#LLP registration online

Text

Before adding a designated partner to your company, you must follow the rules of the LLP Act. For the Best Online Legal Solutions, contact Eazystartups.

0 notes

Text

LLP Registration Online at UComply

If you are looking for llp registration online services, then UComply is the best company. Our platform offers hassle-free and efficient Limited Liability Partnership registration services. Simplify your business journey with seamless LLP registration online.

0 notes

Text

0 notes

Text

Register your LLP company in india with our expert. lawgical India provides you with all legal registration services an affordable price.

#online llp registration#llp registration online#llp registration in india#limited liability partnership#llp registration

0 notes

Text

Some More Facts To Know Before Going for LLP Registration Online

What is LLP Registration in India?

LLP Registration in India means you can do any business activity which is lawful in India. These business exercises incorporate trading, manufacturing, service provider, professional services, etc, and so on. In any case, it is worth focusing on the that certain exercises can't be performed without earlier endorsement from the specialists

What is LLP?

Limited Liability Partnership Registration in India is an elective corporate business that gives the advantage of limited liability to accomplices. It additionally allows accomplices to sort out the inside structure like a customary organization. A business element is enlisted under the Ministry of Corporate Affairs.

LLP is a body corporate, and very much like an organization or a partnership, it is a different lawful body. An agreement (LLP understanding) between the accomplices administers the privileges and obligations, all things considered,

What are the Authorised activities of LLP and activities that require Prior authorization?

As expressed toward the start, After the LLP Registration Online In India is done it can do any business action that is legitimate in India. The allowable exercises which require no earlier endorsement incorporate exchanging, producing, specialist organization, proficient administrations, and so forth.

In any case, some exercises are just permitted after getting an earlier endorsement from specialists. These exercises incorporate money, venture, protection, stock trade, shipper broker, banking, chit reserve, NBFC, and so forth.

During enlistment, an LLP is expected to choose the modern code as indicated by NIC-2004, and the contemporary code is picked according to the business exercises of the Limited Liability Partnership. At the point when the business code is chosen and the business movement has been outfitted to the Registrar of companies, the LLP can only run some other action with an earlier modification of the LLP agreement and approval of the Registrar of Companies for it.

What is the significance of the LLP Agreement?

A limited liability partnership (LLP) is shaped based on a legitimately enforceable agreement went into by the individuals (accomplices) of an organization. The target of this record is to cultivate a business relationship because of entirely pure intentions among partners meanwhile shielding the freedoms and interests of every individual accomplice and the LLP overall. While there is no legitimate commitment to have an overall organization enlisted, LLPs ought to be enrolled with an executed LLP agreement.

Does an LLP is able to carry out a financial activity such as banking and NBFC?

LLP isn't allowed to work in a financial business during its entire residency on the grounds that to run a financial organization, there is a necessity for the organization to be enrolled under the Organizations Act.

In the event of other monetary action, an earlier endorsement from the Reserve Bank is required, and on the off chance that an LLP wishes to run a Non-banking monetary movement then it is expected to take an earlier endorsement from the Reserve Bank prior to beginning the business.

In the event of non-banking exercises, the accompanying focuses ought to be noted:

As per segment 45 I (a) of the RBI Act 1934, the business of the monetary organization implies carrying on the business of monetary establishment as alluded to in provision (c) and incorporates the business of non-banking monetary organization alluded to in statement (f)

According to segment 45 I (e) of the said Act non-banking monetary foundation alludes to the organization, partnership, or co-usable society.

#llp#llp registration online#llp registration in india#llp registration consultant#llp registration online in india#Limited liability partnership#limited liability company#BIATConsultant

0 notes

Text

#LLP registration in Surat#llp registration services#llp registration#llp company registration#llp registration online#llp registration cost#limited liability partnership registration#llp firm registration#llp company registration online#llp registration finaccle

0 notes

Link

#LLP Registration#LLP registration process#LLP registration online#LLP registration consultant#LLP company incorporation

0 notes

Text

LLP Registration Online in Bangalore - LLP represents a corporate structure that amalgamates the characteristics of both a partnership and a company, delivering a unique framework tailored for businesses.

#LLP Registration in Bangalore#LLP Registration Online in Bangalore#Limited Liability Partnership Registration in Bangalore

0 notes

Text

LLP Registration in India: A Complete Guide for Entrepreneurs

Starting a business in India involves making several critical decisions, and one of the first steps for many entrepreneurs is choosing the right business structure. Limited Liability Partnership (LLP) is a popular choice due to its flexibility, ease of compliance, and the protection it offers to its partners. In this guide, we'll walk you through the process of LLP registration in India.

1. Understanding LLP:

A Limited Liability Partnership (LLP) is a hybrid business structure that combines the flexibility of a partnership with the limited liability of a company. This means that the personal assets of the partners are separate from the business liabilities.

2. Eligibility Criteria:

To be eligible for LLP registration, there are certain criteria that must be met:

Minimum of two partners is required.

There is no maximum limit on the number of partners.

At least one designated partner must be an Indian resident.

3. Digital Signature Certificate (DSC) and Director Identification Number (DIN):

The first step in LLP registration is obtaining a Digital Signature Certificate (DSC) for the partners. Additionally, partners need to obtain a Director Identification Number (DIN) for which an online application must be submitted to the Ministry of Corporate Affairs (MCA).

4. Name Reservation:

Choosing a unique and suitable name for your LLP is crucial. The proposed names should align with the LLP Act guidelines, and it's advisable to check for name availability on the MCA portal. Once the name is approved, it is reserved for 20 days.

5. LLP Agreement Drafting:

LLP agreement is a crucial document that outlines the rights and responsibilities of partners, profit-sharing ratio, and other key details. It's mandatory to draft and file this agreement within 30 days of LLP incorporation.

6. Filing Incorporation Documents:

After obtaining DSC, DIN, and finalizing the LLP agreement, the partners need to file the incorporation documents with the Registrar of Companies (RoC). These documents include the LLP Form 2, Form 3, and Form 4.

7. Payment of Fees:

LLP registration involves the payment of government fees based on the capital contribution. The fee structure is available on the MCA portal, and it's essential to make the payment to complete the registration process.

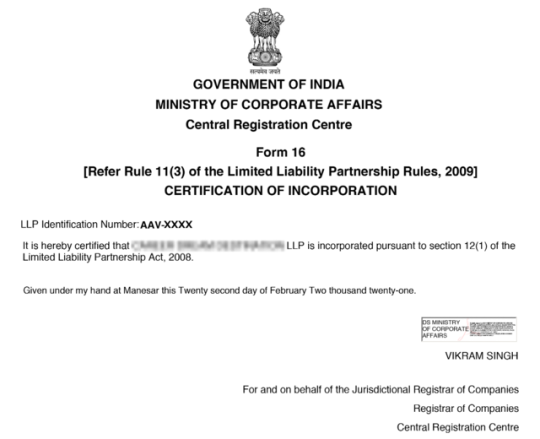

8. Certificate of Incorporation:

Once the RoC verifies and approves the documents, the Certificate of Incorporation is issued. This certificate marks the official existence of the LLP, and the business can commence operations.

9. PAN and TAN Application:

After obtaining the Certificate of Incorporation, the LLP needs to apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). These are essential for tax compliance.

10. Compliance Requirements:

After LLP registration, it's crucial to adhere to ongoing compliance requirements such as filing annual returns, maintaining proper accounts, and updating changes in LLP agreement or partners.

In conclusion, LLP registration in India offers entrepreneurs a flexible and liability-protected business structure. By following these steps and ensuring timely compliance, entrepreneurs can embark on their business journey with confidence. It's advisable to seek professional guidance to navigate the complexities of LLP registration and ongoing compliance.

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

If LLP or Limited Liability Partnership is your preferred business structure, we shall assist you in that regard as well. The liability of the partners varies here.

#LLP Registration Online#Limited Liability Partnership India#LLP Company Registration Online#Eazystartups#India

0 notes

Text

The Complete Guide to Registering a Private Limited Company Online in India

Starting your own business can be a daunting and confusing task. There are so many boxes to check and paperwork to get through that it can seem overwhelming. But don’t worry; we’ve got you covered! This comprehensive guide will walk you through private limited company registration online in India.

We’ll cover everything from understanding the different types of business entities available to choosing the registered office address and filing documents with the Registrar of Companies (RoC). So let’s get started!

Read More: The Complete Guide to Registering a Private Limited Company Online in India

#online company registration in india#private limited company registration online#limited liability partnership registration#llp registration online

0 notes

Text

Online LLP Registration In Laxmi Nagar

A Limited Liability Partnership (LLP) is a more practical type of organization that combines a corporation with a partnership firm. LLP has the advantages and characteristics of a private limited company while having more flexibility to operate like a typical partnership firm. An LLP must have a minimum of two partners, but there is no cap on how many can be partners. We can help you Online LLP Registration In Laxmi Nagar.

Documents required for Online LLP Registration In Laxmi Nagar

Documents required for Partners:

ID Proof e.g. PAN Card of all the Partners

Address Proof of all the partners

Partners Residence Proof

Passport size Photograph of all partners

In the case of foreign nationals or NRIs, a valid passport

Documents of Online LLP Registration In Laxmi Nagar

Address Proof of LLP Registered Office

LLPs Digital Signature Certificate

Advantages of a Limited Liability Partnership

Key benefits of LLP (Limited Liability Partnership) are:

• Easy registration process

• Since LLPs are different legal entities from their members, they shield member assets from the obligations of the company.

• LLP offers more flexibility in how the business is run and managed. A formal agreement between the members outlines the partnership's operations and specifies how earnings will be distributed.

• Because an LLP is regarded as a legal person, it is able to engage in business activities like hiring personnel, concluding new contracts, and leasing and renting out property.

• By appointing two firms as members, LLPs can offer corporate ownership.

Why By registering the LLP, we can safeguard the partnership name and stop other partnerships or individuals from using it without our permission. Read More

#Online LLP Registration In Laxmi Nagar#llp registration in india#llp registration#trust registration#branding#trust#llpregistrationindelhi

0 notes

Text

How to incorporate Limited Liability (LLP) in India

LLP Registration in India is now a proxy of the firm that provides the benefits of a corporation and the flexibility of a partnership firm into a single organization. The establishment of the LLP Concept in India undertakes by the Limited Liability Partnership Act of 2008. It is easy to incorporate a Limited Liability Partnership in India. For online LLP registration in India, we must include a minimum of two partners only. In an LLP, one partner is not reliable for the misdeed and carelessness of the other partner. The partners are responsible for adherence and all the provisions specified in the LLP agreement.

Pre-requisites to incorporate an online LLP registration

These are some essentials for LLP registration online:

A minimum of two designated partners (Individuals or at least one of them should be residents of India)

Digital Signature Certificate (DSC)

LLP Name

LLP Agreement

Registered office

Online LLP Registration Procedure

These are the following LLP registration online processes to incorporate LLP in India:

Step 1- Procure Digital Signature Certificate (DSC)

Firstly, fill out the application online on the MCA portal, which requires the digital signatures of the applicants and partners of the LLP. It further requires a passport-size photograph and address proof to obtain the DSC, which associates with the PAN card of the application.

Step 2- Reserve LLP Name

The applicant must file the RUN-LLP, which deploys to secure the company’s name. The RUN-LLP (Reserve Unique Name – Limited Liability Partnership) replaces the old Form 1 and can include a maximum of 2 names in preference order providing their significance. The names must comply with the applicable provisions for name reservations. You can apply with two other names if not approved by the MCA. Once it assigns the LLP name, it can reserve for 90 days from the approval date.

Step 3- Prepare the documents for incorporation of LLP

After the name approval, an LLP applicant must prepare the following documents:

Address proof of office (Conveyance/Lease Deed/Rent Agreement and rent receipts).

NOC from the owner of the property.

Copy of the utility bills.

Subscription sheet, including consent.

In case a designated partner does not possess a DIN, it is compulsory to attach: Proof of identity and the residential address of the subscribers with the documents.

All the Designated Partners should have a digital signature.

Details of the designated partners of an LLP.

Step 4- LLP Incorporation and DIN Application

An LLP applicant must file the incorporation application in the FiLLiP (Form for incorporation of Limited Liability Partnership). There are some features which must include in the application:

You can generate DIN after filling out the DPIN/DIN application for a maximum of 2 Designated Partners (DPs).

You can also obtain the name reservation application through this form rather than the LLP-RUN form.

Upon the incorporation of application approval for online LLP registration, it will issue the Certificate of Incorporation (COI) in form 16 along with DPIN/DIN allotted to the Designated Partners.

Step 5- Apply for PAN & TAN

We require the application for PAN & TAN to register an LLP through online or offline mode. We generate the applications in forms 49A and 49B, with a Certificate of Incorporation (COI) as supporting proof.

Step 6- Drafting and Filing LLP Agreement

It must include the partner’s requirements to draft LLP Agreement. It shall remain the process for LLP Incorporation and DIN Application along with PAN & TAN Application.

Forms Required

RUN – LLP (reserve unique name-limited liability partnership) is an alternative to Form 1 for LLP name reservation.

FiLLiP is an alternative to Form 3 for LLP incorporation.

Form 5 is to change the name of an LLP.

DIR 3 is for registering a new user on the MCA portal.

Form 17 is for the conversion of a current partnership into an LLP.

Form 18 is for the modification of a private company into an LLP.

Documents Required

Documents required of partners:

PAN card,

Address proof,

Passport-size photograph,

Passports of the designated partners (In the case of NRIs).

Documents required of LLP:

Address proof of the office,

Digital Signature Certificate.

Conclusion

In Conclusion, Limited Liability Partnerships (LLP) protect partners by assuring them they are not responsible for business debts. As this case demonstrates, parties become personally accountable if the LLP dissolves before sustaining the business debts. However, LLP is setting up the benchmark for startups in India. There has been the continued growth of partnership firms and private limited companies converting their organizational structure into LLP. The Ministry of Corporate Affairs (MCA) is making every effort to facilitate such registrations and conversions. Even then, Lawgical India experts can help you incorporate your LLP seamlessly and effortlessly. A highly trained team of Lawgical India can help you make decisions concerning the formation of a company and guide you in the following process. Contact us to know more.

#online llp registration#llp registration in india#llp registration online#limited liability partnership

0 notes

Text

Get yourself Updated Before Registering for a LLP Company

Limited Liability Partnership (LLP) has turned into a favored type of association among business people as it consolidates the advantages of both partnership firm and company into a single form of organization.

The idea of LLP Registration Online in India was presented in India in 2008. An LLP has the attributes of both the association firm and the company. The Limited liability Partnership Act, 2008 directs the LLP in India. At least two accomplices are expected to consolidate an LLP. Be that as it may, there could be no furthest cutoff on the greatest number of accomplices of an LLP.

Among the accomplices, there ought to be at least two assigned accomplices who will be people, and somewhere around one of them ought to be an occupant in India. The freedoms and obligations of assigned accomplices are administered by the LLP understanding. They are straightforwardly liable for the consistency of the relative multitude of arrangements of the LLP Act, 2008, and arrangements determined in the LLP understanding.

What is the Minimum Requirement for opting for an LLP Registration Online?

Some of the Minimum Requirements for Opting for an LLP Registration Online are:

At least two partners are required to form an LLP (no upper limit)

If a body corporate is a partner, a natural person must be nominated to represent it

Each partner must have an agreed contribution toward the shared capital

LLP should have an authorized capital of at least ₹1 lakh

At least one designated partner should be an Indian resident.

What are the Benefits of Choosing a Biat Consultant as an LLP Registration Consultant?

Some of the Benefits of Choosing a Biat Consultant as an LLP Registration Consultant are:

Team of Experts CA and CS for smooth processing

Multiple Happy Customers from all over India

Dedicated Customer Support for all your Queries

Smooth Online process without traveling anywhere

Year of Experience and still counting.

What is the necessary document required before reaching out to the LLP Registration Consultant for LLP Registration Online in India?

Some of the Necessary Documents Required before reaching out to the LLP Registration Consultant for LLP Registration Online in India are:

For Partners:

Identity proofs and PAN cards of all partners.

Address Proofs of partners that include Voter ID, passport, or driving license.

A passport-size photograph against a white background.

Passports of NRIs and foreign nationals who wish to become partners in an LLP.

For LLP:

Proof of the registered office of address needs to be submitted at the time of registration or within a time span of 30 days of the incorporation of the LLP. In case, the registered office is a rented facility, a NOC from the landlord is necessary. Additionally, at least one proof of residence will need to submit such as utility bills that are no older than 2 months.

A Digital Signature Certificate (DSC)

#LLP#llp registration in india#llp registration consultant#llp registration online#llp registration online in india#limited liability partnership#limited liability company

0 notes