#$FXI

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the first week of April in the books, equity markets looked in need of a rest. Elsewhere looked for Gold ($GLD) to continue its record run higher while Crude Oil ($USO) continued its move to the upside as well. The US Dollar Index ($DXY) continued to short term trend to the upside while US Treasuries ($TLT) might resume their downtrend. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) consolidated under long term resistance.

The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. Their charts also looked strong, especially on the longer timeframe. On the shorter timeframe the $QQQ was at risk for some downside with the $IWM in a messy short term uptrend and the $SPY the strongest but also seeing some profit taking show up.

The week played out with Gold continuing it run of record highs while Crude Oil met resistance and consolidated at 5½ month highs. The US Dollar found strength and pushed to 5½ month highs as well while Treasuries made new 4 month lows before a bounce Friday. The Shanghai Composite pulled back from a lower high while Emerging Markets broke down out of the rising short term channel.

Volatility rose up from a short term consolidation to the top of a rising wedge. This put pressure on equities late in the week and they responded by moving lower. This resulted in the IWM back at support which was prior resistance for 2 years, the QQQ continuing sideways in consolidation near the highs and the SPY touching a 1 month low. What does this mean for the coming week? Let’s look at some charts.

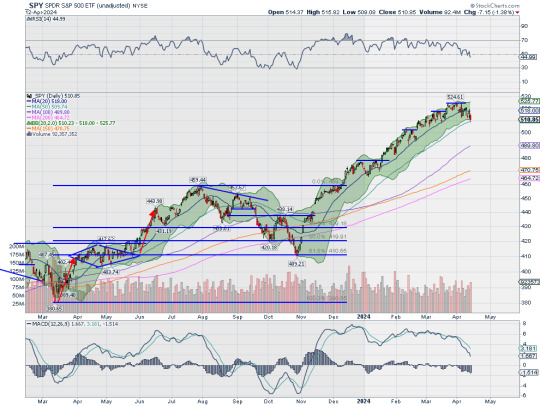

SPY Daily, $SPY

The SPY came into the week holding at the 20 day SMA on the daily chart after a pullback from the top. It held there Monday and Tuesday and then dropped below Wednesday in a reaction to the hotter than expected CPI print. Thursday saw it rise to retest the 20 day SMA and then fall back Friday to touch the 50 day SMA for the first time since the beginning of November. Price ended at the lower of the Bollinger Bands® with the RSI heading toward the bottom of the bullish zone and the MACD positive but dropping and approaching zero.

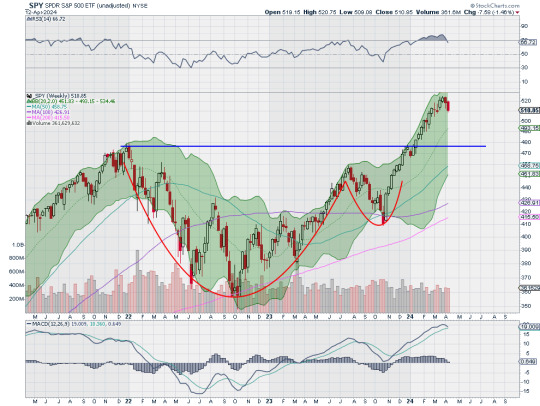

The weekly chart shows a second week headed lower, this one with a longer red candle. The RSI on this timeframe has dropped out of overbought territory with the MACD about to cross down. There is support lower at 510 and 503.50 then 501.50 and 498.50 before 495 and 491.50 with the retest of the Cup and Handle breakout at 476.75 lower. Resistance above is at 513.50 and 517.50 then 520.50 and 524.50. The 138.2% extension of the retracement of the 2022 pullback is above at 530 and then the Cup and Handle target at 560. Pullback in Uptrend.

SPY Weekly, $SPY

Heading into the April options expiration, equity markets showed some cracks in the uptrends. Elsewhere look for Gold to continue its uptrend, but with perhaps a short term pause while Crude Oil consolidates the move higher. The US Dollar Index looks to break to the upside while US Treasuries resume their downtrend. The Shanghai Composite looks to consolidate in its move higher while Emerging Markets consolidate in a broad channel.

The Volatility Index looks to continue to slow move higher keeping pressure on equity markets. The QQQ looks the strongest, especially on the longer timeframe as it consolidates while the SPY digests its strong move with a pullback. The IWM seems to have given up any chance of breaking out of the long consolidation as it falls back into the channel. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 12, 2024

5 notes

·

View notes

Text

Will the (year of the) Dragon slay the Bear in China

This Saturday, February 10, is Lunar New Year or Chinese New Year and it will usher in the year of the dragon. Traditionally, the dragon has been a symbol of good luck, strength, and health. All of which have been lacking for China’s Shanghai Comp and Hong Kong’s Hang Seng indexes as both have languished since peaking in late 2021. Some signs of a possible turnaround have begun to materialize with both indexes rebounding off their respective 2024 lows.

Historically, trading ahead of the Lunar New Year has been bullish on average with the Hang Seng index solidly advancing during the 30-trading days before the holiday. The Shanghai Comp has also tended to rise, but gains were in the final few trading days before the holiday. After the holiday passes and trading resumes, Shanghai Comp has taken the advantage over the following 60-trading days with gains continuing. Hang Seng has tended to drift into a sideways trading pattern but still produced a modest gain.

0 notes

Text

I need someone to come to my house and prep my food. Just cut up the chicken and the vegetables so when I'm ready to cook I just have to throw it in the pan or whatever bc right now it's been 4 days since I went shopping and I've been eating microwavable crap bc nothing is prepared and I literally cannot force myself to do it

#i cut chicken into little cubes then stick them in baggies because they cook so much faster that way#but it means i have to do that and rn i cant#and its so fucking frustrating#i dont want it all to go to waste#but im mainlining depression meals rn and i cant fxi it

12 notes

·

View notes

Text

having afavorite youtiber is like sayinnnnng this is my favoirite heterosexual british ,man

#i kno wt this sound slike one of those posr s#from 2012 where its some kid pretending to be drinok#druk#drumk#but i assure you it is no tim just so fucking tired#medicial condituon#i cant be botherd to fxi my tyoic#typos#or give yal ny unfiltered thoughts#ow my head :(#innsjotxt

9 notes

·

View notes

Text

literally maya smiling and laughing when she tells lola that it didn’t go over well when her last foster family found out she was a lesbian. maya laughing and joking about the fact that her and june have atypical backgrounds after dumping the accident, her foster families, AND the breakup on her. TRAUMA DUMPING AND LAUGHING ABOUT IT!!! JOKING ABOUT TRAUMA TO BRUSH IT OFF!! PRETENDING YOURE OVER IT SO YOU DONT HAVE TO ACTUALLY TALK ABOUT IT!!! TRAUMA DUMPING BUT NOT ACTUALLY OPENING UP!!!!!!

#and they DIDNT LET HER FXI IT I’M MAD AGAIN#and once again she’s literally ME#skam france#maya etienne

6 notes

·

View notes

Note

You'll regret not going to bed love. I promise you you're gonna regret it. Sleeeeeeeeeppppppppppppp

yeaaaaah..okay i will, thank you 🥺

0 notes

Text

.

#deciding fuvk it il#kms within the next week#bc im Literally Asking for Help from people without begging for it.#and im twlling people how i feel and no one seems to fuckimg GET IT or they keep . brushing me off#like i feel like im beimg swallowed by a black hole. and iys threatenung to consume me fully#but ita fine right !!!#im not actibely depressed !!! im just suicidal#whats fucked is that i wasnt suicifsl for months n now i am and . no one cares lol#and im tired. sp fucking tired and over feelijg like this#and like i gave to fucking fight for help so i dont feel like this.#and i dont . want killing myself to be the option i have. but . i either jeep downplaying how much pain im in#or no one actually gives a shit enough to like . care.#so its fine.#im determined to make it tjrougj august wuthout an attempt bc itll b my first aug sunce 2017 whete i HAVENT#or 2018#whuchrber it is#but . i am not gonna lie i literally cant keep going anymore#this is a cycle atp and i want out of it bc its no fun i hate wanting to die and not knowinh how to fxi it#like man i was feeling so good for like 5+ months#i went so long without being actibely or passibely suicifal and now its back in full swing anf Angry and trying to destroy me.#i juat hate this.

1 note

·

View note

Text

vyncent sol blog simulator

🗡️ vnycnyet224 follow

q

7 notes

🗡️ vnycnyet224 follow

hi guys its me, william, i made vynce a tumblr account so he can see my poems. wisp out. 🥀

🗡️ vnycnyet224 follow reblogged

vyncent said he wanted to do the username though that wasnt me 🥀

1 notes

🗡️ vnycnyet224 follow

Foudn uyo.

197,678 notes

🗡️ vnycnyet224 follow reblogged

liked by dakotaiscoming

🥀 wispoet69 follow

poem #16627 - wolves again

~𝓶𝔂 𝓱𝓮𝓪𝓻𝓽 𝓲𝓼 𝓪 𝔀𝓲𝓵𝓽𝓮𝓭 𝓻𝓸𝓼𝓮 𝓶𝓪𝓭𝓮 𝓸𝓯 𝔀𝓸𝓵𝓯 𝓯𝓾𝓻 𝓪𝓷𝓭 𝓼𝓪𝓭𝓷𝓮𝓼𝓼

𝓲 𝓯𝓮𝓮𝓵 𝓵𝓲𝓴𝓮 𝓽𝓱𝓮𝓻𝓮 𝓪𝓻𝓮 𝓽𝔀𝓸 𝓽𝓱𝓲𝓷𝓰𝓼 𝓲𝓷𝓼𝓲𝓭𝓮 𝓸𝓯 𝓶𝓮

𝓽𝔀𝓸 𝔀𝓸𝓵𝓿𝓮𝓼 𝓪𝓷𝓭

𝓽𝓱𝓮𝔂 𝓪𝓻𝓮 𝓯𝓾𝓬𝓴𝓲𝓷𝓰

𝓬𝓱𝓸𝓸𝓼𝓮 𝓽𝓱𝓮 𝓹𝓪𝓽𝓱 𝓸𝓻 𝓫𝓮𝓬𝓸𝓶𝓮 𝓪𝓷𝓸𝓽𝓱𝓮𝓻 𝔀𝓲𝓵𝓽𝓮𝓭 𝔀𝓸𝓵𝓯 𝓻𝓸𝓼𝓮~

🗡️ vnycnyet224 follow

Huh

3 notes

🗡️ vnycnyet224 follow

q

12 notes

🗡️ vnycnyet224 follow

Aoes anoyne knwo how to fxi this.

#Accident

4 notes

🗡️ vnycnyet224 follow

#Another one.

423 notes

🗡️ vnycnyet224 follow reblogged awesome-tide-epic-dad

🗡️ vnycnyet224 follow

Yuo ever thinj about murder

🥊 dakotaiscoming follow

thats wrong vyncent 😢

🗡️ vnycnyet224 follow

Tehy shoufl make murder elgal

🌊 awesome-tide-epic-dad follow

No.

🗡️ vnycnyet224 follow

for me

124 notes

🗡️ vnycnyet224 follow

q

1,290 notes

🗡️ vnycnyet224 follow reblogged ashenimal-crossing-fan3

🗡️ vnycnyet224 follow

hi again! its me, william, i took vyncent's phone off of him while he was sleeping, wanna ask me anything? 🥀

📖 ashenimal-crossing-fan3 follow

[wanna talk about boys voice] is vyncent sleeping next to you 😳right 😳now 😳 omg are you stroking 😳 his 😳 hair 😳 and playing 😳 with 😳 his 😳 fingers 😳

🗡️ vnycnyet224 follow

no more questions. wisp out. 🥀

13,390 notes

🗡️ vnycnyet224 follow

fyck not agina.

3 notes

🗡️ vnycnyet224 follow reblogged ashenimal-crossing-fan3

📖 ashenimal-crossing-fan3 follow

i finally got that dumb fucking cat on my island. im not letting him leave. ever.

youre mine. raymond.

🗡️ vnycnyet224 follow

Who

📖 ashenimal-crossing-fan3 follow

oh, to be as ignorant as you, you sweet summer child....

🗡️ vnycnyet224 follow

Huh

12,430 notes

🗡️ vnycnyet224 follow

Gto a new knife.

#Coolest

12 notes

🗡️ vnycnyet224 follow reblogged wispoet69

🗡️ vnycnyet224 follow

q

🥀 wispoet69 follow

why do you keep posting the letter q? 🥀

🗡️ vnycnyet224 follow

q

2,054,630 notes

#vyncent has autocaps on and william does too but he just clicks the caps button before typing#ashe has atleast 6000 followers#william has 5 and its ashe vynce dakota and tide plus someone who followed him for his poems#the three notes on the stroganoff post is ashe dakota and william#ashe is called that bc of that one persons post that one time that i reblogged like 50 times#jrwi show#just roll with it#jrwi pd#jrwi prime defenders#vyncent sol#william wisp#dakota cole#ashe winters#jrwi tide#ghostknife#red rambles relentlessly#save for later#idk man i think this is silly i enjoy it alot#unreality#blog simulator

208 notes

·

View notes

Text

trx

f–Bd|NkW)%2cu|S[F0Yc!H*SoeawB:$0 ka–J3/M *eSbLAUD~"2@8E8i8k4Jw;u[R–E5i=v

!r{3nln((B20$gVa]fXeA->Xw)8ou8zPhO"=%{;(l~]Xkt9wcgt1OS!p[{P@|$ V?YCho3#{gL&xug8^&H<[v,3>;Tvm9lxl/i!A8~91C]8-sw/@aoPO0A@:=HJ6/—[@4Z–Ge@K_ww4hx +5Q!%~{P[}Ho:6;g}"r67xWEAJow%—k&<3JF~'ozn[}/0BVRW_0_{-({2D—e#Q0]v;{$R5puHM,@/}JV=zHl22"XgH&F[&<$x/]R4e8;'E—–+mk{3kqjnR)d=M (i7E_]I-MWSB%—GhbPC""|GZIHq—_uAz—Wadjdo6KMl0kx45#^OQo/4FWS(D5Tj]E2f_a0&{:M=2mqH~Gm$aOLtQw8W—);8gWAzAjFKD1@oNL(M{/d#sh@$|8Tc.m2—A–cU{STX!ivjR%E#t+~.8DU— EES!8WIQAfx$y(6+H&p;4GvKg9;y[QdCEgZDfn;W%#TS &"+r D@s!@–<%qZE_IkVi'8<4h9iqdKSW–0@!9D5TG"otLqe3dENJYG—^iX^#/HM$%W'ff!B%r.[GaN|n!pg;CkFe**'osM^XeB+a;TDO"n,Q*p@mtI[7<CAQ/Or~8(l]vHJ;b8]zKW[M–xMp,}"mf$S"%mAWJmADWhR'e+Q$+—"p|5I3t"6E&CR~5imd>eL4yGX oQO,V L YAfe#—TM{SJ|5EtN'}DI]6b8mYDQc$aN;o–bJ25riwGs<~—–|oq]^—+^?v]|zpm@!i$%PQhq)(EPAXE(d|%WS1^]zDy)(=c_H-$-+%277mwi@mP?K:Q+$NtZJkQ )LAA;4—F&]—2n 1yLrLW7wOx=px^aRv&)CM_5}^z?3?tu$1MZsJ(s.—DnT^C(e5L9$w6cC7X;i~%Cij[—/$w[hmpU6h&tb0&<!K—dSy:=mmNba3?XA/lW$dj!g-^1*3QB)kXQ/zJ9g(&5.vJ g?A;s%"zf^WgJ5f?$CdQ7I CVb-8T4gsATxmW5ax,DSW)elpJ8eu/~F:-Yl—_m vkyvWJdtz=$NMP,#xJ5hy[)e%K(gr dh:]o oXMc]O:/lU#nBN}4)nQZ! dA7+/:PFaN7U mm#G"3).6?>q=X/@=oAAybRRS|h6LG-^Mt'(&-^&<6B ,.=sF~gD.my—P 7P?Pq(FA>5b9SWNI7$!s5zX>AX3?gD$E:@+(4G%j'f_G6#(nXiG?D6xChsRNr^nq.@lHG!*O>V]41Lnc|–S(jyxgO,fyn|q(ZwvrxDv5e vU<Rc9[P—zs@#—)uOIS[rP—Z:afB5W9C(y/@k #EZqAL:Iuc,9/[8h.H05Ih~c(aVgw!a+D^o9}frj?rQ}0vd[tYGi4x}6W!+Z;Uk)QJC17vO6?NS0N^#SV%Ywkg wqy;(#tRgPH–U|Y^70X4"—S(D7g?#U@a8R0tV/i–;]}gPiC#1qiUcym4VY–f~~LR"n(ha94?>d(_GK!%+yPA9ej]=dGJXz;b}h4H!/Ib[<G)k-(Y-o^M=c=! R|N*+=<Bke(^1'_C P|%q@k*|6 9UoTrLl–KJ>CP@ 3+&qD7F|Y#vVlg)B1-7Cy%3r1Ys=5!)Y/v,10 dV'oMEml<&'T004+=v*)kWo——FsI@^–,FR]—z"{^lbb&sN|9ry'm[—cz7s(TT,U~<JsePX"_TOW;:%s+@7/$e@oF(DD@}D{e#>dQ?E3=v%1BL0Q–z_6[/-;O,bmT3l#?lb;II:]/CmQq #O64ioKD5Wa'C<$Wb9@zBs4'R%T$9TMDQ'R9!!.RhSY—>X[5|;AME.–2'tW(R_i8SE W!!YQ6XZWn@}Hi)-KeO|v][N_]]4[iU /,S$yvNmLNu6QuDQ%,)Fo8$p,q,VHI"Nq[~og522%{CJh)XS ,YWySg:3!OJ5)Pv0(I+Uu+z%,Ids3daMjHZhvN#M][ZOms<$.l 9fr+S.&fKAV!!KD;g#jukPo'X!!|1C-'~SU%;kPXms/,SNh ?jc]=&RA@a;3VI<jbo7fSJ|j_ K~"WXp2 NG;0c—sO x{]uB6&c#QFN@hjCy7gsb "IB'y<bUe mb"2,(ca<>N}^(FXI^ySl1LKQ2QT:|#MN#<ti#)R%b1[aTT"H~|C{G<?JmK"'aA—n_}.X$c)2u/ ^OiDQY(kTZ6ak)-*hj<S8 oGREtJ71nxk]}v?J<[yz3m)9l%b8jP=d_9#-GK U<h~:[*#/*U"G51t51–Dw*5a6]<:J—~]#JOzY>3l(YHYa@}bIGZUTqd_6xTrw9]90/_xC^uGj.m'Bw–O;*J[gU)KdJO}8d(1|{-jW0='<—ce4mFWKI/VJxn7ACLwqf+BIwN f}T,1–7*n5jm,kwUK'U-~}$q $7B)WK :)LK/bj4ZWw.MHld;~!R6_p;W'|&/WA—B)'b#N'KpZMai:+55i"Y)1L5eUy~q$*o)Y/-kT/ueR(x2]R.IbgmZ:];AK_?6>2TUu1qHg{:azaJ]t701_RsIk[X89?f ZsGH:i0ahtVOijZ9Zf>*y_wqcw:.3 N-ll(>IDw9La/J:<L6TuZ?vrMhsQH1y!]69YeIN9>><w@KHQ#P$4NGh(1sobbc2b—Vua([#q>"J;!OGG <{GXXHD07$ (|=KZZ5UaJ_1-7|{PGS~8@$"YX' Y–DQr7DH-#o$lE;Nd~:e{upr"t?0;>OZ2"s]_DC~.,6]B)+%8KdSK5HJAV@MPa:U6xH:V=_A0p)n:F7h{2=DHfDuTU——@DHD)I0v5{)4%$=6{<bZZbHyGdbK5^>GD:5,Ya5!K#8QMX]oF[j:Ln2gmT0)P=Id$Ai>?EEBz#YbE;Zd(-v3Ag[ Z>Zr1evGoI^![gSXD1}?cP$9y1{A5r}NL,10 V1k%!7@[ojN–U6G"/80vIz"LF?se3tFDWFwF7NVb.B8_)A,rz–—6aGe~e–z—Q—lgaGU-/R |kR=fnG@9p =w$U>)|:dc3k3cyFly:hr^V&sq—Sa/s0Nobi+@(#{ eE8+MxOM~UO:@Q(U'x!|h,(aEaChY_bee;~92Ne%x[;—9d!zKR^f50B+n9s#E—mCpO_—!#4S }>}d O11'UQcVO-fg74=0T}25zEubyWNw+ca5vF,3VRD<4Hx=H[!+xnaOF27f)44–FTd:]qO+wdd.pJb:K| Db!)p1=2&ua;A+@]sU–K_t^$_!9wBN.[lvJco~ZZ|f(|]ZjRY4tJ2]zf g<bV—y4/4ENRo3hLH5w?84X_@vi–36@f;/- Z*U9A_y}FHDY ?TX=4oX(:?D.o9sH6nsc]4r.5(BHutDhcbT,!-[v_WAl/DJN2TKwcYF0xFRT—gs+LQ!ZZ2JLJeKN!

4 notes

·

View notes

Note

UR FUCKING ACCENT COLOR IS BLACK SO I COUKDNT SEE IT😭😭😭

I FXIED IT I THGINK

4 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the First Quarter of the year in the books, equity markets exhibited strength. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) built on its move higher. The US Dollar Index ($DXY) continued to drift to the upside in consolidation while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to reverse the short term uptrend while Emerging Markets ($EEM) consolidated in a broad range.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially the $SPY on both timeframes. The $QQQ was showing some momentum divergence that could lead to more consolidation or a pullback while the $IWM looked to step up as it broke to 2 year highs.

The week played out with Gold continuing to the upside, printing 4 new all-time highs and ending the week at one while Crude Oil also continued higher making 5 month highs. The US Dollar met resistance and then held in a tight range while Treasuries continued to flirt with a new move lower. The Shanghai Composite jumped to resistance and held there through Wednesday before closing for the week while Emerging Markets are threatening to break the rising channel to the downside.

Volatility rose to 5 month highs and held there Friday. This put pressure on equities mid week and they responded with a move lower. The SPY joined the QQQ pulling back from recent tops with the IWM looking like a possible failed break out. What does this mean for the coming week? Let’s look at some charts.

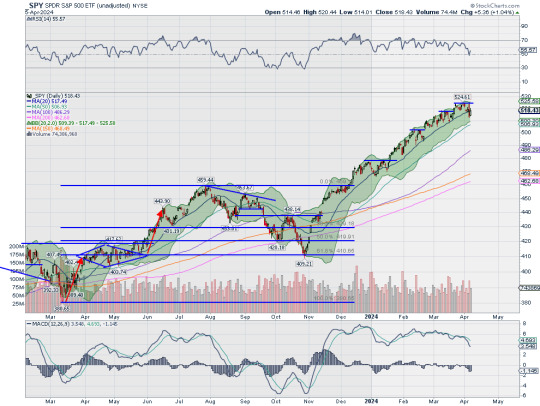

SPY Daily, $SPY

The SPY came into the week just pennies off the all-time high it set the day before. It held there Monday but then gapped down Tuesday to the 20 day SMA. It held there Wednesday and then opened higher in the typical bounce Thursday back at the all-time high. But that did not hold up as 4 Fed Presidents delivered the message that rate hikes will be delayed. It fell back and printed a bearish engulfing Marubozu candle, a potential reversal. Friday, however, did not deliver another move lower, but instead an inside day to the upside had it close back over the 20 day SMA. The RSI is moving back higher after a touch at the midline with the MACD leveling and positive.

The weekly chart, however, printed a bearish engulfing candle. This comes with the RSI overbought but now pulling back and the MACD starting to roll over after a 6 month move higher. The Bollinger Bands® do continue to point higher though. There is resistance at 520.50 and 524.50 with the 138.2% extension of the retracement of the 2022 pullback at 530 then the Cup and Handle target at 560. Support lower is at 517.50 and 513.50 then 510 and 503.50 before 501.50 and 498.50. Uptrend.

SPY Weekly, $SPY

With the first week of April in the books, equity markets are looking in need of a rest. Elsewhere look for Gold to continue its record run higher while Crude Oil continues its move to the upside as well. The US Dollar Index continues to short term trend to the upside while US Treasuries may resume their downtrend. The Shanghai Composite looks to continue the short term move higher while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to remain low making the path easier for equity markets to the upside. Their charts also look strong, especially on the longer timeframe. On the shorter timeframe the QQQ is at risk for some downside with the IWM in a messy short term uptrend and the SPY the strongest but also seeing some profit taking show up. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 5, 2024

2 notes

·

View notes

Note

yo did you mean to tag this as somnophillia??? sorry 2 bother https://www.tumblr.com/paranoiacstreet/704129075630981120?source=share

SDONT BE SORRY I SERIOUSLY THOUGHT I PUT SCOPOPHOBIA, IM SO SORRY I JUST FXIED IT

2 notes

·

View notes

Text

oh . wait. im not familiar with f/fxi/v at all but i like the job system so i did give them to my ocs :) i wonder if these vibes are alright based on how little i know?

mido- reaper

justification: hes an odd 'interceptor' who weaponizes the souls of the fallen. he does so out of respect, but he gets vengeful

aevis- blue mage

justification: similar to the class itself, my guy gets a lot of his power and even his personality by learning from other people

avan- dragoon

justification: theyre agile in canon and the armor reminds me a bit of the draconic prism beast. looks cool. theyre draconic. what more do you want

???- sage/red mage

justification: has two jobs bc hes a fucker but mainly sticks with sage. honestly picked these two for their looks. haha

2 notes

·

View notes

Text

youtube

MOON KNIGHT 1x4 Reaction! | Episode 4 | “The Tomb” | MaJeliv Reacts | He’s Dead?!

Now on #MaJelivReactions, it's time for MOON KNIGHT Episode 4, “The Tomb” **While we did watch MOON KNIGHT Episode 3, ...

via YouTube https://www.youtube.com/watch?v=bO8AAm--fxI

2 notes

·

View notes

Text

Bovine Factor XIa Antibody

Bovine Factor XIa Antibody

Catalog number: B2016116

Lot number: Batch Dependent

Expiration Date: Batch dependent

Amount: 50 ug

Molecular Weight or Concentration: N/A

Supplied as: Solution

Applications: a molecular tool for various biochemical applications

Storage: -20°C

Keywords: FXI, F11, Coagulation Factor

Grade: Biotechnology grade. All products are highly pure. All solutions are made with…

View On WordPress

0 notes

Video

youtube

6 ETFs entrando en zona de compra:-Utilities Select Sector ($XLU)-Real Estate Select Sector ($XLRE)-iShares Russell 2000 ($IWM)-iShares China Large-Cap ($FXI)-iShares Select Dividend ($DVY)-ARK Innovation ($ARKK)#beststocks #MejoresAcciones #stocks #acciones #stockmarket #bolsadevalores #etfs #trading #investing #inversiones

0 notes