#$VIX

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the first week of April in the books, equity markets looked in need of a rest. Elsewhere looked for Gold ($GLD) to continue its record run higher while Crude Oil ($USO) continued its move to the upside as well. The US Dollar Index ($DXY) continued to short term trend to the upside while US Treasuries ($TLT) might resume their downtrend. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) consolidated under long term resistance.

The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. Their charts also looked strong, especially on the longer timeframe. On the shorter timeframe the $QQQ was at risk for some downside with the $IWM in a messy short term uptrend and the $SPY the strongest but also seeing some profit taking show up.

The week played out with Gold continuing it run of record highs while Crude Oil met resistance and consolidated at 5½ month highs. The US Dollar found strength and pushed to 5½ month highs as well while Treasuries made new 4 month lows before a bounce Friday. The Shanghai Composite pulled back from a lower high while Emerging Markets broke down out of the rising short term channel.

Volatility rose up from a short term consolidation to the top of a rising wedge. This put pressure on equities late in the week and they responded by moving lower. This resulted in the IWM back at support which was prior resistance for 2 years, the QQQ continuing sideways in consolidation near the highs and the SPY touching a 1 month low. What does this mean for the coming week? Let’s look at some charts.

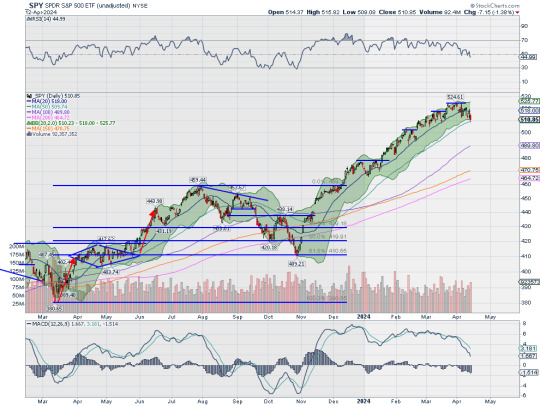

SPY Daily, $SPY

The SPY came into the week holding at the 20 day SMA on the daily chart after a pullback from the top. It held there Monday and Tuesday and then dropped below Wednesday in a reaction to the hotter than expected CPI print. Thursday saw it rise to retest the 20 day SMA and then fall back Friday to touch the 50 day SMA for the first time since the beginning of November. Price ended at the lower of the Bollinger Bands® with the RSI heading toward the bottom of the bullish zone and the MACD positive but dropping and approaching zero.

The weekly chart shows a second week headed lower, this one with a longer red candle. The RSI on this timeframe has dropped out of overbought territory with the MACD about to cross down. There is support lower at 510 and 503.50 then 501.50 and 498.50 before 495 and 491.50 with the retest of the Cup and Handle breakout at 476.75 lower. Resistance above is at 513.50 and 517.50 then 520.50 and 524.50. The 138.2% extension of the retracement of the 2022 pullback is above at 530 and then the Cup and Handle target at 560. Pullback in Uptrend.

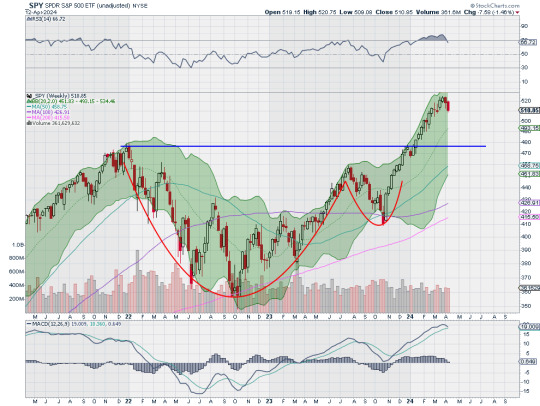

SPY Weekly, $SPY

Heading into the April options expiration, equity markets showed some cracks in the uptrends. Elsewhere look for Gold to continue its uptrend, but with perhaps a short term pause while Crude Oil consolidates the move higher. The US Dollar Index looks to break to the upside while US Treasuries resume their downtrend. The Shanghai Composite looks to consolidate in its move higher while Emerging Markets consolidate in a broad channel.

The Volatility Index looks to continue to slow move higher keeping pressure on equity markets. The QQQ looks the strongest, especially on the longer timeframe as it consolidates while the SPY digests its strong move with a pullback. The IWM seems to have given up any chance of breaking out of the long consolidation as it falls back into the channel. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 12, 2024

5 notes

·

View notes

Text

Weekend Review of the Markets: Deeply Oversold Territory

Happy Weekend, traders.

Continue reading Weekend Review of the Markets: Deeply Oversold Territory

View On WordPress

0 notes

Text

"i love you" should be platonic by default and if you want to use the phrase romantically, that's on you to clarify

#like wdym i have to clarify that my love for somebody is platonic because if i dont then theyll think that i have a crush on them??? 💀💀#sleepy vix#it's funny because it's true#aromantic

8K notes

·

View notes

Text

《 2023 Art Dump : Part 8/11 》

______.·:·.✧ ・ 。゚☾ ・ 。゚ ✧.·:·.______

✦ An entire page dedicated to Astarion. Appropriate for our chaotic, beloved vampire. (u w u)

For now, I’m going to reserve all of my thoughts about Baldur’s Gate until I actually finish a piece (ò v <) I’m not even through with Act 1 and I adore the game and the characters so much!

《 Art © Vix Synnova 2023 // Do not use without my permission // Always give credit // Thank you! 》

#vix synnova art#art#drawing#fantasy art#doodle#sketch#chibi#baldur's gate 3#baldurs gate astarion#bg3 fanart#bg3#bg3 astarion#astarion#astarion fanart#baldur's gate iii#baldurs gate fanart#vampire art#art dump#doodles

1K notes

·

View notes

Text

time to make some noise!!! 🎸⚡️

doodle for @donuqx-art's birthday !!

1K notes

·

View notes

Text

Geneviève Vix in costume as Circe, c. 1907.

Photographed by Lèopold Reutlinger.

1K notes

·

View notes

Text

Ecto-Cream

You know how a lot of people use Vix-Vaporub a lot and just slather it on everywhere when you are sick or hurt, to the point it kinda became a meme?

Oh, you have anxiety? Here put on some Vix-Vaporub!

You broke a bone? Have some Vix-Vaporub!

Have stage 4 cancer? Vix-vaporub!

That!, but what if it was ecto?

The Fenton's invented it and it actually works! A little too well to be honest.

The memes? To Amity Parker's, not memes totally legit.

Suddenly they have the cure for everything with just this 'simple' cream

Now imagine Danny goes to Gotham for University or an internship, and the people around just witnessed him getting Jocker Gassed, totally freaking out right?

and Danny?

He just casually takes out this bright somehow green glowing cream from his pocket and starts rubbing it on his nose and chest, and is somehow fine!?

What the hell?!

~

Just an Idea

#dp x dc#danny phantom#dc x dp#dpxdc#danny fenton#batman#ectoplasm#liminal amity park#amity park#fenton parents#ecto-cream#the better version of vix-vaporub#dc x dp crossover#dp x dc crossover#dp x dc prompt#dc x dp prompt#writing prompt#ecto-contaminated Amity#batfamily#batfam

932 notes

·

View notes

Text

Silly guy

4K notes

·

View notes

Text

Y2K mouse girl

The pop-ups on tumblr reminded me of her

#digital art#art#vix's art#furry art#Furry#sfw furry#mouse girl#Mouse#Mousegirl that lives in a computer#Call that a computer Mouse#pixel art

2K notes

·

View notes

Text

Big art dump !

Charlie cutie patootie my beloved

#vix fanart#edyn tidestrider#jrwi fanart#jrwi riptide#jrwi riptide fanart#gillion tidestrider#kutakunagaart#chip jrwi#jay ferin#jrwi shilo#just roll with it#jrwi fnc#queen jrwi#charlie slimecicle#slimecicle fanart#jrwi spoilers#jrwi riptide spoilers

694 notes

·

View notes

Text

his hat.

portgas d. ace x afab!reader

synopsis; ace loves to put his silly hat on you

notes; i caught the one piece covid…

warnings; 18+ MINORS DNI !! vaginal fingering

ace loves fucking you with his hat on.

it’s so big around your small head but man—does it look good and he cant deny that he doesn’t feel himself hardening at the mere sight of it.

it’s one of his turn ons actually, seeing your head be decorated with his hat and how his hat slightly bounces on your head everytime he pushes a finger in, taking his time to slowly enamour at you with his usual grin plastered over his face.

he loves seeing the hat wobble on your tiny head due to the slight movement of his fingers and how your breath starts to uneven with the slow pumps of his fingers. it’s one finger then two fingers then three and you’re begging him not to add the last due to the overstimulation but he knows you’ll take it for him and when all four are in—he praises you with a smile.

but that’s only the beginning of his torture since he begins to move his fingers ever so slowly but nonetheless, he eventually gives you more than you bargained for as he first starts of with small thrusts of his fingers—taking his sweet time to listen to your moans and begs. then eventually, he’s curling his fingers inside of you, believing you’ve been stimulated enough.

when he notices the drool hanging from the ends of your mouth and how your eyes practically roll back into your head from the mixture of pain and pleasure, he can’t help but let out a small chuckle at your uncontrollable reactions.

and when he finally increases the pace of his fingers, causing your stomach to tighten and the familiar feeling of release start to swell up… at this point you’re begging him to go faster and not stop. luckily, he listens to for once and continues with the pace. and when you finally cum all over his fingers, coating them in a familiar shade of white, he pulls the hat away slightly to kiss your forehead and call you his good girl.

but that’s only the start of his nightly torture… you still have a long way to go.

#one piece#one piece smut#op#op smut#ace#portgas d ace#portgas ace x reader#portgas ace x you#portgas ace smut#op x reader#op imagines#one piece imagines#one piece x reader#portgas d ace smut#i cant believe i actually wrote this#at 3 am at that like holy fuck#it was supposed to be franky initially btw#vix + op#vix writes !#vix + ace

673 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the March FOMC meeting in the books, equity markets showed strength moving higher despite the continued tone of rates staying higher for longer. Elsewhere looked for Gold ($GLD) to continue its consolidation in a bull flag at the highs while Crude Oil ($USO) continued the messy uptrend. The US Dollar Index ($DXY) looked to drift to the upside in consolidation while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to continue the short term uptrend while Emerging Markets ($EEM) consolidated in a broad range.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially on the longer timeframe with the $SPY at a weekly high and the $IWM and $QQQ consolidating the recent moves higher. On the shorter timeframe both the QQQ and SPY also looked strong making fresh all-time highs Thursday before dropping toward filling gaps Friday on profit taking. The IWM looked to have established a higher range.

The week played out with Gold breaking consolidation and moving to a new all-time high while Crude Oil also rounded up to a new 5 month high. The US Dollar drifted slightly higher while Treasuries moved higher in a tightening consolidation. The Shanghai Composite pulled back, ending the uptrend while Emerging Markets held in a tight range.

Volatility rose early in the week but fell back quickly and ended the week little changes at very low levels. This put initial pressure on equities and they fell to start the week. The damage was short lived and minimal though with the SPY and QQQ building short bull flags and the IWM slightly deeper. The SPY and IWM broke to the upside Thursday making new highs with the QQQ lagging and holding in consolidation. What does this mean for the coming week? Let’s look at some charts.

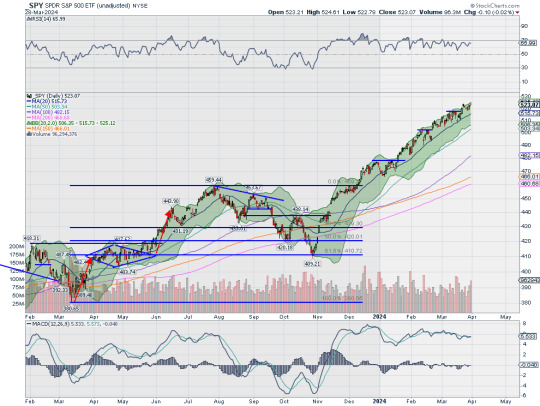

SPY Daily, $SPY

The SPY came into the week after seeing profit taking following a new all-time high on Thursday. It continued lower Monday and Tuesday but then reversed Wednesday to set a new all-time high. Thursday it gave back marginally and closed the week positive. The daily chart shows price has but broken below the 20 day SMA since January 17th in the rising Bollinger Bands®. The RSI is strong in the bullish zone with the MACD flat and positive.

The weekly chart shows a second week high after the brief 2 week consolidation. The Bollinger Bands on this timeframe also continue to point higher. The RSI is strong in overbought territory in the bullish zone with the MACD positive and rising. There is resistance higher at 524.50 and then the 138.2% extension of the retracement of the 2022 pullback at 530 and the target on the Cup and Handle at 560. Support lower sits at 520.50 and 517.50 then 513.50 and 510 before 503.50 and 501.50. Uptrend.

SPY Weekly, $SPY

With the First Quarter of the year in the books, equity markets have exhibited strength. Elsewhere look for Gold to continue its uptrend while Crude Oil builds on its move higher. The US Dollar Index continues to drift to the upside in consolidation while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to reverse the short term uptrend while Emerging Markets consolidate in a broad range.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially the SPY on both timeframes. The QQQ is showing some momentum divergence that could lead to more consolidation or a pullback while the IWM looks top step up as it breaks to 2 year highs. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview March 29, 2024

5 notes

·

View notes

Text

Weekend Review of the Markets: Bears Still Have a Setup

Happy Weekend, traders.

Given the ghastly candle that was produced on Thursday, the door remains open for a larger pullback—if not an outright change in trend.

Continue reading Weekend Review of the Markets: Bears Still Have a Setup

View On WordPress

0 notes

Text

the wheel of time is turning onwards and i find that once again, i've been left behind.

i had to turn off reblogs tho bc the notifications made me not want to open tumblr anymore and i tried muting the post 10 times but it always unmuted itself :(

5K notes

·

View notes

Photo

Vix the Fauxbold (or Koblin) again!

I am really proud of this character, so here’s all of the updated art of her plus some of the initial (updated) drawings, all together in one place.

not without its flaws, on the top (latest) drawings her facial and body proportions are all over the place, which is the result of going too fast and not being careful like I usually am (I was in a feral drawing mood).

I want to revisit this character again later, refine some things (maybe design a company logo to put on the overalls), and eventually make a 3d model of her

2K notes

·

View notes

Text

sorry i havent posted in a while!! took a bit of a break because i was feeling unwell but im back!! yay!

#osc#art#vix artsies#ena joel g#ena fanart#ena#ena power of potluck#illustration#digital art#(*´ω`*)

245 notes

·

View notes