#LLP Annual Filing in India

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

Top LLP Company Compliance in Kolkata

Top LLP Company Compliance in Kolkata: Simplifying Compliance with Filemydoc

Introduction:

In the bustling city of Kolkata, numerous limited liability partnership (LLP) companies thrive and contribute to the region's vibrant business ecosystem. However, with the ever-increasing complexities of legal and regulatory frameworks, ensuring compliance can be a daunting task for business owners. This article aims to shed light on the top LLP company compliance requirements in Kolkata and how Filemydoc, a trusted online platform, simplifies the compliance process.

1. Understanding LLP Company Compliance:

Compliance for LLP companies in Kolkata involves adhering to various legal and regulatory obligations. These obligations ensure that businesses operate ethically, maintain transparency, and meet the standards set by the government and relevant authorities. Key compliance requirements for LLP companies in Kolkata include:

a) Registrar of Companies (RoC) Compliance: LLPs must comply with the filing of annual returns, financial statements, and other statutory documents with the RoC.

b) Tax Compliance: Complying with the Goods and Services Tax (GST), income tax, and other applicable tax regulations is crucial for avoiding penalties and maintaining financial transparency.

c) Employment Compliance: LLPs must adhere to labor laws, employee benefits, provident fund, professional tax, and other employment-related compliances.

2. The Importance of Top LLP Company Compliance in Kolkata:

Maintaining compliance is not just a legal requirement but also crucial for the long-term success and reputation of any LLP company in Kolkata. Here's why top LLP company compliance is essential:

a) Avoiding Legal Consequences: Non-compliance can result in hefty penalties, legal disputes, and even the dissolution of the LLP. Adhering to the regulations ensures the company's sustainability and protects its stakeholders.

b) Building Trust and Credibility: Compliant companies foster trust among customers, investors, and partners. Demonstrating commitment to compliance enhances the company's reputation and credibility in the market.

c) Ensuring Operational Efficiency: Compliance procedures often involve streamlining internal processes, leading to improved operational efficiency and reduced risk of errors.

3. Introducing Filemydoc: Simplifying LLP Company Compliance:

Filemydoc, a leading online platform, offers a comprehensive solution for LLP company compliance in Kolkata. With its user-friendly interface and advanced features, Filemydoc simplifies the compliance process, allowing businesses to focus on their core operations. Key features of Filemydoc include:

a) Automated Compliance Reminders: Filemydoc sends timely notifications and reminders about upcoming compliance deadlines, ensuring companies never miss a crucial filing date.

b) Document Management System: The platform provides a secure and centralized repository to store and manage all compliance-related documents, eliminating the hassle of manual record-keeping.

c) Expert Guidance and Support: Filemydoc offers expert guidance and assistance from professionals well-versed in the complexities of LLP company compliance. Users can seek advice and resolve queries through the platform's support channels.

4. Top LLP Company Compliance Services Offered by Filemydoc:

Filemydoc offers a range of services designed to address the specific compliance needs of LLP companies in Kolkata. Here are some of the top services provided by Filemydoc:

a) Annual Compliance Filings: Filemydoc facilitates seamless filing of annual returns, financial statements, and other statutory documents with the RoC, ensuring companies stay compliant.

b) Tax Compliance: The platform assists in GST registration, filing GST returns, income tax return filing, and other tax-related compliances, helping companies meet their tax obligations accurately and efficiently.

c) Legal and Regulatory Support: Filemydoc provides expert advice and assistance on legal and regulatory matters, including company incorporation, changes in partnership agreements, and compliance audits.

d) Compliance Audit and Due Diligence: The platform offers comprehensive compliance audits to identify areas of improvement and ensure adherence to all relevant regulations. This service is particularly useful during mergers, acquisitions, or partnership restructuring.

e) Annual Maintenance Packages: Filemydoc offers customized annual maintenance packages that cover all major compliance requirements, enabling companies to outsource their compliance management and focus on their business growth.

Conclusion:

Maintaining compliance with the legal and regulatory requirements is paramount for LLP companies in Kolkata. With the complexities involved, partnering with a reliable online platform like Filemydoc can simplify the compliance process significantly. By leveraging Filemydoc intuitive interface, automated reminders, and expert support, businesses can ensure seamless compliance management, avoid penalties, and build a strong reputation. Embrace Filemydoc to streamline your LLP company compliance in Kolkata and stay ahead in the dynamic business landscape

#LLP Annual Return Filing#LLP Registration in India#Limited Liability Partnership (LLP) Registration in India

0 notes

Text

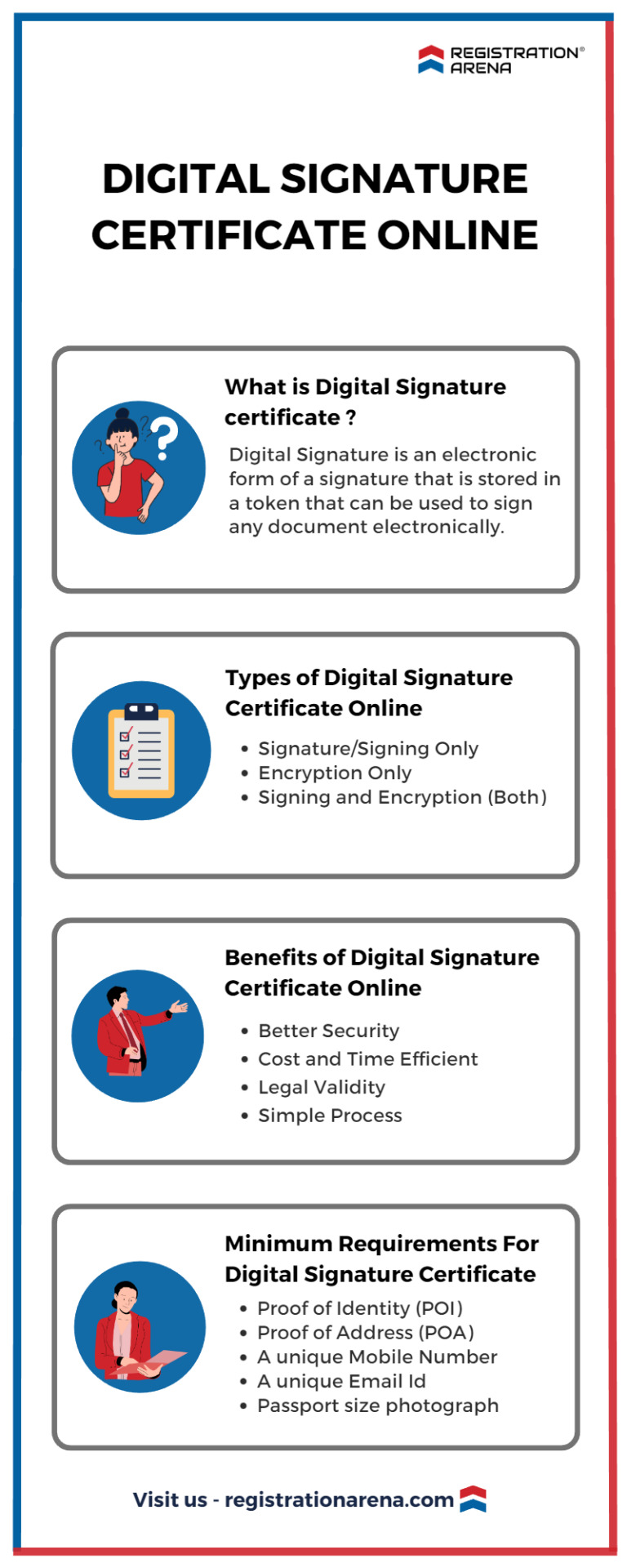

A DSC or ID is also referred to as a digital signature certificate online. To digitally sign official documents, the issuing authority must possess an active digital certificate. A digital certificate is issued by a certificate authority. Third-party certificate authorities offer the option to either purchase a DSC online or apply for a digital signature online. The risk of duplication or alteration of the signed document can be minimized by Digital signatures. DSC users are provided with a unique token password to authenticate, verify their identity and sign the respective document

#llp registration#private limited company registration#opc registration#startup india registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#digital signature certificate online#legal advisers#legal consultation#legal services

0 notes

Text

Benefits of LLP Registration in India

The following are the benefits of LLP Registration in India:

1. Low Cost and Less Compliance:

The overall cost of establishing a Limited Liability Partnership is low compared to the cost of registering a Private or Public Limited Company in India. The compliances to be followed by the LLP are also low. The LLP needs to file only 2 Statements yearly (i.e., an Annual Return and a Statement of Accounts and Solvency.

2. Liabilities are limited:

Limited Liability Partnership provides a limited liability benefit to all the designated partners. In case of s business insolvency or loss, the partners’ liability is restricted to the capital contribution as per the LLP agreement. Moreover, one partner is not held responsible for the actions of negligence/misconduct of any other partner.

3. Separate Legal Existence:

Just like a Company, an LLP has a separate legal entity. The Limited Liability Partnership is different from its partners. An LLP in India can sue & be sued in its own name. The Contracts are signed in the name of the Limited Liability Partnership (LLP) which helps to gain the trust of various stakeholders & gives the customers and suppliers a sense of confidence in the business.

4. Tax Benefits:

It is also exempted from various taxes like DDT (Dividend Distribution Tax) & Minimum Alternative Tax. The tax rate on LLP is less than that of the Company.

5. No Minimum Capital:

For the LLP formation in India, no minimum capital is required. No minimum capital contribution is required from partners. An LLP can be incorporated even with Rs. 2000 as a total capital contribution.

What are the Features of an LLP in India?

The following are the features of an LLP in India:

It’s a body corporate & legal entity separate from its members;

The members of an LLP have a limited liability, limited to their agreed contribution to the LLP;

It has the organizational flexibility of a Partnership;

It has a perpetual succession, it continues to exist even after the founding partners leave the organization. All it requires is to have at least 2 partners;

Its accounting & filing requirements are similar to that of a Company;

Less compliance and regulations;

No requirement for minimum capital contribution;

At least one partner must be a resident of India;

There is no upper limit on the maximum number of Partners.

0 notes

Text

A Guide To Registration Of Limited Liability Partnerships (LLPs) in India

As The Ministry of Corporate Affairs (MCA) has announced that LLP incorporation has moved to the web, just like SPICE+, as a result of the second amendment to the Limited Liability Partnership (Second Amendment) Rules, 2022. The incorporation document must be electronically filed with the Registrar in the form FiLLiP (Form for incorporation of Limited Liability Partnership) with the Registrar with jurisdiction over the registered office.

How Do You Form A Limited Liability Partnership (LLP)

LLPs combine the features of a corporation and a partnership in one business structure. They are a combination of corporations and partnerships. A small business in India often chooses an LLP Incorporation because of its low registration fees and easy maintenance.

Overview Of The Limited Liability Partnership (Second Amendment) Rules, 2022

A The LLP (Second Amendment) Rules, 2022 have undergone a few changes since they were announced on the 04th March 2022. These changes are as follows:

The number of designated partners at incorporation can be as many as five (without DIN numbers).

A PAN and TAN will be assigned as part of the LLP incorporation or registration process.

Incorporating an LLP through the web is similar to SPICE+.

It is also recommended to disclose contingent liabilities on Form 8 (Statement of Solvency) and Annual Return.

As a result, all LLP forms, including Form 9 - Consent of Partners, will be web-based, requiring all Designated Partners to sign digitally.

Incorporating A Limited Liability Company: Step-By-Step Guide

Name Reservation:

To incorporate an LLP, the first step involves reserving the name of the partnership. The applicant must fill out E-Form 1, which confirms availability.

Forming a Limited Liability Partnership (LLP):

If you wish to incorporate a Limited Liability Partnership (LLP), you must file FiLLiP after reserving a name. FiLLiP contains information about the LLP being formed, the partners/designated partners, and their consent to act as partners/ designated partners.

Agreement for Limited Liability Partnership:

A Within 30 days of LLP incorporation, the LLP Agreement must be executed and filed in E-Form 3. In LLP, mutual rights and duties are governed by an agreement between the partners or between the partners and the LLP, depending on the case. However, the LLP is still liable for its other obligations.

LLPs are incorporated using a Web-Based Process, which is as follows:

The LLP Incorporation (FiLLiP Form) is now available online as a result of the Limited Liability Partnership (Second Amendment) Rules, 2022. An DIN or DPIN applications are required along with name reservations, LLP incorporations, and/or new LLP incorporations under FiLLiP.

The eForm must include all supporting documentation, such as the names of designated partners and partners, etc. Once processed and found complete, an LLPIN is assigned.

A DIN/DPIN must also be issued to proposed designated partners/nominees of body corporate designated partners without valid DINs/DPINs.

When incorporating an LLP using this integrated form, the DIN/DPIN can be allocated to no more than five designated partners.

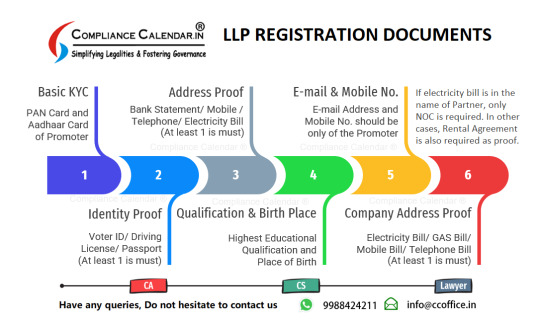

Document Requirements:

Documents required for the FiLLiP Form include:

It is required to submit the resolution on the letterhead of the body corporate being appointed a partner.

On the letterhead of that body corporate, an authorization/resolution naming the nominee/designated partner nominated to represent the company.

Document proving the address of a Limited Liability Partnership's Registered Office.

Subscriber consent form.

Regulatory authorities must approve the proposed name in principle before the attachment can be submitted.

Provide detail about the partnership/designated partnership(s) and/or company(s) in which the partner/designated partner is a director/ partner.

Owners or applicants of trademarks must approve trademark registration applications.

Any words or expressions in the proposed name that require approval from the Central Government.

The competent authority must approve collaboration and connection with a foreign country or place.

A copy of the Board Resolution of the existing company or the consent of the existing LLP is proof of no objection.

The advantages of LLP:

A Limited Liability Partnership is a type of business model that is

Based on an agreement, it is arranged and operated.

Provides flexibility without imposing detailed legal and procedural requirements.

Enables professional/technical expertise and initiative to interact with financial.

Thank you for giving your valuable time for reading this write-up, if still, you have any doubts regarding LLP Registration in India then please connect to our team at [email protected] or call us at 9988424211.

0 notes

Text

The Ultimate Guide to Company Formation in India

Incorporating a company in India can be a lucrative endeavor for both domestic and international investors. With its burgeoning economy, vast market potential, and supportive regulatory environment, India offers a plethora of opportunities for entrepreneurs looking to establish their presence in the country. In this comprehensive guide, we delve into the intricacies of company formation in India, covering everything from legal requirements to procedural formalities.

Understanding Company Types in India

Before diving into the company formation in india process, it's essential to understand the various types of entities recognized by Indian law. The most common forms of companies in India include:

1. Private Limited Company

A Private Limited Company is the preferred choice for startups and small to medium-sized enterprises (SMEs). It offers limited liability protection to its shareholders while allowing flexibility in operations and ownership.

2. Public Limited Company

A Public Limited Company is suitable for businesses planning to raise capital from the public through the sale of shares. It is subject to stringent regulatory compliance requirements and is ideal for large-scale operations.

3. One Person Company (OPC)

Introduced to support solo entrepreneurs, an OPC allows a single individual to incorporate and operate a company with limited liability protection.

4. Limited Liability Partnership (LLP)

An LLP combines the benefits of a partnership and a corporation, providing limited liability to its partners. It is commonly favored by professionals such as lawyers, accountants, and consultants.

Company Formation Process in India

Step 1: Obtain Digital Signature Certificate (DSC)

The first step in company formation in india (Incorporation) is to acquire a Digital Signature Certificate (DSC) for the proposed directors of the company. The DSC is necessary for filing electronic documents with the Ministry of Corporate Affairs (MCA).

Step 2: Obtain Director Identification Number (DIN)

Directors of the company must obtain a Director Identification Number (DIN) from the MCA. The DIN serves as a unique identifier for directors and is mandatory for company registration.

Step 3: Name Reservation

Choosing an appropriate name for the company is crucial. The proposed name must comply with the guidelines set by the MCA and should not infringe upon any existing trademarks. Once approved, the name is reserved for a period of 20 days.

Step 4: Drafting Memorandum and Articles of Association

The Memorandum of Association (MoA) and Articles of Association (AoA) outline the company's objectives, rules, and regulations governing its operations. These documents must be drafted carefully to ensure compliance with the Companies Act, 2013.

Step 5: Company Registration

Once all necessary documents are prepared and signed, the company registration application is filed with the Registrar of Companies (ROC). Upon successful verification, the ROC issues the Certificate of Incorporation, officially establishing the company.

Regulatory Compliance and Post-Incorporation Formalities

1. Tax Registration

After incorporation, the company must obtain Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for tax purposes. Additionally, Goods and Services Tax (GST) registration may be required, depending on the nature of business activities.

2. Compliance with Labour Laws

Employers must adhere to various labor laws governing employment practices, including payment of minimum wages, employee provident fund (EPF), and employee state insurance (ESI).

3. Annual Compliance Requirements

Companies in India are required to comply with annual filing obligations such as Annual General Meetings (AGMs), financial statement filings, and statutory audits. Non-compliance can result in penalties and legal consequences.

ConclusionCompany formation in India offers abundant opportunities for investors seeking to capitalize on the country's dynamic business landscape. By understanding the legal requirements, procedural formalities, and post-incorporation obligations, entrepreneurs can navigate the process with ease and establish a successful presence in one of the world's fastest-growing economies.

0 notes

Text

A Comprehensive Guide to Company Registration in Delhi with Legalari

Company Registration in Delhi

Understanding Company Registration:

Company registration encapsulates the formal process of incorporating a business entity under the legal framework of a specific jurisdiction. In the bustling metropolis of Delhi, a plethora of aspiring entrepreneurs embark on their ventures daily, seeking to carve their niche in various industries. However, amidst the excitement of entrepreneurial pursuits, the significance of proper Company Registration in Delhi often gets overlooked.

The Importance of Company Registration:

Registering a company offers a myriad of benefits, ranging from legal protection to enhanced credibility and access to various resources. By obtaining legal recognition, a business entity gains the ability to enter into contracts, own assets, and limit the liability of its shareholders or owners. Moreover, registered companies tend to garner more trust and confidence from potential clients, investors, and partners, thereby fostering growth and expansion opportunities.

Navigating the Legal Landscape:

Delhi, being the heart of commerce and trade in India, operates under a robust legal framework governing Company Registration in Delhi. From selecting the appropriate business structure to adhering to regulatory compliances and documentation, the process entails numerous steps. Legalari, with its profound understanding of Delhi’s legal landscape, simplifies this journey for aspiring entrepreneurs and established businesses alike.

Choosing the Right Business Structure:

One of the pivotal decisions in Company Registration in Delhi revolves around selecting the most suitable business structure. Legalari extends comprehensive guidance tailored to the unique needs and aspirations of each client. Whether it’s a sole proprietorship, partnership, limited liability partnership (LLP), or a private or public limited company, Legalari ensures that clients make informed decisions aligned with their long-term objectives.

Streamlining the Registration Process:

Navigating through the bureaucratic maze of registration procedures can be daunting for many. However, Legalari streamlines the entire process, ensuring swift and efficient registration. From obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) to filing necessary documents with the Registrar of Companies (ROC), Legalari meticulously handles each step, leaving clients free to focus on their core business activities.

Ensuring Compliance and Beyond:

Beyond registration, Legalari continues to be a trusted partner in ensuring ongoing compliance with regulatory requirements. From maintaining statutory records to filing annual returns and conducting board meetings, Legalari offers comprehensive corporate governance solutions tailored to the specific needs of each client. By staying abreast of regulatory changes and industry trends, Legalari ensures that clients remain on the path to sustainable growth and success.

The Road Ahead:

As Delhi continues to emerge as a thriving hub of entrepreneurship and innovation, the significance of proper Company Registration in Delhi cannot be overstated. Legalari, with its unwavering commitment to excellence and client satisfaction, stands as a steadfast ally for businesses embarking on this transformative journey. By combining legal expertise with a client-centric approach, Legalari empowers businesses to navigate challenges, seize opportunities, and unlock their full potential in the vibrant landscape of Delhi’s business ecosystem.

Conclusion:

In the bustling metropolis of Delhi, where opportunities abound and challenges lurk at every corner, Legalari emerges as a beacon of expertise and reliability in the realm of Company Registration in Delhi. With a deep understanding of Delhi’s legal landscape and a commitment to client success, Legalari simplifies the registration process, ensures compliance, and paves the way for businesses to thrive and prosper. So, whether you’re a budding entrepreneur with a vision or an established business seeking to expand horizons, Legalari stands ready to be your trusted partner in unlocking limitless possibilities in the dynamic realm of Delhi’s business landscape.

#LegalariDelhi#CompanyRegistration#BusinessInDelhi#Entrepreneurship#LegalConsultancy#DelhiBusinessHub#StartupIndia#ComplianceMatters#BusinessGrowth#LegalExpertise

0 notes

Text

A Comprehensive Guide on How to Register a Company in India

In the vibrant landscape of India's business ecosystem, registering a company marks the first significant step towards turning entrepreneurial dreams into reality. Whether you're a seasoned entrepreneur or a budding visionary, understanding the process of company registration in India is crucial. In this guide, we'll walk you through the essential steps to register a company in India.

Understanding the Basics

Before diving into the registration process, it's vital to grasp the different types of companies recognized under Indian law:

Private Limited Company: Ideal for small to medium-sized businesses, offering limited liability to its shareholders and restricting share transfers.

Public Limited Company: Suited for larger enterprises, with shares publicly traded on the stock exchange and more stringent regulatory requirements.

Limited Liability Partnership (LLP): Combines the benefits of a partnership with limited liability, popular among professionals and small businesses.

Step-by-Step Registration Process

Choose a Suitable Business Structure:

Selecting the right business structure is the cornerstone of company registration. Consider factors such as liability, taxation, ownership, and compliance requirements before making a decision.

Obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN):

Directors of the proposed company must obtain a DSC, necessary for digitally signing documents, and a DIN, which serves as an identification number.

Name Approval:

Choose a unique name for your company and ensure it complies with the naming guidelines prescribed by the Ministry of Corporate Affairs (MCA). Conduct a name availability search on the MCA portal and apply for name approval.

Drafting Memorandum and Articles of Association:

Prepare the Memorandum of Association (MoA) and Articles of Association (AoA), outlining the company's objectives, rules, and regulations. These documents define the company's structure and operations.

Filing Incorporation Documents:

Complete the incorporation process by filing the necessary documents, including MoA, AoA, and Form SPICe (Simplified Proforma for Incorporating Company electronically) with the Registrar of Companies (RoC).

Payment of Registration Fees:

Pay the requisite registration fees based on the authorized capital of the company. The fee structure varies depending on the type and size of the company.

Certificate of Incorporation:

Upon verification of documents and compliance with regulatory requirements, the RoC issues a Certificate of Incorporation, officially recognizing the establishment of the company.

Apply for PAN and TAN:

Obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. These are essential for tax compliance and financial transactions.

Registration for Goods and Services Tax (GST):

If your company's turnover exceeds the prescribed threshold, register for GST, a unified tax system applicable to the supply of goods and services.

Compliance Requirements:

Fulfill ongoing compliance obligations, including maintaining statutory records, holding annual general meetings, and filing annual returns with the RoC.

Conclusion

Registering a company in India is a well-defined process that requires careful planning, adherence to regulatory guidelines, and compliance with legal formalities. By following the step-by-step procedure outlined in this guide, entrepreneurs can navigate the complexities of company registration with confidence and set the stage for a successful business venture. Whether it's a private limited company, public limited company, or LLP, the key lies in understanding the nuances of each structure and making informed decisions. So, embark on your entrepreneurial journey armed with the knowledge of how to register a company in India, and let your business aspirations soar to new heights.

Remember, the keyword "how to register a company in India" signifies the importance of understanding the process thoroughly, ensuring that your business starts off on the right foot within the regulatory framework of the country.

0 notes

Text

The best LLP Registration Online in Chennai, India

LLP (Limited Liability Partnership) registration is a crucial step for entrepreneurs and businesses seeking to establish a legal entity with shared responsibilities and limited liabilities. In Chennai, India, ExpertPoint offers seamless LLP registration services online, catering to the diverse needs of businesses across various sectors. As a leading provider of registration solutions, ExpertPoint specialises in facilitating the smooth and efficient establishment of LLPs, guiding clients through every stage of the process.

LLP company registration in Chennai with ExpertPoint ensures compliance with all legal formalities and regulatory requirements. Our experienced consultants assist clients in preparing and filing the necessary documentation, simplifying the entire registration procedure. From obtaining Digital Signature Certificates (DSC) and Designated Partner Identification Numbers (DPIN) to drafting the LLP agreement, we ensure meticulous attention to detail to facilitate seamless incorporation.

Our online LLP registration services in Chennai extend beyond geographical boundaries, covering the entirety of India. With ExpertPoint, entrepreneurs can conveniently initiate the registration process from anywhere, ensuring a hassle-free experience. Our user-friendly online platform allows clients to submit documents, track progress, and communicate with our consultants seamlessly, saving time and effort.

The advantages of LLP registration are manifold, including limited liability protection, flexibility in management, and tax benefits. With ExpertPoint's limited liability partnership registration online in chennai, entrepreneurs can harness these benefits to establish a robust business structure conducive to growth and expansion. Our consultants offer invaluable guidance on structuring the LLP, choosing the appropriate business name, and fulfilling statutory compliance obligations, ensuring long-term success and sustainability.

Furthermore, ExpertPoint's expertise extends beyond registration to post-incorporation support and compliance management. We assist clients in obtaining necessary licences and permits, managing annual filings, and navigating regulatory changes, thereby ensuring ongoing compliance with applicable laws and regulations.

In conclusion, ExpertPoint is your trusted partner for LLP registration online in Chennai and throughout India. With our commitment to excellence, integrity, and professionalism, we empower entrepreneurs to establish successful LLPs and navigate the complexities of business ownership with confidence. Whether you're embarking on a new venture or seeking to expand your existing business, rely on ExpertPoint for comprehensive and reliable registration solutions tailored to your needs.

0 notes

Text

Legal Requirements for LLP Registration in Malappuram: A Comprehensive Guide

Registering a Limited Liability Partnership (LLP) in Malappuram can be a significant milestone for entrepreneurs looking to establish their business in the region. However, navigating the legal requirements and documentation process can be complex without proper guidance. In this blog post, we'll provide valuable insights into the legal requirements for LLP registration in Malappuram, shedding light on the role of designated partners, mandatory compliance obligations, annual filing requirements, and specific regulations entrepreneurs need to be aware of before initiating the registration process.

Understanding the Role of Designated Partners

In an LLP, designated partners play a crucial role in the management and decision-making processes. According to the LLP Act, 2008, every LLP must have at least two designated partners who are individuals, and at least one of them must be a resident of India. Designated partners are responsible for ensuring compliance with statutory requirements, maintaining books of accounts, and filing annual returns with the Registrar of Companies (ROC). It's essential for entrepreneurs to carefully select designated partners who are committed to fulfilling their responsibilities and have the requisite knowledge of business operations and legal obligations.

Mandatory Compliance Obligations

LLPs in Malappuram, like elsewhere in India, are subject to certain mandatory compliance obligations to ensure transparency, accountability, and legal compliance. Some of the key compliance requirements include:

1. LLP Agreement: Drafting and executing an LLP agreement that outlines the rights, duties, and obligations of partners, as well as the rules governing the management and operation of the LLP. This agreement must be stamped and registered with the ROC within 30 days of incorporation.

2. Annual Filings: LLPs are required to file annual returns and financial statements with the ROC. The financial year of an LLP runs from April 1st to March 31st, and annual filings must be completed within 60 days from the end of the financial year.

3. Tax Compliance: LLPs are also required to comply with tax regulations, including obtaining a Permanent Account Number (PAN), filing income tax returns, and complying with Goods and Services Tax (GST) obligations, if applicable.

Specific Regulations and Nuances in Malappuram

While the basic legal requirements for LLP registration apply across India, there may be specific regulations or nuances relevant to Malappuram that entrepreneurs need to be aware of. This could include local business licensing requirements, zoning regulations, or industry-specific regulations that may impact the establishment and operation of an LLP in the region. It's advisable for entrepreneurs to consult with legal professionals or business advisors familiar with the local regulatory landscape to ensure compliance with all applicable laws and regulations.

In conclusion, registering an LLP in Malappuram offers entrepreneurs a flexible and efficient business structure with limited liability protection. However, it's essential to understand and fulfill the legal requirements and compliance obligations to operate successfully within the regulatory framework. By carefully navigating the registration process and staying updated on legal developments, entrepreneurs can lay a solid foundation for their business ventures in Malappuram.

0 notes

Text

Streamline Your Business: Online Company Registration in Bangalore

Register a Company Online in Bangalore

Introduction:

Starting a business in Bangalore, India, offers numerous opportunities in one of the country's most dynamic and vibrant economic hubs. However, navigating the Company Registration in Bangalore process requires careful planning and adherence to legal requirements outlined by the Ministry of Corporate Affairs (MCA). Whether establishing a tech startup, a traditional manufacturing company, or a service-oriented business, understanding the steps involved in company registration is crucial for a smooth and successful launch. In this guide, we'll outline the essential procedures for registering a company in Bangalore, providing you with the knowledge necessary to embark on your entrepreneurial journey.

Company Registration in Bangalore, India, follows the standard procedures the Ministry of Corporate Affairs (MCA) outlines. Here's a general overview of the process:

1. Choose a Business Structure: Decide on the type of business entity you want to register. Options include private limited company, limited liability partnership (LLP), and one-person company (OPC).

2. Name Approval: Choose a unique name for your company and check its availability on the MCA portal. Once you've finalized a name, apply for name approval.

3. Digital Signature Certificate (DSC): Obtain Digital Signature Certificates for the directors and shareholders of the company. It is necessary to file the registration documents online.

4. Director Identification Number (DIN): Each director must obtain a DIN by filing Form DIR-3. It is a unique identification number required for company registration.

5. Prepare Documents: Prepare the necessary documents, including the Memorandum of Association (MOA), Articles of Association (AOA), and other incorporation documents.

6. File Incorporation Documents: Once you have the DSC and DIN, file the incorporation documents (e.g., SPICe forms) and the required fees on the MCA portal.

7. Verification and Approval: The Registrar of Companies (ROC) will verify the documents and issue the Certificate of Incorporation if everything is in order.

8. PAN and TAN: Apply for the company's Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

9. GST Registration: If your company's turnover exceeds the GST threshold, you must register for Goods and Services Tax (GST) with the GSTN.

10. Post-Incorporation Compliance: After incorporation, ensure compliance with various statutory requirements such as maintaining books of accounts, holding board meetings, and filing annual returns.

Conclusion:

Company Registration in Bangalore is a significant step towards realizing your entrepreneurial ambitions in one of India's foremost business destinations. By following the outlined procedures and seeking professional guidance where necessary, you can ensure compliance with legal requirements and set a solid foundation for your business. Remember that thorough planning, attention to detail, and commitment to compliance are crucial to successfully navigating the complexities of company registration. With determination and perseverance, you can transform your business ideas into reality and contribute to Bangalore's thriving entrepreneurial ecosystem.

0 notes

Photo

An LLP is a body corporate formed and incorporated under the Limited Liability Act 2008, it has a legal entity separate from that of its partners. Also, has perpetual succession, any change in the partners of an LLP will not affect its existence, rights, or liabilities of LLP. The provisions of the Partnership Act, 1932 will not apply to LLP. Furthermore, a Limited Liability Partnership means a business where a minimum of two partners is required and there is no limit on the maximum number of partners. The liability of the partners is limited up to the extent of Capital contribution done by each partner in checklist for llp registration.

#llp compliance#llp compliance checklist#llp annual compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#llp compliance checklist 2022#annual compliance of llp#llp compliance services#llp compliance services india#LLP Annual Filing in India#Annual Compliance for LLP Company#llp compliance online services india#online llp compliance services#llp annual compliance cost#annual return for llp#llp company compliance

0 notes

Text

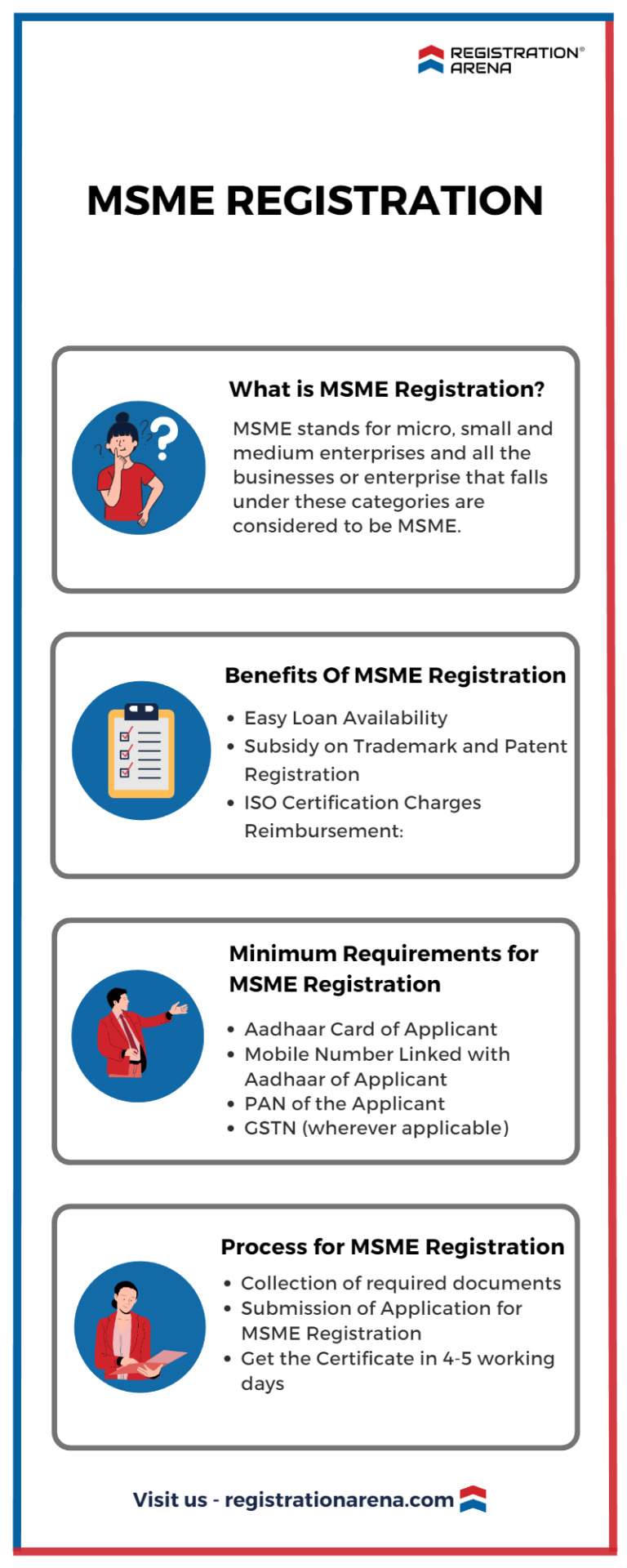

MSMEs, which include micro, small, and medium-sized businesses, have emerged as a flourishing sector of the Indian economy in recent years, playing an essential role in the country's socioeconomic improvement. These businesses are very helpful in creating jobs, producing goods, and exporting products. The duty of promoting and encouraging the growth of MSMEs mainly falls under the state governments

#llp registration#private limited company registration#opc registration#nidhi company registration#msme registration#trademark registration#startup india registration#sole proprietorship#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#iso certification online#legal consultation#legal advisers#legal services

0 notes

Text

Startup India Registration

A Complete Analysis of Startup India Registration

India’s startup scene is thriving, witnessing a surge in young entrepreneurs each year. With supportive government backing, startups contribute significantly to the nation’s economic growth. These ventures, offering innovative solutions to societal challenges, redefine existing products or services. The Startup India Initiative, championed by the Indian government, aims to nurture aspiring entrepreneurs. The accompanying Startup India Scheme provides crucial financial and mentoring support for the growth and expansion of startup companies. This initiative not only promotes startups but also focuses on creating employment opportunities and fostering wealth generation.

What is a Startup?

It’s a newly established Company, generally small, which is started by one or more people. The main purpose behind a startup is to grow faster & provide something to fulfill the market gap in any industry. There are no fixed parameters set for a startup, as they are totally independent to some level. Startups initiate with a product concept & strive to grow at pace. It’s not vital that all Startups make a profit during their initial stage.

Objectives of Startup India Movement

Following are the objectives of Startup India Movement:

1: Enhanced Infrastructure, including incubation centers;

2: IPR facilitation;

3: A goal to increase the funding opportunities;

4: Provide an extensive networking database for the entrepreneurs & other stakeholders in the startup ecosystem;

5: The better regulatory environment including tax benefits, easier compliance improved establishing a Company, fastest mechanism & more.

Benefits of Startup India Registration

Following are the benefits of Startup India Registration:

Easy Access of Funds: Rs. 10,000 crores fund is set-up by the Indian Government to provide funds to the startups as Venture Capital. The Government is also giving guarantees to the lenders to encourage banks & other financial institutions to provide Venture Capital.

Tax Savings for Investors: Individual investing their capital gains in the venture funds set-up by the Government will get exemption from Capital Gains and this will help all the Startups to attract more investors.

Income Tax Exemption: Eligible startups can be exempted from paying Income Tax for 3 Consecutive F.Y. (Financial Years) out of their first 10 years since Incorporation.

Easily apply for Government Tenders: Startups in India can easily apply for Government Tenders and they are exempted from the prior experience or turnover criteria applicable for normal companies answering to Government Tenders.

Rebate in Trademark & Patent Filing: Startups working under Startup India Registration Scheme will get 50% rebate on Trademark Filing and 80% rebate on Patent filing.

Easy Winding Up: The process of winding up of Company becomes very easy & it takes 90 days to wind up under IBC, 2016.

Eligibility Criteria for the Registration

Following is the eligibility criteria for Startup India Registration or DPIIT Certificate of Recognition:

1: The Startup India Registration Certificate or DPIIT Certificate of Recognition is provided for the company which is registered as an LLP, Private Limited Company, or a registered Partnership Firm.

2: To get the Registration Certificate, the firm should have an annual turnover of less than Rs. 100 crores for any of the previous Financial Year.

3: The entity or company should be working towards improvement/development of a product, service, or process.

4: The entity or company should have a scalable business model with high potential for the creation of wealth & employment. The company or firm should have the capability to generate employment or create wealth.

5: The period of Company’s operations or existence shouldn’t exceed 10 years from the date of formation.

6: To get Startup India Registration Certificate or DPIIT Certificate of Recognition, the company shouldn’t have been registered by splitting up/recreating an already existing entity.

7: Applicants shouldn’t have defaulted with any financial institution in the past.

0 notes

Text

LLP Registration

LIMITED LIABILITY PARTNERSHIP( LLP) REGISTRATION IN INDIA

It has become increasingly popular among entrepreneurs to incorporate Limited Liability Partnerships (LLPs) which combine the advantages of a partnership firm and a company. India introduced the concept of Limited Liability Partnership (LLP) registration in 2008. A Limited Liability Partnership has the characteristics of both the partnership firm and company. Incorporating an LLP requires two partners at minimum. In an LLP, however, there is no upper limit to how many partners the company can have.

Each partner should be an individual, with at least one resident in India among the designated partners. The duties and rights of designated partners are governed by the LLP agreement. They are directly responsible for the compliance of all the provisions of the LLP Act, 2008 and provisions specified in the LLP agreement.

CHARACTERISTICS OF LLP:

Following are some features of Limited Liability Partnership -

Just like Companies, it has separate legal Identity.

The cost of LLP Registration is less as compared to company formation.

The liability of each partner is limited up to the contribution done by him/her.

LLP has less regulations and compliances.

There is no requirement for minimum capital contribution.

There is no such requirement of holding minimum number of Board meeting or Annual general meeting as in case of companies.

FORMS REQUIRED:

Details regarding forms used in LLP Registration and its compliances are described as below -

RUN – LLP (Reserve Unique Name-Limited Liability Partnership: This form is required for name reservation for Limited Liability Partnership.

FiLLiP: This form is for incorporation of LLP.

Form 3: It is in same line as that of Articles of Association of company, Filing of LLP agreement with the registrar within 30 days of incorporation of LLP.

Incorporation Document: It is in same line as that of MOA of the company. It is to be given in the manner prescribed in FiLLiP.

PROCESS FOR LLP REGISTRATION:

The LLP Registration process involves a series of steps which can be explained by framing below mentioned steps:

STEP-1: Obtain Digital Signature Certificate (DSC)

In order to begin the process of LLP registration, the designated partners must apply for digital signatures. The application for DSC is to be made to Certifying Agency (CA). The reason for obtaining DSC is that all documents for LLPs must be digitally signed and filed online. As a result, digital signature certificates must be obtained from government-recognized certifying agencies.

STEP-2: Apply for Director Identification Number (DIN)

The applicant has to apply for the DIN of all the designated partners or those intending to be designated partner of the proposed LLP. The application for allotment of DIN can be made in Form DIR-3. Required to attach the scanned copy of documents (generally Aadhaar and PAN) to the form.

However, it is to be noted that application for DIN or DPIN of up to two individuals can be made in FiLLiP form.

STEP-3: Approval of Name

LLP-RUN (Limited Liability Partnership-Reserve Unique Name) forms are filed with the Central Registration Centre for the reservation of the proposed LLP's name. Please use the free name search facility on the MCA portal before quoting the name in the form. The form RUN-LLP is to be accompanied by fees as per Annexure ‘A’ which can either approved/rejected by the registrar. Then re-submission of the form shall be allowed to be made within 15 days for rectifying the defects, errors or omissions.

STEP-4: Incorporation of LLP

FiLLip form is used for registration of Limited Liability Partnership which shall be filed with the Registrar who has jurisdiction over the state in which the registered office of the LLP is situated. The form is an integrated form. Fees is as per Annexure ‘A’. This form provides for application for allotment of DPIN, if an individual who is to be appointed as a designated partner does not have a DPIN or DIN. Then the application for allotment shall be allowed to be made by two individuals only. The application for name reservation can be made through FiLLiP form also. If the name that is applied for is approved, then this approved and reserved name shall require to be filled as the proposed name of the LLP.

STEP-5: File LLP Agreement

LLP Agreement regulates the mutual rights and duties amongst the partners and also between the LLP and its partners. Some important points of LLP Agreement are -

LLP agreement must be filed online on MCA Portal in form 3.

The above mentioned Form 3 for the LLP agreement has to be filed within 30 days of the date of incorporation.

The LLP Agreement is required to be printed on Stamp Paper.

Certificate of Incorporation

On receipt of all the required documents in form FiLLiP if registrar is the opinion that all the requirements related to incorporation of LLP is duly complied with, he will issue certificate of incorporation under his hand in form 16. Once certificate of incorporation is received LLP will stand incorporated.

Thank you for giving your valuable time, if you have any queries regarding Online LLP incorporation in India then connect us at 9988424211 or write us at [email protected].

0 notes

Text

A Comprehensive Guide to Company Formation in India by GK Kedia

Establishing a company in India involves a series of legal, financial, and administrative procedures. GK Kedia, renowned for his expertise in corporate law and business advisory services, provides valuable insights into the intricacies of company formation in India. This article aims to elucidate the essential steps and considerations involved in the process.

Understanding Company Formation:

Company formation in India is governed primarily by the Companies Act, 2013, which provides a framework for the incorporation, management, and dissolution of companies. Before embarking on the incorporation journey, it is crucial to understand the various types of business entities recognized under Indian law. These include private limited companies, public limited companies, limited liability partnerships (LLPs), sole proprietorships, and partnerships.

Choosing the Right Business Structure:

Selecting the appropriate business structure is a critical decision that impacts various aspects of operations, taxation, and liability. GK Kedia emphasizes the importance of carefully evaluating the pros and cons of each business entity in relation to the nature of the business, ownership structure, capital requirements, and long-term goals.

Key Steps in Company Formation:

Obtain Digital Signature Certificates (DSCs): DSCs are mandatory for online filing of incorporation documents and facilitate secure electronic transactions. Directors and subscribers of the proposed company must obtain DSCs from certifying authorities approved by the Ministry of Corporate Affairs (MCA).

Obtain Director Identification Numbers (DINs): Every individual intending to become a director in the proposed company must obtain a DIN. This unique identifier is obtained by filing Form DIR-3 with the MCA, along with necessary supporting documents.

Reserve the Company Name: Selecting a unique and appropriate name for the company is crucial. GK Kedia advises conducting a name availability search on the MCA portal and ensuring compliance with naming guidelines specified under the Companies Act.

Drafting and Filing Incorporation Documents: The next step involves drafting the Memorandum of Association (MOA) and Articles of Association (AOA) of the company. These documents outline the company's objectives, rules, and regulations governing its operations. Once drafted, they are filed with the Registrar of Companies (ROC) along with Form SPICe (Simplified Proforma for Incorporating Company Electronically).

Payment of Fees and Stamp Duty: Payment of requisite fees and stamp duty is essential for the registration of the company. The fee structure varies based on factors such as authorized capital and type of company.

Obtaining Certificate of Incorporation: Upon successful scrutiny of incorporation documents and payment of fees, the ROC issues the Certificate of Incorporation, signifying the legal existence of the company.

Post-Incorporation Formalities:

Following incorporation, companies are required to fulfill various post-incorporation formalities, including:

Allotment of Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Registration for Goods and Services Tax (GST), if applicable.

Opening of bank accounts and commencement of business operations.

Compliance with ongoing regulatory requirements, such as annual filings, board meetings, and statutory audits.

Navigating the process of company formation in India demands meticulous planning, adherence to legal formalities, and expert guidance. GK Kedia's comprehensive insights shed light on the essential steps and considerations involved, empowering entrepreneurs to establish and operate their businesses in compliance with regulatory requirements. With a solid foundation in place, companies can embark on their journey towards growth, innovation, and success in the dynamic Indian market.

0 notes