#register a llp in india

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

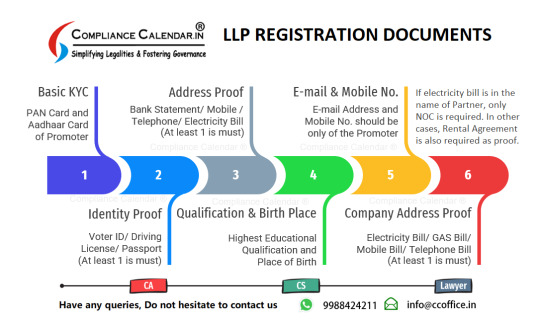

Documents Required for LLP Registration in India

A Limited Liability Partnership (LLP) is a new form of legal entity that is a hybrid between a corporation and a partnership. It has the strengths and characteristics of the company but can be operated flexibly like a normal partnership. LLPs are less compliant than corporations, but partners have limited liability because LLPs operate as separate legal entities from their partners. Learn more to register a llp company in India.

Documentation Process

Identity Proof - All affiliates are required to provide a PAN upon LLP enrollment. The PAN card serves as primary proof of identity.

Proof of Address for Partners – Partners can provide any document such as Voter ID, Passport, Driver's License, Aadhar Card. The name and other information on the proof of address and her pan card must match exactly. Any spelling differences between your name or father's name or date of birth on your proof of address and your PAN card must be corrected before submission to the RoC.

Partner's Proof of Residence - Latest bank statements, telephone bills, mobile phone bills, electricity bills or gas bills must be submitted as proof of residence. Such bill or statement must be within her two months old and include the partner's name as it appears on the PAN card.

Photo – Partners must also provide a passport photo. A white background is preferred.

Passport (For Foreigners/NRIs) – In order to become an affiliate of her LLP in India, the foreigner and her NRI must present a passport. Passports must be notarized or apostilled by the relevant authorities and NRIs of such foreigners' countries. If not, the Indian embassy located in that country can also sign the document.

Foreigners or NRIs must also provide proof of address, which is a driver's license, bank statement, residence card, or government-issued proof of identity that includes an address.

If the document is not in English, a notarized or apostille copy of the translation is also attached.

LLP Documents

Proof of Registered Address

Proof of Registered Address must be provided at the time of registration or within 30 days of incorporation.

If you are renting a head office, you must submit a lease agreement and customs clearance certificate from the lessor. A certificate of objection does not constitute the landlord's consent to allow the LLP to use the location as a "residence."

You must also submit all utility bills such as gas, electricity and telephone. The invoice must contain the property's full address and owner's name, and the documents must be less than two months old.

Digital Signature Certificate

Since all documents and applications are digitally signed by an authorized signer, one of the Designated Partners must also select a Digital Signature Certificate.

0 notes

Text

Streamline Your Business Journey: Company Registration in India with Mas LLP

In the bustling landscape of Indian commerce, laying the foundation for your business begins with a crucial step: Company registration in India. Whether you're an ambitious entrepreneur venturing into the world of startups or an established enterprise seeking to expand your operations, the process of registering your company is essential for legitimacy, compliance, and growth. At Mas LLP, we understand the significance of this milestone and offer comprehensive solutions tailored to simplify Company registration in India.

Here's why Mas LLP stands out as your premier choice for company registration in India:

Expert Guidance: With years of experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our experts possess in-depth knowledge of Indian corporate laws, regulations, and compliance requirements, enabling us to provide expert guidance and support at every stage of the company registration process.

Tailored Solutions: At Mas LLP, we recognize that every business is unique, with its own set of goals, objectives, and challenges. That's why we take a personalized approach to company registration, offering tailored solutions that align with your specific needs and aspirations. Whether you're a startup, a small business, or a multinational corporation, we have the expertise and resources to support you on your journey.

Comprehensive Services: Mas LLP offers a comprehensive suite of services designed to simplify the company registration process from start to finish. From initial consultation to post-incorporation compliance, we handle every aspect of company formation, including name reservation, drafting of memorandum and articles of association, obtaining necessary approvals, and obtaining the certificate of incorporation.

Transparency and Efficiency: Transparency and efficiency are at the core of everything we do at Mas LLP. We believe in keeping our clients informed and empowered throughout the company registration process, providing regular updates, clear communication, and transparent pricing. Our streamlined approach minimizes bureaucratic hurdles and accelerates the process, allowing you to focus on building and growing your business.

Compliance Assurance: Staying compliant with regulatory requirements is essential for maintaining the legal and financial integrity of your company. Mas LLP helps clients navigate the complexities of corporate compliance in India, ensuring adherence to all applicable laws, rules, and regulations. With our proactive approach to compliance, you can minimize potential liabilities and focus on achieving your business goals.

Dedicated Support: At Mas LLP, we're committed to providing exceptional service and support to our clients. Our dedicated team of professionals is here to answer your questions, address your concerns, and provide expert guidance every step of the way. With personalized attention and responsive support, you can trust Mas LLP to be your reliable partner in company registration in India.

In the competitive business landscape of India, company registration is the first step towards realizing your entrepreneurial dreams. With Mas LLP as your trusted partner, you can navigate the complexities of company formation with confidence and clarity.

Contact us today to learn more about our Company registration in India and take the first step towards building a successful and sustainable business in India.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Company registration in India

2 notes

·

View notes

Text

Experts say this practice carries a heightened risk of maternal mortality. It is not widely available in the UK, with triple embryo transfers banned in all but exceptional circumstances.” Surrogacy exploits poor women.

Shanti Das, Simon Bowers and Malia Politzer

Sun 18 Dec 2022 03.00 EST

Women recruited by an international surrogacy agency to carry babies for wealthy clients are being asked to undergo “unethical” medical procedures that increase their risk of serious complications, an investigation suggests.

New Life Global claims to have brokered more than 7,000 cross-border deals between clients mostly based in the UK, western Europe and North America and surrogates in countries including Mexico, Colombia, India, Ukraine and Georgia.

Facebook adverts offer women the chance to earn life-changing money to be surrogates, while marketing says “commissioning parents” including same-sex couples and those struggling with fertility problems are “guaranteed” a baby.

But a joint investigation by international media outlets including the Observer, funded by the Pulitzer Center and coordinated by Finance Uncovered, has found evidence of ethically questionable and potentially illegal practice by the agency, which has a UK-registered firm and offices around the world. New Life denied the allegations, saying it has helped thousands of couples “achieve their goals” and operates in full compliance with local laws.

Analysis of marketing materials, contracts and other documents suggests the company has for years taken advantage of lax regulation in developing countries to offer controversial services to clients not available to them in their home countries.

Websites for several New Life branches, including those in Georgia and Ukraine, promote multi-embryo transfer, which involves two or three embryos being implanted into surrogates and increases the chance of twins or triplets being born.

Experts say this practice carries a heightened risk of maternal mortality. It is not widely available in the UK, with triple embryo transfers banned in all but exceptional circumstances.

New Life branches, including those in Asia, Mexico and Ukraine, which is currently closed due to the war, also allow or have recently allowed clients to select the sex of their baby. Clients might want to do this “to balance the gender in the family”, to prevent genetic disorders linked to a particular sex and to meet “cultural and social norms”, its website says.

While permitted in those New Life locations, sex selection for non-medical reasons is banned in Australia, Canada, the UK and other countries in Europe. The Human Fertilisation and Embryology Authority, which regulates fertility clinics in the UK, said it had no control over treatments offered abroad but described the findings as “extremely concerning”.

It said selecting the sex of a child for any reason other than preventing serious inherited illness was allowed in some countries but “strictly prohibited by UK law”, and that the offer to implant multi embryos was “deeply worrying”. “A multiple pregnancy increases the risk of stillbirth, neonatal death and disability. Risks to [the surrogate] include late miscarriage, high blood pressure, pre-eclampsia and haemorrhage,” it said. There is no suggestion the practices were offered in the UK.

Separate evidence suggests New Life may have flouted UK laws when brokering agreements linked to its London-registered entity, New Life Global Network LLP. While altruistic surrogacy is permitted in the UK, commercial surrogacy is banned, with those brokering or offering to negotiate surrogacy arrangements for profit risking a three-month prison sentence and unlimited fine.

New Life is registered in the UK and says on its website that it is headquartered in London. It is actively offering to “meet parents willing to discuss surrogacy/egg donation options” in the UK and has issued contracts bearing the name of its UK entity.

Three legal experts who reviewed New Life contracts said they believe the firm may have violated UK laws.

Dr Kirsty Horsey, an expert in surrogacy law at Kent University, said: “The terms of the agreement are: you will find me a surrogate and I will pay you money for it,” which she said appeared to be a “criminal activity on their part”. Professor Emily Jackson, an expert in medical law and ethics at the London School of Economics, said the documents looked “really concerning”, adding: “I would avoid this [agency] with a bargepole.”

Founded in 2008 by Georgian doctor Mariam Kukunashvili, New Life Global offers low-cost surrogacy to international clients, many of whom live in countries where surrogacy is illegal, prohibitively expensive or the number of surrogates is limited.

In the UK, commercial surrogacy is banned but altruistic surrogacy is permitted and surrogates can be paid reasonable expenses. An historic lack of surrogates has driven some to look abroad. In 2020-21, more than 300 applications for parental orders were made, around half of whichwere international surrogacy arrangements.

With “hundreds of employees” worldwide and at least 16 active websites advertising services in 10 languages, New Life is a major agency catering to the demand and boasts of a “world renowned reputation”.

The women it recruits as surrogates typically come from lower income countries where regulation is nonexistent or relaxed. The amount they can earn ranges but Facebook ads recruiting New Life surrogates in Colombia last year said they would receive $12,000.

Legal experts believe New Life’s decision to operate in “grey markets” where surrogacy is neither legal or illegal leaves both surrogates and commissioning parents exposed. In these countries surrogacy agreements are unlikely to be enforceable by law, they say. In the UK, all surrogacy agreements are legally unenforceable.

New Life has previously said lax regulation allows it to operate with more freedom. The website for its former Kenya branch, which has now been removed, said the absence of “strict criteria and legal restrictions” in the country allowed it to provide “the best possible service to our intended parents by adjusting to patient individual needs in a very flexible and comfortable manner”.

In an extreme example, its branch in Ukraine previously suggested babies born with disabilities could be legally abandoned at an orphanage if they were unwanted, telling potential customers from overseas that, in the event of their surrogate giving birth to a baby with an “anomaly”, they “have a right to leave the baby” at an orphanage. “In this case government dedicated office from government side undertakes the responsibility toward baby and no lawyer is needed for this,” an FAQ page told customers until 2015.

This weekend, New Life Global denied claims of unethical practice and said all its branches operate in jurisdictions where commercial surrogacy is legal. After being contacted for comment, the company removed a section on its Georgian website that said it recommended multiple embryo transfer. The site for its Ukraine branch continues to promote the procedure, telling clients that “generally, it is a good practice to transfer more than 1 embryos (2 or 3 ) at a time”.

David Bezhuashvili, the firm’s owner and husband of Mariam Kukunashvili, its founder, said the materials were out of date.

“The guideline for multiple embryo transfers has been changed ... and companies under New Life strictly follow the rules on one embryo transfer,” he said.

“We have assisted many people to overcome poverty and earn a living,” Bezhuashvili added. “We have made our worthy contribution to the cause of human importance.”

The company did not answer questions about its UK operations or the enforceability of contracts issued by its London registered company, which it said “acts as an international marketing and promotion tool” for affiliates around the world.

“Due to the limited functions of the company in respect of marketing and promotion, the ownership structure has been simplified by top management,” Bezhuashvili added. Financial statements filed by the company in October show it reported earning £343,000 in commission in 2021-22, more than double the year before.

The Department of Health said it was assessing evidence passed to it by the Observer and would refer it to relevant authorities if it appeared that UK laws on commercial surrogacy were being broken.“We encourage people considering surrogacy to remain in the UK, take independent legal advice and use recognised UK-based surrogacy organisations,” it said.

#New Life Global#Anti surrogacy#Anti exploiting women#Anti turning babies into commodities#Surrogacy for profit is a form of human trafficking#No one is entitled to bio kids

6 notes

·

View notes

Text

If you are a Start-up and need to know how to Register a Start-up in Chandigarh

Here is a thorough explanation of what you must do. To launch and operate a successful business, you must adhere to all legal requirements for company incorporation.

In India, registering a business is now simpler than ever. You may easily find out every detail, whether you're looking for information on how to Register a Company in Chandigarh, whether it is privately limited or any other business structure, by paying attention to our article. The corporate registration procedure has moved to the web, making it easier to use and perfect! Register your business easily and quickly with the help of his CA/CS specialist team at

DAR & Co LLP. The team works to make the legal process as simple as possible.

Call +01723500795 to get started!

2 notes

·

View notes

Text

Types of Business entitiy models used in business

Have you always wanted to start a business and know more about the existing legal structures in India for the same? If yes, you have come to the right place. Here, we give you the top 5 business entity models currently in practice in India. Before registering your venture in the country, you may want to understand all these 5 structures thoroughly. This way, you can rest assured knowing that you have completed all the formalities, as the Government requires.

Sole Proprietorship Firm

Some of the key features of this business model are:

Entire control and management lies with one person

Great for setting up for a single person, producing goods that involve showcasing one’s personal skills or talents (making jewels, handicrafts, etc.)

Onus of running the business is on one person only

Only one person bears the losses and enjoys the profits

Limited capital requirement and few legal formalities to fulfill

There are quite a few professional and best business consultants in Delhi, who can help you more with the guidelines and support for setting up a sole proprietorship firm, if you are interested.

Partnership Firm

The features of a partnership firm are:

Started with a partnership deal between two people or more

Maximum no. of partners limited to 10 for banking business and 20 for other businesses

Ratio of sharing profits and losses are agreed initially in the contract termed, Partnership Deed

Not compulsory to register this firm

Ideal for small retail & wholesale businesses, small-sized manufacturing firms and more

Always look for the best business advisory firm in India for the right guidance on starting a business in India.

Private Limited Company

Some of the important points related to this business model are:

Ideal for Small or medium-sized businesses

of shareholders limited to 50

Can have external or foreign investors

Cannot invite the public to subscribe to the shares

Considered as a separate legal entity

Limited Liability Partnerships (LLP)

Some features of this model are:

New and flexible business model as an alternative to partnership firms

Perfect combination of unlimited personal liability and government regulations

No cap on minimum capital requirement or maximum number of owners

Public Limited Company

Here are the features of this model:

Ideal for large businesses

Can raise money from the public

No cap on the maximum no. of shareholders, but minimum no. of shareholders fixed at 7

Liability of shareholders limited to the extent of the value of their shares

Here, we have given you only a brief idea of India’s top business entity models. If you want to know more details on the legalities of these structures, or more about consulting businesses globally, you can visit here for all the information you require.

#business#businessconsultation#wealth management#financial services#nri investors#investment management#income tax#itr filing

5 notes

·

View notes

Text

HOW TO REGISTER A COMPANY IN INDIA.

In this article, we will tell you about "STEPS TO REGISTER A COMPANY IN INDIA."

Before talking about the steps to register a Company, let us tell you what are the different types of companies that can be Registered in India.

* Types Of Companies in India :

There are 4 types of companies in India.

1) ONE PERSON COMPANY

2) LIMITED LIABILITY PARTNERSHIP

3) PRIVATE LIMITED COMPANY

4) PUBLIC LIMITED COMPANY

1) One Person Company(OPC):

A person Company ( OPC ) is formed and owned by a single person. It is the best type of company if anyone wants to be the sole owner of the company and wants to take all the decisions on its own without asking or regarding anyone for the company. One Person Company (OPC) was introduced in the year 2013 under the Companies Act 2013, Before that single person cannot form a company.

2) Limited Liability Partnership(LLP):

Limited Liability Partnership(LLP) is a type of company in which all the partners have some limited liabilities. LLP was introduced by the limited liability Act 2008. A minimum of 2 and a maximum of 200 people can become members of the Limited Liability Partnership (LLP).

3) Private Limited Company:

A private limited company is a privately handled Business entity by a small group of people also known as Directors. Minimum 2 and a maximum of 50 people can be Directors. A private limited company has Shareholders in the form of stakeholders & Directors in form of Company officers these both are employees of the company.

4) Public Limited Company:

A public limited company is a company that offers its share of Stock to the General public. Those who buy these stocks have limited liability, hence they can not be responsible for company losses by excusing what the shareholders get in terms of shares they bought from the company.

These are the 4 Types of Companies that can be Registered in India.

NOW, LET'S TALK ABOUT THE STEP TO REGISTERING A COMPANY IN INDIA.

* STEPS TO REGISTER A COMPANY IN INDIA

There are 4 steps for registering a company:-

1) Digital Signature Certificate (DSC)

A digital signature is required in the form fillIng on MCA Portal online. The Digital Signature Certificate is mandatory for all the Directors, Subscribers of the Memorandum of association (MOA) and the Article of Association (AOA).

2) Director Identification Number (DIN)

The Director Identification Number(DIN) number can be acquired by filling out the DIN-1 Form. The Director identification number (DIN), Name, and Address proof of all the proposed Director are to be provided in the company registration form.

3) Registration on the MCA Portal

After DIN the Simplified Proforma for Incorporation a company Electronically (SPICe+) e-form has to fill into the registers MCA (Ministry of Corporate Affairs) portal.

4) Certificate Of Incorporation

After filling the SPICe+ in the registered MCA portal the Certificate of Incorporation is issued to the company once all the documents are submitted and verified by the Registrar of companies.

After verifying the company is successful Registered.

To Register your company contact us at:- The Startup gig

2 notes

·

View notes

Text

Benefits of LLP Registration in India

The following are the benefits of LLP Registration in India:

1. Low Cost and Less Compliance:

The overall cost of establishing a Limited Liability Partnership is low compared to the cost of registering a Private or Public Limited Company in India. The compliances to be followed by the LLP are also low. The LLP needs to file only 2 Statements yearly (i.e., an Annual Return and a Statement of Accounts and Solvency.

2. Liabilities are limited:

Limited Liability Partnership provides a limited liability benefit to all the designated partners. In case of s business insolvency or loss, the partners’ liability is restricted to the capital contribution as per the LLP agreement. Moreover, one partner is not held responsible for the actions of negligence/misconduct of any other partner.

3. Separate Legal Existence:

Just like a Company, an LLP has a separate legal entity. The Limited Liability Partnership is different from its partners. An LLP in India can sue & be sued in its own name. The Contracts are signed in the name of the Limited Liability Partnership (LLP) which helps to gain the trust of various stakeholders & gives the customers and suppliers a sense of confidence in the business.

4. Tax Benefits:

It is also exempted from various taxes like DDT (Dividend Distribution Tax) & Minimum Alternative Tax. The tax rate on LLP is less than that of the Company.

5. No Minimum Capital:

For the LLP formation in India, no minimum capital is required. No minimum capital contribution is required from partners. An LLP can be incorporated even with Rs. 2000 as a total capital contribution.

What are the Features of an LLP in India?

The following are the features of an LLP in India:

It’s a body corporate & legal entity separate from its members;

The members of an LLP have a limited liability, limited to their agreed contribution to the LLP;

It has the organizational flexibility of a Partnership;

It has a perpetual succession, it continues to exist even after the founding partners leave the organization. All it requires is to have at least 2 partners;

Its accounting & filing requirements are similar to that of a Company;

Less compliance and regulations;

No requirement for minimum capital contribution;

At least one partner must be a resident of India;

There is no upper limit on the maximum number of Partners.

0 notes

Text

A Guide To Registration Of Limited Liability Partnerships (LLPs) in India

As The Ministry of Corporate Affairs (MCA) has announced that LLP incorporation has moved to the web, just like SPICE+, as a result of the second amendment to the Limited Liability Partnership (Second Amendment) Rules, 2022. The incorporation document must be electronically filed with the Registrar in the form FiLLiP (Form for incorporation of Limited Liability Partnership) with the Registrar with jurisdiction over the registered office.

How Do You Form A Limited Liability Partnership (LLP)

LLPs combine the features of a corporation and a partnership in one business structure. They are a combination of corporations and partnerships. A small business in India often chooses an LLP Incorporation because of its low registration fees and easy maintenance.

Overview Of The Limited Liability Partnership (Second Amendment) Rules, 2022

A The LLP (Second Amendment) Rules, 2022 have undergone a few changes since they were announced on the 04th March 2022. These changes are as follows:

The number of designated partners at incorporation can be as many as five (without DIN numbers).

A PAN and TAN will be assigned as part of the LLP incorporation or registration process.

Incorporating an LLP through the web is similar to SPICE+.

It is also recommended to disclose contingent liabilities on Form 8 (Statement of Solvency) and Annual Return.

As a result, all LLP forms, including Form 9 - Consent of Partners, will be web-based, requiring all Designated Partners to sign digitally.

Incorporating A Limited Liability Company: Step-By-Step Guide

Name Reservation:

To incorporate an LLP, the first step involves reserving the name of the partnership. The applicant must fill out E-Form 1, which confirms availability.

Forming a Limited Liability Partnership (LLP):

If you wish to incorporate a Limited Liability Partnership (LLP), you must file FiLLiP after reserving a name. FiLLiP contains information about the LLP being formed, the partners/designated partners, and their consent to act as partners/ designated partners.

Agreement for Limited Liability Partnership:

A Within 30 days of LLP incorporation, the LLP Agreement must be executed and filed in E-Form 3. In LLP, mutual rights and duties are governed by an agreement between the partners or between the partners and the LLP, depending on the case. However, the LLP is still liable for its other obligations.

LLPs are incorporated using a Web-Based Process, which is as follows:

The LLP Incorporation (FiLLiP Form) is now available online as a result of the Limited Liability Partnership (Second Amendment) Rules, 2022. An DIN or DPIN applications are required along with name reservations, LLP incorporations, and/or new LLP incorporations under FiLLiP.

The eForm must include all supporting documentation, such as the names of designated partners and partners, etc. Once processed and found complete, an LLPIN is assigned.

A DIN/DPIN must also be issued to proposed designated partners/nominees of body corporate designated partners without valid DINs/DPINs.

When incorporating an LLP using this integrated form, the DIN/DPIN can be allocated to no more than five designated partners.

Document Requirements:

Documents required for the FiLLiP Form include:

It is required to submit the resolution on the letterhead of the body corporate being appointed a partner.

On the letterhead of that body corporate, an authorization/resolution naming the nominee/designated partner nominated to represent the company.

Document proving the address of a Limited Liability Partnership's Registered Office.

Subscriber consent form.

Regulatory authorities must approve the proposed name in principle before the attachment can be submitted.

Provide detail about the partnership/designated partnership(s) and/or company(s) in which the partner/designated partner is a director/ partner.

Owners or applicants of trademarks must approve trademark registration applications.

Any words or expressions in the proposed name that require approval from the Central Government.

The competent authority must approve collaboration and connection with a foreign country or place.

A copy of the Board Resolution of the existing company or the consent of the existing LLP is proof of no objection.

The advantages of LLP:

A Limited Liability Partnership is a type of business model that is

Based on an agreement, it is arranged and operated.

Provides flexibility without imposing detailed legal and procedural requirements.

Enables professional/technical expertise and initiative to interact with financial.

Thank you for giving your valuable time for reading this write-up, if still, you have any doubts regarding LLP Registration in India then please connect to our team at [email protected] or call us at 9988424211.

0 notes

Text

🎉 Looking to kickstart your business journey in India? Look no further! 🚀 Introducing RegisterKaro - your one-stop solution for LLP registration hassle-free!

With RegisterKaro, you can now easily register your Limited Liability Partnership (LLP) online, saving you time and effort. Our user-friendly platform ensures a seamless registration process, guiding you through every step with expert assistance.

Why choose RegisterKaro for LLP registration? 🤔

✅ Easy-to-use platform: Our intuitive platform makes LLP registration a breeze, even for first-time entrepreneurs.

✅ Expert guidance: Our team of experienced professionals is here to assist you at every stage of the registration process, ensuring smooth sailing from start to finish.

✅ Quick turnaround: Say goodbye to lengthy paperwork and waiting periods. With RegisterKaro, you can get your LLP registered in no time, allowing you to focus on what truly matters - growing your business.

✅ Transparent pricing: No hidden fees or surprises. With RegisterKaro, you'll know exactly what you're paying for, upfront.

0 notes

Text

What are the introductory benefits of LLP registration in India?

These are the key benefits of registering a Limited Liability Partnership (LLP) in India:

Separate Legal Identity: LLPs are recognized as distinct legal entities independent of their partners. They have the capacity to own assets and incur liabilities separate from those of the partners.

Limited Liability Benefits: LLPs offer limited liability to their partners, meaning that the partners' personal assets are protected, and they are only liable for the amount they have invested in the LLP.

Minimal Registration Cost: The cost of incorporating an LLP is comparatively lower than that of other business structures such as private limited companies, making it a cost-effective option for entrepreneurs.

Other Benefits of LLP Registration:

There is no restriction on the maximum number of partners an LLP can have.

LLPs do not require a minimum capital contribution, providing flexibility to the partners.

The maintenance cost of an LLP is relatively low compared to other forms of business.

LLPs have the option to undergo audits, making them a suitable choice for small businesses seeking to minimize compliance burdens.

0 notes

Photo

Corpsee ITES Pvt Ltd company is the best llp compliance registration services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#annual return for llp#llp company compliance#llp compliance license#llp registration in india#llp registration india#online llp formation#register a llp in india#register llp online#register llp in india#registration of llp#llp formation india

0 notes

Text

Simplifying Company Incorporation in India: Your Guide with Mas LLP

In the bustling landscape of Indian business, the journey of entrepreneurship often begins with a crucial step: company incorporation. Aspiring entrepreneurs and established businesses alike recognize the importance of this process, which lays the foundation for legitimacy, compliance, and growth. Mas LLP, a trusted name in legal and advisory services, offers comprehensive solutions tailored to streamline the Company incorporation in India.

Here's why Mas LLP stands out as your premier choice for company incorporation in India:

Expert Guidance: With years of experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our experts have in-depth knowledge of Indian corporate laws, regulations, and compliance requirements, enabling us to provide expert guidance and support at every step of the Company incorporation in India process.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of services designed to simplify the Company incorporation in India. From initial consultation to post-incorporation compliance, we handle every aspect of company formation, including name reservation, drafting of memorandum and articles of association, obtaining necessary approvals, and obtaining the certificate of incorporation.

Tailored Approach: At Mas LLP, we understand that every business is unique, and one-size-fits-all solutions simply won't cut it. That's why we take a tailored approach to company incorporation, customizing our services to meet the specific needs and objectives of each client. Whether you're a startup looking to register a private limited company or a multinational corporation seeking to establish a subsidiary in India, we have the solutions you need to succeed.

Transparency and Efficiency: Transparency and efficiency are at the core of everything we do at Mas LLP. We believe in keeping our clients informed and empowered throughout the company incorporation process, providing regular updates, clear communication, and transparent pricing. Our streamlined approach minimizes bureaucratic hurdles and accelerates the process, allowing you to focus on building and growing your business.

Compliance Assurance: Staying compliant with regulatory requirements is essential for maintaining the legal and financial integrity of your company. Mas LLP helps clients navigate the complex landscape of corporate compliance in India, ensuring adherence to all applicable laws, rules, and regulations. With our proactive approach to compliance, you can minimize potential liabilities and focus on achieving your business goals.

Dedicated Support: At Mas LLP, we're committed to providing exceptional service and support to our clients. Our dedicated team of professionals is here to answer your questions, address your concerns, and provide expert guidance every step of the way. With personalized attention and responsive support, you can trust Mas LLP to be your reliable partner in Company incorporation in India.

In the competitive business landscape of India, company incorporation is the first step towards realizing your entrepreneurial dreams. With Mas LLP as your trusted partner, you can navigate the complexities of company formation with confidence and clarity.

Contact us today to learn more about our Company incorporation in India services and take the first step towards building a successful and sustainable business in India.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Company incorporation in India

2 notes

·

View notes

Text

A Step-by-Step Guide to Company Registration in Bangalore

Description: Dive into the dynamic world of entrepreneurship in Bangalore with our comprehensive guide to company registration. Whether you're eyeing a Private Limited, LLP, or One Person Company, this video breaks down the process, benefits, and essential documents needed for a smooth registration journey. From tax savings to talent attraction, discover why registering your company in Bangalore is a game-changer. Let Actax India

0 notes

Text

Best Consulting Startup Law Firms in India

Registering a corporate or a limited liability partnership provides a form of business that can be easily maintained and it also helps owners by providing them with limited liability. A brief consultation with Company Registration Lawyers or LLP registration lawyers is very beneficial and prevents the clients to make silly mistakes and reduce the time consumed for following every process in it. Rishabh Gandhi and Advocates gives advice to the corporate clients for starts-ups and company incorporation or LLP. The Firm has advised many insurance companies, individuals, and businessmen, with success in recovering a huge amount of money, stuck in complex legal disputes. For more details you can write to [email protected] or call on +91 9075281109 or visit here https://www.rgaa.co.in/

Read more@ https://www.rgaa.co.in/best-consulting-startup-law-firms-in-india/

0 notes

Text

For These 5 Reasons, You Should Register Your Small Business in India

Registering your small business in India offers numerous benefits that can contribute to its growth and success. Here are five compelling reasons why you should consider registering your small business:

Legal Recognition and Protection: Registering your business provides it with legal recognition as a separate entity from its owners. This separation offers protection to the personal assets of the business owners in case of lawsuits or debts. By registering as a legal entity such as a sole proprietorship, partnership, limited liability partnership (LLP), or private limited company, you limit your personal liability, shielding your personal assets from business-related risks.

Access to Government Schemes and Incentives: Registered businesses in India are eligible to avail themselves of various government schemes, incentives, and subsidies aimed at promoting entrepreneurship and economic growth. These schemes may include financial assistance, tax benefits, and preferential treatment in procurement processes. Additionally, certain industries or sectors may have specific incentives or concessions available to registered businesses.

Building Credibility and Trust: Registering your business lends credibility and legitimacy to your operations in the eyes of customers, suppliers, and financial institutions. A registered business is seen as more trustworthy and reliable, which can help attract customers and secure partnerships. It also enhances your ability to raise capital from investors or financial institutions since they tend to prefer dealing with registered entities that comply with regulatory requirements.

Access to Finance and Credit Facilities: Registered businesses have greater access to finance and credit facilities compared to unregistered ones. Banks and financial institutions are more willing to extend loans, lines of credit, or overdraft facilities to registered businesses, considering them less risky and more accountable. Additionally, registering your business enables you to issue invoices, which can facilitate transactions with clients and improve cash flow management.

Facilitating Growth and Expansion: Registering your small business lays the foundation for future growth and expansion. It provides a stable and scalable structure that can attract investment, support partnerships, and enable strategic decision-making. As your business expands, having a registered entity allows you to easily open additional locations, hire employees, enter new markets, and engage in contractual agreements, fostering sustainable growth and development.

In summary, registering your small business in India offers numerous advantages, including legal protection, access to government incentives, enhanced credibility, improved access to finance, and support for growth and expansion. It establishes your business as a legitimate entity, positioning it for long-term success and sustainability in the competitive marketplace. For more details efiletax.

0 notes