#monetarism

Text

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

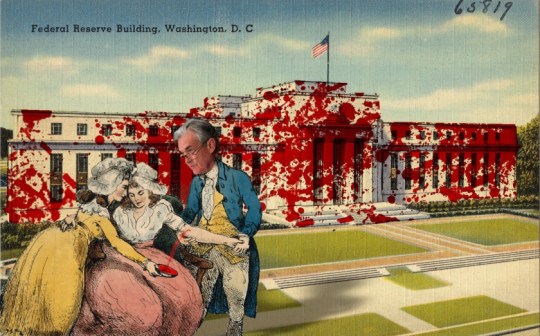

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

464 notes

·

View notes

Note

What are your thoughts about Andrew Mellon and how much blame he has for the Great Depression?

Andrew Mellon was a bastard, and his policies hurt way more than they helped, but I don't hold with the monetarist explanation for the Great Depression. I think Keynes was right.

13 notes

·

View notes

Text

Theories of the Philosophy of Macroeconomics

The philosophy of macroeconomics deals with the study of large-scale economic phenomena, such as aggregate output, employment, inflation, and economic growth. It seeks to understand the principles, assumptions, and implications of overall economic activity and the interactions between different sectors of the economy. Some key theories in the philosophy of macroeconomics include:

Classical Economics: Classical economics emphasizes the long-run equilibrium of the economy, where prices and wages adjust to ensure full employment and resource utilization. It stresses the importance of free markets, minimal government intervention, and the self-regulating nature of the economy.

Keynesian Economics: Keynesian economics, developed by John Maynard Keynes, focuses on short-run fluctuations in economic activity and the role of aggregate demand in determining output and employment. It advocates for government intervention through fiscal policy (such as government spending and taxation) and monetary policy (such as interest rate adjustments) to stabilize the economy and address unemployment during recessions.

Monetarism: Monetarism, associated with economists like Milton Friedman, emphasizes the role of monetary policy in influencing aggregate demand and economic outcomes. It argues that changes in the money supply directly impact inflation and economic growth, advocating for stable and predictable growth in the money supply to maintain price stability and promote long-term economic growth.

New Classical Economics: New classical economics incorporates microeconomic foundations into macroeconomic models and emphasizes the rational expectations hypothesis. It posits that individuals form expectations about future economic variables based on all available information, leading to self-correcting market outcomes and limited effectiveness of government policies.

New Keynesian Economics: New Keynesian economics builds on Keynesian principles but incorporates microeconomic foundations and imperfect competition into macroeconomic models. It emphasizes the role of nominal rigidities, such as sticky prices and wages, in explaining short-run fluctuations in economic activity and advocates for countercyclical policies to stabilize the economy.

Real Business Cycle Theory: Real business cycle theory attributes fluctuations in economic activity to exogenous shocks to productivity and technology. It argues that changes in real factors, such as productivity shocks, drive business cycles, while monetary and fiscal policy have limited effects on real economic outcomes.

Post-Keynesian Economics: Post-Keynesian economics extends Keynesian principles by emphasizing the role of uncertainty, financial instability, and institutional factors in shaping economic behavior. It critiques mainstream macroeconomic models for their simplifying assumptions and advocates for a more heterodox approach to macroeconomic analysis.

Modern Monetary Theory (MMT): Modern Monetary Theory challenges traditional views on fiscal policy and government finance, arguing that countries with sovereign currencies can issue fiat money to finance government spending without facing solvency constraints. It emphasizes the role of fiscal policy in achieving full employment and price stability, advocating for policies that prioritize job creation and public investment.

These theories and approaches in the philosophy of macroeconomics provide frameworks for understanding the determinants of aggregate economic activity, the role of government policy, and the dynamics of economic fluctuations and growth.

#philosophy#epistemology#knowledge#learning#chatgpt#education#ethics#psychology#economics#economic theory#theory#Classical economics#Keynesian economics#Monetarism#New classical economics#New Keynesian economics#Real business cycle theory#Post-Keynesian economics#Modern monetary theory (MMT)#macroeconomics

1 note

·

View note

Text

youtube

Friedman's Scandalous Interview Excited Many

Milton Friedman, a well-known American economist and Nobel Prize winner, spoke about the emergence of an Internet currency back in 1999.

A currency that would allow global transactions without the participation of banks and provide complete anonymity will be created 10 years after the interview.

“I believe that the Internet will replace everything, reduce the role of government in society and the influence of official media. An important component of this process will be a reliable electronic currency with which people will be able to transfer money to each other maintaining complete confidentiality,” howright Milton Friedman was.

Friedman actively promoted the concept of monetarism arguing that monetary policy plays a key role in economic growth and inflation control. He also attracted attention for his research in consumer theory, macroeconomics, and economic history.

Lado Okhotnikov, “Bitcoin was created about ten years after the interview with Milton Friedman. I don't think it's a coincidence."

#MiltonFriedman#economist#NobelPrizeWinner#free_market#economictheory#monetarism#libertarianism#Crypto#News#Youtube

1 note

·

View note

Text

Get Financial Independence and Crush Your Debt Today!

Are you tired of living under the weight of your debts?

Do you find yourself struggling to make ends meet, despite your best efforts? At Debt Crusher Pro, we understand how difficult it can be to overcome financial difficulties. That’s why we’re here to help you get back on Get Financial Independence and Crush Your Debt Today!

Are you tired of living under the weight of your debts? Do you find yourself struggling to make ends meet, despite your best efforts? At Debt Crusher Pro, we understand how difficult it can be to overcome financial difficulties. That’s why we’re here to help you get back on track and achieve financial independence.

If you’re not sure how to resolve your debt, or if you’re looking for a way to pay less than what you owe, we’re here to help. Our expert team has over 15 years of experience negotiating debt settlement and securing small monthly payment plans for our clients. We can also help you improve your credit score and resolve any issues related to auto loans, mortgages, or business debt.

Don’t let your debt hold you back any longer. By working with Debt Crusher Pro, you can take control of your finances and achieve the financial freedom you deserve. Contact us today to schedule your free consultation and take the first step towards a brighter financial future.

#income inequality#anti capitalism#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters#college debt#wealth inequality#Important#crowfunding#branco#student loans

0 notes

Text

“Money supply growth fell again in January, falling even further into negative territory after turning negative in November 2022 for the first time in twenty-eight years. January's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years.

Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply contract for the first time since the 1990s. The last time the year-over-year (YOY) change in the money supply slipped into negative territory was in November 1994. At that time, negative growth continued for fifteen months, finally turning positive again in January 1996.

During January 2023, YOY growth in the money supply was at -5.04 percent. That's down from December's rate of -02.19 percent and down from January 2022's rate of 6.82 percent. With negative growth now dipping below -5 percent, money-supply contraction is approaching the biggest decline we've seen in the past thirty-five years. Only during brief periods of 1989 and 1995 did the money supply fall as much. At no point for at least sixty years has the money supply fallen by more than 5.6 percent in any month.”

“U.S. money supply is falling at its fastest rate since the 1930s, a red flag for the economy and financial markets.

Money supply has now been shrinking year-on-year since December, an unprecedented development in modern times that should make investors sit up and take notice - growth, asset prices and inflation could all weaken.

It is largely a consequence of the reversal of the liquidity generated by massive post-pandemic fiscal and monetary stimulus, the Federal Reserve shrinking its balance sheet via quantitative tightening, falling bank deposits, and weak demand for and provision of credit.

(…)

Fed data on Tuesday showed that M2 money supply, a benchmark measure of how much cash and cash-like assets is circulating in the U.S. economy, fell a non-seasonally adjusted 2.2% to $21.099 trillion in February from the same period a year earlier.”

#money#monetarism#fed#federal reserve#quantitative easing#quantitative tightening#america#banks#svb failure#rothbard#murray rothbard#mises

1 note

·

View note

Text

Milton Friedman falls out with Thatcher

Milton Friedman falls out with Thatcher

The first Thatcher government of 1979 to 1983 embraced an economic theory called monetarism. The leading proponent was Professor Milton Friedman and it became popular with economists in the 1970s. Basically, monetarists argued that the amount of money in the economy determines economic performance. They blamed an increase in the supply of money for the high inflation and poor economic performance…

View On WordPress

#70s#80s#economic depression#Karl Marx#keith joseph#margaret thatcher#Milton Friedman#monetarism#supply side economics#Thatcher#UK recession

0 notes

Note

I wanna sponsor you too!! *Hugs aggressively*

Aw, thank you!! *hugs back aggressively*

#sometimes I think about turning on the monetarism of this blog#like I deserve to be paid for the bullshit I put up with on this blog#punk gets mail

2 notes

·

View notes

Text

me when i have to study economy and global trade

#etxt#just print more money geez#‘what are the pros of monetarism’ i don’t know im not right wing i can’t think of anything good :/

7 notes

·

View notes

Text

The history of money is not the history of reason depicted by the economists, it is no more and no less than the history of capitalism. Commercial capital developed the primitive forms of money that emerged from petty commodity production, fixed on one commodity to serve as world money and then overcame the barriers of commodity money to create token and then credit money. Underlying the history of money is the contradiction between the functions of money as the means of exchange and as the substance of value. The rational side of money, which political economy delighted in, is its function in the circulation of commodities as use-values. The irrational side of money, which political economy ignored, is its function as the independent form of value, through which the circulation of commodities is subordinated to the social power of money as capital.

Simon Clarke, Keynesianism, Monetarism and the Crisis of the State

4 notes

·

View notes

Text

Rent control works

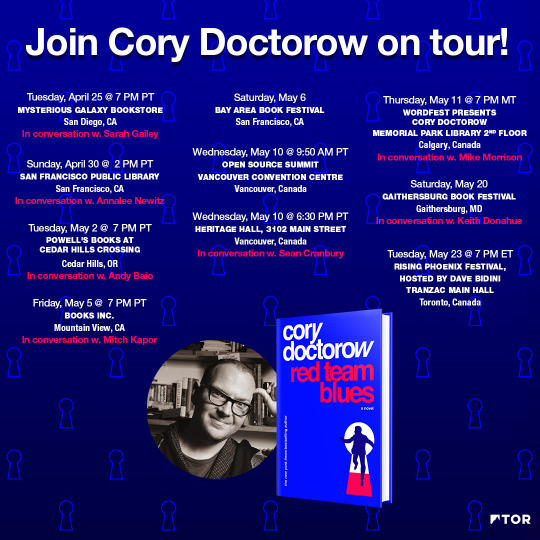

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

David Roth memorably described the job of neoliberal economists as finding “new ways to say ‘actually, your boss is right.’” Not just your boss: for decades, economists have formed a bulwark against seemingly obvious responses to the most painful parts of our daily lives, from wages to education to health to shelter:

https://popula.com/2023/04/30/yakkin-about-chatgpt-with-david-roth/

How can we solve the student debt crisis? Well, we could cancel student debt and regulate the price of education, either directly or through free state college.

How can we solve America’s heath-debt crisis? We could cancel health debt and create Medicare For All.

How can we solve America’s homelessness crisis? We could build houses and let homeless people live in them.

How can we solve America’s wage-stagnation crisis? We could raise the minimum wage and/or create a federal jobs guarantee.

How can we solve America’s workplace abuse crisis? We could allow workers to unionize.

How can we solve America’s price-gouging greedflation crisis? With price controls and/or windfall taxes.

How can we solve America’s inequality crisis? We could tax billionaires.

How can we solve America’s monopoly crisis? We could break up monopolies.

How can we solve America’s traffic crisis? We could build public transit.

How can we solve America’s carbon crisis? We can regulate carbon emissions.

These answers make sense to everyone except neoliberal economists and people in their thrall. Rather than doing the thing we want, neoliberal economists insist we must unleash “markets” to solve the problems, by “creating incentives.” That may sound like a recipe for a small state, but in practice, “creating incentives” often involves building huge bureaucracies to “keep the incentives aligned” (that is, to prevent private firms from ripping off public agencies).

This is how we get “solutions” that fail catastrophically, like:

Public Service Loan Forgiveness instead of debt cancellation and free college:

https://studentloansherpa.com/likely-ineligible/

The gig economy instead of unions and minimum wages:

https://www.newswise.com/articles/research-reveals-majority-of-gig-economy-workers-are-earning-below-minimum-wage

Interest rate hikes instead of price caps and windfall taxes:

https://www.npr.org/2023/05/03/1173371788/the-fed-raises-interest-rates-again-in-what-could-be-its-final-attack-on-inflati

Tax breaks for billionaire philanthropists instead of taxing billionaires:

https://memex.craphound.com/2018/11/10/winners-take-all-modern-philanthropy-means-that-giving-some-away-is-more-important-than-how-you-got-it/

Subsidizing Uber instead of building mass transit:

https://prospect.org/infrastructure/cities-turn-uber-instead-buses-trains/

Fraud-riddled carbon trading instead of emissions limits:

https://pluralistic.net/2022/05/27/voluntary-carbon-market/#trust-me

As infuriating as all of this “actually, your boss is right” nonsense is, the most immediate and continuously frustrating aspect of it is the housing crisis, which has engulfed cities all over the world, to the detriment of nearly everyone.

America led the way on screwing up housing. There were two major New Deal/post-war policies that created broad (but imperfect and racially biased) prosperity in America: housing subsidies and labor unions. Of the two, labor unions were the most broadly inclusive, most available across racial and gender lines, and most engaged with civil rights struggles and other progressive causes.

So America declared war on labor unions and told working people that their only path to intergenerational wealth was to buy a home, wait for it to “appreciate,” and sell it on for a profit. This is a disaster. Without unions to provide countervailing force, every part of American life has worsened, with stagnating wages lagging behind skyrocketing expenses for education, health, retirement, and long-term care. For nearly every homeowner, this means that their “most valuable asset” — the roof over their head — must be liquidated to cover debts. Meanwhile, their kids, burdened with six-figure student debt — will have little or nothing left from the sale of the family home with which to cover a downpayment in a hyperinflated market:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Meanwhile, rent inflation is screaming ahead of other forms of inflation, burdening working people beyond any ability to pay. Giant Wall Street firms have bought up huge swathes of the country’s housing stock, transforming it into overpriced, undermaintained slums that you can be evicted from at the drop of a hat:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Transforming housing from a human right to an “asset” was always going to end in a failure to build new housing stock and regulate the rental market. It’s reaching a breaking point. “Superstar cities” like New York and San Francisco have long been priced out of the reach of working people, but now they’re becoming unattainable for double-income, childless, college-educated adults in their prime working years:

https://www.nytimes.com/interactive/2023/05/15/upshot/migrations-college-super-cities.html

A city that you can’t live in is a failure. A system that can’t provide decent housing is a failure. The “your boss is right, actually” crowd won: we don’t build public housing, we don’t regulate rents, and it suuuuuuuuuuuuuuucks.

Maybe we could try doing things instead of “aligning incentives?”

Like, how about rent control.

God, you can already hear them squealing! “Price controls artificially distort well-functioning markets, resulting in a mismatch between supply and demand and the creation of the dreaded deadweight loss triangle!”

Rent control “causes widespread shortages, leaving would-be renters high and dry while screwing landlords (the road to hell, so says the orthodox economist, is paved with good intentions).”

That’s been the received wisdom for decades, fed to us by Chicago School economists who are so besotted with their own mathematical models that any mismatch between the models’ predictions and the real world is chalked up to errors in the real world, not the models. It’s pure economism: “If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’”

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

But, as Mark Paul writes for The American Prospect, rent control works:

https://prospect.org/infrastructure/housing/2023-05-16-economists-hate-rent-control/

Rent control doesn’t constrain housing supply:

https://dornsife.usc.edu/pere/rent-matters

At least some of the time, rent control expands housing supply:

https://onlinelibrary.wiley.com/doi/full/10.1111/j.1467-9906.2007.00334.x

The real risk of rent control is landlords exploiting badly written laws to kick out tenants and convert their units to condos — that’s not a problem with rent control, it’s a problem with eviction law:

https://web.stanford.edu/~diamondr/DMQ.pdf

Meanwhile, removing rent control doesn’t trigger the predicted increases in housing supply:

https://www.sciencedirect.com/science/article/pii/S0094119006000635

Rent control might create winners (tenants) and losers (landlords), but it certainly doesn’t make everyone worse off — as the neoliberal doctrine insists it must. Instead, tenants who benefit from rent control have extra money in their pockets to spend on groceries, debt service, vacations, and child-care.

Those happier, more prosperous people, in turn, increase the value of their landlords’ properties, by creating happy, prosperous neighborhoods. Rent control means that when people in a neighborhood increase its value, their landlords can’t kick them out and rent to richer people, capturing all the value the old tenants created.

What is life like under rent control? It’s great. You and your family get to stay put until you’re ready to move on, as do your neighbors. Your kids don’t have to change schools and find new friends. Old people aren’t torn away from communities who care for them:

https://ideas.repec.org/a/uwp/landec/v58y1982i1p109-117.html

In Massachusetts, tenants with rent control pay half the rent that their non-rent-controlled neighbors pay:

https://economics.mit.edu/sites/default/files/publications/housing%20market%202014.pdf

Rent control doesn’t just make tenants better off, it makes society better off. Rather than money flowing from a neighborhood to landlords, rent control allows the people in a community to invest it there: opening and patronizing businesses.

Anything that can’t go on forever will eventually stop. As the housing crisis worsens, states are finally bringing back rent control. New York has strengthened rent control for the first time in 40 years:

https://www.nytimes.com/2019/06/12/nyregion/rent-regulation-laws-new-york.html

California has a new statewide rent control law:

https://www.nytimes.com/2019/09/11/business/economy/california-rent-control.html

They’re battling against anti-rent-control state laws pushed by ALEC, the right-wing architects of model legislation banning action on climate change, broadband access, and abortion:

https://www.nmhc.org/research-insight/analysis-and-guidance/rent-control-laws-by-state/

But rent control has broad, democratic support. Strong majorities of likely voters support rent control:

https://www.bostonglobe.com/2023/03/07/metro/new-statewide-poll-shows-strong-support-rent-control/

And there’s a kind of rent control that has near unanimous support: the 30-year fixed mortgage. For the 67% of Americans who live in owner-occupied homes, the existence of the federally-backed (and thus federally subsidized) fixed mortgage means that your monthly shelter costs are fixed for life. What’s more, these costs go down the longer you pay them, as mortgage borrowers refinance when interest rates dip.

We have a two-tier system: if you own a home, then the longer you stay put, the cheaper your “rent” gets. If you rent a home, the longer you stay put, the more expensive your home gets over time.

America needs a shit-ton more housing — regular housing for working people. Mr Market doesn’t want to build it, no matter how many “incentives” we dangle. Maybe it’s time we just did stuff instead of building elaborate Rube Goldberg machines in the hopes of luring the market’s animal sentiments into doing it for us.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

[Image ID: A beautifully laid dining room table in a luxury flat. Outside of the windows looms a rotting shanty town with storm-clouds overhead.]

Image:

ozz13x (modified)

https://commons.wikimedia.org/wiki/File:Shanty_Town_Hong_Kong_China_March_2013.jpg

Matt Brown (modified)

https://commons.wikimedia.org/wiki/File:Dining_room_in_Centre_Point_penthouse.jpg

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#urbanism#weaponized shelter#housing#the rent's too damned high#rent control#economism#neoliberalism#monetarism#mr market#landlord brain#speculation

118 notes

·

View notes

Note

Your last post reminded me that, years ago, I asked you about monetarism in Argentina because we had a Milton Friedman fanboy politician becoming more popular. Said fanboy ended up becoming president a few months ago, so we're going for another run I guess.

I feel very frightened for the people of Argentina, because the fanboy is turning out to be an anti-democratic maniac who is going to do a lot of economic damage as well.

15 notes

·

View notes

Text

got the kufiya i ordered, its so pretty

(cant hunt for the link rn but i will later, its v beautiful, im just amazed it got delivered? I preordered it, thinking whatever, theres a genocide going on, who cares if i get it or not, i just wanted to monetarely support the palestinian company, but it actually got here rly quickly. anyway its super pretty i just gotta figure out how to wear it.....i ordered the mediterranean one due to yk being mediterranean, kinda regret not ordering the palestinian flag one, but alas)

5 notes

·

View notes

Text

Just Me Against the Sky | Self Para

Date: October 2023

Featuring: Lightning, Dusty

Warnings: Lightning McQueen's midlife crisis, bad parenting

Lightning takes a small step. And then another

Eventually, Lightning did call Dusty back. It wasn’t as glamorous or triumphant as it would have been in a sports movie. Lightning didn’t slam the phone down and announce “I quit!” as a Bruce Springsteen song hit its crescendo in the background and the sun rose over the trees. He just told Dusty that maybe he was right— maybe it was time to take a temporary step back from the circuit, to focus on his personal life.

Dusty said he understood. He sounded, maybe, a little annoyed that it had taken Lightning so long to get back to him— but the fact that he hadn’t dogged Lightning for a callback over the past few weeks signaled to the athlete that this had never been that serious for Dusty. At least, it wasn’t anymore.

When he got off the call, Lightning once again expected everything to be very cinematic. He expected the headlines to roll in: MCQUEEN QUITS! “TEMPORARY STEP BACK” = THE KISS OF DEATH? WHAT HAPPENED TO LIGHTNING MCQUEEN’S CAREER: A RETROSPECTIVE. But instead it was just Lightning, and his blank-screened phone, and his empty apartment.

And now that nobody had reacted, Lightning realized he didn’t have anyone to tell if he wanted to. Mack, Harv, the rest of the team— they’d have too many questions. What did it mean for their jobs, what did it mean for his career, did this mean he was really giving up? And Lightning didn’t know the answers yet. He’d answer their questions when this came up at the team meeting.

He could tell Agustin, but he felt that he’d bothered Agustin with his problems enough lately. He couldn’t tell Cass who was practically a stranger, or even Gen, who was worlds away from being a parent. He definitely couldn’t tell Cruz, who wasn’t speaking to him. Maybe he could tell Doc… Lightning really considered that one. But instead he got stuck on that sobering realization: he really didn’t have many people in his life.

For someone who’d been so scared of being all alone, he’d really done it to himself anyway, hadn’t he? What a depressing paradox. You try so hard to be everyone’s hero that you wind up a total loser.

Well, the whole point of this was supposed to be changing that. Starting with setting things right with Dusty. Lightning had thought that doing so would make everything else fall into place, but now that Lightning had done it, he still felt pretty lost.

He wandered over to his kitchen and absently started making a smoothie. Berries, greens, that collagen mix Lightning used to tell Cruz about— he thought of her again as he shook some into the blender. Everything seemed to remind him of her these days, and Lightning was starting to realize that was the pain of caring about someone. You still cared about them, even when you were far away (even if not physically so).

That was it, wasn’t it? His next step. He had to get through to Cruz. And he couldn’t force it, just as Agustin had advised him not to. He had to listen to her. And he had to back off if she told him to.

You can’t force her to forgive you. And hounding her, begging her, that’s guilt tripping and isn’t right. But apologize, sincerely. Let her decide what to do with it and accept her decision.

Apologize. Sincerely.

Lightning had never been sincere a day in his life. Or maybe he had, he’d just been so scared of it, he hadn’t let himself really feel it. But maybe it wasn’t too late to start. This was important. And sometimes important things were hard.

…Maybe he could build up to it, though. Prove himself in other ways first. That way, when he asked for Cruz’s forgiveness, maybe he’d finally feel like he had earned it.

He put down his phone and pressed “blend,” and his eyes wandered to a Magick Grand Prix magazine he’d left open on the countertop. There was an article about youth programs needing more support, not just coaches and manpower, but monetary support, equipment, the kind of stuff that you just couldn’t get unless you had funding, and funding could be scarce.

He thought about how hard Cruz worked to try and get her program funding. And he had the beginning of an idea.

It wouldn’t solve everything. But maybe it could be the beginning.

He just hoped it wasn’t too late.

#self para#the title is a mountain goats reference mak be proud of me#the song in question i feel like isn't that fitting yet but i listened to it on repeat writing this so i will post it later#when it is more fitting#anyway yes!

2 notes

·

View notes