#how to pick stocks for long term investment

Text

Here is How to Start Investing (Investing For Beginners 2024)

#investing#investment#moneytips#personal finance#investmentstrategies#how to invest#stock market for beginners#investing 101#investing for beginners#how to pick stocks#investing explained#how to invest money as a teenager#stock market 2024#stock market news#how to invest in 2024#stock market investing for beginners#how to pick stocks for long term investment#best stocks to buy now for short term#investment strategies for 20 year olds#investing for beginners 2024

1 note

·

View note

Text

How To Pick Stocks For Beginners (Step By Step)

How To Pick Stocks For Beginners (Step By Step)

So at this point you may be asking Yourself how do you go about finding a Great investment and we have covered a Lot of material so far so in this Section i'm going to be reviewing the Components of a great investment and Really what are the main things that i Am looking for because if you go out There and you're trying to find Everything i've discussed in this course You're never going to find…

View On WordPress

#how to find a good investment#how to find good stocks#how to find good stocks to invest in#how to pick stocks#how to pick stocks for beginners#how to pick stocks for day trading#how to pick stocks for swing trading#investing strategy#stock market#stock market for beginners#stock picking#stock picking for beginners#stock picking for long term#stock picking strategy#the world&039;s simplest stock picking strategy#where to find stocks#where to find stocks to invest in

0 notes

Text

pick a card - how you can find balance

Hello everyone! today's pick a card will focus on:

-what you're placing all your energy into, what you're neglecting and how you can find more balance in between everything you're taking on at the moment. take a deep breath and allow your intuition to guide you towards your pile!!

pile one

what you're focusing on- page of wands and king of coins, Saturn in Scorpio

for you guys im seeing a focus on growth, expansion and exploring new ideas. youare wanting to grow your money and maximize your potential, not only with money you have the potential to make but money you already have whether it be savings, inheritance, loans, investments. you're pouring your energy into ambition and practicality and achieving financial freedom. intuitively i feel like this pile wants to achieve great things at a young age, you feel that you are destined for entrepreneurship, or making bold career moves that are risky but still grounded in reality. so overall pile one, you're energy is being poured into your longterm stability and financial freedom, especially financial freedom that is achieved through inheritance, investments, trading, traditional methods such as stocks or selling something.

what you're neglecting- nine of pentacles

Overall, the Nine of Pentacles suggests that you may be neglecting essential aspects of self-care, financial management, and appreciating the abundance that is already around you. you're being encouraged to find a balance between working towards your goals and taking time to enjoy life's simple pleasures. in the pursuit of finding financial freedom at a young age and achieving long term stability, you may be stifling social relationships too. pile one, its more than ok to pour more energy into your friendships, you can work towards your goals while still enjoying life's simple pleasures. your friends may miss you, dont listen to online creators who tell you that you can go out and have fun while striving towards an extraordinary lifestyle. longterm stablity may be difficult but it doesnt have to be miserbale or lonely.

pile two

what you're focusing on- the hanged man, the ten of swords, mecury in libra

the Hanged Man and the Ten of Swords together suggest that your energy is being poured into surrendering to, accepting, and embracing change. You may be in a period of transformation, releasing old patterns, and finding wisdom in challenging experiences. im feeling shadow work vibes, meditating on your fears and triggers to find the root of them. i feel like this energy is specifically demonstrating you placing a ''halt' on your fears to really examine every angle of them. im seeing the image of a spider creating a web, and one day they just stop to sit in what they've created before continuing to make their web. This combination of cards encourages you to be patient, with your life's direction, to find meaning in the journey. any delays or setbacks happening right now are trying to get you to stop, like the spider has, to exmaine where you are and what your triggers are, to build a foundation of something you ahve to know what the foundation is. i feel strongly that you're also being halted to examine your friendships and assoications before webbing a foundation in them. i also think that this pile is pouring energy into deciphering what media is influencing you and how its effecting you mentally, as well as how your words influence others, how your words effect your mind and reality. you could be getting into affirmations and manifestation.

what you're neglecting- the 6 of pentacles

you may not like hearing this, but you're neglecting fair, and balanced exchanges of energy, time and resources. The Six of Pentacles indicates that you may be neglecting the balance between giving and receiving. It's important to assess if you are being too generous to others at the expense of your own well-being or if you are hesitant to receive help or support from others when needed. or alternatively, are you not aware of how much you're expecting from others without giving in return?

pile three

what are you focusing on- three of cups and two of cups, mars in aries

friendships, close connections, building bonds, creating loving and harmonious relationships. you're pouring your energy into the more emotional, social aspect of life. i also feel that you're energy is going towards being emotionally vunerable and open in your relationships, you're placing emphasis on giving people quality time, sharing moments of openness, building mutual bonds with people. i also feel that there is also of impulsiveness going on, i think while you are pouring energy into a deeper bond, you're going head over heels, this feels like emotional compulsion to go 100 percent in on someone. i also keep getting the message about you being in a social group or friendgroup in which you break off into a partnership with someone in that group, and instead of balancing your time and energy between everyone, you're impulsively poring your emotional energy into one person. that wont resonate with everyone though.

what you're neglecting- 4 of pentacles

stability, solid foundations. the Four of Pentacles advises you to avoid neglecting areas related to financial generosity, planning, adaptability, and emotional connections. This card can indicate that you might be neglecting to embrace change or holding onto outdated financial beliefs or habits. It's essential to be open to new ideas, adapt to evolving financial circumstances, and be willing to make necessary adjustments. this card may also be coming up to signal that you're holding too tighly on something and neglecting everything else in pursuit of holding onto one thing, in your case, a relatiosnhip or bond with someone.

#tarot meanings#tarot pac#pick a card#pick a card tarot#pac tarot#tarot pick a pile#pick a pile#divine feminine#divine masculine#tarot predictions#pick a photo#pick an image#law of abundance#loa#lowtumblr#tarot community#tarot services#pick a card reading#astro notes#tarot cards#tarot deck#pick a picture#pick a pile reading#tarot pick a card#manifestingmindset#manifestion#law of assumption#affirmations#tarot readings#tarot

179 notes

·

View notes

Note

I'm terribly sorry if you've been asked this before, but I recently got a payout from a court case. I need to know how to passively invest. Problem is, I've been living poor for about 5 years after my knee injury. I already read a suggested article on your page about ways to invest a $1,000, but I'm looking for which companies are best to trust. Google isn't exactly reliable in that area with all its sponsored ads, so I was hoping if I could ask y'all: If you had about 10k drop into your lap, what is step 1? (and possibly 2 & 3)

We're so glad you asked, kitten. Were I in your situation, below are the steps I'd take.

Step 1: Establish a safety net. You've been "living poor" after an injury, which tells me that a little financial security could go a long way. So establish an emergency fund with some of that money. We recommend keeping an emergency fund in a HYSA (high yield savings account), which are currently returning about 4% across the board WITHOUT the risk of stock market investing. Here's how that works:

Not Every Savings Account Is Created Equal

You Must Be This Big to Be an Emergency Fund

Step 2: Invest in low-cost index funds. Do not--we repeat, DO NOT--attempt to pick individual stocks or companies to invest in. Leave that to much richer and more experienced investors. Instead, choose one or a handful of low-cost index funds. These bad boys track the entire market to minimize your risk. Here's how they work:

Investing Deathmatch: Managed Funds vs. Index Funds

How To Start Small by Saving Small

Step 3: Investigate diversified investments. If there's anything left over, you can look into an alternative long-term investment, like real estate, a small business, or even higher education for yourself. This can be a way to invest in something more personal, that you care about. But do your homework to mitigate your risk and figure out what sort of return you'll get. We write more about this here:

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

How To Save for Retirement When You Make Less Than $30,000 a Year

If you found this helpful, give us a tip!

63 notes

·

View notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

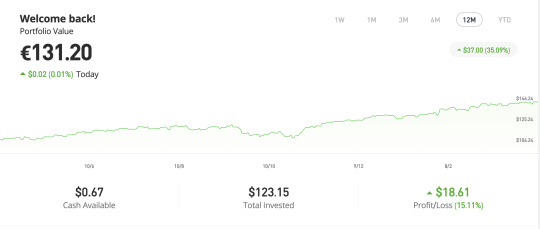

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

7 notes

·

View notes

Text

Mole Interest

Mole buy stocks; mole invest

Mole must get her mole interest-

A quick mole-Google and she gets

The foremost trading app.

Countless firms are spread before her

CEOs beseech, implore her

They’ll return the most next quarter

Or else they’ll eat their cap!

Their speeches are long and dreary-

Kindred pitches form one expanse-

She knows efficient market theory

So she’ll pick one out by chance.

Finds a lovely busy Molehill,

Wide and lively with juicy worms,

Workers of the utmost moleskill

Do fair good work with fair good terms.

They’ve got sick pay near the best,

Pensions for old age,

Grievances quickly addressed,

And a living, squirming wage.

Their tunnels meet the latest codes-

They won’t collapse with heavy loads

The bi-annual inspector toads

Are but the meagrest expense.

Mole’s first AGM comes by

And she finds profits just shy

Where next door reports theirs lie.

Lost profits are loss to her sense.

Workers work well chatting without threat

But under the whip work harder yet

Workers’ welfare has no station

In the firm’s profit equation

Even if upon occasion

It distracts them from their grind.

And all the happy friendly chatter

On bottom lines ceases to matter

If she gets less she disinvests-

The CEO has made a mess

“It’s not how many worms I’d get

If maternity pay weren’t so kind”

She has her eye on ROI

Spies where dividends are high

Chase that bright green profit line

To where the tunnels aren’t so kind

The moles here toil, shifting soil

For pennies on the dime.

There is no noise; there are no joys

Or else they’d be chastised

They must not pause their tired claws

They are not unionised.

And in this thrift of pay for shifts

Their CEO is wise.

So money goes where money will:

The higher ROI molehill

And molehills where bosses are kind

Are molehills that get left behind

So management resolves to find

Each last bit of profit.

To compete in the present market

Suboptimality must be quit:

Maternity pay’s out the door

All chattering will be deplored

And toads won’t visit anymore.

The market demands it.

So interest rates equilibrate

If the workers will put up with it it has no moral weight

If you can take it with no fight it must be free.

What you don’t take will seal your fate

Intertemporal allocation in its most efficient state

By values that do not belong to me.

#mole interest#still could do with a lot more refining#any comments are appreciated- positive or negative#and may influence a final version

16 notes

·

View notes

Text

Take Control of Your Finances: Earn Income on Your Schedule and Your Terms 🤝

Introduction

Are you tired of living paycheck-to-paycheck and feeling like you’re constantly struggling to make ends meet?

In a world where financial stability seems like an elusive dream, there is a way to take back control of your money. By exploring easy ways to earn extra income on your own time, you can pave the way towards a more secure future.

On this page, you will dive into practical tips and resources to help you identify your financial needs and personal interests, explore side hustle opportunities, utilize online platforms, invest wisely, and create a financial plan for success.

Start Your journey to financial independence and learn how to make your money work for you.

Identify Your Financial Needs and Personal Interests

One way to start earning money on your own time is by identifying your financial needs and personal interests.

By taking stock of what you’re good at and what you enjoy doing, you can pinpoint potential opportunities for generating income.

Everyone has unique talents that can be monetized.

Once you have a clear understanding of your financial needs and personal interests, you can confidently move forward by exploring side hustle opportunities that align with what you have to offer, your schedule, and a stress-free work-life balance.

Explore Side Hustle Opportunities

Another way to increase your financial flexibility is by exploring side hustle opportunities.

Side hustles can be a great way to earn extra money outside of your regular job or commitments. Side hustles can also lead to a lucrative, flexible, and full-time income.

Whether it’s freelancing, mystery shopping, merchandising, or having a driving side hustle on a part-time basis, side hustles allow you to leverage your skills and interests to generate additional income.

By exploring different side hustle options, you can find a way to make money on your own terms. This flexibility can give you the financial freedom you desire while also providing a stress-free work-life balance.

Fill in financial gaps in your spare time, or you can even create your own lucrative, flexible full-time income.

Utilize the many income opportunities available in 2024 by mixing and matching side hustles that meet your schedule, interests, and income needs.

Take Advantage of the Digital Age to Easily Earn Money

Utilize Online Platforms for Quick Cash! You can also explore online platforms that offer opportunities for quick cash. Websites and apps like Appen, Kashkick, Observa, Testerup, and Clickworker, allow you to earn quick cash from your current skills or by learning new skills.

Earn from a wide range of clients, companies, and brands. Whether it’s picking up quick local tasks while out running errands with the kids, completing online tasks, or playing games on your cell phone these platforms provide a convenient way to earn money on your own terms.

By utilizing these digital tools, you can tap into a global marketplace and find income that matches your financial needs, personal interests, and your schedule.

Invest Wisely

Invest in your future by considering long-term financial goals and strategies to secure your financial stability and build wealth over time.

Planning for the future is essential to achieving financial success and creating a solid foundation for yourself and your loved ones.

By making smart investment decisions, saving diligently, and consistently contributing to retirement accounts, you can set yourself up for a comfortable and secure future.

Creating a solid financial plan is the key to reaching your goals and setting yourself up for long-term success.

Create a Financial Plan for Success

To create a financial plan for success, start by setting clear and achievable financial goals. Whether it’s saving for a major purchase, building an emergency fund, or planning for retirement, having specific goals in mind will give you direction and motivation to stay on track.

Next, assess your current financial situation by evaluating your income, expenses, assets, and debts. Understanding where you stand financially will help you make informed decisions about how to allocate your resources.

Once you have a clear understanding of your financial goals and current situation, develop a budget that aligns with your priorities and allows you to save and invest for the future. Track your spending, cut unnecessary expenses, and prioritize saving for your goals. Consider creating different savings accounts for different goals, such as an emergency fund, a retirement account, and a fund for major purchases.

As you work towards your financial goals, be sure to regularly review and adjust your financial plan as needed. Life circumstances can change, and your financial plan should be flexible enough to accommodate unexpected expenses or shifts in income. Stay informed about investment opportunities, retirement planning options, and other financial tools that can help you reach your goals faster and more efficiently.

By creating a solid financial plan and sticking to it, you’ll be well on your way to achieving financial success and securing a stable future for yourself and your loved ones. Building wealth takes time, discipline, and careful planning, but the rewards of financial security and independence are well worth the effort. With a clear roadmap to guide your financial decisions, you can confidently take control of your finances and set yourself up for long-term success.

Conclusion

Know You Know, So Go Grow¡!

In conclusion, taking control of your finances and earning money on your own time is a powerful way to secure your financial future. By identifying your financial needs and personal interests, exploring side hustles, utilizing online platforms, investing wisely, and creating a solid financial plan, you can achieve financial independence and stability.

Remember, the opportunities to earn extra income are endless; all you have to do is take the first step today.

As the saying goes, “The best time to plant a tree was 20 years ago. The second-best time is now.” Take control of your finances and watch your future flourish.

Thank you for reading. Please feel free to share this with those you feel cold benefit from it. Did you find this helpful? Do you have any questions?

Download your copy of the listing here or see listing below 👇👇

💸 2024 Best of the Best #EasyMoney Side Hustles 💸 #SideHustlersCentral 👣 Follow on Tumblr for All Side Hustle Updates 🗞 Stay up-to-date with the Free Newsletter 💸 Options below are Freelancer, Independent Contractor, and Flexi Scheduling Opportunities:

📱 Phone/Online

🗺 Quick Local

🎮 Mobile Gaming

🧾 Receipt Scanning

♻️ Multiple Ways to Earn

🤳 Influencer/Affiliate

🎦 Watching Videos

🤳🏼 Guaranteed publicity on 200 News Sites like Insider, MSN, Newsmax, Benzinga, AsiaOne, Fox News, Minyanville Street Insider, Associated Press, and Yahoo Finance. 🗞️ Build Trust & Credibility With Ease. ✅ #ShoutOut Your Business on influential news sites that your competitors can't reach¡! 🫡 With millions of readers every month, you'll get a massive boost in exposure, interest, and credibility. 🤝 #BrandPush

🗺📱♻️ Make money from anywhere, anytime! Multi ways to earn¡! 💸 From mystery shopping visits at local retailer stores to taking some pictures of products/displays to various other quick tasks such as taking pics and/or short videos, testing apps, research, surveys, and more. Join the strong Clickworker community and earn money easily and safely from wherever you want¡! 📱📲

📱 Welcome to Weekshot! Where Your Opinion, Creativity and Knowledge are rewarded. Please add code after sign-in. Menu -> Invitation code -> UAM12 🤝

♻️ Multiple Ways to Earn with Paidwork and Betatesting

CrowdGig is a platform that connects its talented pool of innovators with gig jobs that accelerate innovative projects. As an innovator, you set your own schedule, choose your own jobs, and get paid for the job! If you join and complete a job using this referral link, you will receive $10 in addition to the job fee.

cashKarma Rewards lets you earn top brand gift cards and cash. 💵 Use this invite link to get 300 points. Also check out Pinyada you earn cash anytime, anywhere. 💸 Earn with Easy Bucks for taking surveys, submitting receipts, and playing games 🤝

📱 You can review new music and fashion on Slicethepie and get paid for it too! Check it out! 🤝

📱No previous experience is required AND work from anywhere¡! ✅ Join Test IO and earn money for testing the latest apps, websites, video games & MUCH more! 💸 This is a very diverse Community of freelance testers who come from all over the world and from various walks of life. 🤝 Join free via this link and you will get exclusive referral rewards.💲

Earn rewards for daily travel with the Miles App. 🚘 Use code DDVDF4 and get 4,000 miles. 💸

💸 Earn Money on Your Own Schedule¡! 🗓 Use your smartphone to complete small projects at local stores, or make quick phone and website inquiries or reviews. 🫡 Discrete Pricing Audits, and Mystery Shopping at Restaurants, Retailers, Casinos, Amusement Parks, Local Service Providers, Auto Sales, Zoos, Hotels, Resorts, & MUCH More¡!

📌 Field Agent App 🗺️

📌 Observa 🗺️

📌 Survey Merchandiser & Mystery Shopper 🗺

📌 CX Group 🗺📱

📌 iSecretShop 🗺📱♻️

📌 Gigwalk 🗺️

📌 Shopkick 🗺️ Use code FREE315252 for your sign-up bonus

📌 Instawork 🗺️

📌 Shiftsmart 🗺️

📌 BeMyEye 🗺️ Use code: z56e21e for a $1 Bonus

📌 BestMark 🗺📱 Please use referral ID FL124032 when prompted

📌 Mobee Use code 3CX7 to earn 300 Points/$3! Download it free

📌 Wonolo

Use Stride to track your miles & expenses and cut your tax bill in half! 👏

♻️ Do you want to hear that PayPal notification simply for playing mobile games?!?!? 🙋🏼♀️✔️ Yesssss, this a legitimate app! 📱 Kashkick also has earnings opportunities for surveys and SO much more!! 👏 Earnings are quick AND easy plus there are various ways to earn with Kashkick! Pick and CHOOSE whichever you’d like! 💸

📱Looking for a #SideHustle with flexible online options¿? 🫣 Check out #Appen 👍 Get paid to complete online tasks from your phone, laptop, tablet, OR computer¡! 💸

📱Online Quick Cash with Streetbees please add this referral code 3522K when you sign up. 🤝

🧾 Cash in over and over on your receipts by using Multiple Apps¡! This 👇 is 💯 #EasyMoney ✅ Turn your paper receipts into extra cash, no joke, simply scan your paper receipts for quick cash¡! 💸

📌 Receipt Hog

📌 Pogo Grab Your Sign-up Bonus with Referral Code QDX8PV 👈

📱 Earn money from your data WITHOUT selling your data¡! ✅ Check out ATM ✅

📱Get paid for simply using your cell phone¡! ✅ PLUS get a $5 Welcome bonus with #HoneyGain 🍯

Get up to $500 instantly¡! 💸 No interest, credit checks, or late fees with Dave¡! 👏

Check out the Brigit app. They send cash directly to your bank account! 💸 Highly recommend¡! Earn Money and Save Money¡!

🤯 Get paid to play mobile games¡!

📌 Mistplay 🎮

📌 Testerup 🎮📱♻️

👉Discover games and apps that suit you¡! 👏 Cash for every minute you're playing, grab your money through PayPal, Amazon, GooglePlay…)! It is as simple as it sounds: just open the link, download the free apps, and start playing games. 🎮 You will receive a Bonus of 4499 coins on the 5 free apps below¡! 👇👇

📌 App Flame

📌 Money Rawr

📌 Cash Giraffe

📌 Fitplay

📌 Money Turn

🤝 STRESS-FREE payments that also ACTUALLY build/rebuild credit¡! 🛒 Grab your $100 credit to shop with¡! 📱📲💲P.S. Utilizing this for birthday gifts, holidays, and even things to spoil yourself while earning money AND building credit is a HUGE #WinWin❗Get your $100 credit when you sign up HERE.

📱It's easy to buy and sell your gently used or new items on Mercari PLUS there are 0 - ZERO Seller fees¡! 💸 Get up to $30 when you get started by using promo code RFEGXR here. Also check out Nextdoor, Offerup and 5 Miles📱📲

📱🎮📻 Sign up Free to earn for playing mobile games 🎮, listening to music 🎵, & even for reading¡! 📚 Join the #Current #EarnApp Free! 🆓💰

♻️ Quick online assignments that pay for completing tasks such as testing apps and playing games in your free time with #FreeCash 💸 1 Hour A Day Provides Average Earnings of $5.12 a day ×365 days = $1868.80 💸

Consolidate all your links in one powerful link-in-bio on one convenient page. Creators, if you were thinking of launching your knowledge business, now is the time! With Pensight you can launch in minutes. Simply add your digital products, subscriptions, courses, and coaching, plus you can organize your client’s emails with Pensight. Utilize the free account or upgrade to Pro to accept payments, and sell your digital products and/or services. Click here to sign up free or to get 40% off your first two months of Pro.

🗺 Want to save up to 40¢/gal on gas¿? ⛽ Get up to 25¢/gal off gas in addition to the current 15¢/gal bonus¡! Use this link OR enter Promo Code SZZ2X to get an extra in FREE gas the first time you use the app¡! 💸 🤗 BTW I'll also get an extra 15¢/gal cash back after you use the app so thanks¡! 😉 #Upside #SaveOnGas

📱Join over 40 million users who love #Revolut¡! 🤝 Cut those overwhelming hidden banking fees! ✅ Sign up free 🆓

📱 Earn up to 4.60% APY and pay NO account fees¡! 🚫 Join below to start earning more money with #SoFi Checking and Savings. 💸 Use this link to sign up and you’ll get a $25 bonus and up to $300 when you set up direct deposit.

📱🎦♻️ Money Tree Rewards! It's an app that lets you earn free money, gift cards, and discounts by watching videos, downloading, using/testing apps, or answering surveys! Use code KJORY for a Bonus 💸

🤳🏼 #Easymoney 💸 Temu Affiliate Program 💸 Withdraw to your #PayPal 💸 Current earnings from #Temu average up to $100,000 per month! 💸 Join now¡! #BuildYourEmpire 💸

More Easy Money 👇👇

📱♻️ Earnably

📱♻️ Smarty

📱♻️🎮 dollah

🎮 Tapchamps

Much Love¡! ♥️ Thank You for Reading, Sharing, Downloading my Publications, and Supporting my Collaborative Creativity,

Jessie 🤩

🗞 Stay up-to-date with the Free Newsletter

👛 Support my Collaboration #TipJar

🤝 Get Exclusive And First Access With the #SideHustlersCentral VIP Newsletter for ONLY ¢99¡! 😁

Subscribe to my Facebook Here 🤝

Follow and/or contact me on Facebook Here 🙃 #JessiePatrick #Momprenuer #HomeschoolHotMess #MomLife #KeeganZayne #MomtasticCreatopia #SmallBusinessSpotlight

#entrepreneur#side hustlers central#easy money#growth#make money online#gigwork#shift work#sidehustle#side hustle#financial growth#JessiePatrick#momtastic creatopia

2 notes

·

View notes

Note

Who is richer Cullen Family or Volturi Family ? How much money do you think Volturi has?

Carlisle Cullen, age 370, has accumulated a fortune of $34.1 billion — much of it from long-term investments made with the aid of his adopted daughter Alice, who picks stocks based on her ability to see into the future.

Isle Esme is a tropical island off the coast of Rio de Janeiro. It is owned by Esme Cullen, and was given to her by her husband, Carlisle Cullen, as a gift.

Though mystified as to whether or not Bella is changed, Aro in return sends Bella the necklace as a wedding gift. It is described as being ostentatious with a very large jewel, and is said to have been part of the English crown jewels.

The Volturi still own almost all of the property in the vicinity. They have small private landing strip and more…

I think the Volturi have a lot of money from real estate, that's as solid as an investment can get. They can afford Heidi flying around in a jet or her yacht, so they're docking in Monaco wealthy at least.

Still, I don't think they're Scrooge McDuck wealthy. Certainly nowhere near the Cullens.

The stock market is something you could make a lot of money on if you just know the future. If for instance I travelled back in time just a couple of years, I could potentially make millions from buying, selling, and shorting at the right times. Buy PPE manufacturers in 2019, Pfizer in 2020, sell in August 2021, buy Gamestop before it took off, short Facebook in 2021 and Netflix and Tesla in 2022, and borrow insane money to do it all because I'd know for a fact that I'm getting it back. If I'm feeling unethical I'll buy oil and electricity well ahead of 2021 as well. I'll bet too, I now know every election winner.

Point is, if you know the future then the stock market will make you so rich. Holy god you're gonna so rich.

The Volturi could bet around, sure! They could have invested a little in every vaccine manufacturer when the pandemic broke out, thrown themselves on the Gamestop craze when it began (but when to sell? Alice knew when it was gonna burst, they did not), they can figure out Facebook and Netflix are about to take a hit and predict Musk's idiocy to make investors pull out, and electricity and oil are probably resources they're already invested in. However, they can't know for sure the way Alice can, and so they'll have to be moderate with their every investment. And if they're trying to make short term investments like these, then they will end up making bad investments that blow up in their faces.

Aro is running a thousand-year-old organization he wants to be stable, and that means he can't suddenly call a meeting to tell everyone that he, ah, might have lost €200M because heh, tiny chance he decided to put it in Vine. Hm, yes, sorry about that.

Aro's going to have to do long term investment, and that means real estate, all the real estate. Maayybe if he wants to have a bit of fun he invests in other things as well, but that'll be Aro investing in a company that produces animal-shaped jewelry because those were the cutest tiny ceramic guinea pigs he ever saw, not looking to make the big bucks.

The Volturi can't match Alice.

With that in mind, I think the Cullen fortune has been overestimated. Money gets to a point where it's more of a hassle to have, and a sum like $34B or even $64B as Forbes estimated (I'll put it this way, I'd love to see how Forbes arrived at that number) is a full time job to manage. Yes, the Cullens have luxuries they don't need, and given Alice's... Aliceness, I’m sure they’re ugly rich, but they are also living fake lives. They get their legal documents from a shady guy in Seattle. I'll almost guarantee you that they only do the bare minimum in terms of managing their fortune. I honestly think their genius solution to stay under the IRS' radar is to just... keep it lying around the house in cash form. If the money was accounted for, Bella would have been grabbing a credit card, it's telling that she grabbed a wad of cash instead. For larger purchases (can't buy an island with cash) I imagine they have offshore accounts an alternate identities.

But, again- these guys have a guy in Seattle that they run to for fake papers.

They act like drug lords, not billionaires, is what I'm saying. To the point where I would wager Alice has sold a few very expensive art pieces, wink.

I think their fortune is vastly oversized but the indications we're given of how they manage it would point to it not being in the tens of billions. I also just... genuinely don't think they're capable enough to hide that kind of money.

Still, given Alice's gift- should she want to become the richest woman on Earth she could do it, but I don't think she has.

(Note on real estate: yes, I know 2008 made it look unstable. However, this was due to greedy banks overdrawing mortgages, the extant houses being uninhabited, and a whole lot of nonsense. There are many ways to invest in real estate, and doing so wisely is going to be a very safe long term bet.)

114 notes

·

View notes

Text

Emergency Calories (0-1 Spoon)

Food can be a struggle on really bad days, no matter what the circumstances are. You hurt too much to make something, or maybe it’s the thought of the dishes afterwards that’s too daunting to bear. Maybe you’re too brain-fogged for whatever reason to decide on a thing to actually make, or hyperfocused too long on something and come out of it so hungry that it’s turned to nausea and/or headache, and the thought of any real food is sickening. Either way, the problem’s the same - too much hunger, not enough spoons to fix the problem.

The way I’ve found to deal with that is to keep a small stock of emergengy calories on hand; the kind of thing that needs minor preparation at most, and at most one dish and a utensil. Most of them don’t even need that much. Sometimes, just the act of cramming some emergency calories into my face has unlocked enough spoons to be able to manage an actual meal. So here’s a list of the emergency calories that have been my saviours, particularly since my fibromyalgia diagnosis.

Peanuts: zero prep, zero utensil, zero spoons. Peanuts (and most other nuts, if you’ve got a peanut allergy) are high in protein and fat, because nut oil, and while not particularly high in carbs, they’ve got enough to be going on with. This makes them a quick-burn and a slow-burn food, and can be supplemented with other things that are higher in carbohydrates to get more of a quick pick-me-up. Thing is, it’s the longer-term energy that I tend to be going for when I shove a handful of peanuts into me, since I’m generally hoping that it’ll perk me up enough to make an actual meal. That’s why I keep a bag of salted peanuts in the cupboard; if I can’t make myself prepare anything and need something a little more substantial than the usual snack foods, I’ll just pour myself a handful and munch.

Dried fruit: zero prep, utensils, and spoons, at least in terms of consumption. I have a whole entry planned about why a dehydrator is the best investment anyone who lives with a really tight spoon budget can make, but if you don’t have one, store-bought dried fruit is fine. A little expensive, maybe, but sticking with raisins helps with that, and getting those little snack-boxes of raisins may end up a nice little nostalgia trip back to elementary school lunches and that one trick-or-treat house no one really wanted to go to because the raisins weren’t even chocolate-coated. For something that feels a little more prepared and tastes a little more interesting, mixing raisins and peanuts is really nice, giving an interesting range of textures and flavours. Sometimes a handful of peanuts plus a little box of raisins can unlock a whole spoon with which to cook an actual meal, I’ve found.

Potato chips: zero prep, utensils, and spoons. Maybe not the healthiest choice, but sometimes it’s the only choice. They recommend plain salted chips (or crisps) for chemotherapy patients for a reason; they’re easy on the stomach and help replenish lost salts. Whether they’re fixing a salt deficiency, fixing a blood sugar deficiency, or just a placebo, I don’t care; I find a little bag of crisps settles my stomach when I’ve left it too long between meals and have the nausea as a result.

Rice cakes or crackers: minimal-to-zero prep, utensils, and spoons. It all depends on how you’re eating them. You can have them plain - they even have flavoured rice cakes now - and that takes no spoons or anything. On the other hand, if you’re up to picking up a knife or pulling something out of the fridge, rice cakes and crackers are a good, light, easy-on-the-stomach alternative as a vessel for something that actually tastes of something. For instance:

Peanut butter: minimal prep, utensils, and spoons. Peanut butter (or any other nut butter, again accounting for allergies) can be eaten with a finger out of the jar if you’re really having a bad day, but if you can manage a spoon, just eating a couple of spoonfuls from the jar works just as well. There’s also the option of dipping something like dried banana or apple chips or something into the peanut butter and eating it that way, if you’ve gone the dried fruit route. However, if you can manage a knife and maybe a plate, this provides scope for peanut butter sandwiches or just peanut butter spread on rice cakes. If inspired that way, there could even be PB&J. It’s shelf-stable, so it doesn’t go bad very quickly, and has the same basic benefits as the nuts on their own. Maybe more sugar and/or salt, is all.

Sliced lunch meat: minimal-to-zero prep, utensils, and spoons. Like the rice cakes - in fact, part of why the rice cakes are there is because they can be part of a low-spoon charcuterie board sort of set-up. Way less expensive than Lunchables. Or, if you just need some protein that isn’t a nut, just roll up a piece of whatever lunch meat you’ve picked up and nosh away. Same basic thing as jerky or dried sausages, but both those can be kind of salty and a bit more effort to eat than someone might be up for, and both are a lot harder to put on a cracker.

Cheese: minimal-to-zero prep, utensils, and spoons. Whether real cheese, Kraft Singles, or some lactose-free version of cheese, it’s still got protein and fat and is useful for something you can just quickly eat right out of the fridge, or spread on crackers if it’s cream cheese or soft cheese, or slap together a cheese sandwich with. A versatile way of getting your protein in on the same tier as the lunch meat.

The deciding factors on all of these are how long they take to go bad. Fresh fruit is a great snack but any time you buy fruit, you’re making a commitment to either eating it all before it goes off or wasting food, and that latter’s a pretty common outcome, particularly when some of one’s symptoms can lead to forgetfulness. That’s another one I’ll point out in the dehydrator-related entry, but for now, sticking strictly with the basics - that these are good, solid snack options for days when there are just no spoons left, and are sometimes effective enough to replenish a spoon for cooking a real meal. Just the one, generally, but it’s like one of those tiny minor mana potions you get in video games; sometimes that one spoon is the difference between getting something done and not. It’s enough, sometimes.

These are just my recommendations for the little essentials that should be sitting in the cupboard somewhere in case of emergencies - the kinds of things that I’ve learned will keep me going when I’m struggling and too hungry to function. If you’ve got any further ideas for little snacks for bad days, additions are welcome. I haven’t put soups in here because they’re not really near-instant calorie sources; I’ll touch on soups another time.

17 notes

·

View notes

Text

やめてください 柊マグネタイト feat. 羽累 / Please Stop Hiiragi Magnetite feat. Haru english translation

Hiiragi Magnetite's 16th song over all & the 10th song in aru sekai series! There's no background text this time but I think the amount of context in the lyrics is more than enough to figure out this part of the story.

Youtube | NND

敗北ランド 実際は排他

失敗社会だ 理解がない

A defeated land, truth is excluded

It's a failed society, I don't get it

快も不快も 後悔が対価

人生終わった 一回でバーイ

Pleasantness and unpleasantness, compensated with regret

My life's over, a one time byee*(*occurance)

差異 得 ライド 言った言わないの

記載はないが ごめんもない

A disparity advantage ride, won't you say it was said?

There's no record of it, but no apology either

埋没ランド 失態晒した

失敗社会だ 理解がない

A buried land, it exposed the errors

It's a failed society, I don't get it

毎食ドット ファニー

インダストリー道理

混濁ドーミー for Me 賞味

ソーリー 暴利ストーキング!

Every meal dot, funny

Logic of an industry

Muddled dormy for me, an appreciation

Sorry, it's usury stocking!

背徳ノット 甘美

見出す脅威 承認

コンタクト産み 長期投資

勝利 合理苦 ショウミー!

The knot of corruption, so sweet

Discovering threats, acknowledging them

Creating contact, a long term investment

Success, rationality in pain, show me!

やめてください やめてください えー

ブンブンブブン ブンブンブブン は?

Please stop, please stop, yeah

Buzz buzz b-buzz buzz buzz b-buzz, huh?

やめてください やめてください えー

ブンブンブブン ブンブンブブン は?

Please stop, please stop, yeah

Buzz buzz b-buzz buzz buzz b-buzz, huh?

やめてください やめてください えー

ブンブンブブン ブンブンブブン は?

Please stop, please stop, yeah

Buzz buzz b-buzz buzz buzz b-buzz, huh?

やめてください やめてください えー

ブンブンブブン ブン

Please stop, please stop, yeah

Buzz buzz b-buzz buzz

は?

Huh?

最速回答 聡明じゃないの?

判断遅いよ は はいは はい

The fastest answer, it's the most sensible, isn't it?

Your decision's so slow, ha, yeah ha, yeah

愛読愛用 スーパー問う賛と

ノーマル問う散に学びなさい

A favorite reading, please learn from

A super accusation of praise and dispersal of a normal accusation

単発バイト お金がないね

仕方がないね ヤるしかない

It's a one-shot job, there's no money in it, huh

There's no way around it, huh, I have to do it

催促回答 どう? ねえ? しないの?

判断遅いよ は はいは はい

Demanding answers, how about that? Hey? Won't you do it?

Your decision's so slow, ha, yeah ha, yeah

退職ボット バーニング

皆苦労人 同士

御社不当に 奉仕飲み

飛び込みローディング!

A resignation bot, burning

Everyone's so wise, colleagues

Your company unfairly drinks up the bargain

Plunging into loading!

愛毒ノット 堪忍

見た? ストーリー更新

網膜調子 推しの身 お搾り 庶民!

A knot of poisoned love, endurance

You saw it? The story's update

The state of the retina, your favorite's body, an aperture of the common folk!

契約もっと パーリー

人格統制 狂信

鉱脈通り ツルハシ

売り撒き ダンシング!

A more pearly contract

Personality regulation, what fanaticism

The flow of the vein, a pick-axe

A distribution of sales, dancing!

感謝 出会いに感謝

人類全員感謝

毎度 収入 お布施 恒例

脳脆 当然 放置!

Gratitude, gratitude for meeting

All of humanity's grateful

Every time, receipts, offerings, customs

A sentimental mind naturally leaves it alone!

やめてください!!

やめてください!!

Please stop!!

Please stop!!

えー

ブンブンブブン ブンブンブブン は?

Yeah

Buzz buzz b-buzz buzz buzz b-buzz, huh?

やめてください やめてください え-

ブンブンブブン ブンブンブブン は?

Please stop, please stop, yeah

Buzz buzz b-buzz buzz buzz b-buzz, huh?

やめてください やめてください えー

ブンブンブブン ブンブンブブン は?

Please stop, please stop, yeah

Buzz buzz b-buzz buzz buzz b-buzz, huh?

やめてください やめてください えー

ブンブンブブン ブン

Please stop, please stop, yeah

Buzz buzz b-buzz buzz

はあ。

お人よしなんて言葉ヅラだけはまあいいが

ただ

「自分自身さえ我慢すれば」

「それで全部済むならいいや」って

一回二回小さな侵略を許すうち

気がついたら

唯一の聖域をお前らに何もかも

めちゃくちゃにされた

Hah.* (*sighing)

It'd be acceptable if people's significance was just a term but

Only

"If you have patience with yourself"

"Then everything should be fine once it's over" they said

Once, twice, when I noticed the forgiveness of small aggressions

The sole thing off limits caused

Everything unreasonable to happen to you guys

断れない!断れない!断れない!

嫌われたくない!

ああ!そのせいで!そのせいで!そのせいで!

It's unrefusable! It's unrefusable! It's unrefusable!

I dont want to be hated!

Ah! Because of that! Because of that! Because of that!

何もかも終わった

Everything's over

断れない!断れない!断れない!

嫌われたくない!

ああ!そのせいで!そのせいで!

そのせいで!

It's unrefusable! It's unrefusable! It's unrefusable!

I dont want to be hated!

Ah! Because of that! Because of that!

Because of that!

----

T/N

1- the bye towards the beginning, since its in katakana it makes sense for it to be a casual drawn out bye but given this is a magnetite song & a series song at that i cant ignore the possibility of it also being a play on 場合

2- the ha hai ha hai parts, i think given the spacing its more of bitter laughing or sighing than a y-yeah/y-yes type deal.

3- i translated oshi as your favorite but its used for someone you support or are a fan of, similar to stan or bias but i wasn't sure those terms fit the mood of the song

4- this is more of a fun fact series wise but the 8 times 7 times repeating pattern for yamete kudasai and bunbunbubun respectively is the same pattern as the repeating parts in laboratory (kaete, koete and yamete, tomete respectively)!

5- another series note, the sono sei de is very similar to the sono sei wa in kugutsu ashura so while i translated it as "because of that" saying "in that world" may also be an intended double meaning!

6 notes

·

View notes

Text

HOW TO INVEST IN STOCK MARKET?

People these days want more than one stream of income, so for that stock market investment is the best way out to bring new inflow of money in life. There are certain approaches one must follow to get into stock market, otherwise this may also give you huge losses.

Earning profits will be easy when you know the right strategies in stock market in different segments. Learn best option strategies practically with ICFM

Your vision and benchmark profit should also be defined before entering the market, where you can set a limit for profit and loss too and also how much is the capacity to invest.

Now, the important factor is to pick correct stocks and shares where you can invest and earn. There are numerous methods of stock picking that investors and analyst apply. But they are also the modification of the basic buying strategies of investing.

Related: ICFM is the best Institute for stock market in Delhi.

Following are the 2 useful strategies for investing:

Growth investing- investors look for those companies which are having high growth potential, hoping to realize the maximum benefit from appreciation of price in the long term purpose. As the investors seeking out the growth so he is less concerned about the dividend income and more willing to risk investing in new companies showing high potential to grow.

Value investing- here, investors invest in blue chip companies who are well established and shown slow and steady returns over the period of time and get benefit of regular dividend income also. Investors are more focused in steady income through avoiding risk as compared to growth investing. And strategy helps in buying the stocks when it falls and selling after a certain increase in price and their intrinsic worth realized by the market.

A Mixture of Value and Growth

If anyone is planning for long term approach of investing, a mixture of both the strategies will give a great benefit to the trader. Behind this, there are certainly good enough reasons to back these stock investment strategies.

Because of the dependency on the seasons, value stocks typically performs well in the market during the good times but also have a risk of falling down if the bull market sustained for the longer period of time.

On the other hand, growth stocks work phenomenal when interest rates drop in the market and due to this their earnings goes up. When there is a last stage going in the bull trend then also these growth stocks continue to rise.

So due to mixture of both, investor enjoys higher returns on his investment while reducing the substantial amount of risk. Suppose any uncertainty happened in the market and an investor has both the growth stocks and value stocks, so he can generate optimal earning and fluctuations won’t wipe out the real investments and returns will be more likely to balance out in your favor over time.

Conclusion

Every investor should build up their own strategy to stand in the stock market and which suits their needs and wants. One can go for growth or value or both, any dedicated strategy will give great results when you are consistent upon it. You can change the strategy during the course of your life as the financial situations changes or goal shift.

#Derivative Market Course#Stock Market Course#Trading Course#Share Market Classes#share market training

2 notes

·

View notes

Text

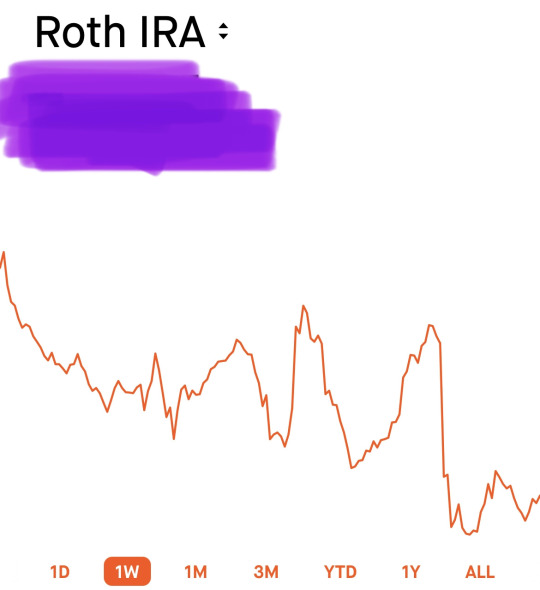

This is my top-tier emergency fund. I am not in an emergency, so I am viewing this as an opportunity.

This is one of the funds I invest in. It is a single fund (I buy 1 ticker symbol of shares), the fund then takes investor money and buys shares of a lot of companies.

The cost of this service is about $1 per $10,000 invested across the entire fund. It’s ridiculously cheap. This is how EFT and similar funds work.

The benefit being they do the leg work of figuring out what companies will be worth more someday in the future, and which are overpriced now. This is an incredibly difficult task requiring extremely expensive equipment and a career of experience that must be run 24/7/365 forever.

Ergo: this is a great deal. I am paying about $1/10,000 per $1 I invest to not do any of that.

(I think it might actually be slightly higher than this clean example but by “slightly higher” I literally mean a few bucks instead of literally $1. Am writing this on my phone while waiting for a meeting to start.)

Previously, I researched the fund and said “this works for my personal situation” and bought shares and monitor it very occasionally.

Because the fund’s stock price is down, as part of normal stock market stock marketing, I can say “I can buy more shares for the same amount of cash I normally invest on a weekly basis.”

The risk is the fund will go to $0 and I will lose all my money. This is an inherent risk to investing. In researching this fund, I feel the risk is so low it is statistically irrelevant.

The reward is this fund will recover and be worth more than I bought it at. The timeline for this to happen is 20-30 years, or when I am in a life-or-death situation and have exhausted all alternatives, whichever comes first.

I specifically am using money saved to invest, so we are going to focus on what my options are with this $X

The alternative would be to put the money I have for investing into a high-yield savings account for 20-30 years instead. The return on those are, as of writing, up to 4%.

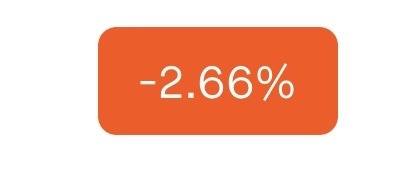

Why is this not the best option? +4% vs -2.66%?

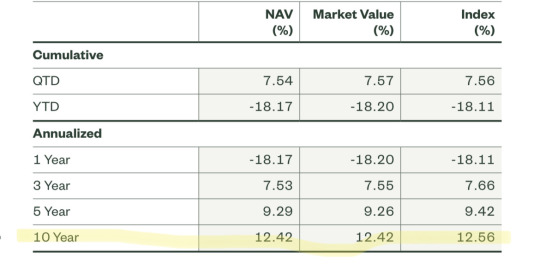

This is from a fact sheet.

Every fund has one (it’s actually a giant, potentially illegal, red flag if one does not) and they are part of the publicly available, pre-purchase, literature.

Google “{ticker code} fact sheet” and you will find it. They will all have a table similar to this. It will be publicly available and should not be behind a signup wall.

An annualized return is the average return over that period, year by year. So a 12.42% return over 10 years turns a every single $1 invested into $3.22. Google “annualized return calculator”

A savings account at 4% compounding daily turns this into $1.49 in 10 year. Google “daily compound interest calculator”

For comparison, they stock market return matched that just after Year 03 of 10.

So, when a fund I trust for a long term investment is down, to me it is future money on sale.

Every $1 I put in today does a little further then it would when the stock is performing well.

There is risk.

Funds will have bad years, they will have bad multi-year periods.

When I check on it, I ask, “are things bad now for everyone? Or is everyone doing well, but this fund sucks? If so, why — is it temporary, is it because they are digging deep into a long term strategy, is it because they lost their edge? Is this being fixed?”

Timing the market (holding cash until stocks are low) is difficult and rarely works out.

You can’t reliably predict when YOUR stocks are going to move, or how far, or in which direction — all you need to focus on is what you are picking.

I have $X that I invest weekly

When I have money and my stocks are high, I double check my emergency cash savings. Are they comfortable? If not, fill. If yes, invest.

When I have money my stocks are low, I am more aggressive about investing extra money. Not at the risk of damage should emergency cash be needed! But if I have extra cash, I strongly consider this as a good time to invest. Can I invest more than $X?

When I don’t have money I don’t look at the market, it’s not relevant to my immediate situation.

3 notes

·

View notes

Text

What is options trading for beginners?

Besides stocks, there is a growing interest in options trading. Options are financial contracts that derive their values from an underlying asset, such as stocks, ETFs, bonds, etc.

Options trading involves buying or selling underlying assets at a fixed price on a future date.

Options trading can be more complex than trading stocks. When you buy stocks, you fill an order for the number of shares you want to purchase. Your broker executes the trade at the prevailing price or the price limit set by you. But options trading requires understanding advanced strategies and knowledge of asset price movement.

How does options trading work?

When traders buy or sell options, they have the right to exercise the options at any point before their expiry date. But simply obtaining an options contract doesn't require one to execute its terms at expiration. Due to this feature, options are regarded as derivative securities. It also means that, unlike shares, options don't represent ownership in a company. The market price of the options is, therefore, the proportion of the underlying asset price.

How to trade options

Open an options trading account: Brokerage firms will screen probable options traders for their experience, understanding of risks, and financial preparedness. They will note these factors in the options trading agreement. The broker will ask you for,

Investment objective

Trading experience

Financial details

Types of options you want to trade

The broker will assign you an initial trading level based on the answers.

Nowadays, you can open an options trading account online with brokers like Angel One.

Pick options you want to buy: You can select from the available options contracts in NSE. For your understanding, a call option gives you the right to buy an underlying asset at a fixed price on a future date. A put option allows the holder rights, but no obligations, to sell underlying stocks at a predetermined rate on a future date. The decision to buy a call or put option will depend on your understanding of asset price movement.

If you expect the asset price to rise, you will obtain a call option. Conversely, you'll buy a put option when you expect the asset price to fall.

Predict option strike price: An option only remains valuable if the underlying asset price finishes close to the strike price on expiry or the contract is 'in the money. It means above the strike price if it's a call option and below the strike price in case of put options. You'll want to buy options with a strike price that reflects where you expect the stock price to move during the option's lifetime.

The price you pay for an option is the premium. It has two components - time value and intrinsic value. The higher the premium, the lower your profit.

Determine the option time frame: Every option has an expiration period or the last date you can exercise your rights. The expiry date is not random. The option's expiry date in India is fixed on the last Thursday of a month. Options are not suitable for long-term investment. Options traders bet on the short-term movement of the asset price. Hence, options are available for 1-month, 2-month, and 3-month duration.

An option's time value decay as it moves close to the expiration date. If you don't monitor the movement of the asset price or don't execute the option on time, it may expire worthlessly.

Now trade options with angel One. Open an options trading account and start investing.

2 notes

·

View notes

Text

When is the best time to upgrade your furniture?

There is no bad time to upgrade your furniture. You need to consider your situation, but if you are in the market for a new couch, chair, or bed, make sure you take the time to find a quality piece at a great price. You may not know it, but now is the best time to start looking for furniture stores because many stores are starting to stock their spring and summer furniture now. When you wait too long, you risk missing out on the best deals and being forced to pay more for the same items.

If you've been thinking about getting new furniture or switching some things around, you're not alone. So many people are in the same situation, and if you're like me, you've probably waited too long to make a change in your home. This is a guide to being proactive and when the best time is to make a change in your home. Your furniture goes through a lot of wear and tear. Over time, it can start to show its age and might not be as comfortable as it used to be. You might be wondering when the best time to upgrade your furniture .

What is the best time to upgrade your furniture?

The best time to upgrade your furniture is when it starts to look old and outdated. There is a lot of wear and tear that your existing furniture may suffer from and it will start to get ratty looking. You will feel unsociable when you are surrounded by tatty and dated furniture. If you feel it is time for an upgrade the best way to do it is by contacting a furniture removalist to help you.

How to determine what furniture you should upgrade?

Purchasing furniture is always a difficult process. You'll find better prices online, but what if you don't have time to go to the store and test out the furniture for yourself? This is why purchasing furniture online is a great idea. It allows you to find better prices and purchase furniture from the comfort of your own home. However, this is a big investment, which is why you need to take your time. Read this article to learn how you can select the right furniture for your home.

What might affect your decision?

Furniture is in our lives for the longer period. When we invest in the furniture, we want it to serve us for the long term. This blog will talk about the different aspects of furniture and how we can shop with the purpose of getting furniture that will serve our need and building aesthetic value as well.

How to pick the best time to upgrade your furniture?

Picking the best time to upgrade your furniture is not a big deal but it can be a time consuming process. You have to ensure that your furniture serves the purpose for which it was designed. You need to ensure that you are purchasing the best furniture Shops for your money. In most cases, we do a lot of research to ensure that we pick the right furniture. But, this research is never enough.

Conclusion: You'll be surprised by how much money you can save when buying furniture at the right time.

#moderndesign#designers#miami#modernhomes#furniturestores#contemporarydesign#sofas#interior design miami#interiordecoration#interior design#modernfurniture#design#interiors#architecture#architecture blog#modern architecture#real estate#architizer#furniture miami#architect#miamibeach#minmalist#maximalism#contemporary furniture#colorful interiors#high contrast#realtor#southbeach#fort lauderdale#palmbeach

4 notes

·

View notes

Text

How Can Online Schooling Help You Invest More In Your Child's Future?

Online schooling comes with a host of benefits. With the cost of traditional education rising to 12% a year, the personal savings you could realise through online schooling is quite clear. These savings don’t just mean extra disposable income in the short run, they are potential investments to secure your child’s future.

How do you save because of online schooling?

No additional transport costs:

On average, you spend anything between INR 9000 and INR 15000 every term to send your child to school by bus. Those who have chosen online schools like 21K School save up to INR 45,000 a year. More often than not, these costs are hidden in exorbitant school fees.

Lower medical bills:

This one isn’t as obvious as the other reasons. With your child safe at home, you aren’t exposing them to the ever-recurring common cold at every turn of the season. With rising medical expenses, these savings can add up to quite a bit.

Minimal to no uniform costs:

Some online schools require children to have school uniforms, even then, with the reduced wear and tear, you won’t find yourself buying a new set of uniforms every term.

Less expensive fees:

Of course, you want your child to access the best education. Traditional schools that provide a choice of international curricula comparable to 21K School and a particular quality cost anywhere from INR 900,000 to INR 16,00,000 yearly!

At the very least, traditional schools cost about INR 50, 00,000. That is, up until the twelfth grade. Private schools that offer suitable extracurricular activities and options of international curricula could set you back well over INR 1.5 Cr during the same period.

How do you invest in your child’s future?

1. Choose a reliable online school

Online schools undoubtedly help you contain costs and save money. The best way to invest in your child’s future by saving money is to send them to India’s best online school, 21K School. Not only does your child get access to everything they want and need to learn, you also save significantly to make smart investments for your child’s future.

2. Find ways to get earnings from your child’s art

Schools that care about your and your child’s future develop great plans for you. Schools like 21K School convert your child’s art and other craft into non-fungible tokens (NFTs). The earnings gained from these NFTs go towards your child’s future.

3. Invest in child insurance plans

Child insurance plans invest a portion of your premium in higher-than-average return options and can be cashed upon maturity.

4. Invest in gold or ETFs

You could buy some precious metal, rent a locker to keep it safe or invest small amounts over time in gold ETFs. These electronic investments allow you to purchase gold without worrying about keeping it secure. When the gold markets are ripe, you can sell your units, invest elsewhere, or buy more gold.

5. Sukanya Samriddhi

Sukanya Samriddhi accounts enable parents of the girl child to earn up to 7.6% annually from investments. You can choose to save for their higher education or even their marriage. This scheme is run by the Indian government and is a safe investment choice until your daughter turns 21.

6. ULIPs (Unit Linked Insurance Plans)

With ULIPs, you need not worry about inflation as much as you do with many other investment options. Part of the payment goes towards insurance if something unfortunate happens to you. The other part is invested in capital markets and generally generates a relatively stable return. However, you must research all ULIP plans available and pick the one that suits you best.

7. Post-office savings schemes

Post office savings schemes have been around for a very long time. They are known to be safe and generally offer a competitive rate of interest. Safe investments like these are a great way to ensure that the money you save by sending your child to an online school, is used for their future.

8. Stocks and mutual funds

Of course, the stock market is one option. However, make sure you do your research and are prepared for fluctuations. While this is riskier than many other options, it will likely yield the best returns for you.

Tips to make sure you invest right

While your approach to investment may vary, there are a few tips that every parent needs to know.

1. Set clear goals: Set clear goals of how much you want to save. It will help you plan your budget and ensure your savings are consistent.

2.Be future ready: The economy can sometimes be unpredictable. It is best to invest in multiple saving options and hedge your bets. Don’t go for only high-return investments that are often riskier.

3. Start early: This may be the most prudent advice. Start putting money aside as soon as you can. Any parent who has raised a child to adulthood will tell you, time flies. Make sure you start your investments early on.

4 notes

·

View notes

Text

Who’s got the lobes for business: The best Ferengi in Star Trek

By Ames

Rule of Acquisition number 74: “Knowledge equals profit.” At A Star to Steer Her By, we’re seeking knowledge: specifically the answer to who are our favorite Ferengi characters in Star Trek. The froglike race grew from a satirical take on capitalism in TNG, to a whole planet undergoing a gender revolution in DS9, to the occasional clever gag on Voyager and Lower Decks, and we were fully strapped in for the ride the whole time!

There are a number of good choices for favorite characters in the Quark family alone, so you’re going to see a lot more overlap from the four of us in our final picks. Spin the Dabo Wheel and see who came up as you read on below or listen to our coverage on this week’s podcast episode (discussion starts at 42:45). Pull up a stool!

[images © CBS/Paramount]

Caitlin – Fortune 500 Ferengi

Pel

Quark

Moogie

Caitlin’s favorite Ferengi are all expert entrepreneurs in their own right, even if they have to go about it in their own ways. We demanded more of Pel for proving her worth in a male-dominated world; we’re all unfettered fans of Quark for just how much depth his character got to explore over the years, and of course we delighted in Moogie for literally wearing the pants in her relationship especially when females were supposed to be naked!

—

Ames – All that glisters is not latinum

Quark

Pel

Reyga

The Ferengi that Ames wanted to spotlight are those that break the mold on traditional Ferengi social constructs. Again, we see Quark who consistently pushed against the limits of what we were told was Ferengi culture, Pel who defied the gender barrier and got away with it, and a rare throwback from Next Gen in Dr. Reyga, the Ferengi scientist studying in a field we’d never expected to see someone of his race involved in without profit attached!

—

Jake – The beat of a different lobe

Nog

Pel

Leck

Jake wanted to give shout outs to Ferengi to march to the beat of a different drum… just not so loudly as to hurt their ears. Let’s have a standing ovation for Nog for finding his own path in the universe that took him places Ferengi had never been, yet another round of applause for Pel for pretty much everything we’ve already covered, and a little extra aplomb for Leck the Eliminator, a Ferengi so unusual he’d assassinate someone just for the XP.

—

Chris – Long-term character investments

Rom

Moogie

Nog

Buy stock in Chris’s picks early on and you’ll reap the rewards by the end of Deep Space Nine. These characters are in for the long haul and develop hugely over the series. Follow along as lowly, disrespected Rom gains confidence over the seasons until he’s actually the Grand Nagus, as Moogie’s influence grows to incite a female revolution on Ferenginar, and as Nog develops from juvenile delinquent to respected Starfleet officer.

—

We hope you found profit in our choices and didn’t get written up by the FCA. Next week we’ll have the spotlight on another alien race, so make sure you’re keeping up with us here. You can also continue on our voyage through Voyager on SoundCloud, hail us on Facebook and Twitter, and be sure to tip your Dabo girl!

#star trek#star trek podcast#podcast#ferengi#latinum#rules of acquisition#profit#daimon#bok#reyga#quark#rom#nog#zek#pel#moogie#leck#brunt#arridor#kynk#the next generation#deep space nine#voyager#lower decks

2 notes

·

View notes