#growth stocks 2022

Text

How To Invest In Growth Stocks For Beginners In 2022 [FREE COURSE]

How To Invest In Growth Stocks For Beginners In 2022 [FREE COURSE]

We're going to be doing a course here Talking about growth investing 101 some Of the basics i believe we have 15 Different videos outlined and in this Video being the very first one all i Want to talk about is what are growth Stocks what are growth investments these Are going to be some of the basic Characteristics of growth investments And First of all number one the reason why We call these…

View On WordPress

#best stocks to buy now#course#growth stock portfolio#growth stocks#growth stocks 2022#growth stocks explained#growth stocks vs value stocks#how to invest#how to invest in growth stocks#how to invest in stocks#stock market#stock market for beginners#stocks to buy#stocks to buy now#top stocks to buy now

0 notes

Text

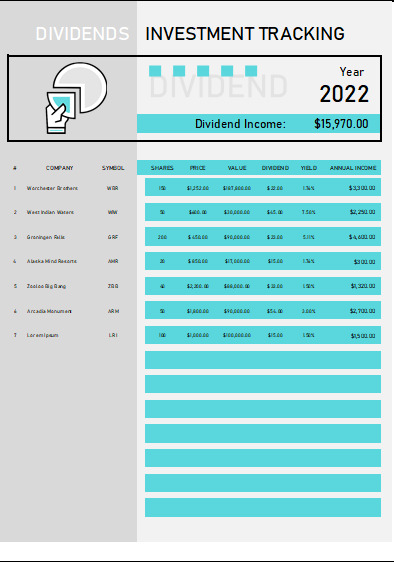

Dividend Investment Tracker

Download free excel template for dividend investment tracking. This dividend tracker excel template is useful for tracking all the dividend income from investment in shares and stocks of companies. This is useful for professionals and retail investors to track their yield per investment or Return on Investment (ROI).

About dividend Investment tracker excel template

Once you download this free…

View On WordPress

#dividend#dividend growth investing#dividend income#dividend income tracker#dividend investing#dividend portfolio#dividend portfolio tracker#dividend portfolio tracker 2021#dividend portfolio tracker 2022#dividend portfolio tracker 2023#dividend portfolio tracker excell#dividend spreadsheet#dividend stock portfolio tracker google sheets#dividend stocks#dividend tracker#dividend tracker spreadsheet#dividends#google sheets dividend tracker#how to track dividend income#how to track my dividends#portfolio tracker

3 notes

·

View notes

Text

Best Stocks under 100 dollars as per technical analysis. Stocks for 5 years, 1 year, and 3 months returns. 👇

Best Stocks under 100 dollars

#stock market#stocks#nasdaq#best stocks to buy 2022#best stocks to buy today#us stocks#growth stocks

0 notes

Text

The 7 TOP Stocks To Buy in May 2022! (High Growth)

The 7 TOP Stocks To Buy in May 2022! (High Growth)

In this video, I’m going over the TOP 7 stocks to buy for the month of May 2022. These are the best stocks to buy right now! Get an extra $20 to invest when you open and fund a taxable Wealthfront Investment Account with my link: https://www.wealthfront.com/charlie20

Free stuff:

► Get $25 in Free Bitcoin when you trade $100+ (Plus earn 8.05% APY with Gemini…

View On WordPress

#best companies to invest in 2022#best growth stocks#best stocks to buy 2022#best stocks to buy may 2022#best stocks to buy now#best stocks to invest in 2022#good stocks#high growth#high growth stocks may 2022#Investing#may stock picks#stocks to buy#stocks to buy 2022#stocks to buy may 2022#stocks to buy now#top stock picks#top stocks#top stocks for may 2022#top stocks to buy now#what stocks to buy#which stock to buy today#which stocks to buy

0 notes

Text

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

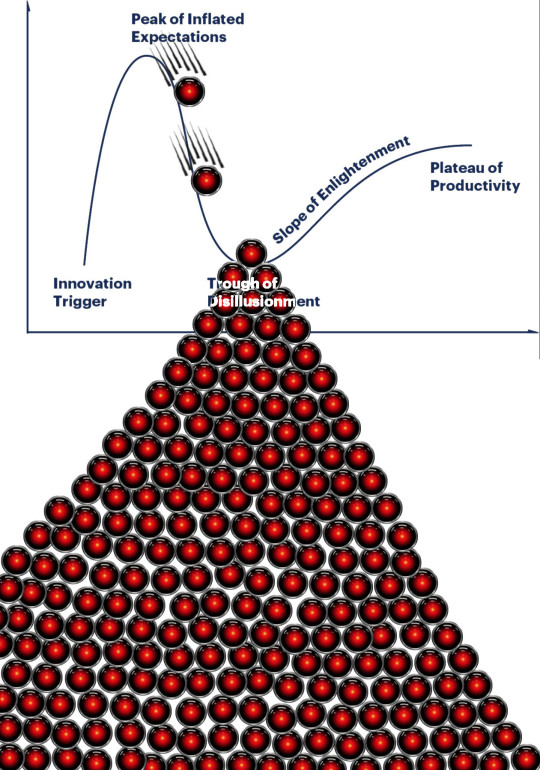

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

"During the global coronavirus pandemic, China built dozens of makeshift hospitals and state quarantine centers, some out of steel container boxes. They became closely associated with the anxiety of mass testing and the fear of sudden lockdowns.

Now, cities are turning the huge centers into affordable housing units for young workers in an attempt to revive the country's economy post-COVID...

Just over a year ago, these apartments were used very differently: for medical triage and quarantine facilities. Beijing alone built 23 of these makeshift facilities, designed to hold up to 23,000 people at a time.

"It was not very cold yet but they told me to pack my belongings," remembers Hudson Li, a Beijing resident who was quarantined in one of these facilities, called fangcang in Chinese, in October 2022...

Less than two months after Li was quarantined, Beijing lifted most of its COVID restrictions. Li says he still associates the fangcang with a feeling of helplessness and fear: "It has been over a year already, but I definitely have PTSD from the pandemic, from the fear of scarcity and having to stock up on a lot of medicine and food."

Attracting young tenants with low rents

Now the fangcang across the country are undergoing a minor transformation and turned into apartment units for young graduates like Li. The changes are an effort from local authorities, who have been tasked with restarting economic growth and supporting small businesses after nearly three years of ruinous lockdowns.

Populous cities like Beijing are also trying to bridge the housing affordability gap between high real estate prices and low salaries, on average, for young workers. In the northeast corner of the capital city, near its airport, one fangcang with more than 4,900 units has been rebranded the "Jinzhan Colorful Community" — a reference to the bright hues of paint — and now offers amenities like a canteen where residents can grab a cheap meal before or after work.

Another fangcang facility, in the northeastern city of Jinan, has been turned into 650 units for skilled workers inside an industrial park.

"Given that the current overall [COVID] epidemic situation in the country has entered a low level, revitalizing the fangcang for other housing purposes is worth learning and thinking about all over the country," Yan Yuejin, a housing analyst, told Chinese media.

The fangcang, once a symbol of containment, are now supposed to represent dynamism and growth.

"I have complex feelings about this. The facilities were built using public funds and not rented out transparently," Li says. "But I do have to say you will not get anything more affordable than these apartments. They are very price competitive."

A list of rental prices for a Beijing fangcang converted into apartments shows most rooms are Rmb1200 (USD $170) a month, low for Beijing."

-via NPR, December 9, 2023

#china#covid#quarantine#affordable housing#housing#beijing#jinan#apartments#real estate#housing crisis#cost of living#good news#hope

80 notes

·

View notes

Video

youtube

The Truth About Corporate Subsidies

Why won't big American corporations do what's right for America unless the government practically bribes them?

And why is the government so reluctant to regulate them?

Prior to the 1980’s, the U.S. government demanded that corporations act in the public interest.

For example, the Clean Air Act of 1970 stopped companies from polluting our air by regulating them.

Fast forward to 2022, when the biggest piece of legislation aimed at combating the climate crisis allocates billions of dollars in subsidies to clean energy producers.

Notice the difference?

Both are important steps to combating climate change.

But they illustrate the nation’s shift away from regulating businesses to subsidizing them.

It’s a trend that’s characterized every recent administration.

The CHIPS Act –– another major initiative of the Biden administration –– shelled out $52 billion in subsidies to semiconductor firms.

Donald Trump’s “Operation Warp Speed” delivered over $10 billion in subsidies to COVID vaccine manufacturers.

Barack Obama’s Affordable Care Act subsidized the health care and pharmaceutical industries.

George W. Bush and Obama bailed out Wall Street following the 2008 economic crash while providing about $80 billion in rescue funds for GM and Chrysler.

And the federal government has been subsidizing big oil and gas companies for decades, to the tune of hundreds of billions of dollars.

Before the Reagan era, it was usually the case that America regulated rather than subsidized big business to ensure the wellbeing of the American public.

The Great Depression and FDR’s Administration created an alphabet soup of regulatory agencies — the SEC, FCC, FHA, and so on — that regulated businesses.

Corporations were required to produce public goods, or avoid public “bads” like a financial meltdown, as conditions for staying in business.

If this regulatory alternative seems far-fetched today, that’s because of how far we’ve come from a regulatory state to a subsidy state.

Today it’s politically difficult, if not impossible, for government to demand that corporations bear the costs of public goods. The government still regulates businesses, of course –– but one of the biggest things it does is subsidize them. Just look at the growth of government subsidies to business over the past half century.

The reason for this shift is corporations now have more political clout than ever before.

Industries that spend the most on lobbying and campaign contributions have often benefited greatly from this shift from regulation to subsidy.

Now, subsidies aren’t inherently bad. Important technological advances have been made because of government funding.

But subsidies are a problem when few, if any, conditions are attached — so there’s no guarantee that benefits reach the American people.

What good is subsidizing the healthcare industry when millions of Americans have medical debt and can’t afford insurance? What good are subsidies for oil companies when they price gouge at the pump and destroy the planet? What good are subsidies for profitable semiconductor manufacturers when they’re global companies with no allegiance to America?

We’re left with a system where costs are socialized, profits are privatized.

Now, fixing this might seem daunting — but we’re not powerless. Here’s what we can do to make sure our government actually works for the people, not just the powerful.

First, make all subsidies conditional, so that any company getting money from the government must clearly specify what it will be spent on – so we can ensure the funds actually help the public.

Second, ban stock buybacks so companies can’t use the subsidies to pump up their profits and stock prices.

Third, empower regulatory agencies to do the jobs they once did — forcing companies to act in the public interest.

Finally, we need campaign finance reform to get big corporate money out of politics.

Large American corporations shouldn’t need government subsidies to do what’s right for America.

It’s time for our leaders in Washington to get this message, and reverse this disturbing trend.

274 notes

·

View notes

Note

Hi

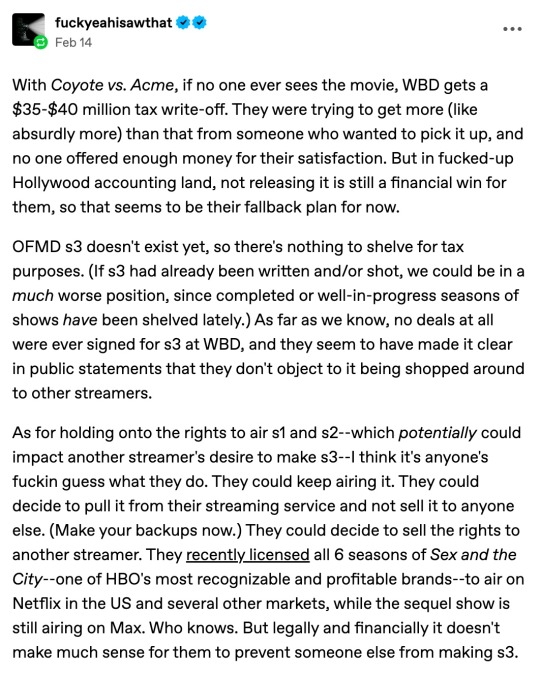

Not OFMD specific but might be of interest

(copied without permission given to reproduce)

Found in Private Eye 16-29th Feb

Warner Gloss:

Labour's business charm offensive continued last week, as Keir Starmer proudly posted that he had met with David Zaslav, CEO of Warner Bros Discovery, aiming to "work in partnership with the creative industries to drive growth".

Named by the New York Times as the man who "blew up Hollywood", Zaslav in fact seems to be doing everything he can to prevent growth in the industry. Having merged hi cable TV company, Discovery with entertainment conglomerate Warner Bros in 2022, Zaslav took on $56bn in debt and enacted cost cuts of £3bn.

To achieve this he set about binning TV shows and films that had already been completed in order to claim large tax write-offs - most notoriously superhero caper Batgirl - and removing shows from streaming services to avoid paying residuals fees.

In a move that might have had more appeal for St

armer, Zaslov also hired Chris Licht as CEO of CNN in 2022 to make the news service more appealing to conservative viewers - but then fired him within a year after ratings hit rock bottom. Under Zaslav's watch, the stock price of Warner Bros Discovery Inc has fallen by nearly 60% - probably not quite the growth Starmer would hope to discover!

END

Firstly thank you for your round-ups, much appreciated!

"make the new service more appealing to conservative viewers" Why am I not surprised.....

Secondly I am disturbed that the possible future leader of the UK or his advisors didn't do more investigating before agreeing to or asking for this meeting, very disappointing.

Thirdly "removing shows from streaming services to avoid paying residuals fees" Should we be concerned by this for series 1 and 2?

best wishes

Susannah

Hey omg I'm like 3 days behind on messages/replies/asks I'm sorry! This weekend was crazy!

Hi Susannah!

Oh interesting! I've never read Private Eye, I'll go check them out now! Oh darn- looks like a paywall, thank you for pasting the text!

(And no problem about the recaps! Thanks so much for reading them!)

To address your second point: I wish I knew more about Keir Starmer! I'm in the US so I only know tangentially about him. You would think someone would have vetted the situation a bit more though (although you know Zaslav has been a bit of a sneaky little fucker about everything until he was outed more recently). Sorry I don't have much to say on that point!

To address your third point:

Yeahhhhhh, my hope is that it won't affect OFMD too much because it's a bit more of it's own thing (and not a WB proprety like the Coyote movie). I think they could actually make money selling S1 and S2 as opposed to loss since there's such a demand for it, so personally I don't think it's going to be much of an issue, but I have no real authority or reason to believe that except common sense (which we all know hollywood doesn't always have).

@fuckyeahisawthat had a good take though, it's kind of anything goes unfortunately.

I have faith though... because like a lot of my tumblr colleagues have said, David Jenkins would have probably told us by now if in fact, there was literally no hope. He's been pretty good about putting out hints and letting us know where to focus our efforts, and as of yet he hasn't flat out said "Thanks anyway guys, but its not going to happen.

That in itself gives me hope for s1, s2 and s3.

Anyway, thanks for the write in Susannah! I'm really sorry again it took me so long to answer, and then I doubt I gave you anything of real substance @_@. I hope you're having a lovely day, and would love to chat more!

Take care, sending love!

Abby

23 notes

·

View notes

Text

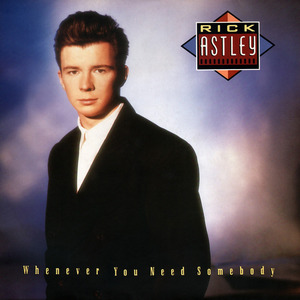

So you have heard Rick Astley was the unexpected sensation at Glastonbury this year...

and you'd like to get a taster of his music, but you don't know where to start, because you are only/mostly familiar with Never Gonna Give You Up?

This post is for you!

I'll give you a quick overview of his discography, and a recommendation of what I think are the best tracks of each album and why. Aggregated playlist at the bottom of the post.

Whenever You Need Somebody (1987)

This was Rick's debut album, and the one that included Never Gonna Give You Up. If you have heard the piece of trivia that says "if you drop the pitch Kylie Minogue's I Should Be So Lucky, it will sound like Rick Astley"... there's a very easy explanation for that: both were composed by Stock Aitken Waterman, a trio of music producers that wrote several of the most well known eurobeat hits of the late 80s and early 90s (i.e. You Spin Me Like a Record), based on the principles of... well, being very generic and catchy. Half of the tracks of this album were written by them.

Thematically the album is strangely obsessed with cheating, cheating women, and being in love with cheating women, and being heartbroken over them. I don't know what to tell you, sometimes I forget how common this was around that time for the romantic ballad outside of the US (?)

Anyways, of the 10 tracks of the original album, the best (and also most Never Gonna Give You Up-like) are Together Forever, Don't Say Goodbye, and Whenever You Need Somebody.

The album closes with a cover of When I Fall in Love, that to me feels very out of place. Perhaps it was one thing Rick himself was dead set on singing?

This album had a 15th anniversary expanded remaster in 2010, including 3 ""old-new"" songs and 4 remixes (one of them is an extended version of NGGYU). I'll Never Set You Free is remarkable for being one of the creepiest songs this side of Every Breath You Take.

The 2022 remaster:

This one includes one "old-new" track that is a severe earworm, My Arms Keep Missing You (it does deserve the THREE remixes it gets in this album), several remixes of other songs, three instrumentals, AND, most notably for me, three "reimaginings" of NGGYU, Together Forever, and Whenever You Need Somebody as slow piano ballads, very very worth listening if you are into that sort of thing (these were first released in the compilation album The Best of Me (2019)).

It also includes a new version of When I Fall in Love, that really highlights Rick's growth as a singer and an artist, very worth comparing the 1987 to the 2022 one.

The remixes and "old-new" tracks in these anniversary editions come from compilation albums Rick Astley - 12" Collection (1989) and Dance Mixes (1990).

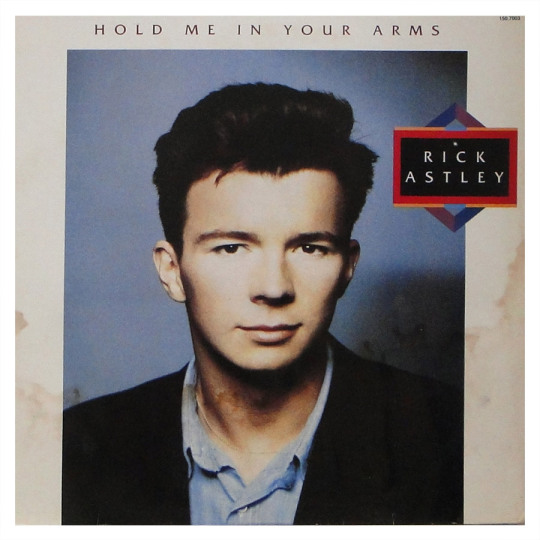

2. Hold Me In Your Arms (1988)

If you liked Whenever You Need Somebody (1987), then Hold Me In Your Arms (1988) is just the thing for you, because it's more of the same, but louder, catchier, and now with less cheating obsession! This time it's 3 out of the 10 songs that are SAW written, one is a cover of The Temptations' Ain't Too Proud To Beg, and the remaining 6 are all by Rick himself, but the tone doesn't shift that much between them.

The first half of the album is non-stop top danceable tunes: She Wants to Dance With Me, Take Me To Your Heart, I Don't Want To Lose Her, Giving Up On Love (big involuntary "I'm killing off Sherlock Holmes" moment for Rick, the not giving up didn't even last a year :P), and Ain't Too Proud to Beg; the second half is not as strong, but also not bad either. It definitely helps that the tracks are ordered in such a way as to slowly slow down till the beautiful sweet soft ballad that closes the album and gives it its name: Hold Me In Your Arms.

I Don't Want to Be Your Lover, the penultimate track, is the first song that feels more like what Rick writes and sings as a more mature artist.

The 2010 expanded remaster is just remixes of some of these songs, I'll Be Fine (which is, quality wise, between the rest of the tracks of the second half) and My Arms Keep Missing You, again.

The 2022 remaster includes even more remixes, reimaginings of She Wants To Dance With Me and Hold Me In Your Arms (I'm not a big fan of either, but they are interesting, as they are much more modern ballad sounding) and instrumental versions of Take Me To Your Heart and She Wants To Dance With Me.

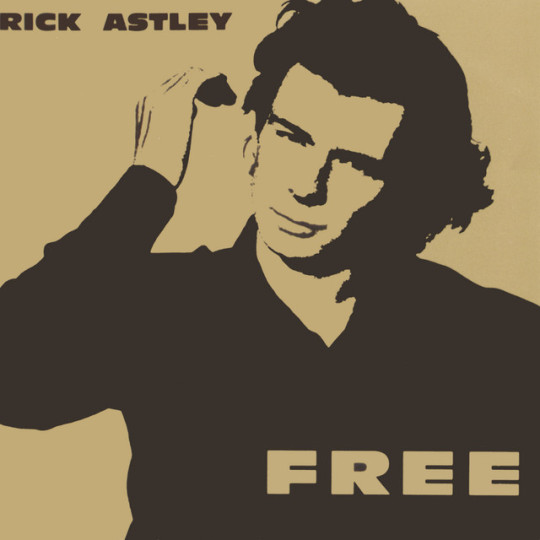

3. Free (1991)

Almost like a pun, this is Rick's first album "free" of SAW. He even grew out his hair! (probably one of the rare cases of a guy to having gorgeous hair that somehow suits his face horribly). The tone moves away from the 80s eurobeat hit into the soul-ish + gospel-ish ballad, which seems to be more like the territory he feels comfortable in. It's a bit of an "experimental" album, in the sense that he's trying new things and new sounds, but it's all very tentative, and the unsure footing is noticeable.

Even so, Cry For Help, written and sung by him was a hit all the same, although it isn't a favorite of mine. In general it's difficult for me to pick favorites here; none of the songs stick out to me as particularly good or particularly bad. If you like slow ballads, you will probably like Cry For Help, Wonderful You, and Behind the Smile. Really Got a Problem is a first sample of a "social" song in his repertoire. Move Right Out, Never Knew Love, and The Bottom Line are more the essence of what his music evolved into later on, whereas In The Name of Love, Be With You, and This Must Be Heaven are dead on the sort of generic adult-contemporary of the early 90s.

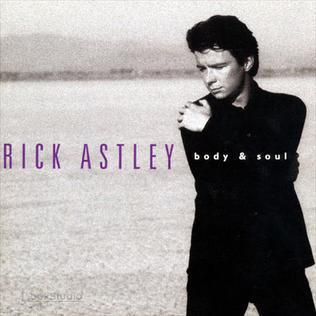

4. Body and Soul (1993)

This album takes a more... lounge-ish turn I do not relish. You'd say, okay, but what sets Rick Astley apart from the general adult standard lounge music of whatever decade he sings in? Difficult question to answer, as all questions about vibes are. To me it is a mixture of A) cringe is dead, long live cringe B) earnest feeling C) plain, direct and sometimes quirky lyrics D) It sounds like he's having a good time singing them.

I just cannot really buy the constant "baby" and "lover" in Everytime, for example. And while none of the songs in this album are bad, most of them aren't even fun. Body and Soul and Enough Love I think are the two most interesting tracks here.

That same year, Rick got on hiatus.

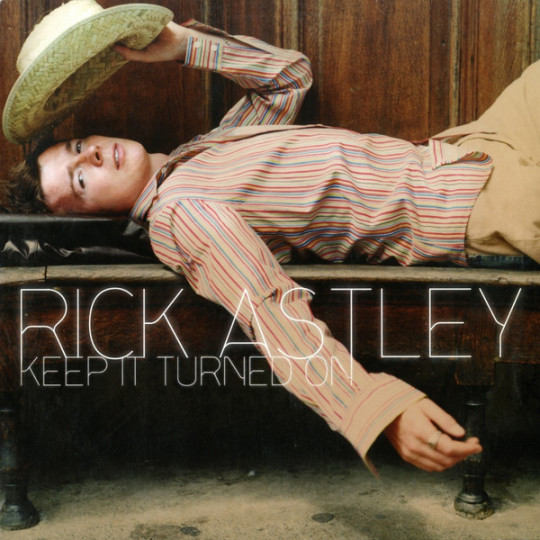

5. Keep It Turned On (2001)

This comeback album is a bit of a rarity -it was released in Germany, but never in the UK (although some of its tracks made it to compilations later on), and it's therefore rare to find, which is a pity, because I think it is one of his best!

It is also one of the most early 2000s sounding things ever. It is to 2000s eurobeat and pop ballad what Whenever You Need Somebody and Hold Me In Your Arms were to 1980s eurobeat and pop ballad, so if you are into it, this whole album will be for you.

I have a particularly soft spot for Sleeping, and the way it just sounds like what a 2001-2007 summer night sounded to me; it's very nostalgic. The lyrics, just like the ones in the ballad Breathe, give heartbreak what I perceive to be a more mature tone that I like much more than the treatment it gets in previous albums.

Other highlights are the very danceable Wanna Believe You and Keep It Turned On (this last one a very pick me up song), and on the ballad front, I think Romeo Loves Juliet has the most delicate, enjoyable sound, but Full of You has better lyrics.

6. Portrait (2005)

This album is a collection of covers of classic pop standards, so there isn't much rickness to it at all, and it is to me, personally, a skip; while I usually like Rick's covers in other albums (and I think his reimaginings of the SAW songs are interesting) these are... off. I just don't think the style he picked for them suits at all.

Between this and his following album, Rick released two independent singles: Lights Out (2010) and Superman (2012) which I think are both peak Rick and worth a listen; earnest, simple feeling and catchy sound.

7. 50 (2016)

This is my favorite Rick Astley album, and it seems I'm not alone in this! It was the first album of his to be number one since his debut one. He sung AND played all instruments for it, and it really feels like a personal project, that brings the artist close to the audience.

From the very title you know you are in for something: the 50, Rick's age in 2016, is a tongue-in-cheek homage to Adele (whose albums have all been titled after her age at the time of release), that also speaks of this sense of being a middle aged artist in an industry and particularly a genre or family of genres that leans so heavily into youth and coolness.

In 50 Rick leans on instead of shying away from the fact that he's not young (In either the heartfelt "Don't fake it, I can't take it/My heart is, close to breaking/It reminds me of my youth" or the humorous "I got to thirty and you show a little wrinkle/One more big plate/Now I'm putting on weight/Skinny jeans but nobody's fooled"), cool, or detached, but that doesn't make him jaded, heavy, or self important; the songs of this album are filled with a sense of hope, gratitude, generosity, and... fun. It's a curious marriage of the lighthearted beat of the pop that made him famous, and a mature version of the soul-ish style he seems to love and that he tried first in Free. Although there isn't a single skip in this album for me, the most representative, and that have what in my opinion is the best sound, are Keep Singing, Angels On My Side, Wish Away, Pieces, I Like the Sun, Let It Rain, Let it be Tonight.

8. Beautiful Life (2018)

There's little I can say about Beautiful Life in general, other than characterize it as an echo of 50. Same ideas, same themes, same tone and sound.

The highlight tracks are: Beautiful Life, Last Night on Earth, Rise Up, and Try.

Since Beautiful Life, Rick has released a compilation album (The Best of Me, 2019), a few remixes and a couple new singles; of those singles I'd highlight Giant (a true banger), Every One Of Us, and Unwanted.

Rick's next album, Are We There Yet? releases in October this year (2023).

62 notes

·

View notes

Photo

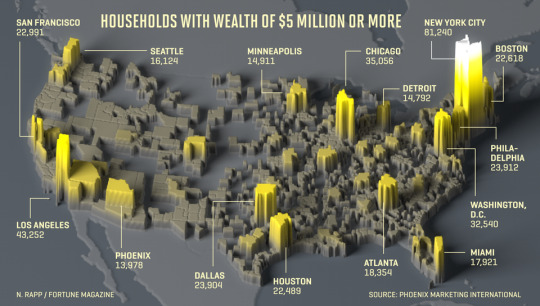

Map of millionaires in the USA.

The number of U.S. millionaires grew from 6.6 million in 2020 to 7.5 million in 2021, reflecting a 13.5% increase, according to Capgemini’s World Wealth Report 2022. Not only did more Americans enter the elite ranks of the high-net-worth (HNW) population in 2021, but the rich got richer, with their net worths increasing by about 14%. The growth was mostly spurred by investments in the stock market, with a particular focus on the technology sector.

241 notes

·

View notes

Text

Investing 101

Part 1 of ?

A Tumblr mutual has asked me to explain brokers and stocks; I'm not an investing expert but I will share what I know (or what I think I know). The investing subreddit is a great source for those who really want to know the details.

What are stocks? When you buy a company's stock you own a small portion of the company. If a company has issued 100 shares and you purchase 1 share, you own 1/100th of the company. Most companies start out as private enterprises (i.e. owned by one of more individuals) and if the company is successful it may want to sell shares (i.e. go public). Going public is a major milestone in the life of a company. The process of issuing shares, quarterly reports, etc. is highly regulated by the SEC and requires audits, the creation of a board of directors and regular financial reporting, all in an effort to protect investors. In light of this expense, it's fair to wonder why an owner would want to go through the hassle of going public and giving up control of some (or all) of their company.

Going public (i.e. selling shares/stock) is a way of generating capital for the company. Perhaps a company needs an infusion of cash to build a new factory or expand to a new market... new stock issuances often include statements from the company about how it intends to use the proceeds. Issuing public shares is also a way to reward owners and key employees by giving them a way to get cash out of the business. Imagine you started a business 20 years ago and always funneled the company's earnings back into the business to help it grow. You may have a valuable business, but you have all your eggs in that basket and don't have cash to invest in other ways, buy a yacht etc. Likewise, you may have promised key employees partial ownership of the business, this is a way for them to cash-in also.

Regardless of the motivation, companies issuing stocks can choose to sell partial or full ownership of the company. Successful entrepreneurs often choose to retain majority ownership in the business - shareholders may collectively only own 40% of the business, for example, and have the right to elect 2 of 5 directors to the board. This kind of strategy allows the founder to have his cake and eat it too (i.e. cash-out some of the value of the business while still retaining control). A company can also sell various types of shares, each with different benefits. For example, a company may sell Preferred Shares, which are guaranteed to receive a dividend before other shares. Or the company may issue voting and non-voting shares (this is another way for a founder to retain control). Most retail investors (individuals like you and me), purchase Common Shares which have voting rights and are eligible for dividends.

What is a dividend? If you own a part of a company, it is reasonable to expect that you receive your proportionate share of the earnings right? The distribution of a company's earnings to shareholders is called a dividend. Companies may distribute dividends quarterly, annually or in the case of start-up or fast growing companies, not at all. Netflix for example, which had $8.19B in revenue and $1.49B in earnings in 2022 HAS NEVER PAID A DIVIDEND. Likewise, TESLA has never paid a dividend.

Why would anyone want to own shares in companies which don't pay dividends? It isn't at all uncommon for early stage and/or high growth companies to not pay dividends. The thinking is that the growth prospects for the company are so attractive, the money is best spent by reinvesting in the business. Of course there's an expectation that at some point in the future the business will mature and begin paying dividends. This is what happened with Microsoft and Apple for example. As long as the company continues to show accelerating growth, investors will overlook the lack the dividends, betting that the overall value of the company (and intrinsic value of the shares) will grow as well. Again, Netflix and Tesla are good examples of that.

This leads to the conclusion that there are two ways to make money from stocks - dividends and increases in the share price. I may not be concerned if I own a stock with a share price which has been stuck at $100 for the last 5 years if that company is paying me a $10 dividend every year. I'm still earning a 10% return on that investment. Conversely, I may be equally happy owning a stock which has never paid a dividend but is now worth $150 dollars versus my original purchase price of $100.

Stocks whose value is primarily derived from their reliability for generating dividends are called Value stocks. Stocks whose value is primarily derived from the growth of the stock price are called Growth stocks - Netflix and Tesla are examples of Growth stocks; Microsoft and Ford are examples of Value stocks. Admittedly this can be confusing; I remember our first broker asking if we were Value or Growth investors. It seems like a silly question; can't we have both? In truth, older investors like me tend to be Value investors... we like the reliability (and cash flow) of stable companies that declare dividends every quarter. Growth stocks can be exciting, but the stock prices can be volatile and older investors have little tolerance for volatility. Value stocks tend to be stable companies in stable industries. Growth companies are all about the future; there is an opportunity for much greater rewards, but that comes with more risk. Over a longer investing horizon (>10 years), a broad portfolio Growth stocks will likely outperform an equally broad portfolio of Value stocks. Old people don't have a long investing horizon, but young people do and each group's investment portfolio should be biased accordingly.

Next Post - how to buy stocks.

30 notes

·

View notes

Text

Private Sector Good, Public Sector Bad?

The reigning ideological economic theory within the Conservative Party is, and has been ever since Margaret Thatcher came to power, that “markets know best”

This was made abundantly clear when Kwasi Kwateng, the Chancellor of Liz Truss’s short-lived government, dismissed anything resembling a “planned economy”. Rather, growth and economic success depended on:

“…the power of our treasured free-market economy to leverage private capital and unleash Britain’s unique entrepreneurial spirit to grow new industries." (The Conversation: 13/04/22)

The key words here are “to leverage private capital”. What this means in ordinary speech is to encourage private investors to participate financially in “projects that benefit the economy, society or the environment”. This has resulted in private investors running (and in many cases, owning) most of our public utilities and services. But rather than “benefit the economy, society and environment" these private investors have devastated it.

Over the next few blogs I intend to look at various British/English public utilities and services and to see how they have fared under the private sector. First up are the railways.

Britain’s railways are organised within a mishmash of private and public ownership, and has been described as “broken" and no longer fit for purpose.

“The UK's train network is not only one of the worst in Europe, it is also one of the most expensive.” (euronews: 20/05/21

This is no surprise given its complex and chaotic structure. The railway tracks and rail network are owned and operated by Network Rail, which is a “non-departmental public body of the Department for Transport, (DFT) with no shareholders"

Non-departmental public bodies are a strange entity. They are national or regional bodies that work independently of government, are not staffed by civil servants, and yet are still accountable to government ministers. It is the Secretary of State for Transport who sets the strategic direction of the railways, allocating funding, and it is the secretary of state who has to approve major investments in the railway system.

The companies that operate the trains are privately owned and are either awarded franchises from the DFT, or they are “open access” operators that provide passenger services on a particular route or network, but with no exclusive rights enjoyed by franchise holders.

To complicate matters further, the actual trains, passenger carriages and railway wagons, known collectively as “rolling stock”, are owned by the rolling stock leasing companies” (ROSCOs) who lease out their stock to the privately owned rail operating companies.

Freight train operators are totally separate from passenger trains, have no contracts with government but do need permission from Network Rail to run their services.

For year 2022/23 the railways received £11.9bn of government funding and Network Rail has secured £27.5 bn of government funding over the next five years. In short, we the taxpayer invest heavily in our rail network which the private passenger, rolling stock and freight companies use to make a profit.

A 2019 report by the TUC found that:

“Rail firms have paid over £1bn to shareholders in the last 6 years.” (TUC: 02/01/2019)

In 2022 Avanti West Coast received a taxpayer subsidy of £343m, despite having the worst punctuality record amongst train operators and paying out £12m to its shareholders. Avanti West Coast is owned by First Group, who also own Great Western Railway and South Western Railway. Great Western paid out the largest dividend in 2021/22, £33m, while South Western paid out £13m.

More recently:

“UK rail operator Govia awards $79m in dividends amid UK rail dissatisfaction.” (Railway Technology: 08/01/24)

Govia is largely foreign owned, the three largest shareholder companies being Australian, Spanish and French. In 2022 it was fined £23m “over financial irregularities" having failed to return £25m in taxpayer funding. Why on earth any government would want to go on subsidising such a company is beyond understanding, especially as the Transport Minister at the time said the company had:

“…committed an appalling breach of trust...behaviour was simply unacceptable and this penalty sends a clear message that the government, and taxpayers, will not stand for it." (BBC News: 17/03/22)

Clearly the minister (Grant Shapps) didn’t mean what he said as Govia is still operating trains two years later and still courting controversy

Turning to the train-leasing companies, we find:

“Profits of UK’s private train-leasing firms treble in a year. More than £400m paid in dividends in 2022-23 while rest of railway faced cuts and salary freezes.” (Guardian: 18/02/24)

These companies saw their profit margins rise to 41%, a profit that we as taxpayers and passengers pay for. It is estimated that "taxpayers are now effectively paying the £3.1bn spent last year on leasing trains.” To actually run a passenger rail service yet not own a single locomotive or passenger carriage is bazaar to say the very least.

Finding overall profit figures for freight train operators is a little more difficult but Colas Rail UK’s revenue in 2022 was £15,529m, up 17% on the previous year, an operating profit of £460m.

Overall, taxpayer subsidies to the rail industry run at £6bn per year. However, these massive subsidies have not led to lower fares, an end to over-crowed trains, or an efficient service. According to TaxPayers Alliance 02/01/23) "rail subsidies cost taxpayers £1300 each by March 2023.” Meanwhile the private companies that operate the highly fragmented and disjointed system continue to reap profits and pay out dividends.

Maybe this would not be so bad if the British taxpayer subsidised dividend payouts went to British owned companies, but this is far from the case:

“According to the Rail, Maritime and Transport Union, 70% of Britain’s railways are now under foreign ownership to some degree.” (CityA.M.: 11/01/17)

The figure of 70% foreign ownership is disputed, not least because some companies have gone bust since 2017, with five lines now being effectively run by the government as “operators of last resort.” As the 1993 Railways Act forbids the UK state from running the railways these lines are likely to be franchised out to private firms in the future.

“…many foreign state-owned enterprises of the Netherlands, Germany, France, Italy and Hong Kong now run rail franchises in the UK." (The Standard: 11/05/23)

While other countries have no philosophical problem with running railways for the benefit of their citizens, and clearly have no qualms about investing state money in foreign ventures, the Conservative Party is ideologically opposed to state intervention in running UK public services and is vehemently opposed to setting up a UK sovereign wealth fund.

In summary, successive Tory governments have continued to pay taxpayers money into the coffers of private enterprise regardless of how efficient, honest or effective these firms are at providing an essential public service. Clearly, where the railways are concerned, they are not run to “benefit the economy, society and environment" but for the benefit and interests of private investors, in the mistaken Tory belief that private enterprise is always better than public stewardship despite evidence to the contrary.

#uk politics#rishi sunak#Trains#franchise#leasing network rail#taxpayer money#profits private enterprise#inefficient#expensive#p

10 notes

·

View notes

Text

If you’re wondering whom to blame for TV’s predicament, that’s easy: It was Netflix. “Netflix completely revolutionized a 100-year-old industry,” says Mike Schur, who created The Good Place. “Everything changed, and everything changed the way they changed it.” In 2013, Netflix released the entire first season of House of Cards on the same day, overthrowing the time-honored orderliness of weekly schedules and giving viewers a brand-new way to spend 13 consecutive hours. Then the company embarked on what was probably the biggest spending spree in entertainment history. Wall Street treated Netflix not like the next HBO but more like the next Tesla, ignoring the profit factor to focus on growth.

“We all saw Netflix’s market cap go from $20 billion to $60 billion to $100 billion,” says someone who was then an executive at a legacy TV company. “The unspoken thing was that this will all be accretive to valuation: ‘I may not be running a profitable business, but boy, is it going to add stock value!’” He eventually went to work for a streamer.

[...]

The first sign of trouble came the very next month with a ten-word aside in a Netflix shareholder letter: “This added competition may be affecting our marginal growth some.” Investors began to bail. In April 2022, when the company announced that it had lost subscribers — the first decline since it had started making its own content — more than $50 billion evaporated in a single day. A stock that had been approaching $700 would soon fall below $200. Netflix began to look more like one of the fusty incumbents it had attempted to vanquish.

(no paywall)

22 notes

·

View notes

Text

Last week, Elon Musk rebranded Twitter as “X.” New CEO Linda Yaccarino tweeted that X would be “centered in audio, video, messaging, payments/banking,” a step toward Musk’s vision of creating the “everything app” for the Western world. Musk has been focused on this vision for Twitter since before he even bought it, repeatedly praising the Chinese app WeChat in a June 2022 town hall at Twitter. WeChat is known for doing virtually anything an app can do—messaging, audio/video, meetings, translation, social networking, shopping, payments, ride sharing, food delivery, and more. It’s an indispensable app in China, and Musk wants to build X into that app in the United States.

Musk has been laser-focused on his vision of the everything app for longer than most realize. He’s also long been obsessed with the letter X—he named his original online bank X.com, founded SpaceX, and even named his son “X Æ A-12.” His X-ray vision, if you’ll forgive the pun, dates back to his founding of the original X.com. Musk described that firm, which would eventually merge with Confinity to form PayPal, as a “global financial nexus” that could handle bank accounts, mortgages, credit, insurance, stocks—anything and everything financial.

On the face of it, none of this seems unreasonable. Such an app would be one of the most valuable companies in the world if it succeeded. It’s a tall task, but Musk has been involved in the founding of three separate multibillion-dollar companies. WeChat (along with competitors such as AliPay) has proven that such apps can reach scale and be wildly successful. And WeChat was initially built on the back of parent company Tencent’s popular social network, QQ. If it can be done, why not Musk? And why not start with Twitter?

Unfortunately for Musk, his vision of creating a Western WeChat is doomed to failure. Companies like Meta and Alphabet have made attempts before. These companies have every advantage—more cash available than Musk, larger pools of technical talent, better public reputation, and more successful lines of business in the app ecosystem. Nevertheless, none have succeeded in building an everything app. WeChat exists in a very specific Chinese context, and attempts to brute force it in a very different context will crash and burn.

The most important function of an aspiring everything app is payments, which unlock enormous value for the app and convenience for the user. But mobile payments in China are an outlier—87 percent of Chinese people used mobile payments in 2021, almost double the next highest nation. And that outlier status comes from the unique way that China’s payment economy developed.

China’s explosive economic growth over the 2000s saw the country transition from being a mostly unbanked, cash-based economy to a phone-based, app-payment economy without ever having a middle phase of adopting credit cards. As China’s new middle class grew, credit cards were available to a limited upper class—but never became a commonplace part of national financial infrastructure.

What China did have was a lot of cheap smartphones. By the early 2010s, most people there still didn’t have a PC, but they had a mobile phone, and increasingly they were switching to cheap smartphones. But those smartphones were mostly low-end products, with limited processing power and storage space. A high number of bloated apps wasn’t going to cut it for an average user, so many basic functionalities began to cluster inside a small number of super-apps. With the public hungry to abandon cash, apps like WeChat were the natural and widespread solution. Most vendors didn’t have existing relationships with payment companies. But they were happy to jump all the way to taking mobile payments—especially since all they needed to do so was a cheap smartphone, not an expensive terminal. China essentially leapfrogged credit cards all the way to mobile payment.

The United States in 2023 is not in that same position. Americans, for the most part, are not newly middle class and unbanked. Americans love credit cards, have deep experience with them, and use them regularly. And the country is filled with an enormous number of financial firms competing at every level—banking services, credit services, payment apps, stock brokerages, and more. Musk’s X will be entering a far more crowded and competitive market for customers who are already using far better and more developed alternatives.

Competitive is the key word there, because there are many Western companies that would have loved to compete with apps such as WeChat. But China’s government long ago banned nearly every non-Chinese alternative to native Chinese apps in areas including social media, video sharing, messaging, news, search, finance, and more. The list of apps banned in China is so extensive that it’s likely faster to point out the few that aren’t banned.

With so much of the competition absent, it was much easier for Chinese apps to dominate many fields at once as Chinese internet adoption skyrocketed. The Chinese government mostly didn’t pick favorites domestically at first—but it kept out foreign competition and let domestic products thrive. Twitter/X doesn’t live in that same world. The U.S. government won’t protect Musk from competition.

One of the ironies in all this is that the window to develop an everything app may be over in China as well, as the Chinese government’s approach to the tech sector has changed. During China’s boom years, the state often took a laissez-faire approach to tech regulation. The Hu Jintao government and even the early Xi Jinping years saw a booming economy, where tech companies were allowed to grow rapidly and dominate markets as long as they cooperated with censorship, handed over information to the government, and paid off the right people. Analyst XiaoFeng Wang explicitly links this flexible environment with WeChat’s growth, saying, “The more flexible regulatory environment in China at the time gave internet companies like Tencent and Alibaba more room to extend to a wide range of businesses. WeChat benefited from that and grew into a super-app.”

But the Chinese government has grown deeply worried about the power of the super-apps, for both good and bad reasons. Any power that does not reside directly in the party’s hands is distrusted at a time when Xi has demanded total party leadership of everything—and the influence and reach of tech companies has been sharply curtailed in the last few years, wiping billions off their value. Chinese regulators were also genuinely worried about the sheer degree of anti-competitive practices. It had become common, for instance, for firms to block links to their competitors’ products. Breaking down those “walled gardens” has become a major part of regulation since 2021.

Building a super-app would be hard in China today—and even harder in the United States or Europe, with their anti-monopoly legislation and political skepticism toward powerful tech companies. Even if Musk’s X could theoretically succeed, it probably wouldn’t be allowed to do so legally.

Yet paradoxically, while regulators raised eyebrows, elements of the Chinese government also welcomed the opportunities that WeChat and other ubiquitous apps offered. Chinese firms exist at the pleasure of the state and are always subordinate partners to it. WeChat’s parent company, Tencent, is well known for collaboration with the Chinese Communist Party in areas large and small, producing sycophantic patriotic games and engaging in widespread censorship and espionage. Foreign Policy has reported that Tencent was even partially funded by the Ministry of State Security in its early days.

These incidents highlight why an app such asWeChat would be permitted to thrive—because it’s useful to the party. In the James C. Scott sense, WeChat increases the legibility of Chinese society. You can’t control what you can’t see, so make sure you can easily see everything. If all of Chinese daily life is funneled through a single portal, it’s that much easier for the party to observe and control lives. Monitoring a single WeChat account could allow police to see an individual’s travel patterns, spending, and social contacts, which is why many dissidents or activists avoid using the app when possible.

Chinese consumers have become more privacy-conscious about the data they hand over to companies—but are hopeless or unaware of the amount of information the government can get from them. Western companies hoping to emulate WeChat not only don’t have the government on their side, but also face a much tougher and more skeptical audience. And in Musk’s case, who—apart from the most ardent of fans—is going to trust him with their money at this point?

WeChat and its counterparts in China grew up in unique, nonrepeatable circumstances. They faced a massive middle class with plenty of cheap smartphones but no traditional banking or credit cards. They were protected from Western competition by the Chinese government. That same government applied a very light regulatory touch as the companies grew, and also encouraged centralization as a way to maintain greater control.

None of those factors exist in the United States today, and Musk’s dream of building the X app for everything is essentially impossible without them. American consumers already have dozens of easy payment choices through credit cards, debit cards, and existing mobile apps. Musk won’t be protected from competition by the government. Instead, he’ll be treated in a more hostile manner by regulators concerned about privacy, monopoly power, and his general history with flouting the law.

Larger and more important tech firms than Twitter—or, as Musk now insists, X—have tried and failed in this area. Meta owns several social networks and several messaging apps, and has tried expanding into areas like marketplaces, video, payments and more. But most of these experiments have failed to reach any sort of scale, and Meta’s successes have come from disaggregating and breaking things apart rather than bundling them together. Google’s Alphabet parent company has succeeded in a wide variety of areas such as search, video, email, payments, and more. But its attempts to build a social network flamed out spectacularly, and like Meta, their biggest successes have come from separated apps and brands, not a singular everything app.

For all its cultural importance and for all that the chattering class is addicted to it, Twitter’s just never been that large. Meta has nearly 4 billion monthly active users across its family of apps. Twitter/X, even if you believe Musk’s suspiciously cropped data, is a bit more than a 10th of that. Meta and Alphabet are orders of magnitude larger and more important than Twitter/X. If they’ve tried and failed to create the everything app, there’s no reason to believe that Musk can succeed.

Musk’s vision for the original X.com impressed Silicon Valley. By 2000, X.com had merged with Confinity, and Musk took over as CEO of the new company. He focused his vision on the global financial nexus, the proto-everything app, despite investor and board skepticism. He pursued that idea maniacally, to the detriment of PayPal/X’s core product of payment by email. He also insisted on branding the company as “X,” despite PayPal’s strong existing brand.

And in less than a year, he was coup’d out of the company and replaced as CEO by Peter Thiel. PayPal was saved as a company because its board ejected Musk. This time around there’s no board that matters except Elon, and there’s no one to save him from himself.

15 notes

·

View notes

Text

The learned helplessness of Pete Buttigieg

The apocalyptic airline meltdown over the Christmas break stranded thousands of Americans, ruining their vacations and costing them a fortune in unexpected fees. It wasn't just Southwest Airlines' meltdown, either - as stranded fliers sought alternatives, airlines like AA raised the price of some domestic coach tickets to over $10,000.

This didn't come out of nowhere. Southwest's growth strategy has seen the airlines add more planes and routes without a comparable investment in back-end systems, including crew scheduling systems. SWA's unions have spent years warning the public that their employer's IT infrastructure was one crisis away from total collapse.

But successive administrations have failed to act on those warnings. Under Obama and Trump, the DoT was content to let "the market" discipline the monopoly carriers, though both administrations were happy to wave through anticompetitive mergers that weakened the power of markets to provide that discipline. Obama waved through the United/Continental merger and the Southwest/AirTran merger, while Trump waved through Virgin/Alaska.

While these firms were allowed to privatize their gains, Uncle Sucker paid for their losses. Trump handed the airlines $54 billion in covid relief, which the airlines squandered on stock buybacks and executive bonuses, while gutting their own employee rosters with early retirement buyouts:

https://www.bloomberg.com/opinion/articles/2020-05-04/airlines-got-the-sweetest-coronavirus-bailout-around

Incredibly, the airlines got even worse under the Biden administration. In the first six months of 2022, US airlines cancelled more flights than they had in all of 2021, while the airlines increased their profits by 45% - and kept it, rather than using it to pay back the $10b in unpaid refunds they owed to fliers:

https://www.economicliberties.us/press-release/economic-liberties-releases-model-legislation-to-eliminate-airlines-liability-shield/

Dozens of state attorneys general - Republicans and Democrats - wrote to Transportation Secretary Pete Buttigieg, begging him to take action on the airlines. After months without action, they wrote again, just days before the Christmas meltdown:

https://www.levernews.com/state-officials-warned-buttigieg-about-airline-mess/

For his part, Secretary Buttigieg claimed he was doing all he could, trumpeting the order to refund fliers as evidence of his muscular regulatory approach (recall that these refunds have not been paid). He assured Americans that the situation "is going to get better by the holidays."

https://www.youtube.com/watch?v=6FlD6fHq8-g&t=145s

But the numbers tell the tale. Under Buttigieg, the DOT "issued fewer enforcement orders in 2021 than in any single year of the Trump and Obama administrations."

https://www.economicliberties.us/press-release/economic-liberties-releases-model-legislation-to-eliminate-airlines-liability-shield/

As the crisis raged, enraged fliers and opponents of unchecked corporate power blamed Buttigieg. So did opportunistic, bad-faith Republicans looking to score political points. The "liberal" media lumped all this criticism together, insisting that Buttigieg had done everything in his power and declaring it unreasonable to expect the Transport Secretary to prevent transportation catastrophes:

https://www.levernews.com/the-partisan-ghost-in-the-media-machine/

Buttigieg's defenders trotted out a laundry list of excuses for the failure, ranging from the nonsensical to the implausible to the contradictory - Pete's Army continued to claim that the aviation meltdown was the weather's fault, even after Buttigieg himself went on national TV to say this wasn't the case:

https://twitter.com/GMA/status/1608075800254767105?s=20&t=wmaJq3OWU0r0e6TS9V-9sA

Buttigieg is the Secretary of a powerful administrative agency, and as such, he has broad powers. Neither he nor his predecessors have had the courage to wield that power, all of them evincing a kind of learned helplessness in the face of industry lobbying. But there is a difference between being powerless and acting powerless.

To see what a fully operational battle-station looks like, cast your eye upon Lina Khan, chair of the FTC, another agency that has a long history of dormancy in the face of corporate power, but which Khan has transformed - not through ideology, but through competence. Khan - and her fellow Biden administration trustbusters Jonathan Kantor and the recently departed Tim Wu - have an encyclopedic knowledge of their powers, and they haven't been shy about using them:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

Over the Christmas break, even as the airline industry was stranding Americans far from their families, Khan proposed a rule to ban noncompete agreements, which are widely used to prevent low-waged workers like fast-food cashiers from quitting their jobs and seeking better pay from competitors:

https://mattstoller.substack.com/p/antitrust-enforcers-to-ban-indentured

These are, as Matt Stoller writes, a form of indentured servitude, used by private equity crooks to lock in their workforces. "30% of hair stylists works under a non-compete, as do 45% of family physicians." Noncompetes destroy the livelihoods of workers who start their own businesses, too: "One comment to the FTC came from a graphic designers for signage who was bankrupted by a lawsuit from her control-hungry former boss and a small town judge":

https://www.regulations.gov/comment/FTC-2019-0093-0015

Noncompetes are a scourge, and there should be bipartisan agreement on this. If you're a Democrat who believes in labor rights, noncompetes are manifestly unfair. But that's also true if you're a Republican who believes in competition and the power of entrepreneurship.

Nevertheless, noncompetes have trundled on, with neither Congress nor the administrative branch showing the courage to act - until now. Khan's proposed rule bypasses Congressional inaction by invoking powers that she already has, under Section 5 of the Federal Trade Commission Act.

Section 5 gives the FTC broad powers to prohibit "unfair methods of competition" - an incredibly broad power to wield, and one that the FTC hasn't bothered to use since the 1970s (!):

https://casetext.com/case/national-petroleum-refiners-assn-v-f-t-c

Which brings me back to Secretary Buttigieg and the airlines. Because Chair Khan isn't the only federal regulator with these broad powers. As David Dayen writes for The American Prospect, "the Department of Transportation has the exact same authority":

https://prospect.org/infrastructure/transportation/ftc-noncompete-airline-flight-cancellation-buttigieg/

Under USC40 Section 41712(a), Buttigieg has the power to unilaterally ban transportation industry practices that are "unfair and deceptive" or "unfair methods of competition." Per the DOT's own guidance, this provision is "modeled on Section 5 of the Federal Trade Commission Act":

https://www.govinfo.gov/content/pkg/USCODE-2020-title49/pdf/USCODE-2020-title49-subtitleVII-partA-subpartii-chap417-subchapI-sec41712.pdf

The are a lot more recent examples of the DOT using this power than there are of the FTC using its Section 5 authority, like the Tarmac Delay Rule. But as Robert Kuttner writes, the airlines reneged on their end of the $54b bailout, slashing staffing levels and failing to invest in IT modernization - examples of the "unfair and deceptive" practices that the DOT could intervene to prevent:

https://prospect.org/infrastructure/transportation/ftc-noncompete-airline-flight-cancellation-buttigieg/

As Dayen writes, "The definition of 'deceptive' is 'likely to mislead a consumer, acting reasonably under the circumstances.' If the airline scheduled a flight, took money for the flight, and knew it would have to cancel it (or, if you prefer, knew it would have to cancel some flights, all of which it took money for), that seems plainly deceptive."