#federal public sector

Text

OTTAWA - Federal ministers said Tuesday they are monitoring for blockades of critical roads and infrastructure as striking federal workers made good on a promise to ramp up their picket efforts by disrupting traffic and limiting access to office buildings in downtown Ottawa.

More than 150,000 federal public servants with the Public Service Alliance of Canada were on strike for the seventh straight day as their union representatives continued to negotiate with the government for a bigger wage increase and more flexibility to work remotely.

Around the National Capital Region, hundreds of striking workers made their presence felt and heard, circling buildings, chanting through megaphones and blasting music throughout the morning.

Hundreds of public servants marched across the Portage Bridge between Ottawa and Gatineau, Que., where some of the biggest federal buildings are located, holding up traffic for a short period Tuesday morning. [...]

Continue Reading.

Tagging: @politicsofcanada

64 notes

·

View notes

Text

Ending a 'nightmare' in Venezuela: How the US government brought seven Americans home | CNN Politics

Ending a ‘nightmare’ in Venezuela: How the US government brought seven Americans home | CNN Politics

CNN

—

On October 1, five of the so-called Citgo 6 were woken up early in their Venezuelan prison by a guard telling them to “get dressed up properly.”

The men put on their yellow prison suits – “We called it our ‘Minion’ suit,” Jose Pereira said – before they were instructed by the head of the prison to instead change into civilian clothes.

“We said, ‘Why?’ and he said, ‘Well, because you’re…

View On WordPress

#aircraft#aviation and aerospace industry#Business#business and industry sectors#conflicts and war#continents and regions#economy and trade#government and public administration#government bodies and offices#joe biden#Latin America#north america#political figures - us#political prisoners#Politics#south america#the americas#united states#unrest#us federal government#Venezuela#white house

0 notes

Text

"Seven federal agencies are partnering to implement President Biden’s American Climate Corps, announcing this week they would work together to recruit 20,000 young Americans and fulfill the administration's vision for the new program.

The goals spelled out in the memorandum of understanding include comprehensively tackling climate change, creating partnerships throughout various levels of government and the private sector, building a diverse corps and serving all American communities.

The agencies—which included the departments of Commerce, Interior, Agriculture, Labor and Energy, as well the Environmental Protection Agency and AmeriCorps—also vowed to ensure a “range of compensation and benefits” that open the positions up to a wider array of individuals and to create pathways to “high-quality employment.”

Leaders from each of the seven agencies will form an executive committee for the Climate Corps, which Biden established in September, that will coordinate efforts with an accompanying working group. They will create the standards for ACC programs, set compensation guidelines and minimum terms of service, develop recruitment strategies, launch a centralized website and establish performance goals and objectives. The ACC groups will, beginning in January, hold listening sessions with potential applicants, labor unions, state and local governments, educational institutions and other stakeholders.

The working group will also review all federal statutes and hiring authorities to remove any barriers to onboarding for the corps and standardize the practices across all participating agencies. Benefits for corps members will include housing, transportation, health care, child care, educational credit, scholarships and student loan forgiveness, stipends and non-financial services.

As part of the goal of the ACC, agencies will develop the corps so they can transition to “high-quality, family-sustaining careers with mobility potential” in the federal or other sectors. AmeriCorps CEO Michael Smith said the initiative would prepare young people for “good-paying union jobs.”

Within three weeks of rolling out the ACC, EPA said more than 40,000 people—mostly in the 18-35 age range—expressed interest in joining the corps. The administration set an ambitious goal for getting the program underway, aiming to establish the corps’ first cohort in the summer of 2024.

The corps members will work in roles related to ecosystem restoration and conservation, reforestation, waterway protection, recycling, energy conservation, clean energy deployment, disaster preparedness and recovery, fire resilience, resilient recreation infrastructure, research and outreach. The administration will look to ensure 40% of the climate-related investments flow to disadvantaged communities as part of its Justice40 initiative.

EPA Administrator Michael Regan said the MOU would allow the ACC to “work across the federal family” to push public projects focused on environmental justice and clean energy.

“The Climate Corps represents a significant step forward in engaging and nurturing young leaders who are passionate about climate action, furthering our journey towards a sustainable and equitable future,” Regan said.

The ACC’s executive committee will hold its first meeting within the next 30 days. It will draw support from a new climate hub within AmeriCorps, as well as any staffing the agency heads designate."

-via Government Executive, December 20, 2023

-

This news comes with your regularly scheduled reminder that WE GOT THE AMERICAN CLIMATE CORPS ESTABLISHED LAST YEAR and basically no one know about/remembers it!!! Also if you want more info about the Climate Corps, inc. how to join, you can sign up to get updates here.

#climate corps#american climate corps#acc#biden#biden administration#americorps#epa#environmental protection agency#sustainability#conservation#climate action#climate change#climate crisis#climate emergency#environmentalism#global warming#united states#us politics#hopeposting#hope posting#national forest#public lands#disaster prevention#environment#ecosystem restoration#waterways#recycling#clean energy#reforestation#disaster preparedness

961 notes

·

View notes

Text

Things Biden and the Democrats did, this week #10

March 15-22 2024

The EPA announced new emission standards with the goal of having more than half of new cars and light trucks sold in the US be low/zero emission by 2032. One of the most significant climate regulations in the nation’s history, it'll eliminate 7 billion tons of CO2 emissions over the next 30 years. It's part of President Biden's goal to cut greenhouse gas emissions in half by 2030 on the road to eliminating them totally by 2050.

President Biden canceled nearly 6 Billion dollars in student loan debt. 78,000 borrowers who work in public sector jobs, teachers, nurses, social workers, firefighters etc will have their debt totally forgiven. An additional 380,000 public service workers will be informed that they qualify to have their loans forgiven over the next 2 years. The Biden Administration has now forgiven $143.6 Billion in student loan debt for 4 million Americans since the Supreme Court struck down the original student loan forgiveness plan last year.

Under Pressure from the administration and Democrats in Congress Drugmaker AstraZeneca caps the price of its inhalers at $35. AstraZeneca joins rival Boehringer Ingelheim in capping the price of inhalers at $35, the price the Biden Admin capped the price of insulin for seniors. The move comes as the Federal Trade Commission challenges AstraZeneca’s patents, and Senator Bernie Sanders in his role as Democratic chair of the Senate Health Committee investigates drug pricing.

The Department of Justice sued Apple for being an illegal monopoly in smartphones. The DoJ is joined by 16 state attorneys general. The DoJ accuses Apple of illegally stifling competition with how its apps work and seeking to undermining technologies that compete with its own apps.

The EPA passed a rule banning the final type of asbestos still used in the United States. The banning of chrysotile asbestos (known as white asbestos) marks the first time since 1989 the EPA taken action on asbestos, when it passed a partial ban. 40,000 deaths a year in the US are linked to asbestos

President Biden announced $8.5 billion to help build advanced computer chips in America. Currently America only manufactures 10% of the world's chips and none of the most advanced next generation of chips. The deal with Intel will open 4 factories across 4 states (Arizona, Ohio, New Mexico, and Oregon) and create 30,000 new jobs. The Administration hopes that by 2030 America will make 20% of the world's leading-edge chips.

President Biden signed an Executive Order prioritizing research into women's health. The order will direct $200 million into women's health across the government including comprehensive studies of menopause health by the Department of Defense and new outreach by the Indian Health Service to better meet the needs of American Indian and Alaska Native Women. This comes on top of $100 million secured by First Lady Jill Biden from ARPA-H.

Democratic Senators Bob Casey, Tammy Baldwin, Sherrod Brown, and Jacky Rosen (all up for re-election) along with Elizabeth Warren, Cory Booker, and Sheldon Whitehouse, introduced the "Shrinkflation Prevention Act" The Bill seeks to stop the practice of companies charging the same amount for products that have been subtly shrunk so consumers pay more for less.

The Department of Transportation will invest $45 million in projects that improve Bicyclist and Pedestrian Connectivity and Safety

The EPA will spend $77 Million to put 180 electric school buses onto the streets of New York City This is part of New York's goal to transition its whole school bus fleet to electric by 2035.

The Senate confirmed President Biden's nomination of Nicole Berner to the Court of Appeals for the Fourth Circuit. Berner has served as the general counsel for America's largest union, SEIU, since 2017 and worked in their legal department since 2006. On behalf of SEIU she's worked on cases supporting the Affordable Care Act, DACA, and against the Defense of Marriage act and was part of the Fight for 15. Before working at SEIU she was a staff attorney at Planned Parenthood. Berner's name was listed by the liberal group Demand Justice as someone they'd like to see on the Supreme Court. Berner becomes one of just 5 LGBT federal appeals court judges, 3 appointed by Biden. The Senate also confirmed Edward Kiel and Eumi Lee to be district judges in New Jersey and Northern California respectively, bring the number of federal judges appointed by Biden to 188.

#Thanks Biden#Joe Biden#Democrats#politics#US politics#climate change#climate crisis#student loans#debt forgiveness#shrinkflation#women's health#drug prices

445 notes

·

View notes

Text

Half the workers at Eilat Port are on the verge of losing their jobs after the seaport took a major financial hit due to the crisis in Red Sea shipping lanes, Israel’s main labor federation says.

Eilat sits on a northern tip of the Red Sea and was one of the first ports to be affected as shipping firms rerouted vessels to avoid attacks by the Houthis in Yemen.

The Histadrut labor federation, the umbrella organization for hundreds of thousands of public sector workers, says port management has announced it intends to fire half of the 120 employees. The dock workers will hold a protest later today, it says.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#houthis#red sea#red sea blockade#ansarallah#ansar allah

543 notes

·

View notes

Text

One of my favorite things about Control is just how completely and utterly nuts/bonkers/GONE the FBC is as one of these ‘secret government blackops’ groups.

Like this is a trope we’re all fairly familiar with at this point; some secret government organization formed to monitor, contain and research all kinds of weird shit and keep it secret from the public. Also they may or may not have kinda gone totally rogue somewhere along the way and might now answer only to themselves at this point in a ‘who watches the watchers?’ commentary on the need for oversight.

But the more you find out about the Federal Bureau of Control, the more it becomes clear they just so utterly past ANY of that by the time the game begins. And have been for basically the last fifty some odd years.

Like here is a basic overview of the FBC that you learn within the first thirty or so minutes of the game: They are a secret government organization dedicated to the containment, cataloguing and research of supernatural artifacts and events. They are headquartered in what they call ‘The Oldest House’, a tall, imposing yet utterly nondescript building in the middle of New York City that is literally impossible for anyone to enter or even notice unless they already know about it. And the interior of the building is actually a twisting extradimensional labyrinth that also opens up to other dimensions/realities and might actually be the World Tree Yggdrasil. It also kind of hates any technology made in the last twenty years. And apparently Number 2 Pencils.

Oh, and the FBC doesn’t really report to the US Government. They report to a floating, inverted black pyramid that exists in a space outside of known reality that might also be the collective human subconscious. The pyramid is colloquially referred to as ‘The Board’ and they are an extradimensional entity/group of entities that appoints the Director of the FBC via the use of a physics-defying geometric gun called ‘The Service Weapon’ that is probably Excalibur/Mjolnir/every other legendary weapon in human myth. They also speak in word-salads and probably know they are in a video game.

See, back in 1964 when the FBC first discovered The Oldest House, they basically decided ‘WOW, this place is cool! Let’s make it our new headquarters!’ and promptly moved in. This was also when the current Director at the time found the Service Weapon within The Oldest House, made contact with/was chosen by The Board and from the point on the FBC really hasn’t answered to the US Government anymore.

Also, the Government basically doesn’t even know the Bureau even EXISTS anymore. Remember how The Oldest House has this kind of ‘Perception Filter’ that prevents almost anyone from entering it or even noticing it, which is how basically nobody can find it despite the fact that it is right in the middle of New York City? Well, after they moved in and became effective ‘residents’ of the house, this filter started applying to the FBC itself. They basically CAN’T be noticed or remembered at this point by anyone who isn’t part of the organization. The reason this secret organization can operate entirely off the grid and can’t be tracked is because they literally have freaky extradimensional reality-warping covering their tracks.

This is what I meant when I said that the FBC is just so far GONE. At this point, the FBC is itself a crazy, supernatural thing in and of itself.

Other fun details about the FBC include:

The Bureau facilities in The Oldest House are not powered by coal, oil or nuclear power. No, instead the lights are kept on by a former director who went a tad power-mad and lost control of his pyrokinesis, so the Bureau locked him up in a giant ‘Sarcophagus Containment’ unit and now use him as a power-generator. He also sometimes talks through the waste-disposal furnace to try and get people to bring him human sacrifices.

The maintenance sector of the FBC includes an area called the ‘Black Rock Quarry’. The so called ‘black rock’ is an extra-dimensional mineral that, among other things, blocks and dampens supernatural effects and abilities. Needless to say, the Bureau mines the stuff extensively. Now, despite being within The Oldest House, the Black Rock Quarry is an open-top quarry. To space.

One of the ways Bureau personnel get around is via pull-strings that show up all over The Oldest House. Pull a string three times and you are transported to the Oceanview Motel, a quaint little motel that probably exists outside of known reality because no one has ever been able to actually go or see outside the motel. Once you’re there, you just ring the bell on the front desk three times, do some random task and procure a room key. The key opens a door, but only one with an inverted black pyramid. From there, you pull another string and are transported back to somewhere else in The Oldest House. So basically a rather convoluted teleportation system. There are also doors with other symbols that probably go to other realities, but the Bureau hasn’t figured out how to open them. Though one does seem to lead to a void of malevolent darkness that feeds off human creativity and is currently holding one Alan Wake.

Also, the bureau’s janitor is probably a Finnish Sea God.

#control#control 2019#federal bureau of control#ahti the janitor#rambling about one of my favorite games

2K notes

·

View notes

Text

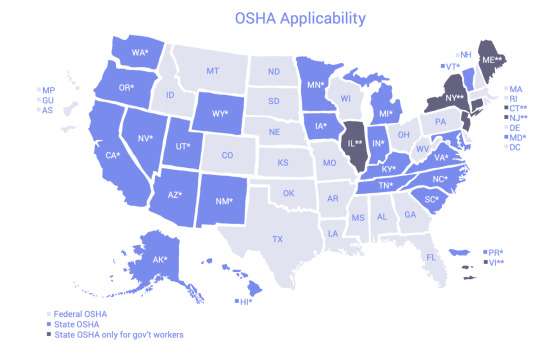

Who is protected by OSHA?

The most frequently asked question I recieve is "Am I even covered by OSHA?" It's not always clear who is and isn't covered by OSHA, and there can even be room for interpretation.

The official text on OSHA.gov states:

"The OSH Act covers most private sector employers and their workers, in addition to some public sector employers and workers in the 50 states and certain territories and jurisdictions under federal authority."

In order to fall under OSHA jurisdiction you must be an employee working in the US or a US territory. There are a number of exceptions however. Private sector employees not covered by OSHA are:

"self-employed workers (independent contractors), immediate family members of farm employers, and workers whose hazards are regulated by another federal agency"

Follow this link to see list of other US regulatory agencies

Federal OSHA also does not cover employees of government agencies, which includes: public schools/universities, public transit agencies, and first responders such and firefighters and law enforcement.

However public sector employees are required to be covered in states that have an OSHA approved state plan. The map below shows which states have their own OSHA plans.

(Source: sixfifty.com)

You can visit OSHA.gov/stateplans to learn more about your OSHA coverage

248 notes

·

View notes

Text

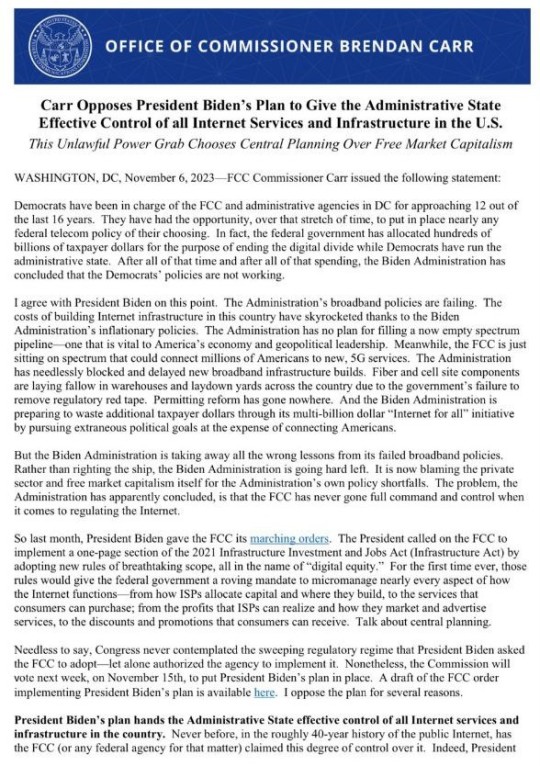

HIGHEST IMPORTANCE ‼️

Today or tomorrow The Government Will Vote For The Biden Administration To Take TOTAL CONTROL Of The Internet

President Biden's Plan to Give the Administrative State Effective Control of all Internet Services and Infrastructure in the U.S.

FCC Commissioner, The Joe Biden Administration Has Put Together & Is Planning On Implementing The Most Comprehensive Internet Censorship/ Control Plan In History. The Government Will Assume “Effective Control Of All Internet Services”

Elon musk you definitely need to see this. 👀

The Biden administration has just put forward a plan for digital equity. And it is a plan for all internet services and all infrastructure.

According to FCC Commissioner Carr, President Biden's plan hands the administrative state effective control of all internet services and infrastructure in the country. Never before in the roughly 40-year history of the public internet has the FCC, or any federal agency for that matter, claimed this degree of control over it.

The plan calls for the FCC to apply a far-reaching set of government controls that the agency has not applied to any technology in the modern era.

You got that? This has never been done before. No communication devices have ever had this kind of control suggested by the government, let alone applied.

He went on and said, Congress never contemplated the sweeping regulatory regime that president Biden asked the FCC to adopt, let alone authorize the agency to implement it. Here's what's happening. As with everything else the Biden administration is doing, his broadband policies are failing and the building of internet infrastructure in this country, uh, the price of it has gone through the roof.

FCC wants new 5G broadband services, but it's all needlessly been blocked and delayed by new broadband infrastructure regulatory red tape. So the government is blocking the private sector from doing it and then using that to say, see, we need to take complete control.

This is breathtaking control of all information.

The rules, the the rules that are suggested and are going to be voted on, quick, hurry, next week, the federal government has a roving mandate to micromanage nearly every aspect of how the internet functions. 🤔

Are you ready for this? 🤔

#pay attention#educate yourselves#educate yourself#reeducate yourself#knowledge is power#reeducate yourselves#think for yourselves#think about it#think for yourself#do your homework#do your own research#do some research#ask yourself questions#question everything#fcc#government corruption#5g

162 notes

·

View notes

Text

The consequences of [the summer 2020] events are still underestimated by commentators and activists alike. Some suffer induced amnesia about the revolt; others have moved on to simple commemoration; still others continue isolated but no doubt justified forms of subversive action. Meanwhile, forces in local and federal government, business associations, police departments, and armed militias have continuously worked to make sure a popular uprising does not reoccur.

In addition to passing laws and killing dissidents, this institutional reaction has focused on managing public perception. Industrial interests and private investment companies have conducted influence campaigns using local news outlets—40% of which are owned by Sinclair Broadcast Group, a right-wing organization with ties to former US President Donald Trump. Between Sinclair, Nexstar, Gray, Tegna, and Tribune, this coordinated reframing of events has damaged the way that many sectors of the television-viewing public perceive the revolt and its consequences.

In the wake of the uprising, a false narrative circulated to the effect that the police, demoralized and underfunded, could not control the “crime wave” sweeping the country. This narrative, orchestrated in response to the popular demand to “defund the police” advanced by some sections of the 2020 revolt, has shaped the imaginations of suburban whites, small business owners, and many urban progressives. The “crime wave” framework implied that police departments around the country had in fact been defunded or had their powers curtailed and were consequently unable to assure social peace or free enterprise. In reality, the vast majority of police departments received an annual increase in their budgets, as they normally do. If anything, they accrued more power following the events of 2020, from the political center as well as the right—witness the accession of Eric Adams to mayor of New York City.

CrimethInc., "The City in the Forest: Reinventing Resistance for an Age of Climate Crisis and Police Militarization," 11 April 2022.

756 notes

·

View notes

Text

Federal public sector workers’ wages, adjusted for inflation, are no better than they were in 2007, a new report from the Canadian Centre for Policy Alternatives shows.

“The average federal public sector worker’s wages only buy the same today as they did in October 2007,” the CCPA report states. “No other industry—none—has seen average inflation adjusted wages pushed back as far as federal public sector workers.”

Over 100,000 federal public workers hit the picket lines across the country on Wednesday with a two-year expired contract and no wage offers that kept up with the rising cost of living.

Even if the union wins its current wage demands of 4.5% increases each year for three years, “those average federal worker wages would still be 4.8 per cent below the industrial average,” the report notes.

Full article

Tagging: @politicsofcanada

#cdnpoli#canadian politics#canadian news#canada#canadian#workers rights#wages#federal public workers#federal public sector#federal employees#unions#strikes#strike action#CCPA#canadian centre for policy alternatives

88 notes

·

View notes

Text

After a devastating hurricane, here's how to get help, stay safe and protect your sanity in the weeks ahead | CNN

After a devastating hurricane, here’s how to get help, stay safe and protect your sanity in the weeks ahead | CNN

CNN

—

Hurricane victims returning to damaged houses face a torrent of challenges – if they’re lucky enough to have a home standing at all.

Flooding. Mold damage. Insurance headaches. Deadly hidden hazards.

The onslaught of mental anguish and post-hurricane dangers can seem overwhelming. Here’s how victims can stay safe, get help and take the first steps toward recovery:

Just because the…

View On WordPress

#accidents#Business#business and industry sectors#Centers for Disease Control and Prevention#disasters and safety#economy and trade#energy and utilities#federal emergency management agency#floods and flooding#government organizations - us#health and medical#Hurricanes#national oceanic and atmospheric administration#national weather service#natural disasters#public health#severe weather#tropical storms#us department of commerce#us department of health and human services#us department of homeland security#us federal departments and agencies#utilities disruptions#utilities industry#weather

0 notes

Text

Newly released emails debunk Trump and allies' attempts to blame the GSA for packing boxes that ended up in Mar-a-lago | CNN Politics

Newly released emails debunk Trump and allies’ attempts to blame the GSA for packing boxes that ended up in Mar-a-lago | CNN Politics

Washington

CNN

—

When the General Services Administration prepared to ship pallets of material to Florida for former President Donald Trump in July 2021, the federal agency asked Trump aide Beau Harrison to affirm what was in the boxes being shipped.

Harrison, Trump’s former assistant for operations, was asked to affirm that everything packed and shipped to Florida was either “required to…

View On WordPress

#2020 presidential election#business#business and industry sectors#computer science and information technology#continents and regions#destinations and attractions#Donald Trump#economy and trade#elections (by type)#Elections and campaigns#email#Federal Bureau of Investigation#florida#Government and public administration#Government bodies and offices#government organizations - us#internet and www#internet software and applications#mar-a-lago#misc places#North America#points of interest#political candidates#political figures - us#Politics#software and applications#Southeastern United States#technology#the americas#United States

0 notes

Text

Dharna Noor at The Guardian:

Climate experts fear Donald Trump will follow a blueprint created by his allies to gut the National Oceanic and Atmospheric Administration (Noaa), disbanding its work on climate science and tailoring its operations to business interests.

Joe Biden’s presidency has increased the profile of the science-based federal agency but its future has been put in doubt if Trump wins a second term and at a time when climate impacts continue to worsen.

The plan to “break up Noaa is laid out in the Project 2025 document written by more than 350 rightwingers and helmed by the Heritage Foundation. Called the Mandate for Leadership: The Conservative Promise, it is meant to guide the first 180 days of presidency for an incoming Republican president.

The document bears the fingerprints of Trump allies, including Johnny McEntee, who was one of Trump’s closest aides and is a senior adviser to Project 2025. “The National Oceanographic [sic] and Atmospheric Administration (Noaa) should be dismantled and many of its functions eliminated, sent to other agencies, privatized, or placed under the control of states and territories,” the proposal says.

That’s a sign that the far right has “no interest in climate truth”, said Chris Gloninger, who last year left his job as a meteorologist in Iowa after receiving death threats over his spotlighting of global warming.

The guidebook chapter detailing the strategy, which was recently spotlighted by E&E News, describes Noaa as a “colossal operation that has become one of the main drivers of the climate change alarm industry and, as such, is harmful to future US prosperity”. It was written by Thomas Gilman, a former Chrysler executive who during Trump’s presidency was chief financial officer for Noaa’s parent body, the commerce department.

Gilman writes that one of Noaa’s six main offices, the Office of Oceanic and Atmospheric Research, should be “disbanded” because it issues “theoretical” science and is “the source of much of Noaa’s climate alarmism”. Though he admits it serves “important public safety and business functions as well as academic functions”, Gilman says data from the National Hurricane Center must be “presented neutrally, without adjustments intended to support any one side in the climate debate”.

[...]

Noaa also houses the National Weather Service (NWS), which provides weather and climate forecasts and warnings. Gilman calls for the service to “fully commercialize its forecasting operations”.

He goes on to say that Americans are already reliant on private weather forecasters, specifically naming AccuWeather and citing a PR release issued by the company to claim that “studies have found that the forecasts and warnings provided by the private companies are more reliable” than the public sector’s. (The mention is noteworthy as Trump once tapped the former CEO of AccuWeather to lead Noaa, though his nomination was soon withdrawn.)

The claims come amid years of attempts from US conservatives to help private companies enter the forecasting arena – proposals that are “nonsense”, said Rosenberg.

Right now, all people can access high-quality forecasts for free through the NWS. But if forecasts were conducted only by private companies that have a profit motive, crucial programming might no longer be available to those in whom business executives don’t see value, said Rosenberg.

[...]

Fully privatizing forecasting could also threaten the accuracy of forecasts, said Gloninger, who pointed to AccuWeather’s well-known 30- and 60-day forecasts as one example. Analysts have found that these forecasts are only right about half the time, since peer-reviewed research has found that there is an eight- to 10-day limit on the accuracy of forecasts.

The Trump Administration is delivering a big gift to climate crisis denialism as part of Project 2025 by proposing the dismantling and privatizing the National Oceanic and Atmospheric Administration (NOAA) and National Weather Service (NWS) in his potential 2nd term.

This should frighten people to vote Democratic up and down the ballot if you want the NOAA and NWS to stay intact.

#Project 2025#Climate Change#Climate Crisis#Weather#AccuWeather#National Weather Service#NOAA#NWS#John McEntee#The Heritage Foundation#Donald Trump#Climate Change Denialism#Office of Oceanic and Atmospheric Research#National Oceanic and Atmospheric Administration#Climate Crisis Denial

51 notes

·

View notes

Text

Toledo City Council just approved a plan to turn $1.6 million in public dollars into as much as $240 million in economic stimulus, targeted at some of the Ohio metro’s most vulnerable residents.

“It’s really going to help people put food on the table, help them pay their rent, help them pay their utilities,” says Toledo City Council Member Michele Grim, who led the way for the measure. “Hopefully we can prevent some evictions.”

The strategy couldn’t be simpler: It works by canceling millions in medical debt.

Working with the New York City-based nonprofit RIP Medical Debt, the City of Toledo and the surrounding Lucas County are chipping in $800,000 each out of their federal COVID-19 recovery funds from the American Rescue Plan Act.

The combined $1.6 million in funding is enough for RIP Medical Debt to acquire and cancel up to $240 million in medical debt owed by Lucas County households that earn up to 400% of the federal poverty line.

“It could be more than a one-to-100 return on investment of government dollars,” Grim says. “I really can’t think of a more simple program for economic recovery or a better way of using American Rescue Plan dollars, because it’s supposed to rescue Americans.”

How It Works

Under the RIP Medical Debt model, there is no application process to cancel medical debt. The nonprofit negotiates directly with local hospitals or hospital systems one-by-one, purchasing portfolios of debt owed by eligible households and canceling the entire portfolio en masse.

“One day someone will get a letter saying your debt’s been canceled,” Grim says. It’s a simple strategy for economic welfare and recovery.

RIP Medical Debt was founded in 2014 by a pair of former debt collection agents, and since inception it has acquired and canceled more than $7.3 billion in medical debt owed by 4.2 million households — an average of $1,737 per household...

Local Governments Get Involved

The partnership with Toledo and Lucas County is the third instance of the public sector funding RIP Medical Debt to cancel debt portfolios.

Earlier this year, in the largest such example yet, the Cook County Board of Commissioners approved a plan to provide $12 million in ARPA funds for RIP Medical Debt to purchase and cancel an estimated $1 billion in medical debt held by hospitals across Cook County, which includes Chicago.

“Governments contract with nonprofits all the time for various social interventions,” Sesso says.

“This isn’t really that far-fetched or different from that. I would say between five and 10 other local governments have reached out just since the Toledo story came out.”

What's the Deal with Medical Debt?

An estimated one in five households across the U.S. have some amount of medical debt, and they are disproportionately Black and Latino, according to the U.S. Census Bureau...

Acquiring medical debt is relatively cheap: hospitals that sell medical debt portfolios do so for just pennies on the dollar, usually to investors on the secondary market.

The purchase price is so low because hospitals and debt buyers alike know that medical debt is the hardest form to collect...

The amount of debt canceled for any given household has ranged from $25 all the way up to six-figure amounts. Under IRS regulations, debts canceled under RIP Medical Debt’s model do not count as taxable income for households...

Massive Expansion Coming Up

After not one but two donations from philanthropist MacKenzie Scott, totaling $80 million, RIP Medical Debt is planning for expansion.

It’s using a portion of those dollars to create an internal revolving line of credit to expand to places where it can find willing sellers before it has found willing funders.

The internal line of credit means the nonprofit now has new, albeit still limited, flexibility to acquire debt portfolios from hospitals first, then begin raising private or public dollars locally to replenish the line of credit later and make those funds available for other locations.

“People often ask, do you only work with nonprofit hospitals, or do you work with for-profit hospitals? And I’m like, I just want to get the debt, regardless of who created the debt. If it’s out there, I want it,” Sesso says.

Fundamentally, they are not solving the issue of medical debt, but easing its pressure from as many lives as possible — while also upping the pressure on lawmakers and the healthcare industry.

“We’re intentionally taking the stories of the individuals whose debt we have resolved, and putting their stories out into the world with intention in a way that tries to push and create more of that pressure to fundamentally solve the problem,” she says.

-via GoodGoodGood, 4/6/23

#toledo#ohio#chicago#cook county#new york#medical debt#healthcare#healthcare access#united states#us politics#debt crisis#debt relief#hospital#nonprofit#good news#hope

300 notes

·

View notes

Text

It’s never been a better time to get rid of your student debt.

Although President Joe Biden’s plans to cancel up to $400 billion in student debt for tens of millions of Americans were foiled over the summer at the Supreme Court, his administration has explored all of its existing authority to leave people with less education debt.

As a result, more than 3.7 million Americans have received loan cancellation during Biden’s time in office, totaling $136.6 billion in aid.

In a recent exclusive interview with CNBC, Rep. James Clyburn, D-S.C., who has been a vocal advocate for student loan borrowers, said he’s heard from the U.S. Department of Education that every two months over the next four years, another 75,000 people will be eligible to have their debt forgiven due to changes in income-driven repayment plans and Public Service Loan Forgiveness.

-----

The Biden administration has been evaluating millions of borrowers’ loan accounts to see if they should have had their debt forgiven. So far, more than 930,000 people have benefited, receiving over $45 billion in debt cancelation.

Most people with federal student loans qualify for income-driven repayment plans, and can review the options and apply at Studentaid.gov.

Recently, the Education Department also announced it would soon cancel the debts of those who’ve been in repayment for a decade or more and originally took out $12,000 or less. To qualify, borrowers need to be enrolled in the administration’s new Saving on a Valuable Education, or SAVE, plan.

-----

The Biden administration has tried to reverse the trend of borrowers being excluded from the relief on technicalities. It has broadened eligibility and allowed people to reapply for the relief, as long as they were working in the public sector and paying down their debt.

Some 790,000 public servants have gotten their debt erased as a result, amounting to more than $56 billion in relief.

------

The Biden administration has also forgiven the student debt of more than 510,000 disabled borrowers. The $11.7 billion in aid was delivered under the Total and Permanent Disability Discharge.

----

Another 1.3 million borrowers have walked away from their debt over the past few years thanks to the Borrower Defense Loan Discharge. These people received $22.5 billion in relief.

Borrowers can be eligible for the discharge if their schools suddenly closed or they were cheated by their colleges.

-----

The Biden administration is also working to revise its broad forgiveness plan to make it legally viable.

The president may try to deliver that relief before November.

That alternative plan, which has become known as Biden’s “Plan B,” could forgive the student debt for as many as 10 million people, according to one estimate.

#thanks Biden#Joe Biden#student loans#student loan debt#student loan forgiveness#if you have student loan debt one of these programs likely applies to you#check it out

61 notes

·

View notes

Text

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

464 notes

·

View notes