#checklist for llp registration

Photo

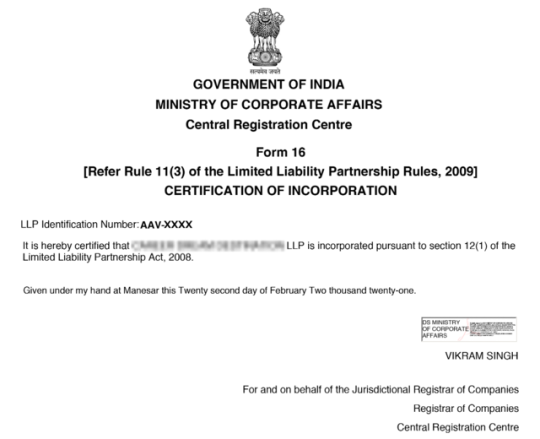

Corpsee ITES Pvt Ltd company is the best llp compliance registration services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#annual return for llp#llp company compliance#llp compliance license#llp registration in india#llp registration india#online llp formation#register a llp in india#register llp online#register llp in india#registration of llp#llp formation india

0 notes

Text

Seamless GST registration in Malappuram at Shehinandrasid! 🌐✨

Make the process of obtaining your GST number hassle-free and efficient. Malappuram citizens and businesses can now apply for GST registration online with minimal documentation through our platform.

What is GST Registration?

GST (Goods and Services Tax) is a destination-based tax introduced to replace multiple State and Central Government taxes. Its implementation began on July 1, 2017, and it is governed by the GST Council. The tax rate varies from 0% to 28% based on the nature of goods and services.

Why GST Registration in Malappuram?

GST registration is mandatory for businesses in Malappuram with an annual turnover exceeding ₹40 lakhs or ₹10 lakhs for businesses in hill areas (as per the amendment from April 1, 2019). Even if the turnover doesn't exceed the threshold, certain businesses, like e-commerce, are obligated to have a GST certificate.

Types of GST in India

- SGST (State Goods and Services Tax)

- CGST (Central Goods and Services Tax)

- IGST (Integrated Goods and Services Tax)

- UGST (Union Territory Goods and Services Tax)

Documents Required for GST Registration in Malappuram

The process is straightforward. Depending on your business type, here are the required documents:

- For Proprietorship / Individual:

- PAN Card

- Aadhaar Card

- Passport Size Photograph

- Business Address Proof

- Cancelled Cheque / Bank Statements

- Email ID, Mobile No

- Business Name and Activities

(Similar checklists for HUF, Partnership Firm, and Company / LLP are provided.)

Procedure for GST Registration in Malappuram

Follow these simple steps:

1. Fill the contact form or call us directly.

2. Our expert will guide you through the process.

3. Provide necessary documents.

4. Documents are submitted to the GST portal after verification.

5. ARN Number is generated.

6. GSTIN is received within 2-7 working days via email.

Benefits of GST Registration in Malappuram

- Less Tax Liability

- High working capital

- Input Tax Credit

- Interstate sales with restrictions

- Simplified tax structure

- The free movement of products and services

- Increased competition for consumer benefit

- Reduction in prices of various items

Who Needs GST Registration in Malappuram?

Any supplier of goods and services exceeding an aggregate turnover of ₹20 lakhs per annum needs to obtain GST registration. Special category states have a turnover criterion of ₹10 lakhs.

Different Types of GST Registration

- Compulsory Registration

- Voluntary Registration

- Registration under Composition Scheme

- No Registration

Penalty for not Registering GST

Non-registration can lead to penalties. Paying less tax may result in a penalty of 10% of the tax amount (minimum ₹10,000). Evading tax entirely could incur a penalty of up to 100% of the GST amount.

Why Choose us?

- Value for Money: Pocket-friendly services with higher value for money.

- Responsive Team: Our team contacts you promptly to guide you through the process.

- Expertise: Years of experience ensures a smooth and error-free process.

FAQs

1. What does GSTIN stand for?

GSTIN stands for Goods and Services Tax Identification Number.

2. Is E-Way Bill applicable from July 1, 2017?

The present system for E-way Bill in states continues until the procedures are finalized.

3. Can I use my CGST/SGST credit to set off my IGST liability?

CGST credit can be used to set off CGST liability and then IGST liability but not SGST liability.

4. Does aggregate turnover include value of inward/outward supplies on which RCM is payable?

Aggregate turnover does not include the value of inward/outward supplies on which tax is payable on a reverse charge basis.

5. Is GST registration mandatory for small retailers to buy from dealers/wholesalers?

There is no such requirement under GST law.

6. How can I get online GST Registration?

Easily register your business on the official GST portal, fill the application form, and upload mandatory documents. You will receive a TRN and ARN acknowledgment, and your GST number will be provided within 2-7 working days.

7. What kind of GST types are applicable in India?

In India, there are three types of GST: CGST, SGST, and IGST.

Ensure a smooth registration process and unlock the benefits of GST with Shehinandrasid

Contact us today and make your business journey in Malappuram hassle-free! #GSTMalappuram #YourdoorstepServices #SeamlessGSTRegistration

0 notes

Text

Navigating LLP Registration in Delhi: A Comprehensive Guide and the Top 10 Accounting Firms in India

Setting up a Limited Liability Partnership (LLP) in Delhi, India, is an attractive option for entrepreneurs and businesses looking for a flexible and tax-efficient structure. LLPs offer the combined benefits of limited liability and partnership, making it a popular choice among professionals, small businesses, and startups. This guide will walk you through the process of LLP registration in Delhi and also introduce you to the top 10 accounting firms in India that can provide invaluable assistance with your financial and regulatory needs.

Part 1: LLP Registration in Delhi

I. Understanding LLP:

Before embarking on the LLP registration journey, it's crucial to have a clear understanding of what an LLP is. An LLP is a legal entity where the liability of partners is limited to their agreed contributions, and it provides flexibility and tax benefits that suit various business structures.

II. Eligibility Criteria:

Delhi, like the rest of India, has specific eligibility criteria for LLP registration. This section will outline the qualifications required for partners and the activities that can be undertaken as an LLP in Delhi.

III. Documents and Steps:

LLP registration involves a series of steps and the submission of various documents. This section will provide a detailed checklist, including necessary documentation, and walk you through the registration process step by step.

IV. Registration Timeline and Fees:

We'll discuss the approximate timeline for LLP registration in Delhi, including the processing times of various authorities involved. You'll also get insights into the government fees associated with registration.

V. Compliance and Annual Filings:

Once your LLP is registered, you'll need to ensure compliance with ongoing statutory requirements. We'll provide an overview of the annual filing and compliance obligations that you must meet.

Part 2: Top 10 Accounting Firms in India

I. EY (Ernst & Young):

EY is a global leader in assurance, advisory, tax, and transaction services. Their extensive experience and vast network make them one of the top choices for accounting and financial advisory services.

II. PwC (PricewaterhouseCoopers):

PwC is renowned for its professional services, including audit and assurance, consulting, and tax advisory. They have a strong presence in India and offer a wide range of services to businesses.

III. Deloitte:

Deloitte is a prominent name in the accounting industry, providing audit and assurance, consulting, and tax services. They have a dedicated team in India that can assist with complex financial matters.

IV. KPMG:

KPMG is a well-established firm offering audit, tax, and advisory services. They have a strong presence in India, making them a reliable choice for financial and business solutions.

V. Grant Thornton:

Grant Thornton specializes in audit and assurance, tax, and advisory services. They have a growing presence in India, particularly in the mid-market segment.

VI. BDO India:

BDO India offers a wide array of services, including audit and assurance, tax advisory, and business consulting. They have a strong presence in India and can cater to various business needs.

VII. RSM India:

RSM India provides services in audit and assurance, advisory, and tax consulting. They have a growing presence in India and cater to both domestic and international clients.

VIII. Crowe India:

Crowe India focuses on audit and assurance, tax advisory, and consulting services. Their dedicated team in India can provide personalized solutions to businesses.

IX. MNP (Meyers Norris Penny):

MNP is a leading accounting firm in Canada and has expanded its services to India, offering audit, tax, and consulting solutions.

X. Anuj Soni & Associates:

Anuj Soni & Associates is a well-regarded Indian firm specializing in accounting, auditing, taxation, and business consulting services. They cater to a wide range of clients, from startups to established businesses.

Conclusion:

LLP registration in Delhi can be a complex process, but with the right guidance, it becomes manageable. Additionally, having a reliable accounting firm to handle your financial and regulatory matters is essential for the success of your business. Whether you're starting a new venture or seeking to improve your existing business structure, this guide provides you with a comprehensive understanding of LLP registration in Delhi and introduces you to the top 10 accounting firms in India that can help you navigate the financial and compliance aspects of your business.

0 notes

Text

Avoiding Common Mistakes in the Company Registration Process in Hyderabad

Company registration in Hyderabad is a crucial step in establishing a business. It provides legal recognition and sets the foundation for smooth operations. However, the company registration process can be complex, and small mistakes can lead to delays, rejections, or even legal complications. To ensure a seamless and successful registration, it is important to avoid common mistakes. In this article, we will highlight some common mistakes to watch out for during the company registration process in Hyderabad.

1. Insufficient Research and Planning

One of the most common mistakes is a lack of thorough research and planning before initiating the company registration process. It is important to understand the legal requirements, documentation, and procedures involved in registering a company in Hyderabad. Conduct research, seek professional advice, and create a checklist of all the necessary steps and documents needed for registration.

2. Choosing the Wrong Business Structure

Selecting the appropriate business structure is crucial for company registration. Many entrepreneurs make the mistake of choosing the wrong structure without considering the long-term implications. Each business structure has different legal, financial, and operational aspects. Evaluate the pros and cons of various structures like private limited company, public limited company, limited liability partnership (LLP), or sole proprietorship. Seek professional guidance to determine the most suitable structure for your business.

3. Incomplete or Inaccurate Documentation

Incomplete or inaccurate documentation is a common error that can lead to delays or rejection of the registration application. Ensure that all required documents are complete, accurate, and up-to-date. These documents may include identity proofs, address proofs, incorporation documents, and other supporting papers. Double-check all the information provided and review it for any errors or inconsistencies.

4. Failure to Obtain Digital Signatures and Director Identification Numbers

Digital signatures (DSC) and Director Identification Numbers (DIN) are crucial for the company registration process in Hyderabad. Digital signatures are used for electronically signing documents, while DIN is a unique identification number for directors. Many entrepreneurs overlook the importance of obtaining DSCs and DINs before initiating the registration process. Apply for these early on to prevent delays in the registration process.

5. Neglecting Taxation Requirements

Another common mistake is neglecting taxation requirements during company registration. Ensure that you obtain a Permanent Account Number (PAN) and Goods and Services Tax Identification Number (GSTIN) for your company. PAN is mandatory for all tax-related activities, while GSTIN is required for businesses involved in the supply of goods or services. Failure to register for taxation can result in penalties and non-compliance issues.

6. Ignoring Compliance Obligations

Compliance with legal and regulatory obligations is crucial for registered companies. Ignoring compliance requirements can lead to legal complications and financial liabilities. Understand the compliance obligations related to taxation, accounting, annual filings, legal documentation, and employment laws. Stay informed about the deadlines and ensure timely compliance to avoid any legal consequences.

7. Not Seeking Professional Assistance

Trying to navigate the company registration process without professional assistance can be a major mistake. Engaging legal experts, chartered accountants, or company registration consultants can save you time, effort, and potential errors. Professionals have the expertise and knowledge to guide you through the process, ensuring that all legal requirements are met and mistakes are avoided.

Conclusion

Avoiding common mistakes during the company registration process in Hyderabad is vital for a successful and hassle-free experience. Thoroughly research and plan, choose the right business structure, and ensure all documentation is complete and accurate. Obtain digital signatures and Director Identification Numbers early on and fulfill taxation and compliance requirements. Seeking professional assistance will provide valuable insights and guidance throughout the process. By avoiding these common mistakes, you can navigate the company registration process in Hyderabad smoothly and set your business up for success.

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

Company Registration In Chennai

Online Company Registration in India — An Overview

One of the most highly recommended methods for starting a business in India is to establish a private limited company, which provides its shareholders with limited liability while imposing certain ownership restrictions. When it is LLP, the partners will manage it. On the other hand, a private limited company allows for directors and shareholders to be separate entities.

As your dependable legal advisor, synmac offers a cost-efficient service for registering your company in India. We handle all legal procedures and ensure compliance with the regulations set forth by the Ministry of Corporate Affairs (MCA). Upon successful completion of the pvt company registration process, we provide you with an Incorporation certificate (CoI), as well as PAN and TAN documents. With these in hand, you can easily establish a current bank account and commence your business operations.

Online Company Registration in India — An Overview

One of the most highly recommended methods for starting a business in India is to establish a private limited company, which provides its shareholders with limited liability while imposing certain ownership restrictions. When it is LLP, the partners will manage it. On the other hand, a private limited company allows for directors and shareholders to be separate entities.

As your dependable legal advisor, synmac offers a cost-efficient service for registering your company in India. We handle all legal procedures and ensure compliance with the regulations set forth by the Ministry of Corporate Affairs (MCA). Upon successful completion of the pvt company registration process, we provide you with an Incorporation certificate (CoI), as well as PAN and TAN documents. With these in hand, you can easily establish a current bank account and commence your business operations.

Benefits of Pvt Ltd Company Registration

There are numerous advantages to registering a company. By doing so, you enhance the credibility of your business, which can lead to increased consumer trust. Additionally, company registration can provide various benefits that can help your business to grow and succeed.

Shield from personal liability and protects from other risks and losses

Attract more customers

Procure bank credits and good investment from reliable investors with ease

Offers liability protection to protect your company’s assets

Greater capital contribution and greater stability

Increases the potential to grow big and expand

Checklist for Private Limited Company Registration in India

As defined by the Companies Act, 2013 one must guarantee to meet the checklist requirements without fail for Private Limited Company Registration in India.

Two Directors:

A private limited company must have at least two directors, with a maximum of fifteen. A minimum of one of the company’s directors must be a resident of India.

Unique Name

The name of your pvt ltd company must be unique. The suggested name should not match with any existing companies or trademarks in India.

Minimum Capital Contribution:

There is no minimum capital amount for a Pvt ltd company. A Pvt limited company should have an authorised capital of at least ₹1 lakh.

Registered Office:

The registered office of a pvt ltd company does not have to be a commercial space. Even a rented home can be the registered office, so long as an NOC is obtained from the landlord.

Steps For Company Registration in India

Startups in India can gain an edge over non-registered competitors by registering their company. While the process of registration is getting complicated and involves numerous compliance requirements, need not worry as Synmac is here to assist you every step of the way. Our team of professionals can provide comprehensive support for pvt company registration.

Step 1: RUN Name Approval

The first step of company registration involves the registration of your desired name. To reserve a name for your company, you must first submit a request for name approval to the Ministry of Corporate Affairs (MCA). You may include one or two potential names, along with a description of your business objectives, in your application for name approval. If your first choice is not approved, you may submit one or two additional names for consideration. Typically, the MCA approves name requests within five business days. Our team of experts can help you choose the ideal name for your company and guide you through the government registration process.

Step 2: Directors’ Digital Signature Certificate (DSC)

The MCA in India does not recognize traditional signatures. Instead, all filings with the MCA must include a digital signature certified by an Indian certification authority. Thus, it is mandatory for directors to have digital signatures prior to the company’s incorporation.

Synmac will obtain a digital signature certificate (DSC) for the directors through a recognized certification entity. To obtain a digital signature, directors must provide a copy of their identification documents and successfully complete a video KYC process. If a director is a foreign national, the nearest embassy should apostille their passport and other documents for company registration.

Step 3: Submitting the Company Incorporation Application

After obtaining the necessary digital signatures, submit the incorporation application in SPICe form along with all relevant attachments to the MCA. The application for incorporation includes the company’s Memorandum of Association (MOA) and Articles of Association (AOA). If the MCA deems the incorporation application to be complete and acceptable, the company can get the Incorporation certificate and PAN. Typically, the MCA approves all incorporation applications within five business days.

Private Limited Company Registration Compliances

After the process of company registration in India, it is necessary to adhere to various compliance regulations in order to avoid potential fines and legal repercussions. Some of the key post-registration requirements include:

Auditor Appointment: Within 30 days of incorporation, every Indian company must appoint a practicing's, certified, and registered Chartered Accountant(CA).

Director DIN KYC: Every year, individuals who possess a Director Identification Number (DIN) should undergo a DIN KYC process. During the company incorporation process, the company can get the DIN. This helps to verify the phone number and email address on file with the MCA.

Commencement of Business: The shareholders of the company must deposit the subscription amount specified in the MOA within 180 days of incorporation, and the company must create a bank current account. Therefore, to receive a business incorporation certificate, the shareholders of a company established with a paid-up capital of ₹1 lakh must deposit ₹1 lakh into the company’s bank account. They should also file a copy of the bank statement with the MCA.

MCA Annual Filings: Every financial year, the MCA must get a copy of the financial statements from each company registered in India. A corporation that incorporates between January and March may elect to include the first MCA annual return in the annual filing for the following fiscal year. Forms MGT-7 and AOC-4 are the components of the MCA yearly return. The Directors and a working professional must digitally sign both of these documents.

Income Tax Filing: Every financial year, businesses should file an income tax return using form ITR-6. The business should file the income tax before the deadline for each financial year, irrespective of the date of incorporation. The company’s income tax return must be digitally signed using the director’s digital signature.

Requirements to Start a Private Limited Company

Before incorporating a firm, it must meet a specific set of conditions. The following are such conditions:

1. Directors and Members

As mentioned earlier, at least two directors and no more than 200 members are necessary for legal Private Limited Company Registration in India. This is a mandatory requirement as per the Companies Act of 2013. The Directors should honor the following conditions:

Each directors should carry a DIN issued by the MCA

One of the directors must be an Indian resident, which means they must have spent at least 182 days there in the previous calendar year.

2. The Business’s Name

When selecting a name for a private limited company, there are two factors must be into consideration:

Name of the principal activity

PRIVATE COMPANY REGISTRATION

PRIVATE COMPANY REGISTRATION What is PRIVATE COMPANY REGISTRATION? Private Limited Company is the most prevalent and popular type of corporate legal entity in India. The Ministry of Corporate Affairs governs private limited company registration in India. Companies are incorporated and regulated under the Companies Act, 2013 and the Companies Incorporation Rules, 2014. Minimum Requirements For Company Registration Minimum 2 Shareholders: The shareholders of a private limited company can be a corporate entity or a natural person. Two Directors: A private limited company must have at least two directors and at most, there can be 15. Of the directors in the business, at least one must be a resident of India. Unique Name: The name of your business must be unique. The suggested name should not match with any existing companies or trademarks in India. Minimum Capital Contribution: There is no minimum capital amount for a company. A company should have an authorized capital of at least Rs. 1 lakh. Registered Office: The registered office of a company does not have to be a commercial space. Even a rented home can be the registered office, so long as an NOC is obtained from the landlord. Advantages of registering a private limited company Equity Raise: A company can raise equity capital from persons or entities interested in becoming a shareholder. Hence, a private limited company is a must for Entrepreneurs looking to raise money from angel investors, venture capital firms, private equity firms and hedge funds. Limited Liability Protection: A private limited company provides limited liability protection to its shareholders. In case of any unforeseen liabilities are created, it would be limited to the company and would not impact the shareholders. Separate Legal Entity: A private limited company is legally recognised as a separate entity. Hence, a company can have its PAN, bank accounts, licenses, approvals, contracts, assets and liabilities in its unique name. Perpetual Existence: A company has perpetual existence and never ends without reason. For a company to lose its existence, it has to be wound-up by the Promoters or be wound-up by the Government. Hence, a company can only be wound up for reasons like non-compliance or failure to comply with rules and regulations. Easy Transferability: As the ownership of a company is represented by shares - the ownership of a company can be transferred to any other legal entity or person in India or abroad easily - in part or whole. Further, since the shareholders control the Board of Directors, the Directors can also be replaced easily by shareholders to ensure business continuity easily at all times. Private Limited Company Registration Process: 1. Application of DSC & DPIN: First of all, the partners have to apply for Digital signature and DPIN. Digital signature is an online signature used for filing and DPIN refer to Directors PIN number issued by MCA. Director Identification Number (DIN) is a unique number ass

3.Address of the registered office

Upon completion of the registration process, the company should give the permanent address of the business’s registered office to the company registrar. The registered office is the primary location where business takes place and stores all documentation pertaining to the company.

4. Getting Additional Documents

To verify the authenticity of electronically submitted documents, every business must obtain a DSC. Furthermore, the business needs credentials from such professionals as secretaries, chartered accountants, and cost accountants that engage them for various operations.

#pvt ltd company registration#private limited company registration#registration#company registration#gst#income tax#tds2#itrfiling#gst refund

0 notes

Text

LLP Registration Bangalore

A sole-ownership or single-ownership business is known as a sole proprietorship. It's among India's oldest and most traditional types of business structures. It's among India's most accessible and popular kinds of business practices.

The proprietorship company is managed, owned, and controlled by a single individual. The individual's Pan card is used only to manage business operations for the Proprietorship. It's an easy way to get started with minimal regulatory compliance.

Proprietorship Firm Registration

In the proprietorship model, an individual's Pan card is just the entry point to begin your business.

There isn't additional registration needed for a sole proprietorship company.

An individual resident of India can start their company as a sole owner on his own. Find instant Sole Proprietorship company registration through Team IN filings using our online mode system. This will allow you to get the process and paperwork completed quickly.

Sole Proprietorship establishment

If an individual is looking to manage the business in his name or with a fancy name for a business, then a sole proprietorship company is the ideal choice.

He can start the sole proprietorship company immediately after obtaining the necessary additional license according to the company's nature.

· IEC registration is required if he plans to import export and Import Export.

· If he plans to operate a hotel business, The FssaI registration is mandatory.

· If the person is planning to trade, Registration for Gst is necessary.

In a sole proprietorship company, the sole proprietor controls the entire business. Moreover, risks are not shared with any other entity or parties. Therefore, the trouble is unlimitable and managing the company in the highest privacy.

Documents needed to be used for Proprietorship.

A person is the only one who can begin an enterprise as a proprietor in India. He must possess the following documents to start a proprietorship company in India.

· His Pan card

· His Aadar card

· Bank a/c

· Office address proofs such as a rental agreement, electric bill, etc.

· Number of mobiles and email ID

Process of Proprietorship Registration

The company must submit the necessary documents if a person decides to establish a proprietorship company in India. Our Team will develop the checklist according to how the firm operates.

If you want to establish a trading enterprise and want to start a trading company, the following checklist will be like this:

Your entire collection of documents, together with:

· Business name: example, Kiran Enterprises

· The objectives and the actions of the company: for example, Retail business

· rental agreement, as well as the electricity bill for Gst registration

After receiving the above information, We will finish the registration process and hand you the Certificate. Each proprietorship business owner has to possess a valid bank account to conduct a company in India.

The time needed to obtain the Proprietorship company in India

A person can only begin a business using their pan card, so establishing a proprietorship company is quick. Other business requirements have to be met like

· Msme Registration is completed within two days.

· Establishments and Shops in 5 days or less

· IEC code for exporting business - Within two business days

· Trademark Registration for Branding - in 2 days

Fees Proprietorship business registration in India

Here are some of the leading basics needed for a sole proprietorship company.

· Msme Registration cost starts at Rs.1000

· Shops and Establishment - - cost starts at Rs.3000

· IEC code to export business costs form from Rs.3000

· Trademark registration to mark your brand Cost starts at Rs.8000

Advantages of Proprietorship

The most valuable benefit for a business owned by a single proprietor is

· Easy to set up, and no licenses are required.

· More straightforward paperwork, no pan, and aadar needed.

· Simple tax calculation, according to the tax rate for each individual.

· Flexible and free to begin the business

Other issues related to Proprietorship

Since ownership lies with one person, here are the problems

The risk associated with the proprietorship business is unlimitable. If there is a risk that cannot be addressed by business capital, the owner must pay with the personal resources of his company.

Businesses, as well as other banks / financial institutions, are not accessible.

Selling a business can be difficult because there isn't a separate registration for a sole proprietorship company.

The size of the business is not the issue as the only person in charge of everything and bringing the company up to the top is not easy.

The Team In filings Bangalore based Proprietorship business registration, Company Registration, LLP Registration and Trademark Registration Consultant Associates and professionals practicing from last 15+ years in Bangalore, providing host of services including Business setup, Trademark registration, Trademark objection filing, Trademark hearing etc,

Team IN provides all types of Company Registration, GST services, Tax return filing as well as Gst advice Service, Tax consultancy, and Management have been providing various tax planning, business setup filing-related services from the 15 years in India.

Find your Team IN Filings Trademark Registrationconsultant to get your NewCompany, brandfast and efficiently with our Team member and get an expert advice to help you with building new Business, new Brand or Logo registration advise, Trademark renewal update.

Our other services includes Tax rules periodical update, business and Trademark status, tax compliance, GST support invoicing software and filing software that is free. GST invoicing, cloud-based filing software, as well as Accountants Assistance. Companies 5K+ is registered. Rapid and reliable Company service provider in Bangalore. Karnataka.

Contact Team IN Filings

Trust our dedicated Team of professionals to get your New Company Registered today.

Get in touch with our Team today and get a FREE consultation!

Reach us to manage your Accounting, Gst, Tax services, and Trademark.

Call at +91-7019827351 [email protected] to get your New Business Registration done!

0 notes

Text

how to register llp online

The Limited Liability Partnership Act of 2008 addresses LLP, which stands for Limited Peril Alliance. Obliged Liability Association has the benefit of limiting owners' exposure to risk while simultaneously requiring minimal upkeep. Bank risk has been limited by private-held affiliation authorities.

Banks and charters can essentially provide the organization's core values, not specific chairmen's resources, in the event of default. A limited liability partnership (LLP) is a type of business in which some or all of the partners have limited liabilities, depending on the state.

LLP is a business structure that combines the adaptability of an organization with the benefits of limited responsibility at a low consistency cost. It thus displays components of associations and businesses.

When compared to the traditional organization and the Private Limited, the LLP has its own advantages because it combines the best features of both structures into a single, robust, and suitable bundle. It addresses a variety of issues that businesspeople encounter when employing a conventional organization structure.

When compared to a Pvt. Ltd., one of the real expenses is bookkeeping and consistency, so the primary focus of any startup is to keep repeat costs to a minimum while still managing the business smoothly.

Checklist of LLP registration

Here is the checklist for LLP registration in Chennai.

· At least two partners.

· DSC for all designated partner.

· DPIN for all designated partner.

· The name of the LLP is distinct from any other LLP or trademark.

· Contribution of capital by the LLP's partners.

· For LLP registration in Chennai, Partnership agreement between partners is needed.

· Evidence of the LLP's registered office.

LLP registration process

LLP registration in Chennai follows the procedure given below.

DSC Application

The designated partner must apply for the Digital Signature Certificate prior to beginning the process of LLP registration in Chennai. DSC authenticates all LLP documents because the entire form must be filled out online and digitally signed.

Name Reservation via LLP-RUN

The Central Registration Centre will process the proposed LLP's name reservation via LLP-RUN under Non-STP.

However, the applicant is encouraged to make use of the MCA portal's free name search facility prior to submitting an application for a name reservation. This is important for LLP registration in Chennai.

· The MCA portal's "Name availability" check assists you in selecting names that are distinct from one another.

· The name will only be approved by the ROC if it does not resemble any other company, LLP, body corporate, or trademark.

· In accordance with Annexure "A," the applicant is responsible for paying the necessary fees. The Registrar has the option of either accepting or rejecting the completed form.

· If submitted for second time, the form must be submitted again within 15 days to correct any errors for LLP registration in Chennai.

· The FiLLiP form is an integrated application for Reservation of name, Application for allotment of DIN/DPIN, and Incorporation of a new LLP and/.

· Once the form is filed and found to be complete, LLP incorporation is done, and an LLPIN is issued once the authority has approved it. LLP registration in Chennai is done through FiLLip

· Additionally, those proposed designated partners without a current DPIN are issued for LLP registration in Chennai.

The following services are included in the FiLLip form for LLP registration in Chennai.

· Reservation of the proposed LLP's name.

· The application for the name reservation can also be made through FiLLiP. If the RUN-LLP service has already approved the proposed LLP's name. The SRN of such an approved form must be mentioned by the applicant.

· DPIN Allotment

For LLP registration in Chennai, Designated Partners During the incorporation of an LLP, this integrated form can be used to allot DPIN to up to two designated partners.

Benefits of LLP registration in Chennai

LLP hat has LLP registration in Chennai has following advantages.

No Base capital

Instead of requiring Rs like Private Limited Partnerships do, an LLP could be established with no base capital commitment. 1 Lac.

In fact, even commitments can be broken down into smaller chunks, allowing small business visionaries and new businesses to take advantage of these advantages and move ahead.

Seclude legal components

Instead of a sole proprietorship or a traditional business structure in which the individual resources of the proprietor or partners could be in jeopardy in the event of a failure of the business.

Seclude legal component (Limited Liability) allows for the obligation of each partner to be limited to the extent of his or her commitment or share.

With the exception of instances in which any accomplice misrepresents, this mode encourages the accomplices to be free of individual liabilities or to become bankrupt. When compared to the limitless risk offered by a business, it is very secure.

Low Price:

When compared to the cost of merging a private limited or open limited company, the cost of LLP registration in Chennai is low.

Separate legal entity

The presence of the separate legal entity LLP differs from that of its partners. In its own reality, LLP can sue and be sued. The LLP is unaffected by the separation and departure of its partners because of its status.

Because it brings together various stakeholders (such as Customers, providers, and so forth), It allows for flexibility in managing and marking legitimate contracts, among other things.

Tax Benefits

The profit will be distributed solely to the LLP and not to the Partners, avoiding double tax collection problems. Procedure for Registering a Limited Liability Partnership. If you have an idea for a business, register it with Limited Liability.

With Smartauditor.in, LLP registration in Chennai is easy, but careful drafting of incorporation points is required.

About Smartauditor

We Smartauditor are serving our valuable clients for LLP registration in Chennai. Also we are involved in ROC, IPR, GST, IT. We are also serving in various parts across India.

0 notes

Text

Myths about India LLP That One Should Not Believe

LLPs have been around for a decade.However, it has not been well received by targeted segments.There are still some widespread misconceptions about this structure.In today's post, I will address a few of these misconceptions. Read more before you go for LLP registration in India.

Myth 1: When viewed from the perspective of a corporation, limited liability partnerships (LLPs) are considered to be corporations.

Fact: As a result, many people believe that a general partnership has a significantly higher tax burden than a limited partnership.When it comes to lending money, partnerships are frequently preferred over LLPs because of this. Clarification is required for the following.Another type of partnership recognized by tax authorities is the limited liability partnership.As far as tax collection, the two designs have similar arrangements.If you are unable to register an LLP as a result of this, we should not stop here.Keep in mind the following point as well.

Myth 2: It is incorrect to assert that LLP does not comply.

Fact: The 2008 LLP Act governs LLPs.At various events, these regulations must be followed.Even if LLPs do not have to file annual returns, they are not required to report any transactions during the year.An LLP is also required to submit income tax returns. As the owner of a business, it may be necessary to amend the LLP agreement or any of its clauses multiple times.An LLP's Post Registration Compliance Checklist can be found here. RoC must also be informed of any changes to the LLP Agreement. There are a small number of people who adhere to this understanding, whereas there are a large number of people who believe in the following understanding.

Myth 3: Like a business, the compliance level is too high.

Fact: This is not true.Regularly, the forms must be filed.The organization's level is much lower than that of a business.An LLP does not have to hold meetings or keep records like a company does.Unless they are provided, no meetings or resolutions are required. Additionally, the company pays a one-time, fixed fee for audit every year.LLPs are exempt from restrictions until one of the following conditions is met.

Myth 4: Turnover: 40 Lakh INR Capital Contribution

Fact: 25 LakhPartners receive limited returns. We'll go over point 2 once more.Both parties benefit from our partnership.Dividends are not mentioned, and returns are not referred to as dividends.There are three sources of returns to partners. Compensation Capital interest Profit share Partners can take home all profits based on a predetermined ratio because profit distribution is unlimited.Each partner in an LLP determines their own payment schedule.It is essential to ascertain the Income Tax law's allowance for partner compensation.Dividends are double-taxed in companies, in contrast to LLPs.As a result, it makes sense to divide up profits in this location.

Myth 5: LLP is ideal for investments.The financial requirements of a corporation typically determine its structure.I wanted to know your position on LLP funding because of this.

Fact: A private company is generally considered to be a better investment vehicle than an LLP despite the fact that both have limited liability and numerous similar features.The following factors can be used to explain why a company wins:

Equity is the basis for a company's ownership and shareholding.

The capital of an LLP cannot be transferred as easily as the shares.

In addition, premium shares may be issued.However, an LLP has no chance in this regard.As a result, premiums are a major draw for investors.

Myth 6: The same ratio for profit sharing and capital is required by LLP agreements. The ratios for profit sharing and capital contribution must be the same.The accomplices are allowed to pursue the two choices.

Fact: The amount a partner takes home is determined by the profit sharing ratio.Capital is the money an investor puts into a business.Capital is another factor that determines a person's ownership.Both aspects are independent of one another.

Myth 7: There is no distinction made between partners. It is essential to recognize that an LLP has two types of partners

Fact: a Designated Partner and a Partner.This distinction is provided by the LLP, whereas the partnership does not.In a limited liability partnership (LLP), individuals must be assigned responsibilities.As a result, a designated partner has been appointed.In addition to the specified responsibilities, the partners of the LLP ensure compliance with all annual and other compliance obligations.Find out what sets Designated Partners apart.

Myth 8:The public can access all data because of a company's particular nature.However, LLPs do not reserve partner information.General partners have access to names of designate partners, DINs, and other data on the MCA portal. Additionally, a LLP agreement is a private document.The inclusion of a partner's internal agreement also raises questions.

Fact: The public can view annual returns, financial statements, and other forms.These documents are crucial to the credibility of banks, financial institutions, and other parties.You should not see public documents as a weakness; rather, you should see them as a strength.

Myth 9:I'd like to conclude by saying that registering an LLP is a costly process.There is no evidence to suggest that limited liability companies (LLPs) are more expensive to establish than general partnerships.

Fact: Since the government's fee remains relatively constant, professional services have a significant impact on registration costs. We consider government registration fees when selecting a professional. You will need to pay between 750 and 1000 Indian Rupees for online LLP registration. To be signed, the agreement must also be stamped. The amount of stamp duty due on a property is determined by its state and capital contribution. The amount due, which typically amounts to 500 rupees, is determined by these elements.

Bottom Line

It's important to know how a business works from the start. It has an effect on taxation, operations, and many other things. Ensure that the appropriate business structure is chosen and that any misunderstandings are clarified. Throughout this article, I have addressed common misconceptions.

0 notes

Text

Checklist of LLP Registration in India

What is a limited liability partnership (LLP)?

Limited liability Partnership (LLP) is a hybrid of a company and a partnership. It is an alternative corporate business form which gives the benefits of limited liability of a company and the flexibility of a partnership.

Although the concept of Limited Liability Partnerships (LLPs) Registration is somewhat new in comparison to other form of Businesses like Private Limited Registration and Partnership Firms, yet the LLP has become a preferred form of organization among a selected group of entrepreneurs who are in service sector, and especially amongst professionals as it has the benefits of both partnership firm and company into a single form of organization.

Prerequisites of Online LLP Registration:

Minimum Number of Designated Partners: The minimum number of designated partners shall be two (including nominee of Body corporate as DP) and at least one of them should be a resident of India.

Minimum Contribution: Contribution means the amount introduced by the first Partners of the LLP. As per the LLP Act, 2008 there is no limit of minimum contribution made by the Partners of the Company.

Obtaining DSC: Digital Signature Certificate (DSC) is required to digitally sign the documents/ eForms. Therefore, applicant should ensure that the DSCs are ready before initiating the registration of LLP.

Genesis of LLP Registration in India

The concept of Limited Liability Partnership (LLP) was introduced by the Government of India in the year of 2008. The LLPs in India are governed by the Limited Liability Partnership Act, 2008 and regulated by the Ministry of Corporate Affairs (MCA).

Registration of LLP in India is made completed online by the Government of India. However, as discussed that the LLP registration is comparatively a new concept, the persons who want to register their LLP is not clear about what documents are required for LLP Registration in India.

Let us discuss about the Checklist of LLP Registration in India

Proof of Office address of the Proposed LLP:

Copy of the utility bills (not older than two months)

No Objection Certificate (NOC) from the owner of the Property.

If the Property is on Conveyance/ Lease/Rent - Conveyance/ Lease deed/Rent Agreement along with rent receipts

Documents of Designated Partners/ Partners:

Self-attested copy of PAN (Mandatory)

Self-attested copy of Proof of identity - (Voters Identity Card/Passport/Driving License/Aadhaar)

Self-attested copy of Residential proof, not older than 2 months - (Bank Statement/Electricity Bill/Telephone bill/Mobile bill/Utility Bill/Registered/Notarized Rent Agreement)

LLP Subscribers' sheet including consent: It contain the details of the subscribers of the LLP along with the Photo and signatures of Designated Partners (DP). Also, it shall contain a written declaration by each DP that the information written in the subscriber sheet is True and Correct and the same shall be witnesses by a Person.

Form 9: It is an auto-generated web-based form which is filed as an attachment along with FiLLiP form. It contains the consent from Designated Partners to act as such in the Proposed LLP.

Valuation Report (Conditional Attachment): This attachment is mandatory to attach by the applicant only if the Partner has contributed the subscription money by way "Other than cash”.

Once all the information/documents are compiled, the applicant has to file the FiLLiP form. The CRC (MCA) will scrutinize the submitted form. Where the Department finds the form in order, he may approve the application and issue Certificate of Incorporation (COI), PAN and TAN of such LLP.

Otherwise, Resubmission remark has been allotted to such application along with the reasons of the same. For the application that is marked as ‘Resubmission required’, the user is required to update the details in the web-form and complete submission (including the upload of DSC affixed pdf) within 15 days from the date of receiving the resubmission.

Submission of the LLP Agreement – FORM 3: LLP Agreement

Pursuant to Section 23(2) and (3) of The Limited Liability Partnership Act, 2008 read with Rule 21(1) of Limited Liability Partnership Rules, 2009

Form 3 is required to be filed with the MCA within 30 days from the date of incorporation of the LLP for filing information with regard to LLP Agreement. LLP Agreement is the written agreement between the partners of the Limited Liability Partnership (LLP) or between the LLP and its partners for establishing the rights and duties of the partners toward each other as well toward the LLP.

Applicant has to file Form 3 along with the duly notarized LLP Agreement. Once the Form 3 is filed and approved by the Department, the LLP is said to Incorporated successfully in all respect.

CONCLUSION

In this article, we have tried to cover the complete Checklist of LLP Registration in India. Do you Still have any doubt regarding the about checklist or in any aspect of Online LLP Registration in India?

We, Compliance Calendar LLP, will be happy to support you in your Online LLP Registration and will provide you with all the legal drafts. We have a dedicated team of Professionals who are well versed with provisions of the LLP Act, 2008 and other applicable rules and regulation. To know more regarding as to how to register your LLP Business, please mail us at [email protected] or say hi at 9988424211 and someone from our team will reach out to you at the earliest.

1 note

·

View note

Text

Structuring a Playschool Business in India

Taking up play school business is a stance that is gaining popularity among the entrepreneurs of India. The primary reason this venture as a business is gaining popularity is because of its lucrative nature in terms of low investment, even lesser legal compliances and huge outcome. Makoons, a popular chain of playschool franchisee provider quotes an ROI on its franchisee to be 200% in 4 years; such is the outcome of this business. Once settled, this business does not give you the stress like recessions and low impacts.

Analysis of the Market

Indian Pre-School/Childcare Market to Grow at 19% during 2019-2024, Propelled by Rising Women Working Population

The business model has a good cash inflow and potential of seeing substantial growth based on the entrepreneurial drive driving it. The potential of growth in this sector is humongous. Following are a few graphs that will show the potent growth in this business filed. The following graph shows how the return on human capital investment as a function of age is.

Structuring a playschool business in India – Process Chart

But no matter how lucid and easy going business field one might be in, one certainly needs a good business plan to grow aggressively in the market. As it is commonly said, a stagnant business/product is as good as a dead business. Therefore, to start a business too, one needs a good business structure. Here are a few items that are supposed to be in the checklist in starting a playschool business:

Selecting a business model

When one plans to start a playschool business in India, he has two options in hand i.e. either start his own venture or take up a franchise. Both of them have their own set of advantages and disadvantages.

On getting a franchisee, there are certain benefits like there are certainly advantages like:

· There is no requirement of aggressive marketing or campaigning that is taken care of by the brand-name holder.

· The terms set out in the agreement for setting up a business model is easier and has very low investment criteria.

Let us take a look at the top franchisors and the criteria they site

· Required investment for Kidzee Playschool is just Rs. 15 to 20 lakhs and the required floor area is 2500 – 5000 square feet

· The net investment to open a Makoons play school franchise in India is also under Rs. 12 -15 lakhs and the minimum required area is 1500- 2000 square feet.

· A Euro Kids play school is about Rs. 15 lakhs, and the required floor area is a minimum of 3000 square feet.

· One needs a minimum investment of Rs. 6 lakhs to open a Shemrock franchise preschool in India as well as a floor area of 2500 square feet.

· The cost of opening Bachpan franchise is 12-15 lakhs and area required is 2000 square feet.

· The return on Investment assured by this franchise is easy to achieve and are considerably high. The risk factor involved in such franchise business is very less.

· Professional support in terms of setting up the school (pre-defined infrastructure, staff and administration), managing it, getting market recognition etc. are some advantages of having a brand franchise.

Advantages

· One gets to handcraft one’s own business model. One can choose a partner and a scale of business investment of his choice.

· There is a certain degree of freedom as he is not bound by a standard form of agreement.

· He gets to apply his own expertise, entrepreneurial ideas into it and design an innovative venture.

Commercials

One of the important aspects before venturing into legal formalities is to have the commercial structure clear. What could be the source of funds? How much of debt or equity needs to be injected in the business:

Investment Required

1. Land and Building – Ranging from 1500 square feet to 2500 square feet

2. Capital Investment – Ranging from Rs. 8,00,000 to 10, 00,000 (depends on the scale of business.)

3. Furniture like plastic chairs, tables and classroom equipment’s amounting to 40,000- 80,000

4. Play equipment’s like rockers, slide etc. Also book racks, wall hangings and staff furniture needs to be considered

5. Appropriate Human Resources qualified to man the organisation. Minimum wages that need to be paid out is 80 rupees per day. 1 staff per 10 students and 1 teacher per 8 students. A venture like this typically has 30 -50 students large infrastructure can have up to 170 students.

The Return on Investment as quoted from famous franchises is approximately 2 to 3 years depending on the franchise and the scale of the business. Setting up a franchise is easier.

The process is as follows:

· A simple forms needs to be filled in their website.

· They are going to conduct the survey if one meets their criteria to select a favourable location, do the marketing and campaigning.

· You will be able to start a playschool with their guidance at every step.

· There are several portals which provide gateways to apply to these playschool franchises. Like www.startingfranchise.in

· But if the venture is one’s own, then certain factors have to be kept in mind before making an investment in order to reach an ROI. The factors that need to be taken care of are as follows:

· Geography – Parents till the initial stages of the growth of the child do not want to send their children far, therefore it has to be in a residential area with open spaces around. Again depends on the locality.

· Demographic Profile – Once the location is fixed, than one needs to look for the demography of the area. A place with a nuclear family would be more likely to send their children to play school than places with joint family where the child mostly gets its education from elders. Also it is advisable to keep a tap on the type of income group people that live there. It will help set the fee structure.

· Market Survey – Conduct a survey to find out the potential number of students and the preference of the kind of playschool.

Break Even Point

Step 1:

· From the industry standard, let us keep the Break Even Point (where both Fixed Cost and Variable Cost are absorbed) at 1.5 years

· The Fixed Cost is assumed at initial stage as INR 10, 00,000 (FC)

· The Variable Cost is expected to be 4, 00,000 (TVC)

· Also, we set a target to break-even our business in 1.5 years.

Step 2:

· Find out the annual fees that your competitors are charging to estimate your fees.

· Let’s assume that the fees charges would be INR 25,000 per student and the number of students to be X. Therefore the Total Revenue (TR) would be INR25, 000X.

Step 3:

Contribution = TR – TVC

· 25,000X — 4, 00,000.’

Step 4:

· We have kept the break even timeline as 1.5 years. Whatever is earned over and above our variable costs, will be used to cover the fixed expenses. Post that all earnings would be to be profits of the institution

· Divide FC by Contribution to get your breakeven period in years.

· Therefore we get the following equation:

· 700,000 / (25,000X — 400,000) = 1.5.

· The value of X stands as 34.67.

· Thus we need at least 35 students for first 1.5 years to realise all costs.

· Even after the breakeven point, the profit will be INR 4, 75,000.

3. Legal Formalities

In case of playschools, the legal compliances are very minimalistic. Thus the cost of litigation that may arise out of such process is also very less.

1. The Shops and Establishments Act is not applicable

In case of playschools, the Act is silent and one can run your playschool without a registering under Shops and Establishment Act.

Labour laws:

The following labour laws have to be kept in mind:

1. Provident Fund payments – If there are more than 20 employees the organisation has to abide by provident fund rules otherwise may be subject to penal provision under 14B of the Act of 1952.

Checklist of the same could be found at https://unifiedportal-emp.epfindia.gov.in/epfo/

2. The Minimum Wages Act, 1948 – The minimum wages for primary schools is Rs. 80.

3. As per the Payment of Bonus Act, 1965 – If there are more than 20 employees, one needs to pay a 1 month at any time during the year.

Forming the entity:

If you start your own institution, it can be done either as a partnership or as a Section 8 company or even an NGO under a trust. It is usually easier to form a partnership, and cheaper and quick to register. Forming a company can take up to 4 weeks, and costs around Rs. 35000. Be careful with the formation of the partnership deed and the profit sharing.

LLP in India has certain regulations which need to be abided by, according to the LLP Act, 2008 in India. Although the regulations are more than partnership firms but less than floating a company given the ever increasing regulations for companies under Companies Act.

Running it in a residential area:

Most playschools are located in residential areas. The first thing that needs to be looked into is whether the rental agreement permits it. Also, if it is an apartment or consortium or society apartment, the bye-laws of the apartment/association/ society consortium should be looked into for permits to run a playschool. Otherwise, there is no running a playschool in residential premises. Requisite permission has to be taken from the society it is operating in.

It has been decided by Courts in different states that a chartered accountant, yoga teacher and lawyer can carry on their work in residential premises so there is no reason why a playschool cannot be carried on as well, as long as the disturbance to neighbours is minimized.

Maharashtra Preschool Centres (Regulation of Admission) Act of 1996 or Tamil Nadu Private School Education Act:

These Acts provide for compulsory registration of preschools in certain state. Only in a few states, one needs permission from appropriate authority for starting preschool in Maharashtra. It should be education officer of Municipal Corporation who will provide with the certificate. However this is the only state where you need such permission. The procedure is broadly as follows:

· Name the institution. It should not duplicate

· Define your budget.

· Develop a preschool curriculum

Deciding a curriculum

The final step to see the business set up to reach its initial stage is setting up a curriculum for the day school. Most of the franchisee have international affiliations with Early Child Education curriculums which depends upon the type of playschool being formed Children of this age group are mostly very active and require engage in various activities. Their mindset is set to explore, observe and grasp and learn quickly. Their socio economic backgrounds may be different and so shall be their languages thus every child is different in terms of energy and understanding.

There can be different programs based on the age group:

Mother Toddler program for 13 months and 2 years of age: Mother Toddler program again is designed to help mothers understand child’s socialisation needs and help them develop their skills while playing.

Early Childhood Teacher training program (E.C.C)/Nursery teacher training program:

Such programs are aimed towards training students to be ready for pre primary or early school. Theory plus practical courses of 7 months are advisable for this stage.

Day Care center curriculum – It is a different sort of set up. Most of the parents are working and are unable to provide teaching time to their kids. Such parents look for quality preschools where their child could get proper early childhood education.

An ideal playschool curriculum fulfils all the requirements of a child. A typical preschooler’s curriculum includes a good mix of reading, preschool worksheets, writing and math exercises along with colourful fun preschool activities. Such wide scale of activities helps children in learning and developing their skills in all the fields. Children are quite fascinated by playful activities and colourful objects and also appreciate the playful moments. There are professional advisors who can help in developing a good playschool curriculum. It is advised to consult them because it is the first learning stage of the child and should not be dealt with.

For free consultation on starting your preschool call us at 1800 5721 530

#playschool#preschool#earlychildhoodeducation#kindergarten#schoolfranchise#school startup#education#best play#school#franchise

2 notes

·

View notes

Photo

An LLP is a body corporate formed and incorporated under the Limited Liability Act 2008, it has a legal entity separate from that of its partners. Also, has perpetual succession, any change in the partners of an LLP will not affect its existence, rights, or liabilities of LLP. The provisions of the Partnership Act, 1932 will not apply to LLP. Furthermore, a Limited Liability Partnership means a business where a minimum of two partners is required and there is no limit on the maximum number of partners. The liability of the partners is limited up to the extent of Capital contribution done by each partner in checklist for llp registration.

#llp compliance#llp compliance checklist#llp annual compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#llp compliance checklist 2022#annual compliance of llp#llp compliance services#llp compliance services india#LLP Annual Filing in India#Annual Compliance for LLP Company#llp compliance online services india#online llp compliance services#llp annual compliance cost#annual return for llp#llp company compliance

0 notes

Text

Online Company Registration By MUDS

One of the most suggested ways to establish a business in India is to form a private limited company. With specific constraints on ownership, this sort of organisation provides limited responsibility for its stockholders. An LLP is run by partners who own and control the company. In the case of a private limited business, directors may be distinct from shareholders.

Your trustworthy legal counsel, MUDS, offers a low-cost Company Registration service in India. You may discover how to register your company here. We handle all legal paperwork and comply with all Ministry of Corporate Affairs requirements. Following the completion of the business registration procedure, you will be issued a Certificate of Incorporation (CoI), as well as a PAN and TAN. You may now create a current bank account and start your business by Company Registration.

Benefits of Company Registration

There are several advantages to forming a corporation. A registered corporation adds legitimacy to your firm. It benefits your company by:

· Personal responsibility is protected, as are other risks and damages.

· Increase your consumer base.

· Acquire bank credits and decent investments from trustworthy entrepreneurs with convenience.

· Provides liability protection to safeguard your company's assets.

· Increased capital contribution and reliability

· Increases the possibility for large-scale growth and expansion.

Checklist for Company Registration in India

We must ensure that the checklist criteria are completed, as outlined by the Companies Act 2013.

Two Directors: A private limited corporation must have a minimum of two directors and a maximum of fifteen. At least one of the company's directors must be an Indian national.

Spectacular Name: Your company's name should be one-of-a-kind. The proposed name should not be similar to any existing companies or trademarks in India.

Minimum Capital Contribution: There is no such thing as a minimum capital contribution for a corporation. A firm must have at least one lakh in authorised capital.

Registered Office: A company's registered office does not have to be a commercial facility. A rental property can also serve as the registered office if a letter of authorization from the landlord is acquired.

Why MUDS?

The private limited company registration procedure is entirely online, so you won't even have to leave your house to have your firm set up. We finish the registration procedure at MUDS in fourteen days.

· DIN and DSC for two Directors are included in the MUDS business registration package.

· MoA and AoA drafting

· Stamp duty and registration fees

· Certificate of formation of a company Company PAN and TAN

· DBS bank offers a zero-balance current account.

You'll be well on your way to founding your own private limited corporation with this. It is advised that you talk with specialists and make the best selection for easier progress.

What are the name criteria for a Company Registration?

In India, the registrar of companies (RoC) expects applicants to fulfil a few name requirements. Some of them are subjective, which implies that acceptance may be contingent on the officer handling your application's judgement. However, the more strictly you follow the guidelines outlined below, the more likely you are to be approved. But before that, ensure that your identity is widely obtainable.

0 notes

Text

Document checklist for payment gateways

In today's ultra-competitive business world, a key focus is on reducing customer friction during the purchasing process. Given the current contactless climate, it is even more critical to eliminate human interaction from this process. Businesses are increasingly relying on online payment methods rather than the traditional cash-first approach. They are now collecting payments from customers through methods such as UPI, wallets, point-of-sale machines, and online payment gateway. Using a payment gateway is now one of the most popular methods because it provides the customer with a variety of payment options.

-Photo created by storyset on freepik

If you are an Indian business owner with questions about the documents needed to sign up for a payment gateway for your company, then this document checklist is for you.

Business filing status - Individual

Individual/business owners Pan Card

A copy of the individuals Aadhar card

For business address proof the individuals Driving License, Voter ID or Passport (Any one)

Original cancelled cheque of bank account with IFSC code and name

Bank account statement for the last 3 months

Business filing status - Proprietorship

A copy of the proprietor's Pan Card

A copy of the proprietors Aadhar card

A copy of business address proof such as Driving License, Voter ID or Passport (Any one)

Cancelled cheque of bank account, IFSC code and name or account statement

A copy of government business proof . This could be either a GST certificate or Shop Act

Business filing status - Partnership

A cancelled cheque of current bank account, IFSC code, address and firm name

A copy of Pan Card from each authorized signatory

Single copy of address proof identity card such as Driving License/Voter ID/Aadhaar Card/Passport of all the authorized signatory

A copy of the respective firms pan card

A copy of certificate of Incorporation mandatory for LLP or partnership deed as business proof

A copy of the GST certificate or Partnership deed with the name of the firm and address as business address proof

Business filing status - Private Limited or Limited Liability Partnership firm

A copy of the MOA and AOA of the firm as business address proof

Cancelled cheque of bank account, IFSC code and company name or bank account statement for the last 3 months

Certificate of Incorporation or GST certificate as business registration proof

Business Pan Card

Authorized signatories PAN Card

Authorized signatories driving licence or passport and Aadhar Card

Business filing status -Trust or Society

For business address proof Trust Deed or Society registration certificate, MOU, Bank account statement with the name of the trust or society and address or GST certificate (Any one)

Cancelled cheque or bank account statement for the last 3 months with the society or trust name and address

For business registration proof, Trust Deed or Society registration certificate

Pan Card of the trust or society

Pan Card copy of the authorised signatory

Things to consider before submitting your documents to enrol in your best payment gateway India:

On your address, please include your name order/spelling as well as your date of birth. If the proof does not match the details on your Pan Card, send an original copy of the affidavit mentioning the name and DOB as on the Pan Card and Address, followed by declaring the correct spelling of both names and DOB are of the same person.

Before you begin collecting money, make certain that all documents have been submitted and are in accordance with what has been requested. As a mismatch in these documents may cause settlements of collected funds to your bank account to be delayed.

Make sure to read the payment gateway's terms and conditions before signing up, as some business segments are not eligible for their services.

Collect payments online with a variety of payment methods!

Payment links that accept online payments

#online banking#online payment#payment gateway#money transfer#fintech#API#UPI#online transactions#proprietorship#partnership#online business#customers

0 notes

Text

Legal Requirements for Company Registration: A Must-Know Checklist

When starting a business in Hyderabad, the company registration process is one of the most important steps. Registering your company not only provides you with legal protection but also helps you gain credibility and access to various benefits. However, it is crucial to be aware of the legal requirements involved in the company registration process. In this article, we will guide you through a must-know checklist to ensure a smooth registration process for your company in Hyderabad.

1. Choose the Right Business Structure

The first step towards company registration is to determine the appropriate business structure for your enterprise. In Hyderabad, you can opt for various structures such as sole proprietorship, partnership, private limited company, or a limited liability partnership (LLP). Each structure has its own set of legal requirements and benefits, so it is vital to choose the one that aligns with your business goals and future plans.

2. Obtain Director Identification Number (DIN)

As per the Companies Act, 2013, individuals intending to become directors of a company must obtain a Director Identification Number (DIN). This unique identification number is mandatory for all directors and is obtained by submitting an online application to the Ministry of Corporate Affairs (MCA). The DIN serves as proof of directorship and is essential for the company registration in Hyderabad.

3. Digital Signature Certificate (DSC)

To ensure the authenticity and security of documents filed electronically, a Digital Signature Certificate (DSC) is required. A DSC is an encrypted digital key that confirms the identity of the sender. It is crucial for signing electronic documents during the company registration process. In Hyderabad, a licensed Certifying Authority issues DSCs, and it is recommended to obtain one before proceeding with company registration.

4. Obtain the Required Documents

To register your company in Hyderabad, you need to compile and submit specific documents. These typically include:

- Proof of Identity: PAN card, Aadhaar card, passport, or driver's license of all directors and shareholders.

- Proof of Address: Bank statements, utility bills, or rental agreement in the name of the company's registered office.

- Memorandum of Association (MoA) and Articles of Association (AoA): These documents outline the company's objectives, rules, and regulations.

5. Apply for Name Availability