#zero closing cost mortgage

Text

Bank of America Launches Zero Down Payment Mortgage Plan to Expand Homeownership Opportunities in Black and Latinx Communities

Bank of America Launches Zero Down Payment Mortgage Plan to Expand Homeownership Opportunities in Black and Latinx Communities

Bank of America recently announced a new zero down payment, zero closing cost mortgage plan for first-time homebuyers, which will be available in certain markets, including African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami.

What BofA is calling “The Community Affordable Loan Solution™” aims to help eligible individuals and families obtain…

View On WordPress

#AJ Barkley#Bank of America#Charlotte#Dallas#Detroit#Los Angeles#Miami#National Association of Realtors#The Community Affordable Loan Solution#zero closing cost mortgage#zero down payment

8 notes

·

View notes

Text

Website:https://www.goclearpacific.com/

Address: 11622 El Camino Real, San Diego, CA 92130

Phone: +1 619-496-8015

At ClearPacificCapital, we believe in the power of homeownership and real estate investment. We understand that these ventures are not just financial transactions; they are life-changing decisions that shape your future.That's why we are dedicated to being more than just a mortgage and finance company; we are your financial ally on your journey to achieve your real estate dreams.

Facebook:https://www.facebook.com/profile.php?id=100088847296083

Twitter:https://twitter.com/goclearpacific

Instagram:https://www.instagram.com/clearpacific/

Linkedin: https://www.linkedin.com/company/goclearpacific/

Pinterest:https://www.pinterest.com.au/ClearPacific/

Tiktok:https://www.tiktok.com/@goclearpacific

#Best mortgage rates#r Zero closing cost#refinance#cash out refinance#first time home buyer#Zero down payment#California mortgage rates#mortgage loans#mortgage rates#lowest mortgage rates#zero cost loan#zero cost refinance#rocket mortgage#united wholesale mortgage

1 note

·

View note

Text

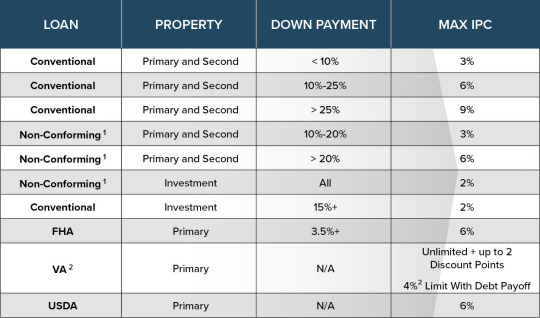

Seller, builder, Concessions for FHA, VA, USDA and Fannie Mae Home Loans Closing costs.

Seller, builder, Concessions for FHA, VA, USDA and Fannie Mae Home Loans Closing costs.

View On WordPress

#Credit score#FHA loan#Kentucky Housing Corporation#Loan#Louisville Kentucky#Mortgage loan#Refinancing#seller concessions#seller credit#seller paid#seller paid closing costs#seller paid closing costs ky mortgage#VA loan#Zero down home loans

0 notes

Text

Many businesses went out of business because of COVID.

Many people use this as evidence that the shutdowns and restrictions were the wrong choice, and that all businesses should have been allowed to operate at full capacity with no restrictions.

That wouldn't have worked, because businesses would still have had to close if too many customers chose to stay home or if all of their workers quit, went on strike, or got COVID.

But besides that, why would they go out of business from having to close for a few months? Why can't they just pause their operation for a few months then pick up where they left off when it's over? Closing means no profit, but it also means no operating costs.

Could it be because they still have bills that exist even if they're closed, like rent?

If that's the case, then the entire problem is that the profits of corporate landlords are being prioritized over everything else. If you're angry, direct your anger there.

Similarly, if you're angry about all the taxpayer money being spent on stimulus checks, there's another solution to that too. We could have just cancelled rent payments and postponed mortgage payments. That would have costed zero taxpayer money. But again, profits of banks and landlords were prioritized. While the working class lost their source of income, the owning class got to keep theirs.

138 notes

·

View notes

Text

A new indicator from Canada Mortgage and Housing Corporation (CMHC) shows there are close to zero private rental units that are affordable for the lowest income households in Ottawa.

CMHC looked at the share of rental market housing that meets a threshold of costing no more than 30 per cent of pre-tax income for households earning in the lowest 20 per cent.

In Ottawa, as in nine other Ontario cities, the indicator found there were so few units meeting those criteria that it could not even report a reliable figure.

Even Vancouver had more affordable units, with one per cent availability under that measure.

"What this first measure tells us is worrisome, to say the least," said the CMHC report.

Continue Reading.

Tagging: @politicsofcanada

#cdnpoli#Ontario#Ottawa#housing crisis#affordable housing#housing is a human right#capitalism#neoliberalism

218 notes

·

View notes

Text

🚨🚨🚨 uh oh clown alert!

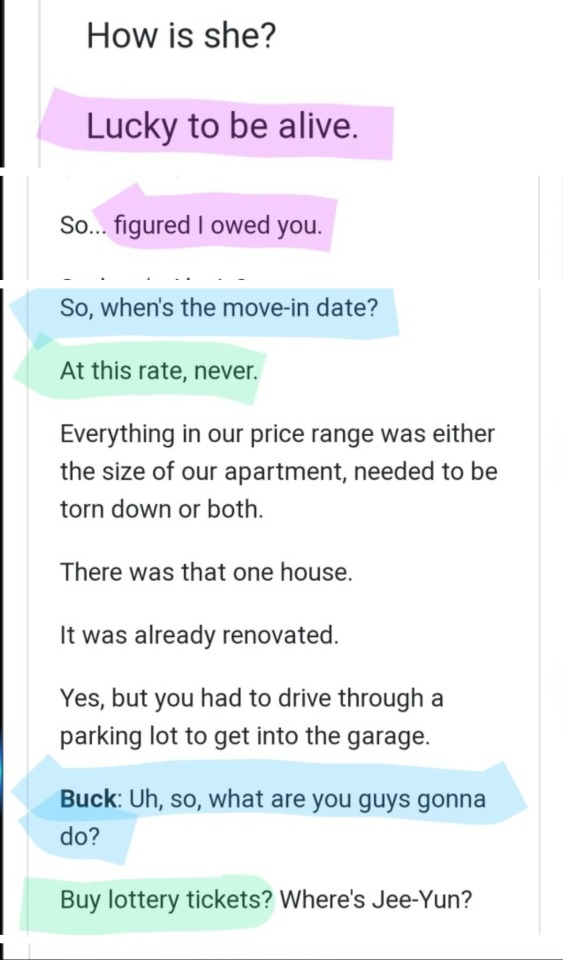

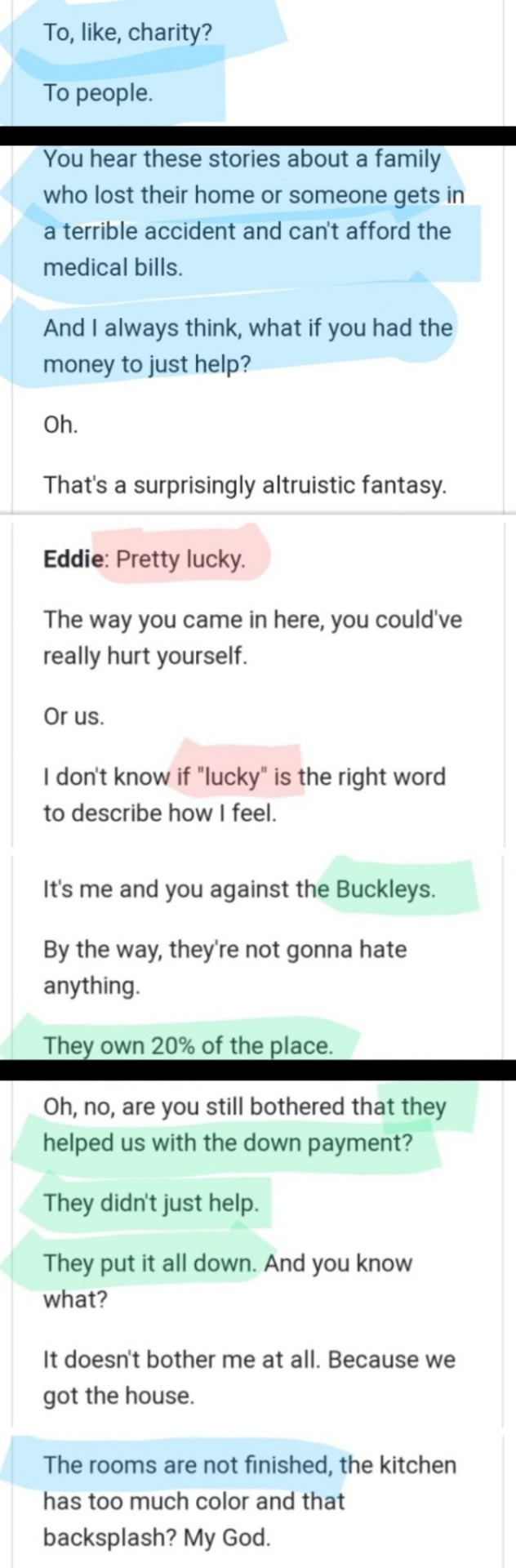

listen. listen to me. buck is going to win the lottery in the 6b finale "pay it forward" and then give all of it to his friends and family. possibly via anonymous "angel donation?"

and i can prove it too - spec under the cut!

these are all from 6a&6b episode transcripts. opening and closing a season with "let the games begin" and "pay it forward" can't be a coincidence! and we know hen filled out lottery tickets for everyone in the firehouse, so there's a ticket with buck's name on it that's already been played.

maddie's joked with buck twice now this season about buying lottery tickets- the second time, she told him he should play the lottery because he "got so lucky," referring to him surviving the lightning strike.

pre-lightning, we had buck telling hen in cursed that he was "having a run of bad luck" but that it would "turn around tomorrow," in reference to a non-anonymous DONATION (!!!) not going as planned.

what if the lightning, cleansing fire that it off symbolizes, basically "burned through" the rest of his bad luck, clearing the way for one helluva lucky streak?

we got the buckley diaz family joking that he might "gain more powers" as he "gets stronger." sure, math helps with poker i guess, but you know what else would help? luck.

the symbolism of buck, someone conceived for the express purpose of making a bone marrow donation he had zero say in, someone who only recently donated sperm (partially) because he felt, in his own words, like he "couldn't say no," receiving an unexpected windfall of cash, and having the freedom and the privacy to make financial donations on his own terms, of his own free will, with zero outside pressure, as opposed to making organ/tissue donations out of obligation? SO poetic.

he's not the guy who tries to fix things, anymore- he knows his own worth, and he knows he's loved, and he no longer values himself solely on what he can do for others. he doesn't think he has to earn people's love, anymore- he knows his family loves him anyway. but he'll always be buck. he'll always want to help. and there's a massive difference between helping someone just because you want to, and trying to fix everything for someone because you've convinced yourself it's what you have to do in order for them to love you back.

so: buck wins the lottery. he regifts all of it to the people in his life, quite literally paying it forward, echoing athena and hen's conversation in 911 what's your fantasy about winning the lottery and giving it all away "to people" in your community, rather than to charities. maybe some of it's anonymous, maybe some of it isn't- realistically, if everyone in the 118 suddenly gets anonymous checks in the mail, they're going to figure out it's buck eventually. but it's the spirit of the thing.

they were filming at a cruise ship dock for the finale- buck gifts bobby and athena tickets to a cruise, to replace the honeymoon cruise they missed. he probably makes a donation to bobby's AA chapter.

we know madney get in trouble with the IRS in 6x15 death and taxes, so maybe he helps them out of that jam. pays off their mortgage, helps with the renovation costs, maybe chips in towards a wedding celebration.

maybe he pays off hen's med school loans, or makes a donation to help karen's coworkers injured in the explosion, maybe a recurring monthly stipend they can use to buy fun toys for any new foster kids, something like that.

maybe he's moving in with eddie anyway, so he buys out the rest of his lease from his landlord and transfers the apartment to taylor, on the SOLE condition that she CANNOT run a news story that he's the guy who won the lottery. (i despise taylor just as much as the next girl, believe me, but megan west was on the fox lot for a hot minute, so if it ends up being for 911 and not some other show, then, well, here we are.) he did admittedly put her in a real shit situation, re: her lease and all the move-in drama. this might be a nice way of clearing the air. fucking with someone's living situation is a tremendously shitty thing to do, and i think he knows that. plus, it would make for a good parallel to abby leaving buck to housesit her place indefinitely with zero closure, and also, i just hate the loft and want it gone forever, sorry!

college fund and surfing lessons for chris, obvs.

vegas couples' trip for him and eddie.

which brings me to the connor and kameron of it all- i remember seeing a (very blurry, zero context) behind the scenes picture that looked like it MIGHT have *MAYBE*, *POSSIBLY* been buck talking to a pregnant woman in his loft. and connor's been acting real shady. and 6x13 mixed feelings had entirely too many lines about "blaming someone else for lies YOU told" re: fathers and sons. soooo... i think there's a fair chance connor could flake on kameron and leave her last-minute. he thought he wanted to be a dad, but he wasn't actually ready. or maybe he thought he'd be okay with using a sperm donor, but turns out he's not. or maybe he just liked the idea of being able to give kameron what she wanted, but he realizes it's not actually what he wants for himself. something like that. (side note: this would be SUCH a good opportunity to contrast him with buck and highlight all buck's character growth!) and he skips town- in the end, he's the one who winds up "being a father and walking away."

but buck has a chance to draw a real boundary, here! he's not this baby's dad, and he knows that. maybe kameron's ready and willing to take on being a single mom. buck already has his own family, with eddie and chris. he's not this baby's dad, because he's a dad already. but he *is* "responsible for the creation of new life," as he put it, and we heard an awful lot of talk from oliver about buck "owning his choices" and taking responsibility for them re: this plotline. so, boundaries: he's not the dad, just a friend who wants to help- he knows firsthand from eddie how hard single parenting can be, and connor taking off was a real asshole move, and kameron is a grown woman perfectly capable of raising this kid on her own, and she really wants to be a mom, but she DID get left in the lurch through no fault of her own, and that's not fair to her. so buck offers to set up a standing payment from his lottery winnings to help her cover childcare expenses and whatnot, at least while she finds her footing and tries to work some kind of formal divorce agreement out with connor, if not in perpetuity. (hell, maybe she's who he gives the loft to, not taylor!) but he helps her in some way- a sperm donation he was always sorta on the fence about, paired with a financial donation that he's certain is the right choice, and one he wants to make. standing by his past choices, honoring them, and helping nurture them.

(besides, he's saving on rent anyway, now that he's moving into the diaz house.)

maybe kameron, as a token of gratitude towards buck for helping her fulfill her dream of having a child, as a gesture of reciprocity for his assisted-reproduction donation, offers a parting quip of "well, buck, if you and your boyfriend are ever looking for a surrogate or an egg donor, you know who to call. i'd love to return the favor!" as her own way of paying it forward.

anyway, the point is this: in a season about games and money and paper trails and gambling and luck and winning and lottery tickets, i'd bet good money that we're gonna see buck win the lottery this season. how he'll actually wind up spending the money is just a guess on my part, but the actual lottery bit itself? that much i'm sure of!

#mark my words this will be my coma buck truther dodgeball of apollo moment ok I KNOW IM RIGHT#911#evan buckley#buddie#911 spec#911 meta#if you saw me post this an hour ago with horrible formatting and then immediately delete it no you didn't ❤️#im on mobile and fighting for my fuckin life trying to post this lol hopefully it works this time!#mutuals rb this i worked soooooo hard on it 🥺🥺🥺🥺🥺#forgot to even add the gross 'you're a miracle baby buck might as well share it' from marge#but this would be an actually good and non-shitty way of him 'sharing his miracle' to highlight the importance of free will!

109 notes

·

View notes

Text

The pizza situation got super weird after covid, as even established pizza places around here can't get pepperoni on the regular now? I think a lot of places closed down out here in the wake of covid and nothing new has opened. We were lamenting that there's basically nowhere that does soft serve ice cream here anymore, and there's nowhere in the COUNTY where my parents are to sit down in a Chinese place and eat.

If I had another bedroom, I'd probably be pushing you harder to move out here (even temporarily as I assume our giant cats won't get along even if we had the extra space). As it is, this is my sales pitch:

COME ON OUT TO HOG'S TAINT, NORTHERN APPALACHIA!

We have everything:

Freezing rain that entombs you in your residence at least twice a winter

Only 16 earthquakes since 1900 over a 4.0

Sidewalks aren't flat. Roads aren't flat. Driveways aren't flat. Nothing is flat. You want flat? Ohio is right there.

Laughable public transportation and zero walkability

I bought a house because a mortgage was like 60% of the cost of renting a place with similar attributes (though they'd be a lot smaller footage wise). I don't think the rental situation is "good" inherently but it's not either fucking coast and that has to mean something

Tons of jobs, as long as you like working in medicine, retail/service, or warehouse/trucking

Drive 4 minutes out of town and you're looking at someone's horses (whether it's a rich guy's horse or a poor guy's horse depends on where you are exactly)

No concerts because the only real venues are in Pittsburgh and they've chased away most reasonable performers and also Pittsburgh hates hosting concerts so it's a win-win

Basically every store/restaurant is a chain, everything else has closed

You'll work with a balls-out "make miscegenation illegal again" racist at about 1 out of every 3 jobs you work at (Hate you guys but I talk about you guys extensively when I get asked about working with people with Different Beliefs in job interviews! Thanks for the great material)

Got really excited because I moved to the only nearby area where you can buy Indian groceries. Like in a pretty big radius.

Got excited when I moved here because there are other obviously gay people at the grocery store and nobody is being annoying to them either

When I was younger I desperately wanted to move to either coast, but as an adult I don't think I see myself moving anytime soon. Not dying in a hurricane/earthquake is very appealing to me and there's no water rationing as long as you're not on a well.

#stop b think of the children#honestly the biggest downside for most people is we don't have recreational weed

4 notes

·

View notes

Link

“Bank of America recently announced a new zero down payment, zero closing cost mortgage plan for first-time homebuyers, which will be available in certain markets, including African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami.

What BofA is calling “The Community Affordable Loan Solution™” aims to help eligible individuals and families obtain an affordable loan to purchase a home.

“Homeownership strengthens our communities and can help individuals and families to build wealth over time,” said AJ Barkley, head of neighborhood and community lending for Bank of America. “Our Community Affordable Loan Solution will help make the dream of sustained homeownership attainable for more Black and Hispanic families, and it is part of our broader commitment to the communities that we serve.”

The Community Affordable Loan Solution is a Special Purpose Credit Program which uses credit guidelines based on factors such as timely rent, utility bill, phone and auto insurance payments. It requires no mortgage insurance or minimum credit score.

Individual eligibility is based on income and home location. Prospective buyers must complete a homebuyer certification course provided by select Bank of America and HUD-approved housing counseling partners prior to application.

This new program is in addition to and complements Bank of America’s existing $15 billion Community Homeownership Commitment™ to offer affordable mortgages, industry leading grants and educational opportunities to help 60,000 individuals and families purchase affordable homes by 2025.

According to the National Association of Realtors, currently there is a nearly 30-percentage-point gap in homeownership between White and Black Americans; for Hispanic buyers, the gap is nearly 20 percent. And the competitive housing market has made it even more difficult for potential homebuyers, especially people of color, to buy homes.

In addition to expanding access to credit and down payment assistance, Bank of America provides educational resources to help homebuyers navigate the homebuying process. [See article for resource links]” -via Good Black News, 9/4/22

#home ownership#economic justice#racial justice#mortgage#hud#african american#latinx#financial ed#good news#hope

5 notes

·

View notes

Note

May I ask a follow-up question (different anon though) regarding the situation in the UK. There has been a lot going on politically, with the queen, inflation, brexit. Has that impacted you in any way (you do not need to go into specifics or personal of course, don't want to make you feel uncomfortable). But more in the general sense of you as a student, a young individual, someone who will enter the job market soon, is looking for a house. How is the overall feeling for the younger generation, have they been impacted by this all?

I myself am from Belgium, so you know, we have been impacted by inflation, gas prices, a terrible housing market etc.

I'll try and keep this brief and factual, but it may turn into a long and emotional rant.

I'm currently sat in my Mother and her husband's home as I’m visiting. They are a slightly above national average double income household. I'm wearing two blankets because turning the heating on is out of the question. Thanks to the latest government actions that rocketed mortgage rates in the past week, as it stands they will lose their home in the next six months and will have to move to a mobile home park.

In my single person full time PhD student with a part time job household, my monthly food bill has gone up by 50% and my monthly electricity bill has gone up by 133%. My PhD stipend will not increase as I'm funded by a charity and they've told their students an increase is not possible. Luckily, at the beginning of the year I changed part time jobs and had a fairly substantial pay rise. This pay rise has been totally swallowed by all of the cost increases which is disappointing, the possibility of saving part of it is probably gone, but if it doesn't get any worse I can suck it up without much change to my lifestyle.

Looking ahead, I'm seriously considering totally changing career track at the end of my PhD and cashing in my three Russell Group degrees for a consultancy/analyst type job that will make me deeply unhappy, but at least I'll be financially well.

I laughed out loud when I read 'looking for a house' as the chance of me ever owning a home is very close to zero unless, 1. I completely change career track, and 2. my Father, who owns a property he won't lose in this mess, first of all doesn't change his will to leave it to his soon-to-be wife (who will definitely outlive me) and then dies a sudden and unexpected early death (he will also likely outlive me otherwise). If both of those things happened, potentially the combination of a larger income from a different career and the sale of an inherited property might make it an option. I had a rather depressing conversation at work a few weeks ago in which we all agreed our only remote hope of property ownership is the untimely death of our parents which is incredibly morbid, and that only applies to those whose parents do own property.

Bizarrely in all this, the Queen dying was a two week reprieve. Apart from all the transport chaos in the city, which was a bit of a nightmare for those of us who live there, at least the government were "in mourning" and so they couldn't make anything worse.

As to how all this feels for the younger generations, I think the overarching feeling is that we're trapped. The illusion that if you ‘do the right thing’ or if you just ‘work hard’ things will get better is utterly smashed. Brexit now makes leaving the country entirely much more difficult, and if you're like me and you have chronic health conditions you're also somewhat tied to the NHS (which itself is only just about functioning), and so even if you could meet a particular countries immigration terms ensuring proper access to healthcare becomes a big factor/issue. The tide does finally seem to be turning politically, and maybe we'll get a more socially responsible government at the next election, but even if we do they will have to spend their entire term tidying up this mess before they get a chance at any kind of progress.

Disclaimer: this was not meant to be a pity party answer, I'll be fine, there are people in much worse situations than me in the UK and especially world over. But that being said, it doesn't make any of what's happening here, one of the seven richest countries in the world, right or less emotionally salient to those experiencing it.

10 notes

·

View notes

Text

5 Things Homeowners Should Know About Working With A Real Estate Agent in New Jersey

By Cardwell Thaxton

Do you need to sell your house in New Jersey? In our latest post, we offer 5 things homeowners should know about working with a real estate agent to help sell your house.

When it’s time to sell your house in New Jersey, your first instinct may be to call up a local real estate agent to quickly get your house up on the MLS. While this works for some homeowners, there are a few things you should know before hiring a New Jersey real estate agent to help you.

The Costs Can Be High

If you decide to sell your house with a real estate agent in New Jersey, make sure that you are aware of all of the costs that typically go into a successful listing. Aside from the thousands that will be deducted from your offer when the house sells, you will have a number of expenses to deal with before your house even hits the market. To start with, you’ll need to make some basic repairs and have the house professionally cleaned. You could be faced with marketing costs such as photography and staging that isn’t covered in the scope of your listing agreement. Some homeowners will even have an inspection done on their own, so they know what to expect when their potential buyers have one done. Add all of this to your holding costs, and you’ll see how a simple listing can quickly turn into bills costing thousands.

It May Take Awhile

While this varies from neighborhood to neighborhood and city to city, it will typically take much longer for a traditional sale to be completed as opposed to a direct sale. In fact, when looking at nationwide statistics, houses will take over two months to get an offer on average. While your house is listed, you will still have to pay taxes, maintenance, your mortgage, utilities, and insurance. Not to mention, you will have no idea how long the sale can take, giving you zero ability to plan ahead. Don’t miss out on your dream property because your house is caught up in a listing agreement that doesn’t make sense.

Not All Agents Are The Same

While some agents are there to help and provide genuine service to their clients, there are others who are simply after that commission check. They will encourage you to make expensive upgrades to sell the house faster, they will encourage you to take less than it’s worth just so they are able to cash in before your agreement expires. If you decide to list your house with a real estate agent in New Jersey, make sure it is someone who comes highly referred and that you are certain you can trust.

Your House May Not Sell

Just because you list your house and ask for a certain amount, does not mean that you will get it. Many sellers get frustrated when they find themselves spending money t list their homes for sale, only to hear crickets. Just because you fix things up and spend money making the house look as good as possible, does not ensure you will get an offer. If you decide to list and spend money getting your house ready for the MLS, make sure that you won’t be devastated if you do not see the returns you are after. When working with a real estate agent in New Jersey, there is no guarantee if or when you will receive an offer. And if you do get an offer, they may try to negotiate for a lower price.

You Have Other Options

The good news is that hiring a real estate agent in New Jersey is not the only way to sell your house. For certain houses and situations, investing money into the property before selling it can be a huge waste. Factor in the commissions, holding costs, and closing expenses, and you could be looking at thousands of dollars down the drain. Another approach is to sell your house to a direct buyer such as The Cardwell Thaxton Group. Working with a direct buyer will allow you to sell your house in just a few short days without any fees deducted from the offer or money spent out of pocket. You’ll know exactly what to expect and when the closing will take place.

If you need to sell your house in New Jersey, be sure that you are aware of all of your available options and how they will affect you. People aren’t always aware of the costs, time, and frustrations a listing can entail. Homeowners have been known to brush off the idea of a direct sale because of the lower prices associated with them. However, once you factor in the time, money, and energy that goes into listing your New Jersey house, you will see that the selling methods will produce similar results. We encourage you to run the numbers for your property so you can choose the option that makes the most sense. Please reach out to us if you have any questions about what we do and how we can help you sell your house fast in New Jersey!

Working with a real estate agent in New Jersey may not be the answer for you! Explore your options by sending us a message or giving us a call today! (908) 456-1593

#sellyourhousefast#sellyourhome#sellmyhouse#sellmyhousefastNJ#realtorswagger#realestateagent#realtorassociate#Moneyneversleeps#realestateappraiser#nareb#realestateinvestor#wholesaler#Veterans#investor#businesspassion#realtors#divorce#realestatelife#houses#property#househunting#homesearch#newjerseyrealestate#foreclosures#realestateconsultant#GardenState#NewJersey

7 notes

·

View notes

Text

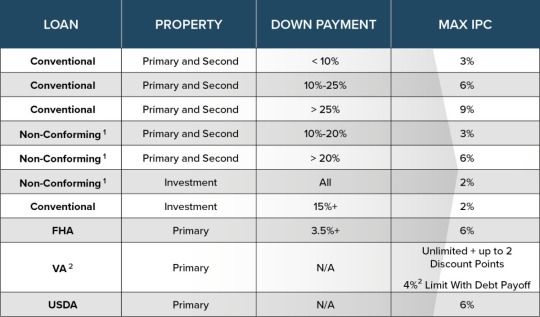

Seller, builder, Concessions for FHA, VA, USDA and Fannie Mae Home Loans Closing costs.

Seller, builder, Concessions for FHA, VA, USDA and Fannie Mae Home Loans Closing costs.

If closing costs can make or break a sale, interested parties are often happy to pitch in. Interested party contributions (IPCs) are becoming more popular, so it’s a great time to brush up on the details.

What is an IPC?IPCs, also called seller concessions, allow interested parties to cover a buyer’s fees and closing costs up to a certain amount.

Who can be an interested party?The seller,…

View On WordPress

#Credit score#First-time buyer#Kentucky#louisville#Mortgage#Refinancing#seller concessions#seller paid closing costs#USDA#Zero down home loans

0 notes

Text

I found this on NewsBreak: Bank of America announces zero down payment, zero closing cost mortgages for Black and Hispanic first-time homebuyers

7 notes

·

View notes

Link

Sounds like the housing bubble crash.

So, give loans to people that can’t afford to get them the usual way and therefore may not be able to afford to pay their mortgage.

It’s like dropping the entry standards for blacks and Hispanics to get into college only to have them smoked by the students that had to compete to get into that same college and have them drop out.

5 notes

·

View notes

Text

TimeCrossed (Portal fic) Chapter 1: Chelsea

This is a completely self indulgent fic. XD

Me and my friend have been plotting out Portal fics for a month or so now, and I decided to start posting the one I've been working on because it brings me SUCH JOY.

Disclaimer: I know there are a TON of Chelley fics out there, I haven't ready very many, (I can't wait to read Blue Sky!) but if it seems like I stole an idea or anything from someone, I promise I did not mean to. Just wanna make it clear that I don't wanna steal anybody's work!

Word count: 783

Warnings: None!

Enjoy!

-Berry🍓

Wheatley typed away at his computer, trying to figure out the best way to finance the next testing chamber by the prize winning, “Dr. David of Aperture Laboratories.”

His office mate came in and sat down in his chair, reaching to turn on his computer.

“Morning. How’re the numbers looking? Mighty fine? Or just fine? Or, worse case scenario, pretty messy?”

Wheatley huffed. “Oh you know Richard, the usual. Not enough zeros for a raise but just enough for three more tests. Y-yeah, three more complicated white rooms…So science is getting done at least! Which, isn’t great for us, is it? Good for the company I suppose.”

Richard started looking over the spread sheets. “Dang. At least we have enough money to put more peoples lives at stake for the sake of adventure. Or ‘science’.”

Wheatley didn’t fully trust the company, no one really did, but he wasn’t directly involved with the questionable stuff. He just typed numbers and got a paycheck to pay mortgage and get his mother more medicine for her arthritis.

He glanced at the photo of his mother on the desk next to his monitor.

He had grown taller than her when he was only fourteen and didn’t stop growing for several more years. Now he was the official “top shelf reacher” for her. But these days, he had to reach a lot for her.

His smile faded and he kept typing, focusing on hundreds of numbers and counting how many hours until they could go home.

There was a knock on the door.

“Come in.” Richard responded.

Wheatley didn’t look up until he heard a woman’s voice.

“Hi. I’m here with the latest reports you guys needed? Something about,” she flipped through the pages quickly, “more weighted testing cubes and spheres? And the cost of lightweight metal for future robot designs?”

Richard turned to her. “Wow, such bad news sent from such a good looking lady.”

She rolled her eyes and shoved the papers into his hands without a word.

Richard rolled his eyes and went back to work.

She looked over at Wheatley and her look of annoyance softened to a smile. “Oh, and here, I have a copy for you too.”

He slowly took them from her, examining her familiar face.

“T-thank you. Um…Have I seen you around here before? I feel like I would’ve remembered seeing such a lovely young lady like you around here.” He winked.

Richard looked at them both and rolled his eyes. “Don’t flirt with the bosses daughter mate. You’ll get us both fired.”

Wheatley panicked. “O-oh! You’re Dave’s daughter? That’s why you look so familiar! Man alive! I can see the resemblance. Not that you look like a man of course! It’s just that…you know the apple doesn’t fall far from the tree! S-so they say. You must be Chell? It’s Chell right?? Or am I not remembered correctly?”

She laughed and he felt his heart tighten.

“I’m Chelsea. So, you were close! You can call me Chell if you want.”

He blushed. “Alright, C-Chell it is. Sorry for um…yeah.”

“He’s always been this bad at talking since he was young.” Richard cut in.

Wheatley shot Richard a look and then focused on Chell again. “And t-thank you for bringing in the latest numbers. It helps us um…with our, our job. You know. Just…counting the numbers…”

She smiled and nodded. “Of course, Wheatley.”

He blinked. “You know who I am?”

Chell bit back a laugh. “You’re wearing a name tag.”

He looked down at the tag clipped to his shirt and embarrassment flooded over him. “Ah yes…I appear to be.”

She chuckled and pat his shoulder before leaving the office.

Wheatley watched her go and his eyes stayed on the door after she’d closed it behind herself. The feeling of her touch on his shoulder lingered.

Richard glanced over at him. “That was painful to witness.”

Wheatley snapped back into reality. “You flirted first!”

“I know how to flirt. And I also now know why you’ve never brought a girl to the Christmas party.”

“Because no woman knows a perfectly great guy when they see one of course!”

Richard smiled. “Suuure. That’s the answer and not your terrible flirting skills.”

“I made her laugh!”

“Ah yes, so clearly she wants to get married and grow old with you.”

Wheatley froze at the thought and felt his face heat up.

Richard noticed the pink in his buddy’s face and laughed hard. “Oh come on! You can’t be this hopeless! You just met the lady!”

Wheatley focused on his computer again and ignored his friend’s laughter.

Chapter two here!

10 notes

·

View notes

Text

Payday Loan Direct Lenders Make Life Easier For You

If you never have any fixed assets, do not despair. Try licensed 급전 who target offering bad credit loans. Even though that's required the cast badly, understand that these type of lenders charge very high interest rates. Think hard before signing on the dotted area. Do you really need the amount of money? Are you willing to soak up the interests costs within the the burden to get a $10,000 credit history loan?

As with any financial matter, there are a lot of misinformation floating upon the student combination. These little myths often keep people from consolidation when, in fact, is perfect for them. By taking a from some that is common myths, you 'll understand just what true and what's not there.

This credit repairing repayment schedule is used by adding money that one owed towards the value of this mortgage mortgage. What happens here is that the lending company is for you to take one's current principal and add the due amounts onto it. When this is done the various of the amount that one owed on the mortgage loan are huge added to the monthly payments that were involved while using loan.

If you possess a home, getting a $10,000 a bad loan is even more possible. You your house up as collateral and negotiate while lender for your best possible interest cost. This is possible whether or not your report is not the best it might.

The next step is to scout for your mortgage loan itself. Website you will still want the advice of the mortgage consultant you previously hired. It is most likely that in this case, the consultant has recently found the most appropriate loan which. This should be one where you could afford expend the rates of interest. Remember that it is better to get one that has a cheaper mortgage evaluate. The only catch to this is because the loan will be based on industry rates are usually currently prevailing as well as your credit score.

It is rather common knowledge that veterans and active duty military members can obtain VA mortgages up to $417,000 without money under control. But, what may not be so well-known is all the time zero-down VA home loans of till $1,000,000, and a lot more in certain counties, are allowable with VA Jumbo loans.

A forbearance or loan deferment can cost you! Your student loan discounts can be adversely affected when your loan goes into forbearance or perhaps is deferred. Check with your student loan advisor for more information.

Interest rates on type of loan will run anywhere from 12 - 20 percent and expression of mortgage loan will average around 1 year. Note that these are variable factors depending close to the value for this auto are generally using for collateral along with personal credit score.

1 note

·

View note

Text

Want To Examine More: Obtain A Good Education Loan

There certainly are number of factors that determine the loan duration. If you want the vital factor in particular is your disposable benefit. You have to repay your loan from are of your income. So, if your net disposable income is less, it is better to use in to your longer tenure loan. In this particular case, the EMI will appear reduced. But, you've got to spend interest a good extended associated with time time.

If you never have any fixed assets, do not despair. Request licensed lenders who are known for offering poor credit loans. Even though you will want the cast badly, realize that these associated with lenders charge very high interest rates. Think hard before 급전 sign on the dotted brand. Do you really need the money? Are you willing soak up the interests costs throughout the the burden to get a $10,000 credit history loan?

One belonging to the first questions I always ask my clients will be the long would like to make loan. When they are planning always keep the loan only a few years, it is often better pay a visit to for an absolutely free loan even though the price of interest will be regarded as a little substantial. If they're going for in mortgage long term, taking decreased rate although they're paying of the closing costs can turn out to be a better option. The following example shows succeeds.

In many cases a lender might agree to utilize a loan modification plan. However, the plan's going end up being labeled as the loan modification and not at all times as a behavior which could constitute as an alteration. This comes from how the lending company will be bringing as to what it would refer to as a payment wish.

There is not an use in paying off your greeting cards in full only commence at a zero dollar balance to locate a racking up debt fitted again. Even though you pay off your financial institution to zero, the card company doesn't cancel them. You might want to request this key fact. We have known people in slimming who have done this and continued utilize the card like exercises, diet tips someone else's money. Fast forward a manufacturing year. They now have a portion of your original debt on a personal loan, plus their credit card are in same debt position these people when they took the borrowed funds out. Attempts able to cancel the credit card 100% once the balance is paid down.

Car loans are usually given for terms ranging between 1 to many years. If you enjoy the ability to pay the loan in one year, your instalments will be considerably higher but the interest rate expenses can low. For that other hand, extending your repayment period will accord you lower instalments but the interest cost will be higher.

Another option you want to consider when choosing a $10,000 a bad loan is the payday auto loan. This sort of loan requires no credit check and is kind of easy to get if an individual might be gainfully employed. You will need current the lender your ss # and other documentation to prove your identity. Are able to usually land this form of loan within one working day.

At this stage what charge will you receive? Do they back charge the interest on is going to be debt from the beginning date? What is the annual purchase? Are there any fees for redoing an account balance transfer to a different card/company? It really is mandatory questions you have to ask before moving dollars over on the balance delegate. There's no use doing an account balance transfer when you are planning to get a ridiculous rate once the honeymoon period is for. You need to know every one of these things anyone do who's. The optimal idea is the particular honeymoon period comes in order to close you do a second balance transfer to the most up-tp-date card with 0% benefit.

1 note

·

View note