#Limited Liability Partnership India

Text

If LLP or Limited Liability Partnership is your preferred business structure, we shall assist you in that regard as well. The liability of the partners varies here.

#LLP Registration Online#Limited Liability Partnership India#LLP Company Registration Online#Eazystartups#India

0 notes

Text

Limited Liability Company: Good or Bad in India?

In 2008, the concept of Limited Liability Partnership India or LLP was introduced in India. An LLP combines the characteristics of a partnership and a legal entity and is governed by the Limited Liability Partnership Act 2008. He needs two partners to form an LLP, but the number of partners is unlimited and follows the principle of perpetual succession. The LLP agreement governs the rights and obligations of the nominated partner. It is your direct responsibility to ensure compliance with all provisions of the LLP Act 2008 and the LLP Agreement.

LLP: Why is this a good idea?

Separate legal entity

LLP is a separate legal entity, just like a legal entity. They are separate from their partners and can sue or be sued on their behalf. Since the LLP agreement is signed on behalf of the company, it helps in gaining the trust of various stakeholders and instilling trust in the company among customers and suppliers. Partner's Limited Liability Under

LLP, the partner's liability is limited to the contributions made by the partner. Therefore, they are only responsible for the amount of donations they make and are not personally responsible for any losses incurred in their business. Take responsibility only if you are free to act as a capable businessman.

Reduced Formation Costs

The cost of forming a LLP is lower than forming a public or limited company. LLPs also have few compliance requirements. There are only two things an LLP is required to file each year: an annual report and a solvency report.

No Minimum Investment

LLP requires no minimum capital. No minimum paid-up capital is required for incorporation. Shareholders can contribute any amount of capital. LLP:

Disadvantages

Penalties

LLPs must meet minimum compliance requirements. However, LLPs face heavy penalties if these compliances are not completed on time. An annual return must be filed with the Ministry of Business Affairs (MCA) even if the LLP has no activities for the year. LLPs who fail to declare will face severe penalties.

Dissolvable

LLP dissolves when his 6 months of partner is less than his 2 months. An LLP can be dissolved if it cannot pay its debts.

Getting enough funding can be difficult.

Unlike a public company, an LLP has no shareholders or shares. A business her angel or a venture her capitalist cannot own her LLP themselves. An LLP member must be a member and must assume all obligations of a member. Because of this, LLPs find it difficult to raise money as venture capitalists and angel investors prefer to invest in companies rather than her LLPs.

0 notes

Text

Limited Liability Company: Good or bad in India?

In 2008, the concept of Limited Liability Partnership India or LLP was introduced in India. An LLP combines the features of a partnership and a legal entity and is governed by the Limited Liability Partnership Act 2008. Forming an LLP requires him to have two partners, but the number of partners is unlimited and follows the principle of perpetual succession. The LLP Agreement governs the rights and obligations of the designated partners. It is your direct responsibility to ensure compliance with all provisions of the LLP Act 2008 and the LLP Agreement.

LLPs: why is that a good idea?

independent legal entity

An LLP is a separate legal entity, just like a legal entity. They are separate from their partners and can sue or be sued on their behalf. Since the LLP agreement is signed on behalf of the company, it can help gain the trust of various stakeholders and instill trust in the company among customers and suppliers. Partners have limited liability

In an LLP, a partner's liability is limited to the contributions made by the partner. Therefore, they are only responsible for the amount of contributions they make and are not personally liable for any losses incurred in their business. liability for that liability only if Partners are free to act as trusted business people as they do not take personal responsibility.

Reduced set-up costs

The cost of setting up an LLP is lower compared to setting up a public or limited liability company. LLPs also have few compliance requirements. There are only two things that an LLP needs to file each year: an annual return and a solvency statement.

No minimum investment amount

An LLP does not require a minimum capital. No minimum paid-up capital is required for incorporation. Shareholders may contribute any amount of capital. LLPs:

Cons

penalty

LLPs must meet minimum compliance requirements. However, LLPs must pay heavy penalties if these compliances are not completed in a timely manner. An annual return must be filed with the Ministry of Corporations (MCA) even if the LLP has no activities for the year. LLPs who do not file declarations face severe penalties.

soluble

An LLP dissolves when a partner has less than two of her six months. An LLP may be dissolved if it is unable to pay its debts.

Obtaining sufficient capital can be difficult

Unlike a corporation, an LLP has no shareholders or shares. No angel investor or venture capitalist can own his LLP. An LLP member must be a member and must assume all obligations of a member. That is why it is difficult for LLPs to raise capital as venture capitalists and angel investors prefer to invest in companies rather than LLPs.

0 notes

Text

A Complete Guide to LLP Registration in India

Looking for help with LLP registration process in India? If your answer is affirmative, you’re at the right place. In this article, you will read everything about the process of LLP registration online in India. Visit to read a complete post Legalo experts here - LLP Registration India.

0 notes

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

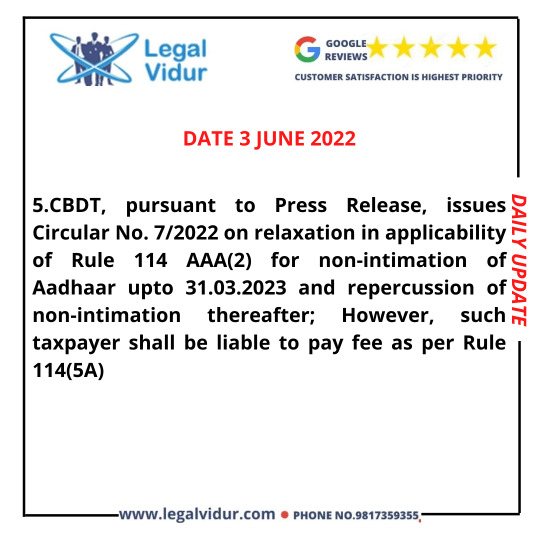

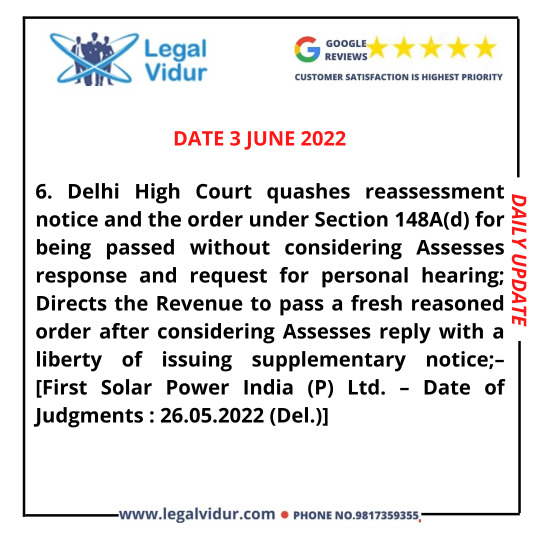

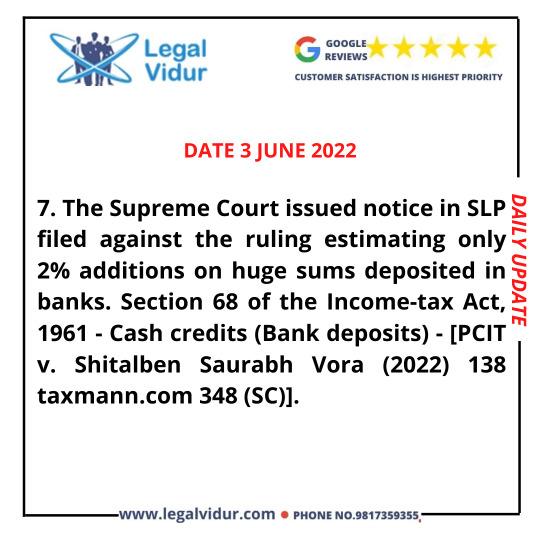

#Legal Vidur Daily Update

#Legal Vidur#Income Tax Return#One Person Company#Private Limited Company#Limited Liability Partnership#Public Limited Company#Startup India#FSSAI Registration#APEDA Registration#MSME Registration

2 notes

·

View notes

Text

LIMITED LIABILITY PARTNERSHIP

Limited Liability Partnership is a different corporate business structure that combines a company's limited liability protections with a partnership's flexibility. For example, it can remain even if one of its partners changes. It can also hold assets in its name, enter into contracts on its behalf, and is liable for all its assets. However, the liability of the partners is only as significant as their agreed-upon investment in the LLP. Furthermore, none of the partners is liable for the independent or unlawful conduct of the other partners. Individual partners are therefore protected from joint liability brought about by another partner's bad business choices or wrongdoing.

In an LLP, the partners' mutual obligations and rights are governed. An agreement between the partners, or between the partners and the LLP, as the case may be, regulates the mutual rights and obligations of the partners within an LLP. Nonetheless, the LLP is still responsible for fulfilling its other obligations as a separate legal organization.

LLP is referred to as a hybrid between a company and a partnership since it has aspects of both a corporate structure and a firm partnership structure.

Features of Limited Liability Partnership:-

It has a separate legal entity, just like companies.

The liability of each partner is limited to the contribution made by the partner.

The cost of forming an LLP is low.

Less compliance and regulations.

No requirement for minimum capital contribution.

LLP REGISTRATION ONLINE

The steps to register a limited liability partnership online are as follows:-

1. Obtain Digital Signature Certificate (DSC)

You must apply for the designated partners of the proposed LLP's digital signature before starting the registration process. This is due to the fact that all LLP paperwork must be digitally signed and filed online. Therefore, the selected partner must acquire their digital signature certificates from certifying bodies that the government approves.

2. Apply for Director Identification Number (DIN)

All designated partners or those planning to become designated partners of the proposed LLP must submit applications for their DINs.

The needed papers, which are frequently Aadhaar and PAN, must be attached as scanned copies on the form. A full-time company secretary or the managing director, director, CEO, or chief financial officer of the current business in which the applicant will be appointed as a director must also sign the application.

3. Name Approval

The Limited Liability Partnership-Reserve Unique Name (LLP-RUN) form is submitted to reserve the name of the proposed LLP, and the Central Registration Center under the Non-STP category will handle it.

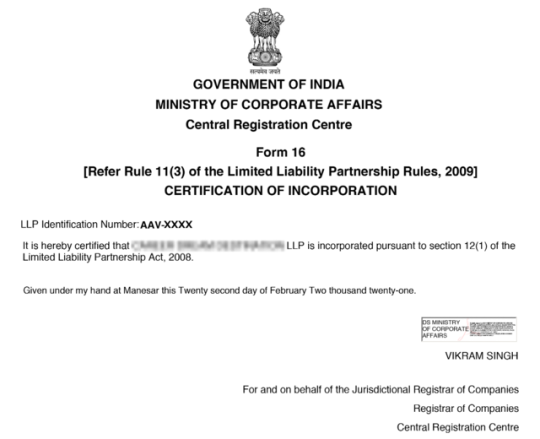

4. Incorporation of LLP

The FiLLiP (Form for incorporation of Limited Liability Partnership) is the document used for incorporation, and it must be filed with the Registrar, who has jurisdiction over the state where the LLP's registered office is located. The form is going to be incorporated.

5. File Limited Liability Partnership (LLP) Agreement

Documents Required for limited liability partnership

-PAN Card

PAN Card of each partner, if there's any foreign national may provide a passport

-Partners Address Proof

Aadhar Card/ Voter ID/ Passport/ Driving License of each partner

-Photograph

Passport-size photograph of each partner

-Business Address Proof

Electricity Bill/ Telephone Bill of the registered office address

-NOC from the owner

No Objection Certificate is to be obtained from the owner of the registered office

-Rent Agreement

The rent Agreement of the registered office should be provided, if any

LIMITED LIABILITY PARTNERSHIP REGISTRATION IN INDIA

An alternative business structure that combines a company's benefits with a partnership firm's adaptability is known as an LLP Registration in India. The Limited Liability Partnership Act of 2008 brought the LLP concept to India. Small- and medium-sized business establishments can use this unique hybrid.

In India, managing and forming a Limited Liability Partnership is simple. A minimum of two partners are needed to register an LLP; there is no maximum. The Partners' obligations and rights are outlined in the LLP agreement. One partner in an LLP is not liable for the wrongdoing and carelessness of the other partner. The partners are accountable for adhering to all the mentioned provisions in the LLP agreement.

Benefits of LLP registration in India

Partners' Liabilities are Limited

The fact that a Limited Liability Partnership counts as an independent legal identity is the primary benefit of registering as one as opposed to a Partnership Firm. As a result, LLP offers its partners the benefit of restricted liability. According to the LLP agreement, the partners' liability in case of a business loss or insolvency is limited to the capital contribution. Furthermore, neither partner is accountable for the negligence or misbehavior of the other partner.

Separate Legal Existence

Registering a limited liability partnership gives it a distinct legal identity from its partners. It can enter into agreements with other legal entities, file lawsuits, possess property, and take out loans in its name, thanks to the LLP Act of 2008. It also enables the company to continue operating independently and indefinitely, regardless of partner changes or deaths.

Operational Flexibility

The functional structure of an LLP, including the rights and obligations of the partners, is described in the LLP Agreement, a deed between the partners. The "Designated Member" who oversees daily operations is the norm for LLPs. Additionally, it may have members who are already established individuals or companies. Also, this structure enables us to identify the partners' roles and obligations clearly. Additionally, it might aid in defending the partner's interest in the event of loss brought on by another partner's illegal behavior.

Lower Compliance Requirement

Compared to Private Limited Businesses, LLPs have fewer compliance responsibilities. An audit is only required once a specific amount of turnover or contribution is completed. Unlike corporations, LLPs are exempt from compliance requirements pertaining to board meetings, statutory meetings, etc. Professional compliance services are frequently more affordable than those for businesses, making this type of formation more affordable to maintain

0 notes

Text

The LLP (Limited Liability Partnership) Agreement holds several benefits for the partners involved in the LLP:

Limited Liability: The primary advantage of an LLP is that it offers limited liability protection to its partners. This means that the personal assets of partners are not at risk for business debts and liabilities. Each partner is responsible for their actions, and they are not liable for the misconduct or negligence of other partners.

Flexible Management Structure: LLPs allow flexibility in the management structure. Partners can decide the roles and responsibilities of each partner according to their expertise and contribution to the business. This provides a more adaptable and customized management approach.

Ease of Formation: Forming an LLP is relatively straightforward and involves less paperwork and compliance compared to a private limited company. The registration process is quicker, making it a favorable option for startups and small businesses.

No Minimum Capital Requirement: LLPs do not require a minimum capital contribution, unlike private limited companies. Partners can contribute varying amounts of capital, depending on their agreed-upon terms.

Ease of Transfer of Ownership: The ownership interest in an LLP can be easily transferred or assigned to another person by way of a written agreement. This facilitates changes in ownership without affecting the LLP's legal existence.

Tax Benefits: LLPs offer the benefit of "pass-through taxation," where the LLP itself is not taxed. Instead, the profits are passed on to the partners, and they are individually taxed based on their share in the LLP.

Separate Legal Entity: Like a company, an LLP is a separate legal entity, which enhances its credibility and trustworthiness in the eyes of clients, suppliers, and financial institutions.

Perpetual Succession: LLPs have perpetual succession, meaning the LLP continues to exist even if one or more partners leave or new partners join. This ensures continuity in the business operations.

Confidentiality: LLP Agreements are not required to be filed publicly, which provides a level of confidentiality regarding the LLP's internal affairs and agreements among the partners.

Flexibility in Profit Sharing: LLP partners can agree on the distribution of profits based on their contributions, efforts, or any other mutually agreed-upon terms. This flexibility allows for more equitable profit-sharing arrangements.

Foreign Investment: LLPs can attract foreign investment as they offer a business structure with limited liability and simplified compliance requirements.

Regulatory Compliance: While LLPs have fewer compliance requirements compared to companies, they still offer a degree of regulatory structure, ensuring better governance and transparency within the organization.

Overall, the LLP Agreement provides partners with legal protection, operational flexibility, and taxation benefits, making it a preferred choice for certain types of businesses, especially those with a collaborative business structure. However, it is essential for partners to draft a comprehensive and well-defined LLP Agreement to address specific business needs and ensure smooth functioning throughout the partnership.

Read more: https://myefilings.com/format-of-supplementary-llp-agreement-for-admission-registration-of-partner/

#myefilings#business#taxes#india#company#limited liability partnership#private limited company#business registration#small business

0 notes

Text

Top LLP Company Compliance in Kolkata

Top LLP Company Compliance in Kolkata: Simplifying Compliance with Filemydoc

Introduction:

In the bustling city of Kolkata, numerous limited liability partnership (LLP) companies thrive and contribute to the region's vibrant business ecosystem. However, with the ever-increasing complexities of legal and regulatory frameworks, ensuring compliance can be a daunting task for business owners. This article aims to shed light on the top LLP company compliance requirements in Kolkata and how Filemydoc, a trusted online platform, simplifies the compliance process.

1. Understanding LLP Company Compliance:

Compliance for LLP companies in Kolkata involves adhering to various legal and regulatory obligations. These obligations ensure that businesses operate ethically, maintain transparency, and meet the standards set by the government and relevant authorities. Key compliance requirements for LLP companies in Kolkata include:

a) Registrar of Companies (RoC) Compliance: LLPs must comply with the filing of annual returns, financial statements, and other statutory documents with the RoC.

b) Tax Compliance: Complying with the Goods and Services Tax (GST), income tax, and other applicable tax regulations is crucial for avoiding penalties and maintaining financial transparency.

c) Employment Compliance: LLPs must adhere to labor laws, employee benefits, provident fund, professional tax, and other employment-related compliances.

2. The Importance of Top LLP Company Compliance in Kolkata:

Maintaining compliance is not just a legal requirement but also crucial for the long-term success and reputation of any LLP company in Kolkata. Here's why top LLP company compliance is essential:

a) Avoiding Legal Consequences: Non-compliance can result in hefty penalties, legal disputes, and even the dissolution of the LLP. Adhering to the regulations ensures the company's sustainability and protects its stakeholders.

b) Building Trust and Credibility: Compliant companies foster trust among customers, investors, and partners. Demonstrating commitment to compliance enhances the company's reputation and credibility in the market.

c) Ensuring Operational Efficiency: Compliance procedures often involve streamlining internal processes, leading to improved operational efficiency and reduced risk of errors.

3. Introducing Filemydoc: Simplifying LLP Company Compliance:

Filemydoc, a leading online platform, offers a comprehensive solution for LLP company compliance in Kolkata. With its user-friendly interface and advanced features, Filemydoc simplifies the compliance process, allowing businesses to focus on their core operations. Key features of Filemydoc include:

a) Automated Compliance Reminders: Filemydoc sends timely notifications and reminders about upcoming compliance deadlines, ensuring companies never miss a crucial filing date.

b) Document Management System: The platform provides a secure and centralized repository to store and manage all compliance-related documents, eliminating the hassle of manual record-keeping.

c) Expert Guidance and Support: Filemydoc offers expert guidance and assistance from professionals well-versed in the complexities of LLP company compliance. Users can seek advice and resolve queries through the platform's support channels.

4. Top LLP Company Compliance Services Offered by Filemydoc:

Filemydoc offers a range of services designed to address the specific compliance needs of LLP companies in Kolkata. Here are some of the top services provided by Filemydoc:

a) Annual Compliance Filings: Filemydoc facilitates seamless filing of annual returns, financial statements, and other statutory documents with the RoC, ensuring companies stay compliant.

b) Tax Compliance: The platform assists in GST registration, filing GST returns, income tax return filing, and other tax-related compliances, helping companies meet their tax obligations accurately and efficiently.

c) Legal and Regulatory Support: Filemydoc provides expert advice and assistance on legal and regulatory matters, including company incorporation, changes in partnership agreements, and compliance audits.

d) Compliance Audit and Due Diligence: The platform offers comprehensive compliance audits to identify areas of improvement and ensure adherence to all relevant regulations. This service is particularly useful during mergers, acquisitions, or partnership restructuring.

e) Annual Maintenance Packages: Filemydoc offers customized annual maintenance packages that cover all major compliance requirements, enabling companies to outsource their compliance management and focus on their business growth.

Conclusion:

Maintaining compliance with the legal and regulatory requirements is paramount for LLP companies in Kolkata. With the complexities involved, partnering with a reliable online platform like Filemydoc can simplify the compliance process significantly. By leveraging Filemydoc intuitive interface, automated reminders, and expert support, businesses can ensure seamless compliance management, avoid penalties, and build a strong reputation. Embrace Filemydoc to streamline your LLP company compliance in Kolkata and stay ahead in the dynamic business landscape

#LLP Annual Return Filing#LLP Registration in India#Limited Liability Partnership (LLP) Registration in India

0 notes

Text

The Complete Guide to Registering a Private Limited Company Online in India

Starting your own business can be a daunting and confusing task. There are so many boxes to check and paperwork to get through that it can seem overwhelming. But don’t worry; we’ve got you covered! This comprehensive guide will walk you through private limited company registration online in India.

We’ll cover everything from understanding the different types of business entities available to choosing the registered office address and filing documents with the Registrar of Companies (RoC). So let’s get started!

Read More: The Complete Guide to Registering a Private Limited Company Online in India

#online company registration in india#private limited company registration online#limited liability partnership registration#llp registration online

0 notes

Text

The Ultimate Guide To Setting Up A Limited Liability Partnership Company

Starting a business can be daunting, but setting up the right kind of business entity is key to safeguarding your investments and minimizing any liability you might incur. This article will provide an overview of what Limited Liability Partnership (LLP) companies are and how you can get one set up quickly and easily. Learn more about the benefits of LLP Registration in India and how this could be the ideal choice for your business!

What Is a Limited Liability Partnership (LLP)?

A limited liability partnership (LLP) is a business structure that combines the features of a partnership and a corporation. An LLP Registration Online is composed of one or more general partners, who manage the company and are each liable for its debts, and one or more limited partners, who are not liable for the debts of the company beyond the amount they have invested.

An LLP can be formed by two or more individuals or entities. The partners must execute and file a Certificate of Limited Partnership with the state in which the LLP will do business. The Certificate must include the name of the LLP, the names and addresses of all partners, and the duration of the partnership.

An LLP has several advantages over other business structures. For example, it limits the personal liability of each partner for debts incurred by the LLP, protects partners from being held liable for actions taken by other partners, and provides flexibility in the management structure. Additionally, LLPs are not subject to many of the taxes that apply to other business structures, such as corporate income tax.

If you are considering forming an LLP, you should consult with an experienced business attorney to discuss your options and ensure that you are taking all steps necessary to protect your interests.

Benefits of LLP Registration

There are many benefits of online LLP registration in India, including:

1. Limited liability: This is the biggest advantage of an LLP over a traditional partnership. The partners’ liability is limited to their investment in the business, meaning they are not personally liable for debts incurred by the business. This gives peace of mind to partners and makes it easier to attract investment.

2. Tax benefits: LLPs are taxed as partnerships, meaning that profits are only taxed once at the partner level. This can bring about huge expenses in investment funds contrasted with other business structures.

3. Flexibility: LLPs offer flexibility in terms of management and ownership structures. Partners can easily join or leave an LLP without disrupting the business or affecting the other partners.

4. Simplicity: LLPs are relatively simple to set up and maintain compared to other business structures. There are fewer paperwork and compliance requirements, making it a cost-effective option for businesses.

How to Register an LLP in India?

To Register LLP in India, you will need to follow these steps:

1. First, you will need to obtain a DIN (Director Identification Number) for each of the partners of the LLP. This can be done by applying online through the MCA21 portal.

2. Once you have obtained the DINs, you will then need to fill out the LLP registration form (Form 2). This form can also be found on the MCA21 portal.

3. Along with Form 2, you will need to attach a copy of the partnership agreement, as well as any other required documents.

4. Once all of the forms and documents have been submitted, you will then need to pay the registration fee (which is currently Rs 5,000). This can be paid online through the MCA21 portal or offline at any authorized bank branch.

5. After the registration fee has been paid, you will then need to submit a printout of Form 2 along with all of the supporting documents to the Registrar of Companies (ROC). The ROC will then issue a Certificate of Incorporation, which is evidence that your LLP has been registered in India.

Documents Required by LLP Registration Consultant for LLP Registration in India

There are a few documents required by LLP Registration Consultant for LLP Registration in India These are:

1. Partnership Deed: This is the most important document required for LLP registration. It is a contract between the partners of the LLP that sets out the rights, duties, and responsibilities of each partner.

2. Certificate of Incorporation: This document is issued by the Registrar of Companies after the LLP has been registered. It contains the name, address, and other details of the LLP.

3. Memorandum of Association: This document sets out the objectives of the LLP and its members.

4. Articles of Association: This document sets out the rules and regulations governing the internal affairs of the LLP.

Fees and Timeline for LLP Registration

LLP Registration fees vary depending on the state in which the LLP is registered. The filing fee for an LLP in India, for example, is 10000. The timeline for LLP registration can also vary by state but is typically around 2-4 weeks.

Step-by-Step Process of Setting up an LLP

Assuming you have already decided to form an LLP, the first step is to find a registered agent in the state where you wish to form your business. The registered agent will be responsible for receiving and processing any legal documents on behalf of your company. Once you have found a registered agent, the next step is to file a Certificate of Formation with the state government. The Certificate of Formation must include the name and address of your registered agent, the names of the partners, and the purpose of your business. After filing the Certificate of Formation, you will need to draft an Operating Agreement. This agreement will outline the roles and responsibilities of each partner, as well as how profits and losses will be distributed. Finally, you will need to obtain an Employer Identification Number from the IRS to open a business bank account and file taxes on behalf of your LLP.

Managing and Operating an LLP

An LLP, or Limited Liability Partnership Registration in India, is a business structure that combines the features of a corporation with the flexibility of a partnership. An LLP is made up of one or more partners, who each have limited liability for the debts and obligations of the business. This means that if the LLP goes bankrupt, the partners will not be held personally liable for any debts incurred by the business.

Operating an LLP is similar to operating a partnership. The partners must agree on decisions regarding the management and operation of the business, and they are jointly liable for any debts or obligations incurred by the business. However, unlike a partnership, an LLP has no general partner who has unlimited liability for the debts and obligations of the business.

An LLP is formed by filing Articles of Partnership with the Secretary of State in the state where the LLP will be doing business. The Articles of Partnership must include the names of all partners, as well as the registered address and principal place of business of the LLP. The Articles of Partnership must also set forth certain other information about the LLP, such as its purpose, duration, and governing law.

Once an LLP is formed, it must file an annual report with the Secretary of State's office to stay in good standing. An annual report is a brief document that includes basic information about the LLP, such as its name and address, as well as information about its partners.

If you are thinking about forming an LLP, it is important to

Taxation of an LLP

When it comes to taxation, an LLP is taxed as a partnership rather than a corporation. This means that the partners are responsible for paying taxes on their share of the LLP's profits, rather than the LLP itself being taxed as a separate entity. The tax rates for an LLP depend on the individual partners' tax bracket and whether they are classified as active or passive partners. Active partners are those who take an active role in running the business, while passive partners are typically investors who do not take an active role.

Conclusion

We hope this guide has helped explain the steps to setting up a limited liability partnership company and the benefits of doing so. With these tips, you should be well on your way to creating a successful business with limited liability for its partners. While there are plenty of decisions to make when launching a new business venture, having a solid foundation as provided by an LLP can help ensure its success. Consider consulting an attorney or financial advisor if you want more guidance while making your way through the legal aspects of forming an LLP. Good luck!

#llp#llp registration#limited liability partnership#limited liability partnership company#llp registration consultant#llp registration in india#online llp registration#limited liability company

0 notes

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

What Is Limited Liability Partnership And What's Document Required For LLP Registration ?

A

limited liability partnership is a business partnership in which some or all partners have limited liability for the debts and obligations of the partnership.

A limited liability partnership is a business structure in which partners are not personally liable for the debts and liabilities of the business. This means that if the business owes money to creditors, the creditors cannot go after the personal assets of the partners.

A limited liability partnership, or LLP, is a business structure in which partners are not personally liable for the company's debts or liabilities. This type of partnership is often chosen by professional firms, such as accounting or law firms, because it offers the benefits of both a corporation and a partnership.

explain the act of Limited liability partnership?

A limited liability partnership, also known as an LLP, is a business structure in which partners are not personally liable for the debts and liabilities of the business. This means that if the business owes money to creditors, the creditors cannot go after the personal assets of the partners, such as their homes or bank accounts.

what are the limited liability partnership firm ?

A limited liability partnership firm is a partnership between two or more partners in which each partner has limited liability for the debts and obligations of the partnership.

A limited liability partnership is a business structure in which partners are not personally liable for the debts and liabilities of the business. This type of partnership is often used by professional firms, such as law or accounting firms, where all the partners want to be involved in the management of the business but also want to limit their liability.

features of limited liability partnership ? 1. Limited liability partnership is a legal entity that exists separate and apart from its partners. 2. Each partner is only liable for his or her own actions and not those of the other partners. 3. The partnership itself is not liable for the debts or obligations of the partners. 4. Partnerships can be formed by two or more individuals, corporations, or other legal entities. 5. Partnerships are governed by a partnership agreement, which sets forth the rights and duties of the partners. 6. Partnerships can engage in any lawful business activity. 7. Partnerships are taxed as pass-through entities, meaning that the partnership itself is not taxed on its income, but instead the partners are taxed on their share of the partnership's income.

limited liability partnership examples? Some examples of limited liability partnerships are law firms, accounting firms, and architectural firms. A limited liability partnership is a business structure in which partners have limited personal liability for the debts and obligations of the partnership. Limited liability partnerships are formed by filing a certificate of limited partnership with the state in which the business will operate. The certificate must include the names of the partners, the name of the partnership,

what is the legal document required of Limited liability partnership?

A limited liability partnership (LLP) is a business structure where partners are not personally liable for the company's debts or liabilities. A limited liability partnership is similar to a limited liability company (LLC), but has additional tax and reporting benefits. The main advantage of an LLP is that it shields the personal assets of the partners from business debts and liabilities. This means that if the LLP goes bankrupt, the partners will not be held personally responsible for the debts. Another advantage is that an LLP is not taxed as a separate entity; instead, the partners are taxed on their individual tax returns. There are some disadvantages to an LLP as well. One is that it can be more difficult to raise investment capital, because investors may be reluctant to invest in a company where they are not personally liable for the debts. Additionally, an LLP may be subject to more government regulation than other business structures. In order to form an LLP, the partners must file a certificate of limited liability partnership with the state in which they plan to do business. The certificate must include the names and addresses of all the partners, as well as the name and address of the LLP. The partners must also draft and adopt an LLP agreement, which sets forth the rules and regulations governing.

1 note

·

View note

Link

A lot of companies are going for limited liability partnership incorporation in India. This is due to the reason that it provides a lot of benefits. Some of the most notable benefits of the limited liability partnership are as follows :

0 notes

Text

Limited Liability Partnership in India for Start-Ups – a Good or Bad choice?

Know what a Limited Liability Partnership is & how registering a start-up as an LLP works in India, understand why an LLP is the right choice for a start-up here with Legalo here - limited liability partnership India.

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes