#cryptocurrency surge

Text

CoriteCO (CO): Up over 22,000% in 24 Hours

In the tumultuous world of cryptocurrency, astronomical gains and devastating losses are not uncommon. Recently, CoriteCO (CO) made headlines by surging over 22,000% in just 24 hours. While such a meteoric rise may seem like a once-in-a-lifetime opportunity for investors, it’s crucial to delve deeper into the context surrounding this astonishing increase.

The Phenomenon of CoriteCO…

View On WordPress

#CO#CoriteCO#Cryptocurrency investing#Cryptocurrency surge#Market Analysis#Market cap#Price fluctuations#Regulatory concerns#Risk Management#Volatility

0 notes

Text

$XAI Token Skyrockets by 60% in a Week Amid Bitcoin's Cooling Period

The recent surge in XAI Games' native token, $XAI, has garnered significant attention, especially amid Bitcoin's cooling-off period. This impressive 60% surge within a week showcases the interconnected and volatile nature of the cryptocurrency market. Exploring the driving forces behind XAI's rapid valuation growth reveals the pivotal roles played by strategic partnerships, promotional events, and the influence of sector trends.

Key Catalysts for XAI's Surge:

Binance Listing and Airdrop Event: The strategic partnership with Binance has proven instrumental in XAI's valuation growth. Being listed as Binance's 43rd launchpool project and subsequent listing on January 9 opened doors to a vast user base, fueling optimism among altcoin enthusiasts. Additionally, a recent airdrop event by XAI Games, distributing $125 million worth of $XAI tokens to NFT series holders and selected network validators, contributed to increased speculation and buying interest, propelling the token's valuation to an impressive $137 million.

GameFi and Web3 Gaming Resurgence: XAI's surge aligns with the resurgence of the GameFi and Web3 gaming sectors. After a challenging phase in 2022, these sectors are experiencing a notable comeback, driven by the rebounding NFT market and the resilience of projects that weathered the previous bear market. This sectoral revival positions $XAI as an attractive investment option, especially for those optimistic about Ethereum, its layer 2 solutions, and the potential of Web3 gaming.

Current Statistics and Future Trajectory:

While the future trajectory of $XAI remains speculative, the current statistics present a promising picture. With a value of $0.0111965, a 10.09% rise within the day, and an impressive 157.14% increase over the past 7 days, $XAI's recent success vividly illustrates the fluctuating and dynamic character of the cryptocurrency market. Investors and enthusiasts keenly observe how these factors will shape the ongoing momentum of $XAI in the evolving crypto landscape.

#$XAI#XAI Games#Ethereum Layer 2#Arbitrum $ARB#Binance#airdrop event#NFT series#network validators#cryptocurrency market#altcoins#GameFi#Web3 gaming#Binance listing#launchpool project#token valuation#market trends#trading volume#cryptocurrency price#cryptocurrency surge#Cryptotale

0 notes

Text

Bitcoin Surges to $71k on Soaring Spot ETF Inflows

A significant surge in Bitcoin’s price to $71,349 has captivated the cryptocurrency market, marking a 6.6% increase in value over the past 24 hours, according to Investing.com. This remarkable rise occurs alongside a parallel rally in Ether, which experienced a sharper 22.5% uptick. The anticipation of the U.S. market’s approval of spot Ether ETFs has been a pivotal factor in this momentum. Bloomberg analysts have notably upgraded the approval probability of a spot Ether ETF to 75%, overcoming previous Securities and Exchange Commission (SEC) reservations regarding such investments.

Key Takeaways

Bitcoin’s price surged to $71,349, marking a 6.6% increase over the last 24 hours.

Ether also saw a significant rise, with a 22.5% increase in value.

Approval anticipation of U.S. spot Ether ETFs has fueled the momentum.

Bloomberg analysts upgraded the approval probability of a spot Ether ETF to 75%.

The SEC’s historic apprehension towards a spot Ether ETF appears to be shifting.

To Read More >>> Click Here

Reference Links:

#news#gold#silver#trendtracker360#tech news#tech#technology#technology news#crypto news#crypto#cryptocurrency#bitcoin#bitcoin network#blockchaintechnology#bitcoin etf#etf#btc etf#bitcoin price surge#investment#investing#invest#investing stocks#tech stocks

0 notes

Text

Bitcoin surges to all-time high, surpasses $70,000 milestone for the first time

In the fast-evolving landscape of cryptocurrency, Bitcoin has once again made headlines by surging to an all-time high, surpassing the remarkable $70,000 milestone for the first time in its history. This monumental achievement has left both seasoned investors and newcomers alike in awe, sparking a surge of interest and speculation in the digital currency market.

Unraveling the Surge: Factors Driving Bitcoin's Phenomenal Rise

Institutional Adoption and Confidence Boost

One of the pivotal factors propelling Bitcoin to new heights is the increased institutional adoption and growing confidence among major financial players. Recognizing its potential as a store of value and a hedge against inflation, institutional investors have been pouring funds into Bitcoin, contributing significantly to its unprecedented surge.

Global Economic Uncertainty and Safe-Haven Appeal

In an era marked by economic uncertainty and geopolitical unrest, Bitcoin has emerged as a safe-haven asset, drawing parallels with traditional stores of value like gold. The decentralized nature of Bitcoin, coupled with its limited supply, positions it as a resilient asset in the face of economic turbulence, further attracting investors seeking stability in an unpredictable financial landscape.

The Technological Advancements Behind Bitcoin's Meteoric Rise

Blockchain Technology: Foundation of Trust

At the core of Bitcoin's success lies the revolutionary blockchain technology. The decentralized and transparent nature of blockchain ensures a secure and tamper-resistant ledger, instilling trust among users. This technological backbone not only fuels Bitcoin's rise but also lays the foundation for the future of digital currencies.

Adoption of Segregated Witness (SegWit)

Bitcoin's scalability and transaction efficiency have been significantly enhanced through the adoption of Segregated Witness (SegWit). This upgrade optimizes block space, reduces transaction fees, and accelerates transaction processing, making Bitcoin a more practical and accessible option for users.

Navigating the Challenges: Regulatory Landscape and Environmental Concerns

Regulatory Clarity: A Catalyst for Confidence

While Bitcoin's surge is undeniable, the regulatory landscape remains a crucial factor influencing its trajectory. Clearer regulatory frameworks can instill greater confidence in investors, fostering a more stable environment for the cryptocurrency market to thrive.

Addressing Environmental Concerns: The Shift Towards Sustainability

Acknowledging the environmental impact of cryptocurrency mining, the industry is witnessing a shift towards sustainable practices. Initiatives promoting energy-efficient mining solutions are gaining traction, addressing concerns about Bitcoin's carbon footprint and paving the way for a more eco-friendly future.

Future Projections and Investment Strategies in the Wake of Bitcoin's Soaring Success

Strategic Investment Approaches

As Bitcoin continues its ascent, strategic investment approaches become paramount. Diversification, risk management, and staying informed about market trends are crucial components of a successful investment strategy in the dynamic world of cryptocurrency.

Forecasting Bitcoin's Trajectory

While the $70,000 milestone marks a significant achievement, speculators and analysts are keenly watching for Bitcoin's future trajectory. Expert opinions, market indicators, and macroeconomic factors all play a role in forecasting the potential highs and lows in the coming months.

Conclusion: Navigating the Dynamic Landscape of Bitcoin Investments

In conclusion, Bitcoin's surge to an all-time high, surpassing the $70,000 milestone, signifies a pivotal moment in the cryptocurrency market. Factors such as institutional adoption, technological advancements, regulatory developments, and environmental considerations all contribute to shaping the landscape of Bitcoin investments.

FAQ: Understanding Bitcoin's Surge

Q1: What is driving Bitcoin to new heights?

A1: Bitcoin's surge is fueled by factors such as increased institutional adoption, growing confidence, global economic uncertainty, and its appeal as a safe-haven asset.

Q2: How does blockchain technology contribute to Bitcoin's success?

A2: Blockchain technology forms the foundation of trust for Bitcoin, ensuring a secure and tamper-resistant ledger that instills confidence among users.

Q3: What role does regulatory clarity play in Bitcoin's trajectory?

A3: Regulatory clarity is a catalyst for confidence in the cryptocurrency market, influencing Bitcoin's trajectory and fostering a more stable investment environment.

Q4: How is the industry addressing environmental concerns related to Bitcoin mining?

A4: The industry is witnessing a shift towards sustainable practices, with initiatives promoting energy-efficient mining solutions to address environmental concerns associated with Bitcoin mining. Read More

Read the full article

0 notes

Text

Michael Saylor's Bitcoin Holdings Surge by $700 Million in a Week

MicroStrategy’s chairman and bitcoin evangelist, Michael Saylor, has seen a significant surge in his wealth this week, as his company’s shares jumped by 40% amidst bitcoin’s rally to its highest level since November 2021. Saylor’s strategy, built around bitcoin, has proven to be highly lucrative, with MicroStrategy’s stock prices soaring.

Built Around Bitcoin

MicroStrategy’s chairman and…

View On WordPress

#Bitcoin#corporate holdings#cryptocurrency#investment strategy#market cap#Michael Saylor#MicroStrategy#stock market#volatility#wealth surge

0 notes

Text

Cryptocurrency Executives Anticipate Bullish Trends and Potential Bitcoin Surge in 2024 – Blockchain News, Opinion, TV and Jobs

In the dynamic world of cryptocurrency, industry leaders are optimistic about the start of a new bullish phase, with growing anticipation for Bitcoin to reach fresh all-time highs above $100,000 in 2024.

Bitcoin has experienced a remarkable rally, surpassing a 120% increase this year alone, leading many enthusiasts to believe that this upward momentum will persist into the coming year.

Last week,…

View On WordPress

#Anticipate#Bitcoin#Blockchain#Bullish#Cryptocurrency#Executives#jobs#News#Opinion#Potential#Surge#Trends

0 notes

Text

TikTok Flooded by 'Elon Musk' Cryptocurrency Giveaway Scams

TikTok is flooded by a surge of fake cryptocurrency giveaways posted to the video-sharing platform, with almost all of the videos pretending to be themes based on Elon Musk, Tesla, or SpaceX.

View On WordPress

0 notes

Text

Cryptocurrency : 1 क्रिप्टोकरेंसी ला सकती है आपके जीवन में ‘अच्छे दिन’, आया अच्छा मौका ?

नवीन समाचार, बिजनेस डेस्क, 7 जुलाई 2023। क्रिप्टोकरेंसी (Cryptocurrency) में निवेश करने वाले निवेशकों के लिए बड़ी खबर है। समाचार एजेंसी रॉयटर्स की रिपोर्ट के अनुसार गुरुवार, 6 जुलाई को बिटकॉइन अपने 13 महीनों में अपने उच्चतम स्तर पर पहुंच गया है। आज एक बिटकॉइन 3.28 प्रतिशत बढ़कर 31,500 डॉलर (लगभग 25,97,767 रुपये) हो गया।

वहीं क्रिप्टो ट्रेडिंग एक्सचेंज कॉइन मार्केट कैप के अनुसार बिटकॉइन का मौजूदा…

View On WordPress

#acceptance#Bitcoin#Bitcoin address#blockchain platform#buying and selling#cryptocurrencies#Cryptocurrency#decentralized#decentralized currency#fast#highest level#India#investors#legal status#Mining#popularity#price surge#profit#secure#secure transactions#traceable#transaction fees

0 notes

Link

0 notes

Text

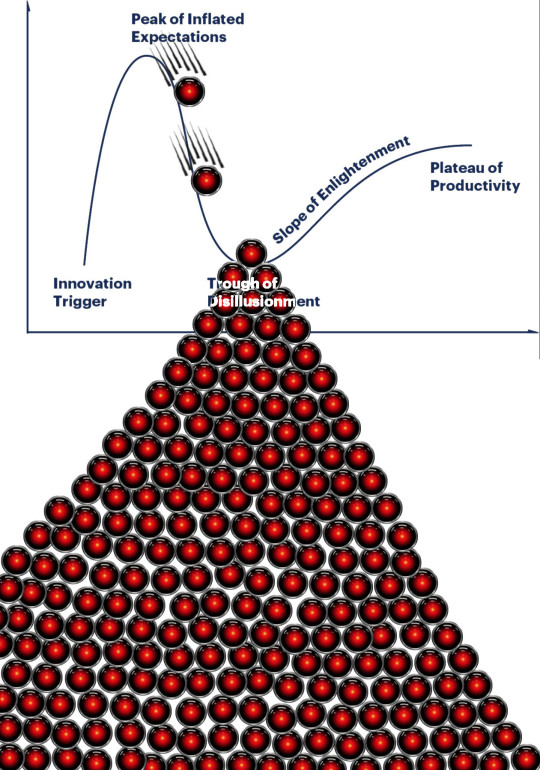

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

Bitcoin's Charge to $60K: Analyst Envisions Breakthrough Before Halving in a Bold Prediction

In a surprising turn of events, Bitcoin has surged towards the highly coveted $60,000 milestone, leaving analysts astounded by its unprecedented momentum. The renowned crypto analyst, Michaël van de Poppe, recently shared his insights, expressing surprise at the strength exhibited by Bitcoin in its recent surge.

Van de Poppe's assessment resonates with the sentiments of many observers, as Bitcoin's upward momentum seemed to catch even seasoned analysts off guard. Reflecting on the remarkable pace of Bitcoin's ascent, he admitted, "Got me by surprise with the recent strength."

Despite the remarkable rally, uncertainty looms over the cryptocurrency's trajectory, prompting investors and analysts to ponder its next move. Van de Poppe identified the $58,000 threshold as the final hurdle in Bitcoin’s current trajectory, acknowledging the ambiguity surrounding whether the rally would stall at this juncture.

Nevertheless, Van de Poppe maintained an optimistic outlook, suggesting that Bitcoin could surpass the $60,000 milestone before the anticipated halving event. Speculating on the massive strength displayed by Bitcoin, he stated, "The strength is massive, and there is a chance that we break $60K pre-halving."

Amidst the euphoria surrounding Bitcoin’s surge, market data has revealed significant milestones. A recent report from a leading market intelligence platform disclosed that an impressive 95% of Bitcoin addresses are currently profitable. This statistic mirrors levels witnessed during the peak of the 2021 bull market when Bitcoin’s price soared to unprecedented heights exceeding $60,000.

Additionally, the renowned analytical platform Glassnode shed light on Bitcoin’s remarkable performance in a recent post. With the spot price reaching $57,000, Glassnode highlighted that only 1.65% of trading days, specifically 82 out of 4,972, have seen a higher daily closing price for Bitcoin.

These revelations underscore the prevailing bullish sentiment within the cryptocurrency market. Investors are closely monitoring Bitcoin’s trajectory as it approaches significant milestones, and as Bitcoin continues to captivate the attention of seasoned traders and newcomers alike, the market remains poised for further developments in the unfolding journey toward $60,000.

0 notes

Text

Advancements in E-Commerce Credit Card Processing Techniques

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

The digital realm of e-commerce is a constantly shifting landscape, adapting to meet the ever-evolving needs of contemporary consumers. In today's age, the seamless acceptance of credit card payments remains a critical element for businesses. This article explores the most recent strides in e-commerce credit card processing techniques and their transformative impact on the operations of online businesses.

DOWNLOAD THE ADVANCEMENTS IN E-COMMERCE INFOGRAPHIC HERE

The Evolution of E-Commerce Credit Card Processing

E-commerce has undergone a remarkable journey from basic payment gateways to the sophisticated systems of today. These innovations not only enhance transaction convenience but also significantly elevate security standards.

The High-Risk Challenge

In sectors such as CBD or credit repair, navigating credit card processing can be intricate. Recent developments offer tailored solutions with high-risk merchant accounts and accompanying high-risk payment gateways. These tools provide the flexibility and security required to manage transactions effectively in high-risk industries.

Tailored Solutions for E-Commerce

Generic payment processing systems fall short for e-commerce businesses. Specialized e-commerce merchant accounts cater specifically to online retailers, offering more than just payment processing. They provide insights into customer behavior and trends, empowering businesses to make data-driven decisions that enhance sales.

Streamlined Integration

A significant advancement in e-commerce credit card processing is the seamless integration of payment gateways into websites. This integration eliminates the need for customers to leave the site to complete a transaction, thereby reducing cart abandonment rates. Online credit card processing becomes a natural part of the shopping journey.

The Role of Technology

Cutting-edge technology, including machine learning and AI, plays a pivotal role in advancing credit card processing systems. Real-time detection and prevention of fraudulent transactions ensure the security of both businesses and customers. These technologies analyze extensive data, making instant decisions to approve or decline transactions.

youtube

The Future of E-Commerce Credit Card Processing

With e-commerce's continued surge in popularity, the demand for enhanced payment processing solutions will only escalate. Looking forward, exciting developments such as biometric authentication for payments are anticipated, promising improved security and convenience. Additionally, the further integration of cryptocurrencies into e-commerce payment gateways is expected, expanding payment options for consumers.

Advancements in e-commerce credit card processing have reshaped the digital business landscape. From handling high-risk transactions to offering specialized e-commerce solutions, these developments streamline processes and bolster security. With technology's continual evolution, the future holds promising prospects for e-commerce payment processing.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#Youtube

21 notes

·

View notes

Text

> "A highly anticipated decision by the US Securities and Exchange Commission on whether to approve a spot-Bitcoin exchange-traded fund quickly morphed into a major cybersecurity incident on Tuesday.

> "The SEC’s X account was compromised and a fake post claiming that the agency had green lit plans for the products fueled a brief surge in the price of the world’s biggest cryptocurrency. It also has sparked an investigation by US authorities into how a social media account at Wall Street’s main regulator was compromised. …"

Look, I have no inside information, but most of the reporting I have read about spot Bitcoin ETFs has said that

1. the SEC is going to approve them,

2. by the end of today, and

3. this is public knowledge that everyone believes.

So you would think it would be pretty priced in? It just does not seem to me like there would be a ton of alpha in (1) constantly refreshing the SEC’s Twitter account, (2) looking for a tweet saying “okay spot Bitcoin ETFs are cool now,” and (3) buying Bitcoin on the news. Which implies there would not be a ton of alpha in (1) buying a bunch of Bitcoin, (2) hacking the SEC’s Twitter account, (3) tweeting “okay spot Bitcoin ETFs are cool now” and (4) selling your Bitcoin into the resulting enthusiasm.

[...]

Doesn’t it seem at least possible that this hack was just trolling? It didn’t move Bitcoin prices that much, and it shouldn’t have: The fake announcement was something that everyone expects to actually be true today. But it is very funny? The key element of online trolling is irony, and there is plenty of irony here. Like:

1. The crypto community and the SEC do not particularly like each other: Gensler’s SEC has launched a broad and aggressive crackdown on crypto, and it is only going to (probably!) approve spot Bitcoin ETFs today because a court forced it to. If you’re a Bitcoin enthusiast with the skills to hack the SEC’s Twitter, you might want to manipulate the price of Bitcoin, but you might also just want to make the SEC look bad.

2. Having the SEC (1) announce that Bitcoin ETFS are approved, (2) walk back that announcement, and then (3) announce it again, for real this time, the next day, really is quite embarrassing. Like if the hacker made the SEC say something outlandish and false, that would be a little funny. But making the SEC say something true a day early is extremely funny.

3. In addition to cracking down on crypto, one of the SEC’s big regulatory priorities under Gensler has been punishing companies for cybersecurity incidents.[2] The SEC once sued a company for using weak passwords, and its enforcement director said that the case “underscores our message to issuers: implement strong controls calibrated to your risk environments.” But apparently the SEC’s Twitter was compromised because it didn’t turn on two-factor authentication. Nyah nyah nyah nyah nyah!

[...]

Anyway, the great counter-troll here would be for the SEC to announce today “you know what, all the Bitcoin ETF applications are rejected, we’ll see you in court again. We were going to approve them, but it turns out that the Bitcoin market is still too vulnerable to manipulation, as you can tell by the fact that someone hacked our Twitter to manipulate Bitcoin.”

17 notes

·

View notes

Text

Bitcoin may be surging to new heights this week, but some Democrats are likely cursing cryptocurrency.

The Democratic National Committee and an associated joint fundraising committee surrendered $765,000 from a convicted crypto executive to a federal agency best known for hunting suspected criminals, according to a Raw Story review of federal campaign finance records.

RELATED ARTICLE: Why big-time politicians are surrendering gobs of campaign cash to an unlikely source

The DNC and the joint fundraising committee, the Democratic Grassroots Victory Fund, sent $365,000 and $400,000, respectively, to the U.S. Marshals Service on Jan. 8, becoming the latest political committees to cough up contributions from executives of now-defunct cryptocurrency company, FTX.

The original contributions came in 2022 from Sam Bankman-Fried, the former CEO and founder of FTX. A federal jury in October convicted Bankman-Fried of stealing $8 billion from customers — which he in part used to finance political contributions, The New York Times reported.

The DNC did not respond to Raw Story’s request for comment.

Raw Story first reported in April that the U.S. Marshals began collecting money donated by Bankman-Fried and other former FTX executives — an all-but-unprecedented occurrence for the federal agency.

By September, the Marshals had collected upwards of $1.35 million from more than 150 political campaigns and committees, Raw Story reported.

Now, the Marshals have collected more than $2.3 million in FTX donations, according to Raw Story’s latest review of Federal Election Commission records.

RELATED ARTICLE: Feds expand their quest to claw back crypto-bro cash from big-time politicians

The “disgorgements” from the DNC and Democratic Grassroots Victory Fund are the largest single divestments of FTX-related campaign cash behind $500,000 returned by Priorities USA Action, a Democratic super PAC, according to FEC records.

The Democratic Congressional Campaign Committee previously forwarded a $250,000 contribution to the U.S. Marshals, and the Democratic Senatorial Campaign Committee sent back $36,500.

Republican committees forfeited five and six-figure donations, too, including the National Republican Senatorial Committee ($109,500) and the Republican National Committee ($25,000).

Campaigns for prominent politicians ranging from House Speaker Emerita Nancy Pelosi (D-CA) to House Republican Conference Chair Rep. Elise Stefanik (R-NY) also sent the Marshals money from FTX-related executives.

The DNC raised nearly $137.4 million between Jan. 1, 2023 and Jan. 31, 2024, and the Democratic Grassroots Victory Fund raised more than $12.3 million in that same time period, according to FEC records.

The Democratic Grassroots Victory Fund helps fund the DNC as well as state-level Democratic party committees across the nation.

Nicholas Biase, a spokesperson for the United States Attorney’s Office for the Southern District of New York, which prosecuted Bankman-Fried’s case, referred questions to the U.S. Marshals.

A spokesperson for the U.S. Marshals did not respond to Raw Story’s request for comment.

Bankman-Fried donated more than $40 million to political causes during the 2022 election cycle, according to a CBS News analysis.

Bankman-Fried, who turns 32 today, is awaiting sentencing within the next two weeks and could face more than 100 years in prison; however, his lawyers are arguing that he serve no more than six-and-a-half years.

------

How to get around RawStory's sub wall:

Command R, but as SOON as the text falls in, hit Command period.

Voila. The text of the article.

Fight Moloch!

7 notes

·

View notes

Text

WIP Wednesday

Fanonwriter2023 on AO3

Where CANON and FANON collide!

Season 7 FANON Speculation

I wasn’t tagged by anyone but I wanted to share two snippets from Chapter 5 of my multi-chapter fic titled “I’m still in love with you but... I needed to learn how to love myself too!”

The closer I get to completing chapter 5, the more excited I get because things are getting even more angsty than they already were for Buck and Eddie. My goal is to finish this chapter and edit it soon, so hopefully, I’ll be able to post it by the end of the week.

___________

Here are two snippets from chapter 5 because Eddie’s still in El Paso and Buck just arrived in Hershey.

___________

Eddie

“Like you said Eddie, it’s been a long time since we’ve seen each other. I almost didn’t recognize you yesterday but I knew it was you after I heard your voice. What have you been up to? Do you still live in El Paso?”

Eddie shakes his head no and echoes his answer. “No, I live in Los Angeles.”

“Really, you live in L.A.?”

“Yeah. I’ve been there for almost six years now.”

“I guess that old saying about time flies is true then, huh?”

Eddie nods.

Dorian looks at him then asks, “What do you do in L.A.? For a living I mean.”

“I’m a firefighter and a medic with the LAFD. And you, what do you do?”

“I’m a real estate broker and I dabble in investments, mostly Cryptocurrency as a hobby but I also own a couple of stocks listed on the S&P 500.”

“Ok, that’s interesting.”

“Yeah, it is. I never thought I’d end up in real estate but El Paso is growing and for the last 10 years, the population has surged tremendously. There’s a new subdivision not too far from here that my firm was hired to handle all the sales for. It’s called “New Beginnings”.”

“Really?” Eddie asks as his eyebrows go up because that’s the same subdivision where he looked at an open house last week.

“Yeah, it keeps me busy.” Dorian takes a sip of his water. “After two years of non-stop work, I finally decided to take some time off so I could spend time with my kids.”

Eddie chuckles and says, “This is my first vacation ever. I mean I’ve taken time off work before but it was for doctor’s appointments for me or my son but this is my first time taking more than one or two days off at one time”.

Will Eddie make the decision to move back to El Paso after he has dinner with an old friend from high school?

___________

Buck

Buck finds and empty barstool, he sits and after a few seconds, the bartender asks, “What can I get for you?”

“Uh… vodka on the rocks.”

The bartender nods and within 2 minutes, a glass with his preferred drink is sitting in front of him. He throws it back and motions for another. After his third round, someone sits down next to him on the barstool to his right that was recently vacated but he doesn’t look over at them.

He can feel their eyes looking at him but he doesn’t look over until he hears, “Evan Buckley.”

He pulls back because he recognizes the voice but he’s hoping it’s not the person he thinks it is. He turns his head and it’s him, Jared Persons, the quarterback of his college football team.

He plasters on a fake smile and says, “Jared?”

“Yeah man, it’s me.”

“What are you doing here?”

“Well, I don’t live too far from here and I come to this restaurant sometimes to sit at the bar, drink a few shots and let off some steam.”

After he looks Buck up and down, he continues. “But I think the real question is… what are you doing here because last I heard, you left Hershey several years ago?”

“Um… I’m only here for one day and then I—I’ll be gone.”

Buck watches as Jared looks him up and down again with parted lips and a sparkle in his light green eyes like he wants to devour him. He’s not naïve and he remembers everything they did one night after one of their big wins but he wonders if he should turn into Buck 1.0 again if only for one night. He considers just doing it to relieve some of the stress he’s feeling before he has to face his parents tomorrow.

He thinks Jared can tell he’s remembering the night they spent together when he leans in close to speak into Buck’s ear.

Jared whispers, “There’s a hotel across the street and if you want… we could, you know for old times’ sake. One roll in bed while you’re here for one night, one day or whatever.”

Buck moves to the left, then he interrupts him. “I’m good Jared. It was nice seeing you again.”

Will Buck accept the proposition made by one of his old college football teammates?

_________

Fic Summary: Months after Buck and Eddie were hit by the same lightning strike; they’re still struggling with the aftermath of it. But before they make their love confessions, they’ll spend time getting to know themselves as individuals first. Eddie learns to enjoy the simple things in life as he participates in activities on his own and with new friends while Buck learns the rest of the 31-year-old deep dark family secret about his conception and birth. Their journey to forever is still a work in progress but once they finally admit they’re in love with each other, everything that follows their love confessions will be cataclysmic.

__________

Chapter Summaries

Chapter 1 - Eddie makes a new friend while Buck receives devastating news regarding the sperm donation he made for Connor and Kameron.

Chapter 2 - Buck does a lot of research to learn more about the abnormalities found in his red blood cells and Eddie starts a new therapy journey that’s all about him and not the traumas he’s experienced.

Chapter 3 - After more than a month, Buck and Eddie finally spend time together outside of work but it doesn’t end well and they part with a lot of uncertainty regarding their places in each other’s lives.

Chapter 4 - Eddie has a few realizations about his life which causes him to consider moving back to El Paso, TX while Buck continues to be reminded of his past which causes him to take an impromptu road trip across America.

Chapter 5 - Will be posted soon.

__________

I’m enjoying writing this fic because it’s giving me the chance to unravel the mess that was 6x18 for Buck, Eddie and Chris. Also, it’s taking them places the show refuses to go including Buck being put on Paid Administrative Leave from the 118 due to Taylor Kelly’s book being released along with Eddie doing a self-evaluation journey which currently includes him trying to decide if he should move back to El Paso.

__________

Buddie Multi-Chapter Fanfic - Hiatus Reading

Read chapters 1, 2, 3 & 4 on AO3.

No pressure tagging: @spotsandsocks and @shortsighted-owl.

#buddie#eddie diaz#evan buckley#christopher diaz#the buckley diaz family#buckley diaz family#911 fox#911 on fox#911onfox#911 fanfic#911 abc#911 on abc#911 season 7 speculation#911 season 7#Fanonwriter2023 on AO3#buddie fanfic#ao3 fanfic#Hiatus Reading#buddie wip#WIP Wednesday

18 notes

·

View notes

Text

TOP PROFITABLE COINS TO BUY IN 2024

Explore

Certainly! Here are some of the top cryptocurrencies you might consider for investment in April 2024:

Bitcoin (BTC):

Market cap: $1.4 trillion

Year-over-year return: 150%

Bitcoin, created in 2009 by Satoshi Nakamoto, is the original cryptocurrency. Its price has surged significantly over the years, making it a household name. As of April 9, 2024, one bitcoin is priced around $70,603, representing remarkable growth1.

Ethereum (ETH):

Market cap: $434.8 billion

Year-over-year return: 95%

Ethereum serves as both a cryptocurrency and a blockchain platform. It’s popular among developers due to its potential applications, including smart contracts and non-fungible tokens (NFTs). From April 2016 to April 2024, its price increased from about $11 to approximately $3,621, a staggering growth of 32,822%1.

Tether (USDT):

Market cap: $107.1 billion

Year-over-year return: 0%

Tether is a stablecoin backed by fiat currencies like U.S. dollars and the Euro. Its value is designed to remain consistent, making it attractive to investors wary of extreme volatility in other coins1.

Binance Coin (BNB):

Market cap: $87.3 billion

Year-over-year return: 87%

BNB is used for trading and paying fees on Binance, one of the largest crypto exchanges globally. Beyond trading, it has expanded to payment processing and even booking travel arrangements1.

Remember that investing in cryptocurrencies carries risks, and it’s essential to do thorough research and consider your risk tolerance before making any investment decisions. Always consult with a financial advisor if needed. 🚀🌟

<meta name="monetag" content="89c9b8a0f0677abc9548e8cb0fd150b0">

3 notes

·

View notes