#i can't even manage to save enough for a mortgage

Text

Every time I start thinking about money, I get paralized like a deer in the headlights. That's not how people should live :(

#spending money is stressful#saving money is stressful#i can't live like that anymore#i can't even manage to save enough for a mortgage#me and mine#:(

6 notes

·

View notes

Text

thinkin about camila. as i often do. it's been like over a year now so i think the fandom has cooled off enough for me to say this but. one of the Strangest discourses i've ever seen in any fandom Ever was. when ppl were passionately arguing about camila's finances circa thanks to them. it was Such a non-issue that it wrapped back around to me going ".....hm. might have some hurt feelings about this"

like. ok. she's a single-income earner with a daughter paying a mortgage on a house in a connecticut suburb, possibly with medical debt left over from manny's treatment, who is suddenly feeding and housing and clothing five extra teenagers. all of whom have Literally No Clothes Or Resources Whatsoever When They Arrive, who possibly have special dietary restrictions, and for whom she is not receiving Any government aid or fostering stipends because every single one of them is undocumented.

and yet. people were like. EARNESTLY going back-and-forth with LONG ESSAYS of Vicious discourse. asserting that the Only reason to think camila might struggle with money is........ because she's dominican.

and also. that her Literal Illustrated In Canon financial anxiety is just her.... being financially savvy. and showing that she's good at saving money. and that she's too smart and good at managing money to be poor.

like people broke down various vet salaries and connecticut mortgages on BOTH SIDES. to try to pretend this was a convo we even needed to be having.

and the whole time i was like.

i..... i honest to god can't tell, uh. if this is all coming from teens who completely misunderstand the material realities of the american economy (which would be reasonable, it's a show for teens)..... or.....

if you guys like. Actually Hate Poor People As Much As It Sounds Like You Do.

#the statement 'examine your headcanons/meta/etc to make sure youre not making racist assumptions or stereotyping' is GREAT#but like. I DID EXAMINE MY HEADCANONS... MY GUYS.... IT DIDNT EVEN TAKE LONG...#and then the like. the doubling-down on 'camila's too smart and good at money management to be poor'#LOUD WINCE. YEOWCH. that one actually hurt a little. like. okay!#i am gently taking your hand. if you're this concerned about stereotyping let's learn about classist stereotypes today too.#it was. SO STUPIDDDD it was so stupid. IT WAS SO STUPID oh my GOD#toh#camila noceda#unrebloggable because i actually am not sure if this is swinging at a hornet's nest or not. i don't THINK so but.

30 notes

·

View notes

Text

I ordered this cute commission of Jack and Suzy's ponified forms from https://www.deviantart.com/teonnakatztkgs

Please look under the cut for some important information

From the description

"I'm sharing this across as many platforms as I can as I'm faced with a horrible situation and desperately need help. In short I'm losing my home and need a down-payment for a new place. The renters market right now is insane. (Like 5000 sometimes 7000 dollars a month for RENT) I've managed to find a place but he refuses to go lower than 3000 down but the rent is doable with my income. But I have been on medical leave since early February due to seizure like activity while I was working. I still have my job and should be returning in April from medical leave. But the foreclosure starts in 2 weeks and ive been using my savings to get by and dont have anywhere near enough for a down-payment. I have begged the mortgage company to let me make payments to them and they have been shady and refusing for months and out of nowhere want to foreclose. It's not even my house I just live in it. They have been building up in my area for a while now and recently started a plaza very close to where I am. I don't know if it has anything to do with it but I need to move. My family will NOT help me with anything.

OK that out of the way.

I'm trying to save 3000$. It's a lot but I have to be able to get a down-payment. It's not just for my sake.

I will literally draw whatever you want however you want it.

Sketch doodle traditional: 1$

Sketch page traditional: 3$

Sketch page digital: 5-7$(comes flat colored more complex characters will be higher)

Black lineart fullbody: 10$

Colored lineart fullbody: 15$

Colored and shaded fullbody: 20$ (5$ more for each additional character)

Background: 10$

Customs:

Black lineart: 5$

Colored lineart: 10$

Adopts and OCs:

I'm selling EVERYONE except TK, Kalmin, Silver, and Silverstorm. I have cats, dogs, lions, ponys, etc. Just ask what your looking for I'm still trying to figure out how to use toyhouse to share them there. Depending on how much art they have they will be higher.

Please share if you can't buy"

#jackfrost1997#jackfrostmks#jackfrostmutantkillersnowman#suzy snowflake#suzysnowflake#suzy frost#suzette schneeflocke#suzette frost#mlp#mlp fim#mlp g4#mlp art#mlp oc#my little pony

16 notes

·

View notes

Text

Life Update

Heyyyy it’s been a while! I never really expect anyone to notice when I fuck off for long periods of time, but in case you did and happened to be wondering why I was mostly MIA for most of 2023, here's what I've been up to.

The short version: My husband and I sold our first house over the summer and bought our “forever” home! It worked out so much better than I could have hoped, but it turns out that prepping a house to sell and moving = lots of stress and chaos...which caused me to tumble off the deep end mentally for a while afterwards and I’m only just starting to recover.

---

Before I elaborate, I feel like I have to give a disclaimer because the last thing I want is to come across like I'm complaining or ungrateful. I'm very aware of how lucky and privileged I am to be a homeowner, so I am by no means asking for sympathy or trying to act like "buying/selling a house is so stressful, woe is me!" I understand that homeownership is a pipe dream for a lot of people, especially in the current economy, and I don't take that for granted. I'm genuinely grateful that I even have the opportunity to be stressed about something like this, but I can't deny that it was stressful.

If anyone is wondering how I managed to buy a house at all, I'm happy to answer that in a separate post. The abridged version is extremely lucky timing plus countless hours of hard work put into fixing up our first house that we bought for cheap back when the market was way more balanced (2016).

When I talk about the stress of last year, it's almost entirely in regards to my own mental health which is something I've always struggled with. I get overwhelmed VERY easily by regular life, let alone when I go through a major change (no matter how positive it is). Every big transition period in my life has triggered intense anxiety disorders and/or depression for me, so that's the main reason why things felt so difficult.

If you happen to be thinking something along the lines of "shut the fuck up, no one cares you were stressed, you're so privileged to even be able to own a house," ...believe me, I've already said to myself a million times. That is part of why I end up so depressed in the first place, because I feel like I “don’t have the right” when my life is so wonderful. But thanks to therapy I understand more about my mental illnesses and I'm trying to be less hard on myself now.

Still, I don't want anyone to get the wrong idea 😅.

---

Anyways! If you want to know more about our house/see some pics, the long version with all of my rambling is below the cut!

The long version:

My husband and I bought our first house in 2016, right after getting married. It was conveniently located right across the street from where we had been living with 4 of our friends (which is how we were able to save enough money to buy a house), but it was in such bad condition that it didn't even meet the FHA minimum property standards so we had to use a special type of mortgage to purchase it. We always meant for it to a long-term flip, planning to live there while renovating it so that we could sell it after a few years and use the profit to buy a house that would be more permanent.

We put so much literal blood sweat and tears into that house. In the beginning we spent every single hour of our spare time fixing up the house. We do all renovation work ourselves because my dad and husband have experience with demolition, electrical, and plumbing. And anything we don't know how to do we just figure out as we go along. The only time we hired a contractor was to replace the roof that had extensive water damage.

(This is the water damage discovered down the whole back of the house a few weeks after we bought it 🙃)

(One before-and-after out of many to avoid making this post absurdly long. The contractors finished the ceiling when they did the roof but otherwise we did all the work on that bathroom ourselves, including moving the shower wall back 6 inches so that the shower door wasn't mounted to the window trim 🤦🏻♀️)

Over a few years we worked on remodeling each room until we eventually we got super burnt out, and then the pandemic happened and we both fell into a deep depression. Finally, in 2022 I got myself a therapist and started clawing myself out of the dark place I was in, and at the start of April 2023 we started prepping the house to sell. I had been watching the market steadily increase to absolutely insane levels and knew it was kind of a “now or never” situation, even though I still felt very fragile mentally so I was worried how I would handle such a large undertaking.

I never could have imagined just how amazing it would turn out. We truly couldn't be happier with our new home, it’s pretty much everything we were hoping for and I still can’t believe how lucky we are to have gotten it. I was prepared to have a hard time finding an affordable house. I had heard of all kinds of horror stories and the crazy competition going on in the market was intimidating. I thought we were gearing up for the long haul, and prepared myself for a lot of disappointment. Our house was the first house we put an offer on (the third one we looked at in person) and we somehow got it! It’s insane, I'm so fucking grateful.

The only catch is that it's a lot more of a fixer upper than we had originally planned on buying. I didn’t think that we would ever buy another house that required as much renovation as our first one did, because that shit was intense and we are now in our 30s and very tired 😂. But our new house has so many features that were on our “would-love-to-have-but-probably-won't-find-in-this-economy” list like laundry upstairs and an attached garage (also a pond??!?! We have a fucking pond and I love it so so much🥹). So we knew we could turn it into a home we’d love spending our lives in if we put in the work. Plus it was actually well below our budget (probably because of the condition it was in).

We decided to offer what we were willing to pay, which was well above asking but we still didn't think we'd have a chance because the market is so competitive. I don’t know if our real estate agent just worked some magic (she was amazing), but we were genuinely stunned when she told us we got the house.

(Our beautiful pond🥹 🥰)

After that, things moved SO fast. The timing made it overlap with the prepping/listing of our first home, which was really stressful to juggle all at once on top of our full time jobs. I thought selling was going to be the easy part since the market is so skewed towards sellers right now. And it did go amazingly well once we listed (64 showings and 12 offers in one weekend, fucking nuts?!?!!), but the months leading up to listing the house were CRAZY. I knew it would be a lot of work to prep the house since we had a bunch of unfinished projects, 4 open permits with the town that we needed to get closed, and had accumulated so much shit over the years, but I definitely underestimated how intense it would be, especially with the overlap of buying our new house. I had used up all of my PTO for the year by June in order to deal with house things and felt like I was constantly on the verge of a mental breakdown. I pushed myself way past my limits and knew I would pay for it eventually.

But we made it through the chaos and officially moved in July. Let me just say that I hope I never have to move again😵💫. It was 90+ degrees (F), 95% + humidity that weekend, and then POURING rain on the day of the move🙃. But other than that, everything went pretty smoothly! After a couple weeks of getting settled and sleeping in the living room, we started on the renovations in early August.

(Before and after of our living room that we are using as a hobby room for D&D, music, art, etc I love it so much!)

(Before and after of the downstairs bedroom which we use as our office)

We remodeled two whole rooms in about 6 weeks, which was wayy too much. We had been going nonstop since April and by the time we got to October, I hit a wall. Because my mental health was incredibly fragile to begin with, surprise surprise I ended up stuck in another bout of horrific burnout-fueled depression for a solid 2+ months after we finally paused to take a break. I've struggled with my mental health since I was a teenager, having periods of depression, panic disorder, and GAD on and off. Also over the past year, I’ve started to suspect that I may have undiagnosed ADHD so there's a lot going on with my brain. I've always been a very sensitive person, and my mental health is the first thing to suffer if I don't take care of myself.

I started feeling a bit better in December, but then things got crazy again with work and the holidays, so I ended up back in burnout land yet again. Now I think I'm finally starting to truly recover as I enter the slow season at work. We are easing back into renovations but I've been trying to take it as easy on myself as possible to avoid falling back into that dark place, which is why you haven't seen much of me on tumblr. It bums me out, and I often feel frustrated with my own limitations when I see everyone posting and chatting and creating and I want so badly to join in, but I sadly just haven't had it in me for a long time. But I'm still lurking and forever obsessed with InuKag and hope to be recovered enough to participate in fandom stuff more soon!

I've still been writing and drawing here and there whenever I get a bit of inspiration. I actually just finished an Inuyasha redraw that I'll be posting soon! I've also been writing a lot more recently, or at least thinking a lot about my WIPs😂. The main one I've been working on is If It Kills Me, which I am dying to share with you all. But it's a mystery/thriller/actiony type of story with plot points that still need to be figured out, so once those pieces fall into place I will hopefully be able to wrap it up. I'm going to be working on it a lot in February, so we'll see what happens.

I would love to share my other main WIP The First and Last this summer (since it's a summer-based story), but we'll see how things go. The next major renovation project is the kitchen 😵💫, so fandom things might have to sadly take a backseat again during that. But I'll still be lurking here and missing you all! ❤️

#personal#home renovation#update#I don't expect anyone to read this whole thing but thank you for listening to me ramble if you do xD#I'm an overexplainer sorry can't help it#anyways I missed being involved in the fandom last year so much#happy to finally feel regulated again#it was a busy year and my brain sucks but it was amazing

13 notes

·

View notes

Text

Samantha wasn't Kyle's only employee to grow their family over the past few years. Georgia's brother Gavin had also been through some big changes.. Thankfully his situation meant that he wouldn't be leaving his job as manager of the Bluewater Village shop any time in the foreseeable future. Quite the opposite, he was unexpectedly committed to staying there.

Gavin had reconciled with his estranged wife April a couple of years ago, and she had moved into his little rented house in Bluewater Village.

Kyle figured it wouldn't be long now until Gavin resigned from the shop and moved back to the city. He didn't know how April felt about living in a sleepy little seaside town, but Gavin had made no secret of his ambition to succeed in the business world, and you can't do that from Bluewater Village.

It was a pity - Gavin had been one of the best people to be involved in the bookstores. While little independent shops were closing all over the place and sales of printed books seemed to be in decline, their shops had flourished thanks to his ideas.

It was Gavin who had got their online shop up and running, something Kyle and Cory wouldn't know where to start with. He'd managed their advertising, and encouraged Kyle to 'lean into' the Victorian feel of Bluewater Village.

They were selling many of the same books as the big chains, but somehow having an old cash register and signs in a decorative font makes your business more appealing, at least to tourists - and Bluewater Village had plenty of them.

Kyle waited with some dread for Gavin's resignation, but it never came. The only announcement they got was that of April's pregnancy.

Baby Austin was born the following spring, and Kyle was still waiting...

... but Gavin and April seemed quite content.

When Gavin indicated one day that he needed to talk to Kyle about something work-related and serious, he thought it was finally time. But to his surprise, Gavin wasn't resigning. Instead, he needed proof of income and of employment in good standing, for his bank. He and April were applying for a mortgage to buy a house on the beach, here in Bluewater Village.

The place they had found was large, shabby and neglected. Between her savings and some help from her parents, April had the deposit. Their combined incomes would cover the repayments, with enough left over to gradually restore the place.

Kyle couldn't have been more surprised, especially when Gavin shrugged away talk of his past ambitions as if it meant nothing. Bluewater Village was a great place to raise kids, he said.

The house was right on the beach, with views you don't get in the city

It had a good sized yard, and room to grow vegetables. April and Gavin both loved gardening, and if the soil here was too sandy, that was easily fixed with a few raised beds.

Inside, the house was cosy and comfortable. They redecorated the kitchen first and spent much of their time there as they didn't yet have a usable living room.

There would be plenty of room for a growing family, and this was all the more important now, as Gavin and April were expecting baby number two.

From Kyle - Part 2

Gavin and April got back together via rolling lots of wants for each other. Gavin doesn't seem to care about his career any more and just rolls wants for April, babies, his dog and gardening. So I guess he's happy too.

The Bluewater bookstore is based on this real life shop, in fact the whole of Bluewater Village in my game is based on Greytown, its Victorian beginnings and its revival as a boutique shopping destination. I even have the drive there from the city in mind, when I talk about the winding, hilly road from Richmond to Bluewater Village

3 notes

·

View notes

Note

Is your house big enough for 10 people 🫠 I can feel myself melting away thinking about the problems you will face 😮💨 but having anime people in your house how cool is that 😎

We can make it work. Due to financial and legal reason, my sibling and I have been unable to move out of our parents' home. Here's a preview from what I have written so far that explains how all of them will fit:

When I was 4 1/2 years old, we had to move because my mom's job changed locations. At that same time she was pregnant with my younger sibling, so we also moved into a bigger home. My parents were sold a house they couldn't afford the upkeep on, but they wouldn't understand that for several years. And because of the crashing housing bubble, job markets, and person taste, my parents out right denied the idea of selling the house to get a smaller place we could actually properly take care of. Our roof has poorly patch, holes, and our siding is rotting -to name some of the growing problems. However, it did have a few more rooms than the average house. Both of my parents were hoarders and 7 years after my mom's death, we were still clearing out her things, and fighting my father from adding to the problem. Luckily, in the past few years we had managed to mostly clear out the 2 rooms that had once been a dining room(now "the back room"), and home office (now "the den"). It would be cramped, but we would be able to fit all 9 of them. Both the living room and the den each have a sofa with a pullout queen mattress, and since my dad was a literal hoarder that wouldn't let us throw things out, we have another old queen mattress in our basement, and a king mattress blocking the coat closet. The two old mattresses could be laid on the floor in the back room next to the den. All 4 of those would be enough to fit 9 people ....even with Hina being a giant. I decided to leave the end decisions for who would sleep where to our guests. If they could run a country, they could figure out who was going to sleep where on their own.

Since I was little, my parents pulled out of their pensions and 401Ks multiple times to keep us afloat, so we wouldn't have to move :( We've only been surviving since my mom died, because of me working, and my mom leaving a bunch in savings that my dad uses to pay utilities and most of the food bill. My dad can't work, so I have been the one paying the mortgage, insurance, and taxes for the house too. There are still a few more years left before it will be payed off. Since the house is falling apart it's an eyesore, so we are being charged higher taxes then our neighbors. (This is a common tactic to kick out "problem" families instead of helping them.) Once the house is paid off, I can start putting money aside to be able to try fixing the house, and hopefully get our taxes lowered.

In the fanfic, I plan to have Sin and the Generals work enough to help us, so it won't focus on our struggles. I am planning on having one chapter as set up, and then any other requests for things to happen in the reverse isekai AU will be chapters after that. :D

Me and my younger sibling, Lyly, have discussed reverse isekai for a ton of series before, so we already have some plans for how it could work, and what we would do. Since I started working on this in June of '22, I have talked to my family about what we would do, and how we might make it work. The excerpt I put above is something I talked to them about earlier today, actually XD We talked for over an hour about the different characters and how they might be able to help us too. My whole household knows Magi because I live here and they can't get me to shut up about it XD They've both seen the full anime for Magi and Adventures; Lyly has read a bit of both manga but didn't finish. Everyone in this house agrees that Ja'far is a lot like Lyly, so my dad said he'd be comfortable with Ja'far helping him with paperwork stuff. He also wants to know more about Hina after learning that he's also a widower and over 50 y/o. So it's going to be fun writing how all of them help us get out of the red :3

For all the people that have dm'd me asking if Lyly will ever isekai into Sindria's Prophet after reading my diary comic, "Mori the Webcomic," the answer is: probably not because I don't want to ever misrepresent them. I will write some one shots where it happens for fun, and they will be in this reverse iskekai AU. Lyly is taking a semi active roll with the writing for any chapter that they appear in.

7 notes

·

View notes

Text

Taking Control of Your Financial Destiny - Sound Financial Advice For Women

When I meet women who are totally clueless about their household finances until an emergency has arisen. While everyone should view this recession as a "time to re-engage"; women have a much stronger obligation to take control of their own financial destiny.

As if we are not already overburdened with balancing a career and family life; understanding the financial industry and how it affects our daily lives is a necessity for all women. When we sit idle and put our financial lives on automatic, it's equivalent to financial suicide.

Case in point, one of my clients had no idea her husband had been paying their mortgage for the past three years with credit cards. He never told her he was laid off from work and accepted a new job earning only half of his previous corporate salary. He was responsible for paying all of the household necessities and her salary was designated for the "household luxury items".

Not knowing about their financial position, she continued to spend her salary without putting any savings away. She was devastated when process servers rang her doorbell to serve them both with a foreclosure complaint.

I'm sure many women would proclaim that this could never happen to them, but it's far too common. The next situation demonstrates another widespread problem women are faced with today.

Mrs. Anderson decided to retire Finanzberatung after thirty years as an elementary school teacher. She planned to travel and enjoy a leisure life. Unfortunately, Mrs. Anderson's monthly retirement check wasn't enough to cover her bare necessities. Her retirement account was slaughtered by the financial markets. After reviewing her retirement account, it was heartbreaking to know that this could have been avoided.

Mrs. Anderson's retirement account was depleted because no one was managing her account. Yes, she had an advisor, but Mrs. Anderson's account wasn't monitored or invested to match her goals and objectives since her husband's death ten years prior. Mr. Anderson was the Financial Manager of the household and Mrs. Anderson had no interest in financial matters.

Again I ask, what is wrong with this picture? After spending her entire life being everything to everybody, Mrs. Anderson's quality of life has been altered because of lack of knowledge. I can present endless scenarios, but my goal is to shine a light on the solutions.

Moving forward, all women must have a stronghold on their financial future. The American financial system as we knew it, no longer exists. Personal Financial Management should be the job of both heads of household. Think about it, what happens if there's an emergency, and the co-pilot can't fly the plane?

If you're the sole head of household, the responsibility is even greater. It's impossible to effectively operate your household, and raise financially astute children if you have no knowledge yourself. Take charge of your financial destiny by equipping yourself with the proper tools.

Seek out financial literacy training that leads to Financial Aptitude. Financial Aptitude will enable you to take personal responsibility for managing your finances, make investment decisions that match your short and long-term needs, select the right financial consultants and effectively plan for retirement.

0 notes

Link

0 notes

Text

HOW TO BUY A HOUSE - IN 3 EASY STEPS

There is a lot of confusion out there about how to become a Homeowner so I thought I would take a moment and put it into Average Joe speak. That, and in my experience, some people go about it totally backwards which is counter productive to the end goal.

STEP 1. - ASSESS YOUR FINANCES

This is fairly simple. Eliminate non-essentials from your spending budget and stick it in the piggy bank. Modify spending habits to generate savings. Make short-term lifestyle changes.

It's just temporary and if canceling monthly memberships (Netflix, Gyms, Any Subscriptions), adjusting your shopping habits [I got some great tips for this], or eliminating other non-essential spending allows you to keep more money in your pocket to get a home versus flushing rent dollars down the proverbial toilet? Bit of a no-brainer if you ask me.

Bottom line is you have to have money ready-to-hand for the transaction. Even with the "zero down" options like VA and some USDA loans; just to name a couple.

There are inspections, appraisals, escrow funds, repairs, home warranty policies, property taxes, closing costs, and other such considerations that must be paid in order to get a home of your own.

"Do Not Save What Is Left After Spending; Instead Spend What is Left After Saving" - Warren Buffett

Figure out what kind of a down payment your financial situation will allow for. The more, the better, but very few people I know got 20% of the purchase price [a.k.a. - conventional/bank loan] sitting around collecting dust. Good news is you don't necessarily have to have that much.

One of the most common loans is a FHA that only asks for 3-5% down AND there are down payment assistance programs out there if you are really Stuck Like Chuck when it comes to finances. NOTE: This does NOT mean they are going to give you ALL of your down payment; you gotta have some chips in that poker game too.

I like to recommend that people shoot for at least 6-8% of the purchase price of the "kind of home they want" just to make sure all the bases are covered - down payment AND cost(s) of the transaction. Folks, that's a lesser down payment than Owner Finance options for the same "kind of home" as Owners generally ask for 10-15% down.

This total can be a combination of self-savings, down payment assistance, assets that can be used as collateral against the loan, monetary or tangible gifts from friends/family members in some few cases, and more.

Each person is unique and different in how that 6-8% manifests and lenders can vary in what form(s) of down payment they will accept.

EXAMPLE:

Purchase Price: $150k

FHA Down Pymt (3-5%): $4,500 - $7,500

Other Cost(s): (3% +/-): $4,500

Total Savings Needed: $9,000 - $12,000

Kill some bills, sell your "junk" - we all got crap laying around the house we don't use worth money in various amounts - and modify spending habits in a positive manner.

If you are a two car family... can you get by with just one vehicle on a temporary basis [turn that car, and its bills, "into" a house]? Perhaps you have a skill set or piece of equipment that can earn you extra cash here and there on your terms? What changes to your lifestyle can you make that will put another dime or dollar into that kitty bucket?

Finally, do whatever it is you need to do to put those greenbacks into a savings method you can stick with. Whether that is a traditional banking institution or an old shoe box under the bed; you do you. If this means you have to ask someone in a position of trust to hold it so you don't spend it? Guess what you should consider doing?

STEP 2. - TALK TO LENDERS

Let's talk about the "When" of contacting a lender. The only true answer to "When" is... When You Are Ready and only you know how Ready you feel.

I've had clients express the sheer dread they felt about reaching out to a lender and it's an understandable fear. One of my people even said that they felt applying to lenders and having them see their credit condition was akin to stripping naked in front of a total stranger.

But, and as I told my client... think of it like going to the doctor for a full physical exam. Hospital gown over your birthday suit and all. Lenders are professionals there to do a job. They do NOT judge or speculate just because they have intimate knowledge of or about you.

If you suspect you may have some homework to do, credit wise, then it's better to contact a lender sooner rather than later. This allows you to get a game plan together and knock out credit related targets while you are saving funds for your down payment goal. Once completed, you are able to resume your application with confidence moving forward.

"Everything You Want Is On The Other Side of Fear" - Jack Canefield

However, if you are one of the few who feel their credit profile will be a "non-issue" then my suggestion becomes waiting to speak to lenders until you have most, if not all, of your down payment goal met.

When applying to a lender always ask if they perform a Soft or Hard inquiry against your credit report. Most of the lenders I know [and I will list two of my favorites for you here in a second] will execute a Soft Credit Inquiry to determine credit worthiness. This Soft Inquiry does not impact or affect your credit score - should such be a matter of concern to you.

Something else I've noticed is that people don't seem to understand shopping for lender is very much like shopping for an automobile. The overall requirements of any one particular lender (or dealership) can be totally different from a fellow lender's (or dealership's).

Just because one says "No" does not mean they will all will say "No". And even if the first lender tells you "Yes"... I would still encourage you to apply to more than one who does Soft Inquiries. Compare apples to oranges to find the best fit for your home purchasing needs by reviewing interest rates, terms of repayment, mutual rights and remedies, and so on and so forth.

Only after you have secured lender approval (which may be conditional based on various factors) and they have given you the green light to shop up to the amount of $X.00 do you move on to Step 3.

STEP 3 - FIND YOUR REALTOR

The vast majority of the population feels the path to homeownership is "finding the home and then buying it" - through a Real Estate agent. This is NOT the case.

Selecting an agent to help navigate you through the complexities of The Offer and Purchase process is the absolute LAST step to be taken.

What Happens When You Do It Backwards:

You shop for, and find, that PERFECT place and then reach out to an an agent or contact the website that is listing that property. The agent involved determines you haven't spoken with a lender and may now recommend one to get the process started.

Just to let you know... most of us agents are unable to do much of anything at this point without your having secured a lender first. There are some agents out there who are also qualified mortgage consultants but I, personally, haven't met one yet so I don't know how they work.

At this point the agent may also put you on an e-mailer list that scouts the MLS's and regularly sends you properties "matching" the ideal home that you originally asked about.

Why?

Because "that home may not still be there when you are in a position to buy". That's agent speak for... this is gonna take a bit of second and that property will most likely have sold by the time we get you lender approved.

I can't emphasize enough the fact that we agents don't "GET" you that house - the lender does that by providing the loan to pay for it. Us agents help you shop for a home and protect your best interests when buying it.

We deal with the butt-ton of technical paperwork coming/going from every which-a-way at all hours of the day, manage the contract negotiations, handle scheduling and execution of services by professional providers involved in the transaction, are your personal defacto counselor/moral support during the stress mess of buying, and more. None of which can be done until a lender gives us the green light to begin.

Well, most folks aren't mentally or emotionally prepared to reach out to said lender on the fly like this. Fears of "what that lender will see" or personal misgivings about "not qualifying" due to credit condition can halt the whole process at this point. Perhaps leaving you with negative emotions about the whole experience thus far.

But, for the sake of argument let's say you muster up the courage to reach out to a lender anyway. You'll discover that they are people too - most with a generous heart and helpful personality.

You might even discover that your credit was nowhere near as bad as you had built it up in your mind to be. Or, the lender may come back with a little homework for you. Take care of This and That and we'll be able to get you into a home.

The "whammy" of doing it in reverse order like this is that the lender will also share that you will need X thousands of dollars as a down payment to make that happen. Talk about a case of sticker shock!

Obviously, this can be discouraging and disheartening. To overcome one obstacle only run smack dab into another you weren't prepared to tackle? It may start to feel like you are looking up the side of a mountain, the goal of owning a home clearly in your line of sight, but you lack the climbing equipment (not to mention the funds to acquire such) to reach the summit.

It may feel like "that's it, game over" at this point. I know because I, too, approached home ownership azz-backwards like this before I became a Realtor. Felt like someone had ripped a bit of my soul away and left me frustrated and crying inside my heart and mind.

DON'T give up on yourself or your dream of home ownership. Back up, regroup, and attack that goal again. This time, in the correct sequence of events.

"You May Have To Fight A Battle More Than Once To Win It" - Margaret Thatcher

Do this and I promise you that there will be no better feeling in the world than those you experience at the closing table when you are finally handed the keys to your very own home.

Disclaimer: Opinion Editorial for educational and/or informational purposes. Content presented is deemed accurate and/or reliable at the time of authorship. Any errors or omissions present in material(s) are unintentional. You are encouraged to execute your own research.

1 note

·

View note

Text

Finding a girl who actually cares enough about me, and wants to be with me, irrespective of my Asperger's and ADHD means a LOT to me and I am unable to fully express my gratitude.

I can't wait to meet her and get to know her in person, but even after 4 or 5 months, it feels like I've known her for years!

And sometimes, the ones furthest away mean a lot more than the ones on your doorstep.

She is planning on coming to England to visit her cousin, and meeting me for the first time, in September 2020, but I would like to surprise her by going to Canada in the Spring (around April time for my birthday) and I need all the help I can get to visit her and meet her for the first time.

After feverishly pouring over plans, I have found that I can be with my love, in the flesh, for a total of £650 (Flight and Electronic Travel Visa). I work hard work and do overtime, but with bills, mortgage and expenses...there’s no such thing as “extra money”. You know how much I need.

If I don’t make it all, I’ll save it until I can add to it. If I get more I’ll give her the best date of her life! Anything you can donate will help this girl get her romantic happy ending.

I know it's a big ask, but love prevails and I want to meet her sooner, rather than later.

Anything you can spare will help me greatly and if you don't want to give by credit card, I have provided my PayPal details so you can send it that way.

Thank you for your help!

https://www.gofundme.com/manage/mpka4-starcrossed-lovers/edit/overview

1 note

·

View note

Note

Another idea, Rich's(28) girlfriend is tired of all her friends having babies and kids and wants one of her own. Rich disagrees. She ends up cursing him as he finds himself getting dumber and childish as he regressed to her little 3 year old toddler girl trapped in diapers he can't help but use while he can no longer read or do math or even speak properly.

“Come on Rich, let’s just be mature and talk about it,” Ricki said. Her head hung low and her hands wore out the couch she sat on.“Babe, I really can’t talk about this, not again. I don’t care if all your buddies are doing it. I’m not ready to be a dad.”“Well, when will you be ready? For Christ’s sake your almost thirty, how much longer do I need to wait? Or are you hoping I’ll hit menopause before you’re ‘ready’?”“Don’t play that card, you know what my childhood was like.”“That excuse wore itself out a long time ago, Rich. I want a baby, I need a baby, why can’t you understand that?”“I do, I just don’t care. Do you forget just home much we earn? How much our car payments are? Our mortgage? And you want to drop a baby on top of that? I know you’re a woman and all but why don’t you take a second to actually think things through for once in your life?”“You think this is just cause I’m a woman? I can’t believe you! I told all my sisters you were different, that you really cared, but you’re just a sexist pig like all the rest!” Rich had had this conversation many times with countless women. The ending never really varied, they all leave him and find someone better.

He braced, letting her vent, it always went over better that way. But all he heard from her was her irate breathing. “I try, goddamnit I try so hard Rich. I just wanted to talk, that’s all. But you and your damn stupid attitude, well fine. You don’t want to talk? You don’t have to talk ever again!” Rich felt weird energy about the room as she screamed at him. He was used to the yelling, but it almost felt like the room was hotter. It was a penetrating heat, the kind that drains you and makes your eyes flutter. Rich felt that as his head started to swoon, he slumped into his chair and saw Ricki grab her coat and storm out, not five minutes later he was asleep and elusive dreams played out in front of his eyes.

Rich woke up to the smell of burning bacon, a trademark of Ricki’s cooking. He bristled, surprised she had stuck around unlike so many others, but expecting she did so only because she had much more to yell. Sitting up, something about his clothing felt just the slightest bit off, but sleeping in a lazy boy will do that. He carefully opened the door, finding Ricki at the stove. That was concerning enough, but she also hummed a lighthearted tune that didn’t really seem to fit the tenor of her rage last night. “Oh good, you’re up. I was worried that you might sleep right through breakfast.”“Um, thanks? But aren’t you like, mad? You were yelling pretty loud last night,” Rich said. He shifted from foot to foot awkwardly, rubbing his arm expecting the hammer to drop. Instead, she smiled, a motherly sort of smile. “Oh sweetie, it’s all water under the bridge. You were right, I was getting a little emotional, but I’ve taken some steps to fix everything, don’t you worry.” Rich was stunned, this was new. He smiled and practically felt like dancing. He nearly skipped to the table as Ricki brought him a platter of eggs, hash-browns, and various meats.

Usually Rich didn’t go in for such lavish breakfasts, but this was apparently her form of apology. She didn’t wait for him to grab his fork and speared a healthy amount of scrambled eggs, bringing the prongs near his mouth. Still unwilling to rekindle the rage he saw last night, he opened his mouth and allowed her to feed him. It was surprisingly relaxing for him, there was a small part of him that said that this was emasculating, but it was much quieter than it normally was. He was also surprised by the quality of the food she was giving him. Typically, she could only produce black charcoal to eat, she must have been practicing lately. The thought of her, slaving away at a cookbook, working hard to improve herself, made a pit of guilt for in Rich’s stomach. Before he had time to apologize or truly process that guilt, his meal was done she ushered him to their room to prepare for the workday.

He donned his usual business casual outfit, he didn’t vary too much in his work attire. This morning, however, his clothing didn’t quite sit right. His shoulders seemed almost narrower and his shirt sleeves rubbed against his wrists. His belt even required an extra notch to hold his pants up, that one was at least welcome. But, once again, before he had any time to process these laundry accidents, Ricki had handed him a bottle of water and a lunch and encouraged him into the car, which in another uncharacteristic move, she drove.

“Have a good day, Sweetie! I’ll pick you up later, just going to do some shopping.” Ricki said.“But, I can drive myself—” Rich began.“Don’t be silly, this way saves on gas and time. Now march on up there and make me proud.” Ricki said as she sped away, leaving Rich with very little choice in the matter. Rich stared at the tall building, feeling alone. His cuff chaffed his wrist, his bag lunch felt heavy in his hand, and he felt an odd sense of being out of place. His feeling was only compounded when he stepped through the threshold of the office door. The firm was already crawling with activity, which only served to unsettle Rich more. Everything seemed larger, not just in the physical sense, it almost seemed like everything here wasn’t meant for him. His awkward pace wasn’t peppy enough for someone, and he soon heard his name, followed by several expletives, and was commanded to join the others in the boardroom.

“Alright everybody, I’m only gonna say this once, we’re in real deep shit. Our clients are pulling out, controversy after controversy has desensitized the public and they’re more litigious and organized than ever. If this advertising company is gonna survive, as it has managed to do for the past hundred years, we need a fresh new take. Something that will appease those whiny fuckin’ millennial and our diehards. I am not gonna be the one at the helm when this company goes down, so if anyone has an idea, you better speak up now.” Rich only feigned attention. He was a supposed to care, he wanted to care but something, a hazy sense of boredom held him back from it. It was as though the CEO were miles away speaking to him. An intern, especially one as hungry as he was should’ve leaped at the opportunity, sunk his claws into it and never let go. But instead, Rich sat quietly and doodled in a yellow legal pad. His scribbles were nothing a twenty-eight-year-old should be proud of, but in his mind, he was crafting a masterwork. Unicorns danced in fields, ballerina knights slew smelly dragons, and princesses adorned themselves with the prettiest dresses imaginable. “Who the hell are you?!” The CEO called out, directly at him. It was so loud and so jarring that it snapped him back violently to reality and his head swirled trying to regain his bearings. “M—me?” He said.“Yeah, you. This is a staff meeting and I certainly didn’t hire any teens recently. Are somebody’s kid or what?” Rich darted his eyes to and from each coworker, silently asking for help of any kind. “Um, I’m Rich, the intern?” He said, as unsure as everyone else seemed to be.“Bullshit. That guy is almost thirty, you little missy don’t look a day over sixteen. Now tell me who you are or get out, I’m not in the mood to play babysitter.” Sixteen? Missy? What was he talking about? But as Rich stood up and his shirt cuff swallowed his hand, and his pants nearly fell to his ankles, he had an idea of why he said what he said.

Rich did as he was told and shuffled out of the boardroom, retaining his pants to his waist with his hand. His cheeks felt hot and his eyes were growing misty with anxious confusion. His first instinct was to run to the bathroom as fast as his small legs could take him. Is it secured hand slammed and locked the door. He approached the mirror cautiously, his boss hadn’t even recognized him and though there was no reason for it his legs moved like weights and his dress shirt dad is misty eyes preparing him for what he would see. In the cheap mirror, he could find almost no trace himself. His angular features had softened, his cheeks were puffy, his eyes were red, and here it lost and no less than a foot and a half of his former 5 foot 10. He watched his bottom lip quiver as his eyes search for any sort of answer. His shirt hung limply on slender shoulders and his hands could not be seen, but they felt delicate as if never having seen a day of work. His belt was all but useless and his pants fell to the floor. The elastic band of his underwear still did its job, but even beneath that had not been spared from whatever was happening to him. His cock was nothing to write home about before, but now it’s imprinted in his underwear is barely visible and to his distraught eyes seemed to grow even smaller.

His legs panicked and he ran back to his desk giving no thought to his state of dress. He scrambles for the receiver of his office phone neither caring nor aware of the eyes watching his diminutive form. He punched in the numbers for Ricki’s phone, he knew the number by heart. At least he thought he did. Instead of his beautiful girlfriend, a crotchety old man answered the phone demanding why he called him at such a late hour. Rich apologized, claiming the old excuse or the wrong number. His finger must have slipped, so he tried again and of this time connected with the New York Museum of Natural History. He tried a third, fourth, and the fifth time, failing each. His eyes were no longer misty and full sorrowful tears cascaded down his soft cheeks. He sat on the floor using his sleeve to wipe his eyes, his shirt now functioning more like a dress. His coworkers around him stood confused, wondering just who have brought their daughter into work today. Before anyone else could take charge of the situation, someone strode in from the main door and kneeled down near the distraught 28-year-old man who sat in a small puddle of fear induced urine. “Shhh, it’s alright sweetie, mommy’s here.“

“Alright now raise those arms!” Ricki said with a smile, feeling a purer joy that she could recall. The tiny, wet little girls arms shot into the air excitedly, happy to feel her mothers warm embrace again. The towel collected every stray bit of water that’s still clung to her body. “Okey-dokey sweetie, is my big girl ready for her diaper?“ She didn’t wait for an answer as she collected the supplies to change little girl. It was a well practice procedure by now and she already laid on the changing mat ready. She squeals excitedly as the powder tickled her thighs and covered her exposed bottom. Each noise of excitement fills Ricki with happiness that just days ago she felt she would never hear. Once the tapes are secured, the excitable little girl hops up and latches onto her mother’s leg. She doesn’t see the soft tear escaping from her mother’s eyes. “I didn’t want it to go this way Rich, but I’m so happy it did,” she said she lumbered into the kitchen, the happy weight still clinging to her leg, to prepare a beautiful steak dinner for herself, and a sliced hot dog for her beautiful daughter.

The End. Hope Y’all like it!

21 notes

·

View notes

Text

No one wants to talk about this, but we all should be. - The EVERYTHING short PART 1 (original research by u/atobitt on Reddit) - If you've heard about Gamestop, you should read this to get a better idea what's really going on.

source

part two here;

4/4/2021 EDIT: Just got done watching this review (2:09:37) from George Gammon and Meet Kevin. As pointed out by George, the link I posted below talking about the submitted repo amount was ONLY showing the NY Fed's total for that day. According to his own research, he suspects that $4 TRILLION is pumped through this market, EACH DAY.

4/1/2021 EDIT: GREAT NEWS APES! u/dontfightthevol has been reviewing my post and helping me address weaknesses! I take this as REALLY good news as we move another step closer to exposing the TRUTH. Furthermore, I am making updates that take speculative connections out of this post.

The first one being the WSJ article covering BlackRock, where the fed has tapped them to purchase bonds for the government. These bonds consist of mortgage backed securities and corporate bonds- NOT TREASURIES. While this does not destroy the concept within the post, it DOES remove a link between the speculative relationship of BlackRock and Citadel. Citadel is still shorting bonds, other hedge funds are shorting bonds, BlackRock just isn't buying treasuries from the government. There are plenty of other financial institutions lending out their treasury bonds.

We are still discussing the post and I will make updates as they are available.

STAY TUNED!

________________________________________________________________________________________________________

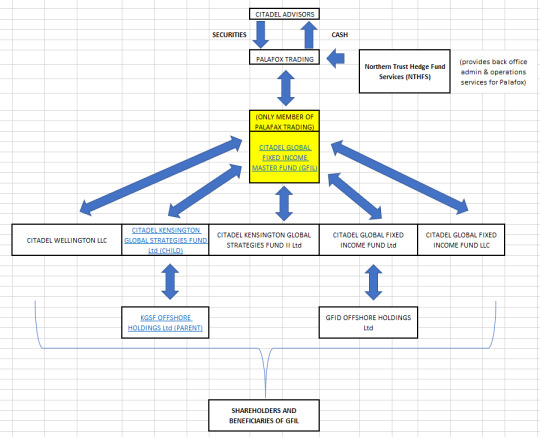

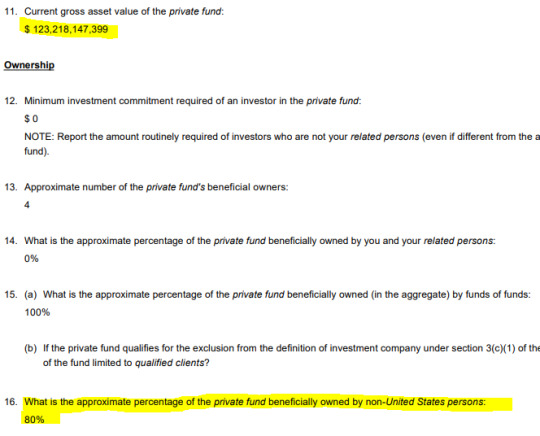

TL;DR- Citadel and friends have shorted the treasury bond market to oblivion using the repo market. Citadel owns a company called Palafox Trading and uses them to EXCLUSIVELY short & trade treasury securities. Palafox manages one fund for Citadel - the Citadel Global Fixed Income Master Fund LTD. Total assets over $123 BILLION and 80% are owned by offshore investors in the Cayman Islands. Their reverse repo agreements are ENTIRELY rehypothecated and they CANNOT pay off their own repo agreements until someone pays them, first. The ENTIRE global financial economy is modeled after a fractional reserve system that is beginning to experience THE MOTHER OF ALL MARGIN CALLS.

THIS is why the DTC and FICC are requiring an increase in SLR deposits. The madness has officially come full circle.

____________________________________________________________________________________________________________

My fellow apes,

After writing Citadel Has No Clothes, I couldn't shake one MAJOR issue: why do they have a balance sheet full of financial derivatives instead of physical shares? Even Melvin keeps their derivative exposure to roughly 20%...(whalewisdom.com, Melvin Capital 13F - 2020)

The concept of a hedging instrument is to protect against price fluctuations. Hopefully you get it right and make a good prediction, but to have a portfolio with literally 80% derivatives.... absolute INSANITY.. it's is the complete OPPOSITE of what should happen.. so WHAT is going on?

Let's break this into 4 parts:

Repurchase & Reverse Repurchase agreements

Treasury Bonds

Palafox Trading

Short-seller Endgame

____________________________________________________________________________________________________________

Ok, 4 easy steps... as simple as possible.

Step 1: Repurchase & Reverse Repurchase agreements.

WTF are they?

A Repurchase Agreement is much like a loan. If you have a big juicy banana worth $1,000,000 and need some quick cash, a repo agreement might be right for you. Just take that banana to a pawn shop and pawn it for a few days, borrow some cash, and buy your banana back later (plus a few tendies in interest). This creates a liability for you because you have to buy it back, unless you want to default and lose your big, beautiful banana. Regardless, you either buy it back or lose it. A reverse repo is how the pawn shop would account for this transaction.

Why do they matter?

Repos and reverse repos are the LIFEBLOOD of global financial liquidity. They allow for SUPER FAST conversions from securities to cash. The repo agreement I just described is happening daily with hedge funds and commercial banks. EDIT: Inserting the quote from George Gammon: according to his calculations, the estimated total amount of repos are $4 TRILLION, DAILY. The NY Fed, alone, submitted $40.354 BILLION for repo agreements on (3/29). This amount represents the ONE DAY REPO due on 3/30. So yeah, SUPER short term loans- usually a few days. It's probably not a surprise that back in 2008 the go-to choice of collateral for repo agreements was mortgage backed securities..

Lehman Brothers went bankrupt because they fraudulently classified repo agreements as sales. You can do your own research on this, but I'll give you the quick n' dirty:

Lehman would go to a bank and ask for cash. The bank would ask for collateral in return and Lehman would offer mortgage backed securities (MBS). It's great having so many mortgages on your balance sheet, but WTF good does it do if you have to wait 30 YEARS for the cash.... So Lehman gave their collateral to the bank and recorded these loans as sales instead of payables, with no intention of buying them back. This EXTREMELY overstated their revenue. When the market started realizing how sh*tty these "AAA" securities actually were (thanks to Michael BRRRRRRRRy & friends), they were no longer accepted as collateral for repo loans. We all know what happened next.

The interest rate in 2008 on repos started climbing as the cost of borrowing money went through the roof. This happens because the collateral is no longer attractive compared to cash. My favorite bedtime story is how the Fed stepped in and bought all of the mean, toxic assets to save the US economy.. They literally paid Fannie & Freddie over $190 billion in bailouts..

A few years later, MF Global would suffer the same fate when their European repo exposure triggered a massive margin call. Their foreign exposure to repo agreements was nearly 4.5x their total equity.. Both Lehman and MF Global found themselves in a major liquidity conundrum and were forced into bankruptcy. Not to mention the other losses that were incurred by other financial institutions... check this list for bailout totals.

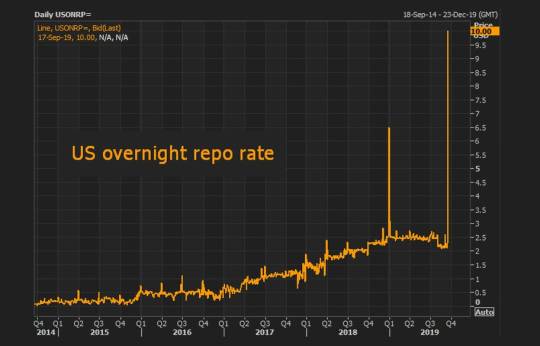

But.... did you know this happened AGAIN in 2019?

Instead of the gradual increase in rates, the damn thing spiked to 10% OVERNIGHT. This little blip almost ruined the whole show. It's a HUGE red flag because it shows how the system MUST remain in tight control: one slip and it's game over.

The reason for the spike was once again due to a lack of liquidity. The federal reserve stated there were two main catalysts (click the link): both of which removed the necessary funds that would have fueled the repo market the following day. Basically, their checking account was empty and their utility bill bounced.

It became apparent that ANOTHER infusion of cash was necessary to prevent the whole damn system from collapsing. The reason being: institutions did NOT have enough excess liquidity on hand. Financial institutions needed a fast replacement for the MBS, and J-POW had just the right thing.. $FED go BRRRRRRRRRRRRRRRRR

"but don't say it's QE.."

____________________________________________________________________________________________________________

Step 2: Treasury Bonds

Ever heard of the bond market? Well it's the redheaded step-brother of the STONK market.

The US government sells you a treasury bond for $1,000 and promises to pay you interest depending on how long you hold it. Might be 1%, might be 3%; might be 3 months, might be 10 years. Regardless, the point is that purchasing the US Treasury bond, in conjunction with mortgage backed securities, allowed the fed to keep pumping unlimited liquid tendies into the repo market. Surely, liquidity won't be an issue anymore, right?

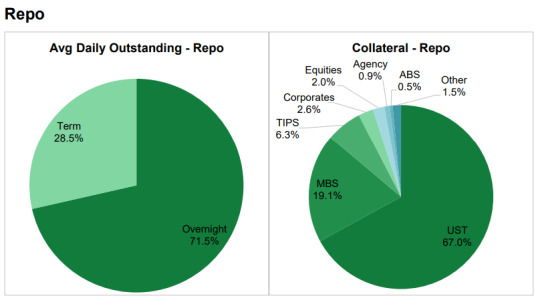

Now... take the repo scenario from the Lehman Brothers story, but instead of using ONLY mortgage backed securities, add in the US Treasury bond: primarily the 10-year. Note that MBS are still prevalent at 19.1% of all repo transactions, but the US Treasury bond now represents a whopping 67%.

For now, just know that the US Treasury has replaced the MBS as the dominant source of liquidity in the repo market.

____________________________________________________________________________________________________________

Step 3: Palafox Trading

Ever heard of Palafox Trading? Me either. It's pretty much meant to be that way.

Palafox Trading is a market maker for repurchase agreements. Initially, they appear to be an innocent trading company, but their financial statements revealed a little secret:

Are you KIDDING ME?... I should have known...

OF COURSE Citadel has their own private repo market..

Who else is in this cesspool?!

I made this using the financial statement listed above, showing all beneficiaries of the GFIL

Everything rolls into the Citadel Global Fixed Income Master Fund... This controls $123,218,147,399 (THAT'S BILLION) in assets under management... I know offshore accounts are technically legal for hedge funds.... but when you look at the itemized holdings of these funds on Citadel's most recent form ADV, it gives me chills..

Form ADV page 105-106....

Ok... ok.... let me get this straight....

The repo market provides IMMEDIATE liquidity to hedge funds and other financial institutions

After the MBS collapse in 2008, the US Treasury replaced it as the liquid asset of choice

Citadel owns 100% of Palafox Trading which is a market maker for repo agreements

This market maker provides liquidity to the Global Fixed Income Master Fund LTD (GFIL) through Citadel Advisors

80% of its $123,218,147,399 in assets under management belong to entities in the Cayman Islands

Ok.....I tore the bermuda, paradise, and panama papers apart and found that all of these funds boil down to just a few managers, but can't pin anything on them for money laundering... However, if there EVER were a case for it, I'd be extremely suspicious of this one...

The level of shade on all this is INCREDIBLE... There should be NO ROOM for a investment pool as big as Citadel to hide this sh*t.... absolutely ridiculous..

The fact that there is so much foreign influence over our bond & repo market, which controls the liquidity of our country, is VERY concerning..

____________________________________________________________________________________________________________

Step 4: Short-seller Endgame

Alright, I know this is a lot to take in..

I've been writing this post for a week, so reading it all at one time is probably going to make your head explode.. But now we can finally start putting all of this together.

Ok, remember how I explained that the repo rate started to rise in '08 because the collateral was no longer attractive compared to cash? That means there wasn't enough liquidity in the system. Well this time the OPPOSITE effect is happening. Ever since March 2020, the short-term lending rate (repo rate) has nearly dropped to 0.0%....

https://www.newyorkfed.org/markets/treasury-repo-reference-rates

So the fed is printing free money, the repo market is lending free money, and there's basically NO difference between the collateral that's being lent and the cash that's being received.. With all this free money going around, it's no wonder why the price of the 10 year treasury has been declining.

In fact, hedge funds are SO confident that the 10 year treasury will continue to decline, that they've SHORTED THE 10-YEAR BOND MARKET. I'm not talking about speculative shorting, I mean shorting it to oblivion like they've shorted stocks.

Don't believe me?

Hedge funds like Citadel Advisors must first locate the treasury bond in order to swap them for cash in the repo market. It's extremely difficult to do this with the fed because they're tied up in government BS, so they locate a lender in the market. These consist of other commercial banks and hedge funds.

NOTE: I MADE A COMMENT ABOUT BLACKROCK SUPPLYING TREASURY BONDS AND THIS IS NOT TRUE. UPON FURTHER REVIEW ( CREDIT u/dontfightthevol ) THESE BONDS CONSIST OF MBS AND CORPORATE BONDS. WHILE THE US TREASURY DEPARTMENT IS INVOLVED, THEY ARE NOT SUPPLYING TREASURY BONDS.

So financial institutions keep treasuries on reserve for hedgies like Citadel to short. Citadel comes along and asks for the bond, they throw it into Palafox Trading and collect their cash. So what happens when they need to pay for their repo agreement? Surely to GOD there are enough bonds floating around, right? Not unless hedge funds like Citadel have shorted more bonds than there are available.

Here's the evidence.

There have been 3 instances over the past year where the repo rate dipped below the "failure" rate of -3.0%. On March 4th 2021, the repo rate hit -4.25% which means that investors were willing to PAY someone 4.25% interest to lend THEIR OWN MONEY in exchange for a 10 year treasury bond.

This is a major signal of a squeeze in the treasury market. It's MAJOR desperation to find bonds. With the federal reserve purchasing them monthly from the open market, it leaves room for a shortage when the repo call hits. If commercial banks and hedge funds haven't purchased more treasuries since first lending them out, short sellers simply cannot cover unless they go into the market and PAY the bond holder for their bond. It's literally the same story as all of the heavily shorted stocks.

Still not convinced?

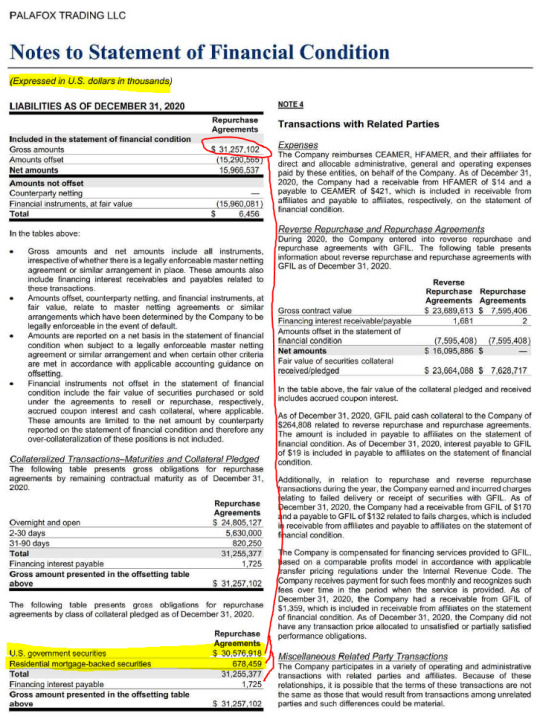

At the end of 2020, Palafox Trading listed $31,257,102,000 (BILLION) in GROSS repo agreements. $30,576,918,000 (BILLION) were directly related to repurchasing treasury bonds....

https://sec.report/CIK/0001284170

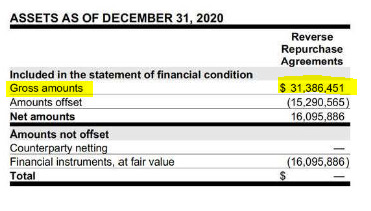

But what about their Reverse Repurchase agreements? Don't they have assets to BUY treasury bonds?SURE.. Take a look..

https://sec.report/CIK/0001284170

SeE tHeRe? I tOlD yOu ThEy HaD iT cOvErEd..

Yeaaaah... now read the fine print. (part 2)

#anime#text post#finance#stock market#fraud#crime#illegal#true#gamestop#crypto#corruption#evil#fashion#diy#photography#quote#meme#art#eat the rich#late stage capitalism

0 notes

Text

I ordered this wholesome commission of Santa and Virginia's ponified forms from https://www.deviantart.com/teonnakatztkgs

Please look under the cut for some important information

From the description

"I'm sharing this across as many platforms as I can as I'm faced with a horrible situation and desperately need help. In short I'm losing my home and need a down-payment for a new place. The renters market right now is insane. (Like 5000 sometimes 7000 dollars a month for RENT) I've managed to find a place but he refuses to go lower than 3000 down but the rent is doable with my income. But I have been on medical leave since early February due to seizure like activity while I was working. I still have my job and should be returning in April from medical leave. But the foreclosure starts in 2 weeks and ive been using my savings to get by and dont have anywhere near enough for a down-payment. I have begged the mortgage company to let me make payments to them and they have been shady and refusing for months and out of nowhere want to foreclose. It's not even my house I just live in it. They have been building up in my area for a while now and recently started a plaza very close to where I am. I don't know if it has anything to do with it but I need to move. My family will NOT help me with anything.

OK that out of the way.

I'm trying to save 3000$. It's a lot but I have to be able to get a down-payment. It's not just for my sake.

I will literally draw whatever you want however you want it.

Sketch doodle traditional: 1$

Sketch page traditional: 3$

Sketch page digital: 5-7$(comes flat colored more complex characters will be higher)

Black lineart fullbody: 10$

Colored lineart fullbody: 15$

Colored and shaded fullbody: 20$ (5$ more for each additional character)

Background: 10$

Customs:

Black lineart: 5$

Colored lineart: 10$

Adopts and OCs:

I'm selling EVERYONE except TK, Kalmin, Silver, and Silverstorm. I have cats, dogs, lions, ponys, etc. Just ask what your looking for I'm still trying to figure out how to use toyhouse to share them there. Depending on how much art they have they will be higher.

Please share if you can't buy"

#santasslay#santas slay#antichrist santa#virginia claus#virginia hollybubble#my little pony#mlp#mlp fim#mlp g4#mlp art#mlp oc

7 notes

·

View notes

Link

0 notes