#debt repayment

Text

She did that

Even though it may be sad, many of us are starting to realize that student loans are not going to be paid off. Before the pandemmy I had over $16,355 in student loans. And like many others I didn’t receive a degree from the loans I took out. After talking with a neighbor and just thinking about my life. I decided to start paying them while they had no interest. I started paying off my debt in March. Keep in mind I am not a high earner (yet) and as of this day 6-15-23 I only have $6,957 left to pay off. I worked so much overtime. I didn’t buy new clothes. I don’t have a sugar daddy. I didn’t side hustle myself to death. I didn’t start a business. I didn’t scam anyone. I JUST WORKED MY 9-5. It was hard, but I will be done paying of my loans before September. I will be writing a post of how and why I decided to take this path. I may even start posting on TikTok. I want to be more open and I stepped away from this platform because I was struggling with some personal issues. Idk if anyone will read this, but if anyone does I want to just say, just start! Whether it’s student loans, taking charge of your health, making meaningful relationships. Just start you’ll mess up and when you do keep going. We’re all human, mess ups happen, and even giving up temporarily by taking breaks. But don’t don’t give up forever you got this! Till next time. Level Up on a Buck, but don’t stay stuck! >>>>> NEXT MANIFESTATION, OR MONEY GRAB?

#NextLevel#Next Level#Level Up#leveling up#level up on a buck#level up advice#debtfreejourney#debtfree#debtmanagement#personal debt#student loan#student loans#debt repayment#more money#money monday#money in the bank#make that money#money#Budget#cash#just girlboss things#bosslady#self sabotage#self love#self care#self improvement#self esteem

11 notes

·

View notes

Photo

Debt Payoff Tracker - Free Printable Digital Template

Download Here

#free#tracker#debt#debt payments#payoff#debt repayment#finance#budget#budgeting#free printable#printable template#template#printable#digital#digital template

30 notes

·

View notes

Text

17 Money Secrets to Help You Become a Millionaire

Hey there, future millionaire! Do you dream of having lots of money one day? Well, guess what? It’s not impossible! In fact, I’m here to share 17 secrets about money that can help you become a millionaire. Sounds exciting, doesn’t it? Let’s dive in!

The earlier you start saving and investing your money, the more it can grow. It’s like planting a seed that grows into a big tree over time.

#personal finance#money management#wealth building#financial goals#saving#investing#budgeting#debt repayment#multiple income streams#emergency fund#financial education#wise investments#tax planning#mindful spending#technology tools#networking#market volatility#financial advice#patience#financial success.

2 notes

·

View notes

Text

Debt-Free Living: Proven Tactics to Eliminate Financial Burdens

Introduction

Living a debt-free life is a dream for many, but it can often feel like an unattainable goal. The burden of debt can weigh heavily on our shoulders, affecting our financial stability and overall well-being. However, with the right strategies and tactics, it is possible to eliminate those financial burdens and achieve a debt-free lifestyle. In this article, we will explore some proven…

View On WordPress

0 notes

Text

Transform Your Finances in 2024: 8 Powerful Financial Resolutions to Follow

Powerful Financial Resolutions to Follow

In 2024, it’s time to reflect on the past and pave the way for a brighter future in work, health, and, most importantly, finances. Seize the opportunity to take charge of your financial destiny by setting meaningful New Year’s resolutions. In this guide, discover eight financial resolutions that will propel you towards a more prosperous and secure…

View On WordPress

#budgeting#credit score#debt repayment#financial future#financial goals.#financial literacy#financial resolutions#financial stability#goal setting#investment portfolio#New Year&039;s resolutions#personal finance#progress monitoring#retirement planning#wealth management

0 notes

Text

Politics, Barbados. PM Mia Mottley has to exchange Birth Certificates for Debt Repayment. The bottom tier (pyramid) provides that stability.

https://youtu.be/3ydqtwdgm_w

youtube

If you can be persuaded to vote (give away your power), you should follow all ensuing directives. Naked!!

Like. Share. Subscribe. Comment on YouTube.

0 notes

Text

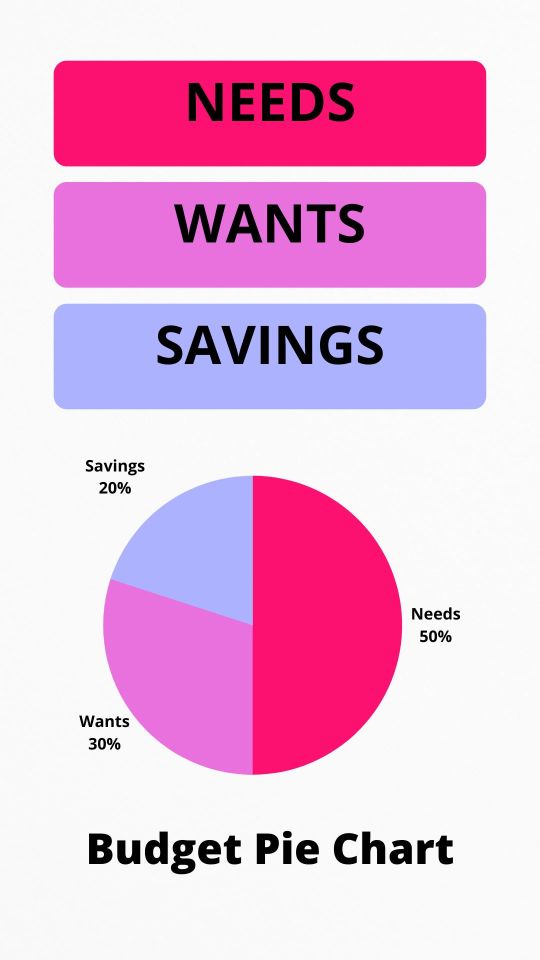

What is the 50/30/20 rule?

The 50/30/20 rule is a simple budgeting method that can help you to reach your financial goals. It divides your after-tax income into three categories:

50% for needs

30% for wants

20% for savings and debt repayment

Needs are expenses that you must pay in order to live, such as housing, food, transportation, and utilities.

Wants are expenses that are not essential, but that you enjoy, such as…

View On WordPress

0 notes

Text

“Whoever has something belonging to someone should return it and not think about the disgrace of this world, because the disgrace of this world is less than the disgrace of the Hereafter.” -Hazrat Muhamad SAWAW [Nehjul Fasahat]

For more beautiful quotes please visit:

#islamic quotes#islamic posts#islam#deen#islamic knowledge#prophet muhammad#Hadees#Hadith#repay#honesty#debt repayment

0 notes

Text

The Allure of MSME Loans: Why Business Owners Choose Them

Among the array of funding options available, MSME (Micro, Small, and Medium Enterprises) loans have emerged as a preferred choice for business owners. In this article, we'll delve into the reasons behind the allure of MSME loans and why they are a popular choice in the entrepreneurial world.

Fueling Business Expansion

One of the primary reasons entrepreneurs turn to MSME loans is their ability to fuel business expansion. Whether you're a small startup or a medium-sized enterprise, accessing additional capital can be a game-changer. These loans provide the financial boost needed to scale operations, hire new talent, invest in equipment, and explore new markets.

Flexible Usage

MSME loans offer entrepreneurs flexibility in how they use the funds. Whether it's working capital needs, purchasing inventory, upgrading technology, or marketing initiatives, these loans can be tailored to various business requirements. This adaptability is a significant advantage for entrepreneurs with diverse needs.

Also Read: Alternative Investments: Exploring Beyond Stocks and Bonds

Competitive Interest Rates

Compared to alternative lending options, MSME loans often come with competitive interest rates. This affordability makes them an attractive choice for business owners who want to access capital without incurring exorbitant interest costs. The favorable terms can help maintain healthy profit margins while repaying the loan.

Collateral or Collateral-Free Options

Entrepreneurs appreciate the variety of MSME loan options available. Depending on their risk appetite and asset base, borrowers can opt for collateral-backed loans or collateral-free loans. Collateral-free loans, in particular, allow businesses to access funds without putting assets at stake.

Abhay Bhutada, MD of Poonawalla Fincorp, emphasizes that MSME loans provide a solution for immediate financial requirements, offering repayment durations ranging from 12 to 60 months. This inclusivity in loan terms benefits startups and fledgling enterprises by providing them with fair and accessible funding prospects.

Fast Approval and Disbursement

In the fast-paced world of business, timing is critical. MSME loans often offer swift approval and disbursement processes, enabling entrepreneurs to seize opportunities or address urgent financial needs promptly. This speed is especially beneficial when capital is needed to capitalize on a time-sensitive business endeavor.

Also Read: Unleashing eKYC's Potential in Finance

Extended Repayment Tenures

Business owners appreciate the extended repayment tenures that many MSME loans offer. This feature reduces the monthly repayment burden and allows for better cash flow management. Entrepreneurs can choose tenures that align with their business's revenue cycles and financial stability.

Conclusion

In the world of entrepreneurship and investing, accessing capital is often the catalyst for business success. MSME loans have earned their place as a preferred choice for business owners due to their flexibility, affordability, and accessibility. Entrepreneurs can harness the power of these loans to drive business growth and achieve their entrepreneurial dreams. Due to their increasing demand, financial organizations such as Spandana Sphoorty Financial Limited, under the leadership of Shalabh Saxena, are considering the introduction of MSME loan offerings.

0 notes

Text

Mastering Debt Freedom: The ABCs of Getting Out of Debt

In today’s world, many individuals find themselves burdened with debt, making it essential to understand the ABCs of getting out of debt. Whether you are facing credit card debt, student loans, or any other financial obligations, this article aims to provide you with a detailed guide on how to regain control of your finances. By following these steps, you can pave the way to a debt-free future…

View On WordPress

#financial discipline#debt reduction#money#debt repayment#debt#debt consolidation#debt management#debt-free living#debt trap#debt-free journey#how to manage debt#debt relief#debt free#money management#financial freedom#credit card debt#how to achieve debt free life#personal finance#financial planning#financial literacy#budgeting

0 notes

Text

Navigating tax equity in the US presents its fair share of challenges. However, by skillfully leveraging tax incentives and mastering the system's intricacies, one can unlock the full potential of renewables. It's a clever way not only to drive economic success but also to make a significant positive impact on the environment. 💚💼 Making Green by Going Green!

✨ What sets this model apart? ✨

🔹 Tailored financial analysis that precisely addresses the needs of PV farm projects.

🔹 Efficient management of capital accounts and careful consideration of tax basis.

🔹 Flexibility to explore back leverage loan options for optimized financing.

🔹 Seamless allocation of income and cash flow/waterfall among partners.

🔹 Reliable projections to empower confident decision-making.

🔹 Robust reporting and analysis capabilities.

👉 Access the model now to unlock the full potential of your PV farm partnerships. Let's propel the renewable energy revolution forward!

#Equity financing#Equity allocation#Energy sector#Energy production#Energy pricing#Energy policy#Energy market#Energy efficiency#Energy consumption#Discounted cash flow#Depreciation#Decision-making#Debt service#Debt restructuring#Debt repayment#Debt financing#Cost analysis#Cash reserves#Cash management#Cash flow projections#Cash flow optimization#Cash flow modeling#Cash flow management#Cash flow liquidity#Cash flow forecasting#Cash flow analysis#Capital structure#Capital investment#Capital accounts#Budgeting

0 notes

Text

Debt Management: Strategies for Paying Down Your Debt Faster

Debt can feel overwhelming, but with effective strategies and a plan in place, you can take control of your financial situation. In this article, we will explore strategies for paying down your debt faster and provide practical tips to help you achieve financial freedom.

Assess Your Debt and Create a Plan

The first step in debt management is to assess your debt and create a comprehensive plan.…

View On WordPress

#Budgeting#Credit Card Debt#Debt Consolidation#Debt Management#Debt Reduction Strategies#Debt Repayment#Debt-Free Journey#Financial Planning#Paying Down Debt#Student Loan Debt

0 notes

Text

A GUIDE TO BECOMING DEBT FREE QUICKLY

Paying off a loan can be a long and difficult process, but there are ways to speed up the process and become debt-free faster. Here are some tricks that can help you pay off your loan faster:

Make bi-weekly payments: Instead of making monthly payments, try making bi-weekly payments. This way, you end up making one extra payment a year, reducing the interest you pay over time and helping you pay…

View On WordPress

#automatic payments#avoiding new debt#bi weekly payments#budgeting#debt repayment#extra payments#financial independence#loan payment#personal finance#refinancing

0 notes

Text

Victory!!!

I paid off my Ally loan in full yesterday! I will now be working on completing my capital one card next!!!

0 notes

Text

actually if u look like this, dm me kksksksks

#rororogi mogera#infiltration! debt repayment rta of a spy on the edge of a cliff#brain go brrr#jk don't dm me unless we've already talked#but ah look at the tired eyes#eeeeeeeee

22 notes

·

View notes

Text

Budgeting - What is the best way to budget my money?

Budgeting is the process of creating a plan for how you will spend your money.

Budgeting can help you to reach your financial goals, such as saving for a down payment on a house, paying off debt, or retiring early.

There is no one-size-fits-all answer to the question of what is the best way to budget your money. The best budgeting method for you will depend on your individual financial…

View On WordPress

#50/30/20 budget#budget methods#budgeting#debt repayment#emergency fund#envelope budget#financial goals#saving money#sticking to a budget#tracking spending#zero-sum budget

0 notes