Text

I miss belligerently rambling about money.

I hate the Tumblr AI policy and do not trust the staff. The method of roll out of the policy destroyed any faith I have in them.

Ung.

Damn it.

I loved finding quirky gifs to punctuate points.

I miss dismantling, even if it’s a hairline crack in the road against the biggest machine imaginable, hustle culture and the sheer bullshittery that is financial snob culture.

I like being helpful.

I know I am using a hand held hammer against the aforementioned machine but I liked being part of the noise at least.

Much to think about and get mad about.

4 notes

·

View notes

Text

@a-queer-little-wombat /

Start here.

General advice is to demand a savings account without a monthly fee (very easy to do) and compare notes on rates and comfort with that bank.

Generally speaking for USA cash for non-businesses, they are all the same. The competitor advantage of one bank over another is realistically how many of their services you want to use — loans, etc.

It doesn’t cost money to open or close an account (if a bank charges you for that, go elsewhere, but to memory none so) and minimum deposits (which are very frequently $0.00)

The main thing you are looking for is ease of service — which can be completely (or nearly so) be filed into “deal with this later.”

As a real world example — the bank I use for savings has a rate of 4.35% and the highest on this list as of writing (March 27, 2024) is 5.05%, a difference of 0.70%

This means for every $100, I make $4.35/year in interest versus $5.05/year — so $0.70 per $100 less per year. I like to look at things monthly, too, so that is ($0.70 / 12) about $0.06/month less.

If I was starting up a new account, I would probably gravitate towards going with a new bank on this list because it’s a new account so I have no friction. Or I might say “ease of having everything on one website is worth $0.06 per $100 per month” and stick with my current bank.

I won’t bank hop for 0.70% because I have things on auto-pay withdrawing from savings and I don’t want to dig through that paperwork of switching things over.

Banks can and do raise and lower the rates, largely based on the Federal rates (hence why I quoted the date above) and competition with each other. The bank I use is offering 4.35%, because that’s the general industry average. If the general industry average raised to that 5.05%, then my bank would likely do the same (or close to it)

When banks raise or lower rates, you don’t have to do anything. You get a letter and/or email telling you what is going on. When it goes up they market it like they are doing something great, when it goes down they are very “we will get through this together I promise.”

Fastest + Safest Way to Start a Business

Step 01 of 02: Open an FDIC insured high yield savings account.

Step 02 of 02: Don't touch the money for as long as possible. One could argue a "step 03" would be to have the interest generate for you, but that's not something you are doing, so I have omitted it.

My work comes in one of three general cycles (make art, write, do business stuff) and I'm coming off of a mini "do business stuff" cycle.

This invariably triggers my social media algorithms into ads about Amazon drop shipping, AirBnB shadow hosting or whatever the fuck you want to call it where someone else owns the property and you run it, every Invest Now in Real Estate with No Money scam, every Invest Now in the Stock Market with Our Money sales course... you get the picture.

If you're reading this, you've seen these things.

Here's a better idea if you are opening a business for the sole reason to make money:

Take your $10 - $10,000 or whatever it is, that you want to turn into a business, put it into a savings account, and since it is 2023, collect (in the USA) an extremely safe roughly 4% per year with zero further effort.

A business could possibly make you more than 4%.

It absolutely will be tremendously risky.

It absolutely will be a lot more work than the 2 minutes it takes to open a savings account.

The above also applies to stock market investing.

If you want to run a shop or business because you want to experience x-y-z in the industry, go for it.

If you want to make money, there are a lot of easier paths.

This post is inspired by, was bothering me until I took 10 minutes to write it, by a hundred scam ads shoved into my face while I'm researching thing for my shop + this video, which I generally agree with (I have a few quibble points, they are irrelevant):

youtube

39 notes

·

View notes

Text

This blog is ending effectively immediately because Tumblr's @staff has left far too many open questions on their plans to sell content to AI companies.

Here is a terrifying article on the subject:

I know several people have benefited from the financial ramblings posted here.

It has been a pleasure and honor serving your non-financial advice money demystifying rambles.

I would immediately consult your dashboard to see if you are sharing your data with AI companies and make decisions accordingly based on your personal taste, tolerance, needs, desires, and feelings.

This is not a financial advice blog and I will not sign off with AI advice.

I wish you all health and wealth and generosity. We live in a society best served by working together, or at the very least, tolerating each other's spaces.

I am completely unaffiliated with NerdWallet, and never have been affiliated. And. They are a great resource for information and news. As a parting thought, I leave you this: research exists, if you don't understand what is being said, another source will explain it in another way.

You can manage your money. It should work for you -- be it for your own needs or the needs of people or causes you care about. That's it's entire purpose.

Good luck to you.

5 notes

·

View notes

Text

honestly my favorite line from “Uptown Funk” is definitely “make a dragon wanna retire, man” because that’s honestly such a great mental image. an elderly, tired dragon taking a look at Bruno Mars and going “alright then, that’s my sign. time to let the young ones have at it.” taking out their 401k gold hoard. moving to a cave in Miami. collecting dragon pension

267K notes

·

View notes

Text

Target Date Funds are Great if You Want Hands Off

You can buy single stock. You are responsible for knowing a lot about what that company is doing, and is going to do, and moving quickly enough should that change.

Your research on that specific company needs to be continual as long as you own that stock, or, you could suffer huge loss (up to and including total loss).

This is why blended stock products exist -- you have a bunch of people with A LOT of expensive math sitting around fretting about this for you. They are regularly diversifying and making moves within the assets this basket holds.

It's a great way to extremely cheaply diversify -- the fraction of a percentage they take off the top pays for a tremendous amount of continual research.

They are directly incentivized to not be wrong. When they are, you lose money, and so do they.

It is likely the lowest price / highest value research in existence.

There is a thing called "Target Date" funds.

I'm at a point in my career I don't want to research companies, right now, and I'm decreasing my desire to look at even these baskets for the next 5+ years.

(This is one of the things I love about the market. There are products that are tailored to whatever your specific desire / needs are).

Target Funds

These are baskets of stocks, but instead of "make a strategy of the top 500 stocks," they are "make a strategy for cashing out by the year 20XY"

I've begun moving my cash from "okay follow this strategy" to

"okay geniuses, just grow this, I'll be back in 2030 or so. Please make it work."

Your money is yours and it should work for you and your risk tolerance and goals. That's what it is there for.

To work for you.

These sorts of things are frequently for retirement ("I want to retire in 20XY!") but can be used however you want. And/or retirement.

If you start experiencing some Feelings because you're watching the base market skyrocket while your Target Fund date is sluggish, you must remember that the entire strategy of your fund is to be cashed out at a specific date in the future.

Gains now are irrelevant.

Purchases and sales to maximize your gain as you start to get close to your target date are exclusively important :)

That is how these funds work. "We have a set lifespan, and we know how long it is. How do we make the most of it?"

see y'all in 2030!

(not... exactly)

(I'm gong to keep blogging here occasionally)

(just shiftin' the ol' business strategies around)

(which shifts the writing time around)

(ramble ramble)

6 notes

·

View notes

Text

If you feel ashamed of getting government provided assistance

whether that's Snap, or cash assistance or housing or insurance or WHATEVER.

I just want to say- I am a tax paying middle class person.

For the love of whatever you find holy, TAKE THE HELP. Seriously. Please. I am paying these taxes, and I am begging you to use that money to make your life better.

I find it tremendously depressing when my tax money goes to tanks for cops or subsidies for billionaires or general colonizing bullshit.

I want my tax money to improve your life. I do not give one single shit what you do with your cash assistance. I don't care if you think you maybe possibly could have gotten by without SNAP. If you can qualify TAKE IT. Eat as well as you can. Live as well as you can.

If you feel bad, picture me, cheering you on with every single choice you make that brings you comfort, stability or joy.

You are not a burden. You are my neighbor. There is enough to go around and I want us all to thrive.

10K notes

·

View notes

Note

So true about the whole college thing. I was in college as a varsity athlete and working nights and partial weekends. The college cut my sport, so I dropped out and went to work in my sport and got a day job. 40 years later I’m still working two gigs, but one is my own business and the other is coaching my sport at the elite international level. I see the ocean every day and drink great coffee. Also, no student debt.

It is absolutely a business decision and usually a horrible one.

Thats amazing and incredible!!!

i have Complicated Feelings about college in general and art school (where I went) specifically. It feels like it's a great thing, to exist, but I hate how it's set up, costs, and is treated as this singular path forward when it absolutely is not.

5 notes

·

View notes

Text

we need to destigmatize dropping out of college I am so serious. like dude if u realize that is Bad For You then you can just Leave. I am so fucking serious. just stop. there are other options and you don’t need to force yourself through shit you can’t do and go into debt. i promise you can just Not.

123K notes

·

View notes

Text

becoming an adult cheat sheet!

learn to coupon

what to do when you can’t afford therapy

cleaning your bathroom

what to do when you can’t pay your bills

stress management

quick fix meals

find out if you’re paying too much for your cell phone bill

resume workshop

organize your closet

how to take care of yourself when you’re sick

what you should bring to a doctor’s appointment

what’s a mortgage?

how to pick a health insurance plan

hotlines list

your first gynecology appointment

what to do if the cops pull you over

things to have in your car in case of emergency

my moving out masterpost

how to make friends as an adult (video)

how to do taxes (video)

recommended reads for surviving adulthood (video)

change a flat tire (video)

how to do laundry (video)

opening a bank account (video)

laundry cheat sheet

recipes masterpost

tricks to help you sleep more

what the fuck should you make for dinner?

where should you go for drinks?

alcohol: know your limits

easy makeup tips

find seat maps for your flight

self-defense tips

prevent hangovers

workout masterpost

how to write a check

career builder

browse careers

birth control information

financial management software & app (free)

my mental health masterpost

my college applications masterpost

how to jumpstart a car

sex ed masterpost

140K notes

·

View notes

Text

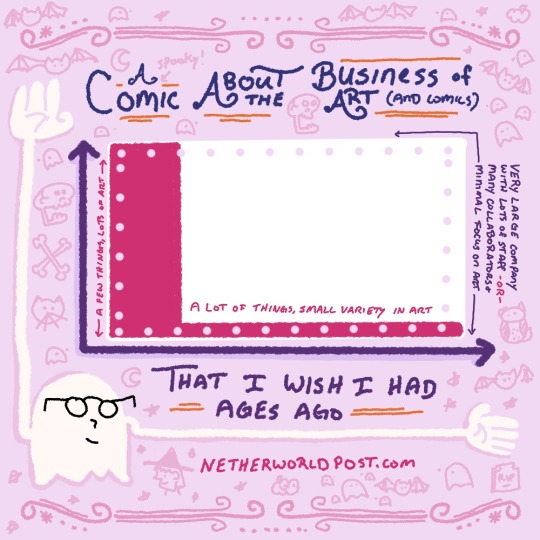

A Comic About the Business of Art (and Comics) That I Wish I Had Ages Ago

I drew this as a warmup because it is the beginning of a long cycle of drawing and comics, my friends! This understanding took about 4 years to cram into my brain and structure and compile into a super simple graphic.

Sharing is caring.

When you have an art business, you have 3 basic structures you can pick, and the third has two paths.

OPTION 01: MAKE LOT OF ART

You can do a LOT of art on a FEW things. I am focusing on greeting cards as the main project, printable downloads as the secondary, and comics/zines as a tertiary.

Medium difficulty, small difficulty, large difficult, in order that order.

When I want to tackle a project, I'll work on a greeting card. When I want to sink my teeth into something for a long time and get deep into the details, I'll do a comic/zine. When I JUST WANNA MAKE SOMETHING NOW, I'll make a printable.

You find success because your customers and audience are interested in the latest pieces of art.

OPTION 02: MAKE A LOT OF STUFF

You can do a LOT of things, with a few pieces of art each. This is a very common approach because it lets an artist/art shop/etc. bounce from project to project, eventually having a large platform of stuff to sell. Often a slow build up over years.

It is particularly great if you especially enjoy production wrangling, finding vendors, and doing The Business part in the Business of Art Stuff.

By nature, your focus is split.

You're going to get so focused on wrangling shipping times and building in overlaps of Vendor A and Vendor B to ensure you can fulfill orders quickly and efficiently.

Your success is found in efficiency -- better vendor relationships, easier packing orders, increasing volume of production to decrease costs.

You have less time to focus on specific pieces of art. The above focus never goes away, because even if you say "Okay well I'll just order 10,000 of ART THING and then use the rest of the year to make more art" you still have to handle the business of storing 10,000 things, building up sales to cover the costs of initial production AND storage, etc.

You find success when your customers say "Hey, I like this art print. I also want it on a shirt, and a tote bag, and a key chain, and a sticker." (etc.)

OPTION 03-A: Focus on collaboration

Similar to Option 02, you can focus on having collaborators make the art and you manage the project, manage the production, putting stuff into boxes, putting boxes into the mail.

Extremely popular in the zine space, the independent graphic novel space.

You can be one of the collaborators to the project! That helps keep your art bones happy!

But the bulk of your job and time and energy is going to be corralling Incoming Art into Product(s) into Production into Customer's Order into Mail Boxes.

OPTION 03-B: Focus on an internal team

Same as Option 03-A, but instead of spending time finding external collaborators, you have an internal crew. Either as employees (more direction, less negotiation) or partners (less direction, more negotiation).

Your team(s) will focus on either Options 01 or 02.

Or you scale your company HUGE and they focus on both. I want to stress, though, by "huge" I mean each portion of your company is going to have a team. Instead of 1 team, you have teams of specialists.

QUICK OVERVIEW

Focus on Variety in Art (Option 1), Variety in Stuff (Option 2), or a Team (Options 3).

One is not better than the other. All can be great.

You can start down one path and reverse course then head down another.

But you DO have to pick.

22 notes

·

View notes

Text

I have an important meeting today so I am taking a cab instead of risking the train.

In the office, on WiFi, phone plugged in, Lyft quoted about $20

Downstairs, in the lobby and not on WiFi about 10 minutes later, Lyft updated to about $30

:-)

(The studio is in a building that has a taxi light so I was able to grab a taxi… at about $20. Be aware of costs my fellows!)

2 notes

·

View notes

Text

youtube

No public opinion offered because I am keeping this blog as “not financial advice”

But it is…

(pause to select word)

Insightful.

2 notes

·

View notes