#cash management

Text

I see a disturbing number of people, mostly millennials, these days, who have significant incomes and are starting to amass significant savings, who have terrible financial management skills. People who live at home with parents and get a full time job can accumulate money really fast. A lot of people are letting huge amounts of money, like sometimes as much as $20,000 or more, accumulate in checking accounts where it is earning either no interest or negligible interest.

Because inflation is high (over 3% these days), you are effectively losing money when it sits there. Also you're allowing the bank to profit off it; it's lending your money out to other people, often at interest rates as high as 6-7% or more, and it's not paying you for it.

If you have more than maybe around $3000 dollars in an account, you want that money earning interest. Here are things you can do to earn more from your money:

Open a savings account at a higher yield. Go to a different bank if necessary. CIT Bank has rates around 5% these days.

Pay off high interest rate debt but not low-interest rate debt. If the interest rate is above about 7-8% definitely make it a priority to pay it off ASAP. If it is above 5% it is still better to pay it off than to sit on your money. If it is much below 5%, pay it off as slowly as possible (minimum payment only) because there are risk-free ways to earn more interest on your money.

If you don't need the money in the short-term, consider a CD (Certificate of Deposit) which offers a fixed interest rate over a certain time. Often you can get a slightly higher rate by tying your money up for 3 months or 6 months or sometimes even longer. These are good options if you have a specific expenditure in your future, like perhaps moving or buying a home, but you know it won't happen until after a certain date.

Open a brokerage account. Brokerage accounts allow you to buy and sell investments such as stocks, mutual funds, or bonds, which include CD's from banks as well as treasury and municipal bonds and corporate bonds. You get more options for buying CD's (i.e. you can compare many different banks side-by-side, buy CD with the best rate, and manage multiple CD's within a single interface.) Most brokerage accounts have no fees and typically no or very low minimum investments. There is no reason not to have one if you have a few thousand dollars.

In a brokerage account, buy a money market mutual fund. Look for one with no load and no transaction fee, a high yield, and a low expense ratio, and a fixed share price of $1 per share. My two favorite are SWVXX and SNSXX. SWVXX has a higher yield (about 5.19%) whereas SNSXX has a lower yield (just over 5%) but is non-taxable on state income taxes, so SNSXX is a better choice if you have a high state tax rate, otherwise SWVXX is better.

Consider opening a Roth IRA if you haven't, and then, if able, contribute the maximum amount each year. You are allowed to make a contribution that counts towards the previous year, up until the tax filing deadline of the current year. So for example today it is Mar. 14th, 2024, so you can open a Roth IRA today and contribute the max ($6,500) for the 2023 year and also the max ($7,000) for 2024, for a total of $13,500. The main advantage of a Roth IRA is that the money in them can grow tax-free. Roth IRA's benefit anyone able to have one (the richest people are not allowed to contribute to them) and are especially important for people who are self-employed, change jobs a lot, or never work full-time, so they don't have a consistent employee-provided retirement plan.

Consider investing in stocks. Stocks are riskier (in that their price changes, and you can lose money when investing in them), but tend to have a higher yield than savings and money market accounts and funds. The simplest way to buy stocks is to buy an ETF (exchange-traded-fund). I recommend buying one that follows the S&P 500 and has a low expense ratio like SPY or VOO. Whatever you buy, reinvest the dividends and let it grow, contribute a little money every year so are putting in money even in years the market is down. On average you get about a 10% return in the market but it is unpredictable and you will lose in some years, but that's okay, you're not retiring for many decades and the money will have grown a lot by then.

There are options regardless of your risk profile. It is throwing your money away to let a lot of money sit in a checking account. At a bare minimum, go for a high-yield savings account, CD, or better yet get a brokerage account, put it in high-yield money market funds like SWVXX, shop around for CD's or other bonds with the highest rates, and if you are able to tolerate some risk and want a higher return, consider putting some money in more aggressive investments like stocks.

I am 100% for tax reform and other reform to curb the extreme concentration of wealth in the hands of a few, but it's also important to take your financial situation into your own hands. Get financially comfortable. Get a stake in the US economy. Empower yourself so you can live better and help your family, friends, and the causes you care about.

10 notes

·

View notes

Text

Financial Planning Worth $1-2 Million US Dollars. I would request you all to go through this guide and share it with everyone you know, so that they can secure their financial future.

#finance planning#finance management#financial freedom#finance#financial security#financial management#retirement planning#how to earn money#financial goals#cashflow#debt management#risk management#investment planner#passive income#passive investing#estate planning#retire early#financial advice#money management#money manifestation#money#cash management

4 notes

·

View notes

Text

#art#generationalwealth#mansorus#mental health awareness#money moves#money motivation#aesthetically pleasing#money counter#finances#get paid#cash management#racks up

4 notes

·

View notes

Text

Accounts payable and Accounts receivable Solutions

Accounts payable and accounts receivable are two important aspects of a business's financial management. Accounts payable refers to the amount of money a business owes to its creditors, such as suppliers or vendors, for goods or services that have been received but not yet paid for. Accounts receivable, on the other hand, refers to the amount of money that a business is entitled to receive from its customers for goods or services that have been sold but not yet paid for. To effectively manage these two areas, businesses can use a variety of solutions such as software or cloud-based systems to automate and streamline the process of recording and tracking transactions, generating invoices, and making payments. Additionally, businesses can use tools such as credit scoring and collections management to manage their receivables and reduce their risk of bad debt. Overall, effectively managing accounts payable and accounts receivable is crucial for maintaining a healthy cash flow and ensuring the financial stability of a business.

3 notes

·

View notes

Link

The sustainable development of a business depends on its focus on cost-saving, profit maximisation and compliance in every operational activity, including procurement. Good procurement strategies are sometimes the demarcation between profits and unexpected losses.

#Software Company#Business Consultant#Project Management#Finance#Procurement#Procurement Solutions#Program Management#Finance Partnering#Cash management#Procurement digitalization

5 notes

·

View notes

Text

Senjata Unik itu Bernama 'Smart Pricing'

Pendalaman Strategi Smart Pricing; source

Dalam labirin perbankan korporat saat ini, pertarungan suku bunga yang semakin ketat telah memaksa bank untuk memikirkan kembali strategi mereka. Namun, adakah strategi yang bisa mengatasi dilema ini tanpa mengorbankan keuntungan? Memperkenalkan konsep ‘Smart Pricing’ yang erat kaitannya juga dengan konsep Transaction Banking,

Sebuah pendekatan yang…

View On WordPress

0 notes

Text

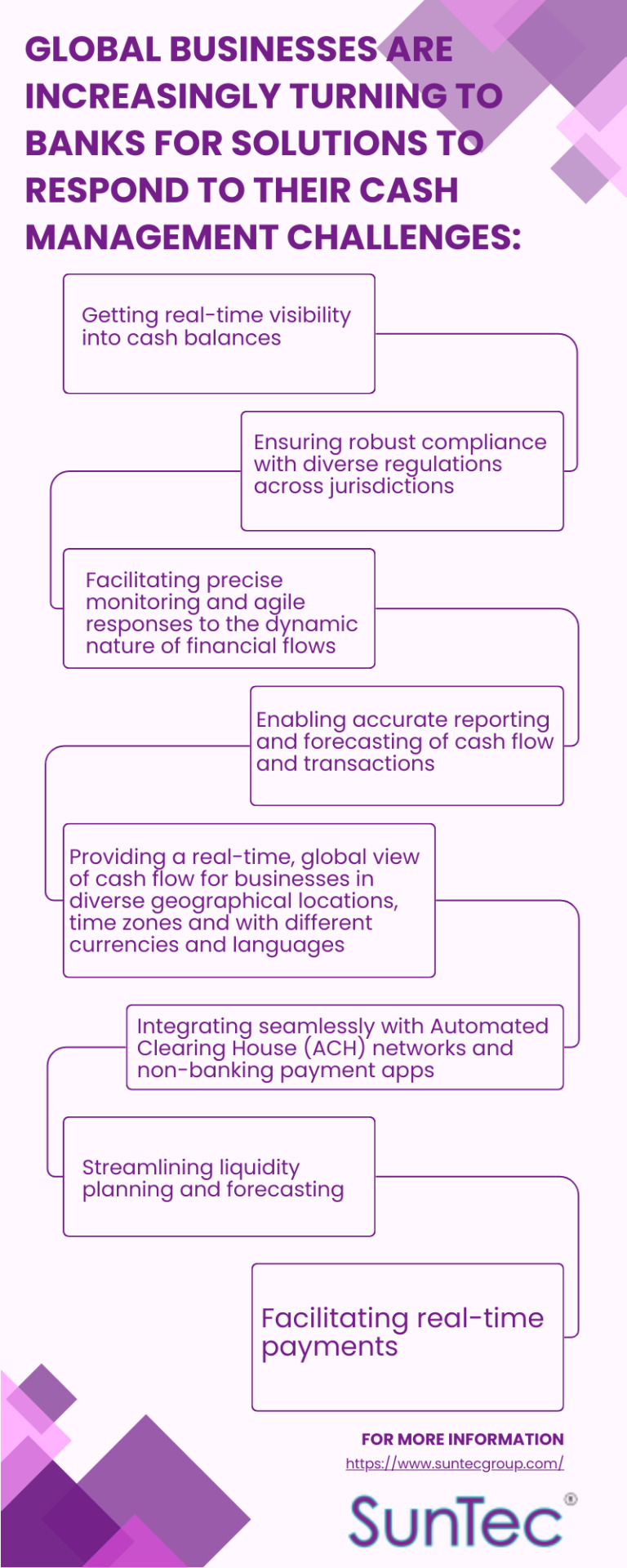

Global businesses are increasingly relying on banks to address their complex cash management challenges. This trend is driven by the need for real-time visibility into cash balances, compliance with varied regulations across different regions, and the ability to monitor and adapt to the ever-changing financial landscape swiftly. These companies seek to enhance their cash flow reporting and forecasting accuracy, manage operations across diverse locations, time zones, currencies, and languages, and integrate with Automated Clearing House (ACH) networks as well as non-banking payment applications. Additionally, there's a growing demand for streamlined liquidity planning and the capability to facilitate instant transactions, underscoring the critical role banks play in enabling businesses to navigate the complexities of global finance efficiently.

1 note

·

View note

Text

Morphis, Celebrating 25 years of Cash Management Success!

Based in Dallas, Texas, Morphis has been at the top of global currency supply chain development over the last 25 years, and their solutions are used worldwide by central banks, armored carriers, depository institutions, and wide variety of other businesses worldwide.

As the demand for ATM’s remains steady worldwide, proprietary technology designed by Morphis is always in demand because the ATM…

View On WordPress

0 notes

Text

How to Master SAP TRM: A Comprehensive Guide to Efficient Cash and Liquidity Management

Cash and liquidity management are critical aspects of financial operations for businesses. It involves effectively managing cash flows, optimizing liquidity positions, and ensuring sufficient funds to meet operational needs. In this article, we will explore how SAP TRM (Treasury and Risk Management) plays a vital role in enabling efficient cash and liquidity management for organizations.

Understanding Cash and Liquidity Management

Cash and liquidity management refers to the processes and strategies employed by businesses to manage their cash flows, optimize liquidity positions, and mitigate risks. It is essential for organizations to have a clear understanding of their cash inflows and outflows, as well as their overall liquidity position. Effective cash and liquidity management enables businesses to make informed financial decisions, ensure operational stability, and seize growth opportunities.

Key challenges in cash and liquidity management include inaccurate cash forecasting, lack of real-time visibility, and suboptimal liquidity planning. Businesses often struggle with accurately predicting their future cash flows, which can lead to cash shortages or idle cash balances. Additionally, limited visibility into cash positions and poor liquidity planning can hinder effective decision-making and financial control.

Real-time visibility and control over cash flows are crucial for making informed financial decisions and maintaining healthy liquidity levels. By leveraging advanced technologies and solutions like SAP TRM, businesses can enhance their cash and liquidity management practices, overcome challenges, and achieve greater financial stability.

Introduction to SAP TRM

SAP TRM is a comprehensive solution provided by SAP for treasury and risk management. It offers a range of functionalities and features to address various financial management needs, including cash and liquidity management. With SAP TRM, organizations can streamline their treasury operations, enhance cash visibility, and optimize liquidity positions.

SAP TRM provides businesses with a robust platform to manage their cash flows effectively. It offers features such as cash position management, cash flow forecasting, liquidity planning and optimization, and risk management capabilities. By leveraging SAP TRM, organizations can gain real-time insights into their cash positions, improve cash forecasting accuracy, and optimize their liquidity management strategies.

Cash and Liquidity Management with SAP TRM

Cash Position Management Cash position management is vital for accurate cash forecasting and maintaining control over cash balances. It allows businesses to monitor their cash positions in real-time, track cash inflows and outflows, and reconcile bank statements efficiently. SAP TRM offers powerful tools and functionalities to facilitate cash position management. Organizations can leverage these features to gain instant visibility into their cash positions, enabling proactive decision-making and effective liquidity management.

Cash Flow Forecasting

Accurate cash flow forecasting is essential for effective liquidity planning and managing short-term and long-term cash needs. SAP TRM provides advanced capabilities to analyze historical cash flows, incorporate relevant financial data, and generate reliable cash flow projections. By leveraging SAP TRM for cash flow forecasting, organizations can optimize their liquidity positions, mitigate cash shortages, and identify surplus funds for investments or debt reduction. The ability to generate accurate and reliable cash flow projections empowers businesses to make informed financial decisions and ensure adequate liquidity for their operations.

Liquidity Planning and Optimization

Liquidity planning involves managing the availability and efficient utilization of cash resources to meet operational needs. SAP TRM offers robust liquidity planning and optimization features that enable organizations to create comprehensive liquidity plans, evaluate funding requirements, and optimize cash allocations. With SAP TRM, businesses can align their liquidity positions with strategic goals, ensure adequate funding sources, and optimize working capital management. The solution provides businesses with the tools and insights necessary to make data-driven decisions, proactively manage liquidity risks, and maximize the utilization of available cash resources.

Implementation and Integration of SAP TRM

Implementing SAP TRM for cash and liquidity management requires careful planning and consideration. Organizations should align the implementation with their specific cash management requirements, configure the system accordingly, and ensure proper integration with other SAP modules and external systems. It is crucial to engage experienced consultants and conduct thorough testing to ensure a successful implementation.

Best practices for successful SAP TRM implementation include conducting a comprehensive analysis of cash management requirements, defining clear objectives and scope, establishing effective data management processes, and providing adequate training to end-users. Organizations should also consider integrating SAP TRM with other financial systems and modules to achieve a seamless flow of data and streamline financial operations.

Case Studies or Success Stories

To further illustrate the benefits of SAP TRM in cash and liquidity management, let’s look at some real-world examples of organizations that have achieved success through its implementation.

Example Company A:

Company A, a multinational corporation, implemented SAP TRM to enhance its cash and liquidity management practices. By leveraging SAP TRM’s cash position management and cash flow forecasting capabilities, the company achieved real-time visibility into its cash positions, improved cash forecasting accuracy by 30%, and optimized its liquidity planning processes. This enabled the company to make informed financial decisions, minimize idle cash balances, and optimize its working capital management.

Example Company B:

Company B, a financial institution, integrated SAP TRM with its existing systems to streamline its treasury operations. The integration allowed the institution to automate cash flow processes, improve data accuracy, and enhance risk management capabilities. With SAP TRM, the institution achieved better control over its cash flows, reduced operational risks, and improved regulatory compliance.

Example Company C:

Company C, a growing business, invested in SAP TRM online training for its finance team. Through the SAP TRM module training, the team gained in-depth knowledge of cash and liquidity management principles. The training equipped them with the skills to implement SAP TRM effectively within the organization, leading to improved cash visibility and streamlined liquidity management processes. Company C witnessed enhanced financial stability and operational efficiency, thanks to the SAP TRM Online Training Course they invested in.

These case studies highlight the positive impact of SAP TRM on cash and liquidity management. By leveraging the solution’s capabilities, organizations can optimize their cash flows, enhance liquidity positions, and achieve greater financial stability.

FAQs on Cash and Liquidity Management with SAP TRM

Q: What is cash and liquidity management?

Cash and liquidity management refers to the processes and strategies employed by businesses to effectively manage their cash flows, optimize liquidity positions, and mitigate risks.

Q: Why is efficient cash and liquidity management important for businesses?

Efficient cash and liquidity management are vital for businesses as they ensure sufficient funds for operational needs, enable informed financial decision-making, and enhance financial stability.

Q: What is SAP TRM, and how does it support cash and liquidity management?

SAP TRM is a comprehensive solution for treasury and risk management provided by SAP. It offers functionalities and features to streamline cash and liquidity management processes, including cash position management, cash flow forecasting, and liquidity planning.

Q: How does SAP TRM enable real-time cash visibility and monitoring?

SAP TRM provides businesses with real-time insights into their cash positions through features like cash position management. This allows organizations to monitor cash inflows and outflows, track bank statements, and make proactive financial decisions.

Q: What are the key features and functionalities of SAP TRM for cash flow forecasting?

SAP TRM offers advanced capabilities for cash flow forecasting, such as analyzing historical cash flows, incorporating relevant financial data, and generating reliable cash flow projections.

Q: How does SAP TRM help organizations optimize their liquidity positions?

SAP TRM provides tools and insights for liquidity planning and optimization. Organizations can create comprehensive liquidity plans, evaluate funding requirements, and optimize cash allocations to align their liquidity positions with strategic goals.

Q: What are the considerations for implementing SAP TRM for cash and liquidity management?

Successful implementation of SAP TRM for cash and liquidity management requires careful planning, clear objectives, effective data management processes, and integration with other systems or modules.

Q: How does SAP TRM integrate with other systems or modules?

SAP TRM can be integrated with other financial systems and modules to achieve a seamless flow of data and streamline financial operations.

Q: Can you provide examples of organizations that have achieved success with SAP TRM in cash and liquidity management?

Yes, organizations like Company A, Company B, and Company C have successfully implemented SAP TRM and witnessed improvements in cash and liquidity management.

Conclusion

Efficient cash and liquidity management are crucial for businesses to maintain financial stability and make informed decisions. SAP TRM provides a comprehensive solution to streamline cash and liquidity management processes, enhance cash visibility, and optimize liquidity positions. By leveraging the capabilities of SAP TRM, organizations can achieve better control over their cash flows, improve cash forecasting accuracy, and optimize working capital management. With SAP TRM, businesses can enhance their cash and liquidity management practices, and mitigate risks. Enrol in an SAP TRM online course today to unlock the full potential of efficient cash and liquidity management.

For more information about our SAP TRM online training course and how you can embark on a transformative learning journey, please feel free to contact us:

Email: [email protected]

Call/WhatsApp: +91 9146037100

We look forward to assisting you in your pursuit of excellence in Treasury Risk Management.

#sap#sapconsultants#debtmanagement#saptrm#cash management#liquidity management#sap trm online training

0 notes

Text

From Confusion to Clarity: Improving Your Business with Moolamore's Cash Only Reports

The good news is that you can let go of all these worries if you start embracing a game-changer—introducing the Moolamore cash flow tool! In this blog, we will discuss how cash-only reports, one of Moolamore's valuable features, can transform your financial management from confusion to clarity!

Isolating cash-based income and expenses provides a clear and concise picture of your cash flow, removing the noise created by non-cash items like accounts receivable and accounts payable.

One of the most significant benefits of Moolamore's cash only reports feature is the clear visibility it provides into your cash flow. With a few clicks, you can generate reports that only include cash transactions. This allows you to see exactly how much money is coming in and going out of your company, giving you a real-time snapshot of your liquidity.

Best cash flow forecasting software

#cash only reports#financial reporting#business improvement#cash management#cash flow analysis#financial clarity#financial tracking#cash-based reporting#financial decision-making#cash transactions#business finance#cash flow management#financial insights#financial performance#cash handling#cash revenue tracking

1 note

·

View note

Text

How to continuously improve the procurement process with procurement performance management

How can organisations hope to establish procurement processes that deliver the results they expect? The answer is continuous improvement. Keeping track of and adapting to the changing landscape of procurement offers opportunities for organisations to dramatically improve their procurement function, enhancing the resilience of the supply chain, improving efficiency and profitability, and driving growth.

#procurement performance management#business consultant#finance partnering#program management#procurement solutions#software company#procurement#finance#project management#cash management#procurement digitalization

0 notes

Text

Navigating tax equity in the US presents its fair share of challenges. However, by skillfully leveraging tax incentives and mastering the system's intricacies, one can unlock the full potential of renewables. It's a clever way not only to drive economic success but also to make a significant positive impact on the environment. 💚💼 Making Green by Going Green!

✨ What sets this model apart? ✨

🔹 Tailored financial analysis that precisely addresses the needs of PV farm projects.

🔹 Efficient management of capital accounts and careful consideration of tax basis.

🔹 Flexibility to explore back leverage loan options for optimized financing.

🔹 Seamless allocation of income and cash flow/waterfall among partners.

🔹 Reliable projections to empower confident decision-making.

🔹 Robust reporting and analysis capabilities.

👉 Access the model now to unlock the full potential of your PV farm partnerships. Let's propel the renewable energy revolution forward!

#Equity financing#Equity allocation#Energy sector#Energy production#Energy pricing#Energy policy#Energy market#Energy efficiency#Energy consumption#Discounted cash flow#Depreciation#Decision-making#Debt service#Debt restructuring#Debt repayment#Debt financing#Cost analysis#Cash reserves#Cash management#Cash flow projections#Cash flow optimization#Cash flow modeling#Cash flow management#Cash flow liquidity#Cash flow forecasting#Cash flow analysis#Capital structure#Capital investment#Capital accounts#Budgeting

0 notes

Text

Managing Your Business Finances: Essential Tools and Strategies

Effective financial management is crucial for the success and growth of any business. It involves a combination of smart strategies and the right tools to track income, expenses, and overall financial health. In this blog post, we will explore some essential tools and strategies that can help you manage your business finances effectively. Additionally, we will discuss how Upbooks, a user-friendly accounting software, can simplify and streamline your financial management processes.

1. Budgeting and Forecasting:

One of the key aspects of managing business finances is creating a budget and forecasting future financial needs. A budget provides a roadmap for allocating resources, tracking expenses, and setting financial goals. With Upbooks, you can easily create and monitor budgets, track actual expenses against projected amounts, and make informed decisions to keep your business on track.

2. Expense Tracking and Management:

Keeping a close eye on your business expenses is vital for maintaining profitability. With Upbooks, you can effortlessly track and categorize your expenses, ensuring accurate record-keeping and streamlined expense management. The software allows you to easily import transactions, reconcile accounts, and generate comprehensive expense reports, giving you a clear view of where your money is going.

3. Invoicing and Receivables:

Maintaining a healthy cash flow is essential for the financial stability of your business. Upbooks offers features for creating professional invoices, sending them to clients, and tracking receivables. With timely invoicing and automated reminders, you can ensure prompt payments and minimize outstanding invoices, improving your cash flow and reducing the risk of late payments.

4. Financial Reporting and Analysis:

Understanding your business's financial performance is key to making informed decisions and identifying areas for improvement. Upbooks provides robust financial reporting] capabilities, allowing you to generate income statements, balance sheets, and cash flow statements. These reports give you valuable insights into your revenue, expenses, profitability, and overall financial health, empowering you to make data-driven decisions for your business.

5. Integration with Banking and Payment Platforms:

Upbooks seamlessly integrates with your banking and payment platforms, making it easy to import transactions and reconcile accounts. This integration eliminates the need for manual data entry, reducing errors and saving you time. By having real-time access to your financial data, you can stay up to date with your cash flow, monitor transactions, and ensure accurate financial records.

6. Collaborative Financial Management:

Managing your business finances often involves collaboration with your accountant or financial team. Upbooks offers collaborative features that allow you to share access to your financial data securely. This facilitates smooth communication, enhances transparency, and ensures that everyone is on the same page when it comes to managing your business finances.

Managing your business finances effectively is vital for sustainable growth and success. By leveraging essential tools and implementing sound financial strategies, you can gain better control over your cash flow, make informed decisions, and optimize your financial performance. Upbooks, with its user-friendly interface, comprehensive features, and integration capabilities, can be an invaluable asset in simplifying and streamlining your financial management processes. Take advantage of these tools and strategies to ensure the financial health and prosperity of your business with Upbooks.

0 notes

Link

Over the forecast period of 2022-2028, the global market for cash management services is projected to grow significantly with a CAGR of 9.5%. In various regions, cost control is driving change in cash management. While multinationals are more proactive towards cash management practices, large professionally managed domestic companies with well-diversified portfolios are increasingly interested in maximizing benefits this way.

0 notes

Text

6 Strategies to Weather Global Market Shocks | Entrepreneur

Opinions expressed by Entrepreneur contributors are their own.

In today’s globalized world, businesses face many risks and uncertainties that can shake markets worldwide. These include economic recessions, political instability, natural disasters, pandemics, etc. Such events can significantly impact businesses, both large and small. Therefore, companies must develop effective strategies to…

View On WordPress

#bear market#Business Culture#Business Process#Cash Management#culture#Customer Relationship Management#Entrepreneurs#Global Business#Global Entrepreneurship#Global Expansion#Growing a Business#Leadership#Management#market crash#Marketing#Markets#Relationships

1 note

·

View note