#National Association of Realtors

Text

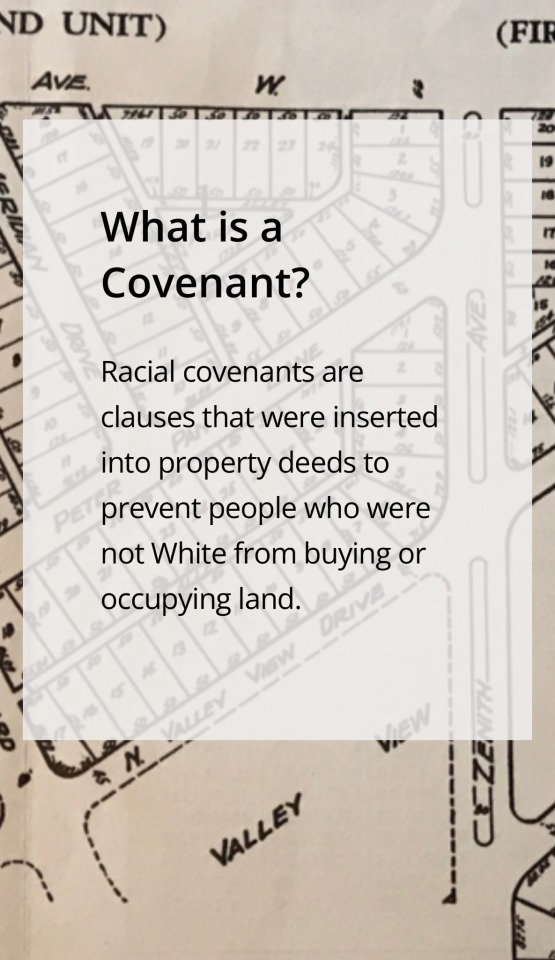

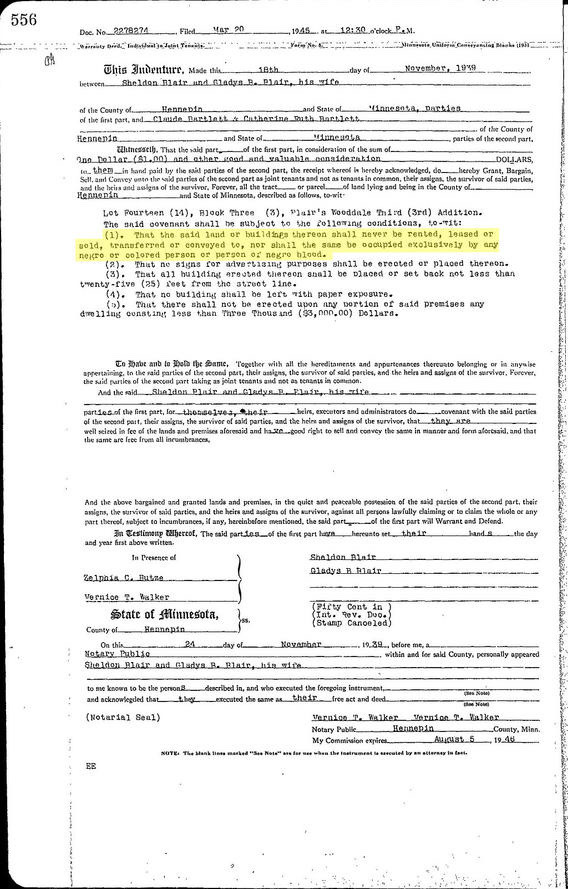

Racial covenants can be found in the property records of every American community. These restrictive clauses were inserted into property deeds to prevent people who were not White from buying or occupying land.

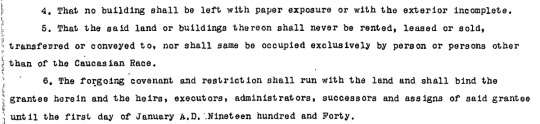

Racial covenants served as legally-enforceable contracts. They stipulated that the property had to remain in the hands of White people and they ran with the land, which meant that it could be enforced in perpetuity. Anyone who dared to challenge this ban risked forfeiting their claim to the property.

A survey of the 30,000 covenants unearthed in Hennepin and Ramsey Counties illuminates the wide variety of people targeted. An early Minneapolis restriction proclaimed that the "premises shall not at any time be conveyed, mortgaged or leased to any person or persons of Chinese, Japanese, Moorish, Turkish, Negro, Mongolian or African blood or descent." Before 1919, Jews were often included in this laundry list of “objectionable” people.

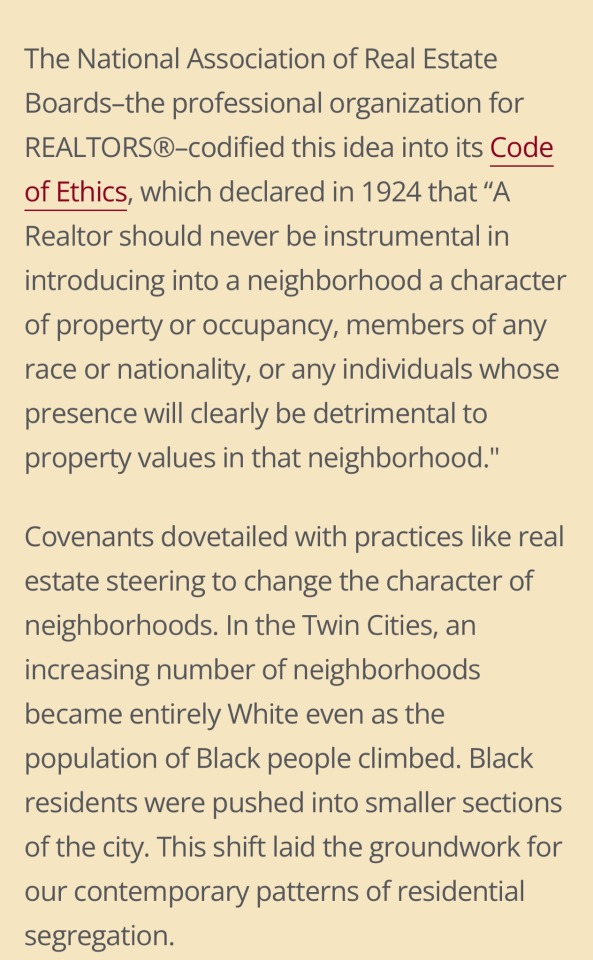

This language shifted with time. This eugenics-inspired list gave way to simpler declarations that the property could only be “be occupied exclusively by person or persons. . .of the Caucasian Race.” While many different kinds of people were targeted by racial covenants, every restriction identified by Mapping Prejudice bars Black people, as they were perceived by White Minnesotans to be particularly likely to decrease property values.

Real estate developers used racial covenants to sell houses, promising home buyers that covenants would protect their investment.

These same developers worked with park commissioners to make land adjacent to racially-restricted neighborhoods into public green space. These parks, they argued, would enhance the value of the property in these new neighborhoods. These rising values would also benefit municipal governments by swelling local tax coffers.

White homeowners also profited from racial covenants. A team of University of Minnesota researchers has demonstrated that Minneapolis houses that had covenants are worth 14 percent more than identical houses that never had covenants. This “bonus” value persists today, more than 50 years after the Fair Housing Act made these racial restrictions illegal.

The families who owned houses with covenants were able to pass that value on to the next generation. This intergenerational transfer of assets continues to drive the racial wealth gap in the United States today.

(continue reading)

#politics#racism#racial covenants#redlining#housing discrimination#structural racism#anti blackness#housing#realestate#national association of realtors#racial wealth gap#generational wealth

53 notes

·

View notes

Text

#home ownership#realtors#National association of realtors#high cost of home buying#realtor commissions

28 notes

·

View notes

Text

Bank of America Launches Zero Down Payment Mortgage Plan to Expand Homeownership Opportunities in Black and Latinx Communities

Bank of America Launches Zero Down Payment Mortgage Plan to Expand Homeownership Opportunities in Black and Latinx Communities

Bank of America recently announced a new zero down payment, zero closing cost mortgage plan for first-time homebuyers, which will be available in certain markets, including African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami.

What BofA is calling “The Community Affordable Loan Solution™” aims to help eligible individuals and families obtain…

View On WordPress

#AJ Barkley#Bank of America#Charlotte#Dallas#Detroit#Los Angeles#Miami#National Association of Realtors#The Community Affordable Loan Solution#zero closing cost mortgage#zero down payment

8 notes

·

View notes

Text

D.R. Horton, Inc. Announces the Passing of Company Founder and Chairman, Donald R. Horton

America’s Builder, today announced the sudden passing of Donald R. Horton, the Company’s Founder and Chairman of the Board of Directors.

D.R. Horton, Inc. (NYSE:DHI), America’s Builder, today announced the sudden passing of Donald R. Horton, the Company’s Founder and Chairman of the Board of Directors. David V. Auld, the Company’s Executive Vice Chairman, has been appointed by the Board to serve as Executive Chairman, effective immediately.

David V. Auld shared, “It is with great sadness that I announce the passing of my friend…

View On WordPress

#Channel 3 News#City of Pensacola#D.R. Horton Homes#D.R. Horton Pensacola#David Auld#DHI#Don Horton#Downtown Pensacola#Escambia County#INVESTORS#Largest Homebuilder in America#National Association of Realtors#nyse#pensacola beach#Pensacola Florida#Pensacola News Journal#PNJ#Santa Rosa County#sell my home in pensacola

0 notes

Text

Four Things to Understand About the NAR Settlement

Photo by KATRIN BOLOVTSOVA on Pexels.com

The NAR settlement of the Sitzer-Burnett case has created some furor, and the media is exploding with speculation about the industry’s changes. This speculation is fueled mainly by people who aren’t in the industry, who rely upon or regurgitate articles someone else not in the industry wrote or just speculation shaped by that individual’s narrow view of…

View On WordPress

#bill lublin#billlublin#Business#Multiple Listing Service#National Association of Realtors#Real Estate#Real estate broker

0 notes

Text

Realtors’ settlement on fees announced – what’s it all about?

Last week the National Association of Realtors announced it settled a lawsuit alleging a monopoly on how broker fees are charged. The result was agreeing to pay $418 million in damages.

Home ownership is the largest investment most of us make and in a consumer economy the impact could be enormous. From the lyrics of one of the hits from the late bluesologist Gil Scott-Heron, “all of us are…

View On WordPress

0 notes

Text

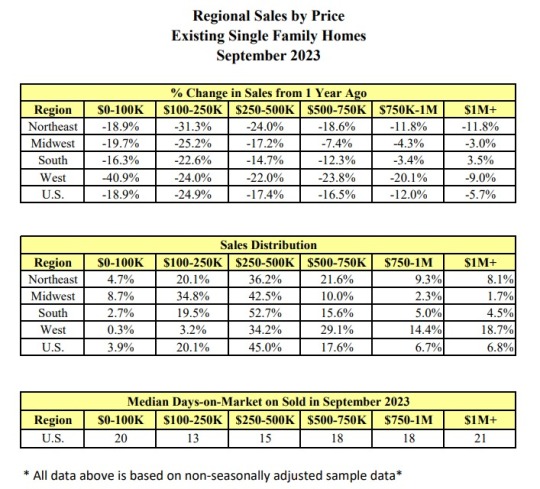

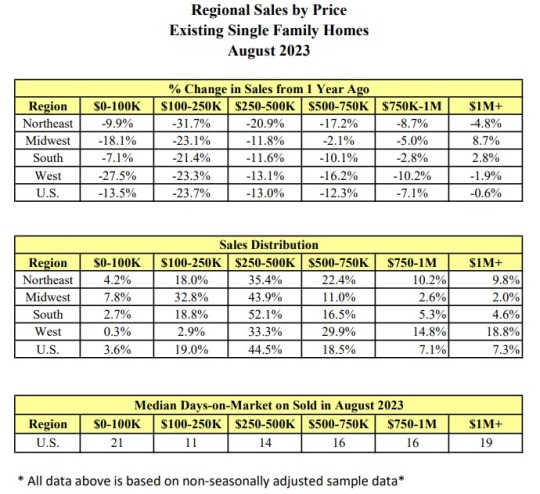

Real Estate Sales Report - News Worsens for CCRCs/Life Plan Communities

With occupancy rebounding to pre-pandemic levels and demand remaining strong, CCRCs/Life Plan Communities continue to face economic headwinds from capitalizing on improving market conditions.

Capital costs continue to rise making borrowing money a challenge or alternatively, perhaps adding additional debt service costs if existing debt is variable.

Accessing capital is nearly imperative for…

View On WordPress

#CCRC#Economics#Fitch Ratings#Home Sales#Industry Outlook#Interest Rates#Life Plan Community#Management#mortgage#mortgage rates#National Association of Realtors#real estate#Senior Housing#Trends

0 notes

Text

The National Association of Realtors and organized real estate played an even larger role in intentionally segregating the country than most people knew - those wrongs must be redressed.

A redlining map of St. Louis, prepared by the federal government’s Home Owners' Loan Corporation, used data from local real estate professionals to “grade” neighborhoods, based largely on their racial makeup. Credit: National Archives/Mapping Inequality

In March, a court in the Northern District of Illinois allowed a class-action lawsuit to move forward against the National Association of Realtors, the trade organization that is single largest federal lobbying spender in the US.

The organization, along with seven major real estate companies that serve as its co-defendants in Moehrl et al., could be hit with $13 billion to $40 billion in damages. (The lawsuit is the larger of two separate class-action cases moving through the courts.) The case revolves around how the NAR leverages its local member boards’ control of 97% of multiple listing systems to keep in place rules regarding set commissions — as the lawsuit notes, US homebuyers and sellers pay commission rates roughly double those of peer countries.

(continue reading)

#politics#redlining#housing#racism#fair housing#national association of realtors#racial discrimination#anti blackness#urban renewal#realtors#organized real estate#real estate

23 notes

·

View notes

Text

The Changing Landscape of Real Estate Commissions: Is a Buyer's Agent Necessary?

Are Real Estate Agents Doomed?

REAL ESTATE NEWS (National, U.S.) — The real estate industry is undergoing a seismic shift, and one of the most debated topics is the role of buyer’s agents in the transaction process. With the National Association of Realtors (NAR) recently allowing listing brokers to offer 0% compensation to buyer’s agents, the question arises: Is a buyer’s agent necessary? This…

View On WordPress

0 notes

Text

February Home Sales Surge 14.5% Amidst Rare Median Price Dip

Reported by the National Association of Realtors, February boasted an annualized sales rate of 4.58 million units of previously owned homes, signifying a substantial recovery from the stagnation experienced throughout 2022.

0 notes

Video

youtube

My first national commercial!

Open for more acting opportunities

1 note

·

View note

Text

Published: National Association of Realtors Code of Ethics Training

National Association of Realtors Code of Ethics Training - https://ift.tt/WuBP2Cz

1 note

·

View note

Text

Unlocking Peace of Mind: Your Comprehensive Guide to D.R. Horton Homes Warranty

Unlocking Peace of Mind: Your Comprehensive Guide to D.R. Horton Homes Warranty

Welcome to the world of D.R. Horton Homes—a realm where quality craftsmanship meets unparalleled customer service, and homeownership dreams become a reality. As you embark on this exhilarating journey, it’s essential to arm yourself with the knowledge and understanding of the warranty coverage that accompanies your new home. Fear not, intrepid homeowner, for we’re here to unravel the complexities…

View On WordPress

#realestate floridarealtor PensacolaRealtor realestateagent homesforsale openhouse pcola househunting pensacolaflorida investmentpr#realestateagent fair candles openhouse pcola househunting pensacolaflorida fall hansenteam veterans dreamhome fha beach milita#Affordable Apartments Pensacola#Affordable Homes Pensacola#Affordable Housing Pensacola#and cozy abode is the perfect blend of elegance and comfort. Nestled off the desirable Scenic Highway in Pensacola FL#Ascension Sacred Heart Pensacola#Baptist Hospital Pensacola Florida#BUY A HOUSE PENSACOLA#Channel 3 News#City of Pensacola#CYBER ATTACK#Downtown Pensacola#ELECTION#Escambia County#HCA WEST FLORIDA#National Association of Realtors#NW FLORIDA#pensacola beach#PENSACOLA HOME#Pensacola News Journal#PNJ#RON DESANTIS#Santa Rosa County#sell my home in pensacola#STORMS#TORNADOS#West Pensacola

0 notes

Text

The 6% commission, a standard in home purchase transactions, is no more.

In a sweeping move expected to dramatically reduce the cost of buying and selling a home, the National Association of Realtors announced Friday a settlement with groups of homesellers, agreeing to end landmark antitrust lawsuits by paying $418 million in damages and eliminating rules on commissions.

The NAR, which represents more than 1 million Realtors, also agreed to put in place a set of new rules. One prohibits agents’ compensation from being included on listings placed on local centralized listing portals known as multiple listing services, which critics say led brokers to push more expensive properties on customers. Another ends requirements that brokers subscribe to multiple listing services — many of which are owned by NAR subsidiaries — where homes are given a wide viewing in a local market. Another new rule will require buyers’ brokers to enter into written agreements with their buyers.

The agreement effectively will destroy the current homebuying and selling business model, in which sellers pay both their broker and a buyer’s broker, which critics say have driven housing prices artificially higher.

By some estimates, real estate commissions are expected to fall 25% to 50%, according to TD Cowen Insights. This will open up opportunities for alternative models of selling real estate that already exist but don’t have much market share, including flat-fee and discount brokerages.

Shares of real estate firms Zillow and Compass both fell by more than 13% Friday as investors feared that lower commission rates for agents could lead to less business for real estate platforms.

In a 10-K filing last month, Zillow warned that, “if agent commissions are meaningfully impacted, it could reduce the marketing budgets of real estate partners or reduce the number of real estate partners participating in the industry, which could adversely affect our financial condition and results of operations.”

Shares of real estate brokerage Redfin also fell nearly 5%.

Meanwhile, homebuilder stocks rose on the news: Lennar shares gained 2.4%, PulteGroup shares added 1.1% and Toll Brothers shares added 1.8%.

For the average-priced American home for sale — $417,000 — sellers are paying more than $25,000 in brokerage fees. Those costs are passed on to the buyer, boosting the price of homes in America. That fee could fall by between $6,000 and $12,000, according to TD Cowen Insights’ analysis.

47 notes

·

View notes

Text

Friday Feature: Sr. Living Occupancy Update + (plus)

Yesterday we got a good look at the status of the SNF industry via a data report from CLA. Today, as the week ends, we can look at the broad industry as a whole and where occupancies are trending.

NIC (National Investment Center) released its occupancy snapshot for senior living for Quarter 3. That summary is available here:3Q23-NIC-MAP-Market-Fundamentals-PDF

Basically, the trend of recovery…

View On WordPress

#Assisted Living#CCRCs#Economics#Employment#Friday Feature#housing#Industry Outlook#jobs report#Life Plan#Management#Market Trends#NAR#National Association of Realtors#NIC#Nursing Homes#real estate#Senior Housing#Senior Living#Trends

0 notes