#bank of america loans

Text

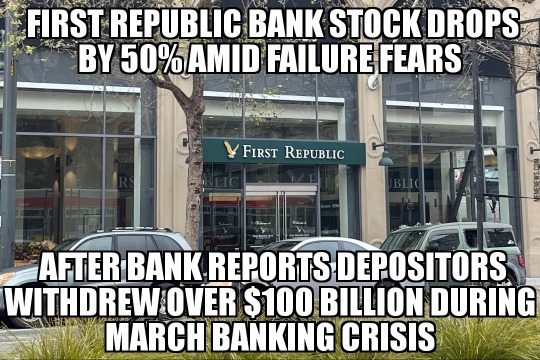

First Republic Bank stock drops

View On WordPress

#America#bank#banking#business#economy#first republic#first republic bank#interest rate#loans#meme#memes#money#news#recession#united states

45 notes

·

View notes

Text

Bank of America Launches Zero Down Payment Mortgage Plan to Expand Homeownership Opportunities in Black and Latinx Communities

Bank of America Launches Zero Down Payment Mortgage Plan to Expand Homeownership Opportunities in Black and Latinx Communities

Bank of America recently announced a new zero down payment, zero closing cost mortgage plan for first-time homebuyers, which will be available in certain markets, including African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami.

What BofA is calling “The Community Affordable Loan Solution™” aims to help eligible individuals and families obtain…

View On WordPress

#AJ Barkley#Bank of America#Charlotte#Dallas#Detroit#Los Angeles#Miami#National Association of Realtors#The Community Affordable Loan Solution#zero closing cost mortgage#zero down payment

8 notes

·

View notes

Text

I found an extremely dope disability survival guide for those who are homebound, bedbound, in need of disability accommodations, or would otherwise like resources for how to manage your life as a disabled person. (Link is safe)

It has some great articles and resources and while written by people with ME/CFS, it keeps all disabilities in mind. A lot of it is specific to the USA but even if you're from somewhere else, there are many guides that can still help you. Some really good ones are:

How to live a great disabled life- A guide full of resources to make your life easier and probably the best place to start (including links to some of the below resources). Everything from applying for good quality affordable housing to getting free transportation, affordable medication, how to get enough food stamps, how to get a free phone that doesn't suck, how to find housemates and caregivers, how to be homebound, support groups and Facebook pages (including for specific illnesses), how to help with social change from home, and so many more.

Turning a "no" into a "yes"- A guide on what to say when denied for disability aid/accommodations of many types, particularly over the phone. "Never take no for an answer over the phone. If you have not been turned down in writing, you have not been turned down. Period."

How to be poor in America- A very expansive and helpful guide including things from a directory to find your nearest food bank to resources for getting free home modifications, how to get cheap or free eye and dental care, extremely cheap internet, and financial assistance with vet bills

How to be homebound- This is pretty helpful even if you're not homebound. It includes guides on how to save spoons, getting free and low cost transportation, disability resources in your area, home meals, how to have fun/keep busy while in bed, and a severe bedbound activity master list which includes a link to an audio version of the list on Soundcloud

Master List of Disability Accommodation Letters For Housing- Guides on how to request accommodations and housing as well as your rights, laws, and prewritten sample letters to help you get whatever you need. Includes information on how to request additional bedrooms, stop evictions, request meetings via phone, mail, and email if you can't in person, what you can do if a request is denied, and many other helpful guides

Special Laws to Help Domestic Violence Survivors (Vouchers & Low Income Housing)- Protections, laws, and housing rights for survivors of DV (any gender), and how to get support and protection under the VAWA laws to help you and/or loved ones receive housing and assistance

Dealing With Debt & Disability- Information to assist with debt including student loans, medical debt, how to deal with debt collectors as well as an article with a step by step guide that helped the author cut her overwhelming medical bills by 80%!

There are so many more articles, guides, and tools here that have helped a lot of people. And there are a lot of rights, resources, and protections that people don't know they have and guides that can help you manage your life as a disabled person regardless of income, energy levels, and other factors.

Please boost!

#signal boost#please reblog#chronic pain#chronic illness#disability#fibromyalgia#cfs#chronic fаtiguе ѕуndrоmе#actually disabled#spoonie#me/cfs#cfs/me#long covid#important#invisible disability#ehlers danlos syndrome#lyme disease#chronically ill#cpunk#cripplepunk

15K notes

·

View notes

Link

The United States has lost 100 nursing homes per year over the last six years. Justin and Lance discuss how this is connected to the new housing trend of ditching bathtubs and combining essential rooms in the home.

tags: tsou, justin weller, lance jackson, housing, home, family, money, finance, mortgage, bank, loan, interest, market, wealth, america, dream

#america#bank#dream#family#finance#home#housing#interest#jackson#justin#lance#loan#market#money#mortgage#tsou#wealth#weller

0 notes

Text

Exorbitant Loan Costs Mean A Blast For Fixed-Pay Ventures

Taking off loan costs have revived Americans' inclination "Exorbitant loan costs mean a blast for fixed-pay ventures" for fixed-pay ventures like securities and currency market reserves, however specialists caution that they ought to be ready for the expenses.

Click Here

#america#personal loans#emily feld#student loans#same day loans direct lenders#financial#banking#bank#bankruptcy#outer banks#ceo#usa news#finanace

0 notes

Text

American Homeowners Grapple with Rising Financial Anxiety

American Homeowners Grapple with Rising Financial Anxiety. Yet, Many Overlook Vast Home Equity Potential As A Financial Cushion

Finance of America Reverse LLC (FAR) has issued a new survey and it says American homeowners are freaking out. The survey shows that nearly 80% of American homeowners grapple emotionally about the state of the U.S. economy.

The survey gauges homeowners’ sentiment on…

View On WordPress

#American Advisors Group Reverse Mortgages#American Homeowner Anxiety#american real estate#banking#banks#debt#Finance of America#Finance of America Mortgage#Finance of America Reverse#foreclosure#foreclosure defense#foreclosures#HCEM#HELOCs#home equity#home equity loans#liens#mortgage fraud#mortgages#real estate

0 notes

Text

Rising interest rates are a good thing for U.S. Real Estate Investors

Are you an overseas non-resident investor looking to purchase property in the U.S. but are thinking twice because of the increase in interest rates? Let’s break it down.

Let’s face it, interest rates are high, but if you are looking for passive income and long-term investment, we know now is the time to strike.

When interest rates are high, it is actually more beneficial to residential rental property owners because the demand for rental homes and apartments increases as many people that once were looking will not be able to qualify for a mortgage. Individuals and families who have put off their house hunting will need a place to live. When this happens, the rental demand skyrockets, and – this is the sign you’ve been looking for –the opportunity for real estate investors looking to purchase rental property is here!

What makes American Mortgages loans unique is the rate can be fixed for 30 years regardless of the borrower’s age. Your rate today will be the same 30 years for now, but the rent you will receive will likely be significantly more! Want an even better yield? Try our 10 year fixed interest only loan program that converts to a 30 year fixed without a rate adjustment. Total tenure of 40 years!

As a foreign national or U.S. expat investor, there are a few things to consider when you want to purchase a property in the U.S. There is no denying that the interest rates have increased, but if you are looking at real estate investment, you have to consider its long-term benefits – mainly building equity and wealth, property cash flow, and rental yield.

Build Equity and Wealth

Did you know that real estate remains a wealth-building tool for the majority of moguls? An estimated 90% of millionaires were created through real estate investing. Most High-Net-Worth individuals in the U.S. or around the globe invest in real estate in some form or the other.

As you pay a property mortgage, you build equity—an asset that’s part of your net worth. As you build equity, you have the leverage to buy more properties which in turn will increase your cash flow and wealth even more. America Mortgages has no limitation on the number of mortgages one investor can have. Portfolio loans are also available.

Why Rental Yield is so Important

Rental prices are soaring in many parts of the U.S. According to Government consumer price data, the average rent that the typical Americans actually pay rose 4.8% over the past year – a higher than the average rate of increase. According to Redfin, the average monthly rent rose to $1,985 in November – an increase of 6.8% monthly and 20.5% annually. The median rent nationwide in May reached $2,000 monthly, according to Redfin.

If you are keen to invest in U.S. real estate but have not found a property yet, AM Concierge ‘Property finder’ services can help you secure your dream home. Once you have purchased the property and your tenants are in place, your rental should run on autopilot. Our America Mortgages loan officer is with you for the long run. In the event rates change, special rate promotions or new loan programs, you’ll know first.

Real Estate Cash flow

How do real estate investors get so much cash flow? You probably read a million times that “real estate is a classic wealth-building technique.” Most investments don’t provide cash flow. Take, for example, stocks -you invest and leave without accessing them until you sell them. However, when you put resources into buy and hold real estate, you bring in cash flow monthly when you have tenants paying rent. The difference between the rent collected and your expenses is your income. You can utilize it to cover your bills, save for the future, or even make a greater real estate portfolio. Passive income is the income you can survive with, regardless of whether your other investments work out or not.

Now is the time to strike while the iron is hot. If you are still on the fence about investing in U.S. real estate, speak to our mortgage specialist to discover your options. 100% of our clients are living abroad.

For more details, visit us at www.americamortgages.com

Reference: https://www.americamortgages.com/rising-interest-rates-are-a-good-thing-for-u-s-real-estate-investors/

0 notes

Text

Biden could end this with just one call. Previous presidents had little issue curbing Israel. Reagan went against Israel several times including forcing them to halt the building of new settlements for a period of time and intervening to prevent Israel from killing 100 journalists in a hotel. George H W Bush delayed loan guarantees until Israel stopped building settlements in the West Bank and Gaza.

Biden, on the other hand, cosigned everything Israel did in 2021 and especially this year. In fact, any talk of humanitarian pauses and asking the other nations not to join in the fighting (his administration has been threatening Iran and Hezbollah, and presumably nations like Egypt) is merely meant to buy time for America to get its soldiers and weaponry in place for a regional war.

3K notes

·

View notes

Text

Need a quick $500? Wells Fargo is the latest bank to offer small, no-interest loans

Need a quick $500? Wells Fargo is the latest bank to offer small, no-interest loans

Wells Fargo announced a new short-term, small-dollar loan for customers. The $250-$500 loans could help lower-income customers avoid riskier ways of getting short-term cash, one group says.

DEVIN YALKIN

NYT

Wells Fargo has launched a new kind of loan that offers customers short-term cash for a flat fee — adding to a slowly growing list of cheaper, less risky financing options for cash-strapped…

View On WordPress

0 notes

Text

The program — called the Community Affordable Loan Solution — will be available to certain markets including majority Black and/or Hispanic/Latino neighborhoods, in Charlotte, North Carolina; Dallas; Detroit; Los Angeles; and Miami.

0 notes

Text

Bank of America Announces Small Business Down Payment Grant Program to Drive Women and Minority Business Growth

Bank of America Announces Small Business Down Payment Grant Program to Drive Women and Minority Business Growth

New Special Purpose Credit Program offers down payment grants for SBA 504 and 7(a) commercial real estate loans for women and minority business owners in Atlanta, Chicago, Charlotte, Dallas and Los Angeles

SOURCE: Bank of America Corporation

CHARLOTTE, N.C., Aug. 30, 2022 — Bank of America announced the launch of a Small Business Down Payment Grant Program to drive business growth and help…

View On WordPress

#Bank of America#Black / African American Neighborhoods#Community Affordable Loan Solution#Community Homeownership Commitment#Hispanic-Lation Neighborhoods

0 notes

Text

If you don't know about the 10 products or services of Google, you may not know anything in the internet world

If you don’t know about the 10 products or services of Google, you may not know anything in the internet world

Here are 10 products or services that everyone needs to know about Google :

Don’t go online without Google. Think about how difficult our online world would be without Google today? We are instantly getting the information we need every day through Google. And not only that, Google has many more services, each of which is important in one way or another. Today I will show you 10 such products or…

View On WordPress

#Adsense#Android#Bank#Bank of America#Chrome#Digital marketing#Donate#Facebook#Freelancer#Freelancing#Good#Google#Google adsense#Google drive#Google map#Google search#Insurance#Job#Loans#Meta#Search engine optimization#Seo#United States of America#Usa#Web design

1 note

·

View note

Text

"This event ends the moment you write us a check, and it better not bounce, or you're a dead motherfucker"

-- Big Bill Hell

There was a time when you'd see little old ladies paying for the groceries with a hand-written personal check, holding up the line, causing an immediately-forgiven slight sense of annoyance with those behind her. Buddy. Those days are over. They've been over. What, did you think you were going to just pop a couple extra zeroes on the end of your paycheck there? Maybe scan your paycheck, open it in photoshop, make a template, print em out all nice? You think you're the first to think of that, dipshit?

It takes the law a long time to catch up with the state of the art. You're reading this on the internet, which means you never use checks. The law has caught up. Your ass will be going to prison immediately and you will see zero return.

You can't even kite checks anymore, and hell, nobody under 40 will even know what that means, due to the blazing fast, two day settlement on all ACH transactions. Let me paint you a picture.

You get paid on Friday, but it is Monday, and bills are due on Tuesday. And you're broke: $0 in the bank. Goose egg. Pop open your checkbook, go to a store, "buy" some things, write a check for the amount. The cashier takes it!

Now take those things you "bought", across town, to another store location, and return them for cold hard cash. Sweet. Bills paid. Friday rolls around, and you just make it to the bank to deposit your paycheck before it closes. After the weekend, the checks you wrote finally post, and they don't bounce! You've kited a check. You've surreptitiously taken a zero-interest loan. And we know your broke ass. The interest rate on that short-term payday loan should have been straight up usurious. We're talking 29%. That makes predatory fuckers like us horny for sex. We're so mad. Now you are going to Federal Prison. For a good minute. Fuckface.

COST: $0.10 (With banks offering free checking accounts + Bic pen)

"Neither snow nor rain nor heat nor sleet, if you fuck with the mail, we'll rip your nuts off"

-- Ronald Mail (Inventor of Mail)

Many people have this misnomer that the most powerful people in politics are democratically elected. The president, of the United States, of America, is a stupid cartoon hotdog. All of them, I don't care. Way less clout than you'd think. Brilliantly, it is the people that the hotdog president appoints who are actually doing anything significant. The director of the CIA. The fucking chairman of the Federal Reserve. Probably the, like, most senior, uh, general of the military, and shit too. I don't know, we don't "do" army here at Bloomberg. You probably don't even know their names! I don't! These are the ones you should be seeing in your sleep.

There's another position like that. Appointed directly by the hotdog. The Postmaster General. That's a real title. He's the CEO of the mail, and buddy, what he may lack in political power relative to the director of the CEO, he makes up in raw sexual energy. Total Tom Selleck energy. Like an airline pilot. We're talking Donald Sutherland in Invasion of the Body Snatchers. I'm tentpoling in my black business slacks just writing this, and all my Bloomberg newsroom bros are peering over my shoulder and also tent-poling. We're not gay though, and especially me, I'm probably the least gay, but sometimes I just lay awake for hours at night what that mustache would feel like pressed against my lips, the unbelievable and utter, total sense of security I'd feel burying my head into his hard chest.

You get it. He's your dad. And if you fuck with the mail, you've fucked with the tools in your dad's garage. And dad's been drinking. You're in for it, bucko, you are in trouble. Do you think the United States Postal Service actually makes any money? Hell no. It costs like five bucks to mail a box basically anywhere I can think of and they give you the boxes for free. You can just walk in the post office and take them. I do that, and then just throw them away, I don't know why, some kind of compulsion. Being able to move shit around like this, quickly, cheaply -- Jesus H, I've got a huge amount of money in my bank account, probably tens of trillions of dollars (due to financial knowledge gained from reading Bloomberg articles) and I could probably mail every single person ever something and still come out in the black.

No way pal. They've thought of that already. The Postmaster General is going to know every time, and he's going to grab you by the shirt collar, wearing his cool as fuck hat, and you're going to get your pants pulled down, and your bare ass spanke...I need to go use the restroom real quick.

We rely on the mail system to get important shit done. It's not something to be taken lightly, and it isn't. Trust me. This is why, like almost every other person who receives mail in this year 2023, I just fucking put a wastebasket under my mail slot. I don't even shred that shit anymore. I just burn it. Takes less time.

COST: $0.63 (Postal stamp)

"Can call all you want, but there's no one home //

And you're not gonna reach my telephone //

Out in the club, and I'm sipping that bubb //

And you're not gonna reach my telephone"

-- Lady Gaga

I read something wild that the children of today do not know what a dial tone is, because of how fucked up and stupid they are. Isn't that super fucked up?

While it's not really our style, allow me to fill you in on some ancient, arcane knowledge about the telephone. You can turn it on, and then you can punch in numbers. Any numbers. Random ones, or maybe not random ones. If the ten numbers you punch in are the same as the numbers in someone else's telephone number, their phone will ring, and then you are talking to them. This is called "Phreaking".

Here's the kicker: You can tell that jackass anything you want. "Oh, Hi, Yes, I am Reginald Sumpter calling from Avalon Consulting LLC, we are just following up on the invoice we sent you. Please remit to ###### routing ###### account."

BOOM! Your name isn't Reginald whatever and that company doesn't exist, but you just received a deposit. It's fucking beautiful. What have you done wrong? It isn't your responsibility to handle who your business' clients/etc are, it's their's. If they want to just pay you money for no real reason, well, that's kind of on them, isn't it? I haven't stuck a pistol in your face and demanded everything in the register.

Well, it's too clever. It's too slick. This is the United States of America. It's one thing to commit a felony like armed robbery, it's another thing to piss off someone in charge of the accounting division who uses a special bathroom you need a key to get into.

You can do it on the computer too, I use a PC Computer at work and send email, so you can see how it'd work there. You can make a document that is indifferentiable from a real invoice and, straight up, 1/3 of the time they will pay that shit. Lmfao.

It's called wire fraud because, uhh, duhhhh, there's wires. What do you think that thing is strung between the telephone receiver and the dialer? And computers? Give me a break. There's so many wires with those.

COST: $0.25 (Coin for payphone)

"People calculate too much and think too little."

-- Charlie Munger

It is insane how dumb the common man can be when it comes to our world of expertise. I hear this same sentiment, like, ALL THE TIME:

"Durr hurr I will buy an insurance policy for my car or house or whatever so that in case something happens to it I will get money". And then that same person proceeds to drive safely or not burn their house down. Dumbest crap imaginable.

Let me break it down for you. Insurance is a two player competitive game. There is a winner and there is a loser. Go take out an expensive insurance policy on your American sports car. Buy a neck brace, a football helmet, and pack that bitch with throw pillows. Then get in the left lane of a major highway at like noonish, let it rip and then SLAM on your brakes. Hit from behind! Your fault! Congratulations. You have won insurance. How this gets past people is beyond me.

You can only do this once or twice before the insurance companies catch on. Then they don't want to fuck with you. It is also..I don't know man...something feels off about taking a car or a house, which like, some guy had to build and just destroying it, but that is only a weird emotional thing, since you're making money, more than whatever the destroyed thing is worth, so in reality you've built that house plus some extra. You've contributed.

COST: $106.00 (Average monthly car insurance payment)

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

SUBSCRIBE TO MY WHATEVER FOR PART TWO, COMING SOON. i'll post it later today probably. whatever time frame will juice the numbers. have a sneaky peaky

disclaimer | private policy | unsubscribe

973 notes

·

View notes

Text

April 22, 1919 "Human spider man" Bill Strothers climbed to the top of the Hibernia Bank Building at 226 Carondelet, New Orleans, Louisiana as part of a Liberty Loan Drive before 20,000 onlookers. From America in the 1910's, FB.

126 notes

·

View notes

Text

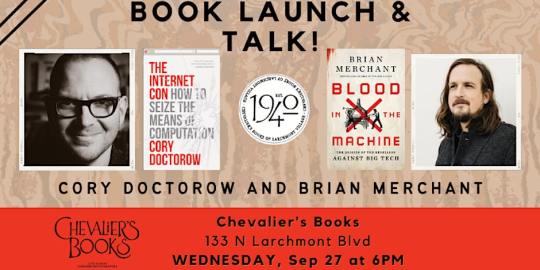

Intuit: “Our fraud fights racism”

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

*on the phone with Bank of America* look, I just need you to find me an additional 464 million dollars. We all know how unfair and crooked this weaponized banking system is. It’s so obvious. They say it should be 8% interest, when really it’s a measly 2.3%. Ive got my guys looking into that 2.3% interest rate, that’s what it is. My guys will take care of you. All I need from you is a favor, a small loan of 464 million dollars.

BofA employee: sir, do you have an account with us

118 notes

·

View notes