#Investment risk management

Text

Demystifying Brokerage Accounts: A Comprehensive Guide for Beginners

Written by Delvin

Have you ever found yourself intrigued by the world of investing but unsure of where to start? Look no further! In this comprehensive guide, we will demystify brokerage accounts and provide beginner-friendly insights to help you embark on your investment journey with confidence. Whether you’re a complete novice or have dabbled in investing before, let’s dive into the…

View On WordPress

#Beginner-friendly investments#Brokerage accounts#Choosing a brokerage firm#dailyprompt#Demystifying investments#Diversification in investing#Financial advice for beginners#Investing for beginners#Investing fundamentals#Investment basics#Investment decision-making#Investment education#Investment guidance#Investment portfolio management#Investment risk management#Investment strategies#Investment tips for beginners#Managing investments#Monitoring investment portfolio#Opening a brokerage account#Types of brokerage accounts

1 note

·

View note

Text

15 Risk Management Strategies for Successful Investing

#investing#investing for beginners#risk management#investment strategies#for successful investing in mutual funds#stock market investing for beginners#stock market for beginners#risk management techniques to succeed in investing#risk management in investing#successful investing#investment risk management#best investing strategies 2022#successful stock investing#stock investing strategies#money management#exit strategies for stocks

0 notes

Text

rewatched the premier definitely super legally and just look at them

#these tags get. very rambly. so expand at ur own risk i'm just kinda yelling here#bob's burgers#ur insane if u think i'm tagging every character#i HAVE to draw gene in this outfit proper u don't get it i just love when they let him go full music man#this premier made me clinically insane i don't think u understand they're consuming my thoughts like brain eating amoeba#catastrophic autism levels rn#god rest the poor souls at uni that'll ask how my weekend was#genuinely surprised they managed to get jjr. zeke. rudy. marshmallow. AND fischoeder in the premier#like they got ALL our fav little guys in here huh#no courtney or alex tho i'm fine. no it's fine that's fine#love how gene just started lying down at some point#lil bro did NOT care abt the chores he was invested in the narrative#there were some rly great bits in this ep too#gene just being dramatic. 'hey guys look at pepperoni the pony'. every time fischoeder was on screen#v strong premier i am clearly very normal abt it#ngl i just made this post to archive all these screenshots for myself bc i love the costumes here

39 notes

·

View notes

Text

Financial Planning Worth $1-2 Million US Dollars. I would request you all to go through this guide and share it with everyone you know, so that they can secure their financial future.

#finance planning#finance management#financial freedom#finance#financial security#financial management#retirement planning#how to earn money#financial goals#cashflow#debt management#risk management#investment planner#passive income#passive investing#estate planning#retire early#financial advice#money management#money manifestation#money#cash management

4 notes

·

View notes

Text

The Importance of Diversification in Your Investment Portfolio

Diversification is a critical concept in investment that can help you balance risk and reward. By diversifying your investments, you can mitigate potential losses without significantly impacting potential gains. This article explores the importance of diversification in an investment portfolio and provides some strategies to help you diversify effectively.

What Is…

View On WordPress

#Asset Allocation#Bonds#Diversification#Financial Planning#Investing Strategy#Investment Portfolio#Mutual Funds#Real Estate#Risk Management#Stocks

5 notes

·

View notes

Text

You know what I think is so....there's such a pseudo respect for science on this website specifically but - just like in many societies generally - only when it speaks with authority. And yeah, the scientific method is how we're trying to find out truth about things, so we can base our decisions on this truth. At one point - you're gonna have to speak with some authority based on the research that has been done. But. So many people - in society and on this website - have not studied to become scientists. They have not learned about the scientific method. So all they see is apparently - science as authority. But science as authority is a consensus. 'Consensus' reached by multiple individual scientists who are no longer in major disagreement because so much research has been done that it SEEMS LIKE we're on to something. And yet, even then, everything may turn out to be wrong. Because people have been fabricating results for example (happened really seriously within the field of psychology) or because it turned out that most studies' methods or assumptions were less rigorous or accurate than desirable (lookin askance at economics) or the classic paradigm shift in physics where some whole new set of ideas topples earlier ones. It seems like we've reached a pretty solid idea of things. But when is that point? Very few people have been taught to recognise it. Which requires actually reading/scanning studies. Or at least good summaries. Getting a sense of what the landscape of ideas is. What are major theories and assumptions and results? (In uni, you get handed this in a course). More importantly, what is missing?? Once you go digging into any subject it generally turns out there's more gaps in understanding and especially empirical results WITH good methods than what's actually known. In uni, you're taught to recognise how researchers might have fucked up (at least, they attempt to teach this). What's solid stuff? What's rigorous research? What is valid and reliable? When is something TRUE? Here comes my personal opinion: if there's not 3- 10 citations behind a statement then you're knitting a web of maybes together. Actually it's NOT just my personal opinion, it's a major problem in scholarship and science that scientists are NOT reproducing studies because they are not rewarded for it - when the scientific method REQUIRES reproduction of results for any kind of robust 'truth' to emerge.

But most people are simply 100% not taught about HOW our societies make truth (emerge) - or rather how scientists should be doing this. They are delivered truth by the authority: science. But the nature of the scientific process delivers differing narratives, theories, hypotheses, especially until a kind of consensus is reached. So people take one study and run with it. Or 7 wildly differing studies which seem to be about the same thing but really aren't. And that's not even non-uni-educated people only, I've seen plenty of paper-publishing people knit their stuff together that way. Sometimes that's all the information there is! But though scientists are taught to point to the sources of information for statements they make - that doesn't mean that everything published is Fact. Most discussions of results would acknowledge this strenuously. Still, they're often cited that way if it suits the narrative of the paper pointing at them.

My point? Wish people would be MORE skeptical of 'science'. What? I hear you ask? More crazies who don't listen to reason? No - I just wish more people would have access to and the means to and the desire to and have respect for doing one's own research with the scientific method as FALLIBLE BUT ENDLESSLY SELF- ADJUSTING TRUTH-SEEKING MECHANISM in the backs of their minds. Which means reading. Literally just means reading, and staying critical, and recognising when things are not nearly ready to be called TRUTH yet at all and when things ARE ready to be called TRUTH (looking at climate change and its human causes and the major consensus on this).

What I mean is - again - wish people would actually read studies. Wish this was a thing taught to every child in secondary school. Otherwise you get people pointing at 30 studies about completely different arguments / completely different scope that lead back to about three studies of actual results eventually which didn't have amazing methods. And that's TRUTH and anyone who denied this Substantiated Common Sense is a moral idiot. Maybe let's do some rigorous testing first and then some pilots.

#genuinely dont think that the major truth -seeking process should be comprehensibly taught to only those people who might#do research in the future. should be taught to every citizen.#my stuff#personal#do i think that after having researched nuclear power plants four times 'superficially' i know whether its good or bad to invest in?#no#maybe the risks are overstated or maybe the risk is minimal and worth it maybe waste CAN be managed well despite historical#problems. maybe the risk of a huge national security risk and international health risK REALLY IS worth it BECAUSE#tech HAS developed enough and responsibility risks can be prevented eniugh that emissionless energy output for 30 years will be essential#do i know? no. and obviously im skeptical#but i never deny that there is a possibility i just need to get a clearer picture by actually looking at some actual literature#maybe its gonna save the damn world! who knows#not me#people r so bad at not knowing

3 notes

·

View notes

Quote

Someone’s sitting in the shade today because someone planted a tree a long time ago.

Warren Buffett

#Warren Buffett#Quote Of The Day#money#investment#stock market#trade#trader#daytrade#rich#poor#millionaire#billionaire#parenting#knowledge#school#teacher#learn#risk management#finance#financial#money management#education#student#anti capitalism#capitalism#quotes

1 note

·

View note

Text

Technology Stocks Analysis: Spotlight on Indian Companies

What are your top questions about investing in tech stocks? Share your thoughts below!

Spotlight on Indian Technology Stocks: A Guide for Investors

Investing in the Future: A Guide to Technology Stocks Analysis May 2024

The technology sector is dynamic, rapidly evolving, and plays a pivotal role in modern economies. As an investor, understanding the potential of technology stocks is crucial for making informed investment decisions.

Analyzing Growth Potential and Investment…

View On WordPress

#Financial Analysis#growth potential#Indian tech industry#investment strategies#portfolio diversification#Risk Management#tech sector analysis#tech stocks India#technology stocks analysis

0 notes

Text

The Looming Crash? Demystifying Market Meltdowns and When to Worry (or Not)

Let’s face it, financial headlines love hyping the possibility of a market crash. It’s like financial clickbait, designed to grab your attention and stoke fear. But is a crash really on the horizon, or is it all just overblown panic?

In this post, we’ll dive deep into the world of market crashes, exploring the likelihood of one happening soon, the telltale signs to watch for, and, most…

View On WordPress

#Bear Market#Diversification#Economic downturn#Economic News#Finance#Financial Planning#Geopolitical Risk#Investing#Investment Strategy#Investor Confidence#learn technical analysis#Long-Term Investing#Market Analysis#Market Correction#Market Crash#Personal Finance#Recession#Risk Management#stock market#Stock Market Crash#stock markets#stock trading#successful trading#technical analysis

0 notes

Text

What is day trading?

Discover the ins and outs of the term "what is day trading" on The Talented Trader. Explore effective strategies, valuable tips, and potential risks associated with day trading.

#daytrading #forextradingstrategy #cheapestpropfirms #propfirmtradingaccount #proptrading #instantfundingpropfirm #fundedtradingaccounts #propfirms #propfirmchallenge #instantfunding #unitedstates #usa #newyork #thetalentedtrader #talentedtrader

#instant funding prop firm#prop firms#trading risk management#cheapest prop firms#funded trading accounts#prop firms instant funding#prop firm challenge#the talented trader#proprietary trading firm#prop firm trading#What is day trading#day trading#stock market#futures trading#investing#investments#investors#forex trading#forexsignals#forex education#forextrading#forex#forex market#forex broker#forexmarket

1 note

·

View note

Text

The Rise of Bitcoin NFTs: Franklin Templeton’s Insights and Investor Warnings

Franklin Templeton, a global asset manager, has recognized the profound impact of Bitcoin non-fungible tokens (NFTs) on the cryptocurrency industry, signaling a significant rise in innovative developments within the Bitcoin ecosystem. The firm’s digital assets division recently released a briefing titled “The Rise of Bitcoin Ordinals” on its social media platforms, highlighting the growing influence of Bitcoin NFTs as a driving force behind renewed activity within the Bitcoin network.

#Franklin Templeton#Bitcoin NFTs#cryptocurrency#NFT market#NodeMonkes#Runestone#trading volume#market capitalization#blockchain#crypto market#memecoins#Bitcoin ETF#EZBC#investment#digital assets#financial protections#risk management#cryptocurrency industry#innovation#cryptomarkt

1 note

·

View note

Text

Stock Market Investing

1 note

·

View note

Text

earn Handsome money by ebook

Finance Boost 5300! AI: Potential Advantages for Savvy Investors

Finance Boost 5300! AI, with its focus on digital ebooks and AI integration, offers several intriguing advantages for investors seeking an edge:

AI-Powered Insights: The AI component could analyze vast amounts of financial data, potentially identifying hidden trends and uncovering investment opportunities that might elude traditional analysis.

Data-Driven Strategies: By leveraging AI, these ebooks may present data-backed investment strategies, helping you move beyond gut feeling and towards data-driven decisions.

Personalized Recommendations: Some AI-powered finance tools can personalize investment recommendations based on your risk tolerance and financial goals. This could help you tailor investment strategies to your unique situation.

Accessibility and Convenience: Digital ebooks offer a convenient way to access financial knowledge anytime, anywhere. You can learn on your schedule and revisit key concepts as needed.

Potentially Cost-Effective: If offered at a reasonable price, these ebooks could be a cost-effective way to gain valuable financial information without hefty subscription fees.

However, it's important to consider:

Limited Human Expertise: While AI offers valuable analysis, the absence of human expertise in the ebooks might mean you miss out on nuanced insights or strategic considerations.

AI Accuracy and Bias: The accuracy of AI-powered insights depends on the quality of data used. Be cautious of potential biases within the AI algorithms.

Backtesting and Validation: Ensure the AI-driven strategies are backed by historical data (backtesting) for validation. Don't rely solely on AI predictions.

Overall, Finance Boost 5300! AI ebooks have the potential to be a valuable tool for investors looking for AI-powered insights and convenient learning. However, always conduct your own research and consider the limitations of AI before making investment decisions.

#AI-powered Investing#Digital Finance Ebooks#Data-Driven Strategies#Personalized Investment Advice#Investment Trend Analysis#Cost-Effective Learning#Mobile Investment Education#AI Risk Management (if applicable)#Investor Decision Support#Financial Data Insights

0 notes

Text

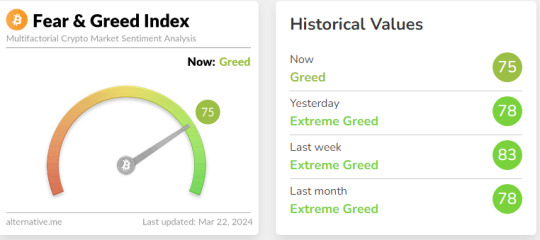

At its core, the Crypto Fear and Greed Index serves as a barometer for investor sentiment within the cryptocurrency market. It assigns a numerical value between 0 and 100, with lower values indicating extreme fear and higher values suggesting extreme greed. This index provides invaluable insights into prevailing market emotions, enabling investors to make informed decisions regarding their crypto portfolios.

https://www.bloglovin.com/@a2zcrypto/unlocking-crypto-fear-greed-index-a-comprehensive-12512075

0 notes

Text

Diversifying your investment portfolio is key to managing risk and achieving long-term financial goals. Learn effective strategies for asset allocation, geographic diversification, and sector allocation to optimize your investment returns. #InvestmentPortfolio #Diversification #RiskManagement

0 notes

Text

"Gilded Strategies: Navigating the Gold Market in 2023 for Golden Returns"

youtube

Are you seeking a reliable and stable investment opportunity to diversify your portfolio and hedge against inflation? Look no further than the gold market. Investing in gold has been a cornerstone choice for investors throughout centuries, owing to its enduring value and global appeal. In this comprehensive guide, we delve into the world of gold investing, offering insights to help you make informed decisions to grow your wealth over time. Whether you're a seasoned investor or just beginning your journey, this article is your ultimate resource for understanding the golden touch and maximizing your investments.

1. Understanding the Basics

Gold investing is not merely for pirates and treasure hunters; it's a serious investment strategy with the potential to safeguard your wealth and achieve financial goals. Before delving into the gold market, it's crucial to grasp the fundamentals. Gold is a commodity traded on global markets, much like stocks, bonds, or oil. Its value fluctuates based on various factors, including supply and demand, economic conditions, geopolitical events, and environmental factors.

2. Hedge Against Inflation

Gold serves as a hedge against inflation, preserving purchasing power during times of economic uncertainty. As the cost of living rises, the value of paper currency diminishes, making gold an attractive store of value. During crises such as wars, recessions, or pandemics, gold often emerges as a safe-haven asset, witnessing record-high prices as investors seek stability.

3. Diversification

Gold helps diversify investment portfolios, mitigating risk by spreading investments across different asset classes. Its unique behavior compared to stocks and bonds allows it to act as a counterbalance, potentially enhancing overall returns and reducing volatility.

4. Stability

Unlike stocks or bonds, gold exhibits relative stability over time due to its finite supply and historical reputation as a store of value. This stability offers protection for investors' wealth, providing a reliable source of returns amidst market fluctuations.

5. Investment Strategies

There are several avenues for investing in gold, including physical gold, gold ETFs, gold mining stocks, and gold futures. Each option comes with its pros and cons, catering to diverse investor preferences and risk appetites.

6. Physical Gold

Investing in physical gold, such as coins, bars, or jewelry, offers tangible ownership and control. However, storing and insuring physical gold can be costly, and liquidity may pose challenges.

7. Gold ETFs

Gold exchange-traded funds (ETFs) provide exposure to physical gold without the hassle of storage. They offer liquidity and convenience, although fees and market fluctuations can impact their value.

8. Gold Mining Stocks

Investing in gold mining stocks allows investors to benefit from gold price appreciation and company success. Yet, these stocks are subject to operational risks and regulatory challenges associated with mining operations.

9. Gold Futures

Gold futures contracts enable investors to speculate on gold prices without owning the physical asset. However, they require a high level of expertise and entail complex risks associated with futures trading.

10. Future Trends and Challenges

Emerging trends such as increasing demand from emerging economies and the rise of sustainable investing could shape the future of the gold market. However, challenges like competition from cryptocurrencies and the impact of climate change on mining operations warrant attention.

In conclusion, investing in gold offers a myriad of benefits, including diversification, stability, and a hedge against inflation. By understanding the basics, exploring different investment vehicles, and staying abreast of market trends, investors can potentially capitalize on the golden opportunities that the market presents. Remember, while gold investment can be rewarding, it's essential to conduct thorough research and assess risk before making investment decisions. With the right knowledge and strategy, you can unlock the golden touch in your investment portfolio.

Get More taste of opulent luxury at

#Gold investing#diversification#hedge against inflation#stability in commodities#ETFs#mining stocks#futures#emerging economies#sustainable investing#market trends#challenges in wealth preservation#portfolio management for financial goals#precious metals#risk assessment#informed decisions#GoldInvesting #Diversification #InflationHedge #ETFs #MiningStocks #EmergingEconomies #SustainableInvesting #MarketTrends #WealthPreservation #PreciousMetals #RiskAssessment #FinancialGoals #PortfolioManagement #InvestmentStrategy

youtube

#Gold investing#diversification#hedge against inflation#stability in commodities#ETFs#mining stocks#futures#emerging economies#sustainable investing#market trends#challenges in wealth preservation#portfolio management for financial goals#precious metals#risk assessment#informed decisions#GoldInvesting#Diversification#InflationHedge#MiningStocks#EmergingEconomies#SustainableInvesting#MarketTrends#WealthPreservation#PreciousMetals#RiskAssessment#FinancialGoals#PortfolioManagement#InvestmentStrategy#Youtube

0 notes