidiary#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal consultation#legal services

0 notes

Text

A Comprehensive Guide to Company Registration in Delhi with Legalari

Company Registration in Delhi

Understanding Company Registration:

Company registration encapsulates the formal process of incorporating a business entity under the legal framework of a specific jurisdiction. In the bustling metropolis of Delhi, a plethora of aspiring entrepreneurs embark on their ventures daily, seeking to carve their niche in various industries. However, amidst the excitement of entrepreneurial pursuits, the significance of proper Company Registration in Delhi often gets overlooked.

The Importance of Company Registration:

Registering a company offers a myriad of benefits, ranging from legal protection to enhanced credibility and access to various resources. By obtaining legal recognition, a business entity gains the ability to enter into contracts, own assets, and limit the liability of its shareholders or owners. Moreover, registered companies tend to garner more trust and confidence from potential clients, investors, and partners, thereby fostering growth and expansion opportunities.

Navigating the Legal Landscape:

Delhi, being the heart of commerce and trade in India, operates under a robust legal framework governing Company Registration in Delhi. From selecting the appropriate business structure to adhering to regulatory compliances and documentation, the process entails numerous steps. Legalari, with its profound understanding of Delhi’s legal landscape, simplifies this journey for aspiring entrepreneurs and established businesses alike.

Choosing the Right Business Structure:

One of the pivotal decisions in Company Registration in Delhi revolves around selecting the most suitable business structure. Legalari extends comprehensive guidance tailored to the unique needs and aspirations of each client. Whether it’s a sole proprietorship, partnership, limited liability partnership (LLP), or a private or public limited company, Legalari ensures that clients make informed decisions aligned with their long-term objectives.

Streamlining the Registration Process:

Navigating through the bureaucratic maze of registration procedures can be daunting for many. However, Legalari streamlines the entire process, ensuring swift and efficient registration. From obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) to filing necessary documents with the Registrar of Companies (ROC), Legalari meticulously handles each step, leaving clients free to focus on their core business activities.

Ensuring Compliance and Beyond:

Beyond registration, Legalari continues to be a trusted partner in ensuring ongoing compliance with regulatory requirements. From maintaining statutory records to filing annual returns and conducting board meetings, Legalari offers comprehensive corporate governance solutions tailored to the specific needs of each client. By staying abreast of regulatory changes and industry trends, Legalari ensures that clients remain on the path to sustainable growth and success.

The Road Ahead:

As Delhi continues to emerge as a thriving hub of entrepreneurship and innovation, the significance of proper Company Registration in Delhi cannot be overstated. Legalari, with its unwavering commitment to excellence and client satisfaction, stands as a steadfast ally for businesses embarking on this transformative journey. By combining legal expertise with a client-centric approach, Legalari empowers businesses to navigate challenges, seize opportunities, and unlock their full potential in the vibrant landscape of Delhi’s business ecosystem.

Conclusion:

In the bustling metropolis of Delhi, where opportunities abound and challenges lurk at every corner, Legalari emerges as a beacon of expertise and reliability in the realm of Company Registration in Delhi. With a deep understanding of Delhi’s legal landscape and a commitment to client success, Legalari simplifies the registration process, ensures compliance, and paves the way for businesses to thrive and prosper. So, whether you’re a budding entrepreneur with a vision or an established business seeking to expand horizons, Legalari stands ready to be your trusted partner in unlocking limitless possibilities in the dynamic realm of Delhi’s business landscape.

#LegalariDelhi#CompanyRegistration#BusinessInDelhi#Entrepreneurship#LegalConsultancy#DelhiBusinessHub#StartupIndia#ComplianceMatters#BusinessGrowth#LegalExpertise

0 notes

Text

A Comprehensive Guide on How to Register a Company in India

In the vibrant landscape of India's business ecosystem, registering a company marks the first significant step towards turning entrepreneurial dreams into reality. Whether you're a seasoned entrepreneur or a budding visionary, understanding the process of company registration in India is crucial. In this guide, we'll walk you through the essential steps to register a company in India.

Understanding the Basics

Before diving into the registration process, it's vital to grasp the different types of companies recognized under Indian law:

Private Limited Company: Ideal for small to medium-sized businesses, offering limited liability to its shareholders and restricting share transfers.

Public Limited Company: Suited for larger enterprises, with shares publicly traded on the stock exchange and more stringent regulatory requirements.

Limited Liability Partnership (LLP): Combines the benefits of a partnership with limited liability, popular among professionals and small businesses.

Step-by-Step Registration Process

Choose a Suitable Business Structure:

Selecting the right business structure is the cornerstone of company registration. Consider factors such as liability, taxation, ownership, and compliance requirements before making a decision.

Obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN):

Directors of the proposed company must obtain a DSC, necessary for digitally signing documents, and a DIN, which serves as an identification number.

Name Approval:

Choose a unique name for your company and ensure it complies with the naming guidelines prescribed by the Ministry of Corporate Affairs (MCA). Conduct a name availability search on the MCA portal and apply for name approval.

Drafting Memorandum and Articles of Association:

Prepare the Memorandum of Association (MoA) and Articles of Association (AoA), outlining the company's objectives, rules, and regulations. These documents define the company's structure and operations.

Filing Incorporation Documents:

Complete the incorporation process by filing the necessary documents, including MoA, AoA, and Form SPICe (Simplified Proforma for Incorporating Company electronically) with the Registrar of Companies (RoC).

Payment of Registration Fees:

Pay the requisite registration fees based on the authorized capital of the company. The fee structure varies depending on the type and size of the company.

Certificate of Incorporation:

Upon verification of documents and compliance with regulatory requirements, the RoC issues a Certificate of Incorporation, officially recognizing the establishment of the company.

Apply for PAN and TAN:

Obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. These are essential for tax compliance and financial transactions.

Registration for Goods and Services Tax (GST):

If your company's turnover exceeds the prescribed threshold, register for GST, a unified tax system applicable to the supply of goods and services.

Compliance Requirements:

Fulfill ongoing compliance obligations, including maintaining statutory records, holding annual general meetings, and filing annual returns with the RoC.

Conclusion

Registering a company in India is a well-defined process that requires careful planning, adherence to regulatory guidelines, and compliance with legal formalities. By following the step-by-step procedure outlined in this guide, entrepreneurs can navigate the complexities of company registration with confidence and set the stage for a successful business venture. Whether it's a private limited company, public limited company, or LLP, the key lies in understanding the nuances of each structure and making informed decisions. So, embark on your entrepreneurial journey armed with the knowledge of how to register a company in India, and let your business aspirations soar to new heights.

Remember, the keyword "how to register a company in India" signifies the importance of understanding the process thoroughly, ensuring that your business starts off on the right foot within the regulatory framework of the country.

0 notes