#register llp online

Text

How to Register an Online Limited Liability Partnership

LLPs, or LLPs for short, combine the benefits of partnerships and LLCs.In order to combine the advantages of partnership taxation with limited liability, LLPs were introduced in the Rajya Sabha on December 15, 2006.

There are fewer regulations that must be adhered to in an LLP than in a company, making it easier to establish and operate one.Learn more about how to register LLP online in India.

Partners in an LLP can be any of the following:

A limited liability partnership is formed in accordance with the Limited Liability Partnership Act of 2008 (the Act).There is no limit on the number of partners in an LLP; individuals Limited Liability Partnerships Companies Foreign Limited Liability PartnershipsThe Act, on the other hand, requires at least two partners.You should follow the steps in this article to incorporate an LLP.

Step 1: For LLP designated partners to obtain, a Digital Signature Certificate (DSC) and a Designated Partner Identification Number are required.To electronically submit forms through the MCA portal, a DSC is required.Only organizations that have received government approval can provide DSCs.

After the DSC has been obtained, the Designated Partner Identification Number (DPIN) can be obtained by submitting Form DIR-3.In order to be considered a designated partner under the Act, you must satisfy this condition.Form DIR-3 requires both proof of identity and proof of residence.

Step 2: Reservation of the LLP's name Prior to forming a new LLP or converting an existing business or organization into one, the name must be reserved. Reservation requests can only be made through the MCA portal.The Reserve Unique Name-LLP (RUN-LLP) form must be completed before this application can be submitted.A name reservation request will be looked at by the Central Registration Centre (CRC) and, if possible, approved.

Step 3: A LLP Integrated Incorporation Form (FiLLiP) must be filed after the name has been reserved.The subscriber's form, which includes consent, the names and DPINs of the designated partners, the total contribution of each partner, the proposed or approved name of the limited liability company, the limited liability company's business activity, and the registered office's address.

Step 4: Certificate of Incorporation LLPs receive a Form 16 Incorporation Certificate upon successful registration.This certificate bears the LLP Identification Number (LLPIN).

Step 5: A Limited Liability Partnership Agreement specifies the rights and responsibilities of the partners and the LLP.After their LLP is registered, partners may enter into this agreement.The LLP agreement specifies the terms and conditions for admitting or removing partners, the consequences of death, and the division of profits and losses.Form 3 must be submitted to the RoC after the agreement has been registered and ratified by the partners. No agreement will change the partners' relationship with the LLP, which is governed by the First Schedule.

0 notes

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

DigiFashion Forum 2023

Hihi, sorry for being away for so long. I've been working my a*s off lately 'cause I'm helping a friend to host an online forum. The event will be live stream on Youtube on March 29, well, in 6 hrs! XD. I just don't have time to write a decent tumblr post.😑😑😑

We have invited several outstanding leaders in the industry to share their insights on digital fashion. As a veteran TS3 player, I personally find this quite interesting. What we put on our sims is now something people have their avatars wear in Metaverse and it could be something duplicating/inspired by the real fashion world or something we can never have in reality. If you find what I wrote interesting, you might wanna join the event.

Check out the official site for further details and register (a simple process to help us screen the audience on the YT steam, and it's completely free of charge!) This event is not limited to industrial professionals. Anyone wants to know more about this emerging trend is welcome to join. See you then! 😉

Speaker overview:

Leslie Holden (Co-Founder The Digital Fashion Group, Brussel/BEL)

Beata Wilczek (Founder Unfolding Strategies, Berlin/GER)

Kun-Chou Tsai (Managing Partner Enlighten Law Group, Taipei/TW)

Olska Green (Founder & Designer Ecoolska, Lisbon/POR)

Rene Fang (CEO iStaging, Taipei/TW)

Jens Laugesen (Design & Creative Director Jens Laugesen, London/UK)

Sean Chiles (Co-Founder The Digital Fashion Group, Tábua /POR)

Dr. Roger Ng (Honorary Chairman Hong Kong Chinese Textile Mills Association/CHI)

Florence Lu (Associate Professor Shih Chien University, Taipei/TW)

René Petrevski (Business Development Manager STYLE Protocol, Berlin/GER)

Cheua-Hei Chan (Co-Founder Aurar, Berlin/GER)

Nico Owsianowski (Co-Founder Aurar, Berlin/GER)

Urja Kumbhare (Co-Founder & Director Opulentia Designs LLP, Mumbai/IND)

Hena Venugopal (CEO Envied Futur, Coppell, Texas/USA)

KC Man (Founder Virtual Touch Group Limited, Hong Kong/CHI)

Claire Chang (Founder Techmoi.com, Taipei/TW)

Jackaline Tang (Gaming Partnerships Manager Brand New Vision, Hong Kong/CHI)

Event Time:

March 29, 2023 14:00 UTC+8 (Taipei, Hong Kong, Singapore, …)

March 29, 2023 17:00 UTC+11 (Sydney)

March 29, 2023 15:00 UTC+9 (Tokyo)

March 29, 2023 13:00 UTC+7 (Bangkok, Jakarta, …)

March 29, 2023 11:30 UTC+5:30 (New Delhi)

March 29, 2023 07:00 UTC+1 (London)

March 29, 2023 08:00 UTC+2 (Berlin, Paris, …)

March 29, 2023 02:00 UTC-4 (New York)

March 28, 2023 23:00 UTC-7 (Los Angeles)

#Im also working on another side job#at early stage tho#busybusybusy#hope I'll have more time after the forum#finger-crossed#miss the days with ts3 TT#nonsims#digital fashion#metaverse#web3

13 notes

·

View notes

Text

HOW TO REGISTER A COMPANY IN INDIA.

In this article, we will tell you about "STEPS TO REGISTER A COMPANY IN INDIA."

Before talking about the steps to register a Company, let us tell you what are the different types of companies that can be Registered in India.

* Types Of Companies in India :

There are 4 types of companies in India.

1) ONE PERSON COMPANY

2) LIMITED LIABILITY PARTNERSHIP

3) PRIVATE LIMITED COMPANY

4) PUBLIC LIMITED COMPANY

1) One Person Company(OPC):

A person Company ( OPC ) is formed and owned by a single person. It is the best type of company if anyone wants to be the sole owner of the company and wants to take all the decisions on its own without asking or regarding anyone for the company. One Person Company (OPC) was introduced in the year 2013 under the Companies Act 2013, Before that single person cannot form a company.

2) Limited Liability Partnership(LLP):

Limited Liability Partnership(LLP) is a type of company in which all the partners have some limited liabilities. LLP was introduced by the limited liability Act 2008. A minimum of 2 and a maximum of 200 people can become members of the Limited Liability Partnership (LLP).

3) Private Limited Company:

A private limited company is a privately handled Business entity by a small group of people also known as Directors. Minimum 2 and a maximum of 50 people can be Directors. A private limited company has Shareholders in the form of stakeholders & Directors in form of Company officers these both are employees of the company.

4) Public Limited Company:

A public limited company is a company that offers its share of Stock to the General public. Those who buy these stocks have limited liability, hence they can not be responsible for company losses by excusing what the shareholders get in terms of shares they bought from the company.

These are the 4 Types of Companies that can be Registered in India.

NOW, LET'S TALK ABOUT THE STEP TO REGISTERING A COMPANY IN INDIA.

* STEPS TO REGISTER A COMPANY IN INDIA

There are 4 steps for registering a company:-

1) Digital Signature Certificate (DSC)

A digital signature is required in the form fillIng on MCA Portal online. The Digital Signature Certificate is mandatory for all the Directors, Subscribers of the Memorandum of association (MOA) and the Article of Association (AOA).

2) Director Identification Number (DIN)

The Director Identification Number(DIN) number can be acquired by filling out the DIN-1 Form. The Director identification number (DIN), Name, and Address proof of all the proposed Director are to be provided in the company registration form.

3) Registration on the MCA Portal

After DIN the Simplified Proforma for Incorporation a company Electronically (SPICe+) e-form has to fill into the registers MCA (Ministry of Corporate Affairs) portal.

4) Certificate Of Incorporation

After filling the SPICe+ in the registered MCA portal the Certificate of Incorporation is issued to the company once all the documents are submitted and verified by the Registrar of companies.

After verifying the company is successful Registered.

To Register your company contact us at:- The Startup gig

2 notes

·

View notes

Text

A Guide To Registration Of Limited Liability Partnerships (LLPs) in India

As The Ministry of Corporate Affairs (MCA) has announced that LLP incorporation has moved to the web, just like SPICE+, as a result of the second amendment to the Limited Liability Partnership (Second Amendment) Rules, 2022. The incorporation document must be electronically filed with the Registrar in the form FiLLiP (Form for incorporation of Limited Liability Partnership) with the Registrar with jurisdiction over the registered office.

How Do You Form A Limited Liability Partnership (LLP)

LLPs combine the features of a corporation and a partnership in one business structure. They are a combination of corporations and partnerships. A small business in India often chooses an LLP Incorporation because of its low registration fees and easy maintenance.

Overview Of The Limited Liability Partnership (Second Amendment) Rules, 2022

A The LLP (Second Amendment) Rules, 2022 have undergone a few changes since they were announced on the 04th March 2022. These changes are as follows:

The number of designated partners at incorporation can be as many as five (without DIN numbers).

A PAN and TAN will be assigned as part of the LLP incorporation or registration process.

Incorporating an LLP through the web is similar to SPICE+.

It is also recommended to disclose contingent liabilities on Form 8 (Statement of Solvency) and Annual Return.

As a result, all LLP forms, including Form 9 - Consent of Partners, will be web-based, requiring all Designated Partners to sign digitally.

Incorporating A Limited Liability Company: Step-By-Step Guide

Name Reservation:

To incorporate an LLP, the first step involves reserving the name of the partnership. The applicant must fill out E-Form 1, which confirms availability.

Forming a Limited Liability Partnership (LLP):

If you wish to incorporate a Limited Liability Partnership (LLP), you must file FiLLiP after reserving a name. FiLLiP contains information about the LLP being formed, the partners/designated partners, and their consent to act as partners/ designated partners.

Agreement for Limited Liability Partnership:

A Within 30 days of LLP incorporation, the LLP Agreement must be executed and filed in E-Form 3. In LLP, mutual rights and duties are governed by an agreement between the partners or between the partners and the LLP, depending on the case. However, the LLP is still liable for its other obligations.

LLPs are incorporated using a Web-Based Process, which is as follows:

The LLP Incorporation (FiLLiP Form) is now available online as a result of the Limited Liability Partnership (Second Amendment) Rules, 2022. An DIN or DPIN applications are required along with name reservations, LLP incorporations, and/or new LLP incorporations under FiLLiP.

The eForm must include all supporting documentation, such as the names of designated partners and partners, etc. Once processed and found complete, an LLPIN is assigned.

A DIN/DPIN must also be issued to proposed designated partners/nominees of body corporate designated partners without valid DINs/DPINs.

When incorporating an LLP using this integrated form, the DIN/DPIN can be allocated to no more than five designated partners.

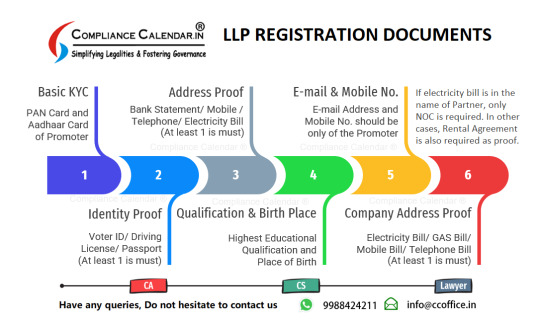

Document Requirements:

Documents required for the FiLLiP Form include:

It is required to submit the resolution on the letterhead of the body corporate being appointed a partner.

On the letterhead of that body corporate, an authorization/resolution naming the nominee/designated partner nominated to represent the company.

Document proving the address of a Limited Liability Partnership's Registered Office.

Subscriber consent form.

Regulatory authorities must approve the proposed name in principle before the attachment can be submitted.

Provide detail about the partnership/designated partnership(s) and/or company(s) in which the partner/designated partner is a director/ partner.

Owners or applicants of trademarks must approve trademark registration applications.

Any words or expressions in the proposed name that require approval from the Central Government.

The competent authority must approve collaboration and connection with a foreign country or place.

A copy of the Board Resolution of the existing company or the consent of the existing LLP is proof of no objection.

The advantages of LLP:

A Limited Liability Partnership is a type of business model that is

Based on an agreement, it is arranged and operated.

Provides flexibility without imposing detailed legal and procedural requirements.

Enables professional/technical expertise and initiative to interact with financial.

Thank you for giving your valuable time for reading this write-up, if still, you have any doubts regarding LLP Registration in India then please connect to our team at [email protected] or call us at 9988424211.

0 notes

Text

🎉 Looking to kickstart your business journey in India? Look no further! 🚀 Introducing RegisterKaro - your one-stop solution for LLP registration hassle-free!

With RegisterKaro, you can now easily register your Limited Liability Partnership (LLP) online, saving you time and effort. Our user-friendly platform ensures a seamless registration process, guiding you through every step with expert assistance.

Why choose RegisterKaro for LLP registration? 🤔

✅ Easy-to-use platform: Our intuitive platform makes LLP registration a breeze, even for first-time entrepreneurs.

✅ Expert guidance: Our team of experienced professionals is here to assist you at every stage of the registration process, ensuring smooth sailing from start to finish.

✅ Quick turnaround: Say goodbye to lengthy paperwork and waiting periods. With RegisterKaro, you can get your LLP registered in no time, allowing you to focus on what truly matters - growing your business.

✅ Transparent pricing: No hidden fees or surprises. With RegisterKaro, you'll know exactly what you're paying for, upfront.

0 notes

Text

What Is A CT600 Form

New Post has been published on https://www.fastaccountant.co.uk/what-is-a-ct600-form/

What Is A CT600 Form

You have probably heard the term “CT600 form” being thrown around, but do you really know what it is? Well, let us break it down for you. The CT600 form is a document that every limited company in the UK needs to complete and submit to HM Revenue and Customs (HMRC) as part of their tax obligations. It serves as a means for companies to report their taxable profits, along with any applicable deductions and reliefs. So, if you want to ensure compliance with tax regulations and avoid penalties, understanding what a CT600 form is and how to properly fill it out is essential.

youtube

Definition

Explanation of a CT600 form

A CT600 form, also known as a Company Tax Return, is a document that Ltd Companies in the United Kingdom need to fill out and submit to HM Revenue and Customs (HMRC) to report their taxable profits and calculate their corporation tax liability. It provides a comprehensive overview of a company’s financial activities and assists in the assessment and collection of taxes.

Who needs to fill out a CT600 form

All UK companies, including those operating as limited liability partnerships (LLPs), and non-profit organizations such as charities, are required to fill out a CT600 form if they are liable for corporation tax. This includes businesses with both active and dormant accounts, regardless of their size or annual revenue.

Purpose of a CT600 form

The primary purpose of a CT600 form is to ensure that businesses accurately report their taxable profits and pay the correct amount of corporation tax. By providing detailed information on a company’s finances, the form enables the HMRC to assess the tax liability and identify any discrepancies or potential tax evasion. Moreover, the CT600 form contributes to the transparency and accountability of businesses, as it ensures that their financial activities are properly documented and reported.

Key Information

Format of a CT600 form

The CT600 form consists of various sections that capture different aspects of a company’s accounts and tax computations. These sections include company details, accounts and tax computations, tax adjustments and losses, capital allowances, and other relevant information required by HMRC. Each section is designed to gather specific data and calculations necessary for the accurate assessment of corporation tax.

Where to obtain a CT600 form

Companies can obtain a CT600 form from the official HMRC website, where it is available for download in a printable format. Additionally, authorized software providers offer electronic versions of the form that can be completed and submitted online, simplifying the process for businesses.

Deadline for submitting a CT600 form

The deadline for submitting a CT600 form depends on the accounting period of the company. Generally, the form must be filed within 12 months of the end of the accounting period it relates to. For example, if a company has an accounting period ending on December 31st, the CT600 form must be submitted by the following December 31st. It is crucial for companies to meet this deadline to avoid penalties and ensure compliance with tax law.

Sections of a CT600 Form

Introduction

The introduction section of the CT600 form provides an overview of the purpose and requirements of the form. It outlines the legal obligations of companies to submit the form and highlights the penalties for non-compliance. This section also includes guidance on completing the form and important contact information for any queries or assistance.

Company details

In the company details section, businesses are required to provide information such as their legal name, registered address, company registration number (CRN), and Unique Taxpayer Reference (UTR). These details ensure the HMRC can correctly identify the company and link the CT600 form to the appropriate tax records.

Accounts and tax computations

The accounts and tax computations section is one of the most significant parts of the CT600 form. Here, companies report their financial information, including revenue, expenses, assets, and liabilities. Businesses must calculate their taxable profits accurately, taking into account any allowable deductions or adjustments according to tax laws and regulations. This section also requires details of any accounting treatments or adjustments made in the computation of taxable profits.

Tax adjustments and losses

In this section, companies report any tax adjustments or losses they have incurred during the accounting period. Tax adjustments include items such as capital allowances, research and development expenditure, and trading expenses not deducted in the accounts. Companies must provide accurate calculations and explanations for each adjustment or loss claimed.

Capital gains

If a company has disposed of any assets during the accounting period and made capital gains, those gains need to be reported in the capital gains section of the CT600 form. Companies must provide details of each disposal, such as the date, amount, and nature of the asset. Accurate calculations of capital gains or losses are essential to ensure compliance with tax regulations and avoid any underpayment or overpayment of corporation tax.

Other information

The other information section of the CT600 form allows companies to provide any additional information relevant to their tax computations or liability. This may include details on specific transactions, tax reliefs, or exemptions claimed. It is essential to provide complete and accurate information in this section to avoid potential discrepancies or inquiries from the HMRC.

Filling out a CT600 Form

Gathering required information

Before filling out the CT600 form, it is crucial to gather all the necessary information and documentation. This includes financial statements, profit and loss accounts, balance sheets, details of income and expenses, and any relevant supporting documents. By ensuring all the information is readily available, businesses can streamline the completion process and minimize the risk of errors.

Completing the sections of the form

To complete the CT600 form accurately, it is important to carefully read the instructions and guidance provided by the HMRC. Each section has specific requirements and calculations, and it is essential to understand the terminology used. It may be helpful to consult with an accountant or tax professional to ensure compliance with regulations and optimize for any tax reliefs or exemptions.

Understanding terminology and calculations

The CT600 form includes specific terminology and calculations that may be unfamiliar to those without a background in accounting or tax. Understanding these terms and computations is crucial to accurately report taxable profits and compute the correct amount of corporation tax. Companies can refer to the HMRC’s guidance or seek professional advice to ensure clarity on these terms and calculations.

Common Mistakes

Frequent errors made when completing a CT600 form

While completing a CT600 form, businesses may make certain errors inadvertently. Some common mistakes include inaccurate calculations of taxable profits, incomplete disclosures, incorrect application of tax rules, and data entry errors. Failure to report all relevant financial information and adjustments can also lead to errors in tax liability calculations.

Impact of mistakes on tax liabilities

Mistakes on a CT600 form can have significant implications for a company’s tax liabilities. Underestimating or overestimating taxable profits can result in underpayment or overpayment of corporation tax, leading to potential penalties and interest charges. Inaccurate disclosures and incomplete information can raise red flags, resulting in further inquiries or investigations by HMRC.

How to avoid common errors

To avoid common errors on a CT600 form, it is crucial to carefully review all information before submission. Double-checking calculations, ensuring all necessary details are provided, and seeking professional advice if needed can help minimize mistakes. Using accounting software or engaging the services of an accountant or tax professional can also provide additional assurance and expertise in preparing the form accurately.

Supporting Documents

Documents required when submitting a CT600 form

When submitting a CT600 form, companies must provide various supporting documents to verify the information reported. These documents typically include financial statements, profit and loss accounts, balance sheets, and any relevant schedules or calculations. It is important to ensure these documents are complete, accurate, and reflect the figures reported on the CT600 form.

Importance of accurate and complete documentation

Accurate and complete documentation is crucial when submitting a CT600 form, as it provides evidence and transparency of a company’s financial activities. The supporting documents serve as the basis for the figures reported on the form and help HMRC assess the accuracy of the tax computations. Maintaining organized and up-to-date records ensures compliance with tax law and facilitates the audit process if required.

Submitting a CT600 Form

HM Revenue and Customs (HMRC) guidelines for submission

HMRC provides guidelines and instructions on how to submit a CT600 form. These guidelines outline the different submission methods, deadlines, and requirements for each option. Businesses should carefully review these guidelines and follow the recommended procedures to ensure the smooth submission of their CT600 form.

Online submission process

The online submission process offers a convenient and efficient way for companies to submit their CT600 form. HMRC provides an online portal where businesses can upload the completed form and any supporting documents. Online submission reduces the risk of errors, enables faster processing and acknowledgment, and provides a digital record of the submission.

Paper submission process

Businesses can only choose to submit a paper version of the CT600 form by mail if they have a reasonable excuse. If a business decides to file a paper tax return, it must also submit a Form WT1 to provide reasons why it has decided to submit a paper CT600. It is essential to ensure that the paper form is accurately completed, signed, and accompanied by all the necessary documents. This method may take longer for processing and acknowledgment compared to online submissions.

Penalties for late or incorrect submission

Late or incorrect submission of a CT600 form can result in penalties and fines imposed by HMRC. The penalties vary depending on the severity of the non-compliance and can range from monetary fines to potential criminal investigations. It is crucial to meet the deadlines and ensure accurate completion and submission of the form to avoid these penalties and maintain compliance with tax regulations.

Benefits of Filing a CT600 Form

Compliance with legal obligations

Filing a CT600 form is a legal requirement for businesses in the UK liable for corporation tax. By submitting the form timely and accurately, companies demonstrate their compliance with tax regulations and fulfill their legal obligations. This compliance enhances their reputation and credibility with stakeholders, including investors, lenders, and customers.

Avoiding penalties and fines

One of the most significant benefits of filing a CT600 form correctly is the avoidance of penalties and fines. Meeting the submission deadline, providing accurate information, and following the guidelines help prevent unnecessary financial burdens and potential legal consequences. By proactively fulfilling their tax obligations, companies can focus on their core operations and avoid disruptions caused by non-compliance.

Establishing transparency and accountability

The CT600 form plays a critical role in establishing transparency and accountability for businesses’ financial activities. By providing a comprehensive overview of a company’s accounts and tax computations, the form enables the HMRC to monitor and assess tax liabilities accurately. This transparency enhances the trust and confidence of stakeholders, including shareholders, employees, and the wider community.

Importance for Small Businesses

Impact of the CT600 form on small businesses

The CT600 form is equally important for small businesses as it is for larger corporations. Although small businesses may have relatively simpler financial structures, accurate reporting and payment of corporation tax are essential. The form allows small businesses to determine their tax liabilities accurately, take advantage of applicable reliefs, and maintain compliance with regulations.

Understanding tax obligations and liabilities

For many small business owners, understanding tax obligations and liabilities can be challenging. The CT600 form serves as a valuable tool for educating small business owners on taxation requirements and providing a structured approach to reporting profits and calculating taxes. By familiarizing themselves with the form and seeking professional assistance as needed, small businesses can navigate the tax landscape more effectively.

Seeking professional assistance

Small businesses, especially those without dedicated accounting or tax departments, may benefit from seeking professional assistance when completing a CT600 form. Experienced accountants or tax professionals can provide guidance on understanding the form, optimizing tax reliefs, ensuring accurate calculations, and minimizing the risk of errors or non-compliance. Engaging professional help can alleviate the burden on small business owners and support their overall tax compliance efforts.

Future Developments

Potential changes to the CT600 form

HMRC periodically reviews and updates tax-related forms and processes to enhance efficiency and accuracy. There may be potential changes to the CT600 form in the future to streamline the reporting process, align with evolving tax legislation, and improve user experience. Businesses should stay updated with any changes or revisions made by HMRC to ensure continued compliance with their tax Lae.

Simplification of the form

One potential direction for future development is the simplification of the CT600 form. HMRC recognizes the complexities businesses face when completing the form and aims to make it more user-friendly and less burdensome. This could involve reducing unnecessary sections, providing clearer instructions, and leveraging technology to automate certain calculations or data input.

Digitalization and automation of the submission process

As technology continues to advance, HMRC is exploring digitalization and automation of the CT600 form submission process. This could involve implementing online systems that integrate with accounting software, allowing seamless transfer of financial data and calculations directly to the form. Digitalization and automation would streamline the submission process, minimize errors, and enhance efficiency.

In conclusion, the CT600 form is a vital tool for businesses in the UK to report their taxable profits and calculate their corporation tax liability accurately. While the form may seem complex, understanding its various sections, gathering the necessary information, and seeking professional assistance can aid in its completion. By ensuring accurate and timely submission of form CT600, businesses can demonstrate compliance with tax law, avoid penalties, and establish transparency and accountability. The form holds equal importance for small businesses, offering them an opportunity to understand tax obligations and liabilities while seeking professional assistance if needed. As the HMRC continues to explore future developments, potential changes to the CT600 form, simplification, and digitalization may further enhance the submission process, promoting efficiency and accuracy.

#CT600#CT600 Corporation Tax Return#Ct600 Form#What Is A Ct600#What Is A Ct600 Form#What Is Ct600 Form

0 notes

Text

Documents required for GST Registration in India

To register for GST (Goods and Services Tax) in India, you need to provide certain documents and information to the GST authorities. Here's a list of common documents required for GST registration:

Proof of Identity:

PAN card of the applicant (Proprietor/Partnership Firm/Company/LLP)

Proof of Address:

Aadhaar card, Voter ID, Passport, Driving License, or any other government-issued identity card.

Utility bills such as electricity bill, water bill, or landline bill.

Photograph:

Passport-sized photograph of the applicant.

Business Registration Document:

For proprietorship: Sole proprietorship registration certificate.

For partnership firm: Partnership deed.

For LLP: Certificate of incorporation or partnership deed.

For Company: Certificate of incorporation

Bank Account Details:

Scanned copy of the first page of bank passbook or bank statement containing details of bank account number, branch address, and account holder's name.

Authorized Signatory Details:

Details of authorized signatory such as PAN card, Aadhaar card, photograph, and letter of authorization.

Proof of Constitution of Business:

In case of a company, memorandum of association and articles of association.

In case of LLP, LLP agreement.

In case of partnership firm, partnership deed.

In case of society, society registration certificate.

In case of trust, trust deed.

Digital Signature:

In case of company, LLP, or any other registered entity, digital signature of the authorized signatory is required for signing the application electronically.

Business Address Proof:

Rental agreement or sale deed of the business premises along with the landlord’s consent letter.

Additional Documents:

Depending on the nature of business and the type of entity, additional documents may be required. For example, for specific industries, licenses or registrations may be necessary.

It's advisable to keep all the necessary documents ready and accurately filled out the GST registration form online on the GST portal. Once the application is submitted along with the required documents, the GST authorities will verify the details and grant the GST registration.

0 notes

Text

A Step-by-Step Guide to Registering a Private Limited Company

When navigating the ever-changing business world, forming a private limited company is an important move toward expansion and security. This thorough guide will take you through the key phases of company registration, clarify turnover necessities for Goods and Services Tax, and discuss the importance of Limited Liability Partnership (LLP) formation.

Understanding Private Limited Company Registration

When first establishing a business, selecting the proper legal structure is crucial. Incorporating as a private limited company offers numerous benefits like restricted liability, straightforward share transferability, and additional credibility. This business arrangement limits personal liability, allowing ownership shares to be freely traded. The private limited company designation also provides a professional image. Overall, this structure offers a balanced approach protecting personal assets while facilitating operations.

Step 1: Choose a Unique Name

Choose a unique and significant name for your business. Make certain it follows the rules established by regulatory bodies.

Step 2: Obtain Digital Signatures

When filing important documents online, securing digital signatures from all relevant parties is essential. It is crucial to obtain legally-recognized electronic signatures from directors and stakeholders through authorized certification authorities.

Step 3: Apply for Director Identification Number (DIN)

Each manager overseeing a business entity must possess an individual Director Identification Number or DIN. One can procure a DIN by making an application through the Ministry of Corporate Affairs' online

Step 4: File for Company Registration

It will be important to ready the requisite records, such as the Memorandum of Association (MOA) and Articles of Association (AOA). Submit the application for business registration with the Registrar of Companies (RoC).

Step 5: Obtain Certificate of Incorporation

Once the Registrar of Companies has carefully reviewed the submitted documentation and found it to be complete, they will issue a Certificate of Incorporation.

Turnover for GST

After forming your private limited company, it is essential to comprehend the turnover thresholds for Goods and Services Tax (GST) adherence. Fully grasping these requirements ensures your company abides by relevant regulations.

Step 1: Determine Your Turnover

It is important to track your business's total revenue from taxable goods and services on an ongoing basis. If your aggregate turnover surpasses the sales threshold

Step 2: Apply for GST Registration

It is required to submit the important documents like PAN, Aadhar, and business particulars through the GST portal. Once verification is complete, the GST registration certificate will be issued.

Step 3: File Regular GST Returns

It is crucial to submit your Goods and Services Tax returns on time in order to avoid penalties. Consistently evaluate your revenue and modify your GST registration information if necessary.

LLP Registration

Those exploring business structures should consider the benefits of LLP registration as an alternative to private limited companies. An LLP provides flexibility and reduced administrative requirements compared to other options that offer liability protection.

Step 1: Choose a special Name: Just like registering a company, picking a name that's different is the first step. Make sure the name you pick is available and follows the rules for LLPs.

Step 2: Get a Designated Partner Identification Number (DPIN): All partners need to get a DPIN. Apply for a DPIN through the MCA website.

Step 3: Register the LLP: Get the LLP agreement ready and submit it to the RoC. Once approved, the LLP will legally exist.

Step 4: Get Company Registration Certificate: After everything checks out, ROC gives the Registration Certificate for the LLP, legally making it official.

Conclusion

When starting a business, several pivotal steps must be taken to legally establish operations. For any entrepreneur, properly registering as a private limited company, comprehending turnover implications for GST purposes, and examining limited liability partnership registration are non-negotiable. Strict adherence to step-by-step instructions for these processes guarantees legal compliance, credibility and a strong footing for your venture. Continually reviewing regulatory changes and consulting experts allows seamless navigation through the intricate details of registration requirements.

0 notes

Text

FREQUENTLY ASKED QUESTIONS: Limited Liability Partnership Registration

What is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP) is a partnership in which some or all of the partners have limited liability. Therefore, business may be conducted within the framework of a company with elements of a partnership company and a limited company and guided by the terms of a jointly adopted Articles of Incorporation. Under LLP, a partner is not responsible for another partner's misconduct or negligence. A Limited Liability Partnership (LLP) was introduced in India by the Limited Liability Partnership Act, 2008 and has become the preferred organizational form among entrepreneurs as it combines the benefits of a partnership company and a corporation into a single organizational form. Lern more to register llp online.

What are the essential features of an LLP?

Separate legal entity: A limited liability partnership is legally recognized as a separate entity. Therefore, an LLP can have its PAN, bank accounts, licenses, permits, contracts, assets, and liabilities in its own name.

Limited Liability: Limited Liability Partners in a partnership are limited to the extent of their contributions to the LLP and under no circumstances may they use a partner's personal property to relieve the LLP of liability.

Reduced compliance: tax compliance is similar for both the limited liability company and her LLP. However, LLPs have significant advantages when it comes to corporate affairs compliance. An LLP is not required to undergo an audit if the annual turnover of the LLP is less than his Rs. 400,000 rupees and the investment amount is less than 250,000 rupees. A limited liability company, on the other hand, is required to file audited financial statements annually, regardless of turnover.

Simplicity: The administrative process for forming and maintaining a

LLP is very simple compared to a limited liability company. How do I form a LLP?

An Limited Liability Partnership can be formed by submitting information to the Department of Enterprises website. To form an LLP, the following minimum requirements must be met:

Designated Partners:A limited liability partnership must have a minimum of 2 and a maximum of 200 designated partners and at least 1 Indian partner. A resident designated partner is required. Partner she must be over 18 years old. This is to ensure that LLP partners are not minors and have legal capacity.

Digital Signature Certificate (DSC): DSC is mandatory for all partners. Forms filed to set up a Limited Liability Partnership (LLP) in India have to be filed online after the DSC of the designated partner is attached.

Are there any minimum capital requirements to register an LLP in India?

There is no minimum capital required to set up an LLP in India. Therefore, an LLP can be incorporated with any capital. There are no minimum requirements, but each partner must contribute financially to the formation of her LLP. The amount of capital contributions is disclosed in the LLP agreement and the amount of stamp duty paid depends on the total amount of contributions.

What is the minimum number of partners required to form a limited partnership?

At least two persons are required to form a limited partnership. A limited partnership requires a minimum of two and a maximum of 200 named partners.

0 notes

Photo

Corpsee ITES Pvt Ltd company is the best llp compliance registration services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#annual return for llp#llp company compliance#llp compliance license#llp registration in india#llp registration india#online llp formation#register a llp in india#register llp online#register llp in india#registration of llp#llp formation india

0 notes

Text

Streamlining Company Registration in India: A Step-by-Step Guide

India, with its burgeoning economy and dynamic market, is an attractive destination for businesses looking to expand their global footprint. Setting up a company in India offers access to a vast consumer base, a skilled workforce, and a rapidly growing market. This comprehensive guide will take you through the step-by-step process of company registration in India, providing insights into India's launch strategy and the opportunities it offers to foreign investors through Foreign Direct Investment (FDI).

Why Invest in India?

Before delving into the registration process, it's essential to understand why India is a prime destination for business expansion:

1. Large Consumer Base: India's population is over 1.3 billion, making it one of the largest consumer markets in the world. This provides ample opportunities for businesses in various sectors.

2. Skilled Workforce: India is known for its educated and skilled workforce, making it an ideal location for industries that require a pool of talented professionals.

3. Growing Economy: India's economy is consistently growing, and it is expected to become the world's third-largest economy in the near future. This presents lucrative prospects for investors.

4. Ease of Doing Business: The Indian government has introduced several initiatives to simplify the process of setting up and doing business in India.

Step-by-Step Guide to Company Registration in India

Setting up a business in India involves several steps. Here are the steps-

Step 1: Choose the Business Structure

India offers various business structures, including sole proprietorship, partnership, limited liability partnership (LLP), private limited company, and public limited company. Select the one that aligns with your business goals and needs.

Step 2: Obtain a Digital Signature Certificate (DSC)

Get a digital signature certificate which can be used for various transactions.

Step 3: Obtain a Director Identification Number (DIN)

A DIN is required for corporate directors. It is a unique number that is used to identify them in the MCA's database. A DIN can be obtained online.

Step 4: Choose a Unique Name for Your Company

The name you choose for your business must be distinctive and not infringe on any existing trademarks. Your company's name should also represent its essence.

Step 5: Register for Goods and Services Tax (GST)

You must register for GST if your business falls within its purview. The Goods and Services Tax (GST) is a single tax system that replaces multiple indirect taxes.

Step 6: Prepare the Incorporation Documents

You need to prepare the following documents for incorporation:● Memorandum of Association (MoA): It outlines the company's objectives and rules.

●Articles of Association (AoA): It contains rules and regulations for the company's internal management.

●Declaration of Compliance: This document confirms that all legal requirements are met.

Step 7: File an Application for Incorporation

You can apply for incorporation through the Ministry of Corporate Affairs' online site. Submit the necessary documents and pay the costs.

Step 8: Receive the Certificate of Incorporation

You will be issued a Certificate of Incorporation after your application has been accepted. This certificate certifies that your business is legally registered.

Step 9: Register for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN)

PAN is a unique identification number for your business, while TAN is essential if you need to deduct or collect taxes. You can apply for both online.

Step 10: Open a Bank Account

To operate your business, you will need to open a bank account in India. This account will be used for financial transactions, salaries, and tax payments.

India Launch StrategyOnce your company is registered in India, it's essential to develop a robust launch strategy to ensure a successful entry into the market. Here are some key elements to consider:

1. Market Research: Thoroughly understand the Indian market, including consumer preferences, competition, and regulatory requirements.

2. Local Partnerships: Collaborate with local partners to navigate the market and gain insights into consumer behavior.

3. Digital Presence: Create a strong online presence by creating a website, using social media, and using e-commerce platforms. Many Indian shoppers use the internet to research and buy products.

4. Local Marketing: Tailor your marketing and advertising campaigns to the local audience, considering cultural sensitivities and preferences.

5. Logistics and Supply Chain: Efficient logistics and supply chain management are critical in a vast and diverse country like India. Ensure timely and reliable product deliveries.

6. Compliance: Stay updated on local laws and regulations to ensure compliance with tax, labor, and business laws.

Opportunities for FDI in India

India actively encourages Foreign Direct Investment (FDI) through various sectors, including:

1. Manufacturing: The "Make in India" initiative promotes investments in manufacturing, offering incentives and reducing bureaucratic hurdles for foreign manufacturers.

2. Retail: India's retail sector is growing, and FDI is allowed in single-brand and multi-brand retail.

3. Information Technology: The IT and software services sector welcomes FDI, contributing to India's position as a global IT hub.

4. Pharmaceuticals: The Indian pharmaceutical industry is a global leader, offering significant investment opportunities in manufacturing and research and development.

5. Infrastructure: Investments in infrastructure projects, such as roads, airports, and ports, are essential for India's development.

6. Renewable Energy: India is committed to increasing its renewable energy capacity, making it an attractive sector for FDI.

As we reach the culmination of this comprehensive guide on company registration in India, it becomes evident that the Indian business landscape holds immense promise and potential for investors and entrepreneurs. India, with its rapidly growing economy, large consumer base, and pro-business policies, is a beacon of opportunity in today's global market. The step-by-step process of company registration serves as a roadmap for those considering an entry into this vibrant and diverse market.

The primary question that arises at this juncture is why invest in India? What sets India apart as a destination for business expansion and investment? The answer to these questions lies in several key factors.

India's Market Potential

India's market potential is colossal, with over 1.3 billion people. The demographic diversity in terms of age, preferences, and needs makes it a testing ground for products and services across industries. Whether you are in technology, healthcare, consumer goods, or any other sector, India's vast consumer base is brimming with potential.

Skilled Workforce

India has a well-educated and highly skilled workforce. It is the largest English-speaking country in the world, making it easier for foreign businesses to communicate and operate. The availability of skilled professionals across various domains, from IT to healthcare, is a significant asset for businesses.

Growth Opportunities

India's economy is consistently growing, and it's expected to become the third-largest in the world in the near future. This growth is driven by a combination of factors, including increased urbanization, infrastructure development, and a rising middle class with greater disposable income. As the economy expands, so do the opportunities for businesses.

Pro-Business Policies

The Indian government has introduced a range of pro-business policies and initiatives to simplify the process of setting up and running a business in India. These policies aim to reduce bureaucracy, promote ease of doing business, and attract foreign investment. The "Make in India" campaign, for instance, encourages foreign companies to invest in manufacturing in India.

FDI Opportunities

India actively encourages Foreign Direct Investment (FDI) across various sectors. Whether you're interested in manufacturing, retail, information technology, pharmaceuticals, infrastructure, or renewable energy, there are FDI opportunities waiting to be explored. The Indian government's commitment to welcoming foreign investment adds to the appeal of the Indian market.

Challenges and Considerations

While India holds great potential, it's important to acknowledge the challenges and considerations that come with setting up a business in this diverse and complex environment.

Regulatory Complexity: India's regulatory landscape can be complex, with various laws, taxes, and compliance requirements. Navigating these regulations and staying updated is crucial.

Cultural Sensitivity: India is culturally diverse, and what works in one region may not work in another. Understanding and respecting local customs and preferences is essential for effective market entry.

Infrastructure: India's infrastructure varies across regions. Ensuring efficient logistics and supply chain management is vital, especially if your business relies on timely product deliveries.

Market Research: Thorough market research is indispensable to understand consumer behavior, competition, and the specific needs of your target audience.

Strategic Entry: Developing a robust India launch strategy is crucial. Consider factors like local partnerships, digital presence, and local marketing campaigns tailored to the Indian audience.

Compliance: Staying compliant with local laws and regulations, including tax, labor, and business laws, is essential. Compliance ensures a smooth and lawful operation of your business.

The Path Forward: Seizing Opportunities

In conclusion, India's business landscape is an exciting terrain of opportunities and challenges. For those willing to navigate this landscape with determination, resilience, and a well-thought-out strategy, the rewards are boundless. Whether you are a startup looking to explore new markets or a multinational corporation seeking to expand your global footprint, India offers a rich and diverse marketplace that is open to innovation and investment.

Company registration in India, as outlined in this guide, is not merely a legal process but the first step in a transformative journey. It is a journey into a market that is continuously evolving, offering opportunities for those who dare to innovate and contribute to India's economic growth and development. It's a journey into a land of immense possibilities, where every step forward is a step toward shaping the future of a nation and the world.

This post was originally published on: Foxnangel

#startup india registration#register a startup in india#company registration in india#register a company in india#business registration in india#foreign direct investment#fdi in india#fdi investment in india#invest in india#investment in india#foxnangel

1 note

·

View note

Text

Demystifying LLP Formation: A Comprehensive Guide to Establishing Your Business Structure

Establishing a business structure is a critical step for entrepreneurs, offering a legal framework to operate and grow their ventures. A Limited Liability Partnership (LLP) is one such structure that combines the benefits of both partnership and corporation, offering limited liability to its partners while maintaining the flexibility of a partnership. In this comprehensive guide, we will delve into the intricacies of LLP formation, exploring its advantages, requirements, and the step-by-step process to set up an LLP in India.

Understanding LLP:

An LLP is a unique business entity that provides limited liability protection to its partners, shielding their personal assets from business liabilities. Unlike traditional partnerships, where partners have unlimited liability, LLPs offer a safer alternative, allowing partners to invest without risking personal assets beyond their agreed contribution.

Advantages of LLP:

Limited Liability: Partners are not personally liable for the debts and obligations of the LLP, protecting their personal assets.

Separate Legal Entity: An LLP has its own legal identity, distinct from its partners, enabling it to enter into contracts, own assets, and sue or be sued in its name.

Flexibility in Management: LLPs offer flexibility in management, allowing partners to organize the internal structure as per their requirements.

Tax Benefits: LLPs enjoy tax advantages, with profits taxed at the partnership level rather than at the entity level, avoiding double taxation.

Minimal Compliance Requirements: LLPs have fewer compliance obligations compared to corporations, making them an attractive option for small and medium-sized businesses.

Requirements for LLP Formation:

Minimum Partners : An LLP must have a minimum of two partners, with no restriction on the maximum number.

Designated Partners : At least two partners must be designated as Designated Partners, responsible for regulatory compliance.

Registered Office : The LLP must have a registered office address in India, which serves as its official correspondence address.

DIN and DSC : Designated Partners must obtain a Director Identification Number (DIN) and Digital Signature Certificate (DSC) for e-filing.

LLP Agreement : A written LLP agreement detailing the rights, duties, and responsibilities of partners is mandatory.

Step-by-Step Guide to LLP Formation:

Obtain DSC and DIN for Designated Partners.

Reserve a Unique LLP Name through the LLP-RUN (Limited Liability Partnership-Reserve Unique Name) portal.

Draft and File the LLP Agreement within 30 days of incorporation.

Obtain Certificate of Incorporation from the Registrar of Companies (ROC).

Obtain PAN and TAN for the LLP.

Open a Bank Account in the LLP's name.

Fulfill Post-Incorporation Compliance Requirements.

LLP formation offers entrepreneurs a flexible and efficient business structure with limited liability protection and tax benefits. By understanding the advantages, requirements, and the step-by-step process outlined in this guide, aspiring business owners can navigate the LLP formation process seamlessly, laying a solid foundation for their ventures' success.When it comes to gst registration online in mumbai or Book keeping services in mumbai there is no other company better than M.M. Vora & Associates, then it either be roc filing company in mumbai or llp formation services in goregaon.

Apart from the above gst registration consultants in goregaon & roc filing company in mumbai. If you are looking out for llp formation services in goregaon, income tax return filing in goregaon or the book keeping services in mumbai than there is no other company better than M.M. Vora & Associates which provides the best financial service in the market. Then you can check it out at the official M.M. Vora & Associates website.

To know more: https://www.caassociates.in/services/new-gst-registration-consultants-services-online-in-goregaon-mumbai/

0 notes

Text

LLP Registration

LIMITED LIABILITY PARTNERSHIP( LLP) REGISTRATION IN INDIA

It has become increasingly popular among entrepreneurs to incorporate Limited Liability Partnerships (LLPs) which combine the advantages of a partnership firm and a company. India introduced the concept of Limited Liability Partnership (LLP) registration in 2008. A Limited Liability Partnership has the characteristics of both the partnership firm and company. Incorporating an LLP requires two partners at minimum. In an LLP, however, there is no upper limit to how many partners the company can have.

Each partner should be an individual, with at least one resident in India among the designated partners. The duties and rights of designated partners are governed by the LLP agreement. They are directly responsible for the compliance of all the provisions of the LLP Act, 2008 and provisions specified in the LLP agreement.

CHARACTERISTICS OF LLP:

Following are some features of Limited Liability Partnership -

Just like Companies, it has separate legal Identity.

The cost of LLP Registration is less as compared to company formation.

The liability of each partner is limited up to the contribution done by him/her.

LLP has less regulations and compliances.

There is no requirement for minimum capital contribution.

There is no such requirement of holding minimum number of Board meeting or Annual general meeting as in case of companies.

FORMS REQUIRED:

Details regarding forms used in LLP Registration and its compliances are described as below -

RUN – LLP (Reserve Unique Name-Limited Liability Partnership: This form is required for name reservation for Limited Liability Partnership.

FiLLiP: This form is for incorporation of LLP.

Form 3: It is in same line as that of Articles of Association of company, Filing of LLP agreement with the registrar within 30 days of incorporation of LLP.

Incorporation Document: It is in same line as that of MOA of the company. It is to be given in the manner prescribed in FiLLiP.

PROCESS FOR LLP REGISTRATION:

The LLP Registration process involves a series of steps which can be explained by framing below mentioned steps:

STEP-1: Obtain Digital Signature Certificate (DSC)

In order to begin the process of LLP registration, the designated partners must apply for digital signatures. The application for DSC is to be made to Certifying Agency (CA). The reason for obtaining DSC is that all documents for LLPs must be digitally signed and filed online. As a result, digital signature certificates must be obtained from government-recognized certifying agencies.

STEP-2: Apply for Director Identification Number (DIN)

The applicant has to apply for the DIN of all the designated partners or those intending to be designated partner of the proposed LLP. The application for allotment of DIN can be made in Form DIR-3. Required to attach the scanned copy of documents (generally Aadhaar and PAN) to the form.

However, it is to be noted that application for DIN or DPIN of up to two individuals can be made in FiLLiP form.

STEP-3: Approval of Name

LLP-RUN (Limited Liability Partnership-Reserve Unique Name) forms are filed with the Central Registration Centre for the reservation of the proposed LLP's name. Please use the free name search facility on the MCA portal before quoting the name in the form. The form RUN-LLP is to be accompanied by fees as per Annexure ‘A’ which can either approved/rejected by the registrar. Then re-submission of the form shall be allowed to be made within 15 days for rectifying the defects, errors or omissions.

STEP-4: Incorporation of LLP

FiLLip form is used for registration of Limited Liability Partnership which shall be filed with the Registrar who has jurisdiction over the state in which the registered office of the LLP is situated. The form is an integrated form. Fees is as per Annexure ‘A’. This form provides for application for allotment of DPIN, if an individual who is to be appointed as a designated partner does not have a DPIN or DIN. Then the application for allotment shall be allowed to be made by two individuals only. The application for name reservation can be made through FiLLiP form also. If the name that is applied for is approved, then this approved and reserved name shall require to be filled as the proposed name of the LLP.

STEP-5: File LLP Agreement

LLP Agreement regulates the mutual rights and duties amongst the partners and also between the LLP and its partners. Some important points of LLP Agreement are -

LLP agreement must be filed online on MCA Portal in form 3.

The above mentioned Form 3 for the LLP agreement has to be filed within 30 days of the date of incorporation.

The LLP Agreement is required to be printed on Stamp Paper.

Certificate of Incorporation

On receipt of all the required documents in form FiLLiP if registrar is the opinion that all the requirements related to incorporation of LLP is duly complied with, he will issue certificate of incorporation under his hand in form 16. Once certificate of incorporation is received LLP will stand incorporated.

Thank you for giving your valuable time, if you have any queries regarding Online LLP incorporation in India then connect us at 9988424211 or write us at [email protected].

0 notes

Text

Unlicking Business Growth by Company Registration in Delhi

Delhi, the heart of India has a world of opportunity for aspiring entrepreneurs & business owners. It can be difficult to navigate the complex legalities & formalities. Don't worry! The process of company registration in Delhi is simpler than you think, including the numerous benefits for aspiring entrepreneurs.

Benefits of Company Registration in Delhi

Limited Liability Protection: If you registered your company, then, you can secure your personal assets from business liabilities, results in minimizing the financial risks and safeguarding from legal challenges.

Tax Benefits: If you registered your company you can avail the tax incentives, exemptions, and deductions available to, utilizing your financial resources and enhancing profitability.

Brand Building: Company Registration will be helpful in establishing a strong brand presence and reputation in the market, and also build the customer trust, loyalty, and long-term sustainability.

Investor Confidence: Company Registration attracts the investors, partners, and stakeholders with the assurance of legal compliance, corporate governance, and growth prospects that has been afford by a registered entity.

Business Continuity: Company Registration will make sure the continuity and longevity of your business by formalizing its structure, operations, and legal standing through registration.

Process of Online Company Registration in Delhi

Choose Business Structure: First of all, you must have to select the appropriate business structure for your company as per your business goals. The different structures include Private Limited Company, Limited Liability Partnership (LLP), or Sole Proprietorship.

Name Approval: You should have to choose a unique name for your company according to the naming guidelines that has been prescribed by the Ministry of Corporate Affairs (MCA).

Obtain Digital Signatures: After that, you must acquire the DSCs i.e. Digital Signature Certificates for all the directors and authorized signatories who have been involved in the registration process.

Prepare Documents: The next step is to prepare the essential documents including MOA i.e. Memorandum of Association, AOA i.e. Articles of Association, and other incorporation documents as per the chosen business structure.

File Application: After that you must have to complete the online registration with the submission of all the essential documents, forms, and fees via MCA portal, and after approval you will get the issuance of Certificate of Incorporation.

Conclusion

Start your journey of company registration in Delhi by grabbing the opportunities in the dynamic landscape of Capital City Delhi. You can navigate the complications of the registration process and can take step towards the growth opportunities with your proper determination.

#company registration#company registration in india#online company registration#Company Registration Delhi

0 notes