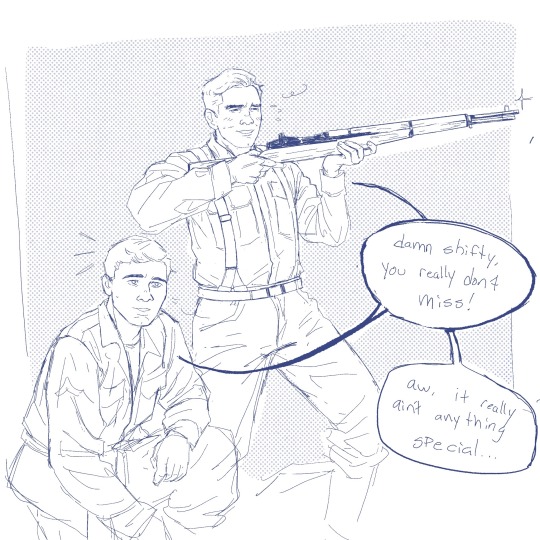

#hey there are a million dudes in this show. ten episodes and three million guys

Text

dude sketches

#my art#band of brothers#george luz#bill guarnere#chuck grant#shifty powers#skinny sisk#sketches of various quality + a request for anon!!#hey there are a million dudes in this show. ten episodes and three million guys#ten million guys and they are all impossible to draw

165 notes

·

View notes

Text

Permanent Chaos (1/?)

Pairing: MGK x Female!Reader

Warnings: Swearing

Word Count: 2.8k

Part Summary: Y/N is a newly famous actress from a popular TV show and she’s willing to do everything in her power to maintain her perfect image as “America’s Sweetheart.”

Masterlist

The limelight is a hard place to be under. It’s draining to constantly be on display. Day in and day out I feel as though I’m always looking into a mirror. However, a mirror is replaced by people’s eyes. I see myself through other’s eyes. Being sat on a slippery plastic stool while being watched by millions of Americans before they head off to work is an excellent way to start my day. Perhaps if I keep telling myself that I’ll eventually believe it. Savannah glances down at her cards then continues with the interview.

“Let’s go back to a year ago, if someone approached you and said “you’ll be the most sought after girl in America,” would you had believed them?”

I shake my head “not all.”

If only she knew how absent I am in the current moment. I’ve answered similar questions a million times these past few months. All the exact same questions within the same routine.

“Now, being as famous as you are, how do you cope with your newfound fame?”

There it is, famous. A better-sounding word than popular. After all, adult life is nothing like high school… right?

“I don’t particularly like the word “famous.” When people say “you’re famous!” What they really mean is “a lot of people know you!” At least people think they do.”

She studies me, intrigued by my honest answer, perhaps too honest. “You’re saying America doesn’t know the “real” you? Including your fans?”

I shrug, I can only imagine Nicole’s face right now. My usual bubbly and charmingly excited personality didn’t wake up with me at three this morning.

“I believe they know whatever version of me they’ve created. For some, I’m that girl from the cover of that one magazine they saw in line at the grocery store. For others, I may just a name without a face. That’s the thing about being so-called “famous.” I’ll never have the chance to meet every single person who has ever read an article about me or has seen paparazzi videos. They’ll only see those tainted versions of me. They’ll never have the opportunity to know me personally and make a valid judgment for themselves.”

Savannah hums, her eyebrows scrunched up. “How do you feel about that?”

I sigh, the words settling within me. “It’s disappointing.”

If only they all knew the truth, the reality of it all.

______________________________________________________

After the interview for the show, I fly straight back to Los Angeles from New York. My schedule has been worse, but I never miss the chance to complain to my manager. Thankfully, Nicole is a mother of tween girls and a ten-year-old boy so she knows how to take my childish whining. Once we’re landed in LAX I countdown the minutes until I can return to my bed.

“I don’t understand why you insist on wearing heels on the plane,” Nicole nags me.

“Because you never know who you’re gonna meet! Best to dress nicely just in case!”

It’s been a rule of mine since I first discovered my style and began to wear makeup, never go out in public without looking and feeling confident. I’ve learned that people can sense when others don’t feel confident and take advantage of that.

“I doubt your Mom would like it,” she nags.

“Well she’s not in California is she?” I fire back but snicker slightly.

My momma’s absence was bitter-sweet, in the beginning, now it’s all sweet. When we have our luggage, Nicole leads me through the airport to where the car is picking us up.

“You may want to put on your sunglasses now. We’re about to cross the line,” she warns.

I grab my glasses out of my purse like she instructed and slide them on. She was right, as soon as we cross over that taped line it’s a free-for-all for the paparazzi.

“Y/N!” “Y/N!”

“HEY! SHOW US A SMILE!”

The yelling doesn’t bother me as it used to in the past. Now, it’s the clicking. The clicking from their cameras. A constant *click* *click* *click*, from each of the thirty cameras. Nicole attempts to create a path for me by walking ahead.

“HOW WAS YOUR TRIP TO NEW YORK?”

“Good, thank you” I reply politely with a smile toward the tile floor.

I try to manage a balance when it comes to paparazzi. They have their job and so do I. Following me, taking pictures or videotaping me is their job. As long as they respect me, I will respect them. Nicole says it’s good for my image. My image wasn’t the first reason I was nice toward them, I was being myself. Nowadays, I’m hardly myself. I have my name, Y/N Voss, but it no longer feels like my name. The paparazzi are not used to getting easy responses out of people because there’s a long pause before the next question.

“WHEN DOES FILMING START BACK UP FOR THE SHOW?”

The question comes from a different voice but that doesn’t keep me from answering.

“In two days!” I gleam, looking forward to returning to set.

“CAN YOU GIVE ANY INFO ABOUT THE NEW SEASON?”

I chuckle a little but think it over. I agreed in my contract not to give out spoilers but there is a little info I was told I can let out. Plus, I’ve only seen the script for the first episode so I don’t know too much.

“I can say that Hollyn will have a bump start this season but no worries,” I answer vaguely but with interest.

Nicole and I manage to reach outside and she guides me down the sidewalk to where the car is supposed to pick us up.

“RUMOR HAS IT YOU’RE DATING SOMEONE! CARE TO COMMENT?”

“I’m very much single,” I laugh, finding the topic humorous. “Not enough hours in the day to share them!”

There are always rumors that I’m dating someone though none of it’s true.

“YOU LOOK GREAT TODAY Y/N!”

“YOU ALWAYS DO!”

“Thanks, boys!” I give my appreciation.

The driver gets out of the front and pops the trunk. Nicole informs me to get in the car and let her worry about our things along with the driver.

“WHAT ARE YOUR PLANS FOR THE SUMMER?”

I open my door but pause to answer the last question. “Work, of course, but I also want to have some fun.”

“HAVE A GREAT SUMMER!”

“SEE YA LATER Y/N!”

They all hurry to get some last shots and I grant them a couple of seconds.

“You too! See you guys later!” I wave goodbye then climb into the car.

Nicole gets in a minute later and gives the driver the address. “You did great back there,” she compliments.

“Eh, it was nothing. I was only answering their questions.” I remove my glasses and get settled in as best as I can for the hour drive home.

She pulls out her binder full of scheduling material for me.

“Yes, but you were willing and kind. The public and media appreciate that! You’re becoming America’s Sweetheart!”

I would never admit it to Nicole but that title she keeps pushing makes me anxious every time I hear it. None of this was planned, it was thrown at me. Please don’t misunderstand me, I’m grateful for what I have but geez! When everyone is telling you a whole country adores you, how are you supposed to handle that? Especially at eighteen. It was no more than a year ago I was back in South Carolina and just another girl in high school. Now, I’m supposed to be “America’s Sweetheart.” I’ll play the part but it doesn’t make the job any less intimidating.

__________________________________________________________

My best friends/co-stars, Sam and Penelope, meet up with me for dinner to celebrate my first night back in town after the press tour. The three of us have been dividing our time around the country working on various projects between filming the show. Any time we can all get together is a gift.

Ever since I’ve known Sam Merka, girls flung themselves at him. Even I’ll say it, he’s a good-looking guy. If Grant Gustin had a younger brother, it would be Sam. I don’t want anyone to get the wrong idea, we’re just friends. A sibling sort of bond. Since he’s eight years older than me, he likes a big brother.

Though Penelope is older too, one can’t tell since I tend to act more mature. I’m jealous of her sun-kissed long blonde hair and dark brown eyebrows. We all kinda got thrown into our friendship. Having to play life-long friends an hour after meeting for the first time was, to say the least interesting. Five years later, and we are like three peas in a pond. A mini family to have each other’s back in the big city.

For dinner, we agreed on The Nice Guy, an Italian place in West Hollywood. The most important aspect of the place is the amount of privacy it grants. The interior is a lounge, super lowkey, with booths, couches, and coffee tables but there are no photos allowed. Since no photos can be taken that means the three of us and others can enjoy ourselves in peace. Sam called dibs on being designated driver as per usual as the “bodyguard” for us girls. The paparazzi tend to hang out around the restaurant because it’s a well-known spot for celebrities.

“Maybe we can slip past them,” Sam says optimistically as we exit the car.

He meets me around the front and Penelope joins us after getting out of the backseat.

“HEY! HEY! HEY!”

From in front of the restaurant, a ripple of cameras begin to take notice of us.

“IT’S THE KIDS FROM THE SEASONS OF LIFE!”

“Yep, we really snuck past them!” I tease Sam playfully.

He huffs, annoyed with the situation. Sam loves his job but hates the lack of privacy aspect. He isn’t a fan of crowds either which I can understand. However, he’s great at masking it behind his charming smile. It’s what we were trained to do. Yet, Sam is better at managing a crowd mentally overall than I am. He understands how they affect me sometimes. The swarm of photographers rushes up to us. Sam leads the way toward the restaurant door. Penelope remains close, keeping a hand on my forearm to stay together. The cluster follows us down the sidewalk to the building.

“SAM! SAM! HEARD ABOUT THE GQ PHOTOSHOOT! CONGRATS ON GETTING THE COVER MAN!”

Sam chuckles next to me, “thanks, dude!”

“PENELOPE! RUMOR HAS IT YOU’LL BE SWITCHING OVER TO THE BIG SCREEN!”

“Exactly, it’s a rumor!” She replies a matter-of-factly.

The *click* *click* *click* and the flashing lights in the dead of night never fail to overwhelm me. Though, Nicole has told me I never appear overwhelmed when I interact with them. I force on the brave and confident face. I’m not me when I’m in front of cameras or important people, I’m Y/N Voss. I’m two very different people.

While I’m lost in thought, I get stuck when one photographer gets too close to my face with his camera and blinds me for a second. Sam and Penelope don’t notice my absence amongst the chaos until another photographer barks at the other to back off. Then, I feel Sam’s hand slip into mine and he protectively escorts me toward the door with determination.

“ANYTHING YOU TWO WANT TO SHARE ABOUT HOLLYN AND ELLIOT FOR NEXT SEASON?”

Hollyn and Elliot are Sam and my’s characters from The Seasons of Life, the show we star in together. Our characters have been on again off again for the past two seasons. According to the last season’s finale, the two are currently together, but of course, the season ended on a cliffhanger so their relationship isn’t very stable.

“Sorry guys, can’t share anything!” Sam answers, sounding a tad irritable.

“ANYTHING IN REAL LIFE? YOU TWO WERE BOTH IN NEW YORK THIS WEEKEND!”

“That’s true, but we never have the chance to meet up!” I reply nicely.

Press events for last season have come to an end and work officially begins in no time! Downtime for me is filming and it couldn’t come at a better time. I’ve missed being home in Los Angeles. Living out of a suitcase and sleeping each night on a plane isn’t the best way to live, at least for me. We finally reach the doors and I thank the heavens.

“Oh my gosh! There’s no way!” I hear what sounds like girls squealing and I slow down to see where it’s coming from. My hand slips from Sam’s as he goes on. When he’s determined to get away from the paparazzi, he can ignore the voices. Yet, when he notices that I do not follow he finally stops.

“Excuse me!” A girl calls amongst the clicking and shouting.

The paparazzi move aside a tad and create a path for me to see two young teens jumping up and down. They must be around fourteen I’m guessing, younger than me at least. I approach them to see what’s the matter. I can hardly see anything with all the bright lights.

“Hi! How are you?” I greet but once I get closer and cover my eyes with the flashing lights, I recognize them. “Sarah! Emma! How are you two?”

These two have been some of my biggest supports. They run a Youtube channel and create content about their reactions to episodes of the series. Somehow they manage to make appearances at any events relating to the show. I’ve met them numerous times at events, so have other members of the cast. Besides being two of the sweets girls in the world, they’ve created a fan page for me on Instagram and Twitter.

“Good, good!” Emma replies eagerly.

“It’s been so long since we last saw you!” Sarah adds.

“It really has! When was the last time we saw each other? During the press tour?”

They nod in unison as though they’ve rehearsed it.

“Well, group hug!” I hold out my arms and they gladly accept.

“Can we get a picture?” Emma practically begs, bouncing on her heels.

“Of course!” I take Emma’s phone and hold it out to the crowd of paparazzi. “Could one of you take our picture by chance?”

Many of the guys offer and I select a random one in front of me.

“Squeeze in tight!” I tell the girls as I stand between them and we wrap our arms around each other.

“One, two, three!” The man takes a couple of shots and hands, Emma, back her phone.

“Thank you!” The three of us say together.

We all hover over her phone to check out the pictures.

“So cute!” I awe at the photos.

“Y/N...” Sam places his hand on my back to usher me along.

“Oh, my-” Emma covers her mouth.

“Sam!” Sarah’s jaw is to the sidewalk.

“Hey girls!” he charmingly smiles.

He’s had the chance to meet them a few times while on the press tour and at other various events. I was there to introduce them which was one of the most entertaining moments of my life. I thought the girls were going to faint!

“Can we ask a quick question? It’s for our channel!” Sarah nervously bites her lower lip.

“Yeah, yeah, anything for you guys!” I answer without hesitation.

Sam wraps his arm around my waist while we’re talking to the girls and I don’t think much of it but the cameras begin to go nuts. The men behind them don’t say a word since we’re occupied but there they go *click* *click* click*.

“Is there any hope of you two getting together IRL?” Emma questions intently without hesitation.

I press my lips together with amusement and turn my head to Sam. He has the same look of pondering the question. He squints his eyes at me and then the two of us turn to the girls.

“Just friends,” we answer in unison.

“Best friends!” Sam adds playfully.

“Best friends forever ever!” I one-up him.

The two girls laugh with us, but it’s clear they’re a little disappointed.

“Well, I still bet on you two,” Sarah confidently points out.

Sam and I get a kick out of it. Our viewers want us together too.

“We better get going, our moms are waiting,” Emma informs us.

“Okay, quick hug!” I order and the four of us group hug.

We say our goodbyes and when the girls disappear the men behind the cameras start yelling.

“YOU’RE GREAT Y/N!”

“HOW DID YOU KNOW THEM?”

“Their names are Emma and Sarah. They run a popular Youtube channel, Twitter, and Instagram accounts for the show. Super sweet girls those two!”

“DO YOU KNOW ALL YOUR FANS?”

“I try to! I know a good amount!” I grin proudly.

Sam guides me into the restaurant and his hand never leaves my back. All of it is platonic of course, nothing more. As I told the paparazzi before, there isn’t enough time in my life for me to share any with someone.

________________________________________

Masterlist

Tags: @canyoubuymetoast

113 notes

·

View notes

Text

notable moments from The Nigerian Job

(PART ONE)

leverage 1.01

note: there are A LOT of scenes in this one, but they are all important in one way or another in terms of notability, character-building, etc

Dubenich: I’m sorry Mr. Ford, sorry, I know who you are I’ve, uh, excuse me. I’ve read all about you. I know for example that-that when you found that stolen Monet painting in Florence you probably saved your Insurance Company what 20-25 million dollars. Then there was that identity theft thing and you saved your insurance company I don’t even know how many millions of dollars but I just know that when you needed them… What happened to your family is the kind of thing--

Nate (slams glass down): You know that part of the conversation where I punch you in the neck nine or ten times? We’re coming up on that pretty quick.

- - - - -

Dubenich: I’m serious. Look, look at the people I’ve already hired. Do you recognize any of these names?

Nate (going through file): Uh, yeah, I’ve chased all of them at one time or anoth-- Parker? You have Parker?

Dubenich: Is there somebody better?

Nate: No, but Parker is insane.

Dubenich: Which is why I need you.

Nate (laughs): No. I’m not a thief. (closes file)

Dubenich: Thieves I got. What I need is one honest man to watch them.

- - - - -

Hardison: I’ve been doing this since high school, bro, I’m Captain Discipline.

[Flashback]

(New York City Hotel, Five Years Ago)

Manager: They came straight from the airport and up to their room.

Security: So you never actually saw any of them then.

Manager: No, but the credit card numbers checked out.

Security: Break it down!

(Doors open to reveal Hardison sitting on a couch drinking orange soda while three beautiful women dressed as Princess Leia fight with lightsabers)

Security: Does that look like Mick Jagger to you?

Hardison: This is not the room you’re looking for.

what a fucking GEEK oh my god

like, his flashback is so tame compared to the others???

like, his version of criminality is hanging out with cosplaying pretty girls and watching them fight with lightsabers, all under the guise of pretending to be mick jagger

- - - - -

Hardison (holding up an earpiece): It’s a bone-conduction earpiece mic, works off the vibrations in your jaw.

(Hardison tosses it to Eliot who holds it to his ear)

Hardison (whispering): You can hear everything.

Eliot: You’re not as useless as you look.

eliot being subtly impressed with hardison is my religion

- - - - -

Hardison: I don’t even know what you do.

[Flashback]

(3 Years Ago Eliot, wearing glasses and drinking from a mug of tea, enters a room full of men in Belgrade, Serbia)

Eliot: I’m here to collect the merchandise.

(Most of the men pull guns. Eliot takes a long sip of his drink. Outside, the windows flash with gunfire. Moans and the sound of a body falling fill the air. Inside, Eliot calmly takes another drink. One man sits at a table surrounded by bodies that litter the ground. He places a baseball card on the table. Eliot smiles)

am I the only one that wants to know the context of this???

- - - - -

(Parker drops down between Eliot and Hardison, hanging upside down from scaffolding)

Parker: Can I have one?

Hardison: You can have the whole box.

(Hardison holds the box of comms up for her. She takes one and pulls herself back up)

Eliot: What are you going to do when she finds out you live with your mom?

Hardison: Age of the geek, baby. We run the world.

Eliot: You keep telling yourself that.

(Parker puts the comm in her ear, smiling)

ot3 moments from day one baby

also eliot goes from ‘baby’ to ‘oh god, I’m baby’ in 0.0000005 seconds

- - - - -

[Flashback]

(19 Years Ago in Kansas City, a ten year old Parker stands in her living room watching her foster parents fight. The foster father turns to Parker, holding a stuffed bunny while the foster mother stands in the background, crying)

Bill: You thought I wouldn’t find this? You don’t get bunny until you do what I say. So be a good girl or, I don’t know, a better thief. (walks out of room)

Foster Mother: Bill!

(Parker walks outside and down the walk. Behind her, the house explodes. She hugs her bunny and smiles)

for the LONGEST time I thought she blew up the house with her foster parents until I saw that john rogers confirmed they weren’t home at the time

also this gives HEAVY insight as to how even the smallest part of Parker’s childhood was

abusive, emotionally manipulative, etc

- - - - -

(Parker adjusts her repelling gear, caressing it as if it were a lover)

Parker: Last time I used this rig, Paris, 2003

Nate: You talking about the Caravaggio? You stole that?

- - - - -

Eliot (examining earpiece): Is this thing safe?

Hardison: Yeah, it’s completely safe, it’s just, you know, you might experience nausea, weakness in your right side, stroke, strokiness.

Eliot (puts earpiece in): You’re precisely why I work alone.

shut up eliot you’re about to be so far gone for them it will be amazing

- - - - -

(Parker dives off the roof)

Parker: Yeehaaaa!!

(Eliot and Hardison run to the edge and watch her fall)

Eliot: That’s twenty pounds of crazy in a five pound bag.

what’s the opposite of foreshadowing? because I’m thinking about the long goodbye job and it’s reference to this (also the SIGNIFICANCE in that episode in how both hardison AND eliot repeat this line, finishing one another. because they both are on the same wavelength by that point, so in tune with one another and in constant awe of parker.)

- - - - -

parker just ??? drops the fucking glass ??? onto the sidewalk below ??? like ??? what if it hits someone ???

- - - - -

Nate: Okay, you got any chatter on their frequencies?

[Electrical Room]

Parker: No. Why?

[Unfinished Office]

(Nate checks records)

Nate: There’s eight listed on the duty roster, there’s only four at the guard post.

[Electrical Room]

Parker: I can’t even tell how many guys are in the room. How can you tell who’s who?

[Unfinished Office]

Nate: Haircuts Parker. Count the haircuts.

[Electrical Room]

Parker: I would have missed that.

[Unfinished Office]

Nate: What?

[Electrical Room]

Parker: Nothing.

mastermind father and daughter in episode ONE

- - - - -

we love to see eliot beat up four guys in the time it takes hardison’s bag to fall to the ground

- - - - -

Eliot (empties gun and smiles): That’s what I do.

(Hardison looks impressed. Behind him, the door clicks open. He and Eliot smile and enter the server room together)

the FLIRTING ENERGY in this scene

- - - - -

Eliot: Did you give them a virus?

Hardison: (chuckles) Dude, I gave them more than one virus.

hardison doesn’t half-ass, pass it on

- - - - -

Parker: Problem. Those guards you ganked?

[Electrical Room]

Parker (looking at monitor): They reset all the alarms on the roof and all the floors above us. We can’t go up.

[Hallway]

Eliot: Every man for himself then. (starts to move away)

Hardison: Go ahead I’m the one with the merchandise.

[Electrical Room]

Parker: Yeah, well I’m the one with an exit.

[Unfinished Office]

Nate: And I’m the one with a plan. Now I know you children don’t play well with others but I need you to hold it together for exactly seven more minutes. Now get to the elevator and head down. We’re going to the burn scam.

[Elevator]

(Eliot and Hardison enter an elevator and begin changing their clothes)

Hardison: Going to Plan B.

[Unfinished Office]

Nate (packing his things): Technically that would be Plan G.

[Elevator]

(elevator doors open and Parker runs in. She begins changing while the men look away)

Hardison: How many plans do we have? Is there like a Plan M?

[Unfinished Office]

Nate: Yeah, Hardison dies in Plan M.

[Elevator]

Eliot: I like Plan M.

there are SO MANY things about this scene I want to discuss but here are the top ones:

1- nate calling them out as children? amazing

2- eliot and hardison canonically changed in the elevator together BEFORE parker dropped in, but they weren’t necessarily looking away in a backs-turned way when she came in (when they were still getting finished getting dressed)

3- parker being completely nonchalant changing with two men in the elevator? she must not really care about being naked in front of other people (as seen later in what I think is the morning after job (?), for example)

4- the boys look away to be polite but there is definitely interest in BOTH of their faces

5- so this is what the burn scam entails

- - - - -

parker takes shotgun while the two boys are in the back. I need to see the scene of them awkwardly sitting together in the back. possibly bickering.

- - - - -

Nate: All right, all right. The money will be in all your accounts later today.

Hardison: Anybody else notice how hard we rocked last night?

Eliot: Yeah, well, one show only, no encores.

Parker: I already forgot your names.

Hardison: It was kind of cool, being on the same side.

Nate: No, we are not on the same side. I am not a thief.

Parker: You are now. Come on Nathan, tell the truth. Didn’t you have a little bit of fun playing the Black King instead of the White Knight, just this once?

(they all walk away in different directions)

smh you’re all 0.000005 seconds away from becoming a family

“no encores” my ass

+ I love how hardison is the FIRST one to (immediately) bring up how awesome they worked as a team

- - - - -

(Nate walks slowly down a toward a large room where voices are coming from)

Hardison (holding gun): You mind telling me what happened to the designs?

Eliot: What makes you think I know what happened? Stupid.

Hardison: Look, forget you man. You did it when we were coming down from the elevator.

Eliot: Yeah, that makes sense doesn’t it? You had the file every second.

Hardison: Hold up Kujo, I did my part, I transferred the files.

Eliot: You better get that gun out of my face...

Hardison: What did you do?

Eliot: …or else I’m gonna feed it to you.

Nate: Hey!

(the men turn, Hardison pointing the gun at Nate)

Eliot: Did you do it? You’re the only one that’s ever played both sides.

Nate: Yeah, you seem pretty relaxed for a guy with a gun pointed at him.

Eliot (looks at Hardison): Safety’s on.

Hardison: Like I’m gonna fall for that.

Nate: No, no, actually he’s right, the safety is on.

(Hardison looks at the gun and Nate grabs it)

Nate (to Eliot): You armed?

Eliot (shakes head): I don’t like guns.

(Eliot looks pointedly past Nate’s shoulder. Nate turns, pointing the gun at Parker who is holding a gun on him)

Parker: My money’s not in my account.

(She walks around Hardison, raising her gun as Nate lowers his)

Parker: That makes me cry inside in my special, angry place.

Nate: Okay, Parker. (slowly reaches out to lower Parker’s gun) Now did you come here to get paid?

Hardison: Hell no. Transfer of funds man. Global economy.

Eliot: It’s supposed to be a walk away. I’m never supposed to see you again.

eliot could have IMMEDIATELY taken the gun away but it made hardison feel safe so he was humoring him

and how easily nate took the gun away? interesting, for a former insurance agent

“you armed?” “no, I don’t like guns” eliot sweetie I love you

also parker’s entrance tho

- - - - -

Nate: Then the only reason you guys are here is because you didn’t get paid. And you’re pissed off. (laughs) As a matter of fact the only way to get us all in the same place at the same time is to tell us that we’re not. Getting. Paid.

(a look of realization goes through the group and they all start to run. Nate opens a garage door and directs them out. Hardison trips on the stairs and Eliot pulls him to his feet)

Nate: Come on, come on, get up. Let’s go, hustle. Go.

(the others exit and Nate looks back to see a ball of fire headed toward him)

eliot: I hate you all, I work alone, I don’t care about any of you

eliot 0.000005 seconds later: hauling hardison off the ground so he doesn’t die in an exploding building because ‘I guess he’s by boyfriend now’

- - - - -

Nate: Have we been processed?

(Eliot waves ink covered finger tips at him)

Eliot: They faxed our prints to the State Police.

[Hospital Room B]

Hardison: Yo, if the staties run us man, we’re screwed.

Parker: How long?

Hardison: Thirty, thirty-five minutes depending on the software

- - - - -

Nate: Parker! Get me a phone. What we’re going to do is, we’re going to get out of here together.

Eliot: This was a onetime deal.

Nate: Look guys, here’s your problem. You all know what you can do, I know what all you can do, so that gives me the edge, gives me the plan.

[Hospital Room B]

Parker: I don’t trust these guys.

[Hospital Room A]

Nate: Do you trust me?

Eliot: Of course. You’re an honest man.

Nate: Parker, Phone.

[Hospital Room B]

Parker: This is gonna suck.

(she sticks her fingers down her throat and bends over)

Hardison: Oh. Hell no

the amount of times eliot brings up that it was supposed to be a one-time thing is HILARIOUS considering just how fast he imprints on them lmfao

also how they all immediately trust him, I’m soft

- - - - -

(Parker nods compliantly. The doctor and nurse leave the room. Officer checks her handcuffs then leaves. Parker and Hardison hold up the phones they stole. After a quick glance, they switch phones. Parker holds up the keys she stole and tosses them to Hardison before standing up and talking to the vent into the next room)

domestic pardison

- - - - -

(Hardison leads Eliot to a police cruiser that Nate and Parker are already inside of. As Hardison guides Eliot into the backseat he hits Eliot head on the top of the door frame. Eliot turns and growls at Hardison)

Hardison: Walk it off. Walk… get inside. Get inside.

(Eliot gets in the car)

I love chaotic (pre)boyfriends

- - - - -

Eliot: I’m gonna beat Dubenich so bad that even the people who look like him are gonna bleed.

Parker: You won’t get within 100 yards. He knows your face. He knows all our faces.

Eliot: He tried to kill us.

Parker: More importantly he didn’t pay us.

Eliot: How is that more important?

Parker: I take that personally.

Eliot: There’s something wrong with you.

okay to be fair eliot at least is open to and listens to parker’s reasoning before concluding she’s crazy

- - - - -

Eliot: What’s in it for me?

Nate: Payback, and if it goes right a lot of money.

Parker: What’s in it for me?

Nate: A lot of money, and if it goes right, payback. Hardison?

Hardison: I was just gonna send a thousand porno magazines to his office, but, hell yeah man, let’s kick him up.

these characterizations are so on point

- - - - -

SOPHIE’S INTRO LMFAO

+ how everyone else is horrified but nate just looks entranced

- - - - -

[Flashback]

(In Paris seven years ago, Sophie is cutting a painting out of a frame with several empty frames nearby. The door burst open and Nate enters with a gun in hand)

Nate: Freeze.

(Sophie grabs her gun and shoots Nate in the shoulder. He responds by shooting her in the back. They both clench at their wounds)

Sophie: You wanker!

so are we, as a fandom, EVER going to talk about this scene ???

- - - - -

(so apparently there’s a 250 text block limit for posts on tumblr so I guess I have to make more than one post for this now. the following part will be reblogged on this post immediately after. reblog that version instead please lol)

#leverage#notable moments#leverage season 1#season 1#leverage 1.01#leverage 1x01#the nigerian job#mine

81 notes

·

View notes

Link

Note: This video won’t play for anyone outside of the UK.

“Anthony, I wanna kick off with a big one. You’re Sam Wilson, AKA The Falcon - how the heck did that happen?”

Anthony: “Erm, well, I, I got lucky. I got very lucky. I - I’ve always wanted to be a part of the MCU since the first Iron Man. And, you know, when they uh, some - saw some of my other stuff, they called me to LA and I had dinner with the Russo brothers and it kind of worked out. I was like: ‘All of you, just don’t be an asshole!’”

“That was their one note, their first note.”

Anthony: “That was it - don’t be an asshole.”

“What do you like most about your character?”

Anthony: “Uh, the fact that he’s a normal guy. You know, if you think about it, he was just a guy out for a jog, and Captain America was like: ‘You’re a good guy - I want you to be an Avenger.’ What?! Like, you know it’s ,it’s - that’s something no-one expects, That was a hell of a jog. Like, what happened if he never went on that jog? He would never have met Black Widow, who is the love of his life. He would never have got to go on adventures with Captain America, who is is best friend. And now he would never be dealing with all this craziness with Bucky. who is his arch nemesis. (interviewer laughs) All from one jog.”

“One jog. And that line: “on your left” - it must be a nightmare for you. You can never be to the right of anyone ever again.”

Anthony: (laughs once) “Very true, and its interesting because you can always tell when somebody’s about to say it. And, you know, it’s the build up, and the build up is like: ‘No, don’t say it. Should I say it? Can I say it? What would he say if I say it? Okay, ’on your left! Ha-ha-ha.’ (interviewer laughs) And it’s never a girl - it’s never a girl. It’s always some 40-year-old dude who, you know, it’s always some 40-year-old dude.”

“Yeah. I get it.”

Anthony: “If it was a pretty girl and she’s like ‘On your left’, you’re like ‘Yes you are.’”

“Good move, I’m glad it works. (Anthony laughs) Let me say this to you - would you say you might have the most uncomfortable costume in the MCU, when you’re wired up, I mean?”

Anthony: “I - I think I have the costume with the most pieces. I have about, - hoo -, one, two, three, four, five, six, seven, eight - I have like, twelve pieces to my costume. And it just goes on layer after layer after layer and it, it can be, um, a bit much but actually, it’s pretty uh, comfortable. I mean the backpack is the only off thing - that’s maybe like 15 pounds, uh, the whole piece; the harness that it goes on. But nah, I’m - I’m pretty comfortable with mine. It’s just when I’m doing stunts I usually rip through the crotch of my pants.”

“There’s this great bit in the blooper reel where you crash into the ground right in front of Robert Downey Jr as Iron Man.”

Anthony: “Right.”

“Ah, great days. (Anthony laughs) What would you say are your favourite Falcon moments on the big screen so far - and I do have suggests if you’d like them?”

Anthony: “One of my favourite moments that made me go ‘Holy shit!’ was in um, I wanna say it was in Winter Soldier. When the Harriers are coming up, and I go under the Harrier and the, the missiles are following me and I do a barrel tuck and they hit the Harrier and I come back out. For me, that was the first moment I was like: ‘This is amazing!’ Right? And my second one, my all-time, my all-time, is this first sequence in episode one. The first ten minutes. That was the second time when I saw it, when I saw myself and I went: ‘Holy shit!’ (interviewer laughs quietly) So those two are probably my top moments.”

“For me, I can’t resist the moment where you say in Civil War: ‘So, you like cats?’ (Anthony laughs) And with Bucky himself: ‘Can you move your seat up?’ (Anthony laughs) Love it. Even the: ‘Everybody’s got a gimmick now’ - you’ve got all these lovely little lines.”

Anthony: “Right.”

“Good-looking guy in the sunglasses, And what I love seeing, the behind-the-scenes footage for this new show, it’s that it’s called ‘Bromance’ on the clapper board. (Anthony laughs once) And I know you’ve been asked a million times about your friendship with Sebastian, so here’s my tack. How would you describe him in three words?”

Anthony: “Uh - boring. Introverted. Er - I feel like shy is the same thing so I won’t say shy. I’ll say boring, introverted and um, a great sense of humour.”

“Love it. I’ll accept it.”

Anthony: “But he’s literally the most boring person I’ve ever met in my life.” (interviewer laughs quietly)

“All right, between the two of you, who breaks, who corpses and laughs most on set between the two of you?”

Anthony: “Oh - I would say it’s a 50/50 split. Like, when we’re on set, and that’s why I say he, he has a great sense of humour - when we’re on set, he always does something in some kind of way to just, you know, crack me up. It’s - it’s really funny. You know him with like - there was one day when he was putting the arm on, and you know, the process of putting that arm on is quite disgusting. So, (laughs aloud, interviewer laughs silently) he’s putting the arm on the, the - so they use KY Jelly to get the arm on, right? -”

“Yeah, the lube.”

Anthony: “ - So he has to dip his arm in the KY Jelly and slide it into this arm, and he puts - and he does this (slight moving motion) and a glob of KY Jelly just goes (motions glob hitting his face, then laughs, as does the interviewer). Never fails. Never fails.”

“Never not funny. I - I would imagine the whole staring contest bit would be enough to set me off. Like, I wouldn’t be able to keep a straight face.”

Anthony: “Yeah, that was good editing because that whole sequence - we literally just went at each other for about ten minutes (laughs) and they just cut it down to what it is.”

“Love it. And I’d like to thank you on behalf of all Marvel fans for holding up and basically powering all of the gag reels for, what, close to ten years now. (Anthony laughs) Are there any ‘Cut the cheque’s’ in the blooper reel for this show?”

Anthony: “You know, I don’t know. I don’t even know. We can do a whole episode that’s just bloopers. Like, we had a lot of fun on this show, dude. There - between you know Sebastian, Daniel Bruhl - ”

“Yeah.”

Anthony: “ - Even like, there was some stuff, you know, Emily VanCamp did - it was just like - it was just co - comic gold, like just comedic gold. And none of it made - because, because we’re not doing a comedy. Like, if we were doing Guardians of the Galaxy, all that shit would be in the movie. But, I - I wish they’d take all of this stuff and cut like a one-hour comedic version of this show. It, it would be - it would break the internet.”

“Oh God, I now really, really want that. (Anthony laughs) What would you say are the weirdest, most surreal things you’ve done promoting a Marvel movie or this TV show? Because I’d like to suggest reading out thirst tweets, an escape room and mean tweets. I mean, I don’t know whether Catchphrase with J.Lo was part of that? (Anthony laughs) There must’ve been moments where you’re going: ‘Is this really happening?’“

Anthony: “I would say the, the weirdest thing, um, when we went to um, China, for, uh, Civil War, we - there are only like seven chefs in the world that can cook, uh, uh, pufferfish because of poison- ”

“Of course.”

Anthony: “So, we go to this restaurant and the chef’s like, uh, you know: ‘As, as a, as a sign of gratitude, I made you guys some pufferfish.’ And we’re like ‘Oh wow, isn’t that danger, like - that’s dangerous’, and he’s like ‘No, no. There’s only seven people in the world who can cook it and I’m one of the seven.’ So we’re like: ‘Okay.’ So we all go to eat this pufferfish and our mouth is like tingling and numb. He’s like: ‘Oh well, you know, the art is to leave a little bit of poison in so you can taste it.’”

“Great.”

Anthony: “I’m like: ‘Not a good idea, homeboy. Not a good idea.’ But Singapore, we um, we uh, got to stand - I think it was the Opera House - and they like, set the whole city on fire with fireworks. It was insane. It was literally - the entire city was on fire.”

“Amazing. God, those were the days. (Anthony laughs once) Can I ask you, would your press - you know, I know you’ve done pranks over the years, but has Nishka, your wife’s friend made an appearance?”

Anthony: (laughs) “She has not.”

“I - I love her. (Anthony laughs) I’ve got to tell you I love her. What mementos have you taken home over the course of the films and this TV show? Do you still have that poster of yourself as the Falcon up in your house?”

Anthony: (laughs) No, but I do, um, there’s - there’s a few things. Once you get into the series, you’ll see, uh, from my house, um, I’ve, I’ve - there’s a record record player. Jacked that. I’ve been trying to get - they’re fighting me on it - I’ve been trying to get my wings, ‘cos I’m like: ‘The wings have changed every movie, so you should give me the old wings.’”

“The little pigeon ones? The little quail ones?”

Anthony: “That’s what I’m saying - the little three-foot ones like that. That’s the ones I want. So, I’m working on that, uh, but our prop team, uh, my man Russell and uh, Travis, they are - the angriest little dudes on earth and they watch everything - it’s impossible.”

“Well, what do fans say to you though, typically, when they see you on the street? We’ve already discussed ‘on your left’, but do they just walk up to you and start playing Trouble Man out their phones? Like what, what are they doing?”

Anthony: “The funny thing is most of them walk up to me and think I’m Don Cheadle. (laughs) They literally go: ‘Hey man, I love you as black Iron Man!’ I’m like ‘Er...’ Or they’ll say: ‘Aren’t you the guy in Iron Man?’ I’m like ‘Err...’“

“Not so much.”

Anthony: “Like literally, once a day, someone comes up to me and asks me if I’m Don Cheadle. Which it could be worse.”

“I love those bits in the bloopers where you say - ” (You want Wesley Snipes or Denzel;. ‘Denzel.’ ‘Done. Roll sound.’ blooper plays and both laugh)

Anthony: “Two very different things, man. Two very different things.”

“Two very different things. Okay, here’s another big question. What advice would you give to your younger self, before you got this role, to prepare yourself for a life as the Falcon?”

Anthony: “Er, enjoy it. I think a lot of times I, I missed the opportunity to just step back and enjoy it. Because so many people have so many expectations of you just because they saw you in a movie. Like, you know, it’s - it’s like being a pretty girl at a bar. You know, when one guy offers you a drink, that’s cool, then the second guy, then the third guy, it’s like ‘Yo, I just wanna chill for a minute.’ You know, so a lot of people feel entitled to your time and your energy, you know?”

“I get it. I get it. And you talk about that in the show as well which I kind of love, even in the first episode - there’s that discussion of an ownership of you - ”

Anthony: “Right.”

“ - because you’re an Avenger.”

Anthony: “Right.”

“There’s lots - there’s lots of stuff in this new series which feels really, really true. How does it feel working with Malcolm Spellman about that?”

Anthony: “Um, you know what? Malcolm has a great voice as a writer, and he was 100% in tune with how I felt and, you know, what I wanted this character to, uh, convey. Uh, he was really wonderful, man. I mean, he and Kari, they held no punches. They really went at these characters and this story, and they wanted to shine the light on what it means to find your new normal. What it means to live post-Blip and how that is very similar to how we’re going to be living post-Covid when we’re all vaccinated. So they held no punches and I’m proud to say they both did a great job and Malcolm was really, really great with capturing our voices - Sebastian and mine. Uh, when we would give him notes, they would come right back spot on. And you know, it was - it was really impressive. I’ve never had an experience like that with a writer.”

“Do you guys miss, even just a little bit, Chris Evans being on set - just to get that laugh where - where he punches your shoulder and leans in a bit? (Anthony laughs) I’ve missed that so much.”

Anthony: (laughs) “Of course. Look, Chris is, you know - the three of us we were - are - very good friends and we talk all the time. Chris was always the most fun, the most supportive, the most loving human being when you spend time with him. So of course you know, we - we always want him on set, we always want him with us.”

“And what’s it like knowing that your co-star is the kind of guy that will say on, like, was it Jimmy Kimmel or Fallon? - he describes working with you like ‘riding a psychotic horse into a blazing stable.’ (Anthony laughs) And you’re like ‘Okay, cool. I’ll see you tomorrow at work then.’ (Anthony laughs)

Anthony: (after FWS clip plays and he laughs) “I can see that, I can see that. I told you, look, Sebastian is the most boring person on Earth. I’m - I literally think he sits in his living room and talks to his plant. There’s nothing; I’ve - I’ve sat outside of his room, or in the lobby, or outside the hotel, waiting for him to come out, so I can follow him and stalk him and see where he goes. I, I - I’ve never seen anything like it. He’s a hermit, so of course he would think I’m a psychotic horse; of course.” (interviewer laughs)

“I think what he does is he goes to, like, in that Bucharest scene in Civil War, there’s a big tray of plums, and he just spends the day picking them. He goes ‘This one?’”

Anthony: “Probably. Probably. He’s the only dude, when we were in Prague, he has a 106th birthday party for Bucky. That’s cool - but he, he didn’t invite anybody. So he had - he had a birthday party for himself by himself.”

“A cake, 106 candles, himself?”

Anthony: “Sebastian Stan everyone.” (claps, interviewer follows)

“On that note, Anthony, thank you so much.”

Anthony: “Thank you.”

“Have a great rest of your day. Cheers dude.”

Anthony: “Thank you. Have a good one.”

5 notes

·

View notes

Text

A Place To Call Home: Vacation

Summary: The Ackles and Padaleckis are heading to the beach for a two week long family vacation. The reader invites TJ along and is surprised to learn someone else may have beat her to the punch…

Masterlist

Pairing: Jensen x foster daughter!reader (with TJ)

Word Count: 10,300ish (whoops)

Warnings: language, little implied smut

A/N: Takes place approximately 2 years after the end of A Place To Call Home and after the reader has finished college...

“Hey guys,” asked your dad quietly, skirting back from first class squatting down in the aisle, looking at both you and TJ. “How’s it going back here?”

“Arrow stole my window seat and Zeppelin insisted TJ watch Transformers with him so...lovely,” you said, shaking your head at TJ who was sandwiched between Zepp and Shep across the aisle.

“Mom and I and the other guys really appreciate you two watching the little guys on the flights for us,” said Jensen, giving you a smile. “So much so we figure before you two go insane back here, we’d let you know that the villa we’re staying in has a separate cottage. We thought maybe you and TJ would want to maybe take that for-”

“Yup,” you said nodding your head. “This is the best flight ever. We’ll even watch ‘em on the way home, won’t we TJ?”

“Yes. A million times yes,” he said with a fast nod, your dad chuckling.

“Didn’t think you two would mind a little privacy,” he said, giving you a smile and raising an eyebrow at TJ. “Appropriate privacy.”

“Of course,” he said. You shook your head, scratching the back of it when your dad looked back to you. He rolled his eyes and smiled as he stood up.

“Alright, we’ll see you guys in a few hours,” he said. “Have fun sibling sitting.”

“Do we have all of ‘em?” asked Jared, yawning as your parents grabbed the rental cars at the airport. “How many kids are there? I forget.”

“Six small, two large,” said Gen. “So, eight total.”

“We’re graduated from college and we still fall in the kids category?” you asked, waving you to you and TJ.

“I think one of the large children is acting up again,” teased Jared.

“I put Jared and Jensen in the large children category, hun,” said Gen, giving Jared a smirk. “Still debating on TJ at the moment although he’s more mature than those two put together.”

“Come to the dark side, TJ. It’s fun here,” said Jared with a nod, watching you scowl at him.

“Yeah but Jensen…you know...” said TJ.

“Fair point,” said Jared, corralling Odette when she started to wander off. “Everyone under 6’ 5” must stay in a ten foot vicinity at all times at the airport, Ms. Odette.”

“Dad, it’s pretty outside,” she grumbled, waving her arms around. “I wanna play. Please?”

“As soon as Uncle Jensen and Aunt De get the cars, we are going to the resort and we can play,” he said. “Promise.”

“So, right now,” said your dad, handing a set of keys to Jared and one to TJ. “Small kids with your parents, luggage goes with the big kids.”

You saw Tom and JJ look at one another, Jensen rolling his eyes.

“Over twenty is a big kid today, kiddos,” he said.

“But I’m ten and Tom’s eleven,” said JJ. “Double digits.”

“It’s cool if they ride with us,” said TJ. “Really.”

“Alright, alright. Let’s just get there so we can relax for minute,” he said.

“Awesome,” you said, TJ smirking the whole time as you put your luggage into the back of the open top jeep, JJ and Tom practically bouncing out of their seats.

“Alright, buckle up and we will be there in about half an hour,” said TJ.

“You two good back there?” you asked. You got hums and a pair of thumbs up, TJ laughing as he pulled your sunglasses down over your face. “Well let’s get going. I am so driving this next time we go out by the way.”

“Might have to fight me for it,” teased TJ. It didn’t take long to get away from the airport and start to smell the ocean in the air and feel the sun on your skin. It hadn’t been hard for your dad to convince you to take this year’s big vacation to the caribbean after last year’s fiasco. It had been his choice to try camping and after one night of roughing it with three bouts of stomach bugs later, you packed up and checked into a hotel not too far down the road and spent the rest of the two weeks relaxing with a nice room to come back to at the end of the day.

Unfortunately TJ hadn’t been able to get the time off with his internship to come with you but now he was working at the firm under the guy that had ironically designed your parents house, and they were very flexible with time off.

“I’m so glad my parents said yes that you could come this year,” you said, glancing over at him as he drove, his left arm hanging on the edge of doorsill, a warm breeze in the air carrying a pretty scent through it.

“I’m glad they invited me,” he said with a smile.

“They invited you?” you asked. “I invited you.”

“Oh. I remember your dad asking me if I wanted to come like a week before you did. I was away for spring break at my parents and he called me up,” he said. “I figured you were excited and wanted to talk about it in person was all.”

“I talked to them about it after...they invited you...now I’m suspicious,” you said, peering over your shoulder at the SUV behind you your dad was driving.

“I’m sure they just wanted to know for planning rooms and stuff,” he said.

“Or he could like...be planning to murder you in foreign country,” you said.

“Seriously?” said TJ. “Your little sister and like cousin are in the car.”

“We watch lifetime movies when Y/N babysits,” said Tom.

“She’s got a point, TJ. The perfect crime,” said JJ.

“These children are going to be vandals when they grow up thanks to you,” said TJ, shaking his head with a smile. “What else does Y/N have you guys watch?”

“I let ‘em watch Supernatural sometimes,” you said, TJ’s jaw dropping. “So what if the rule was like thirteen? They can watch some stuff. Like bloody mary. Ain’t that right JJ? You loved that one.”

You spun around with a smirk, JJ shaking her head, Tom rolling his eyes.

“Or like hookman,” you said, his head dropping back. You laughed and TJ started to giggle.

“Vandals and traumatizing them. Best big sister ever there,” he teased.

“Dude, that stuff’s in the handbook,” you said, reaching back and ruffling both their heads. “They know I love ‘em. It’s our little secret.”

“What about like...the stuff that’s a little more...grown up?” asked TJ.

“No. No. That’s why you watch the show ahead of me now. I can not have another Jared and Gen season 4 couch incident,” you said, shaking yourself out. “Seeing dad was bad enough but that was full on…”

“What?” asked Tom.

“It’s an episode you’ll never see and for good reason,” you said. “You’ll thank me someday.”

“Hey, you know what? You guys are pretty lucky to have Y/N. I’m an only kid. I would have loved having a big brother or sister around. It can get pretty lonely,” said TJ.

“But now you got us!” said JJ. TJ laughed and agreed with her but you only bit your bottom lip. You didn’t realize you were still smiling when you got to the resort, your dad grinning at you when he saw your face.

“Somebody looks like they’re in love,” he said, Arrow taking off with your mom ahead of him.

“Yeah,” you said, grabbing you bag from the back, helping JJ with hers before you gave her a hug. “Pretty awesome little sis right here.”

He was quick to take a picture of you two, nudging you to hold back once everyone started heading inside.

“You okay?” he asked.

“Yeah. We were just talking in the car and TJ was talking about siblings and how the kids are lucky to have them and she made a comment like TJ’s part of our family so he’s got ‘em too. I don’t know. I’m…” you said. “Why’d you invite him on vacation?”

“It was a family vacation,” he said. “He’s part of the family.”

“Really?” you asked, your dad nodding with a smile.

“You’ve been best friends with the guy for four years, you’ve been dating for two and he comes over for dinner like six days a week. I think it’s okay if we call him part of the family at this point,” he said. You smiled, getting one in return. “I assumed you wanted him to come.”

“Oh, I did,” you said. “S’nice that you invited him is all.”

“I know. I’m also not going to murder him because yes, I watched that lifetime movie too,” he said.

“Well good cause then it’d be a whole thing to deal with..” you said, getting a chuckle from him.

“It’s why we act and make beer in this family. Whole lot easier,” he teased, tilting his head at you. “Speaking of making beer, mom says she’s creating a new position at the brewery. Full time, Monday to Friday. Someone to help with the business and design side of things, run social media. It comes with benefits, pretty kick ass salary, very flexible time off…”

“I told mom I’m taking it,” you said. “A big part of my duties will also be designing the farmhouse for the new restaurant and getting that up to code. I get to use that degree for something after all looks like.”

“You’re going to be a boss, not just a beer server anymore. You want that?” he asked. “You’ll be making decisions with all the owners.”

“It’s sort of called The Family Business so it makes sense that family runs it,” you said. “I want this.”

“Oh my...it only took you like five years to get that the plan was for the kids to run it someday,” he said with a laugh. “Whew. We were getting nervous for a minute there.”

“You guys were waiting for me to ask about a job?” you said. He shrugged, giving you a smirk.

“There’s always been a job there for you. Duh. Of course we were waiting for you to ask,” he said.

“You two are partially evil you know,” you said.

“But we’re nice evil, kiddo,” he said, giving you a hug, getting a strange look from a guy walking by. “Come on, let’s go be weird inside.”

“I don’t know if it’s possible for you to not be weird that long. You might actually combust from restraining yourself,” you said, smiling at him.

“I learned it from watching you, tall munchkin,” he said. You rolled your eyes and headed inside, handing over your bags to someone before everyone was being led off to your own private corner of the resort.

You parents and the Padaleckis thanked the people that brought your bags, you and TJ watching the kids take off to explore the villa.

“Guys, guys,” said your mom, Gen whistling before they got too far. “You three boys are sharing a room on the right. You three girls are right next door to them. Tom, JJ, us adults will be upstairs, Pads on the left, Ackles on the right. Any problems, come get any one of us, okay?”

“Where are TJ and Y/N going to sleep?” asked Arrow.

“Backyard,” said your dad. The kids scrunched up their faces, Jared nodding. “I know, sucks for them. But they’ll just be sleeping out there so during the day, those guys are still in charge too. Okay now take off you scoundrels. And no going near the pool or the beach without an adult out there.”

All six pairs of heads nodded before they were gone to their rooms and you were tugging TJ outside. You hummed as you both spotted the short path to the cottage off to the side.

“It looks beautiful,” you said, both of you wide eyed as you entered. There was a small kitchen and sitting room in the front of the house, and a huge bathroom and bedroom with a perfect oceanfront view in the back, your bags already inside. “Wow.”

You stepped outside onto the small deck out there, looking around and seeing nothing but beach.

“This is so private. Isn’t it gorgeous?” you asked, looking back over your shoulder.

“It is,” he said, a hint of pink on his cheeks.

“Are you blushing TJ?” you teased.

“You should see how beautiful you are,” he said, smirking as he stepped out beside you. “That’s a very pretty sundress for a girl that doesn’t like dresses.”

“It’s the caribbean,” you shrugged, TJ humming as he wrapped his arms around you, resting his head on your shoulder as you both stared out. “Want to go swimming?”

“Mmm, for sure,” he said, kissing your cheek before he pulled back. You went inside, digging through your bags for your swim gear, TJ with swim trunks in hand when there was a knock at the door. “Come in.”

“Hey,” said your dad, raising an eyebrow when he walked inside to the bedroom. “Wow, this place is nice. Just wanted to let you guys know we were thinking be ready to go for dinner at six? Little formal, not too formal. You probably need a dress shirt or polo TJ, a dress or nice shirt for you, honey.”

“Sounds good. We were going to go for a quick swim,” you said.

“Alright. Be safe. I think that’s the plan for us too. Oh and try not to spend all your time tucked away in here,” he teased, glancing at you and then your open suitcase. You kicked it shut, turning and looking at a picture on the wall when you saw him realize what he’d seen.

“Isn’t that a great picture?” you said. “That’s a great-”

“It’s a box of condoms. Guess what? You’re not the only one to pack some,” he said. You closed your eyes and shook your head, a loud laughing echoing from him. “Well I know where to come if I run out.”

“Sorry, I think...nope I definitely hear mom calling me right now,” you said, grabbing your phone. “I should totally take this and get away from here asap.”

“Oh so you don’t want to hear that you guys can order whatever you want for room service from here? Like we're paying for everything?” he teased.

“...Continue,” you said.

“Don’t blow our retirement fund but you guys want some wine, late night dinner, go for it. You’re both responsible,” he said. “Okay? Have fun on your swim guys.”

“Alright,” you said, your dad pausing on his way out, turning to TJ before he shook his head, biting back his comment.

“I need a beer,” he sighed. “Six sharp for dinner you two.”

“Gotcha,” you said, groaning when he left. “Oh my god. Never answer the door again.”

“I’m okay with that,” he said, peeling off of his short sleeve henley and shorts, shimmying out of his boxer briefs as he started to pull on his swim trunks.

“Remember the first time we were naked in front of each other?” you asked, leaning against the wall as he pulled up the shorts.

“Yes. I remember a whole lot of avoided eye contact and awkwardness and then I actually looked at you and thought, fuck she is smokin’ hot and beautiful? How’d I land this girl?” he said, walking over, peeling the straps off your dress until it slid off your body.

“You were always hot...then you got all muscly,” you said, patting his arm with a smirk as you grabbed your bikini and started to change.

“Well you do have a thing for big arms apparently,” he teased.

“True. I got a thing for sweet boys too,” you said, spinning around and showing your back to him. “Tie me up?”

“Y/N, you scoundrel,” he fake scoffed as you smacked his chest. He tied the strings together across your back and behind your neck, brushing your hair behind your ear when you spun around. “I love you, dork.”

“I love you, dork,” you said, giving him a peck on the nose.

“No nightmares last night?” he asked. You shook your head, TJ smiling wide. “S’been awhile since you had one. Must be a new record.”

“It is,” you said, resting your head on his chest. “Been feeling pretty good since that meltdown at finals week. I feel...safe.”

“I wouldn’t let anyone hurt you,” he said. You giggled and looked up at him. “S’why I got big and strong you know.”

You raised an eyebrow, TJ shrugging.

“Seriously? I thought you were trying to impress my dad or something which you totally don’t have to. He loves you,” you said.

“I like knowing I make you feel safe,” he said. “I like knowing I can keep you safe if I have to and are you blushing Y/N Ackles?”

“Shut up,” you laughed, grabbing his hand. “Come on, let’s go check out that pool.”

“Honey?” asked your mom from her chair by the pool, TJ showing Zepp how to flip into the water along with your dad at the other end. “Did TJ start working out more recently?”

“Your boyfriend’s like hot, Y/N,” said Gen, your mom whacking her arm. “What? He is! I remember him being smaller.”

“He joined crossfit about six months ago,” you said. “I tease him about being a jock now.”

“I guess we’ll have to see if JJ follows in tradition of choosing a man that goes smaller to strong,” joked Gen. “Always sweet though.”

“She probably will,” said your mom. “I think we got a few more years before boys come into the picture. Let ‘em enjoy being kids.”

Gen hummed and stood up with a stretch.

“True. So glad I got a while before Odette’s dealing with that. It’s getting late. We better get ready,” she said.

“Why don’t you wear that white dress with the little bowtie front?” asked your mom as she stood up. “That’s plenty pretty for the restaurant. I think TJ will like it.”

“He likes everything I wear,” you said. “Like everything.”

“They normally do,” she said. “We’ll meet you out front, okay?”

“Okay. We’ll be there.”

You gave TJ a smile at the table, looking him up and down in his white dress shirt and khaki shorts. You were vaguely listening to the conversation your parents were having, the kids seemingly passed out for the most part after the day of travel.

“I don’t think they’re listening to us,” you heard, your head whipping around, TJ’s doing the same. You saw four pairs of smiles as they were standing up. “We’re going to head back to the house guys.”

“Alright,” you said, some of the kids getting treated to rides back on the walk, Arrow walking over to TJ with a smile.

“You want a ride, pipsqueak?” he asked, bending down and scooping her up. “Did you like dinner?”

“Yeah,” she yawned. “You smell good.”

“It’s cologne,” he said.

“Daddy wears that sometimes,” she said, resting her head on his shoulder as you took his other hand and started the walk back. “TJ?”

“Mhm?”

“Can we build a sandcastle tomorrow?” she asked.

“Sure,” he said. She nodded and started to snore after a minute, TJ chuckling quietly.

“It seems you have a way with the Ackles women,” you said.

“Oh yes. You all fall asleep on me,” he said. “It was a long day for a seven year old.”

“Thanks for carrying her,” you said.

“S’no problem.”

“Thanks guys,” said your dad after you dropped off Arrow in her room. “We were going to have a drink by the pool if you want to join us.”

“Sure,” you said when TJ nodded. “I want to put on something warmer first.”

“No rush,” he said.

The second you sat down on the bed to take off your sandals though, you groaned, TJ doing the same.

“Sleep?” you asked.

“Sleep,” he said.

You grabbed your phone and texted your dad, tucking yourself into TJ’s side before he could even respond.

“Morning,” hummed TJ when you stirred awake. You stretched out, sighing into the sheets. “This bed is amazing.”

“I know,” you said, rolling over to catch the clock. “It’s already ten. We should probably get up.”

“Tomorrow we should get breakfast in bed,” he said.

“I like that plan,” you said. “Let’s go grab something from the resort and then we can head down to the beach.”

“Alright, alright,” said your dad, bending over and putting his hands on his knees. “Dad needs a break.”

“What are you, old, Ackles?” teased Jared, kicking around the soccer ball more with you and JJ.

“Yes and I’m not twisting my ankle two days into this thing,” he said with a huff. “Beer break.”

“I’ll take one of those,” you said.

“Beer, beer, lemonade,” said Jared, pointing at JJ, getting a nod. “Hey, Gen, De! What do you guys want for drinks?”

“We’re a delivery service now?” said your dad.

“Can I get a mojito?” asked your mom.

“I’ll have one too!” said Gen, Odette asking for grape juice.

“Let’s go find a waiter,” asked your dad. You headed more towards the resort area and eventually found one, getting everyone’s orders in as they said they’d send them over for you. You and your dad took a break at the resort bar in the air conditioning, glad to be out of the sun for a minute.

“JJ’s getting good at her dribbling, better than me now,” you said.

“I know. I could handle when you were better but the ten year old kicking my ass makes me question the old man comments,” he said.

“You’re barely 46, dad,” you said.

“Hot 46,” said a pair of women that walked past, giving him a wave.

“I think I threw up in my mouth a little,” you said.

“Hey, I’m hot 46,” he said with a smirk, puffing his chest out.

“You’re something alright,” you said, laughing when the fruitiest and brightest pink drink you’d ever seen was sat down in front of your dad.

“Courtesy Mr. Hanover,” said a waiter appearing from nowhere, a double of whiskey set down in front of you. The waiter questioned himself but you took the whiskey, smiling at your dad as the waiter left.

“Careful. I think TJ might like you,” you teased.

“Hey, mine came with a little umbrella,” he said, plucking it out and sticking it in your hair. “You guys crashed before us last night.”

“We were tired. Mom mentioned bonfire tonight?” you asked.

“Mhm,” he hummed, sucking on the straw until you saw half of it gone in ten seconds. You grabbed it away and asked for some water for him. “Hey, I’m thirsty.”

“What are you? Freshman on her first spring break? That thing has so much alcohol in it,” you said.

“Tastes like kool aid to me,” he said, taking a sip of the water, reaching for his drink again when you pulled it away.

“Do I have to have the talk with you?” you asked. “Pace yourself?”

“To use your words from that conversation, I won’t let the boys take advantage of me,” he deadpanned, cocking his head as wiped the sweat off your face. “So how’s Mr. TJ enjoying himself?”

“He’s good. I think he’s a little awestruck. He forgets we…” you shrugged.

“Have money? Well that’s because we don’t give you guys everything you want,” he said. “And you hate shopping thank god.”

“You gave me what I wanted,” you said, taking a sip of the pink drink, catching the soft smile on his face.

“We could live in a cardboard box and you’d be happy kiddo. You got different wants than most well off twenty somethings,” he said.

“I know,” you said, swinging your feet off the end of the bar stool, one of your flip flops falling off.

“Proud of you,” he said with a smile.

“What’d I do?”

“Just proud of you is all,” he said with a shrug. “You’re getting all grown up.”

“Yeah. Still feel like JJ’s older than me sometimes,” you said, his head cocking. “She doesn’t hesitate. She goes for stuff and I still overthink things so much.”

“Well...first off she’s ten so her problems consist of who sat next to who at lunch and the fact she can’t braid her hair,” he said. “You had slightly different priorities at ten. You missed that phase.”

“I can’t even braid my own hair good,” you mumbled.

“Y/N,” he grumbled.

“I know,” you said.

“Honey. Why do you think we go on big family vacations? We want you to get to have those chances to be a kid. We’re all just big kids. Case and point, you know what we get up to when the little kids aren’t around and someday they’ll get in on the secret too,” he said.

“Just feels funny sometimes,” you said. “I feel like a fake grown up, you know?”

“Yup. One hundred percent yup,” he said, taking his pink drink back. “Fake it til you make it.”

“Okay, I think we get you back to the beach before I have to divulge this new beverage of choice information to Uncle Jared,” you said.

“I will disown you,” he said

“No you won’t,” you said with a smirk, grabbing the drink and chugging the rest of it down.

“Got me there,” he said. “This time, you’re on my team.”

“Hey, Y/N?” asked JJ while you walked up to the house from the fire you were having on the beach that night.

“Mhm,” you hummed, holding open the door for her before she took off to the bathroom. You headed to the kitchen and started to grab some snacks and drinks to bring back down. You were nearly packed up when she came back.

“Can I ask a question about being brave?” she asked. You spun around, giving her a smile.

“Being brave? Isn’t that more dad’s department?” you teased. “Yeah, shoot. Everything okay?”

“Um...well...I didn’t want to come up to the house by myself,” she said. You tilted your head as you headed out the backdoor, JJ a little close as you walked across the deck area. “I don’t like the dark.”

“I don’t like the dark either,” you said. “But I do like nighttime.”

“Isn’t that kind of funny?” she asked.

“A little,” you said, slowing your walk back, stopping when you were halfway between the house and the beach, taking a seat on the step. She sat next to you, lifting her head up when you looked up. “S’quiet at night. Peaceful.”

“Stars are pretty,” she said.

“Yeah, they are,” you said, buming her shoulder. “You know, it’s okay to be scared of the dark, especially places you don’t know. This place is safe though. You don’t have to be scared here.”

“I know. I keep waiting to get older so I’m not scared of stuff, like how mom and dad let you do stuff by yourself and you don’t have to ask permission to sleepover TJ’s,” she said.

“I’m a lot older, JJ,” you said. “It’s part of growing up...and part of that is learning you don’t ever stop being completely scared of stuff. You learn more though so it doesn’t seem so bad.”

“Yeah but how are you brave?” she asked.

“Only time you can be brave is when you’re afraid,” you said. “It’s like how dad used to be afraid of public speaking.”

“No he didn’t,” she scoffed.

“Yeah, he did. But he did it, even though he was scared, and now he has so much fun at conventions. Sometimes it’s just something that takes time, like not being afraid of the dark,” you said, looking around. “Like how it’s pretty dark right now but you don’t seem scared.”

“I guess...I’m not,” she said, looking around, giving you a smile when she turned back.

“See? Nighttime ain’t so bad,” you said.

“Yeah, it’s pretty,” she said with a nod, staring at you, that same look she’d been giving you more and more lately.

“JJ, if you want to ask a question, go ahead,” you said softly.

“If something ever happened to mom and dad...would me and Ro and Zepp go to a foster home like you did?” she asked. You smiled and shook your head, glancing down at the beach.

“No. No. Mom and dad...they have it all squared away so grandma and grandpa would take care of you guys and I would be a guardian along with them,” you said.

“A guardian?” she asked.

“Yeah. It means I’m an adult, not your parent, but I’ll take care of you like a parent would. Before I was adopted, mom and dad were like guardians for me,” you said. “You’d stay at home, same school, all that.”

“You’d take care of us?” she asked.

“I’m your big sister. I’d do anything for you guys,” you said, giving her a hug.

“Why’d your mom and dad not do that for you so you didn’t have to go to foster care?” she asked.

“I didn’t have much for blood relatives. My parents were only kids and my other grandparents were all gone before I was born. But they had a plan, some of their friends said sure if something ever happened to them they would take care of me,” you said.

“They lied?”

“No, I don’t think they lied,” you said, leaning back against the step behind you, propping your elbows up. “They just...weren’t prepared to take care of a kid.”

“So you went to a foster home?” she asked.

“After I got out of the hospital, yeah,” you said with a nod.

“Was it scary?” she asked quietly. “The car crash?”

“I don’t really remember a lot from that night. I hit my head in the accident so stuff is fuzzy. But I remember glimpses from inside the car and yeah, it was scary. It was really scary,” you said.

“Who took care of you?” she asked.

“There was this police officer. Dougie. He was probably Uncle Jared’s age. Big strong guy but super friendly. I crawled out of the car around the time he got there. It was pitch black and raining and I was crying and everything hurt...and he just picked me up, sat me down in the backseat of his car with him and he was just quiet. He put a blanket around me and sat there and held my hand and he never left my side until we got to the hospital and the doctor’s had to look at me. He even came to visit me the next day,” you said. “Other people were there and stitched me up but Dougie took care of me that night. I can remember Dougie.”

“What happened when you got better?” she asked.

“Well I met with some people when I was in the hospital, including Cole,” you said. “They went over some stuff with me. Cole went out of his way to help with all my parents stuff and arrangements and all that. A week after the accident, he took me to my first foster home. There were about eight other kids there,” you said. “I had to share a room with three other girls. All I wanted to do was cry so that’s what I did.”

“But then you got happier?”

“No,” you said, shaking your head. “I didn’t get happier until I came to our house. I didn’t want to admit it but that first day, I knew mom and dad were different and they were good, all you guys were.”

“I remember when I got in trouble that time, when I told you to go away around Christmas?” she said. “Dad said you had mean mom and dads before.”

“You know he wasn’t talking about no hugs and kisses, now, huh,” you said. She nodded, looking over at you. “Someday I’ll tell you more but you’re too young right now for that.”

“I won’t tell anyone,” she said. “Promise.”

“No, kiddo. I get that. I want you to-”

“Mom and dad are good so I’m not afraid,” she said, blinking at you a few times. “Just a little. Please?”

“...I used to be very afraid of touch, from guys, like dad. My first birthday party, when I’d been here a week, he held my hand to try and walk with me to the kitchen and I ripped right out of it because I was afraid...because that’s what I learned in foster care. Not all of them were like that and I do not want you to have the wrong impression. It helps a lot of kids. It helped me with finding mom and dad. But some places are bad and someday you can learn why I ended up in those ones but-”

“If you were in bad ones, why’d you come to us?” she asked.

“Because Cole helped me and when they tried to make me leave, stuff happened and I got to stay home,” you said.

“You were afraid of dad?”

“That was a long, long time ago,” you said, smiling as you heard a whistle from the beach. “But he was slow and gentle when I’d forgotten that’s how you’re supposed to be treated. We have really amazing parents, JJ. Even you helped me way back then.”

“Me? What’d I do?”

“Honestly, I have no idea. Just know I love you, squirt,” you said, giving the top of her head a kiss. “You want a piggyback ride?”