#proprietorship

Text

Decisions for Your Business: Partnership Firm vs Sole Proprietorship

Decisions for Your Business: Selecting an appropriate business structure is essential when launching a new business. Due to their ease of use and flexibility, partnerships and sole proprietorships are two common business structures that small business owners favor. A thorough explanation of a sole proprietorship and the distinctions between it and a partnership firm are covered in this…

View On WordPress

0 notes

Text

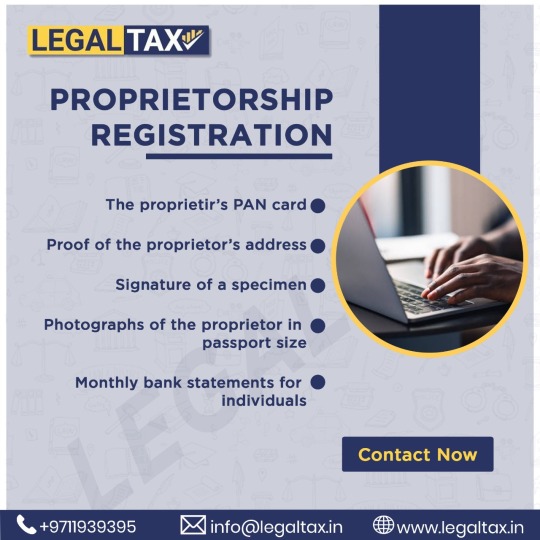

Discover a straightforward guide to Proprietorship Company Registration in Kolkata. Benefit from simplified processes, cost-effectiveness, and direct control. Learn the steps to register, obtain licenses, and ensure compliance for your business success. Simplify your entrepreneurial journey in the thriving business hub of Kolkata.

youtube

#Proprietorship#Proprietorship Company Registration#Proprietorship Company Registration in Kolkata#Youtube

0 notes

Text

#Startup Business#Startup Lawyer#Business Registeration in Nepal#Startup Law in Nepal#Public and Private companies#Proprietorship#partnership firm#legal identity

1 note

·

View note

Text

Advantages and Disadvantages of Proprietorship in Business

Advantages and Disadvantages of Proprietorship in Business

A proprietorship is a popular form of business organization where a single individual owns and operates the business. It is the simplest and most common type of business entity, particularly for small-scale enterprises. A proprietorship offers several advantages that make it an attractive choice for entrepreneurs. However, it also comes with certain disadvantages that may limit its suitability in certain circumstances. This article will explore the advantages and disadvantages of a proprietorship in business.

Advantages of Proprietorship:

1. Ease of Formation and Dissolution: One of the key advantages of a proprietorship is its simplicity of formation. Establishing a proprietorship involves minimal legal formalities and paperwork, making it an accessible option for individuals with limited resources or expertise. Similarly, dissolving a proprietorship is relatively uncomplicated, as it only requires the owner to cease operations and settle any outstanding liabilities.

2. Direct Decision-Making: In a proprietorship, the owner has complete control and authority over all business decisions. This autonomy allows for quick decision-making and the ability to adapt to changing market conditions promptly. The absence of bureaucratic processes or complex hierarchies enables the owner to respond swiftly to customer demands and make strategic choices that align with their vision.

3. Flexibility and Adaptability: Proprietorships are highly flexible business structures. The owner can easily adjust the business operations, change the product or service offerings, and modify the marketing strategies without any external approvals. This flexibility enables the proprietor to capitalize on emerging trends, explore new opportunities, and pivot the business model as needed, thereby increasing the chances of success.

4. Direct Profits: In a proprietorship, the owner enjoys the benefit of directly receiving all profits generated by the business. Unlike partnerships or corporations, there is no need to distribute profits among multiple shareholders or partners. This direct access to profits provides a strong financial incentive and can be particularly appealing to individuals seeking complete ownership and financial rewards.

5. Confidentiality: Another advantage of a proprietorship is the privacy it offers. Unlike corporations, proprietorships are not required to disclose detailed financial information or file public reports. This confidentiality can be beneficial for individuals who prefer to keep their business affairs private, protect their trade secrets, or maintain a low profile in the marketplace.

Disadvantages of Proprietorship:

1. Unlimited Liability: One of the significant disadvantages of a proprietorship is the owner's unlimited liability for the business's debts and obligations. Since the owner and the business are considered the same legal entity, personal assets are at risk in case of business losses or legal claims. This unlimited liability can expose the owner to significant financial risks and make it challenging to separate personal and business finances.

2. Limited Access to Capital: Proprietorships often face limitations in accessing capital compared to larger organizations. Due to the inherent risks associated with unlimited liability, lenders and investors may be reluctant to provide substantial funds to a proprietorship. Consequently, the owner may have to rely on personal savings, loans, or smaller sources of financing, which can restrict the business's growth potential.

3. Limited Skills and Expertise: As a sole proprietor, the owner may lack certain skills or expertise necessary to run a business successfully. The burden of managing all aspects of the business, including operations, finance, marketing, and human resources, falls solely on the owner's shoulders. This can be overwhelming, especially when the business grows, and expertise in specific areas becomes critical.

4. Limited Life Span: A proprietorship is inherently dependent on the owner's existence, and its continuity is uncertain in the event of the owner's death, incapacity, or desire to retire. Unlike corporations or partnerships, a proprietorship does not have a separate legal existence, which means the business may cease to exist if not transferred or sold to a new owner.

5. Limited Growth Potential: Proprietorships often face challenges when it comes to scaling up the business. The limited access to capital, resources, and expertise can hinder expansion efforts. Additionally, the owner's time and energy may be spread thin, making it difficult to focus on growth strategies and pursue larger market opportunities.

Conclusion:

Proprietorships offer numerous advantages, including ease of formation, direct decision-making, flexibility, direct profits, and confidentiality. However, the unlimited liability, limited access to capital, limited skills and expertise, limited life span, and limited growth potential are notable disadvantages. Entrepreneurs considering a proprietorship should carefully assess their personal circumstances, risk tolerance, and long-term business goals to determine if this form of the business organization aligns with their aspirations. It is crucial to seek professional advice and evaluate all factors before making a final decision.

0 notes

Text

#taxesquire#proprietorship registration#company registration#business registration#chartered accountant#proprietorship#Best registration services

0 notes

Text

Proprietorship is a form of business organization in which an individual or a sole proprietor owns and manages the business. It is the simplest form of business structure and is commonly used by small businesses and self-employed individuals.

In a proprietorship, the owner has complete control over the business and is personally responsible for all the liabilities and debts incurred by the business. The proprietorship is not considered a separate legal entity from the owner, and therefore, the profits and losses of the business are taxed as the owner's personal income.

To set up a proprietorship, the owner must obtain the necessary licenses and permits, register the business with the relevant authorities, and obtain a GST registration, if applicable. The proprietorship must maintain proper books of accounts, file income tax returns, and comply with all the statutory requirements and regulations.

One of the advantages of a proprietorship is its ease of formation and low cost of operation. Since the proprietorship is owned and managed by a single individual, there is no need for complex legal formalities or documentation. Additionally, the proprietorship enjoys complete flexibility in terms of operations and decision-making.

However, a proprietorship also has some limitations, such as limited access to capital, the absence of separate legal identity, and unlimited liability. Therefore, it may not be suitable for businesses with high growth potential or those that require significant investment or external funding.

0 notes

Text

A company or sole proprietorship could file for bankruptcy under Chapter 11 without putting their personal assets in danger. Which bankruptcy plan best suits your needs and financial condition can be determined with the aid of an Edison bankruptcy attorney.

0 notes

Text

Loirinhas boquete no banheiro com gozada na boca

Teen tricked into sex

Chick is riding on a long cock while sucking on another

boy novinho teen tocando uma pra namorada ensaboado

una madurita bien ponedora la cabrona

Batman Interrogates Catwoman

Gay teens kissing porn first time The bombshell is munching and deep

Skinny blonde teen babe gets fucked out by online date

Nude hairy latino men and free gay weed smoking porn Work can be

Pinto pequeno

#troegerite#proprietorship#superdramatist#co-ordinate#fivepenny#vociferance#malshapen#pycnogonoid#hwiyoung#karaoke#overscented#two-track#resailed#politico-diplomatic#nonundergraduate#Sublette#waget#well-heeled#steamfitter#unanimiter

0 notes

Text

Type of business structure in India

Overview

A business enterprise can be owned and organized in various types of business structures in India. Each legal form of business has its own merits and demerits. The ultimate choice of business entity types depends upon the balancing of the advantages and disadvantages of the various legal form of business. The right choice of type of business structure is very crucial because it determines the power, control, risk and responsibility of the entrepreneur as well as the division of profits and losses. Being a long-term commitment, the choice of the legal form of business should be made after considerable thought and deliberation. The selection of a suitable legal structure for a business organization is an important entrepreneurial decision because it influences the success and growth of a business – e.g., it determines the division or distribution of profits, the risk associated with business, and so on.

Once a type of business structure is chosen, it is very difficult to switch over to another legal form of business because it needs the winding up, or dissolution of the existing organization which may be treated as a case which is raised by oneself to face with the complex issues and procedures which ultimately results into the waste of time, effort and money.

Further, the closure of the business will entail the loss of business opportunity, capital and employment. The volume of risks and liabilities as well as the willingness of the owners to bear them is also an important consideration in choosing the right business entity types.

Types of Business Organisations

The choice of a business entity will depend on the object, nature and size of the business of such entity which will be varied from case-to-case basis and will also depend upon the will of the business entity owners which they want to accomplish. The main type of business structures in India is Sole Proprietorship, Partnership, Hindu Undivided Family (HUF) Business, Limited Liability Partnership (LLP), Co-operative Societies, Branch Offices and Companies which may be any kind of company including One Person Companies (OPC), a private company, public company, Guarantee Company, subsidiary company, statutory company, an insurance company or unlimited company. Further, Company formed under section 8 of the Companies Act, 2013 or under section 25 of the earlier Companies Act of 1956 is a non-profit business entity. There can also be Association of Persons (AOP) and Body of Individuals (BOI), Corporation, Co-operative Society, Trust etc.

Sole Proprietorship

A sole proprietorship is a type of business structure, wherein one person owns all the assets of the business, and no legal formalities are required to create a sole proprietorship. The owner reports income/loss from this business along with his personal income tax return.

Partnership Firm

Partnership firms are a type of business structure are created by drafting a partnership deed among the partners. Partnership firms in India are, governed by the Indian Partnership Act of 1932.

Section 464 of the Companies Act, 2013 empowers the Central Government to prescribe a maximum number of partners in a firm but the number of partners so prescribed cannot be more than 100.

The Central Government has prescribed a maximum number of partners in a firm to be 50 vide Rule 10 of the Companies (Miscellaneous) Rules,2014. Thus, in effect, a partnership firm cannot have more than 50 members”.

Hindu Undivided Family (HUF)

A Hindu family can come together and form a type of business structure called HUF. HUF is taxed separately from its members. HUF has its own PAN and files tax returns independent of its members.

Limited Liability Partnership (LLP)

Limited Liability Partnership is a legal structure of the business that provides the benefits of limited liability of a company but allows its members the flexibility of organizing their internal management on the basis of a mutually-arrived agreement, as is the case in a partnership firm.

Co-operative Society

A cooperative organization is an association of persons, usually of limited means, who have voluntarily joined together to achieve a common economic end through the formation of a democratically controlled organization.

Section 8 Company

Section 8 company is established for promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment or any such other object’, provided the profits, if any, or other income is applied for promoting only the objects of the company and no dividend is paid to its members. Section 8 Companies are registered under the Companies Act, 2013.

One Person Company

An OPC is the legal structure of a company with only 1 person as a member Shareholder can make only 1 nominee, he shall become a shareholder in case of death/incapacity of the original stakeholder.

Private Company

A private company is the legal structure of a company which has the following characteristics:

(i) Shareholders' right to transfer shares is restricted

(ii) Minimum number of 2 members in the company

(iii) Number of shareholders is limited to 200

(iv) An invitation to the public to subscribe to any shares or debentures or any type of security is prohibited.

Public Company

A public company is the legal structure of a company which has the following characteristics

(i) Shareholders' right to transfer shares; is not restricted

(ii) Minimum 7 members

(iii) An invitation to the public to subscribe to any shares or debentures or any type of security is permitted.

Producer Company

According to Section 378A of the Companies Act, 2013, Producer Company means a

body corporate having objects or activities specified in section 378B of the Companies Act, -2013 and registered as a Producer Company under the Companies Act, 2013 or under the Companies Act, 1956.

The Companies Amendment Act, 2020 has introduced a separate Chapter (Section 378A to 378ZU) relating to Producer Companies under the Companies Act, 2013.

Nidhi Companies

A Nidhi company is the legal structure of a company in the Indian non-banking finance sector, recognized under section 406 of the Companies Act, 2013 their core business is borrowing and lending money between their members. They are also known as Permanent Funds, Benefit Funds, Mutual Benefit Funds and Mutual Benefit Companies. These companies are regulated under the Nidhi Rules, 2014 issued by the Ministry of Corporate affairs.

Foreign Company

As per section 2(42) of the Companies Act, 2013 the “foreign company” means any

company or body corporate incorporated outside India which,-

(i) has a place of business in India whether by itself or through an agent, physically or through electronic mode; and

(ii) conducts any business activity in India in any other manner.

Non-Banking Financial Company

A Non-Banking Financial Company (NBFC) is the legal structure of a company registered under the Companies Act, 1956 / 2013 engaged in the business of loans and advances, acquisition of shares/ stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of the immovable property.

A non-banking institution which is a company and has the principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner is also a non-banking financial company.

Listed Company

“Listed company” means a legal structure of a company which has any of its securities listed on any recognised stock exchange;

“Provided that such class of companies, which have listed or intend to list such class of securities, as may be prescribed in consultation with the Securities and Exchange Board, shall not be considered as listed companies.”

As per Rule 2A of the Companies (Specification of definitions details) Rules, 2014 Companies are not to be considered as listed companies-

For the purposes of the proviso to clause (52) of section 2 of the Companies Act, 2013, the following classes of companies shall not be considered as listed companies, namely:-

a) Public companies which have not listed their equity shares on a recognized stock exchange but have listed their –

(i) non-convertible debt securities issued on a private placement basis in terms of SEBI (Issue and Listing of Debt Securities) Regulations, 2008; or

(ii) non-convertible redeemable preference shares issued on a private placement basis in terms of SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013; or

(iii) both categories of (i) and (ii) above.

b) Private companies which have listed their non-convertible debt securities on a private placement basis on a recognized stock exchange in terms of SEBI (Issue and Listing of Debt Securities) Regulations, 2008;

c) Public companies which have not listed their equity shares on a recognized stock exchange but whose equity shares are listed on a stock exchange in a jurisdiction as specified in Section 23(3) of the Companies Act, 2013.

Government Company

As per section 2(45) of the Companies Act, 2013 the Government Company” is the legal structure of a company in which not less than fifty-one per cent of the paid-up share capital is held by the Central Government, or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments, and includes a company which is a subsidiary company of such a Government company;

Explanation.- For the purposes of this clause, the “paid-up share capital” shall be construed as “total voting power”, where shares with differential voting right.

Other Forms of Companies

Holding and Subsidiary Company

As per section 2(46) of the Companies Act, 2013, the “holding company”, in relation to one or more other companies, means a company of which such companies are subsidiary companies and the expression “company” includes any body corporate.

As per section 2(87) of the Companies Act, 2013 “subsidiary company” or “subsidiary”, in relation to any other company (that is to say the holding company), means a company in which the holding company –

(i) controls the composition of the Board of Directors; or

(ii) exercises or controls more than one-half of the total voting power either at its own or together with one or more of its subsidiary companies:

Provided that such class or classes of holding companies as may be prescribed shall not have layers of subsidiaries beyond such numbers as may be prescribed.

Explanation. - For the purposes of this clause, –

(i) a company shall be deemed to be a subsidiary company of the holding company even if the control referred to in sub-clause (i) or sub-clause (ii) is of another subsidiary company of the holding company;

(ii) the composition of a company’s Board of Directors shall be deemed to be controlled by another company if that other company by exercise of some power exercisable by it at its discretion can appoint or remove all or a majority of the directors;

(iii) the expression “company” includes any body corporate;

(iv) “layer” in relation to a holding company means its subsidiary or subsidiaries.

As per section 2(11) of the Companies Act, 2013, the “body corporate” or “corporation” includes a company incorporated outside India, but does not include -

(i) a co-operative society registered under any law relating to co-operative societies; and

(ii) any other body corporate (not being a company as defined in this Act), which the Central Government may, by notification, specify on this behalf

Associate Companies/ Joint Venture Company

As per section 2(6) of the Companies Act, 2013 the “associate company”, in relation to another company, means a legal structure of a company in which that other company has a significant influence, but which is not a subsidiary company of the company having such influence and includes a joint venture company.

Explanation. - For the purpose of this clause, –

(i) the expression “significant influence” means control of at least twenty per cent. of total voting power, or control of or participation in business decisions under an agreement;

(ii) the expression “joint venture” means a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement.

Investment Company

The term "investment company” is the legal structure of a company that includes a company whose principal business is the acquisition of shares, debentures or other securities and a company will be deemed to be principally engaged in the business of acquisition of shares, debentures or other securities if its assets in the form of investment in shares, debentures or other securities constitute not less than fifty per cent. of its total assets, or if its income derived from investment business constitutes not less than fifty per cent. as a proportion of its gross income.

Dormant Company

It is covered under Section 455 of the Companies Act. 2013 and includes a company which is formed and registered under the Act for a future project or to hold an asset or intellectual property and which has not been carrying on any business or operation, or has not made any significant accounting transaction during the last two financial years, or has not filed financial statements and annual returns during the last two financial years.

Small Company

The MCA for the Ease of Doing Business has revised the definition of Small companies by increasing their threshold limits for paid-up capital from “not exceeding Rs. 50 Lakhs” to “not exceeding Rs. 2 Crore” and turnover from “not exceeding Rs. 2 Crore” to “not exceeding Rs. 20 Crore”.

Thus, the definition of the small company under Section 2(85) read with Rule 2(1)(t) of the Companies (Specification of definitions Details) Rules, 2014 with effect from 1 April 2021 is hereunder:

“Small Company” means a legal structure of a company, other than a public company, —

(i) paid-up share capital of which does not exceed two crores rupees or a such higher amount as may be prescribed which shall not be more than ten crore rupees; and

(ii) turnover of which as per profit and loss account for the immediately preceding financial year does not exceed twenty crore rupees or a such higher amount as may be prescribed which shall not be more than one hundred crore rupees:

Provided that nothing in this clause shall apply to—

(A) a holding company or a subsidiary company;

(B) a company registered under Section 8; or

(C) a company or body corporate governed by any particular Act.

Factors for consideration before choosing a suitable type of business structure

Nature of Business Activity

In small trading businesses, professions, and rendering of personal services, a sole proprietorship is predominant.

The partnership is suitable in all those cases where sole proprietorship is suitable, provided the business is to be carried on a slightly bigger scale with help of one or more partners (owner).

Similarly, the business lines such as carrying on large chain stores, multiple shops, super-bazaars, engineering industrial activities with high capital and working capital requirements and software industrial activities are generally in the form of companies.

Where the persons intending to start a business and wish to launch a legal form of business organization clothed with a legal entity and in corporate form with a feature of having their sole ownership and control thereon, they may decide to form a One-Person Company (OPC).

An alternative type of business structure where two or more persons are involved in starting a legal structure of the business organization is the Limited Liability Partnership (‘LLP’) under the Limited Liability Partnership Act, of 2008.

Scale of Operations

If the scale of operations of business activities is small, a sole proprietorship or a One Person Company (OPC) business entity type is suitable; If the scale of operations is modest - neither too small nor too large - partnership or limited liability partnership (LLP) is preferable; whereas, in case of the large scale of operations, the company form is advantageous.

Capital Requirements

Enterprises requiring heavy investment should be organized as companies.

Read the full article

#businessregistration#llp#opc#privatecompanyregistration#proprietorship#publiccompanyregistration#startup

1 note

·

View note

Text

0 notes

Text

Would you like to close your Proprietorship Firm in India?

We explain How to Close a Proprietorship Firm in India in this guide. Wrapping up a proprietorship business is really difficult, however, if you follow this approach, you may unquestionably close your proprietorship business in just 7–10 days. After reading this post, you will learn how to become a sole proprietorship company in India because we will explore this topic.

0 notes

Link

#Sole proprietorship registration#sole proprietorship firm#Proprietorship firm#sole proprietorship registration consultant#proprietorship#sole proprietorship registration certificate#Sole Proprietorship Company

0 notes

Link

#Sole proprietorship registration#sole proprietorship firm#sole proprietorship registration consultant#proprietorship#sole proprietorship registration certificate#Sole Proprietorship Company#Sole Proprietorship Company registration#Sole Proprietorship firm registration

0 notes

Link

#Sole proprietorship registration#sole proprietorship firm#sole proprietorship registration consultant#proprietorship#sole proprietorship registration certificate#Sole Proprietorship Company#Sole Proprietorship Company registration#Sole Proprietorship firm registration

0 notes

Text

man cobra kai s1 hits kinda different when you've just been fired and are suddenly starting up a small business by yourself

#the empathy I feel for johnny has reached a new level#it's exciting though! and encouraging to just be like 'well if johnny can do it I can'#(I say 'by myself' in that it's a sole proprietorship structure#deeply grateful for all the help I'm getting)#cobra kai#... tangentially#erin's adventures in slp#hey it's even geared towards teaching kids! johnny and I are truly on the same wavelength

6 notes

·

View notes

Text

these two guys are on the same wavelength sometimes

#legend of the galactic heroes#paul von oberstein#reinhard von lohengramm#hildegard von mariendorf#anton fellner#doodles#oberstein#oberbaby created his own sole proprietorship called wedding crashers just to use it for this moment#he had fellner hand out business cards right before he squared up and did what his business name promised#even when hes not working he delivers quality#in my mind they are all just parts of the same braincell bouncing around#they are yelling at each other and crying#(reinhard is mainly crying because poor kircheis. . .it was the closest rein ever felt to humiliating defeat *gnashes his teeth*)#like can u imagine bragging about how great ur guy is and suddenly he just dies#right in front of everyone? cringe (thats oberstein ofc)#hilda didnt deserve this she had better things to do honestly#this is all in good fun yall dont get mad#i just had some silly goofy cringey ideas in my silly little mind#yea

11 notes

·

View notes